The Global Diamond Report 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ШОС Справочник Делегата МСК 20-23.08 ENG.Indd

DELEGATE HANDBOOK MEETING OF THE COUNCIL OF NATIONAL COORDINATORS OF THE SCO MEMBER STATES MOSCOW, RUSSIAN FEDERATION 20–23 AUGUST, 2019 CONTENTS 1. Meeting dates and venue . .3 2. Meeting programme . .3 3. Access to meeting . 4 3.1. ID Badges . .4 3.2. Summary of Access Procedures . .4 3.3. Lost Badges . .4 4. Meeting facilities . 4 4.1. SCO Information Desk . .4 4.2. Wi-Fi . .4 5. General information . 4 5.1. Weather . .4 5.2. Time . .4 5.3. Electricity . .4 5.4. Smoking . .5 5.5. Credit cards . .5 5.6. Currency and ATMs . .5 5.7. Mobile phone information . .5 5.8. Pharmacies . .5 5.9. Souvenir shops . .5 5.10. Shoe repairs . .6 6. Useful telephone numbers . 6 7. City information . 6 8. Restaurants . 9 9. Venue plan . 9 MOSCOW | 20–23 AUGUST 2 1. MEETING DATES AND VENUE The meeting of the Council of National Coordinators of the SCO Member States will be held on 20–23 August 2019 in Moscow. Meeting venue: THE RITZ-CARLTON HOTEL, MOSCOW 3, Tverskaya str., Moscow, 125009 www.ritzcarlton.com/ru/hotels/europe/moscow 2. MEETING PROGRAMME 20 August, Mon The meeting of the Council of National Coordinators of the SCO 09:30–18:00 Member States 09:00 Delegates arrival 11:00–11:15 Coff ee-break 13:00–14:30 Lunch 16:00–16:20 Coff ee-break 21 August, Tue The meeting of the Council of National Coordinators of the SCO 09:30–18:00 Member States 09:00 Delegates arrival 11:00–11:15 Coff ee-break 13:00–14:30 Lunch 16:00–16:20 Coff ee-break 18:30 Reception on behalf of the Special Presidential Envoy for SCO Aff airs in honourмof the participants in the Council of National Coordinators meeting Cultural programme 22 August, Wed The meeting of the Council of National Coordinators of the SCO 09:30– 18:00 Member States 09:00 Delegates arrival 11:00–11:15 Coff ee-break 13:00–14:30 Lunch 16:00–16:15 Coff ee-break 23 August, Thu The meeting of the Council of National Coordinators of the SCO 09:30– 18:00 Member States 09:00 Delegates arrival 11:00–11:15 Coff ee-break 13:00–14:30 Lunch 16:00–16:15 Coff ee-break 16:15–18:00 Signing of the fi nal Protocol MOSCOW | 20–23 AUGUST 3 3. -

Cut Shape and Style the Diamond Course

Cut Shape and Style The Diamond Course Diamond Council of America © 2015 Cut Shape and Style In This Lesson: • The C of Personality • Optical Performance • The Features of Cut • The Round Brilliant • Classic Fancy Shapes • Branded Diamond Cuts • Shape, Style, and Cost • Presenting Cuts and Brands THE C OF PERSONALITY In the diamond industry the term “cut” has two distinct meanings. One is descriptive. It refers to the diamond’s shape and faceting style. The other relates to quality, and includes proportions, symmetry, and polish. Most customers are familiar with only the first meaning – cut shape and style. That’s the aspect of All sorts of cutting shapes are cut you’re going to examine in this lesson. The next possible with diamonds. lesson explores the second part of this C. For many customers, cut shape and style is part of their mental image of a diamond. Shape contrib- utes to the messages that a diamond sends about the personality of the one who gives or wears it. When presenting this aspect of cut, you need to match the images and messages of the diamonds you show with the customers you serve. With branded diamond cuts, you may need to explain other elements that add appeal or value. When you’ve accomplished these objectives you’ve taken an important step toward closing the sale. The Diamond Course 5 Diamond Council of America © 1 Cut Shape and Style Lesson Objectives When you have successfully completed this lesson you will be able to: • Define the optical ingredients of diamond’s beauty. • Describe diamond cuts in understandable terms. -

