Directors' Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Di Grande Risparmio Su Ortofrutta, Carne, Pesce, Gastronomia, Pane E

* . di grande risparmio su ortofrutta, carne, 14 pesce, gastronomia, GIORNI pane e pasticceria. Extracoop. ed Ipercoop Coop, Supermercati nei garantiti minimi sconti gli rappresentano indicate percentuali Le E nei weekend 21-22-23* e 28-29-30* maggio arrivano SPECIALISSIMI con o erte fresche fresche da non perdere. *per i negozi aperti 21-22-23 MAGGIO MOZZARELLA MACINATO SCELTO SC , LATTE DI BOVINO ADULTO PUGLIESE ORIGINE COOP CAPURSO , confezione 600 g -% , take away, 500 g , al kg , SC al kg MOSCARDINI SC C ONFEZIONE SC al kg PASTE FRESCHE vari gusti Paneenuto fresco da o o pane parzialmente o surgelatoenuto co da o o pane crudo surgelato o decongelato: care da verifi nel singolo punto vendita. , , SC_ SC_ Le percentuali indicate rappresentano gli sconti minimi garantiti nei Supermercati Coop, Ipercoop ed Extracoop. 28-29-30 MAGGIO INSALATA DI MARE SC FUSI 850 g SC , take away, 1 kg O SOVRACOSCE 950 g DI POLLO ORIGINE COOP , confezione maxi. -% , Esempio: fusi 850 g , al kg SC CUORE DI MERLUZZO SC MELONE RETATO NORDICO sfuso, al kg al kg , , SC_ Le percentuali indicate rappresentano gli sconti minimi garantiti nei Supermercati Coop, Ipercoop ed Extracoop. SALAME PAESANO I GUSTOSI SC SA.VEN so ovuoto, take away, 350 g , , al kg PROSCIUTTO COTTO SC SPECK DELL'ALTO SC SCELTO ADIGE IGP SENFTER al taglio, al kg , al taglio, al kg , BRESAOLA DI BOVINO SC ANGUS GARDANI al taglio, al kg , LASAGNE DI CARNE SC STRACCHINO SC al kg BIANCADE , 170 g , , al kg SC_ SC_ Le percentuali indicate rappresentano gli sconti minimi garantiti nei Supermercati Coop, Ipercoop ed Extracoop. -

Cas N° COMP/M.6242 - LACTALIS/ PARMALAT

FR Cas n° COMP/M.6242 - LACTALIS/ PARMALAT Le texte en langue française est le seul disponible et faisant foi. REGLEMENT (EC) n° 139/2004 SUR LES CONCENTRATIONS Article 6, paragraphe 1, point b) NON-OPPOSITION date: 14/06/2011 En support électronique sur le site Internet EUR-Lex sous le numéro de document 32011M6242 Commission européenne, B-1049 Bruxelles / Europese Commissie, B-1049 Brussel - Belgium. Telephone: (32-2) 299 11 11. COMMISSION EUROPÉENNE Bruxelles, le 14/06/2011 C(2011) 4278 Dans la version publique de cette décision, des informations ont été supprimées conformément VERSION PUBLIQUE à l'article 17 (2) du règlement du Conseil (CE) n° 139/2004 concernant la non-divulgation des secrets d'affaires et autres informations confidentielles. Les omissions sont donc indiquées par [...]. Quand cela était possible, les informations omises ont été remplacées par des PROCÉDURE DE CONTRÔLE DES fourchettes de chiffres ou une description OPÉRATIONS DE CONCENTRATION générale. A la partie notifiante: Madame, Monsieur, Objet: Affaire n COMP/M.6242 - LACTALIS/ PARMALAT Décision de la Commission en application de l’article 6(1)(b) du règlement (CE) n°139/2004 du Conseil1 1. Le 4 Mai 2011, la Commission européenne a reçu notification, conformément à l’article 4 du règlement sur les concentrations, d’un projet de concentration par lequel Groupe Lactalis ("Lactalis", France), contrôlé par BSA S.A., (France), acquiert au sens de l'article 3, paragraphe 1, point b), du règlement sur les concentrations, le contrôle de l'ensemble des activités de l'entreprise Parmalat S.p.A ("Parmalat", Italie) par achat d'actions à hauteur de 28.97% du capital de Parmalat et offre publique d'achat annoncée le 26 avril 2011. -

