The Mega-Boxship Phenomenon

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

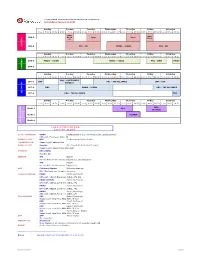

Factbook 2011

◇◆◇◆◇◆ INDEX ◆◇◆◇◆◇ 1. Management Plan and Improvement of Business Structure 3-5. Emerging Markets (China) ④ Chinese Economic Disparities between Regions P21 1-1. "K"Line Vision 100 General View (as Announced in April 2008) P1 ⑤ Gap of the No. of Durable Goods Owned between Urban and Rural Area 1-2. April 2011, "K"Line Vision 100 ①Review of the Mid-term Management Plan KV100 P2 4. Bulk Carrier Business -New Challenges- ②Target for Financial Index 4-1. "K"Line Fleet ① "K"Line Dry Bulk Fleet P22 ③Trends of Business Performance (P/L) P3 ② "K"Line Energy Transportation Fleet ④Improvement in Financial Position ③ Ship Price as of Placing Order (Dry Bulkers, Tankers) ⑤Changes in Income and Major Financial Indicators ④ Ship Price as of Completion (Dry Bulkers, Tankers) ⑥Fleet Upgrading Plan and Investment P4 4-2. Drybulk Business Expansion into the World P23 ⑦Fleet Size Transition 4-3. Demand on Dry Bulk ① Transition of Crude Steel Production P24 ⑧New Buildings (Results and Plan) ② Global Main Trades of Coal P25 1-3. Trends of Financial Indices ①Net Income and Dividend per Share P5 ③ World Coal Consumption ②Consolidated ROE/ROA ④ Iron Ore Import into Major Asian Countries ③Consolidated Assets Turnover ⑤ Iron Ore Stocks at Chinese Ports ④Consolidated EV/EBITDA ⑥ BDI & Port Congestion in Australia ⑤Operating Cash Flow 5. Car Carrier Business ⑥Consolidated Interest Coverage Ratio 5-1. Fleet and Cargo Movements ① "K"Line PCC Fleet P26 1-4. History of Management Plans P6 ② Cars/Trucks Transported by Our Fleet 1-5. Effort for Structural Reform ①No. of Seafarers/ "K"Line Employee P7 ③ Total Cars/Trucks Exported from Japan ②Our Fleet Scale, Revenures & Ordinary Income 5-2. -

Federal Register/Vol. 70, No. 192/Wednesday, October 5, 2005

58222 Federal Register / Vol. 70, No. 192 / Wednesday, October 5, 2005 / Notices however, will be limited to the seating of the date this notice appears in the Parties: American President Lines, available. Unless so requested by the Federal Register. Copies of agreements Ltd.; APL Co. Pte Ltd.; China Shipping Council’s Chair, there will be no public are available through the Commission’s Container Lines Co., Ltd.; COSCO oral participation, but the public may Office of Agreements (202–523–5793 or Container Lines Company Limited; submit written comments to Jeffery [email protected]). Evergreen Marine Corporation (Taiwan), Goldthorp, the Federal Communications Agreement No.: 011223–031. Ltd.; Hanjin Shipping Co., Ltd.; Hapag- Commission’s Designated Federal Title: Transpacific Stabilization Lloyd Container Line GmbH; Kawasaki Officer for the Technological Advisory Agreement. Kisen Kaisha, Ltd.; Mitsui O.S.K. Lines, Council, before the meeting. Mr. Parties: American President Lines, Ltd.; Hyundai Merchant Marine Co. Goldthorp’s e-mail address is Ltd.; APL Co. Pte Ltd.; CMA CGM, S.A.; Ltd.; Kawasaki Kisen Kaisha Ltd.; [email protected]. Mail delivery COSCO Container Lines Ltd.; Evergreen Mitsui O.S.K. Lines, Ltd.; Nippon Yusen address is: Federal Communications Marine Corp. (Taiwan) Ltd.; Hanjin Kaisha Line; Orient Overseas Container Commission, 445 12th Street, SW., Shipping Co., Ltd.; Hapag-Lloyd Line Limited; and Yangming Marine Room 7–A325, Washington, DC 20554. Container Linie GmbH; Hyundai Transport Corp. Merchant Marine Co., Ltd.; Kawasaki Filing Party: David F. Smith, Esq.; Federal Communications Commission. Kisen Kaisha, Ltd.; Mitsui O.S.K. Lines, Sher & Blackwell; 1850 M Street, NW.; Marlene H. -