Changing Experiences

Considered the central square of Moscow, the Red Square is one of Russia’s most vibrant public spaces and was the location of the country’s most important historical and political events since the 13th century. PABLO1980 / CONTRIBUTOR / SHUTTERSTOCK.COM A Visit to Woman Catherine of the the Great’s World With women-centric travel by Jennifer Eremeeva skyrocketing, one female-run, female-only travel company is offering the chance for life- Russia changing experiences. By Angela Caraway-Carlton 90 • l’hiver 2019 • readelysian.com readelysian.com • l’automne 2019 • 91 Aerial view of the Winter Palace and Aleksandr Column in Palace Square as seen through the triumphal chariot, a symbol of military glory, beyond ascertaining which languages she faith. Russia had weathered a 200-year atop the arch of the General Staff Building. could speak. This was less of a concern DROZDIN VLADIMIR / SHUTTERSTOCK.COM occupation by the Tatar Mongols, and the than her ability to give birth to an heir. Had civilizing influences of the Renaissance and Elizabeth inquired, she might have learned Reformation had passed the country by. that Princess Sophia was unusually bright In the subsequent two centuries, there had and well trained by a dedicated governess been frequent violent uprisings, civil strife who had honed and developed Sophia’s and numerous succession crises. Catherine the Great, portrait painting keen mind and natural curiosity, instilling in profile by Fyodor Rokotov, 1763. Sophia was following in the footsteps in Sophia rigorous study habits that would of another Princess Sophia who had left serve the princess well in the years to come. -

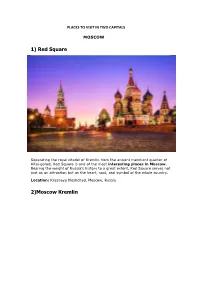

1) Red Square 2)Moscow Kremlin

PLACES TO VISIT IN TWO CAPITALS MOSCOW 1) Red Square Separating the royal citadel of Kremlin from the ancient merchant quarter of Kitai-gorod, Red Square is one of the most interesting places in Moscow. Bearing the weight of Russia’s history to a great extent, Red Square serves not just as an attraction but as the heart, soul, and symbol of the whole country. Location: Krasnaya Ploshchad, Moscow, Russia 2)Moscow Kremlin If all the attractions serve as members of the city, then Moscow Kremlin serves as the home in which all these tourist sites reside. Encompassing of almost all the famous sightseeing attractions, the royal residence of the President of Russia, the Moscow Kremlin is undoubtedly one of the best places to visit in Moscow. Offering breathtaking views of River Moskva and located at the heart of the city, it is a must for everyone to explore this fortified complex once in their lifetime. Location: Moscow, Russia, 103073 Timings: Friday to Wednesday – 10 AM to 5 PM; Closed on Thursday 2) VDNKh What Pragati Maidan is to Delhi, VDNKh is for Moscow. Being one of the popular Moscow sightseeing places, VDNKh or Vystavka Dostizheniy Narodnogo Khozyaystva is a grand trade and exhibition center in Moscow that assures the travelers an experience like none other. Home to numerous palaces, fountains, architectural marvels, arches, and pavilions, there will never be a dull moment on your visit to VDNKh during your trip to Moscow. Location: Prospekt Mira, 119, Moskva, Russia, 129223 Timings: Monday to Sunday – 24 Hours 4.Ostankino Tower Standing tall at a height of 1,772 feet, Ostankino Tower is famous for being the only free-standing structure in the whole of Europe. -

Trans Hex Group Limited Valuation of Mineral Assets Project Number JB009790 September 2016

Trans Hex Group Limited Valuation of Mineral Assets Trans Hex Group Limited Valuation of Mineral Assets Project Number JB009790 September 2016 Final 12 September 2016 Page 1 of 181 Trans Hex Group Limited Valuation of Mineral Assets OFFICE LOCATIONS This report has been prepared by Snowden Mining Industry Consultants Pty Limited (Snowden) for exclusive use by Trans Hex Group Limited pursuant to the Scope of Services contemplated and Perth agreed between Snowden and Trans Hex Group Limited. Snowden Level 6, 130 Stirling Street makes no representation or warranty as to the suitability of the Perth WA 6000 contents of this report for any third party use or reliance and AUSTRALIA Snowden denies any liability for any such third party reliance Tel: +61 8 9213 9213 (whether in whole or in part) on the contents of this report. ABN: 99 085 319 562 [email protected] 2016 Brisbane All rights are reserved. No part of this document may be reproduced, stored in a retrieval system, or transmitted in any form 104 Melbourne Street South Brisbane QLD 4101 or by any means, electronic, mechanical, photocopying, recording AUSTRALIA or otherwise, without the prior written permission of Snowden. Tel: +61 7 3026 6666 Fax: +61 7 3026 6060 ABN: 99 085 319 562 [email protected] Prepared by: VN Agnello BSc Geo (Hons), M Eng (Min Econ), Pr.Sc.Nat, MGSSA, MSAIMM Johannesburg Senior Consultant – Corporate Technology House, Greenacres Services Office Park, Cnr. Victory and Rustenburg Roads, Victory Park Reviewed by: WF McKechnie Johannesburg 2195 BSc Geo (Hons), Pr.Sci.Nat., SOUTH AFRICA FGSSA, MSAIMM PO Box 2613, Parklands 2121 General Manager - EMEA SOUTH AFRICA Tel: +27 11 782 2379 Fax: +27 11 782 2396 Reg. -