ACS 2018 Judging & Competition Awards

ACS 2018 Judging & Competition Awards Listed in order of presentation at the ACS Awards Ceremony on Friday, July 28, 2018 R. BUTTERS Whey Butter, Salted Butter, Sweet Butter, Cultured Butter, etc. RC: Salted Butter with or without cultures - made from cow's milk 3rd Cultured Butter COWS CREAMERY, Prince Edward Island COWS CREAMERY 2nd Gray Salt Butter Cherry Valley Dairy, Washington Blain Hages 1st Lightly Salted Cultured Butter Vermont Creamery, Vermont Vermont Creamery Butter Team RO: Unsalted Butter with or without cultures - made from cow's milk 3rd Brethren Butter Amish Style Handrolled Unsalted Butter Graf Creamery Inc., Wisconsin Roy M. Philippi 2nd Lactantia Premium Cultured salted butter Parmalat Canada, Ontario Winchester Butter Team 1st Unsalted Cultured Butter Cherry Valley Dairy, Washington Blain Hages RM: Butter with or without cultures - made from goat's milk 2nd Celebrity Goat’s Milk Butter Atalanta Corporation/Mariposa Dairy, Ontario Pieter vanOudenaren Q. CULTURED MILK AND CREAM PRODUCTS Limited to Buttermilk, Yogurt, Sour Cream, Crème Fraiche, Kefir, Labneh, etc. QF: Crème Fraiche and Sour Cream Products - made from cow's milk 3rd Crème Fraiche Bellwether Farms, California Liam Callahan 2nd Cabot Sour Cream Cabot Creamery Cooperative, Vermont Team Cabot Creamery 1st Alouette Crème Fraȋche Savencia Cheese USA, Pennsylvania Team New Holland QK: Kefir, Drinkable Yogurt, Buttermilk, and Other Drinkable Cultured Products - all milks 3rd Karoun Whole Milk Kefir Drink Karoun Dairies Inc, California Jaime Graca 1st Fresa Drinkable -

ANALYST PRESENTATION Star Conference 2016 London, October

ANALYST PRESENTATION Star Conference 2016 London, October 6th 2016 Business combination through the merger by incorporation of Centrale del Latte di Firenze Form and terms for the transaction From September, the 30th the merger by incorporation of CLF in CLT has taken effect. TERMS FOR THE TRANSACTION Exchange Rate n. 1 new ordinary share of CLT for 6.1965 ordinary CLF shares; CLT has increased its share capital from Euro 20,600,000 to 28,840,041.20 by issuing 4,000,020 new ordinary shares; Further to the merger, CLT has changed the name in CENTRALE DEL LATTE D’ITALIA S.p.A. and the ordinary shares are still listed on the MTA STAR segment organized and managed by Borsa Italiana S.p.A. (Alphanumeric Code: CLI ); Immediately after the effectiveness of the merger, CLI has transferred the firm CLF at the value of 24,780,000 Euro into a new company 100% subsidiary of CLI called Centrale del Latte della Toscana S.p.A. with the head office and plant in Florence. October, 6th 2016 London, STAR Conference 2016 Shareholders after the transaction Finanziaria Centrale del Latte di Torino S.p.A. Lavia S.S. 36,99% 29,87% City of Florence Fidi Toscana Firenze Chamber of Commerce City of Pistoia 2,56% Luzzati's Family 5,26% 2,31% Other shareholders < 5% 3,94% 6,83% 12,25% October,October, 6 th62016th 2016 London,London, STAR STAR Conference Conference 2016 2016 The new Company Centrale del Latte d’Italia S.p.A. 100 % 100 % 50% Centrale del Latte della Toscana Centrale del Latte di Vicenza Odilla Chocolat S.r.l. -

