Local4green National Handbook on Green Local

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

VKM Nr.412, Datë 19.6.2019 “Për Miratimin E Planit Kombëtar Për

VENDIM Nr. 412, datë 19.6.2019 PËR MIRATIMIN E PLANIT KOMBËTAR PËR MENAXHIMIN E CILËSISË SË AJRIT Në mbështetje të nenit 100 të Kushtetutës, të pikës 4, të nenit 21, të ligjit nr. 10431, datë 9.6.2011, “Për mbrojtjen e mjedisit”, të ndryshuar, dhe të nenit 7, të ligjit nr. 162/2014, “Për mbrojtjen e cilësisë së ajrit në mjedis”, me propozimin e ministrit të Turizmit dhe Mjedisit dhe të ministrit të Shëndetësisë dhe Mbrojtjes Sociale, Këshilli i Ministrave VENDOSI: 1. Miratimin e Planit Kombëtar për Menaxhimin e Cilësisë së Ajrit, sipas tekstit që i bashkëlidhet këtij vendimi. 2. Ngarkohen Ministria e Turizmit dhe Mjedisit, Ministria e Shëndetësisë dhe Mbrojtjes Sociale, Ministria e Bujqësisë dhe Zhvillimit Rural, Ministria e Arsimit, Sportit dhe Rinisë, Ministria e Infrastrukturës dhe Energjisë, Ministria e Financave dhe Ekonominë, Ministria e Brendshme, Inspektorati Shtetëror i Mjedisit, Pyjeve, Ujërave dhe Turizmit, Agjencia Kombëtare e Mjedisit (AKM) dhe njësitë e vetëqeverisjes vendore për zbatimin e këtij vendimi. Ky vendim hyn në fuqi pas botimit në Fletoren Zyrtare. ZËVENDËSKRYEMINISTËR Erion Braçe PLANI KOMBËTAR PËR MENAXHIMIN E CILËSISË SË AJRIT Hyrje Plani kombëtar i menaxhimit të cilësisë së ajrit është mjeti planifikues, me anë të të cilit Qeveria shqiptare synon zbatimin e direktivës 2008/50/EC1 mbi vlerësimin dhe menaxhimin e cilësisë së ajrit në ambient, si dhe direktivave bijë përkatëse. Në përputhje me kërkesat e ligjit nr. 162/2014 “Mbi mbrojtjen e cilësisë së ajrit të mjedisit”, ky plan ndjek dy objektiva: 1. përmirësimin e cilësisë së ajrit në zonat ku janë tejkaluar limitet e vendosura me ligj, si dhe në zonat ku ekziston një risk i lartë i tejkalimit të këtyre limiteve; 2. -