Western Russia: Inside Treasures & Traditions July 13-24, 2017 Get to Know Western Russia from an Insider’S Perspective

The Women’s Travel Group presents Western Russia: Inside Treasures & Traditions July 13-24, 2017 Get to know Western Russia from an insider’s perspective. Explore the classic sites, such as Red Square and the Amber Room at Catherine’s Palace, but also enjoy lunch in a Soviet-style café, and visit ancient towns and early churches in Russia’s Golden Ring. Learn from an expert about Soviet life, perestroika and the transition to capitalism. Come away feeling like you’ve caught a glimpse of Russia’s soul. Program Highlights • By special arrangement, peruse the Kremlin’s glittering Diamond Fund. • Enjoy a private tour and tasting of double-distilled vodkas at the Cristall vodka museum. • Attend performances at world-renowned theaters in both Moscow and St. Petersburg. • Visit Suzdal’s UNESCO-listed Savior Monastery of St. Euphinius, founded in 1352. • Discover Sergiev Posad, center of wooden toy making in Russia. • Visit the Fabergé museum, boasting the largest collection of Fabergé eggs in the world. • Drive out of St. Petersburg for a quintessential Russian dacha experience. • Attend a ballet master class to appreciate first-hand the high level of artistry in Russian dance. Overview Day 1: Arrive Moscow, Russia Days 2-4: Moscow Day 5: Moscow • drive to Suzdal Day 6: Suzdal • drive to Sergiev Posad For Reservations & Information Day 7: Sergiev Posad • drive to Moscow • train to St. Petersburg MIR Corporation Days 8-11: St. Petersburg Tel: 855-691-7903 • Fax: 206-624-7360 Day 12: Depart St. Petersburg Email: [email protected] • www.mircorp.com Western Russia: Inside Treasures & Traditions Day by Day Itinerary Day 1 Arrive Moscow, Russia Arrive in Moscow and transfer to a centrally located hotel to rest and relax. -

Summer 2001 Gems & Gemology Gem News

GEM NEWS International EDITOR Brendan M. Laurs ([email protected]) CONTRIBUTING EDITORS Emmanuel Fritsch, IMN, University of Nantes, France ([email protected]) Henry A. Hänni, SSEF, Basel, Switzerland ([email protected]) Kenneth Scarratt, AGTA Gemological Testing Center, New York ([email protected]) Karl Schmetzer, Petershausen, Germany James E. Shigley, GIA Research, Carlsbad, California ([email protected]) Christopher P. Smith, Gübelin Gem Lab, Lucerne, Switzerland ([email protected]) DIAMONDS Diamonds in Canada: An update. In 1991, Canada’s Northwest Territories (NWT) was catapulted into the Royal Asscher cut. Amsterdam’s Royal Asscher Diamond world spotlight with the discovery of diamond-bearing Co., cutters of the Cullinan diamond, recently debuted kimberlites in the Lac de Gras area of the Slave the Royal Asscher cut (figure 1) at the JCK show in Las Geological Province (see, e.g., A. A. Levinson et al., Vegas. The original Asscher cut (patented in 1902) was a “Diamond sources and production: Past, present, and squarish diamond with large corners, a high crown, a future,” Winter 1992 Gems & Gemology, pp. 234–254). small table, and a deep pavilion (see, e.g., p. 165 of the Fall Success has been swift, with several major developments 1999 issue of Gems & Gemology). With 74 facets and a in the last 10 years. The Ekati mine started production in more geometric look, the Royal Asscher still retains the 1998 (see, e.g., Winter 1998 Gem News, pp. 290–292), and distinctive appearance of its predecessor. Both loose the Diavik project is scheduled to begin production in stones and a Royal Asscher cut diamond jewelry line are 2003 (see the following entry by K. -

"RICI" Commodity Fund Ltd. Registered 12-Jun-2008 1620824 100 Acre Digital Asset Offshore Fund, Ltd