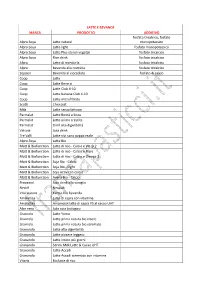

Latte E Formaggi

LATTE E BEVANDE MARCA PRODOTTO ADDITIVO fosfato tricalcico, fosfato Alpro Soya Latte natural monopotassico Alpro Soya Latte light fosfato monopotassico Alpro Soya Latte Plus steroli vegetali fosfato tricalcico Alpro Soya Rice drink fosfato tricalcico Alpro Latte di mandorla fosfato tricalcico Alpro Bevanda alla nocciola fosfato tricalcico Sojasun Bevanda al cioccolato fosfato di calcio Coop Latte Coop Latte Bene si Coop Latte Club 4-10 Coop Latte banana Club 4-10 Coop Latte microfiltrato Scotti Chiccolat Mila Latte senza lattosio Parmalat Latte Bontà e linea Parmalat Latte prima crescita Parmalat Zimil alta digeribilità Valsoia Soia drink Tre Valli Latte vivi sano pappa reale Alpro Soya Latte Bio Matt & Biofunction Latte di riso - Calcio e Vit. D 2 Matt & Biofunction Latte di riso - Calcio e Fibre Matt & Biofunction Latte di riso - Calcio e Omega 3 Matt & Biofunction Soja Bio - Calcio Matt & Biofunction Soja Bio - Light Matt & Biofunction Soja Activ con calcio Matt & Biofunction Avena Bio - Calcio Provamel Soia drink alla vaniglia Nestlè Nesquik Vital nature Kamut bio bevanda Amalattea Latte di capra con vitamine Amalattea Amamciok latte di capra PS al cacao UHT Alce nero Solo soia biologico Granrolo Latte Yomo Granrolo Latte prima natura bio intero Granrolo Latte prima natura bio scremato Granarolo Latte alta digeribilità Granarolo Latte piacere leggero Granarolo Latte intero più giorni Granarolo Sdrink Milk Latte & Cacao UHT Granarolo Latte Accadi Granarolo Latte Accadi scremato con vitamine Vitariz Bio latte di riso Yakult Latte scremato -

Technological Strategies to Preserve Burrata Cheese Quality

coatings Article Technological Strategies to Preserve Burrata Cheese Quality Cristina Costa 1, Annalisa Lucera 1, Amalia Conte 1,*, Angelo Vittorio Zambrini 2 and Matteo Alessandro Del Nobile 1 1 Department of Agricultural Sciences, Food and Environment, University of Foggia, Via Napoli, 25–71122 Foggia, Italy; [email protected] (C.C.); [email protected] (A.L.); [email protected] (M.A.D.N.) 2 Department of Quality, Innovation, Safety, Environment, Granarolo S.p.A., Via Cadriano, 27/2–40127 Bologna, Italy; [email protected] * Correspondence: [email protected]; Tel.: +39-881-589-240 Received: 4 May 2017; Accepted: 4 July 2017; Published: 9 July 2017 Abstract: Burrata cheese is a very perishable product due to microbial proliferation and undesirable sensory changes. In this work, a step-by-step optimization approach was used to design proper processing and packaging conditions for burrata in brine. In particular, four different steps were carried out to extend its shelf life. Different headspace gas compositions (MAP-1 30:70 CO2:N2; MAP-2 50:50 CO2:N2 and MAP-3 65:35 CO2:N2) were firstly tested. To further promote product preservation, a coating was also optimized. Then, antimicrobial compounds in the filling of the burrata cheese (lysozyme and Na2-EDTA) and later in the coating (enzymatic complex and silver nanoparticles) were analyzed. To evaluate the quality of the samples, in each step headspace gas composition, microbial population, and pH and sensory attributes were monitored during storage at 8 ± 1 ◦C. The results highlight that the antimicrobial compounds in the stracciatella, coating with silver nanoparticles, and packaging under MAP-3 represent effective conditions to guarantee product preservation, moving burrata shelf life from three days (control sample) to ten days. -

