Investment Market Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GENEVA COMMONS SWC Randall Road & Bricher Road | Geneva, IL

GENEVA COMMONS SWC Randall Road & Bricher Road | Geneva, IL ANCHORS ▪ Geneva Commons is the premier lifestyle center serving the west suburban FEATURES Chicago metropolitan area. With co-tenants including Dick’s Sporting Goods, Barnes & Noble, Forever 21, H&M, Pottery Barn, Sephora, California Pizza Kitchen, Houlihan’s and Bar Louie, Geneva Commons provides the ultimate shopping and dining experience ▪ The Geneva Commons trade area serves over 54,000 households with a population of nearly 159,000 and average household income of $114,575 within a 15 minute drive time ▪ Dynamic new gathering green featuring digital screens for movies on the lawn, pergola and outdoor seating, fireplace and life-size chessboard ▪ Premier retail and restaurant opportunities are available from 876 up to 10,000+ square feet CONTACT MARGET GRAHAM MARIA ROSSOBILLO APRIL SMITH T: 630.954.7307 T: 630.954.7385 T: 630.954.7451 One Parkview Plaza, 9th Floor F: 630.954.7306 F: 630.954.7306 F: 630.954.7306 Oakbrook Terrace, IL 60181 [email protected] [email protected] [email protected] www.midamericagrp.com The information contained herein has either been given to us by the owner of the property or obtained from sources that we deem reliable. We have no reason to doubt its accuracy but we do not guarantee it. S31 GENEVA/BATAVIA, IL RANDALL RD.GENEVA & FABYAN PKWY. COMMONS SWC Randall Road & Bricher Road | Geneva, IL 48,600 T Y S K E P I R I ILLINOIS N T A A S R BY P 38 N I A A F T D S R M W N E I L L A I V M E N W VACANT A K 24,700 T S E E -

Case 17-12906-CSS Doc 352 Filed 01/19/18 Page 1 of 183

Case 17-12906-CSS Doc 352 Filed 01/19/18 Page 1 of 183 UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ) In re ) Chapter 11 ) Charming Charlie Holdings Inc., et al.,) Case No 17-12906 (CSS) Debtors. ) (Jointly Administered) ) STATEMENT OF FINANCIAL AFFAIRS FOR Charming Charlie LLC Case No: 17-12909 (CSS) Case 17-12906-CSS Doc 352 Filed 01/19/18 Page 2 of 183 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ) In re: ) Chapter 11 ) CHARMING CHARLIE HOLDINGS INC., et al.,1 ) Case No. 17-12906 (CSS) ) ) Debtors. ) (Jointly Administered) ) GLOBAL NOTES AND STATEMENT OF LIMITATIONS, METHODOLOGY, AND DISCLAIMERS REGARDING THE DEBTORS’ SCHEDULES OF ASSETS AND LIABILITIES AND STATEMENTS OF FINANCIAL AFFAIRS Charming Charlie Holdings Inc. and certain of its affiliates, as debtors and debtors in possession in the above-captioned chapter 11 cases (the “Debtors”), have filed their respective Schedules of Assets and Liabilities (the “Schedules”) and Statements of Financial Affairs (the “Statements”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). The Debtors, with the assistance of their legal and financial advisors, prepared the Schedules and Statements in accordance with section 521 of title 11 of the United States Code (the “Bankruptcy Code”) and rule 1007 of the Federal Rules of Bankruptcy Procedure. Robert Adamek has signed each set of the Schedules and Statements. Mr. Adamek serves as the Senior Vice President and Chief Financial Officer at Debtor Charming Charlie Holdings Inc., and he is an authorized signatory for each of the Debtors. In reviewing and signing the Schedules and Statements, Mr. -

