Under Judicial Reorganization TELEMAR NORTE LESTE SA

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Comissão Parlamentar De Inquérito - Cpi Da Telefonia

Assembléia Legislativa do Estado do Tocantins Coordenação de Assistência às Comissões COMISSÃO PARLAMENTAR DE INQUÉRITO - CPI DA TELEFONIA 7ª LEGISLATURA - 3ª SESSÃO LEGISLATIVA ATA DA QUARTA REUNIÃO EXTRAORDINÁRIA EM 13 DE DEZEMBRO DE 2013 Às noves horas, do dia treze de dezembro de dois mil e treze, reuniu-se a Comissão Parlamentar de Inquérito - CPI da Telefonia, no Plenarinho da Assembléia Legislativa, nesta Capital. A Senhora Presidente, Deputada Josi Nunes, sob a proteção de Deus, havendo número legal e em nome do povo tocantinense, declaro aberta a presente reunião da Comissão Parlamentar de Inquérito, com a presença dos Srs. Deputados Marcello Leis, Eli Borges, Carlão da Saneatins e eu, Josi Nunes, que presido a Comissão Parlamentar de Inquérito da Telefonia do Estado do Tocantins. Eu quero agradecer cada um por sua presença. Eu quero agradecer também a presença aos representantes das operadoras de telefonia: Da operadora Tim: agradeço ao assessor de comunicação da operadora Tim, Rafael Guimarães; executivo de relações institucionais da operadora Tim, Roger Monteiro; gerente executivo de relações institucionais norte-nordeste da Tim, Luiz Fortes; e a advogada da operadora Tim, Márcia Bonito. Da operadora Vivo: o assessor executivo da Diretoria de Relações Institucionais da operadora, Eduardo Leal Macedo, e gerente de vendas da operadora Vivo no Tocantins, Orlan Alves Cardoso. Da operadora Claro: Quero aqui agradecer a presença à advogada da operadora Claro no Tocantins, Luma Mayara, e ao gerente da filial da Claro, Rainer Oliveira da Cruz. Da operadora Oi: agradeço a presença ao diretor re relações institucionais no Distrito Federal, da Diretoria de Planejamento Executivo, João Antônio Monteiro Tavares; representante de relações institucionais da referida operadora no Estado do Tocantins, Cláudio Roberto; e o advogado da operadora Oi, Alexandre Nunes Cachoeira. -

A Situação Do Serviço De Telefonia Na Amazônia Ção Do Serviço De Telefoni a N Am Zôni a Si T U a Ção Do Serviço

Biblioteca Digital da Câmara dos Deputados Centro de Documentação e Informação Coordenação de Biblioteca http://bd.camara.gov.br "Dissemina os documentos digitais de interesse da atividade legislativa e da sociedade.” Câmara dos Deputados ação parlamentar A Situação do Serviço de Telefonia na Amazônia A SI T U A ÇÃO DO SERVIÇO DE TELEFONI A N A AM A ZÔNI A Comissão da Amazônia, Integração Nacional e de Desenvolvimento Regional Brasília ı 2010 Mesa da Câmara dos Deputados 53ª Legislatura – 4ª Sessão Legislativa 2010 Presidente Michel Temer 1O Vice-Presidente Marco Maia 2O Vice-Presidente Antônio Carlos Magalhães Neto 1O Secretário Rafael Guerra 2O Secretário Inocêncio Oliveira 3O Secretário Odair Cunha 4O Secretário Nelson Marquezelli Suplentes de Secretário 1O Suplente Marcelo Ortiz 2O Suplente Giovanni Queiroz 3O Suplente Leandro Sampaio 4O Suplente Manoel Junior Diretor-Geral Sérgio Sampaio Contreiras de Almeida Secretário-Geral da Mesa Mozart Vianna de Paiva ação parlamentar Câmara dos Deputados Comissão da Amazônia, Integração Nacional e de Desenvolvimento Regional A Situação do Serviço de Telefonia na Amazônia Audiência pública realizada pela Comissão da Amazônia, Integração Nacional e de De- senvolvimento Regional so- bre a “A Situação do Serviço de Telefonia na Amazônia”, em 5 de maio de 2009, na Câmara dos Deputados. Centro de Documentação e Informação Edições Câmara Brasília | 2010 CÂMARA DOS DEPUTADOS DIRETORIA LEGISLATIVA Diretor Afrísio Vieira Lima Filho CENTRO DE DOCUMENTAÇÃO E INFORMAÇÃO Diretor Adolfo C. A. R. Furtado COORDENAÇÃO -