62 Final List of 2019 ACS Judging & Competition Winners RC BUTTERS

Final List of 2019 ACS Judging & Competition Winners RC BUTTERS Salted Butter with or without cultures - made from cow's milk 3rd PLACE Organic Valley Salted Butter CROPP Cooperative/Organic Valley, Wisconsin Team Chaseburg 2nd PLACE CROPP/Organic Valley Salted Butter CROPP Cooperative/Organic Valley, Wisconsin Team McMinnville 1st PLACE Brethren Butter Amish Style Handrolled Salted Butter Graf Creamery Inc., Wisconsin Roy M. Philippi RO BUTTERS Unsalted Butter with or without cultures - made from cow's milk 3rd PLACE Cabot Unsalted Butter Cabot Creamery Cooperative, Massachusetts Team West Springfield 3rd PLACE Organic Valley Cultured Butter, Unsalted CROPP Cooperative/Organic Valley, Wisconsin Team Chaseburg 2nd PLACE CROPP/Organic Valley Pasture Butter, Cultured CROPP Cooperative/Organic Valley, Wisconsin Team McMinnville 1st PLACE Organic Valley European Style Cultured Butter, Unsalted CROPP Cooperative/Organic Valley, Wisconsin Team Chaseburg P a g e 1 | 62 RM BUTTERS Butter with or without cultures - made from goat's milk 3rd PLACE Celebrity Butter (Salted) Atalanta Corporation/Mariposa Dairy, Ontario Pieter Van Oudenaren 2nd PLACE Bella Capra Goat Butter Sierra Nevada Cheese Company, California Ben Gregersen QF CULTURED MILK AND CREAM PRODUCTS Creme Fraiche and Sour Cream Products - made from cow's milk 3rd PLACE Crema Supremo Sour Cream V&V Supremo Foods, Illinois Team Michoacan 2nd PLACE Creme Fraiche Sierra Nevada Cheese Company, California Ben Gregersen 1st PLACE Creme Agria (Sour Cream) Marquez Brothers International, Inc., California Marquez Brothers International, Inc. QK CULTURED MILK AND CREAM PRODUCTS Kefir, Drinkable Yogurt, Buttermilk, and Other Drinkable Cultured Products - all milks 3rd PLACE Karoun Whole Milk Kefir Drink Karoun Dairies LLC, California Jaime Graca P a g e 2 | 62 2nd PLACE Jocoque Marquez Brothers International, Inc., California Marquez Brothers International, Inc. -

Microbiological Risk Assessment of Raw Milk Cheese

Microbiological Risk Assessment of Raw Milk Cheese Risk Assessment Microbiology Section December 2009 MICROBIOLOGICAL RISK ASSESSMENT OF RAW MILK CHEESES ii TABLE OF CONTENTS ACKNOWLEDGEMENTS ................................................................................................. VII ABBREVIATIONS ............................................................................................................. VIII 1. EXECUTIVE SUMMARY .................................................................................................. 1 2. BACKGROUND ................................................................................................................... 8 3. PURPOSE AND SCOPE ..................................................................................................... 9 3.1 PURPOSE...................................................................................................................... 9 3.2 SCOPE .......................................................................................................................... 9 3.3 DEFINITION OF RAW MILK CHEESE ............................................................................... 9 3.4 APPROACH ................................................................................................................ 10 3.5 OTHER RAW MILK CHEESE ASSESSMENTS .................................................................. 16 4. INTRODUCTION .............................................................................................................. 18 4.1 CLASSIFICATION -

