The· New·Single· Copy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Support Our Hool Sfall C2019 - Spring 2020

Go to APmags.com/store and enter: Write your unique code here! Support our SFall c2019 ho- Spring 2020ol Choose from 750+ offers available online Kids & Parents Register Online - it’s easy & fun! Order Online at: APmags.com - Mobile Friendly! America's Favorites! Favorite Women's Favorite Home Favorite Health Favorite Men's ELLE COUNTRY LIVING BICYCLING CAR & DRIVER Cover Price: $47.88 Cover Price: $49.90 Cover Price: $35.94 Cover Price: $59.88 Code: 9335A1 Code: 3653A1 Code: 0082A1 Code: 0170A1 12 issues for $10 10 issues for $15 6 issues for $20 12 issues for $12 HARPER'S ELLE DÉCOR MEN'S HEALTH BAZAAR Cover Price: $59.90 Cover Price: $49.90 Cover Price: $59.90 ESQUIRE Cover Price: $47.92 Code: 0620A1 Code: 2329A1 Code: 4852A1 10 issues for $10 10 issues for $12 10 issues for $24 Code: 0400A1 8 issues for $10 MARIE CLAIRE GOOD PREVENTION HOUSEKEEPING Cover Price: $59.88 Cover Price: $43.89 Cover Price: $43.89 1390A1 POPULAR Code: 1581A1 Code: 0560A1 Code: MECHANICS 11 issues for $10 11 issues for $12 12 issues for $30 Cover Price: $44.91 Code: 1350A1 9 issues for $12 O, THE OPRAH HOUSE RUNNER'S MAGAZINE BEAUTIFUL WORLD Cover Price: $54.00 Cover Price: $49.90 Cover Price: $29.94 Code: 6799A1 Code: 0690A1 Code: 1505A1 12 issues for $15 10 issues for $15 6 issues for $20 ROAD & TRACK Cover Price: $59.90 Code: 1470A1 10 issues for $12 WOMEN'S VERANDA WOMAN'S DAY HEALTH Cover Price: $2 7.90 Cover Price: $35.94 Cover Price: $49.90 Code: 2040A1 Code: 2524A1 Code: 104GA1 10 issues for $12 6 issues for $20 10 issues for $15 Find magazines for -

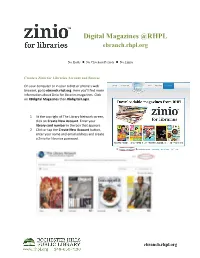

Digital Magazines @RHPL Ebranch.Rhpl.Org

Digital Magazines @RHPL ebranch.rhpl.org No Holds No Checkout Periods No Limits Create a Zinio for Libraries Account and Browse On your computer or in your tablet or phone’s web browser, go to ebranch.rhpl.org. Here you’ll find more information about Zinio for libraries magazines. Click on RBdigital Magazines then Rbdigital Login. 1. At the top right of The Library Network screen, click on Create New Account. Enter your library card number in the box that appears. 2. Click or tap the Create New Account button, enter your name and email address and create a Zinio for libraries password. ebranch.rhpl.org You are now logged into the RHPL Zinio for Libraries digital magazine site and can read all of the magazines you see in the site. Once you find a magazine you’d like to read: 1. Click or tap on the add button and then click or tap Start Reading to read the magazine right away 2. OR click or tap on the cover to read a description of the magazine or view back issues and select an older issue to read. A new tab will open on your internet browser and you can read the magazine in this tab on your PC or Mac. (Please note: to read magazines on your tablet you will need to download a separate Zinio for Libraries app) Read Your Magazines Note: You must first browse for and download magazines using a web browser on your computer or mobile device. Computer users - Zinio for Libraries is available for use entirely in your internet web browser. -

