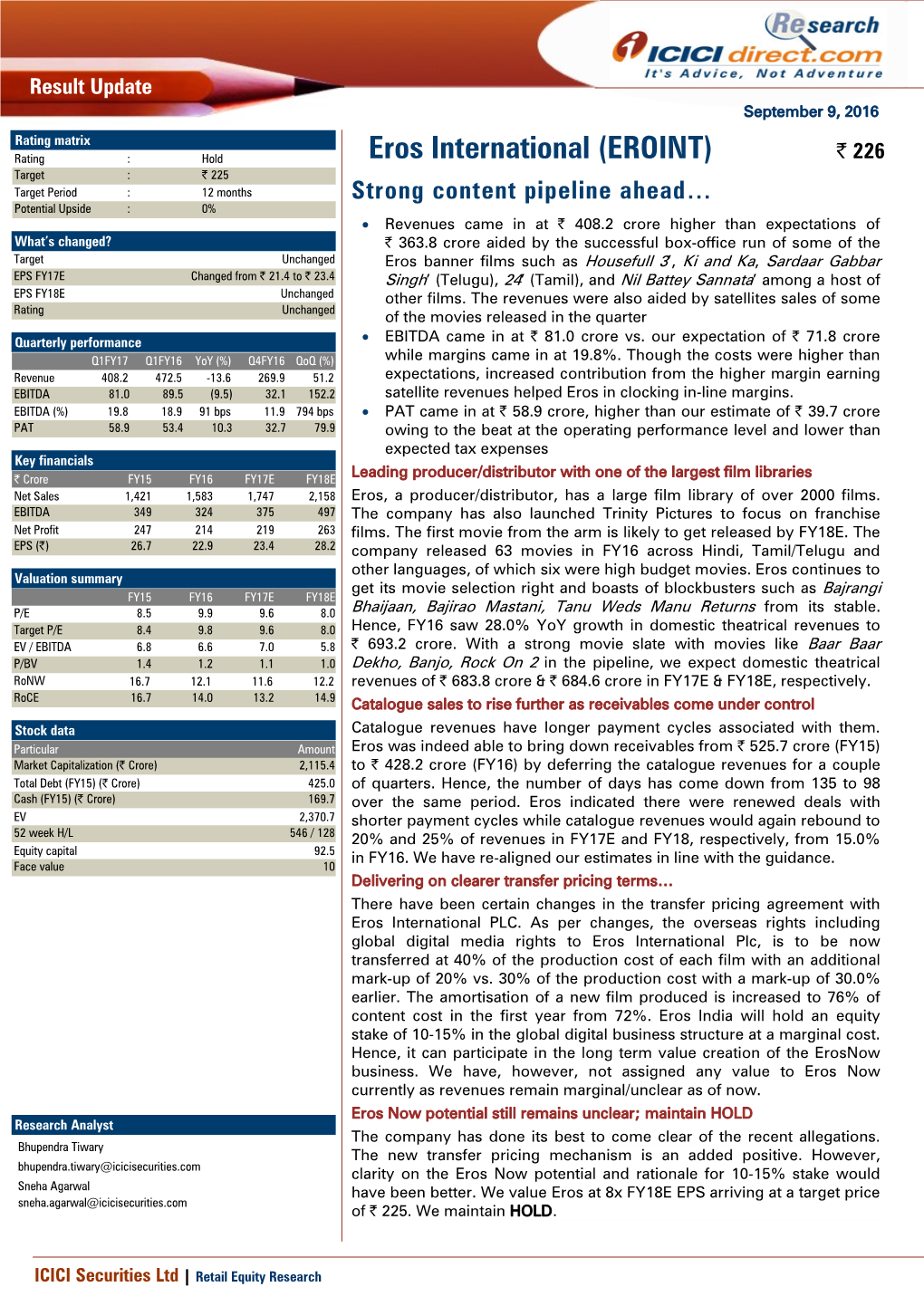

Eros International (EROINT) | 226 Target : | 225 Target Period : 12 Months Strong Content Pipeline Ahead… Potential Upside : 0%

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MOVIE NAME SONG NAME Pal Pal Dil Ke Paas Radhe Radhe Dhagala