CONTAINER SERVICES BERTH WINDOW SCHEDULE Last Updated January 12, 2018

CONTAINER SERVICES BERTH WINDOW SCHEDULE Last Updated January 12, 2018 Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 WEST WEST CEN-5 WOOD Barge Barge WOOD (2) CENTERM CEN-6 TP1 - 2M CPNW - OCEAN TP9 - 2M Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 VTM-5 PNW3 - OCEAN PNW1 - OCEAN PN2 - HMM PNW3 VTM-6 VANTERM Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 MSC - CALIFORNIA DPT-1 ZMP PN1 - THE ALLIANCE ZMP - ZIM EXPRESS DPT-2 PN2 PNW4 - OCEAN PN2 - THE ALLIANCE DELTAPORT DPT-3 PN3 - THE ALLIANCE PN3 Sunday Monday Tuesday Wednesday Thursday Friday Saturday 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30* 1:00 8:00 16:30 1:00 8:00 16:30 1:00 8:00 16:30 MPS Berth 7 AL5 (MedPac) Berth 8 OCEANIA DOCKS Berth 9 FRASER SURREY FRASER L I N E / C O N S O R T I U M S e r v i c e N a m e COSCO SHIPPING CPWN (China/Canada & U.S. -

![Market Position in the Industry[111KB/2Pages]](https://docslib.b-cdn.net/cover/6717/market-position-in-the-industry-111kb-2pages-596717.webp)

Market Position in the Industry[111KB/2Pages]

Market Position in the Industry MOL operates a large and balanced oceangoing fl eet. In terms of its total fl eet size and presence in individual market categories, MOL ranks among the world’s largest shipping companies. World Major Carriers’ Fleets (All Vessel Types) (Number of vessels) 0 200 400 600800 1,000 1,200 947 MOL (Japan) 68 NYK (Japan) COSCO (China) K Line (Japan) China Shipping (China) APM-Maersk (Denmark) Oldendorff (Germany) MSC (Switzerland) Swiss Marine (Switzerland) CMA-CGM (France) Fredriksen (Norway) Teekay (Canada) 0 20 40 6080 100 120 (Million deadweight tons (DWT)) ■■ Number of vessels ■■ Million deadweight tons (DWT) Source: MOL internal estimation based on each companies’ published data, Clarkson and Alphaliner (March 2015) World Major Carriers’ Revenue Portfolio by Segment (%) 0 2040608010047 43 10 MOL NYK K Line APM-Maersk COSCO NOL OOIL MISC Frontline Teekay Pacifi c Basin Golar LNG ■ Bulkships ■ Containerships and related business ■ Other businesses Source: MOL calculations based on each company’s fi nancial statements and/or news. MOL’s containerships and related business includes revenue from Containerships, Terminals and Logistics. NYK’s containerships and related business includes revenue from Containerships, Air freighters and Logistics. APM-Maersk’s containerships and related business includes revenue from Terminal business. COSCO’s containerships and related business includes revenue from Terminal business. 38 Mitsui O.S.K. Lines 115mol_英文0723入稿PDF.indd5mol_英文0723入稿PDF.indd 3838 22015/07/23015/07/23 117:337:33 -

October 31St, 2016 to Whom It May Concern, Kawasaki Kisen Kaisha

October 31 st , 2016 To Whom it May Concern, Kawasaki Kisen Kaisha, Ltd. Eizo Murakami, President & CEO Mitsui O.S.K. Lines, Ltd. Junichiro Ikeda, President & CEO Nippon Yusen Kabushiki Kaisha Tadaaki Naito, President Notice of Agreement to the Integration of Container Shipping Businesses Kawasaki Kisen Kaisha, Ltd., Mitsui O.S.K. Lines Ltd., and Nippon Yusen Kabushiki Kaisha have agreed, after the resolution by the board of directors of each company held today, and subject to regulatory approval from the authorities, to establish a new joint-venture company to integrate the container shipping businesses (including worldwide terminal operating businesses excluding Japan) of all three companies and to sign a business integration contract and a shareholders agreement. 1. Background Although growing modestly, the container shipping industry has struggled in recent years due to a decline in the container growth rate and the rapid influx of newly built vessels. These two factors have contributed to an imbalance of supply and demand which has destabilized the industry and has created an environment that is adverse to container line profitability. In order to combat these factors, industry participants have sought to gain scale merit through mergers and acquisitions and consequently the structure of the industry is changing through consolidation. Under these circumstances, three companies have now decided to integrate their respective container shipping on an equal footing to ensure future stable, efficient and competitive business operations. The new joint-venture company is expected to create a synergy effect by utilizing the best practices of the three companies. And by taking advantage of scale merit of its vessel fleet totaling 1.4 million TEUs, realize integration effect of approximately 110 billion Japanese Yen annually and seek swiftly financial performance stabilization. -

