December 29, 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Shinsegae Buy (004170 KS) (Maintain)

[Korea] Retail Shinsegae Buy (004170 KS) (Maintain) Additional negatives to be limited TP: W290,000 ▼ Upside: 31.5% Mirae Asset Daewoo Co., Ltd. Myoungjoo Kim [email protected] Minjeong Kyeong [email protected] 2Q20 review Operating loss due to COVID-19 For 2Q20, Shinsegae reported consolidated revenue of W1.01tr (-32.6% YoY) and an operating loss of W43.1bn (turning to loss YoY). For department stores (non-consolidated), operating profit plunged 56.3% YoY to W14.3bn. The duty-free division posted an operating loss of W37bn (turning to loss YoY). The results missed our estimates and the consensus, hurt by: 1) sluggish department store earnings due to sales mix deterioration; and 2) continued weakness at the duty-free division. In the department store division, the apparel/accessories segments have been slow to recover due to the rapid shift to online shopping amid the lingering impact of COVID-19. Additional negatives to be 2Q20 marked a bottom limited The pandemic weighed on all of Shinsegae’s businesses in 1H20, not just the department store and duty-free divisions. That said, we believe additional negatives are limited. Monthly same-store sales growth at department stores has recovered swiftly (to approximately 9% currently). Considering additional rent cuts for the Terminal 1 airport location (i.e., the temporary introduction of variable rent payments linked to sales), we expect the duty-free division to improve meaningfully in line with the recovery of revenue. Valuation and recommendation Lower TP to W290,000 (from W360,000) We revised down our 2021 EPS estimate by 5.1%, reflecting the decline in the value of Shinsegae’s stakes in subsidiaries (e.g., Shinsegae International [031430 KS/CP: W158,000]). -

FTSE Korea 30/18 Capped

2 FTSE Russell Publications 19 August 2021 FTSE Korea 30/18 Capped Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Alteogen 0.19 KOREA Hyundai Engineering & Construction 0.35 KOREA NH Investment & Securities 0.14 KOREA AmoreG 0.15 KOREA Hyundai Glovis 0.32 KOREA NHN 0.07 KOREA Amorepacific Corp 0.65 KOREA Hyundai Heavy Industries 0.29 KOREA Nong Shim 0.08 KOREA Amorepacific Pfd. 0.08 KOREA Hyundai Marine & Fire Insurance 0.13 KOREA OCI 0.17 KOREA BGF Retail 0.09 KOREA Hyundai Merchant Marine 1.02 KOREA Orion 0.21 KOREA BNK Financial Group 0.18 KOREA Hyundai Mipo Dockyard 0.15 KOREA Ottogi 0.06 KOREA Celltrion Healthcare 0.68 KOREA Hyundai Mobis 1.53 KOREA Paradise 0.07 KOREA Celltrion Inc 2.29 KOREA Hyundai Motor 2.74 KOREA Posco 1.85 KOREA Celltrion Pharm 0.24 KOREA Hyundai Motor 2nd Pfd. 0.33 KOREA Posco Chemical 0.32 KOREA Cheil Worldwide 0.14 KOREA Hyundai Motor Pfd. 0.21 KOREA Posco International 0.09 KOREA CJ Cheiljedang 0.3 KOREA Hyundai Steel 0.33 KOREA S1 Corporation 0.13 KOREA CJ CheilJedang Pfd. 0.02 KOREA Hyundai Wia 0.13 KOREA Samsung Biologics 0.92 KOREA CJ Corp 0.11 KOREA Industrial Bank of Korea 0.22 KOREA Samsung C&T 0.94 KOREA CJ ENM 0.15 KOREA Kakao 3.65 KOREA Samsung Card 0.08 KOREA CJ Logistics 0.12 KOREA Kangwon Land 0.23 KOREA Samsung Electro-Mechanics 0.81 KOREA Coway 0.36 KOREA KB Financial Group 1.78 KOREA Samsung Electronics 25.36 KOREA Daewoo Engineering & Construction 0.12 KOREA KCC Corp 0.12 KOREA Samsung Electronics Pfd. -

