Directors' Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

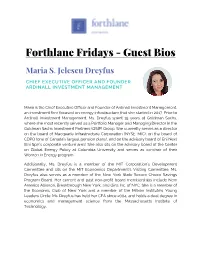

Forthlane Fridays - Guest Bios

Forthlane Fridays - Guest Bios Maria S. Jelescu Dreyfus CHIEF EXECUTIVE OFFICER AND FOUNDER ARDINALL INVESTMENT MANAGEMENT Maria is the Chief Executive Officer and Founder of Ardinall Investment Management, an investment firm focused on energy infrastructure that she started in 2017. Prior to Ardinall Investment Management, Ms. Dreyfus spent 15 years at Goldman Sachs, where she most recently served as a Portfolio Manager and Managing Director in the Goldman Sachs Investment Partners (GSIP) Group. She currently serves as a director on the board of Macquarie Infrastructure Corporation (NYSE: MIC), on the board of CDPQ (one of Canada’s largest pension plans), and on the advisory board of Eni Next (Eni SpA’s corporate venture arm). She also sits on the advisory board of the Center on Global Energy Policy at Columbia University and serves as co-chair of their Women in Energy program. Additionally, Ms. Dreyfus is a member of the MIT Corporation’s Development Committee and sits on the MIT Economics Department’s Visiting Committee. Ms. Dreyfus also serves as a member of the New York State Secure Choice Savings Program Board. Her current and past non-profit board memberships include New America Alliance, Breakthrough New York, and Girls Inc. of NYC. She is a member of the Economic Club of New York and a member of the Milken Institute’s Young Leaders Circle. Ms. Dreyfus has held her CFA since 2004, and holds a dual degree in economics and management science from the Massachusetts Institute of Technology. Daniel Dreyfus CHIEF INVESTMENT OFFICER AND FOUNDER BORNITE CAPITAL Dan serves as the Founder and Chief Investment Officer at Bornite Capital. -

The Preqin Quarterly Update: Private Equity

Q1 2013 The Preqin Quarterly Update: Private Equity Content Includes: Fundraising We review the latest fundraising figures, including regional breakdown, time spent on the road, and the largest funds to close in the quarter. Investors We take a look at investor appetite for private equity in the year ahead, including geographies and strategies to be targeted. Buyout Deals We examine private equity buyout deals and exits in Q1 2013 by type, value and region. Venture Capital Deals We provide a breakdown of the latest venture capital deal activity by value, region and stage. Performance We analyze the latest performance data for private equity funds, featuring dry powder figures, IRRs by fund type and vintage and the PrEQIn Private Equity Quarterly Index. alternative assets. intelligent data. The Preqin Quarterly Update: Private Equity, Q1 2013 Download Data Foreword Private equity fundraising in the fi rst quarter of 2013 was relatively robust, with 130 funds closed having raised an aggregate $67.2bn. However, in an increasingly competitive fundraising market – 1,906 funds are in market as of the start of Q2 2013 – many LPs are choosing to invest in funds raised by more established managers. First-time funds that closed in Q1 2013 secured just $4.2bn in aggregate capital, compared to the peak of $31.6bn in Q2 2008. However, Preqin’s interviews with private equity investors in December 2012 reveal that investor attitudes towards fi rst-time fund managers are more positive moving forwards; half of LPs interviewed will consider committing to fi rst-time funds or those managed by spin-off teams in the following 12 months. -