APL (Also See ANL & CMA) MC's Need to Call Equipment Control on Waivers Or RRG Approvals 757/961-2574 Dispute Contact PSW

Frequently Called Equipment Providers as of 09/16/2021 and how they receive updates APL (also see ANL & MC’s need to call Equipment Control on Waivers or RRG 757/961-2574 Internet CMA) Approvals Dispute Contact [email protected] 866/574-1364 Equipment East [email protected] 757/961-2102 Atlanta, Baltimore, Boston, Buffalo, Charleston, Charlotte, Greensboro, Greer, Jacksonville, Memphis, Miami, Nashville, New York, Norfolk, Philadelphia, Pittsburgh, Richmond, Savannah, Tampa. Equipment Midwest & [email protected] 757/961-2105 Gulf Chicago, Cincinnati, Cleveland, Columbus, Dallas, Detroit, Houston, Indianapolis, Kansas City, Loredo, Louisville, Minneapolis, Mobile, New Orleans, Omaha, Rochelle, San Antonio, Santa Teresa. Equipment West [email protected] 602/586-4940 Denver, Long Beach, Los Angeles, Oakland, Phoenix, Portland, Salt Lake City, Seattle, Tacoma. Special Equipment (US) [email protected] 757/961-2600 Equipment Canada (Dry & [email protected] 514/908-7866 Special) Calgary, Edmonton, Halifax, Montreal, Prince George, Prince Rupert, Saskatoon, St. John/New Brunswick, Toronto, Vancouver, Winnipeg. LAX/LGB [email protected] Or [email protected] 562/624-5676 Long Beach, Los Angeles. City Code for Emails- Dallas: USDAL-El Paso: USELP-Houston: USHOU- Mobile: Please add City Code to USMOB- New Orleans: USMSY- San Antonio: USSAT- Santa subject line on your Tereas: USSXT emails for CMA and APL Atlanta:USATL-Baltimore:USBAL-Boston:USBOS- Bessemer:USBMV-Buffalo: USBUF-Chicago:USCHI- Cincinnatti:USCVG-Charleston:USCHS-Charlotte:USCLT- Cleveland: USCLE-Columbus:USCMH-Denver:USDEN- Detroit: USDET-Greensboro: USGBO-Indianapolis: USIND- Jacksonville:USJAX-Joliet: USJOT-Kansas City:USKCK- Laredo:USLRD-Louisville:USLUI-Los Angeles:USLAX- Memphis:USMEM-Miami:USMIA-Minneapolis:USMES- Nashville:USBNA-New York:USNYC-Norfolk:USORF- Oakland:USOAK-Omaha:USOMA-Phildelphia:USPHL- Phoenix:USPHX-Pittsburgh:USPIT-Portland:USPDX-Salt Lake City: USSLC-Savannah:USSAV-Seattle:USSEA-St. -

2014 Shipping Lines Directory

SHIPPING 2015LINES DIRECTORY Bigger and better is the order of the day as shipping lines take delivery of containerships with ever-larger capacity and sustainable upgrades. But with some forecasters predicting that fleet capacity will outstrip industry growth, today’s ocean carriers find that modernizing vessels is just the first port of call. Indeed, sailing to profitability involves forming shipping alliances, enhancing service routes, and deploying innovative web tools for shippers. Inbound Logistics’ 2015 Shipping Lines Directory dives into the latest service enhancements and innovations offered by some of the industry’s major ocean carriers. October 2015 • Inbound Logistics 53 The ports of Seattle and Tacoma have combined their strengths and resources. BOLD STEP 3rd largest gateway in North America. Ranked #1 for ease of doing business. 2015SHIPPING LINES DIRECTORY Atlantic Container Line (ACL) 800-ACL-1235 | www.ACLcargo.com | www.nextgenerationconro.com PARENT COMPANY: Grimaldi Group of Naples, Italy Since 1967, ACL has been a specialized transatlantic carrier of containers, project and oversized cargo, heavy equipment, and vehicles with the world’s largest combination roll-on/roll-off (RoRo) containerships (CONROs). Headquartered in Westfield, N.J., with offices throughout Europe and North America, ACL offers five transatlantic sailings each week and handles the Grimaldi Lines’ service between the United States and West Africa, as well as the Grimaldi EuroMed service between North America and the Mediterranean. The company also offers service for non-containerized cargo from North America to the Middle East, South Africa, Australia, and Asia. APL 800-999-7733 | www.apl.com | www.nol.com.sg PARENT COMPANY: NOL Group SISTER COMPANY: APL Logistics APL offers more than 90 weekly services that cover 165 ports, and provides container transportation and value-added supply chain management services internationally, including intermodal operations with information technology, equipment, and e-commerce. -