2021 Virtual Buyer Meetings: Korea

VIRTUAL TRADE EVENT 2021 VIRTUAL BUYER MEETINGS: KOREA Tuesday, Jun 8 - Wednesday, Jun 9, 2021 Registration: Thursday, Apr 8 - Friday, Apr 30, 2021 | 12:00 PM Virtual Meetings | Korea, Republic of | East Asia https://www.wusata.org/e/JW6OHLO EVENT DETAILS The Western United States Agricultural Trade Association (WUSATA®) and the PRODUCT DESCRIPTION 13 Western State Departments of Agriculture, announce participation and registration in the following activity, brought to you by the USDA's Foreign Agricultural Service: Frozen fruit, canned vegetables, beverage mixes, coffee, tea, wine, cereals, wheat & grain products, oatmeal, 2021 Virtual Buyer Meetings: Korea ~ June 8-9, 2021 confectioneries, bakery products, oils, condiments, Introduce your unique consumer-oriented products to buyers remotely! maple syrup, sauces, spices & seasonings, organic Seven companies from South Korea are seeking products to import for their foods, healthy & natural products, snacks, chocolates, customers. These companies have experience importing food and beverage protein snacks, ice cream, frozen meals, vegan meat, products into the Korean market. They distribute to retail, online and foodservice peanut butter, nuts (hazelnuts, almonds, walnuts, businesses across the country. This is a great opportunity for companies seeking a pistachios & pecans), pet food and animal feed. distribution partner in Korea. INDUSTRY FOCUS Please review the list of products each company is seeking to see if your Consumer Oriented products fit. If you are interested in meeting with buyers from any of these companies, please sign up quickly. Meeting times are limited. Here is more information about each of the Korean companies: 1. GED Corporation (www.gedfood.co.kr) - Importer and distributor based in Seoul, which sells into the retail, online and foodservice channels. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Tested Websites

1 Appendix: Lists of tested websites monetary non-monetary Name URL Name URL KDB www.kdb.co.kr e-Post www.epostbank.go.kr IBK www.ibk.co.kr Saemaeul www.kfcc.co.kr KB www.kbstar.com Shinhyup openbank.cu.co.kr KEB www.keb.co.kr Aju aju.banking.fsb.or.kr Hana www.hanabank.com Dongyang dy.banking.fsb.or.kr Shinhan www.shinhan.com Yeju www.yejubank.co.kr Suhyup www.suhyup-bank.com HS www.hsb.co.kr NH banking.nonghyup.com HK www.hansolbank.co.kr Woori www.wooribank.com SC www.scstandardmutualsavingsbank.co.kr SC (bank) www.standardchartered.co.kr Yenarae http://www.yenaraebank.co.kr Citi www.citibank.co.kr Shinan http://www.shinanbank.co.kr Daegu www.dgb.co.kr Moa www.moa-bank.co.kr Busan www.busanbank.co.kr TS www.samsungbank.co.kr Gwangju www.kjbank.com Hyundai www.hyundaisb.com Jeju www.e-jejubank.com Shinhan www.shinhansavings.com Jeonbuk www.jbbank.co.kr Hanwha hanwhas.banking.fsb.or.kr Kyoungnam www.knbank.co.kr EG egbank.banking.fsb.or.kr HSBC www.hsbc.co.kr Hankuk kibank.banking.fsb.or.kr Table 1. List of financial institution websites in Korea 2 Rank Name URL Rank Name URL 1 Naver www.naver.com 51 Hangame www.hangame.com 2 Daum www.daum.net 52 Twitter www.twitter.com 3 Nate www.nate.com 53 Tcloud www.tcloud.co.kr 4 Cyworld www.nate.com/cymain 54 Digital times www.dt.co.kr 5 11st www.11st.co.kr 55 Wownet www.wownet.co.kr 6 Gmarket www.gmarket.com 56 Tmap www.tmap.co.kr 7 Google www.google.com 57 Nexon www.nexon.com 8 Facebook www.facebook.com 58 Lotte i mall www.lotteimall.com 9 Auction www.auction.co.kr 59 CJ mall www.cjmall.com 10 -