Grupo Oi Anexo 2.6 – Laudo Econômico-Financeiro

Grupo Oi Anexo 2.6 – Laudo Econômico-Financeiro Rio de Janeiro, 21 de dezembro de 2017 Sumário Considerações Gerais ................................................................................................. 4 Limitações ................................................................................................................. 6 Atualizações do Laudo Econômico-Financeiro ............................................................. 8 Contextualização ........................................................................................................ 9 Breve Histórico do Setor .......................................................................................... 9 Histórico do Grupo Oi ............................................................................................ 11 Situação Econômico-Financeira do Grupo Oi ........................................................... 14 A Companhia e o Mercado de Telecom ...................................................................... 17 Estrutura Societária da Oi ...................................................................................... 17 Descrição das Recuperandas ................................................................................. 19 Análise de Mercado ............................................................................................... 21 Indicadores Financeiros da Oi e do Mercado ........................................................... 23 Projeção Econômico-Financeira ............................................................................... -

TELEFÓNICA, S.A. (Exact Name of Registrant As Specified in Its Charter)

As filed with the Securities and Exchange Commission on April 12, 2006 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2005 Commission file number: 1-9531 TELEFÓNICA, S.A. (Exact name of Registrant as specified in its charter) KINGDOM OF SPAIN (Jurisdiction of incorporation or organization) Gran Vía, 28, 28013 Madrid, Spain (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Name of each Title of each class exchange on which registered Ordinary Shares, nominal value €1.00 per share* New York Stock Exchange American Depositary Shares, each representing three New York Stock Exchange Ordinary Shares * Not for trading, but only in connection with the listing of American Depositary Shares, pursuant to the requirements of the New York Stock Exchange. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None The number of outstanding shares of each class of capital stock of Telefónica, S.A. at December 31, 2005 was: Ordinary Shares, nominal value €1.00 per share: 4,921,130,397 Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ⌧ No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. -

Brasil Telecom Holding Co

SECURITIES AND EXCHANGE COMMISSION FORM 6-K/A Current report of foreign issuer pursuant to Rules 13a-16 and 15d-16 Amendments [amend] Filing Date: 2005-08-31 | Period of Report: 2005-09-30 SEC Accession No. 0001292814-05-001467 (HTML Version on secdatabase.com) FILER BRASIL TELECOM HOLDING CO Mailing Address Business Address SIA/SUL ASP LOTE D BLOCO SIA/SUL ASP LOTE D BLOCO CIK:1066115| IRS No.: 000000000 B 1ST FLOOR B 1ST FLOOR Type: 6-K/A | Act: 34 | File No.: 001-14477 | Film No.: 051059893 BRASILIA DF D5 71215000 BRASILIA DF D5 71215000 SIC: 4813 Telephone communications (no radiotelephone) 55 61 415-1140 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 6-K/A REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 OF THE SECURITIES EXCHANGE ACT OF 1934 THROUGH AUGUST 30, 2005 (Commission File No. 1-14477) BRASIL TELECOM PARTICIPAÇÕES S.A. (Exact name of registrant as specified in its charter) BRAZIL TELECOM HOLDING COMPANY (Translation of Registrant's name into English) SIA Sul, Área de Serviços Públicos, Lote D, Bloco B Brasília, D.F., 71.215-000 Federative Republic of Brazil (Address of Regristrant's principal executive offices) Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F ______ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)__. -