The Last 23 Years Progression of Asia-Europe Carrier Alliances

The Last 23 Years Progression of Asia-Europe Carrier Alliances Number of Providers Grand Alliance Global Alliance 1996 Tricon-Hanjin Hapag-Lloyd Nedlloyd HMM DSR-Senator OOCL Maersk MSC CMA COSCO K Line Evergreen NYK 23 Sea-Land Yangming Choyang LLoyd Triestino MISC Norasia Hanjin NOL APL P&O MOL Grand Alliance Global Alliance 1997 CYK Consortium Hapag-Lloyd Nedlloyd Maersk MSC COSCO Evergreen OOCL HMM CMA NYK MISC 20 Sea-Land Norasia K Line LLoyd Triestino NOL Yangming APL P&O MOL Grand Alliance New World 1998 CKY Consortium United Alliance Hapag-Lloyd Alliance COSCO Choyang NYK Maersk MSC Norasia Evergreen APL 21 Sea-Land CMA K Line Hanjin-Senator LLoyd Triestino OOCL MOL Yangming UASC MISC P&O Nedlloyd HMM 1999-2000 Grand Alliance New World Maersk- CKY Consortium United Alliance Evergreen-LT Hapag-Lloyd Alliance Sealand COSCO Choyang NYK MSC Norasia APL 19 Maersk acquired CMA CGM K Line Hanjin-Senator OOCL MOL Sea-Land Yangming UASC MISC P&O Nedlloyd HMM United Alliance Grand Alliance New World 2001 CKY Consortium CSCL Hanjin-Senator Evergreen-LT Hapag-Lloyd Alliance COSCO NYK Maersk- MSC CMA CGM UASC APL 20 Sealand Zim K Line CSAV Norasia OOCL MOL Yangming Choyang Bankrupt MISC P&O Nedlloyd HMM 2002-2004 Grand Alliance CKYH Alliance Evergreen-LT New World CSCL COSCO Hapag-Lloyd Alliance NYK Maersk- MSC CMA CGM UASC K Line APL 20 Sealand OOCL Zim Yangming MISC MOL Hanjin-Senator CSAV Norasia P&O Nedlloyd HMM CKYH Alliance Grand Alliance New World 2005 Maersk- CSCL Evergreen-LT COSCO Hapag-Lloyd Alliance Sealand MSC CMA CGM UASC K Line -