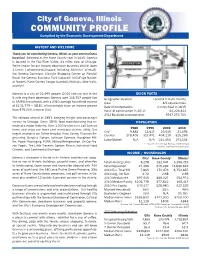

COMMUNITY PROFILE Compiled by the Economic Development Department

City of Geneva, Illinois COMMUNITY PROFILE Compiled by the Economic Development Department HISTORY AND WELCOME Thank you for considering Geneva, Illinois as your next business location! Selected as the Kane County seat in 1835, Geneva is located in the Fox River Valley, 43 miles west of Chicago. We’re known for our historic downtown business district (over 1.1 mil s.f. of commercial space, including .66 mil s.f. of retail), the Geneva Commons Lifestyle Shopping Center on Randall Road, the Geneva Business Park (adjacent to DuPage Nation- al Airport), Kane County Cougar baseball, festivals, bike trails, and fun! Geneva is a city of 21,495 people (2010 census) but in the QUICK FACTS 5 mile ring from downtown Geneva over 116,757 people live Geographic location: Located in Kane County in 39,951 households with a 2010 average household income Area: 8.5 square miles of $105,779 — 58.8% of households have an income greater Date of incorporation: County Seat in 1835 than $75,000. (source: Esri) Value of construction in 2012: $4,223,324 2012 Equalized assessed value: $937,275,763 The railroad arrived in 1853, bringing freight and passenger service to Chicago. Since 1840, food manufacturing has re- POPULatiON mained a major industry. Over 1,000 businesses call Geneva 1980 1990 2000 2010 home and enjoy our lower cost municipal electric utility. Our City1 9,881 12,617 19,515 21,495 largest employers are Delnor Hospital, Kane County, Peacock En- County2 278,405 317,471 404,119 515,269 gineering, Burgess Norton, Johnson Controls, Houghton Mif- Labor Market3 N/A N/A 212,454 271,334 flin, Power Packaging, FONA, Millard Refrigeration, On-Cor Fro- 1, 2 Source: U.S. -

Bank of America (Ground Lease | Chicago MSA) 802 Commons Drive Geneva, Illinois 60134 TABLE of CONTENTS

NET LEASE INVESTMENT OFFERING Bank of America (Ground Lease | Chicago MSA) 802 Commons Drive Geneva, Illinois 60134 TABLE OF CONTENTS I. Executive Summary II. Location Overview III. Market & Tenant Overview Executive Summary Site Plan Tenant Profile Investment Highlights Aerial Location Overview Property Overview Map Demographics Photos NET LEASE INVESTMENT OFFERING DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. It STATEMENT: is intended to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING EXECUTIVE SUMMARY EXECUTIVE The Boulder Group is pleased to exclusively market for sale a single tenant Bank of America ground lease located SUMMARY: within the Chicago MSA, in Geneva, Illinois. -

Retail Market Study and Recruitment Project Date: 12/11/2014

TO: JOSEPH CAVALLARO, VILLAGE MANAGER FROM: CATHLEEN TYMOSZENKO, COMMUNITY DEVELOPMENT DIRECTOR SUBJECT: RETAIL MARKET STUDY AND RECRUITMENT PROJECT DATE: 12/11/2014 INTRODUCTION To assist with our efforts to identify and recruit national and regional potential retailers and restaurants, the Village Board approved the commencement of a two phase Retail Market Study and Recruitment Project and authorized a contract with Barry Bain of GRS Group in January 2014. Phase 1 consists of a Retail Market Study to map and identify national and regional retailers who are not presently operating in this market. Phase 2 consists of a Recruitment Project to work to bring identified operators to West Dundee. BACKGROUND The Retail Market Study was initiated in January 2014 and concluded at ICSC Dealmakers in October 2014. A phase 1 report was completed in May 2014 and is attached. The information garnered during phase 1 informed the efforts put forward in phase 2, the recruitment phase of the project. Phase 2 recruitment efforts work involved direct contact with potential users and efforts were initiated at ReCon ICSC in Las Vegas on May 18-20 th . Barry Bain was already attending this conference and worked to generate interest in West Dundee existing retail spaces and developable areas at no additional cost to the Village. To gear up for the event and initial contact, a number of different tools were created including a general marketing brochures, targeted lists of available existing retail spaces and available properties for development, a marketing brochure to highlight the Spring Hill Market Area existing retailers and demographic information, a few different potential site plans for the redevelopment of Gateway East as designed with staff and consultant input by Rick Gilmore, architect. -