Brasil Telecom Participações SA

www.brasiltelecom.com.br Brasil Telecom Participações S.A. Relatório Anual 2001 Annual Report Relatório Anual 2001 2001 Annual Report Perfil corporativo Mensagem do Presidente do Conselho de Administração Corporate profile Message from the Chairman of the Board of Directors Nome Name O ano de 2001 representou mais um desafio para a Brasil Telecom. O dinamismo do setor The year 2001 was a big challenge for Brasil Telecom. The Brasil Telecom Participações S.A. Brasil Telecom Participações S.A. dinamism of the telecom sector demanded the commitment of the Incorporation de telecomunicações exigiu o comprometimento de toda a Empresa, que pode ser constata- Fundação Incorporated on May 22, 1998, from the spin-off of Sistema Telebrás, whole Company, which can be seen in the year´s achieved results. Constituída em 22 de maio de 1998, a partir da cisão do Sistema Telebrás, a Brasil Telecom do nos resultados alcançados. Brasil Telecom Participações S.A. (then Tele Centro Sul Participações As CEO and Investor Relations Officer of Brasil Telecom Participações Participações S.A. (à época Tele Centro Sul Participações S.A.) foi adquirida em leilão de privati- S.A.) was acquired through a privatization auction, held on July 29 of Henrique Neves contribuiu para essa conquista enquanto Presidente e Diretor de Relações S.A., Henrique Neves contributed to this achievement. The execu- zação, realizado no dia 29 de julho do mesmo ano, pela Solpart Participações S.A., que hoje the same year, by Solpart Participações S.A., which now holds 19% of the Company’s total capital. com Investidores da Brasil Telecom Participações S.A. -

Wireline Market Analysis Assessment Using Arcgis Geostatistical Analyst Extension

Wireline Market Analysis Assessment using ArcGIS Geostatistical Analyst Extension Maria da Conceição Pereira (Marketing - Brasil Telecom) Adriano Martins Junqueira (Business Development – Imagem) George Eduardo Serra Almeida (Geoprocessing Analyst – Imagem) Abstract The solution was customized to understand the structural factors of the Brazilian cities for cross- selling proposes. The ArcGIS Geostatistical Analyst extension was used for exploratory spatial data analysis and to create a statistically valid surface. The analisys was developed using a municipal Geodatabase (more than 800 variables and 5561 cities). The final cluster (market segments) was composed for 12 groups with different patterns for cultural, infrastructural and urban behavior. The results were integrated to marketing users of Brasil Telecom - a brazilian wireline operator - for forecasts and cross-selling proposes. The results presented herre are fictitious, ilustrating the employed method and the potential of ESRI Tools for the generation of models for estimating market potential. 1. Environment The Brasil Telecom S.A. – Brt - is a telecom company and provides services in Brazil in Region II, covering the states of Acre, Rondônia, Mato Grosso, Mato Grosso do Sul, Tocantins, Goiás, Santa Catarina, Paraná e Rio Grande do Sul, as in Distrito Federal. Nowadays, the working area correspondes about 23% of the population, 25% of the GDP and 33% of the national territory (aproximately 2,8 million Km2). The Brt provides voice services for local and long distance modalities, in national intra-sectorial and intra-regional areas, as for the public telephoning system, data communication, network services (infrastructure for other telecom companies or network capacity rental), value added services and supplementary services, sech as conference, call identification, virtual answering machine, 0800 and others. -

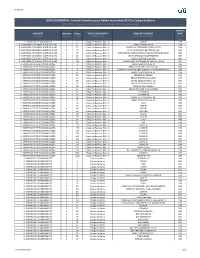

CONCESSIONÁRIAS - Lista De Convênios Para Débito Automático (DAC) E Código De Barras UTILITIES - Agreements for Automatic Debit (DAC) and Barcode

Out/2018 CONCESSIONÁRIAS - Lista de Convênios para Débito Automático (DAC) e Código de Barras UTILITIES - Agreements for Automatic Debit (DAC) and Barcode HORÁRIO SEGMENTO Segmento Código TIPO DE PAGAMENTO NOME DO CONVÊNIO LIMITE SEGMENT Segment Code PAYMENT TYPE AGREEMENT NAME CUT OFF TIME 2 - EMPRESAS DE SANEAMENTO 2 97 Código de Barras e DAC - C SABESP 19H 3 - EMPRESAS DE ENERGIA ELÉTRICA E GÁS 3 5 Código de Barras e DAC - C CEB DISTRIBUICAO SA 19H 3 - EMPRESAS DE ENERGIA ELÉTRICA E GÁS 3 22 Código de Barras e DAC - C ELEKTRO ELETRICIDADE E SERVICOS SA 19H 3 - EMPRESAS DE ENERGIA ELÉTRICA E GÁS 3 40 Código de Barras e DAC - C CPFL CIA PAULISTA DE FORCA E LUZ 19H 3 - EMPRESAS DE ENERGIA ELÉTRICA E GÁS 3 48 Código de Barras e DAC - C ELETROPAULO METROPOLITANA DE ELETRICIDADE DE SP 19H 3 - EMPRESAS DE ENERGIA ELÉTRICA E GÁS 3 53 Código de Barras e DAC - C LIGHT SERVICOS DE ELETRICIDADE 19H 3 - EMPRESAS DE ENERGIA ELÉTRICA E GÁS 3 56 Código de Barras e DAC - C CEG CIA ESTADUAL DE GAS 19H 3 - EMPRESAS DE ENERGIA ELÉTRICA E GÁS 3 110 Código de Barras e DAC - C COMPANHIA PIRATININGA DE FORCA E LUZ SA 19H 4 - EMPRESAS DE TELECOMUNICAÇÕES 4 2 Código de Barras e DAC - C BRASILTELECOM FILIAL RS 19H 4 - EMPRESAS DE TELECOMUNICAÇÕES 4 5 Código de Barras e DAC - C BRASIL TELECOM FILIAL PELOTAS 19H 4 - EMPRESAS DE TELECOMUNICAÇÕES 4 6 Código de Barras e DAC - C EMBRATEL EMPRESA BRASILEIRA DE TELECOMUNICACOES 19H 4 - EMPRESAS DE TELECOMUNICAÇÕES 4 11 Código de Barras e DAC - C BRASIL TELECOM FILIAL AC 19H 4 - EMPRESAS DE TELECOMUNICAÇÕES 4 13 Código -