Last Updated : 2021-08-25 ASIA CHINA INDIA EXPRESS 3

Last Updated : 2021-10-06 KOREA INBOUND ASIA CHINA INDIA EXPRESS 3(CIX3) VESSEL VOY BUSAN Xingang Hong Kong Singapore Port Kelang Pipavav Nhava Sheva SEAMAX STRATFORD 111 W 10/21 10/19 10/15 10/10 10/8 9/30 9/28 - - - - - - - - - XIN HONG KONG 050 W 11/3 11/1 10/28 10/23 10/21 10/13 10/11 THORSTAR 038 W 11/5 11/3 10/30 10/25 10/23 10/15 10/13 OOCL SAN FRANCISCO 161 W 11/12 11/10 11/6 11/1 10/30 10/22 10/20 TO BE ADVISED 001 W 11/19 11/17 11/13 11/8 11/6 10/29 10/27 FAR EAST CHENNAI (FCS) VESSEL VOY BUSAN Manila Singapore Port Kelang Vizag Chennai AKA BHUM 003 E 10/18 10/14 10/9 10/8 10/3 9/30 KMTC MUMBAI 004 E 10/25 10/21 10/16 10/15 10/10 10/7 XIN LIAN YUN GANG 088 E 10/31 10/27 10/22 10/21 10/16 10/13 CMA CGM RACINE 001 E 11/10 11/6 11/1 10/31 10/26 10/23 - - - - - - - - TS SYDNEY 002 E 11/18 11/14 11/9 11/8 11/3 10/31 CHINA LAEM CHABANG (CHL) VESSEL VOY Incheon Shekou Hong Kong Ho Chi Minh - - - - - - YM CREDENTIAL 021 N 10/21 10/18 10/17 10/14 XUTRA BHUM 908 N 10/27 10/24 10/23 10/20 GH BORA 069 N 11/3 10/31 10/30 10/27 YM CREDENTIAL 022 N 11/10 11/7 11/6 11/3 XUTRA BHUM 909 N 11/17 11/14 11/13 11/10 Laem VESSEL VOY Incheon Xiamen Hong Kong Chabang - - - - - - OOCL AMERICA 135 N 10/20 10/10 10/9 10/4 COSCO SHANGHAI 185 N 10/27 10/17 10/16 10/11 WAN HAI 511 075 N 11/9 10/30 10/29 10/24 COSCO HAMBURG 248 N 11/10 10/31 10/30 10/25 OOCL AMERICA 136 N 11/17 11/7 11/6 11/1 Asia-North Europe Loop 4 (LL4) VESSEL VOY BUSAN Xingang Xiamen Port Kelang CMA CGM SORBONNE 001 E 10/13 10/10 10/5 9/29 CMA CGM CHAMPS ELYSEES 005 W 10/20 10/17 10/12 -

Markets Odfjell Predicts Chemical Tanker Market

Friday February 16, 2018 Daily Briefing Leading maritime commerce since 1734 LEAD STORY: Jeremy Nixon sets out vision for ONE Jeremy Nixon sets out NEWS: vision for ONE Time to make the case for oceangoing shipping OPINION: Cryptocurrency blockchain plans should sound warning bells Racing to the bottom MARKets: Odfjell predicts chemical tanker market recovery in 2019 IN OTHER NEWS: Foresight confirms VLCC deal with Fredriksen Avance Gas expects better VLGC IN AN EXCLUSIVE interview with Lloyd’s List, the Ocean Network markets in 2018 Express chief executive explains why the carrier that will launch services on April 1 is a brand new business rather than the more Korea Line’s earnings more than traditional product of a merger, and how a new hybrid class of lines can double but Heung-A reports a loss deliver services for customers that are different to those offered by the South Korean journalist jailed for mega carriers or niche players. taking bribes from DSME The container shipping industry is about to witness something that has NYK grabs a methanol-fuelled never happened before, the arrival of a new line that will rank among chemical tanker the biggest in the world from day one. Essar Shipping narrows loss as finance costs halve Six weeks from now, Ocean Network Express will inaugurate services, and immediately join the industry heavyweights at number six in Safe Bulkers beats expectations with terms of fleet capacity. profitable fourth quarter What distinguishes the new Japanese-owned carrier from its competitors is the fact that this really will be a new business in every sense, rather than the product of a merger or acquisition that seeks to maintain existing brands, or absorb one line into another. -