November 11, 2015

November 11, 2015 KOREA Company News & Analysis Major Indices Close Chg Chg (%) Wonik IPS (030530/Buy/TP: W16,000) KOSPI 1,997.27 0.68 0.03 Implications of the spin-off KOSPI 200 245.86 0.00 0.00 KOSDAQ 667.21 10.51 1.60 CJ E&M (130960/Buy/TP: W110,000) Ready for the next big leap Turnover ('000 shares, Wbn) Volume Value Interpark (108790/Buy/TP: W30,000) KOSPI 282,596 3,796 Mobile and tour growth story remains intact KOSPI 200 63,222 2,712 KOSDAQ 628,336 3,430 Kangwon Land (035250/Buy/TP: W54,000) Market Cap (Wbn) 3Q report reaffirms golden goose status Value KOSPI 1,266,258 Korea Gas (036460/Hold) Downgrade rating KOSDAQ 190,795 Wait until uncertainties are cleared KOSPI Turnover (Wbn) Buy Sell Net Sector News & Analysis Foreign 904 1,128 -224 Institutional 726 720 6 Healthcare (Overweight) Retail 2,067 1,931 136 Healthcare Weekly Briefing KOSDAQ Turnover (Wbn) Buy Sell Net Foreign 218 171 48 Institutional 115 144 -30 Retail 3,090 3,114 -24 Program Buy / Sell (Wbn) Buy Sell Net KOSPI 729 841 -112 KOSDAQ 56 44 12 Advances & Declines Advances Declines Unchanged KOSPI 511 296 68 KOSDAQ 746 297 64 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Hanmi Pharm 818,000 34,000 303 Samsung Electronics 1,333,000 12,000 187 KODEX LEVERAGE 10,095 -20 170 Hanmi Science 164,000 -4,000 158 KODEX INVERSE 8,185 5 124 KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Celltrion 79,900 4,100 155 New Pride 15,800 -200 119 NATURECELL 7,680 -320 117 Digital-Tech 2,400 280 97 Kolon Life Science 210,600 11,100 87 Note: As of November 11, 2015 This document is a summary of a report prepared by Daewoo Securities Co., Ltd. -

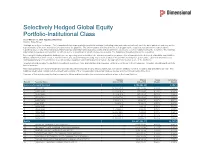

Selectively Hedged Global Equity Portfolio-Institutional Class As of March 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

Selectively Hedged Global Equity Portfolio-Institutional Class As of March 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. This fund operates as a fund-of-funds and generally allocates its assets among other mutual funds, but has the ability to invest in securities and derivatives directly. The holdings listed below contain both the investment holdings of the corresponding underlying funds as well as any direct investments of the fund. -