List of Mutual Funds Cayman Islands Monetary Authority P.O. Box 10052 171 Elgin Avenue, SIX Cricket Square Grand Cayman, KY1-1001 CAYMAN ISLANDS Licence # Mutual Fund Name Registration Type Licence Date 15279 "RICI" Commodity Fund Ltd. Registered 12-Jun-2008 1620824 100 Acre Digital Asset Offshore Fund, Ltd. Registered 03-Apr-2020 1337361 1060 Capital Opportunity Fund, Ltd. Registered 01-Jan-2017 1612645 11 Capital Master Fund LP Master Fund 21-Feb-2020 1612601 11 Capital Offshore Fund Ltd Registered 21-Feb-2020 583634 12 West Capital Fund Ltd Registered 30-Sep-2011 649736 12 West Capital Offshore Fund LP Master Fund 22-Feb-2013 1637226 140 Summer Partners Master Fund LP Master Fund 05-Jun-2020 1637204 140 Summer Partners Offshore Ltd. Registered 05-Jun-2020 1629865 162 SPC Registered 21-Apr-2020 1613614 1798 Adapt Fund Ltd Registered 28-Feb-2020 1613673 1798 Adapt Master Fund Ltd Master Fund 28-Feb-2020 1343915 1798 Bear Convexity Master Fund Ltd Master Fund 31-Jan-2017 1304741 1798 Center Master Fund Ltd Master Fund 30-Jun-2016 1322580 1798 Credit Convexity Fund Ltd Registered 27-Sep-2016 1322591 1798 Credit Convexity Master Fund Ltd Master Fund 27-Sep-2016 1343904 1798 Event Convexity Fund Ltd Registered 31-Jan-2017 14237 1798 Fundamental Strategies Fund Ltd Registered 16-Nov-2007 1514601 1798 Q Fund Ltd Registered 31-Oct-2018 1514634 1798 Q Master Fund Ltd Master Fund 31-Oct-2018 1471422 1798 TerreNeuve Fund Ltd Registered 29-Mar-2018 1481992 1798 TerreNeuve Master Fund Ltd Master Fund 29-Mar-2018 6845 1798 UK Small Cap Best Ideas Fund Ltd Registered 08-Aug-2003 1563461 1798 US Consumer Fund Ltd Registered 01-Aug-2019 1563531 1798 US Consumer Master Fund Ltd Master Fund 01-Aug-2019 1278351 1798 Volantis Catalyst Fund II Ltd Registered 15-Feb-2016 633566 1798 Volantis Catalyst Fund Ltd Registered 23-Jul-2012 5584 1798 Volantis Fund Ltd Registered 02-May-2002 1438393 17K South Cayman, LLC Registered 28-Sep-2017 4325 1818 Master Partners, Ltd. -

Moscow Bolshoi Ballet Break

For Expert Advice Call A unique occasion deserves a unique experience. 01722 744 695 https://www.weekendalacarte.co.uk/special-occasion-holidays/destinations/russia/moscow-bolshoi-ballet-break/ Moscow Bolshoi Ballet Break Break available: Year round (August RAMT not Highlights Bolshoi performing) 3 Night Break Who can resist a trip to Moscow to attend an evening at the ● Best Seats at the Bolshoi Ballet Bolshoi Ballet, arguably the best Ballet company in the world, in ● Kremlin private tour including the Diamond fund the very best seats? Combine this with private tours around the ● Visit the amazing Moscow Metro with private guide city with your own guide sharing Moscow's highlights and you ● Private Airport Transfers have a fascinating cultural city break lined up for you. Do not ● Private City Tour including The Red Square ● underestimate how hard it is to travel around Moscow and the River Tour seeing Kremlin Skyline, Saint Basil's Cathedral benefit of a private guide for easing your visit, as well as of course and the Convent Novodevichy sharing all their knowledge on Moscow and its history. Day by Day Itinerary Day 1Fly to Moscow and start your Moscow City Break with a river tour seeing Saint Basils Cathedral, Kremlin and the Convent Novodevichy On arrival for your Moscow city break a private driver will pick you up at the airport and transfer you to your hotel. During a late afternoon river tour you will pass the major sites of St. Sophia Cathedral, St Basils, and the panorama of the Kremlin walls. page 1/5 Day 2Private Moscow Metro and Private City Tour including Red Square, Ballet at the Bolshoi Theatre It may seem a strange recommendation but the Moscow Metro is a must see on your holiday and we will organise a tour with your private guide. -