Kraft Heinz Merger

Kraft Heinz Merger Mohd Sakib Agenda n Overview of Merger Companies n Deal Terms and Merger Structure n Synergies and Risks n Effects on Investors – 3G Capital and Berkshire Hathaway n Future of Kraft Heinz 4/22/15 Wall Street Club 2 Overview of Kraft n Kraft Foods Group, Inc. is a consumer packaged food and beverage company founded in 1903 – Operates in six segments; portfolio of >70 major brands – Primarily serves supermarket chains, club stores, retail food outlets, etc n Kraft split into Kraft Foods, focusing on grocery products in North America, and Mondelez International Inc., focused on snacks – Stable financial performance – $18 Billion in annual sales – 9 brands with more than $500 Million in annual sales 4/22/15 Wall Street Club 3 Overview of Heinz n H.J. Heinz Company is a global food player that was established in 1869 – Three core categories: Ketchup and Sauces, Meals and Snacks, and Infant/Nutrition – Products have #1 or #2 market share in 50+ countries n Acquired by Warren Buffett and 3G Capital for $28 Billion in 2013 – Appealing due to strong, durable brands and global presence – Strong international presence with emerging market sales consisting of 25% of total revenue 4/22/15 Wall Street Club 4 Deal Terms and Merger Structure n Stock for stock merger possibly valued at $46.6 Billion and orchestrated by Berkshire Hathaway and 3G Capital – Heinz will control 51% whereas Kraft will own remaining 49% n $10 Billion special cash dividend to be paid out by 3G and Berkshire – Kraft shareholders will receive $16.50 a share, representing -

Michel Terpins and Rodrigo Terpins (Collectively, the "Defendants") and Relief

SANJAY WADHWA Attorney for Plaintiff SECURITIES AND EXCHANGE COMMISSION New York Regional Office 3 World Financial Center, Suite 400 New York, New York 10281 (212) 336-0181 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK ----~-------------------------------------------------------------------x SECURITIES AND EXCHANGE COMMISSION, Plaintiff, -against- 13 Civ. 1080 (JSR) MICHEL TERPINS and ECFCASE RODRIGO TERPINS, AMENDED Defendants, COMPLAINT -and- ALPINE SWIFT LTD. Relief Defendant. ------------------------------------------------------------------------x Plaintiff Securities and Exchange Commission ("Commission"), for its Complaint against defendants Michel Terpins and Rodrigo Terpins (collectively, the "Defendants") and relief defendant Alpine Swift Ltd. ("Alpine Swift") alleges as follows: SUMMARY 1. This is an insider trading case involving highly suspicious trading in call option contracts ("calls") ofH.J. Heinz Company ("Heinz") the day prior to the February 14, 2013 announcement that Heinz had entered into an agreement to be acquired for $72.50 per share by an investment consortium comprised of Berkshire Hathaway and 3G Capital (the "Announcement"). The $72.50 per share price represented a 20% premium to Heinz's closing share price on February 13, 2013. As a result of the Announcement, Heinz's stock price increased from a close of$60.48 on February 13 to a close of$72.50 on February 14, an increase of nearly 20%. 2. The Defendants arranged for the purchase of the Heinz calls in advance of the Announcement using a Swiss account held by Alpine Swift, a corporate entity formed to hold assets for which a close relative of the Defendants was the ultimate beneficial owner. Specifically, on February 13, the day prior to the Announcement, the Defendants used Alpine Swift's account to purchase 2,533 out-of-the money June $65 calls for a total of nearly $90,000. -

The Pennsylvania State University Schreyer Honors College

THE PENNSYLVANIA STATE UNIVERSITY SCHREYER HONORS COLLEGE DEPARTMENT OF SUPPLY CHAIN AND INFORMATION SYSTEMS LOGISTIC INTEGRATION: THE OVERLOOKED FORCE DRIVING THE FUTURE OF THE KRAFT HEINZ MERGER TANNER VANKLEECK SPRING 2016 A thesis submitted in partial fulfillment of the requirements for baccalaureate degrees in Accounting and Finance with honors in Supply Chain and Information Systems Reviewed and approved* by the following: Robert Novack Associate Professor of Supply Chain Management Thesis Supervisor John Spychalski Professor Emeritus of Supply Chain Management Honors Adviser * Signatures are on file in the Schreyer Honors College. i ABSTRACT Over the past three decades, mergers and acquisitions have become an integral component of the economic system. Although the financial crises of 2008 cut M&A activity in half, the past four years have seen volume and value of M&A deals recover to near record highs. Fueled by cheap credit and a need to expand, the economy is appearing to be in the midst of another merger wave. Although the macroeconomic events driving these waves and the individual motives behind each merger are ever changing, the failure rate of mergers has remained fairly constant. Between sixty and eighty percent of all mergers end without achieving the desired economic return. Although much research has been done regarding this topic, success rates have not improved. The issue concerning many of these deals is that they are only analyzed on the financial level, and not at the logistical operating level. The result is that many potential financial synergies and gains are not realized since the logistics networks either cannot be combined or the integration is handled poorly. -