PDF Media Kit Online

Where they drop till they shop! Seemore Shopping 2008 Media Kit SeeMore Shopping.com - General Website 2 Monthly Unique Visitors, 28,500 Page Views, 340,000 Site Hits 790,000 PREMIUM LISTINGS Sept-Dec Monthly Type Inventory Rates Specs $39.95/MONTH Premium Listings: FOR STORES $399 ANNUAL DESIGNERS OR Businesses register BRANDS $29.95/MONTH on-line in the “Join Us” FULL PAGE $299 ANNUAL Page. Account set-up WITH PROMO assistance available by CODE contacting a SMS account manager or email: [email protected] HOME PAGE BANNER ADS For more Banners: information, contact : Size: pixel dimensions stated (can fl oat within BIG BOX Liz, designated area) 300 X 250 A 312.953.3635 Rich media/animation: liz@seemore 40K maximum size, A CUSTOM shopping .com BANNER GIF/Flash limited to 3 300 X 60 B cycles of :10 ea., or B total :30 Sound: user initiated by HOT SALES click only LINK C Static: HTML, JPEG, GIF 20K recommended size UNDER C BANNER UP TO 780 X 90 D Choose one targeting option to complement D your banner rotation : Targeting – Search INTERNAL PAGE BANNER ADS Brand (Result for listed brands only) Store Name (Opportunity for brands/designers) SKYSCRAPER Category (Men’s Shoes) 120 X 600 E City/Location (Evanston) (River North) E Mall/Shopping Center (Deer Park) Targeting – Editorial* Featured Destinations Featured Stores VERTICAL Chicago Style 120 X 240 F Fashion/Beauty Boutiques Local Designers Window Shopping F Personal Shopper *Contextual links available Online Shopping Guides 3 City: Suburbs: Themed: Andersonville Pilsen Aurora Chicago Boutiques Bucktown /Wicker Ravenswood Evanston Chicago Designer Park River North Forest Park Gold Coast/ Oak Street Roscoe Village Geneva Lakeview (Southport) South Loop/ Glen Ellyn University Village Lincoln Park Highland Park Streeterville Lincoln Square Hinsdale West Loop Loop LaGrange West Town Mag Mile Naperville Old Town Oak Park Online Mall Directories Chicago-Downtown 900 N. -

Aurora, Illinois

AURORA, ILLINOIS PROPERTY OVERVIEW CHICAGO PREMIUM OUTLETS® AURORA, IL y MAJOR METROPOLITAN AREAS SELECT TENANTS No ollwa rthwes 90 t To 94 Elgin llw ay n Chicago: 30 miles east Saks Fifth Avenue OFF 5TH, Abercrombie & Fitch, Ann Taylor Factory i-State T Schaumburg Skokie Store, Armani Outlet, Banana Republic Factory Store, Calvin Klein Chicago Tr . 290 O'Hare 190 90 Company Store, Coach Factory Store, Columbia Sportswear, Diesel, RETAIL Lake Michiga DKNY Company Store, Dooney & Bourke, Express, Gap Outlet, HUGO 294 Stevenson Expwy BOSS, kate spade new york, LACOSTE Outlet, Michael Kors Outlet, Nike Chicago GLA (sq. ft.) 688,000; 170 stores . Eisenhower Expwy. No Elmhurst rthwes ve 290 t To llw Factory Store, Old Navy Outlet, Polo Ralph Lauren Factory Store, Robert A ay Graham, TAG Heuer, Tommy Hilfiger Company Store, True Religion, Ronald Reagan 88 OPENING DATES Memorial Tollway Downers Midway UGG®, Under Armour, Versace, Vera Bradley, Vince. Aurora Grove 55 90 Naperville Farnsworth Airport Opened May 2004 355 94 59 Expansion Opened August 2015 TOURISM / TRAFFIC 294 Chicago is a major tourist and convention destination. Over 48 million RADIUS POPULATION business and leisure travelers visit Chicago annually, of which 15 miles: 1,313,627 approximately 1.38 million are international. O’Hare International Airport CHICAGO PREMIUM OUTLETS 30 miles: 5,109,910 logs over 70 million passengers per year, with Midway contributing AURORA, IL 45 miles: 8,827,170 another 21 million. Attractions in the Chicago area include Navy Pier, Lincoln Park Zoo, AVERAGE HH INCOME Art Institute of Chicago, Field Museum of Natural History, Wrigley Field, 30 miles: $88,290 Willis Tower and John G. -