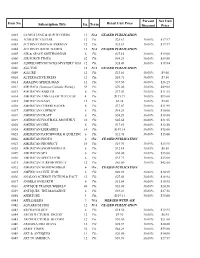

Magazine Subscriptions

Magazine Subscriptions PTP 2707 Princeton Drive Austin, Texas 78741 Local Phone: 512/442-5470 Outside Austin, Call: 1-800-733-5470 Fax: 512/442-5253 e-mail: [email protected] Website: www.magazinesptp.com Jessica Cobb Killeen ISD Bid for 16-20-06-207 (Magazine Subscriptions) 7/11/16 Purchasing Dept. Retail Item Percent Net Unit Ter Unit No. Discount Price Subscription Title Iss. m Price 0001 5.0 MUSTANG & SUPER FORDS now Muscle Mustangs & Fast Fords 12 1Yr. $ 44.99 30% $ 31.49 0002 ACOUSTIC GUITAR 12 1Yr. $ 36.95 30% $ 25.87 0003 ACTION COMICS SUPERMAN 12 1Yr. $ 29.99 30% $ 20.99 0004 ACTION PURSUIT GAMES Single issues through the website only 12 1Yr. $ - 0005 AIR & SPACE SMITHSONIAN 6 1Yr. $ 28.00 30% $ 19.60 0006 AIR FORCE TIMES **No discount 52 1Yr. $ 58.00 0% $ 58.00 0007 ALFRED HITCHCOCKS MYSTERY MAGAZINE 12 1Yr. $ 32.00 30% $ 22.40 0008 ALL YOU 2015 Dec: Ceased 12 1Yr. $ - 0009 ALLURE 12 1Yr. $ 15.00 30% $ 10.50 0010 ALTERNATIVE PRESS 12 1Yr. $ 15.00 15% $ 12.75 0011 AMAZING SPIDER-MAN 12 1Yr. $ 64.00 15% $ 54.40 0012 AMERICA (National Catholic Weekly) 39 1Yr. $ 60.95 15% $ 51.81 0013 AMERICAN ANGLER 6 1Yr. $ 19.95 30% $ 13.97 0014 AMERICAN ANNALS OF THE DEAF **No discount 4 1Yr. $ 95.00 0% $ 95.00 0015 AMERICAN BABY 2015 May: Free Online at americanbaby.com 12 1Yr. $ - 0016 AMERICAN CHEERLEADER 6 1Yr. $ 17.95 30% $ 12.57 0017 AMERICAN COWBOY 6 1Yr. $ 26.60 15% $ 22.61 0018 AMERICAN CRAFT 6 1Yr. -

Slayage, Numbers 13/14

Giada Da Ros When, Where, and How Much is Buffy a Soap Opera? Translated from the Italian and with the editorial assistance of Rhonda Wilcox. Spike: Passions is on! Timmy's down the bloody well, and if you make me miss it I'll — Giles: Do what? Lick me to death? (Something Blue, 4009) Joyce: I-I love what you've, um... neglected to do with the place. Spike: Just don't break anything. And don't make a lotta noise. Passions is coming on. Joyce: Passions? Oh, do you think Timmy's really dead? Spike: Oh, no, no. She can just sew him back together. He's a doll, for God's sake. Joyce: Ah, what about the wedding? I mean, there's no way they're gonna go through with that. (Checkpoint, 5012) Tabitha (talking to Timmy): When will you get it through your fat head? Charity is the enemy. Buffy the Vampire Slayer is the enemy. The busybodies that call themselves the Others are the enemy! One of these days Buffy and the others will be wiped off the face of the earth, but until that time, we don’t want to make our friend in the basement mad, do we? (Passions) Stephen/Caleb: And your job is? Rafe: Vampire slayer. (Port Charles – Naked Eyes) BUFFY AS A SOAP (1) Very often, Buffy the Vampire Slayer is referred to as a soap opera. There are many occasions when it has been defined as such, or at least linked to the genre of daytime dramas. This perception is shared by at least three types of viewers. -