Amrest Holdings SE 28 FEBRUARY 2020

(all figures in EUR millions unless stated otherwise) Consolidated Directors’ Report for the year ended 31 December 2019 AmRest Holdings SE 28 FEBRUARY 2020 Net 1 AmRest Group Consolidated Directors’ Report for the year ended 31 December 201 9 (all figures in EUR millions unless stated otherwise) 2 AmRest Group Consolidated Directors’ Report for the year ended 31 December 201 9 (all figures in EUR millions unless stated otherwise) Contents LETTER TO THE SHAREHOLDERS ........................................................................................................................................ 4 FINANCIAL HIGHLIGHTS (CONSOLIDATED DATA) ........................................................................................................... 6 GROUP BUSINESS OVERVIEW .............................................................................................................................................. 7 FINANCIAL AND ASSET POSITION OF THE GROUP ...................................................................................................... 12 BRANDS OPERATED BY THE GROUP............................................................................................................................... 21 KEY INVESTMENTS .............................................................................................................................................................. 25 PLANNED INVESTMENT ACTIVITIES ................................................................................................................................ -

Publisher's Version

Source: Management and Finance Online Published by: Harvard Extension Student Journal: Vol. 2. No. 2 (July, 2019) Management and Finance Club (HESMFC) ANALYSIS OF HEINZ COMPANY’S ACQUISITION OF KRAFT FOODS GROUP INC. MANAGEMENT AND FINANCE ONLINE JOURNAL Published by Harvard Extension Student Management and Finance Club (HESMFC) HESMFC is a not-for-profit, student organization, an affiliate of Harvard Extension Student Association (HESA) that serves as a platform for academic publication. The HESMFC online journal helps student researchers and scholars to publish a wide range of topics in the fields of business management and finance. Author(s): David A.J. Abrahams • URL : https://hesmfc.extension.harvard.edu/ Management and Finance Online Journal, Vol. 2, No. 2, (July, 2019), Published by Harvard Extension Stude nt Management and Finance Club AANALYSISNALYSIS OF HEINZ COMPANY’S ACQUISITION OF KRAFT FOODS GROUP INC. David A.J. Abrahams Harvard Extension School, Harvard University, 51 Brattle Street, Cambridge, MA 02138, United States Email: [email protected] David A.J. Abrahams has a Master of Science degree in Financial Macro-Economics with a specialization in Monetary Economics from Erasmus University of Rotterdam, The Netherlands. ABSTRACT He is currently pursuing Master of Liberal Arts degree in the field of Management at Harvard Extension School. Currently, he is a Resolution Officer at De Nederlandsche Bank (Central Bank of The Netherlands, Amsterdam, The Netherlands). Previously he worked at the Boards of Financial Supervision (Curacao and Sint Maarten, This article discusses the acquisition of Kraft Foods Group Inc. by H.J. Heinz Dutch Caribbean) and both Co. to form the Kraft Heinz Company. -

The Terpins Brothers and the Heinz Takeover a Case Study of Company Valuation and Insider Trading in Options∗