Telecom Italia S.P.A. 2006 Annual Report

Telecom Italia S.p.A. 2006 Annual Report Report on operations Corporate Governance Consolidated financ. stat. Financ. stat. Telecom Italia S.p.A. Appendix Contents Report Corporate boards at December 31, 2006 4 on operations Macro-organization chart - Telecom Italia Group at December 31, 2006 6 The Telecom Italia Group 10 Regulatory framework and Competition 14 Shareholder information 22 Selected operating and financial data - Telecom Italia Group 25 Alternative performance measures 27 Comments on operating and financial performance - Telecom Italia Group 28 Comments on operating and financial performance - Telecom Italia S.p.A. 45 Reconciliation of consolidated equity 55 Related party transactions 56 Business outlook: business outlook 57 The Business Units of the Telecom Italia Group 58 Operations 61 Wireline 63 Domestic Mobile 78 Brazil Mobile 86 Media 89 Olivetti 94 Other activities 98 Sustainability 103 Introduction 103 Customers 112 Suppliers 119 Competitors 122 Institutions 125 The Environment 129 The Community 138 – Research, development and innovation 142 Human resources 146 Shareholders 158 Equity investments held by Directors, Statutory Auditors, General Managers and Key Managers 161 Glossary 163 ANNUAL REPORT ON CORPORATE GOVERNANCE 171 Telecom Italia Contents 204 Group - Consolidated balances sheets 205 Consolidated Consolidated statements of income 207 financial Statements of consolidated equity 208 statements Consolidated statements of cash flows 210 Notes 212 Independent Auditors’ report 340 Telecom Contents 342 Italia S.p.A. - Balance sheets 343 Financial Statements of income 345 statements Statements of changes in equity 346 Statements of cash flows 348 Notes 350 Independent Auditors’ report 464 APPENDIX Board of Statutory Auditors’ report 465 Motions for resolutions 486 Useful information 519 Contents 3 Report on operations Corporate Governance Consolidated financ. -

Brazil Mobile Observatory 2012 Brazil Mobile Observatory 2012 Contents

Brazil Mobile Observatory 2012 Brazil Mobile Observatory 2012 Contents Introduction 1 Executive Summary 3 1 Characteristics of the Brazilian mobile market 9 1.1 The telecom industry and mobile services in Brazil 9 1.2 A growing market 11 1.3 A highly competitive market for mobile 20 2 The economic contribution of the Brazilian mobile industry 23 2.1 The economic contribution of mobile telephony to the economy 23 2.2 The economic impact of mobile broadband and mobile data 34 2.3 The social impact of mobile telephony 36 3 Market outlook: mobile at the centre of the future Brazilian society 45 3.1 Affordable smartphones will make mobile broadband a daily user experience 47 3.2 Mobile will be at centre of the World Cup and Olympic Games delivery 49 3.3 New business opportunities will be driven by mobile technology 50 3.4 Operators have committed to significant network investment to meet the increasing demand 57 4 Regulation of the Brazilian mobile sector 59 4.1 Taxation on mobile consumers and operators is one of the highest worldwide 59 4.2 The telecommunications sector is strictly regulated 61 5 A roadmap for growth and social and digital inclusion 71 5.1 Three key areas for growth and regional leadership 71 5.2 Existing barriers to growth can be removed by supportive policies 72 5.3 A collaborative approach between government and operators 74 can maximise the benefits from growth Appendix A Mobile operators in Brazil 75 Appendix B About This Study 78 Acronyms and Abbreviations 79 Important Notice from Deloitte 95 1 Brazil Mobile Observatory 2012 Introduction Introduction The GSMA Mobile Observatory series first started with an analysis of the European market in 2008 and continued with reports on Asia and Africa. -