Stanton Rounds up New Food and Lifestyle Center, Rodeo 39

SUNDAY,OCTOBER 11,2020 /// Times Community News publication serving Orange County /// timesoc.com Voters assured fraud won’t be tolerated At a news conference, county officials maintain ballots will be protected and intimidation will not be allowed. BY BEN BRAZIL Following President Trump’s repeated — and disproven — statements about widespread election fraud, Orange County officials sought to assure voters Monday that they would defend ballot integrity and protect polling places from outside inter- ference. “I think one of the messages that I want to make clear is that we’re not going to tolerate intim- idation, we’re not going to toler- Photos courtesy of Rodeo 39 ate rule-breaking in the vote cen- RODEO 39, a new dining and lifestyle center in Stanton, is set to open Saturday. It is the creation of San Juan Capistrano developer Dan Almquist. ters, and we want to make sure that the laws, the regulations and the rules are followed,” Orange County Registrar Neal Kelley said at a news conference outside the Stanton rounds up new food Santa Ana office. During the event, crews loaded semi-trucks with 1.7million bal- lots set to be mailed this week to and lifestyle center, Rodeo 39 registered voters. Trump has urged supporters to monitor voting centers for fraud, BY LORI BASHEDA adirective that has led to con- cerns nationwide about the po- Mention that you’re headed to Stanton and tential for intimidation and dis- you’re likely to hear something along the ruption. lines of: Where’s Stanton? Trump has repeated the widely But a new public market is putting the tiny discredited claim that mail-in city on Orange County’s map in a big way. -

Flipster Titles Available for Shreve Memorial Library

Flipster Titles Available for Shreve Memorial Library 5 Ingredients 15 Minutes Entertainment Weekly 25 Beautiful Homes Entrepreneur Allrecipes Esquire Alternative Medicine Essence Amateur Gardening Family Handyman American Craft Flea Market Décor Archaeology Food Network Magazine Ask Four Wheeler Astronomy Girl’s Life Atlantic Gluten-Free Living Backpacker Good Housekeeping Backyard Good Old Days Better Nutrition Good Organic Gardening Bicycling Health Brainspace HGTV Magazine Car & Driver Highlights Clean Eating House Beautiful Cobblestone In Touch Weekly Color the Cosmos (Adult Coloring Book) Kiss My Sass (Adult Coloring Book) Comics & Gaming Magazine Knitscene Consumer Reports Buying Guide Library Journal Cosmopolitan Louisiana Life Country Living Men’s Journal Country Sampler Mindful Country Woman Muse Countryside & Small Stock Journal My Wedding Creative Patterns (Adult Coloring Book) National Enquirer Cricket National Geographic Kids Crochet! New Old House Diabetic Living Newsweek Global Discover O, the Oprah Magazine Do It Yourself OK! Dr. Oz: The Good Life Old House Journal Dwell Outdoor Photographer Paper People Star People en Espanol Storytime Popular Mechanics Stress Relieving Patterns Vol. II (Adult Coloring Book) Prevention Stress Relieving Paisley Patterns (Adult Coloring Book) Quilter’s World Style @ Home Quilting Arts Taste of Home Readers Digest This Old House Real Simple Time Rolling Stone Us Weekly School Library Journal Week Sew News Woman’s Day Soap Opera Digest Women’s Health Southern Living Yoga Journal Sports Illustrated Updated: January 2020 Access Flipster @ www.shreve-lib.org. -

Media Perspektiven Basisdaten

ISSN 0942-072X Media Perspektiven Basisdaten Daten zur Mediensituation in Deutschland 2020 Rundfunk: Programmangebot und Empfangssituation Öffentlich-rechtlicher Rundfunk: Erträge/Leistungen Privater Rundfunk: Erträge/Leistungen Programmprofile im dualen Rundfunksystem Medienkonzerne: Beteiligungen Presse, Buch Kino/Film und Video/DVD Theater Unterhaltungselektronik, Musikmedien Mediennutzung Werbung Allgemeine Daten Media Perspektiven Basisdaten 2020 Media Perspektiven Basisdaten Daten zur Mediensituation in Deutschland 2020 In dieser jährlich aktualisierten Publikation werden Basisdaten zum gesamten Mediensektor zusammengestellt. Berücksichtigt werden Hörfunk und Fernsehen, Presse, der Buchmarkt, Kino/Film, Video/DVD, Theater, Unterhaltungselektronik/Musikmedien sowie Werbung. Weitere Schwerpunkte sind die Beteiligungen und Verflechtungen der großen Medienkonzerne sowie die Nutzung der tagesaktuellen Medien Fernsehen, Radio, Presse und Internet. In der Sammlung werden nur kontinuierlich erhobene Datenquellen berücksichtigt, um Entwicklungen im Zeitverlauf dokumentieren zu können. Frankfurt am Main, Februar 2021 Datenrecherche: Michael Braband Redaktion: Hanna Puffer Verzeichnis der Tabellen und Grafiken Media Perspektiven Basisdaten 2020 1 Seite Rundfunk: Programmangebot und Empfangssituation TV-Haushalte nach Empfangsebenen in Deutschland 2020 4 Empfangspotenzial der deutschen Fernsehsender 2020 4 Öffentlich-rechtlicher Rundfunk: Erträge/Leistungen Rundfunkgebühren/Rundfunkbeitrag 6 Erträge aus der Rundfunkgebühr bzw. dem Rundfunkbeitrag -