Potential Partners

INVESTMENT OPPORTUNITIES IN KOREA PotentialIndustry Partners Trends List of Related Companies Company name Major items Website Location Sugar, processed meat, instant CJ Cheiljedang www.cj.co.kr Seoul Potential foods, etc. Lotte Chilsung Beverage company.lottechilsung.co.kr Seoul Beverage Starch, sauce, processed meat, Daesang www.daesang.co.kr Seoul Partners etc. Instant noodles, processed Ottogi www.ottogi.co.kr Gyeonggi-do seafood, etc. Noodles including instant noodles Nongshim www.nongshim.com Seoul and macaroni Lotte Foods Lotte Foods www.lottefoods.co.kr Seoul Paris Croissant Bakery production www.pariscroissant.co.kr Gyeonggi-do Oriental Brewery Production of malt and beer www.ob.co.kr Seoul Company Seoul Dairy Production of liquid milk and other www.seoulmilk.co.kr Seoul Cooperative dairy products Samyang Sugar, flour, etc. www.samyangcorp.com Seoul Alcoholic beverages including soju Hite Jinro www.hitejinro.com Seoul and beer Processed seafood, dairy Dongwon F&B www.dongwonfnb.com Seoul products, etc. Lotte Confectionery Cookies, cocoa products, etc. www.lotteconf.co.kr Seoul Dongsuh Foods Coffee processing www.dongsuh.co.kr Seoul Korea Ginseng Production of ginseng products www.kgc.co.kr Daejeon Corp. Dairy products, coffee products, Maeil Dairies www.maeil.com Seoul etc. Coca-Cola Production of other nonalcoholic Gyeongsang www.ccbk.co.kr Beverage Company beverages nam-do INVESTMENT OPPORTUNITIES IN KOREA PotentialIndustry Partners Trends Company name Major items Website Location Related Associations Nonghyup Feed Production of feed formula www.nonghyupsaryo.co.kr Seoul Name of association Website Main roles Dongwon Home Production of natural and multi- www.dwhf.co.kr Seoul Food compound seasonings Information on the food industry, training on Korea Foods Industry www.kfia.or.kr food safety, support for the development of TS Corporation Sugar www.ts.co.kr Incheon Association government policies, export support, etc. -

2014 ESG Integrated Ratings of Public Companies in Korea

2014 ESG Integrated Ratings of public companies in Korea Korea Corporate Governance Service(KCGS) annouced 2014 ESG ratings for public companies in Korea on Aug 13. With the ESG ratings, investors may figure out the level of ESG risks that companies face and use them in making investment decision. KCGS provides four ratings for each company which consist of Environmental, Social, Governance and Integrated rating. ESG ratings by KCGS are graded into seven levels: S, A+, A, B+, B, C, D. 'S' rating means that a company has all the system and practices that the code of best practices requires and there hardly exists a possibility of damaging shareholder value due to ESG risks. 'D' rating means that there is a high possibility of damaging shareholder value due to ESG risks. Company ESG Integrated Company Name Code Rating 010950 S-Oil Corporation A+ 009150 Samsung Electro-Mechanics Co., Ltd. A+ 000150 DOOSAN CORPORATION A 000210 Daelim Industrial Co., Ltd. A 000810 Samsung Fire & Marine Insurance Co., Ltd. A 001300 Cheil Industries Inc. A 001450 Hyundai Marine&Fire Insurance Co., Ltd. A 005490 POSCO. A 006360 GS Engineering & Construction Corp. A 006400 SAMSUNG SDI Co., Ltd. A 010620 Hyundai Mipo Dockyard Co., Ltd. A 011070 LG Innotek Co., Ltd. A 011170 LOTTE CHEMICAL CORPORATION A 011790 SKC Co., Ltd. A 012330 HYUNDAI MOBIS A 012450 Samsung Techwin Co., Ltd. A 023530 Lotte Shopping Co., Ltd. A 028050 Samsung Engineering Co., Ltd. (SECL) A 033780 KT&G Corporation A 034020 Doosan Heavy Industries & Construction Co., Ltd. A 034220 LG Display Co., Ltd. -