Inside a C Ham Pion

Inside a Champion An Analysis of the Brazilian Development Model Héctor Alimonda Debating Development in Latin America: From ECLAC to the Brazilian Azevedo Said To Be a Woman in Brazil: Gender Inequalities and Development Larissa Packer Workers’ Party Lauro Mattei Brazilian Development at the Beginning of the 21st Century: From Nature to Natural Capital: How New Legal and Financial Mechanisms Create a Market Economic Growth, Income Distribution, and Environmental Destruction Camila Moreno for the Green Economy Christian Russau Lula “Superstar” – Why the Brazilian Development Green Economy and Development(alism) in Brazil: Resources, Climate and Energy Politics Model is a Huge Success Abroad Gerhard Dilger Extractivism and Nuclear Ambitions – The Carlos Tautz, João Roberto Lopes Pinto, and Maíra Borges Fainguelernt The Big Agent Brazilian Development Model and the Germans Britta Rennkamp “Development First” in the of Change: The National and Transnational Expansion of Brazilian Companies Through the G-20 and the BRICS? – Reflections on Brazil’s Foreign Politics and Civil Society Silvio Caccia National Development Bank BNDES Thomas Fatheuer The Amazon Basin – A Paradigmatic Bava Short Circuits of Production and Consumption Fábio Pierre Fontenelle Pacheco A Region Between Destruction, Valorization, and Resistance Marilene de Paula Obstacles for Brazil Unknown to Many Brazilians: Agroecology as a Solution to the Food, Ecological, and Development? – Human Rights, Infrastructure Policies, and “Mega-events” in Brazil Magnólia Social Crises Alberto Acosta The Buen Vivir – An Opportunity to Imagine Another World INSIDE A CHAMPION PUBLICATION SERIES ON DEMOCRACY Inside a champion An Analysis of the Brazilian Development Model Edited by the Heinrich Böll Foundation Published under the following Creative Commons License: http://creative- commons.org/licenses/by-nc-nd/3.0/. -

Oi S.A. Company Report

MASTERS IN FINANCE EQUITY RESEARCH OI S.A. COMPANY REPORT TELECOMMUNICATION SERVICES JANUARY 7, 2015 STUDENT: RICARDO JORGE LUÍS GOMES [email protected] Future is all about uncertainty Recommendation: BUY Good business prospects, massive leverage Price Target FY15: R$ 19.51 Price (as of Jan. 6, 15) R$ 7.10 . We recommend buying Oi S.A.’s ordinary shares, provided our price target of R$ 19.51 as of December 31, 2015, which Reuters: OIBR3.SA, Bloomberg: OIBR3:BZ underlines an upside potential of 174.78% and represents a 5.78 52-week range (R$) 7.10-48.80 EV-to-EBITDA multiple. However, one should bear in mind the risk Market Cap (R$ mn) 5,984 Outstanding Shares 842,766,135 implied by the small expected participation of equity in the 52-week average daily volume 469,973 company’s enterprise value in 2015 (21.88%). Sources: Analyst estimates; Bloomberg . Selling PT Portugal – which will be decided by PT SGPS’s shareholders on January 12, 2015 – and consolidating in Brazil by acquiring a stake in TIM adds value to the company, as it would allow for a reduction of indebtedness while enjoying from operational synergies. Actually, the target price for this scenario is R$ 19.78, R$ 0.89 above the target price implied by the current scenario, on a standalone basis. We believe Oi S.A. will be able to leverage its wireline Source: Bloomberg footprint in Brazil in the coming years and capture market share in the pay TV segment. However, the debt burden and the possible (1) 2013 2014E 2015F focus on de-leveraging might impair its ability to explore growth Financials Revenues (R$ mn) 36,873 36,937 37,083 opportunities, particularly in a market within a wave of EBITDA (R$ mn) 13,049 10,066 10,272 consolidation.