The Terpins Brothers and the Heinz Takeover A Case Study of Company Valuation and Insider Trading in Options∗ Patrick Augustiny Menachem Brennerz Marti G. Subrahmanyamx McGill University, Desautels New York University, Stern New York University, Stern January 19, 2015 Abstract This teaching case study illustrates the illicit insider trades in equity options ahead of the Heinz takeover by Berkshire Hathaway and 3G Capital. The case introduces students to various concepts of option valuation and option strategies. These include option payoff diagrams, put-call parity, arbitrage strategies, the Black-Scholes formula, and option Greeks, as well as an application to company valuation using the Merton model. Keywords: Case Study; Derivatives; Insider Trading; Mergers and Acquisitions; Methodology; Options; Teaching JEL Classification: A22; A23; A29; B40; G13, G14, G34, G38, K22, K41 Target Audience: Advanced Bachelor, M.Sc., MBA, Executive MBA ∗We thank Christopher Dou for truly outstanding research assistance. All errors remain our own. yMcGill University - Desautels Faculty of Management, 1001 Sherbrooke St. West, Montreal, Quebec H3A 1G5, Canada. Email: [email protected]. zNew York University - Leonard N. Stern School of Business, 44 West 4th St., NY 10012-1126 New York, USA. Email: [email protected]. xNew York University - Leonard N. Stern School of Business, 44 West 4th St., NY 10012-1126 New York, USA. Email: [email protected]. 1 Introduction On February 14, 2013, Berkshire Hathaway Inc. and 3G Capital announced a deal in which the world famous ketchup maker H.J. Heinz Co would eventually be purchased for USD $28 billion. 1 This would result in an offer price of USD $72.50 per H.J. -

FINANCIAL POST MAGAZINE (EDITORIAL) 34 1450 Don Mills Road, Suite 300 FAMILY FINANCE

> > Ready for his close-up Encana CEO Randy Eresman steps into the spotlight with a great big bet on natural gas MAY 2010 =@E8E:@8CGFJKD8>8Q@E< 00504FPM001504FPM001 1 44/14/10/14/10 55:06:45:06:45 PPMM MAY/10 CONTENTS. CANADA’S BUSINESS VOICE 6 Feedback Editor Terence Corcoran 9 Editor’s Letter Deputy Editor Cooper Langford Contributing Editors Mark Anderson (Ottawa), Dan Bortolotti, Paul Brent, 11 Jamie Golombek, John Greenwood, Andy Holloway, FIRST BUSINESS. Brian Hutchinson (Vancouver), Sanam Islam, George Koch 11 Mover. 3G Capital rethinks the (Calgary), Dana Lacey, David Leach (Victoria), Kevin hedge fund. 13 At A Glance. Glob- Libin (Calgary), Ken Mark, Jared Mitchell, Karin Mizgala Big Fish. (Vancouver), Joanna Pachner, A.J. Sull (Vancouver) al debt: Who owes what? =@E8E:@8CGFJKD8>8Q@E< A maritime technology comes Art ashore and wins . 14 Innovator. Art Director Lina McPhee Ostara makes water treatment Assistant Art Director Brianna Freitag cleaner and cheaper. Infographic Contributing Artists Solo dancers: The loonie vs. Andrew Barr, Kevin Hewitt, Frances Juriansz, Will Lew, Kagan GDP. 15 My Word. Why native McLeod, Darcy Muenchrath, Sandy Nicholson, Jonathon Rivait, reserves need private property Graham Roumieu, Nick Westover, Daniel Wood FINANCIAL POST MAGAZINE (EDITORIAL) 34 1450 Don Mills Road, Suite 300 FAMILY FINANCE. Toronto, Ontario M3B 3R5 34 Family File. Jacques and Phone: 416-383-2300 Fax: 416-386-2836 Marie fear Jacques will lose his E-mail: [email protected] job before retirement. Do they Customer service: 1-800-668-7678 have enough to manage? 37 www.financialpost.com/magazine Boomer vs Junior. -