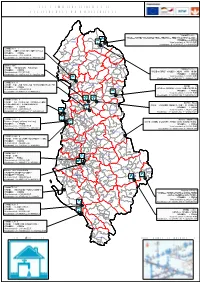

INVENTARI SIPAS NUMRIT TE RRUGEVE 1 Tiranë

INVENTARI SIPAS NUMRIT TE RRUGEVE Emërtimi i Aksit Rrugor (m) (km) Gjërësia B= Gjatësia L= Kufiri ndares mes rretheve Nr. i segmentit 1 Tiranë - Hani i Hotit (aksi i vjetër) 150.15 Mbikalimi Kamëz 2.43 8.5 Kryq. Universiteti Bujqësor Kryq. Universiteti Bujqësor 1/1 2.67 8.5 Kryq. Kamëz qendër Kryq. Kamëz qendër 2.40 8.5 Tapizë (kufi Krujë) Tiranë Qerekë (kufi Tiranë) 11.00 7 Fushë Krujë Fushë Krujë 7.70 7 K/Qendër Borizanë 1/2 K/Qendër Borizanë 4.70 7 K/Thumanë Qendër K/Thumanë Qendër 2.70 7 Ura e Drojës (aksi i vjetër ) Krujë Ura e Drojës, Mamurras 9.80 7 Laç 1/3 Lac 6.70 7 Kryqëzim Milot Lac Kryqëzim Milot 1.10 7 Pllanë (dalja e Urës së Matit) Milot 1/4 Pllanë (dalja e Urës së Matit) 12.85 7 Lezhë (dalja e Urës mbi lumin Drin) Lezhë (dalja e Urës mbi lumin Drin) 4.40 7 Balldre 1/5 Balldre 19.50 7 Bisht Jugë Lezhë Bisht Jugë 11.10 7 Krye Bushat Krye Bushat 1/6 9.00 7 Ura e Bahcallëkut Ura e Bahcallëkut 6.50 7 Shkodër (K/Dobrac) Shkodër (K/Dobrac) 1/7 35.60 10 Hani i Hotit Shkodër 1 Tiranë - Hani i Hotit (aksi i ri) 131.65 Mbikalimi Kamëz 2.43 8.5 Kryq. Universiteti Bujqësor Kryq. Universiteti Bujqësor 1/1 2.67 8.5 1/1 2.67 8.5 Kryq. Kamëz qendër Kryq. Kamëz qendër 2.40 8.5 Tapizë (kufi Krujë) Tiranë Qerekë (kufi Tiranë) 11.00 7 Fushë Krujë Fushë Krujë 2.35 7 K/Fshat Hasan K/Fshat Hasan 1.10 7 K/Fshat Luz K/Fshat Luz 2.60 7 K/Fshat Derven 1/2 K/Fshat Derven 1.30 7 D/Borizane D/Borizane 1.60 7 D/Thumanë D/Thumanë 2.70 7 K/Fshat Bushnesh K/Fshat Bushnesh 1.00 24 Ura e Drojës (aksi i ri) Krujë Ura e Drojës, (aksi i ri) 8.20 24 K/Laç 1/3 -

Tor KRDI Mid-Term Assessment 08Mar07.Pdf

United Nations Development Programme Terms of Reference: KRDI Mid-Term Assessment Dates: 12 March – 03 April 2007 1). Rationale: In follow up to the Tri-partite review of European Commission funded projects in the Kukes Region, and as part of overall monitoring and evaluation activities the UNDP-Albania Country Office will undertake a comprehensive mid-term assessment of the results of the EC funded KRDI project in order to develop lessons learned and best practices for improved project efficacy and for utilization in future interventions in the Kukes Region. The results to be assessed are broadly categorized as follows: a). Level of community participation in selection and implementation of projects including the extent to which women and the poorest were involved in the project selection process; b). Behavior and attitude change amongst local government officials and CBO and community beneficiaries as a result of the training and capacity building offered through KRDI; c). Direct development impact of infrastructure works on the CBO and community beneficiaries including changes (positive or negative) in life styles, economic opportunities, migration, education, quality of health, etc. A mid-term assessment was conducted by the UNDP in November 2005 and the objective was to look at the results achieved. The findings of this mid-term assessment report can be downloaded from the UNDP website by visiting http://www.undp.org.al/?elib,717 . 2). Scope: The Assessment Mission will cover the follow groups: all beneficiaries of training and capacity building initiatives as part of KRDI; and all CBOs, Communities, and Local Government counterparts that have benefited from an infrastructure project under KRDI. -

Extractive Industries Transparency Initiative in Albania Report for the Year 2013 and 2014

