Analysis of Financial Performance and Liquidity Trends of Banks in Ghana

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Summary of Status Report February 2020

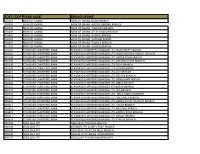

SUMMARY OF STATUS REPORT FEBRUARY 2020 1 MEMBERSHIP GFIM as at the end of February 2020 has 38 registered members categorized as follows: LICENSED DEALING MEMBERS PRIMARY DEALER BANKS 1. African Alliance Securities Limited 1. Access Bank Ghana Limited 2. Black Star Brokerage Limited 2. ARB Apex Bank 3. Bullion Securities Limited 3. ABSA Bank Ghana Limited 4. Databank Brokerage Limited 4. Cal Bank Ghana Limited 5. EDC Stockbrokers Limited 5. Consolidated Bank Ghana Limited 6. Teak Tree Brokerage Limited 6. Ecobank Ghana Limited 7. Republic Securities Ghana Limited 7. Fidelity Bank Ghana Limited 8. IC Securities Limited 8. GCB Bank Limited 9. NTHC Securities Ltd 9. Guaranty Trust Bank Ghana Limited 10. Prudential Stockbrokers Limited 10. Societe Generale Ghana Limited 11. SBG Securities Ghana Limited 11. Stanbic Bank Limited 12. SIC Brokerage Limited 12. Standard Chartered Bank Limited 13. Strategic African Securities Limited 13. Universal Merchant Bank 14. UMB Stock Brokers Ltd NON - PRIMARY DEALER BANKS 1. Agricultural Development Bank 2. Bank of Africa Ghana Ltd 3. First Atlantic Bank Ghana Ltd 4. First National Bank Limited 5. FBN Bank Ghana Ltd 6. National Investment Bank 7. Prudential Bank Limited 8. Republic Bank Ghana Limited 9. Sahel Sahara Bank Ghana Limited 10. UBA Ghana Limited 11. Zenith Bank Ghana Ltd 2 SUMMARY OF SECURITIES • Benchmark Securities: 8 5yr Government bond- 5 7yr Government bond- 1 10yr Government bond- 1 15yr Government bond- 1 • Non-Benchmark Securities: 28 3yr Government bond-14 5yr Government bond- 6 6yr Government bond- 1 7yr Government bond- 3 10yr Government bond-2 15yr Government bond-1 20yr Government bond-1 • Treasury Notes: 14 1yr Government note- 1 2yr Government note- 13 • Treasury Bills:80 364 day bill- 28 182 day bill- 26 91 day bill- 13 182-day Cocoa Bill- 13 ❖ Local US dollar 3-year bond-1 ❖ Eurobond-9 ❖ Corporate Bonds AFB Ghana Plc 18 Bayport Financial Services (Ghana) 9 Edendale Properties 2 Izwe Loans Ghana 6 E.S.L.A. -

Annual Report 2020.Pdf

ANNUAL REPORT 2020 CONTENTS 03 CORPORATE PROFILE 05 VISION, MISSION & CORE VALUES 07 CORPORATE INFORMATION 09 BOARD OF DIRECTORS 16 BOARD CHAIRMAN’S STATEMENT 19 MD/CEO’S STATEMENT 22 EXECUTIVE COMMITTEE 32 REPORT OF THE DIRECTORS 33 CORPORATE GOVERNANCE FRAMEWORK 36 REPORT OF THE INDEPENDENT AUDITOR 40 STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME 41 STATEMENT OF FINANCIAL POSITION 42 STATEMENT OF CHANGES IN EQUITY 43 STATEMENT OF CASH FLOWS 44 NOTES TO THE FINANCIAL STATEMENTS 94 APPENDIX I 95 APPENDIX II 2 CONTENTS ANNUAL REPORT 2020 CORPORATE PROFILE First Atlantic Bank is a full-scale institution that competes effectively between African countries also commercial bank with over 25 years in the local and sub-regional feature strongly on our agenda. of experience in the Ghanaian financial market place in a manner market. Originally founded as a that showcases the best of our First Atlantic Bank’s value merchant bank, First Atlantic Bank collective talents. Our aspiration is propositions are geared towards has won several awards recognizing borne out of a vision to be a global identifying customer needs and its leadership in customer care, bank out of Ghana and the West expectations and providing value advisory services, trade finance and African Sub-region. added solutions for those needs. corporate banking. The overriding goal is to be at the We therefore pursue the agenda forefront of banking innovation, First Atlantic Bank offers three of creating a well differentiated defining the industry landscape and distinctive service categories: Private brand with bespoke product and creating value for all our stakeholders, Banking, Personal & Business service offerings delivered by a thereby living our mantra of being Banking and Corporate Banking. -