Amrest Holdings SE Capital Group Report for the 1St Half of 2015

AmRest Holdings SE Capital Group Report for the 1st half of 2015 August 13th, 2015 AmRest Holdings SE Report for the 1st half of 2015 PART I Directors' report Contents: 1. Selected Financial and Operating Results – Summary I-2 2. Company Business Overview I-5 3. Management and Supervisory Board members as at 30.06.2015 I-7 4. Information relevant for the evaluation of human resources, financial situation and financial results of the Company I-8 5. Planned investment activities and assessment of their feasibility I-18 6. External and internal factors which are significant to the Company's development in 2015 I-19 7. Basic risks and threats to which the Company is exposed I-20 8. Management representations I-24 I- 1 1. Selected Financial and Operating Results 30.06.2015 – Summary CHART 1 THE AMREST SALES VALUE IN THE FIRST HALVES OF THE YEARS 2013–2015 (PLN ‘000) Increase in sales +22% 1 559 675 1 387 764 1 600 000 1 274 267 1 400 000 1 200 000 1 000 000 800 000 600 000 400 000 200 000 0 H1 2013 H1 2014 H1 2015 CHART 2 EBITDA IN THE FIRST HALF OF THE YEARS 2013–2015 (PLN ‘000) 197 987 Increase of EBITDA 85% 200 000 180 000 155 101 160 000 140 000 106 855 120 000 100 000 80 000 60 000 40 000 20 000 0 H1 2013 H1 2014 H1 2015 I- 2 CHART 3 NUMBER OF RESTAURANTS AT THE END OF THE FIRST HALVES OF THE YEARS 2013–2015 Increase of 161 stores 851 900 749 690 800 700 600 500 400 300 200 100 0 H1 2013 H1 2014 H1 2015 * Including restaurants operated by franchisees of La Tagliatella brand. -

H.J. Heinz Company and Kraft Foods Group Sign Definitive Merger Agreement to Form the Kraft Heinz Company

H.J. Heinz Company and Kraft Foods Group Sign Definitive Merger Agreement to Form The Kraft Heinz Company Combination Creates Unparalleled Portfolio of Powerful and Iconic Brands Merger will create the 3rd largest food and beverage company in North America and the 5th largest food and beverage company in the world. Combined company to be named The Kraft Heinz Company and to be co- headquartered in Pittsburgh and the Chicago area. The new company will have revenues of approximately $28 billion with eight $1+ billion brands and five brands between $500 million-$1 billion. Stock and cash transaction, with Kraft shareholders to receive a special cash dividend of $16.50 per share upon closing and stock in the combined company representing a 49% stake in the new company. Berkshire Hathaway and 3G Capital will invest an additional $10 billion in The Kraft Heinz Company; existing Heinz shareholders will collectively own 51% of the new company. Significant synergy opportunities with strong platform for organic growth in North America, as well as global expansion, by combining Kraft’s brands with Heinz’s international platform. The Kraft Heinz Company is fully committed to maintaining an investment grade rating; Company plans to maintain Kraft’s current dividend per share, which is expected to increase over time. Investment community conference call at 8:30 a.m. EDT; Media conference call at 10:00 a.m. EDT. PITTSBURGH, Pa. and NORTHFIELD, Ill. – March 25, 2015 – H.J. Heinz Company and Kraft Foods Group, Inc. (NASDAQ: KRFT) today announced that they have entered into a definitive merger agreement to create The Kraft Heinz Company, forming the third largest food and beverage company in North America with an unparalleled portfolio of iconic brands. -

Amrest Holdings SE 24 FEBRUARY 2021

Consolidated Financial Statements for the year ended 31 December 2020 AmRest Holdings SE 24 FEBRUARY 2021 This document has been prepared for convenience purposes only. AmRest Group's consolidated annual report has been prepared in XHTML format. Consolidated income statement for the year ended 31 December 2020 .................................................................................... 5 Consolidated statement of comprehensive income for the year ended 31 December 2020 ................................................... 6 Consolidated statement of financial position at 31 December 2020 ........................................................................................... 7 Consolidated statement of cash flows for the year ended 31 December 2020 ......................................................................... 8 Consolidated statement of changes in equity for the year ended 31 December 2020 .............................................................. 9 Notes to the Consolidated Financial Statements ......................................................................................................................... 10 1. General information on AmRest Group ............................................................................................................................... 10 2. Group Structure ...................................................................................................................................................................... 13 3. Basis of preparation ..............................................................................................................................................................