Mohsen Manutchehr-Danai Dictionary of Gems and Gemology Mohsen Manutchehr-Danai

Mohsen Manutchehr-Danai Dictionary of Gems and Gemology Mohsen Manutchehr-Danai Dictionary of Gems and Gemology 2nd extended and revised edition With approx. 25 000 entries, 1 500 figures and 42 tables Author Professor Dr. Mohsen Manutchehr-Danai Dr. Johann-Maier-Straße 1 93049 Regensburg Germany Library of Congress Control Number: 2004116870 ISBN 3-540-23970-7 Springer Berlin Heidelberg New York This work is subject to copyright. All rights are reserved, whether the whole or part of the material is concerned, specifically the rights of translation, reprinting, reuse of illustrations, recitations, broadcasting, reproduction on microfilm or in any other way, and storage in data banks. Duplica- tion of this publication or parts thereof is permitted only under the provisions of the German Copy- right Law of September 9, 1965, in its current version, and permission for use must always be ob- tained from Springer. Violations are liable to prosecution under the German Copyright Law. Springer is a part of Springer Science+Business Media springeronline.com © Springer-Verlag Berlin Heidelberg 2005 Printed in Germany The use of general descriptive names, registered names, trademarks, etc. in this publication does not imply, even in the absence of a specific statement, that such names are exempt from the relevant protective laws and regulations and therefore free for general use. Cover design: Erich Kirchner, Heidelberg Typesetting: Camera ready by the author Production: Luisa Tonarelli Printing and binding: Stürtz, Würzburg Printed on acid-free paper 30/2132/LT – 5 4 3 2 1 0 Preface to the Second Edition The worldwide acceptance of the first edition of this book encouraged me to exten- sively revise and extend the second edition. -

Winter in Moscow & St Petersburg

WINTER IN MOSCOW & ST PETERSBURG JANUARY 6-20, 2019 TOUR LEADER: MICHAEL CARR WINTER IN MOSCOW Overview & ST PETERSBURG Experience the wonders of Moscow and St Petersburg – two vastly different cities – against the back drop of winter and Orthodox Christmas, Tour dates: January 6-20, 2019 when twinkling lights and snow turn Red Square and the Kremlin into a winter wonderland and St Petersburg’s beauty is at its most delightful. Tour leader: Michael Carr This tour explores the art, history and culture of Russia when the galleries and museums are less crowded and during a season that has a special Tour Price: $10,795 per person, twin share place in Russian culture, permeating its literature, performing arts and national identity. Single Supplement: $1,675 for sole use of double room Our 15-day residential-style tour starts in Moscow, the heart of Old Russia, the city of the Tsars before Peter the Great, centre of the Russian Booking deposit: $500 per person Orthodox Church and the capital since the Russian Revolution. We then travel to St Petersburg, founded by Peter the Great, arguably Russia’s Recommended airline: Emirates AIrlines greatest ruler, to rival the great capitals of western Europe. Its European style and elegance are reflected in the architecture, culture and grand Maximum places: 20 palaces built by Peter and championed by Catherine the Great. Itinerary: Moscow (7 nights), St Petersburg Throughout the tour, we visit a range of museums and galleries, including (7 nights) the Great Armory Collection, State Diamond Fund and Tretyakov Gallery in Moscow. We also see some of Moscow’s leading contemporary art galleries, the hub of new Russian art, where we will be greeted by senior Date published: March 26, 2018 curators and dealers. -

THE GLOBAL DIAMOND INDUSTRY Lifting the Veil of Mystery This Work Was Commissioned by AWDC and Prepared by Bain

THE GLOBAL DIAMOND INDUSTRY Lifting the Veil of Mystery This work was commissioned by AWDC and prepared by Bain. This work is based on secondary market research, analysis of financial informa- tion available or provided to Bain & Company and AWDC, and a range of interviews with customers, competitors and industry experts. Bain & Company and AWDC have not independently verified this information and make no representation or warranty, express or implied, that such information is accurate or complete. Projected market and financial information, analyses and conclusions contained herein are based (unless sourced otherwise) on the information described above and on Bain & Company’s and AWDC’s judgment, and should not be construed as definitive forecasts or guarantees of future performance or results. Neither Bain & Company nor AWDC nor any of their subsidiaries or their re- spective officers, directors, shareholders, employees or agents accept any responsibility or liability with respect to this document. This document is copyright Bain & Company, Inc. and AWDC and may not be published, copied or duplicated, in whole or in part, without the written permis- sion of Bain and AWDC. Copyright © 2011 Bain & Company, Inc. and Antwerp World Diamond Centre private foundation (AWDC) All rights reserved Diamond Industry Report 2011 | Bain & Company, Inc. Contents Note to readers..................................................................................................1 1. Introduction to diamonds.....................................................................................3