Survey of Bank Charges Second Quarter, 2019

Survey of Bank Charges Second Quarter, 2019 Financial Stability Department Contents Abbreviations ............................................................................................................................................................................................................................................. 3 DOMESTIC BANKING PRODUCTS AND SERVICES ....................................................................................................................................................................... 5 Savings account: E-banking Product and Services Fees ............................................................................................................................................................... 6 Initial Deposit Required for Savings Accounts ................................................................................................................................................................................. 7 Minimum Operating Balance Required for Saving Accounts ......................................................................................................................................................... 8 Current Account: Initial Deposit Required (IDR) and Minimum Operating Balance (MOB) ...................................................................................................... 9 Current Account Charges: Commission on Turnover (COT) ...................................................................................................................................................... -

Sort Code Bank Name Branch Name

SORT CODE BANK NAME BRANCH NAME 010101 BANK OF GHANA BANK OF GHANA ACCRA BRANCH 010303 BANK OF GHANA BANK OF GHANA -AGONA SWEDRU BRANCH 010401 BANK OF GHANA BANK OF GHANA -TAKORADI BRANCH 010402 BANK OF GHANA BANK OF GHANA -SEFWI BOAKO BRANCH 010601 BANK OF GHANA BANK OF GHANA -KUMASI BRANCH 010701 BANK OF GHANA BANK OF GHANA -SUNYANI BRANCH 010801 BANK OF GHANA BANK OF GHANA -TAMALE BRANCH 011101 BANK OF GHANA BANK OF GHANA - HOHOE BRANCH 020101 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-HIGH STREET BRANCH 020102 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- INDEPENDENCE AVENUE BRANCH 020104 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-LIBERIA ROAD BRANCH 020105 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-OPEIBEA HOUSE BRANCH 020106 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-TEMA BRANCH 020108 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-LEGON BRANCH 020112 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-OSU BRANCH 020118 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-SPINTEX BRANCH 020121 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-DANSOMAN BRANCH 020126 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD-ABEKA BRANCH 020127 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH)-ACHIMOTA BRANCH 020129 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- NIA BRANCH 020132 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- TEMA HABOUR BRANCH 020133 STANDARD CHARTERED BANK STANDARD CHARTERED BANK(GH) LTD- WESTHILLS BRANCH 020436 -

First National Bank Ghana

First National Bank Online Banking Enterprise™ - Payment Cut-Off Times Direct Payment Express Payment Instant Payment Service Service Service Service Anytime during the day Monday - Friday Anytime (including Saturdays, Sundays within the allowed cut-off and Public Holidays) processing times. In accordance with the cut-off Submission times below. Payments submitted after the cut-off times below will be processed on the next business day. Monday to Friday To First National Bank: To Participating Banks n/a No cut-off time between 09h15 and 11h35 Cut-off To other banks: 09h00 - Times 18h00 Saturdays, Sundays and Public Holidays Payments to both First National Bank and to other banks will n/a only be submitted for processing on the next business day. Any payment processed to a Any payment processed to a Participating Any payment authorised Bank through the Instant Payment service and fully processed to a Participating Bank through the Express service type within the type will be cleared within 1 minute of it Participating Bank being authorised and fully processed on Clearing allowed cut-off processing through the Direct the same day. Times: Payment service type times will be cleared within 6 within the allowed cut-off hours of it being authorised and processing times will be fully processed on the same cleared on the next day. business day. Express payments are Instant payments are posted to the posted to the recipient’s recipient’s account on the same business All payments are posted account on the same day. to the recipient’s account business day. on the next business day. -

(Gh) Ltd 280104 4 Access Bank

S/N BANK ROUTING_NUMBER 1 ACCESS BANK (GH) LTD 280105 2 ACCESS BANK (GH) LTD 280601 3 ACCESS BANK (GH) LTD 280104 4 ACCESS BANK (GH) LTD 280100 5 ACCESS BANK (GH) LTD 280102 6 ACCESS BANK (GH) LTD 280103 7 ACCESS BANK (GH) LTD 280106 8 ACCESS BANK (GH) LTD 280107 9 ACCESS BANK (GH) LTD 280108 10 ACCESS BANK (GH) LTD 280109 11 ACCESS BANK (GH) LTD 280110 12 ACCESS BANK (GH) LTD 280801 13 ACCESS BANK (GH) LTD 280602 14 ACCESS BANK (GH) LTD 280603 15 ACCESS BANK (GH) LTD 280401 16 ACCESS BANK (GH) LTD 280402 17 ACCESS BANK (GH) LTD 280111 18 ACCESS BANK (GH) LTD 280112 19 ACCESS BANK (GH) LTD 280113 20 ACCESS BANK (GH) LTD 280114 21 ACCESS BANK (GH) LTD 280115 22 ACCESS BANK (GH) LTD 280116 23 ACCESS BANK (GH) LTD 280701 24 ACCESS BANK (GH) LTD 280117 25 ACCESS BANK (GH) LTD 280118 26 ACCESS BANK (GH) LTD 280119 27 ACCESS BANK (GH) LTD 280120 28 ACCESS BANK (GH) LTD 280604 29 ACCESS BANK (GH) LTD 280121 30 ACCESS BANK (GH) LTD 280403 31 ACCESS BANK (GH) LTD 280404 32 ACCESS BANK (GH) LTD 280122 33 ACCESS BANK (GH) LTD 280124 34 ACCESS BANK (GH) LTD 280125 35 ACCESS BANK (GH) LTD 280501 36 ACCESS BANK (GH) LTD 280123 37 ACCESS BANK (GH) LTD 280162 38 ACCESS BANK (GH) LTD 280198 39 ACCESS BANK (GH) LTD 280696 40 ACCESS BANK (GH) LTD 280605 41 ACCESS BANK (GH) LTD 280126 42 ACCESS BANK (GH) LTD 280607 43 ACCESS BANK (GH) LTD 280130 44 ACCESS BANK (GH) LTD 280201 45 ACCESS BANK (GH) LTD 280901 46 ACCESS BANK (GH) LTD 280127 47 ACCESS BANK (GH) LTD 281001 48 ACCESS BANK (GH) LTD 280606 49 ACCESS BANK (GH) LTD 280128 50 ACCESS BANK (GH) LTD 280129 -