Item No. Subscription Title Iss. Term Retail Unit Price Percent Discount Net Unit Price

Percent Net Unit Item No. Retail Unit Price Subscription Title Iss. Term Discount Price 0001 5.0 MUSTANG & SUPER FORDS 12 N/A CEASED PUBLICATION 0002 ACOUSTIC GUITAR 12 1Yr. $25.67 30.00% $17.97 0003 ACTION COMICS SUPERMAN 12 1Yr. $25.67 30.00% $17.97 0004 ACTION PURSUIT GAMES 12 N/A CEASED PUBLICATION 0005 AIR & SPACE SMITHSONIAN 6 1Yr. $27.14 30.00% $19.00 0006 AIR FORCE TIMES 52 1Yr. $84.29 30.00% $59.00 0007 ALFRED HITCHCOCKS MYSTERY MAG 12 1Yr. $28.49 30.00% $19.94 0008 ALL YOU 12 N/A CEASED PUBLICATION 0009 ALLURE 12 1Yr. $12.86 30.00% $9.00 0010 ALTERNATIVE PRESS 12 1Yr. $10.71 30.00% $7.50 0011 AMAZING SPIDER-MAN 12 1Yr. $37.50 30.00% $26.25 0012 AMERICA (National Catholic Weekly) 39 1Yr. $70.00 30.00% $49.00 0013 AMERICAN ANGLER 6 1Yr. $17.07 30.00% $11.95 0014 AMERICAN ANNALS OF THE DEAF 4 1Yr. $135.71 30.00% $95.00 0015 AMERICAN BABY 12 1Yr. $7.14 30.00% $5.00 0016 AMERICAN CHEERLEADER 6 1Yr. $17.07 30.00% $11.95 0017 AMERICAN COWBOY 6 1Yr. $14.29 30.00% $10.00 0018 AMERICAN CRAFT 6 1Yr. $54.29 30.00% $38.00 0019 AMERICAN FOOTBALL MONTHLY 10 1Yr. $45.64 30.00% $31.95 0020 AMERICAN GIRL 6 1Yr. $17.86 30.00% $12.50 0024 AMERICAN LIBRARIES 10 1Yr. $107.14 30.00% $75.00 0025 AMERICAN PATCHWORK & QUILTING 6 1Yr. $21.43 30.00% $15.00 0026 AMERICAN PHOTO 6 1Yr. -

Title Publisher ISSN Category Start Date Expire Date (Inside) Niche Media Pty Ltd 13269631 Art & Design 01/01/2019 12/31/2019 .Net Future Publishing Ltd