Singapore - Outbound to USA

Singapore - Outbound to USA Closing Singapore (ETA) USA VESSEL VOY Reference Code CYETA ETD LAX OAKHAL NYC SAV CHS ORF CMA CGM ANDROMEDA 0TUJVE1M SEAP-CDM-005-E 13-Oct 14-Oct 16-Oct 9-Nov 13-Nov - - - - - APL SENTOSA 0TUL1S1M SEAP-APS-411-S 17-Oct 18-Oct 19-Oct - - 12-Nov 14-Nov 19-Nov - 17-Nov COSCO SHIPPING ALPS 020S VCE-CJA-020-S 19-Oct 20-Oct 20-Oct - - - 13-Nov 17-Nov - - COSCO AFRICA 069S VCE-CCI-069-S 22-Oct 23-Oct 23-Oct - - - 16-Nov 20-Nov - - CMA CGM MEXICO 0TUJZE1M SEAP-EXI-007-E 23-Oct 24-Oct 26-Oct 19-Nov 23-Nov - - - - - CMA CGM CORTE REAL 0TUK3E1M SEAP-GCR-243-E 27-Oct 28-Oct 30-Oct 23-Nov 27-Nov - - - - - CMA CGM A. LINCOLN 0TUL9S1MA SEAP-GLC-409-S 30-Oct 31-Oct 1-Nov - - 25-Nov 27-Nov 2-Dec - 30-Nov COSCO OCEANIA 083S VCE-CSO-083-S 2-Nov 3-Nov 3-Nov - - - 27-Nov 1-Dec - - CMA CGM J. MADISON 0TUK7E1M SEAP-CJS-132-E 3-Nov 4-Nov 6-Nov 30-Nov 4-Dec - - - - - MA CGM PANAMA 0TUL5S1M SEAP-GPN-009-S 5-Nov 6-Nov 7-Nov - - 1-Dec 3-Dec 8-Dec - 6-Dec CMA CGM BRAZIL 0TUKBE1M SEAP-CZM-005-E 10-Nov 11-Nov 13-Nov 7-Dec 11-Dec - - - - - COSCO SHIPPING ROSE 022S VCE-IPR-022-S 13-Nov 14-Nov 14-Nov - - - 8-Dec 12-Dec - - CMA CGM JULES VERNE 0TULHS1M SEAP-AVR-429-S 14-Nov 15-Nov 16-Nov - - 10-Dec 12-Dec 17-Dec - 15-Dec CMA CGM ALEXANDER VON0TULDS1M HUMBOLDT SEAP-GCV-420-S 16-Nov 17-Nov 18-Nov - - 12-Dec 14-Dec 19-Dec - 17-Dec CMA CGM MARCO POLO 0TUKFE1M SEAP-GCM-335-E 17-Nov 18-Nov 20-Nov 14-Dec 18-Dec - - - - - CMA CGM THALASSA 0TULLS1M SEAP-TLA-422-S 21-Nov 22-Nov 23-Nov - - 17-Dec 19-Dec 24-Dec - 22-Dec CMA CGM CHILE 0TUKJE1M SEAP-ILH-007-E 24-Nov 25-Nov 27-Nov 21-Dec 25-Dec - - - - - CMA CGM J. -

PAUL KENT, PHD Senior Vice President/Global Advisor for Ports and Logistics Nathan Associates Inc

EASTERN PA FREIGHT SUMMIT Global Logistics Drivers and Implications for Freight Logistics 21-22 June 2018 PAUL KENT, PHD Senior Vice President/Global Advisor for Ports and Logistics Nathan Associates Inc. [email protected]/+1-703-516-7830 Importance of Ports • Important (English) • Importante (Italian, Spanish, Portuguese) • Important (French, Romanian) 2 Strategic Drivers Shaping Logistics Global Economy and Trade Growth • Gap between GDP growth and trade 0.2 growth narrowing 0.15 0.1 • Excess fleet capacity/liner 0.05 concentration 0 • Global urban population growth 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 -0.05 • Disruptive technologies -0.1 TEU Growth GDP Growth 4 Liner Consolidation Year of Formation Q4 2009 Q1 2012 Q2 2015 Q2 2017 NWA G6 Alliance G6 Alliance THE Alliance • New and larger alliances APL/NOL APL/NOL APL/NOL MOL MOL MOL MOL K-Line emerging, largely driven HMM HMM HMM NYK Line Grand Alliance IV Hapaq-Lloyd Hapaq-Lloyd Yang Ming by excess capacity Hapag-Lloyd NYK Line NYK Line Hapag-Lloyd NYK OOCL OOCL Ocean Alliance • Of top 20 carriers, only 2 OOCL CKYH CKYHE CMA CGM have not joined an CKYH Hanjin Hanjin COSCO CS Hanjin K-Line K-Line OOCL alliance, with Maersk K-Line Yang Ming Yang Ming Evergreen Yang Ming COSCO COSCO 2M recently acquiring COSCO MSC/CMA CGM Evergreen MSC MSC 2M Maersk Line Hamburg Sud CMA CGM MSC HMM Maersk Line • Top 5 carriers control 62% Ocean Three CMA CGM of container trades China Shipping • Increased from 44% just 4 UASC years ago Top 20 Carriers Not Part of Alliance Maersk Line Maersk Line PIL, Zim Line PIL, Zim Line MSC Hamburg Sud Hamburg Sud CMA CGM Wan Hai Wan Hai Evergreen Evergreen Source: Notteboom, Theo, PortEconomics, Rounds of alliance formation in container shipping, May 2016, revised by Nathan 5 Associates Inc.