Extractive Industries Transparency Initiative in Albania Report for the year 2013 and 2014 December 2015 © Bankers Petroleum Alba nia Ltd Table of contents Executive Summary 4 1. Introduction 6 2. Overview of the extractive sector and hydro-energy sector in Albania 10 2.1 Key facts 11 2.2 Oil and gas sector 20 2.3 Mining and quarry sector 40 2.4 Hydro-energy sector 50 3. Overview of flows reported and reporting entities 73 4. Approach, methodology and work done 79 5. Reconciliation summary 85 6. Results of the reconciliation 87 7. Lessons learned and recommendations 102 Glossary and abbreviations 113 Appendix 1.1: Disaggregated reconciliation from the oil and gas sector 2013 Appendix 1.2: Disaggregated reconciliation from the oil and gas sector 2014 Appendix 2.1: Disaggregated reconciliation from the mining sector 2013 Appendix 2.2: Disaggregated reconciliation from the mining sector 2013 Appendix 3.1: Disaggregated reconciliation from the oil and gas sector 2014 Appendix 3.2: Disaggregated reconciliation from the oil and gas sector 2014 Appendix 4: List of Petroleum Agreements hold by Albpetrol at 31 December 2014 Appendix 5: List of Petroleum Agreements hold by AKBN at 31 December 2014 Appendix 6: Oil sold by Albpetrol in 2013 and 2014 Appendix 7: Register of licensees in the Mining sector in November 2015 Appendix 8: Mining licenses awarded in 2013 Appendix 9: Mining licenses awarded in 2014 Appendix 10: Register of concessions in the hydro-energy sector in November 2015 Appendix 11: Content list providing link per each of the EITI standard clauses to the EITI report Deloitte Audit Albania sh.p.k Rr. -

RAPORT VJETOR Gjëndja E Sektorit Të Energjisë Dhe Veprimtaria E ERE

Raport Vjetor 2016 ERE Mars 2017 REPUBLIKA E SHQIPËRISË ENTI RREGULLATOR I ENERGJISË __________________________________________________________________________________ RAPORT VJETOR Gjëndja e Sektorit të Energjisë dhe Veprimtaria e ERE-s gjatë Vitit 2016 Tiranë, 2017 ______________________________________________________________________________________________ Adresa: Blv “Bajram Curri”, Tel/Fax: +355 42 22 963 Rruga “Viktor Eftimiu” 1023, Tel: +355 42 69 590 Tiranë, Shqipëri 1 www.ere.gov.al Raport Vjetor 2016 ERE Mars 2017 Përmbajtja Fjala e Kryetarit...............................................................................................................................................8 PJESA I:Rregullimi në Tregun e Energjisë Elektrike ..............................................................................14 1.1 Tregu i Energjisë Elektrike .................................................................................................................. 15 1.2 Prodhimi i Energjisë Elektrike ............................................................................................................. 18 1.2.1 Kapacitetet dhe Prodhimi i Energjisë Elektrike............................................................................18 1.2.2 Realizimi i treguesve të prodhimit dhe menaxhimi i rezervës hidrike........................................35 1.2.3 Gjendja e TEC-it Vlorë. ...............................................................................................................36 1.2.4 Prodhimi nga HEC-et Private/Koncesion -

Barina Et Al Albania.Indd

DOI: 10.17110/StudBot.2015.46.2.119 Studia bot. hung. 46(2), pp. 119–140, 2015 CONTRIBUTIONS TO THE FLORA OF ALBANIA, 5 Zoltán Barina1*, Dániel Pifkó1 and Marash Rakaj2 1Department of Botany, Hungarian Natural History Museum, H–1476 Budapest, Pf. 222, Hungary; *[email protected] 2Universiteti i Shkodrës “Luigj Gurakuqi” Sheshi 2 Prilli, Rruga Studenti 24, Shkodër, Albania Barina, Z., Pifk ó, D. & Rakaj, M. (2015): Contributions to the fl ora of Albania, 5. – Studia bot. hung. 46(2): 119–140. Abstract: Records of 63 vascular plant taxa are reported in this paper from Albania with notes about their known European and Balkan distribution. Altogether 51 of the discussed taxa are na- tive in Albania, eight are aliens and four are absent from the country, but previously reported in error. Most of the records presented here are the fi rst mentions of the given taxa in Albania, with a few additional ones which though had some questionable or unvouchered reports but the fi rst localised records are given here. Old-established nomenclatural misapprehensions are ascertained here based on own and latest published results. Key words: alien, casual, native, naturalised, nomenclature INTRODUCTION Hundreds of newly discovered plant species have been reported in the last ten years from the territory of Albania (see Rakaj et al. 2013), together with evincing the erroneous reports of others from the country (Barina et al. 2013, Shuka and Tan 2013). Beyond the publishing of primary data, more sum- marising works have also been published, which all can serve as checklists of the Albanian fl ora (Vangjeli 2003, 2015). -