Holdings-Report.Pdf

The Fund is a closed-end exchange traded management Investment company. This material is presented only to provide information and is not intended for trading purposes. Closed-end funds, unlike open-end funds are not continuously offered. After the initial public offering, shares are sold on the open market through a stock exchange. Changes to investment policies, current management fees, and other matters of interest to investors may be found in each closed-end fund's most recent report to shareholders. Holdings are subject to change daily. PORTFOLIO HOLDINGS FOR THE KOREA FUND as of July 31, 2021 *Note: Cash (including for these purposes cash equivalents) is not included. Security Description Shares/Par Value Base Market Value (USD) Percent of Base Market Value SAMSUNG ELECTRONICS CO 793,950 54,183,938.27 20.99 SK HYNIX INC COMMON 197,500 19,316,452.95 7.48 NAVER CORP COMMON STOCK 37,800 14,245,859.60 5.52 LG CHEM LTD COMMON STOCK 15,450 11,309,628.34 4.38 HANA FINANCIAL GROUP INC 225,900 8,533,236.25 3.31 SK INNOVATION CO LTD 38,200 8,402,173.44 3.26 KIA CORP COMMON STOCK 107,000 7,776,744.19 3.01 HYUNDAI MOBIS CO LTD 26,450 6,128,167.79 2.37 HYUNDAI MOTOR CO 66,700 6,030,688.98 2.34 NCSOFT CORP COMMON STOCK 8,100 5,802,564.66 2.25 SAMSUNG BIOLOGICS CO LTD 7,230 5,594,175.18 2.17 KB FINANCIAL GROUP INC 123,000 5,485,677.03 2.13 KAKAO CORP COMMON STOCK 42,700 5,456,987.61 2.11 HUGEL INC COMMON STOCK 24,900 5,169,415.34 2.00 SAMSUNG 29,900 4,990,915.02 1.93 SK TELECOM CO LTD COMMON 17,500 4,579,439.25 1.77 KOREA INVESTMENT 53,100 4,427,115.84 -

CJ Corporation (001040 KS) BUY (Upgrade)

EQUITYEQUITY RESEARCH RESEARCH 5 Mar 2008 CJ (001040 KS) CJ Corporation (001040 KS) BUY (Upgrade) Waiting for positive signals as it converts to a holding company Patrick Kim (82-2-769-3809) [email protected] Upgrade to BUY, and boost TP to W120,000 We have a BUY rating on CJ Corporation (CJ), setting our target price at W120,000. Based Share price (Mar 5) W73,300 on our sum-of-parts valuation we derived our target price by adding the per share stake value Six-month TP W120,000 of W131,650 to the per share tangible asset value of W5,080, and then deducting W16,260 Par value W5,000 per share in borrowings. KOSPI 1,676.18 52 week high/low W147,968/W64,000 It has been half a year since it converted to a holding company structure Capital stock In Sep 2007, CJ began to convert to a holding company with a subsidiary spin-off. Then in W137.7bn (Common stock) Dec 2007, as it completed a tender offer for shares of CJ CheilJedang, CJ emerged as an Market cap W2,062.6bn undisputed holding company. As such, the company is comprised of a total of 15 subsidiaries, Foreign ownership 15.5% including three food production and food service companies, five E&M (Entertainment & Performance (%) Absolute Relative Media) companies, three new retail businesses, and three companies working in either the 1 m 0.4 1.3 financial industry or the infrastructure industry. Meanwhile, it has six listed subsidiaries and 6 m -11.5 1.3 nine unlisted ones. -

Interbrand-Best-Korean-Brands-2015

Contents 02 Introduction 04 The future of business is personal 06 The Age of You: key questions answered 10 Best Korea Brands 2015 Top50 46 Best Korea Brands 2015 Analysis 54 Authors & Contributors 1 engage customers and generate genuine result, each of us will become our own 2015 will provide the insights you need value for the business. marketplace or “Mecosystem.” to drive your organization forward—and Introduction new inspiration to push creative thought The need to create brand experiences In our report, Jez Frampton, Global CEO Jihun Moon and innovation in these changing times. that are seamless and more holistic has of Interbrand, will elaborate on this new been precipitated by sector convergence era, which we at Interbrand refer to as Congratulations to all of Korea’s Best The origin of the term “branding” was and the rise of Big Data. Harnessing the the “Age of You”—the move from brand Global Brands—in particular those whose lit¬erally to burn one’s name onto prop- potential of Big Data isn’t just for tech as monologue, to brand as dialogue, leadership skills have earned them a erty as a crude mark of ownership. But companies anymore—it offers huge to brand as a communal experience, to place among the nation’s top brands. it’s only in our relatively recent history opportunities for all brands. By collecting brand as a truly personal and curated ex- that branding has become recognized as To your continued success, and analyzing customer data and honing perience created around each and every a business discipline.