Title Publisher ISSN Category Start Date Expire Date (inside) Niche Media Pty Ltd 13269631 Art & Design 01/01/2019 12/31/2019 .net Future Publishing Ltd. 13557602 Science & Technology 01/01/2019 12/31/2019 Immediate Media London Company 220 Triathlon 0958675X Sports 01/01/2019 12/31/2019 Limited 24 Images Revue 24 Images 7079389 French 01/01/2019 12/31/2019 25 Beautiful Homes Time Inc. UK 14475693 Home & Garden 01/01/2019 12/31/2019 3D Artist Future Publishing Ltd. 17599636 Art & Design 01/01/2019 12/31/2019 3D World Future Publishing Ltd. 14704382 Science & Technology 01/01/2019 12/31/2019 3x3: The Magazine of Contemporary Illustration ARTISANAL MEDIA LLC 1546640X Art & Design 01/01/2019 12/31/2019 5 Ingredients 15 Minutes Editions Pratico-Pratiques 19235038 French 01/01/2019 12/31/2019 50 United States Coloring Book Really Big Coloring Books Adult Coloring Books 01/01/2019 12/31/2019 5280 5280 Publishing Inc. 10826815 Travel & Regional 01/01/2019 12/31/2019 5280 Home 5280 Publishing Inc. Travel & Regional 01/01/2019 12/31/2019 7 Habits of Highly Effective Teens Workbook FranklinCovey Teens 01/01/2019 12/31/2019 7 Jours TVA Publications 8470952 French 01/01/2019 12/31/2019 AARP Bulletin AARP 10441123 Lifestyle 01/01/2019 12/31/2019 AARP: The Magazine AARP 15482014 Lifestyle 01/01/2019 12/31/2019 ABAJUB Dream Wave Publishing Inc. Family & Kids 01/01/2019 12/31/2019 ABC Soaps In Depth Bauer Publishing Company, L.P. 15257800 Entertainment 01/01/2019 12/31/2019 ABC-123 Learn My Letter & Numbers Really Big Really Big Coloring Books Adult Coloring Books 01/01/2019 12/31/2019 Coloring Book Abstract Patterns: Magic Dot Adult Coloring for Skyhorse Publishing Hobbies, Interests & DIY 01/01/2019 12/31/2019 Artists Abstract Patterns: Magic Dot Adult Coloring for Skyhorse Publishing Hobbies, Interests & DIY 01/01/2019 12/31/2019 Everyone Acadiana Profile: Magazine of the Cajun Country Renaissance Publishing, LLC 14397 Travel & Regional 01/01/2019 12/31/2019 Acres U.S.A. -

Download Our Catalog

Alini Magazine Services, LLC 961 Oakwood Place Plainfield, NJ 07060-3437 Phone: (800) 292-1231 • Fax: (908) 791-4434 [email protected] If you do not see it, ask for it ... we can get it THESE ARE STRICTLY LIST/NEWSSTAND PRICES ONLY contact Alini for an actual price quote TITLES - Issues List Price ADMINISTRATIVE PRO TODAY 12 48.00 ADOPTIVE FAMILIES 6 25.00 ADULESCENS 5 40.00 Adventure Box 10 86.00 ADVERTISING AGE 24 199.00 ADWEEK 51 99.00 TITLES - A Issues List Price ADWEEK - digital 51 300.00 A NEW DAY 6 30.00 ADWEEK - digital/PR 51 200.00 A Public Space 3 52.00 AERA MEMBERSHIP W/REVIEW OF EDUC 4 340.00 RESEARCH AAA LIVING 6 51.00 AFAR 6 20.00 AAll Spectrum - Membership 9 75.00 AFRICA AND ASIA A TEACHER REFERENCE 1 30.95 AARC TIMES-membship 12 91.00 AFRICAN AMERICAN REVIEW 4 105.00 AARP Magazine/Bulletin 12 16.00 AFRICAN ARTS 4 235.00 AASA MEMBERSHIP 403.00 AFRICAN VOICES 4 12.00 ABA JOURNAL 12 75.00 AGNI 2 32.00 ABC Soaps in Depth 12 22.97 AIDS EDUC AND PREVENTION 6 515.00 ABOUT…TIME 12 14.00 AIR COND/HEATING/REF NEWS 52 69.00 ABRIDGED READERS GUIDE TO PL 235.00 AIR FORCE TIMES 52 65.00 Absolute Sound 10 15.00 AIRBRUSH ACTION 6 26.95 Academic Leader print only 12 227.00 AKC FAMILY DOG 6 18.00 ACADIAN PROFILE 6 21.00 Al AHRAM-WEEKLY 52 100.00 ACCENT ON ACADEMICS 34 81.00 AL JUMAH 12 30.00 ACOUSTIC GUITAR 06 40.00 AL MAJALLA 52 320.00 Acres USA 12 29.00 AL-HEWAR - 4 22.00 ACTION COMICS teen 12 29.00 ALAN REVIEW 3 56.00 ACTIVATE -MUSIC K-6 5 120.00 ALASKA 10 24.00 ACTIVE LIVING 2 15.00 Albany Business Review 96.00 AD ASTRA- membership -