Krdi VMA Assessment Part 2.Pdf

KRDI VMA Assessment – Part 2 4.6 Impact Indicators Assessment To quantify the improvements in the communities where KRDI works, the project has identified a series of indicators measuring the improvements in sectors of health care, the environment, agriculture, potable water supply, and education. VMA-Kukes worked with several local government units to collect data relevant to the indicators. Sources of data were collected from the Development departments of the Communes and Municipalities, the regional Health and Education Directorates, the Regional Council and the Prefecture. The data found for the indicators is based on the 19 completed infrastructure projects implemented during 2006 in Kukes and Has districts. The process of gathering the data was a slow task since there were changes to the administration of the local government staff following the local elections in early 2006. The table below describes the improvements that have resulted from KRDI interventions. The tables below are categorized by each sector and compares of the villages in 2005 (before KRDI involvement) to community improvements in 2006 (after KRDI project implementation). A. Health 3 Health Centers were implemented by KRDI in 2006 (Health centre in Ujmisht , Surroj, and Orgjost) Nr. Health Center Unit Outcome/Impact Construction Project Indicators Situation at the Situation at the Change end of 2005 end of 2006 1 Number of Villages in the District # 9 12 +3 with Health Centers 2 Number of Families benefiting # 1686 2081 +395 from proximity of health centers 3 Number of women using local # 2026 2124 +98 health centers 4 Number of child patients # 31 57 +26 attended 5 The average distance to travel to km 0.5 0.4 -0.1 the nearest health center 6 Number of vaccinations provided # 2883 5150 +2267 7 Number of health specialists # 33 39 +6 working in rural communities B. -

Plani I Menaxhimit Te Integruar Te Mbetjeve, Bashkia Kuke S 2016 - 2020 Shkurt 2016

PLANI I MENAXHIMIT TE INTEGRUAR 4 TE MBETJEVE, BASHKIA KUKE S 2016 - 2020 SHKURT 2016 PLANI I MENAXHIMIT TE INTEGRUAR TE MBETJEVE, BASHKIA KUKE S 2016 - 2020 SHKURT 2016 1 2 Tabela e përmbajtjes MIRËNJOHJE .................................................................................................................................... 9 SHKURTIME .................................................................................................................................... 10 MESAZHI I KRYETARIT ............................................................................................................ 11 PËRKUFIZIME ................................................................................................................................ 12 I. KUADRI I ZHVILLIMIT PLANIT TË MENAXHIMIT TË INTEGRUAR TË MBETJEVE ...................................................................................................................................... 16 II. HYRJE ................................................................................................................................... 17 2.1 METODOLOGJIA E PËRGATITJES SË PMIM-SË ........................................................ 17 2.2 ÇFARË ËSHTË PMIM ................................................................................................................ 18 2.3 KOSTO MBI BAZË AKTIVITETI ............................................................................................. 19 2.4 INTEGRIMI I PMIM-SË ME DOKUMENTET STRATEGJIKE .................................. -

Annual Report 2017

Organization: "Different & Equal" ANNUAL REPORT 2017 D&E Vision: “We believe in a society without trafficking, exploitation, abuse or discrimination where everyone’s rights are respected and they are free to pursue opportunities equally” Support Advocacy for policy- makers Mentoring Alternative Activities care for for income children generation Commitment to the Studies / community Research Community Free Services legal service Residential services Staff training 2 I am S, At first we were happy. We met in Greece and everything between us was wonderful. Then, when I was pregnant and when I thought I would experience the most beautiful emotions, in anticipation of the first child, my life was overwhelmed and agitated. He became violent and very dangerous. He beated, offended, and exploited me while I was pregnant. He forced me to work in a nightclub and to go with clients. For years, I lived with violence, threats and closed. Even when the second child came, the third ... nothing changed, he began to abuse them too. He behaved badly; he did not like us, and left us without bread. I worked but he always took my money. I was afraid and I hadn’t support by anyone until someone gave me a hand and offered protection for me and the children. Now I'm here, helped by the organization that brought me back to life, while he is where he deserves to be, in jail! Now, I feel safe! Whatever happens, I will never give up, never! S. 3 Content I. Projects implemented during January - December 2017 and donors.............................5 II. Program Beneficiaries..................................................................................................6 Case profile victims / potential victims of trafficking ………………….……..…7 Case profile victims of abuse and domestic violence ……….………………....16 III. -