Aurora, Illinois

AURORA, ILLINOIS PROPERTY OVERVIEW CHICAGO PREMIUM OUTLETS® AURORA, IL y MAJOR METROPOLITAN AREAS SELECT TENANTS No ollwa rthwes 90 t To 94 Elgin llw ay n Chicago: 30 miles east Saks Fifth Avenue OFF 5TH, Abercrombie & Fitch, Ann Taylor Factory i-State T Schaumburg Skokie Store, Armani, Banana Republic Factory Store, Calvin Klein Company Chicago Tr . 290 O'Hare 190 90 Store, Coach Factory Store, Columbia Sportswear, Diesel, DKNY RETAIL Lake Michiga Company Store, Dooney & Bourke, Express, Gap Outlet, HUGO 294 Stevenson Expwy BOSS, kate spade new york, LACOSTE Outlet, Michael Kors Outlet, Chicago GLA (sq. ft.) 688,000; 170 stores . Eisenhower Expwy. No Elmhurst rthwes ve 290 t To llw NikeFactoryStore, Old Navy, Polo Ralph Lauren Factory Store, Robert A ay Graham, TAG Heuer, Tommy Hilfiger Company Store, True Religion, Ronald Reagan 88 OPENING DATES Memorial Tollway Downers Midway UGG® Australia, Under Armour, Versace, Vera Bradley, Vince. Aurora Grove 55 90 Naperville Farnsworth Airport Opened May 2004 355 94 59 Expansion Opened August 2015 TOURISM / TRAFFIC 294 Chicago is a major tourist and convention destination. Over 48 million RADIUS POPULATION business and leisure travelers visit Chicago annually, of which 15 miles: 1,302,762 approximately 1.38 million are international. O’Hare International Airport CHICAGO PREMIUM OUTLETS 30 miles: 5,091,578 logs over 70 million passengers per year, with Midway contributing AURORA, IL 45 miles: 8,809,097 another 21 million. Attractions in the Chicago area include Navy Pier, Lincoln Park Zoo, AVERAGE HH INCOME Art Institute of Chicago, Field Museum of Natural History, Wrigley Field, 30 miles: $86,826 Willis Tower and John G. -

Downloads/Dtaus Tin Retail Strategy.Pdf Keyser Marston Associates, Inc., Portland Center for Urban Economic Development, the Development Commission