2019 Results ICDA.Pdf

Class Description Gold Silver Bronze VHC VHC DP1 Best Showdressed Farmhouse / Joseph Heler Ltd 4 Traditional Cheese in the following classes DP2 to DP19. Automatic Entry Showdressed cheese DP2 Farmhouse / Traditional Cheshire Carron Lodge 10 Belton Farm Limited1 Belton Farm Limited 5 Cheese - White. Any weight. Traditional Cheshire Cheese Trad White Cheshire Trad White Cheshire DP3 Farmhouse / Traditional Cheshire Belton Farm Limited 3 Applebys 4 Belton Farm Limited 1 Dewlay 2 Cheese - Coloured. Any weight. Cheesemakers Trad Coloured Cheshire Raw Milk Traditional Trad Coloured Cheshire Coloured Cheshire DP4 Farmhouse / Traditional Mild Belton Farm Limited 1 Hayfields Dairy 4 Hayfields Dairy 2 Cheddar - White or Coloured. Any weight Mild Coloured Cheddar - Top Hat DP5 Farmhouse / Traditional Medium Hayfields Dairy 1 Hayfields Dairy 3 Barbers Farmhouse 2 Cheddar - White or Coloured. Any Cheesemakers weight Farmhouse Medium Cheddar Sponsored by : - High quality ingredients for the dairy industry 1 Class Description Gold Silver Bronze VHC VHC DP6 Farmhouse / Traditional Mature Trethowans Dairy 8 Keens Cheddar Raw 7 Ashley Chase Estate 1 Barbers Farmhouse 3 Cheddar - White or Coloured. Any Ltd Milk Cheddar Cheesemakers weight Pitchfork - organic, Raw milk Traditional Cave aged cheddar Farmhouse Mature Cheddar unpasteurised cheddar Mature Cheddar DP7 Farmhouse / Traditional Extra Ashley Chase Estate 4 Barbers Farmhouse 5 Keens Cheddar Raw 3 Matured Cheddar - White or Cheesemakers Milk Cheddar Coloured. Any weight Cave aged cheddar Farmhouse Extra Mature Raw Milk Traditional Extra Cheddar Mature Cheddar DP8 Farmhouse / Traditional Vintage Ashley Chase Estate 1 Barbers Farmhouse 5 Butlers Farmhouse 6 Cheddar - White or Coloured. Any Cheesemakers Cheeses weight Cave aged cheddar Farmhouse Vintage Cheddar Farmhouse Vintage Cheddar DP9 Farmhouse / Traditional Crumbly Greenfields dairy 3 Greenfields dairy 9 Dewlay 8 Lancashire Cheese. -

The Global Cheese Market Report 2000-‐2015

The Global Cheese Market Report 2000-2015 PM FOOD & DAIRY CONSULTING JANUARY 2012 New report about the global cheese market – Subscribe now! The World Cheese Market Report PM FOOD & DAIRY CONSULTING is publishing a new report: The World Cheese Market Report 2010-2015. It is a follow up on the report from 2009: The Global Cheese Markets –Opportunities and Challenges in a volatile Market, but the new report contains a lot of new features and valuable information (see content of the report). The report gives the overall view of the development on the world market for cheese in the 2000s in all regions of the world. The future prospects for cheese in the next decade is analyzed with focus on consumer trends, impact of the economic crisis, developments in the emerging dairy markets, and prognosis for the overall prospects until 2020. The report also provides in debt analysis of more than 60 countries from all region of the world. This provides all the necessary information for evaluating the different cheese markets in the world and the future potential for expansion. Is your company seeking new opportunities in the global cheese market this report is a must! Subscribe now by replying to PM FOOD & DAIRY CONSULTING on [email protected] Price: €2,000 or $2,500 You will receive an invoice and when the payment is registered the report will be sent electronically. Background Several dairy experts have in advocated that the future for the dairy sector will be to return to the basic commodities butter and milk powder instead of value added products like cheese. -