Kukes Regional Development Initiative.Pdf

A Difference in the Making: An Independent Evaluation of the Kukes Regional Development Initiative Community Infrastructure Project Acknowledgements This report was prepared by Jonuz Kola, Executive Director of VMA-Kukes. The information gathered from interviews and group discussion was processed by: Avni Germizi and Ramiz Spahiu. Translation of the material and text was provided by Elida Cenaj. The interviews and focus group discussions were conducted by the staff of`“VMA-Kukes” as follows: Avni Germizi, Aida Mucmata, Ramiz Spahiu, Klodiana Pacara, Riza Ademi, Neritan Muja, Violeta Cengu, Izet Ademaj, Agron Bytyci, Osman Cengu, Shpresa Kastrati. Pre-survey training was given by the UNDP-Albania Local Governance Programme Staff: Natasha Mistry and Eva Martiri. We thank all those who participated actively in group discussions and all those who devoted their time during interviews. Throughout this report, quotes are given of the beneficiaries to further illustrate the results of the project; these are the voices that matter most. A special thanks goes to the staff of UNDP, who spent their time to create necessary facilities and who did not intervene in our work, thereby allowing us to conduct a realistic evaluation of the Project. Kukes, 10/12/2005 Victims of Mines & Weapons Association - Kukes Tel/Fax 0242 4006, Mobile: 0682070905, E mail: [email protected] 1 Table of Contents 1. Executive Summary 3 2. Background to the Assessment 4 2.1 Summary of KRDI’s Objective and Activities 4 2.2 Tripartite Review and Recommendations for the Assessment 4 3. Scope of the Assessment and Methodologies Used 4 3.1 Rationale 4 3.2 Scope and Model 4 3.3 Methodology 5 3.3.1 Phase 1: Training of VMA 5 3.3.2 Phase 2: Field Interviews 5 3.3.3 Phase 3: Focus Group Discussions 6 4. -

Lejet Minerare Update Janar 2020

Nr Nr. Leje Date Emri i subjektit Nipt Bashkia Emertimi i vendburimit Lloji i Mineralit S=km2 1 126/1 11.01.1995 Kumega shpk J68118904D Mat Dukagjin, Rrethi Mat Kuarc 0,006 2 223/1 25.02.2016 Oskeola shpk.(Ish Kuarci- Bllacë shpk) K81407085C Pukë Vrith, Pukë Krom 0.027 3 226 26.12.1995 Inerto Beton shpk J64228817E Sarandë Lukovë Sarandë (Gur gëlqeror) Gur gëlqeror 0.1820 4 232/1 10.02.2016 MineralInvest sh.p.k (ish Lahaze) L32009020I Tropojë Maja e Gjate 2 Krom 0,01 5 234/1 05.11.2015 Bledi shpk K36811904G Tropojë Qafe Prushit 3 Krom 0.019 6 253 01.04.1996 XHIRETON shpk J71909005P Bulqizë Mali Lopes Krom 0,045 7 276 15.05.1996 OFMAN shpk J68117219D Kukës Bria e Minit, afer Surroj-t Krom 0,0007 8 297/1 24.06.1996 MALI shpk K82916504G Tropojë Per minieren e Ragam 2 Krom 0.02 9 349/1 12.10.2016 Bl- Arsi sh p k (Ish ALBA shpk) L39413601P Tropojë Objekti Kallmisht Krom 0.012 10 355/1 14.10.2016 Selenice Bitumi K16815202M Selenicë Selenice Bitum, Zhavor Bituminoz 1.543 11 390/1 22.01.1998 ROMSI shpk J86510257N Selenicë Vidhat e Haxhiut Zhavor Bituminoz 0,099 12 413 27.05.1998 FLORIDA shpk J79602604P Has Qafe Prush 5 Krom 0,015 13 442 19.02.1999 Afrimi-K Shpk (Ish FLORIDA shpk) K07713216Q Tropojë Maja e Lajthizes Krom 0,072 14 447/1 19.02.1999 Besjana Sh.p.k K07729915P Klos Qafe e Burrelit Krom 0,076 15 450/1 24.02.1999 KURTI shpk K07729906Q Dibër Vanas Krom 0,02 16 458/4 19.03.1999 ATEANI MINING shpk L88520901F Bulqizë Liqeni I Sopeve Z= +1680 e poshte Krom 1.691 17 459/1 26.03.1999 LESHNICA shpk K67617205B Kukës Leshnice Krom 0,015 18 463 08.04.1999 -