Introduction 3 CONTENTS Welcome to Retail 1-2-3: 1 Introduction A WORKBOOK FOR LOCAL OFFICIALS AND COMMUNITY LEADERS 3 Chapter 1 • Planning for Retail Development 17 Chapter 2 • What Do You Want From Retail? istorically, economic development has meant attracting and retaining major corporate and manufacturing jobs for a community, with less emphasis on retail potential. Indeed, for 39 Chapter 3 • What Do Retailers Want From You? Hgenerations, rooftops followed jobs and retail followed the rooftops. However, as global 57 Chapter 4 • Organizing for Retail Success forces reduce America’s industrial and manufacturing jobs, communities are looking to the growing 71 Chapter 5 • Measuring Success and Looking service and retail sectors to strengthen local economies. Simultaneously, the face of retail is changing Ahead with the modern tastes and needs of shoppers, retailers, and developers. Terms and expressions — 81 Chapter 6 • Resources “the shopping experience,” “big box,” and “lifestyle center” — unheard of 20 years ago, are today a part of our lexicon. Without a clear understanding of how retail fits into economic development in the new millennium, communities can find themselves at a competitive disadvantage. Many communities seek economic development assistance, particularly with growing their retail options. Recognizing that retail development, economic development, and redevelopment are vitally important to the future of commu- nities, the Campaign for Sensible Growth, International Council of Shopping Centers (ICSC), Metropolitan Mayors Caucus, and Metropolitan Planning Council, worked cooperatively to produce Retail 1-2-3: A Workbook for Local Officials and Community Leaders. This guidebook harnesses the experience, resources and expertise of ICSC and its members, and the policy research, con- A current trend in retail development, particularly in down- town settings, mixed use maximizes a property’s potential by pairing retail with residences, offices, or other uses. -

2017 Participating Barnes & Noble Mini Maker Faire Stores

2017 Participating Barnes & Noble Mini Maker Faire Stores Store Store Store Name Store City Address City State Zip Number State 2784 Anchorage ANCHORAGE AK 200 East Northern Lights Blvd Anchorage AK 99503 2235 Fairbanks FAIRBANKS AK 421 Mehar Avenue Fairbanks AK 99701 2858 The Summit Birmingham BIRMINGHAM AL 201 Summit Boulevard Suite 100 Birmingham AL 35243 2310 Dothan DOTHAN AL 4601 Montgomery Hwy #100 Dothan AL 36303 2287 Huntsville HUNTSVILLE AL 300 The Bridge Street NW Huntsville AL 35806 2186 Eastern Shore SPANISH FORT AL 30500 State Hwy 181 Suite 414 Spanish Fort AL 36527 2658 Little Rock LITTLE ROCK AR 11500 Financial Ctr Pkwy Little Rock AR 72211 2081 Chandler Fashion Mall CHANDLER AZ 3111 W. Chandler Blvd #2054 Chandler AZ 85226 2143 Dana Park Village Square MESA AZ 1758 South Val Vista Drive Mesa AZ 85204 2746 Arrowhead PEORIA AZ 7685 West Bell Road Peoria AZ 85382 2039 Desert Ridge PHOENIX AZ 21001 N. Tatum Blvd. Suite 42 Phoenix AZ 85050 2211 Happy Valley PHOENIX AZ 2501 West Happy Valley Road StePhoenix 20 AZ 85085 2680 Pima & Shea SCOTTSDALE AZ 10500 N. 90th Street Scottsdale AZ 85258 2243 Tempe Marketplace TEMPE AZ 2000 E.Rio Salado Pkwy #1032 Tempe AZ 85281 2892 Eastside TUCSON AZ 5130 E. Broadway Tucson AZ 85711 2882 Aliso Viejo ALISO VIEJO CA 26751 Aliso Creek Road Aliso Viejo CA 92656 2173 Antioch ANTIOCH CA 5709 Lone Tree Way Antioch CA 94531 2815 Chico CHICO CA 2031 Dr Martin Luther King Pkwy Chico CA 95928 2300 Chino Hills CHINO HILLS CA 3625 Grand Ave Chino Hills CA 91709 2205 South Corona CORONA CA 2470 Tuscany Street Suite 101 Corona CA 92881 2274 Corte Madera CORTE MADERA CA 313 Corte Madera Town Center Corte Madera CA 94925 2942 Dublin DUBLIN CA 4972 Dublin Boulevard Dublin CA 94568 2113 El Cerrito EL CERRITO CA 6050 El Cerrito Plaza El Cerrito CA 94530 2072 Bay Street - Emeryville EMERYVILLE CA 5604 Bay Street Emeryville CA 94608 2785 Encinitas ENCINITAS CA 1040 N. -