All Periodicals Tuesday, April 20, 2021

All Periodicals Tuesday, April 20, 2021 Titles Branch Location Shelving Location Holding Info Notes AARP BULLETIN HFCL-Print Magazine Racks 2020-Current AARP THE MAGAZINE HFCL-Print Magazine Racks 2019-Current ADVOCATE, THE Overdrive Online 2020-Current ADVOCATE, THE EBL Magazine Racks 2020-Current ADWEEK Overdrive Online 2019-Current AIR & SPACE SMITHSONIAN EBL Magazine Racks 2020-Current AIR & SPACE SMITHSONIAN Overdrive Online 2019-Current AIR & SPACE SMITHSONIAN HFCL-Print Magazine Racks 2020-Current AIR & SPACE SMITHSONIAN BBL Magazine Racks 2020-Current AL-ARABI HFCL-Print International Language 2020-Current AL-JAMILA HFCL-Print International Language 2019-Current Suspended due to COVID ALLRECIPES EBL Magazine Racks 2020-Current ALLRECIPES HFCL-Print Magazine Racks 2020-Current ALLURE Overdrive Online 2019-Current ALLURE HFCL-Print Magazine Racks 2020-Current AMERICAN ATHEIST HFCL-Print Magazine Racks 2019-Current Publication suspended AMERICAN CRAFT HFCL-Print Magazine Racks 2019-Current AMERICAN CRAFT Overdrive Online 2019-Current AMERICAN HISTORY HFCL-Print Magazine Racks 2019-Current AMERICAN LIBRARIES HFCL-Print Routed to Staff 2019-Current AMERICAN PHILATELIST, THE HFCL-Print Magazine Racks 2020-Current AMERICAN POETRY REVIEW, Overdrive Online 2019-Current THE Page 1 of 27 Titles Branch Location Shelving Location Holding Info Notes AMERICAN THEATRE Overdrive Online 2019-Current ANDROID ADVISOR Overdrive Online 2019-Current ANGELS ON EARTH MAGAZINE Overdrive Online 2019-Current ANIMAL TALES EBL Magazine Racks 2020-Current ANIMATION -

The Volatility Score: a New Measure of the Issue-To-Issue Stability of a Magazine’S Audience

Worldwide Readership Research Symposium 2009 Session 3.4 THE VOLATILITY SCORE: A NEW MEASURE OF THE ISSUE-TO-ISSUE STABILITY OF A MAGAZINE’S AUDIENCE Roger Baron, DRAFTFCB Caryn Klein & Lori Jacobs, Time, Inc. INTRODUCTION Historically, magazine circulation along with average-issue-audience have been used as the currency for the planning and buying of print advertising. And while circulation has acted as a “surrogate” for audience, we now have MRI’s Issue Specific measurement that can be integrated into pre-existing systems and possibly introduce a change in the way magazines are planned and bought. Magazine readership has traditionally been expressed as the average-issue-audience (AIA), but the issue-to-issue variation around this average is different for each magazine – some magazines are relatively stable, others highly volatile. The Issue Specific study provides an adjustment factor that reflects the percent difference between the audience to a given issue of a magazine versus the average (AIA). While this is useful historical information, we believe that a more forward-looking metric would allow planners to better estimate the audience to future issues of a magazine. The purpose of this paper is to present a new metric, the Volatility Score (VS), that quantifies the issue-to-issue variability of a magazine’s audience, and in turn identify factors that explain the differences in volatility from one magazine to another. The VS will tell planners the margin of error that can be expected in the readership of a single issue versus the reported AIA. It would help them more accurately predict future readership than is possible today with average-issue-audience, and would become another normative characteristic of a magazine to be considered in the planning and buying process.