Zonat E Implementimit Të Ujësjellësave (Pdf)

352*5$0,,8-É6-(//É6$9(585$/É =21$7(,03/(0(17,0,77É8-É6-(//É6$9( Vermosh /HSXVKs 6HOFs dHUHP %UDGRVKQLFs .sUUQDMs 6KNsO]HQ 9XNsO 1LNo Myhejan 9DOERQs 7DPDUs Papaj %DVKNLD75232-É Gegaj Kozhnje %XoDM Ragam )VKDWUDW 7URSRMD)VKDW9LoLGRO0HMGDQ.RMHO6KSDW.RMHO)XVKs6KXPLFs%DELQs Broje Theth Dragobi Kasaj .RYDo Manastirec 7URSRMs)VKDW 6KXMLFs$KPDWDM Shoshan 3RSXOOVLDEDQRUs Rapsh-Starje Markaj %DELQs Begaj .RoDQDM M.MADHE Margegaj Sopot Paqe 9LoLGRO %RJs Kastrat Vrith Vlera Investimit - 2,150,000 EUR Qerecmulaj Bajram Curri Hot 5Us]s0DOL &XUUDML6LSsUP )XVKs/XPs 1GsUO\VDM 6 -DKR6DOLKL &HUQLFs Llugaj Dojan Bratosh 5RVXMs %OODWs *RUDM%XGLVKs Koordinatat - X = 431830.17; Y = 4694865.31 %XNRYs =KHUNs Lekaj Bujan Gri e Re Gimaj Betosh 9/X]Ks Vlad 9Xo.XUWDM Abat Gjonpepaj &XUUDML3RVKWsP Lekurtaj Vukpalaj Gri Prush Plan 1LFDM6KDOs %]KHWs Selimaj %]KHWs0DNDM 6KsQJMHUJM 1sQPDYULT Peraj TROPOJE Zogaj Pecaj Pac Ivanaj Peraj Gjuraj Letaj =JMHo Zagore %DVKNLD/(=+É Lekbibaj dRUU9HODM Dedaj %UHJOXPs Kepenek Jaran Tetaj Lotaj Vuksanaj 6DOFs 0JXOOs Pog Dushaj Premal Aliaj 'REUXQs )LHU]s4\WHW Tpla /RKsH6LSsUPH 'HJs Repisht Kam Qytet Qarr Gradec 3DOos %ULVs Pjetroshan Nicaj-Shosh )VKDWUDW .DOOPHWL0DGKGKH.DOOPHWL9RJsO 5Ho %\W\o Ndrejaj $SUULSs 0DVKs Perollaj Xhan .DPLFs)OODNs /RKsH3RVKWPH 4DIs*UDGs Leniq .RNGRGs )LHU]s %HULVKs 0sUWXU Vlahen .RSOLNL6LSsUP Golaj Nikoliq Bugjon -XELFs Koplik 3RUDYs Kokpapaj Kir Pepsumaj %UDVKWs 3RSXOOVLDEDQRUs Vajush Palaj Kurt-Kurtaj %HULVKsH6LSsUPH Miliska HASI 6WsUEHT %RJLo3DOYDU Helshan 6HUPs %UXoDM 9LVKRos Kalldrun 0sVKTHUUs Kostur