Banks' SORT CODES

BANK OF GHANA ___ ________ _____________ _________________ ______________________ ______________________________ _____________________________________ ___________________________________________ ___________________________________________ Banks’ Sort Codes _____________________________________________ ________________________________________ ________________________________ __________________________ ______________________ _______________ _________ ______ ___ AUGUST 2017 1. Introduction To facilitate the efficient clearing and settlement of interbank paper payment instruments throughout the country, cheques and other paper payment instruments were standardized to make them amenable to automated processing. The standardization included dividing the country into 11 clearing zones, with each zone having its clearing house; assigning a 6-digit unique sort code to each bank branch; and MICR-encoding paper payment instruments presented to the clearing house. A 6-digit unique sort code is also printed on all paper payment instruments. 2. Components of the sort code The sort code was developed to facilitate the clearing and settlement of interbank payment instructions according to the clearing zone within which the paying bank is located, as the case may be. The 6-digit sort codes are allocated based on pre-defined criteria to identify the bank, the clearing zone in which a bank branch is located and the branch number of the bank. Consider the sort code 01-02-03 - The first two digits (01) represent the bank’s code - The second two digits(02) represent the code of the clearing zone within which the branch of the bank is located - The last two digits (03) represent the branch’s code. On January 16, 2010 electronic clearing of cheques was introduced under the Cheque Codeline Clearing (CCC) with truncation system with nationwide coverage. All the clearing houses were collapsed and a new national clearing house was established. -

Licensed Banks and Registered Offices in Ghana

LICENSED BANKS, REPRESENTATIVE OFFICES & THEIR REGISTERED OFFICES IN GHANA – AUGUST 2018 1. Access Bank (Ghana) Limited Starlets’ 91 Road, Opposite Accra Sports Stadium, Osu P. O. Box GP 353, Accra, Ghana Tel: +233-302-661769 +233-302-684858 +233-302-661613 +233-302-661813 Fax: +233-302-666020 Email: [email protected] Website: www.ghana.accessbankplc.com 2. ADB Bank Limited Accra Financial Centre, 3rd Ambassadorial Development Area, Ridge-Accra, P.O. Box 4191, Accra-Ghana 1 Tel: +233-302-770403; 762104; 783123; 784394 +233-28-9255 880, +233-28-9225 881 Telex: 233 302 2295/2708 AGBANK GH Fax: 233 302 784893; 770411 Website: www.agricbank.com Email: [email protected] 3. Bank of Africa Ghana Ltd Head Office 1st Floor, Block A&B The Octagon, Independence Avenue P.O. Box C1541 Cantonments, Accra – Ghana Tel: +233-302-249690 +233-302-249679 +233-302-249683 +233-302-249690 +233-302-249698 Fax: +233-302-249697 Website : www.boaghana.com Email: [email protected] 2 4. Bank of Baroda (Ghana) Limited Kwame Nkrumah Avenue, (Next to Melcom) Adabraka, PMB 298 AN, Accra – Ghana Tel: +233-302-248460 +233-302-250072 +233-302-667399 Fax: +233-302-248480 E-mail: [email protected]; Website: http://www.bankofbarodaghana.com 5. Banque Sahélo-Saharienne pour I’Investissement et le Commerce BSIC (Ghana) Limited 47 Kwame Nkrumah Avenue, Glico House – Adabraka, P. O. Box CT 1732, Cantonments, Accra- Ghana Tel: +233-302-222394, +233-302-222923, +233-21-242861, +233-302-245062, Fax: +233-302-234490 Email: [email protected] Website: www.bsic.com.gh 3 6.