Impaginato Magnoneparco X16 346.Indd

2 Carni Piemontesi di prima qualità servite al banco ALL’ETTO ALL’ETTO MEC 9,90 AL KG. MEC 11,00 AL KG. GALLINELLA SOTTOFESA DI BOVINO DI BOVINO ADULTO FRANCESE ADULTO FRANCESE dai nostri Macellai PER ARROSTO MORBIDO 0,99 IDEALE PER MILANESI 1,10 La Piemontese è una razza bovina autoctona del Piemonte originariamente a triplice attitudine. Viene utilizzata oggi principalmente per la carne, in particolare ALL’ETTO MEC 12,50 AL KG. per la presenza di una ipertrofia muscolare della coscia, e rappresenta tuttora NOCE DI BOVINO ADULTO FRANCESE IDEALE PER un elemento caratterizzante del territorio piemontese. FETTINE AL BURRO 1,25 AIA SALSICCIA AIA DI PURO SUINO SALAMELLE NOSTRANO PURO SUINO NOSTRANO ALL’ETTO ALL’ETTO 5,90 AL KG. 5,90 AL KG. 0,59 0,59 AIA RUSTICHELLE DI POLLO ALL’ETTO 6,80 AL KG. 3,90 AL KG. AIA POLLO PER SPIEDO 0,68 ALL’ETTO 0,39 3 AIA EQUILIBRIUM TARKY ARROSTO DI TACCHINO AL FORNO BORGO DORA SERVITO AL BANCO LARDO PANCETTATO ALL’ETTO ALL’ETTO 11,90 AL KG. 10,50 AL KG. 7,50 AL KG. BORGO DORA SPALLA COTTA CASTELLANA 1,19 1,05 ALL’ETTO 0,75 SALUMIFICIO CHIESA SALUMIFICIO CHIESA SALUMIFICIO CHIESA DI FINALE LIGURE 17,50 AL KG. 14,50 AL KG. 14,50 AL KG. PROSCIUTTO COTTO DI FINALE LIGURE DI FINALE LIGURE GRIGLIATO ALL’ERBE LIGURI SALAME CRUDO DI COLLINA ARROSTO DI SUINO AL FORNO ALL’ETTO 1,75 ALL’ETTO 1,45 ALL’ETTO 1,45 29,90 AL KG. SALUMI LEONI RANDOLFO PORCHETTA D’ARICCIA I.G.P. -

Annual Report 2013

Annual Report 2013 9th financial year PARMALAT ANNUAL REPORT 2013 Mission NUTRITION AND WELLNESS ALL OVER THE WORLD 2 MISSION The Parmalat Group is a food-industry group with a multinational strategy that seeks to increase the well-being of consumers throughout the world. The ultimate purpose of the Group is to create value for its shareholders while adhering to ethical principles of business conduct, to perform a useful social function by fostering the professional development of its employees and associates, and to serve the communities in which it operates by contributing to their economic and social progress. We intend to establish Parmalat as one of the top players in the global market for functional foods with high value added, which deliver improved nutrition and wellness to consumers, and attain clear leadership in selected product categories and countries with high growth potential for the Group. Milk and dairy products and fruit beverages, foods that play an essential role in everyone’s daily diet, are key categories for the Group. 3 PARMALAT ANNUAL REPORT 2013 Countries of Operation 72 manufacturing facilities 3 research centres of excellence Castellaro (Parma, Italy) for milk, yoghurt and fruit beverages London (Ontario, Canada) for cheeses and dairy ingredients Buffalo (New York, USA) for cheeses more than 16,000 employees about 5.4 mld € net revenues 4 COUNTRIES OF OPERATION DIRECT PRESENCE Europe Italy, Portugal, Romania, Russia Rest of the World Australia, Bolivia, Botswana, Brazil, Canada, Colombia, Cuba, Ecuador, Mexico, Mozambique, Paraguay, Peru, South Africa, Swaziland, United States of America, Uruguay, Venezuela, Zambia PRESENCE THROUGH LICENSEES Brazil, Chile, China, Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, Hungary, Mexico, Nicaragua, United States of America, Uruguay 5 PARMALAT ANNUAL REPORT 2013 Contents Mission ...............................................................................................