Dry Goods Compliance Guide, Effective April 1, 2021

Effective April 1, 2021 Compliance Guide Dry Goods,Effective a mall -Julybased 1, 201 boutique,6 is a wholly owned subsidiary of Von Maur specializing in women’s clothing, accessories and shoes. Vendors that are shipping to Dry Goods must follow this guide. If you are shipping to Dry Goods, please reference the Dry Goods Compliance Guide, available here. Changes to the Compliance Guide will be in BLUE ITALICS. Significant changes are listed below. It is the responsibility of the Vendor to understand and comply with all sections of the Compliance Guide. APRIL UPDATES • State Routing Pages 12 and 14 – Must call to schedule at least 2 business days prior to pickup date when shipping via City Fashion Express PLEASE NOTE – Due to COVID-19, certain carriers may not be able to pick up shipments or have temporary procedure changes. In the event this occurs, please contact the Logistics Manager at [email protected] for further information. UPS Freight – The sale by UPS of its LTL division to TFI and the subsequent name change to T-Force Freight will not impact routing at this time. Please continue to route as instructed. JANUARY UPDATES • State Routing Page 10 – Carrier change for LTL shipments from the following locations; Florida, Georgia, Louisiana, Maine, Maryland, Mississippi, Montana, New Hampshire, New Mexico, North Carolina, Pennsylvania, Rhode Island, South Carolina, Texas, Utah, Virginia, Washington California – zips 955 & 961 New York – zips 120-149 THE UPS GROUND ACCOUNT NUMBER IS AVAILABLE AT WWW.DRYGOODSUSA.COM/VENDORPORTAL.ASPX PLEASE LOGIN USING YOUR VENDOR NUMBER AND A VALID PO# Dry Goods Compliance Guide Effective April 1, 2021 These instructions, changes, and updates supersede any previously issued Dry Goods Compliance Guides, Routing Guides and Purchase Orders. -

St. Charles Circulator Feasibility Study

CityCity ofof St.St. CharlesCharles TRANSIT CIRCULATOR PLAN Land Vision, Inc. TranSystems Corporation DLK Civic Design, Inc. | June 2010 Land Vision, Inc. | TranSystems Corporation | DLK Civic Design, Inc. ACKNOWLEDGEMENTS Thank you to everyone who participated in the planning PUBLIC TRANSPOrtatiON AGENCIES: process for the City of St. Charles Transit Circulator Plan. The success of this planning effort was made possible only Representatives of the Regional Transportation Authority through the concerted and sustained efforts, input, and of Northeastern Illinois (RTA), Pace, and Metra. insights of the residents, business and property owners, and representatives of the City of St. Charles, Regional To establish with the local residents, Transportation Authority, Pace, and Metra. merchants, and stakeholders their desired TransitT Improvement Plan vision, values, and ideas for corridor transit, ST. CHARLES CITY COUNCIL: GOAL and transportation improvements along Route 20/Lake Steeet. Donald P. DeWitte, Mayor Nancy Garrison, City Clerk PlaNNING CONSUltaNT TEAM: PLANNING VILLAGE OF ADDISON Warren J. Drewes, City Treasurer RTA Daniel P. Stellato, Alderman Land Vision, Inc. WORKSHOP Jon Monken, Alderman 116 W. Main Street, Suite 208 Betsy Penny, Alderman St. Charles, Illinois 60174 IMAGE SURVEY Clifford X. Carrignan, Alderman 630.584.0591 SPONSORS John McGuirk, Alderman www.landvision.com April 2, 2009 Village of Addison William Turner, Alderman 11:30 AM - 2:00 PM LUNCH 630.693.7501 James E. Martin, Alderman With assistance provided by: Location PROVIDED! RSVP: Jo Krieger, Alderman E-mail: [email protected] Ed Bessner, Alderman Transystems Corporation Village of Addison Room 1301 222 South Riverside Plaza, Suite 2320 Phone: 630.693.7501 David W.