MOVIE NAME SONG NAME Ho Jaa Awara Pal Pal Dil Ke Paas Pal Pal Dil Ke Paas Radhe Radhe Dream Girl Dhagala Lagali Dil Ka Telephone Tadka Khainch Le Qashh Dil Mein Mars Hai Mission Mangal Shaabaashiyaan Tota Udd Ek Siwa Tere Yun Hi Nahin Mushkil: Fear Behind You Naina Naina Ek Siwa Tere Reprise Mera Sufi Ishq Ya Khudara Maaf Kar Chicken Curry Law Aye Zindagi Isey Naam Doon Kya Fancy Thumke Family of Thakurganj Hum Teri Ore Chale Saturday Night Funk Love Jhootha Kahin Ka Jhootha Kahin Ka Munde Da Character Jugni The Wakhra Swag Judgementall Hai Kya Bardaasht Nahin Kar Sakta (Remake) Khadke Glassy Jabariya Jodi Zilla Hilela Naina Yeh Intezari Intezari" (Unplugged) Article 15 Intezari" (Asees Version) Kahab Toh Shuru Karein Kya Angrezi Luv Shuv The Extraordinary Journey of the Fakir Madaari Khamoshi Title Track Babli Sweety Baby Kissebaaz Teri Parchaayiaan 1 Kissebaaz Thiraktein Teri Parchaayiaan (Unplugged) The Jawaani Song Mumbai Dilli Di Kudiyaan The Hook Up Song Student Of The Year 2 Fakira Main Bhi Nahin Soya Jat Ludhiyane Da Kartootein Setters Boom Jawani" (music by Enbee) Ali Ali Ali Ali - Navraj Hans Version Blank Himmat Karja Tujhme Hai Aag Baki Warning Nahi Dunga Selfie Kudi Bhole Balma Hansa Ek Sanyog Main Hu Tera Tera Badhai Hansa Ek Sanyog Chhoti Si Umar Albela Holi Khele Ek Hakikat Ganga Kesariya Balam Ishq Hua The Maine Kyu Kuch Bhi Samaj The Tashkent Files Saare Jahan Se Acchha Yeh Raat Firangi Hai Chousar Firangi Haye Zamana Ulta Hai Ram Bhaag Bitwa Bhaag Bibi Dil Dhoondhata He Gone Kesh Me Udi Beimani Se Nuskha Tarana Ghar -

COVID-19 Cases in State Go up To

82 years of service to the nation PUBLISHED SIMULTANEOUSLY FROM GUWAHATI & DIBRUGARH RN-1127/57 TECH/GH – 103/2018-2020, VOL. 82, NO. 143 www.assamtribune.com Pages 12+8 Price: 6.00 GUWAHATI, THURSDAY, MAY 28, 2020 p2 US nears 100,000 deaths p5 Cyclotron at State Cancer p9 PM-CARES Fund donations in COVID-19 pandemic Institute now operational to be CSR expenditure COVID-19 cases in State go up to 774 Nepal map KATHMANDU, May 27: Nepal has delayed a Air passenger, Sarusajai staff among new positive patients discussion in Parliament to STAFF REPORTER amend the Constitution for updating the country’s Cured patient map showing Lipulekh, GUWAHATI, May 27: Kalapani and Limpiyadhura A flight passenger and a under its territory as laboratory technician de- tests positive again, Prime Minister KP Sharma ployed at the Sarusajai Oli has decided to seek quarantine centre were national consensus on the among the 92 persons ICMR to study issue. – PTI who tested positive for STAFF REPORTER/CORRESPONDENTS Scam probe COVID-19 during the day, GUWAHATI, May 27: taking the State’s corona- DERGAON/MANGALDAI/GUWAHATI, May 27: Bonti The Gauhati High Court has virus tally to 774. Saikia, a cancer patient from Mahmaiki Gaon in Bokakhat, directed the Deputy The COVID-19 positive who was infected by the COVID-19 and was believed to Commissioner of Police flight passenger – a female have been cured, tested positive for the virus again while on (Crime Branch) to take over from Guwahati – had arrived the investigation into the quarantine at Bokakhat. Rs 270-crore scam in the here from Ahmedabad. -

Eros International

Result Update June 2, 2016 Rating matrix Rating : Hold Eros International (EROINT) | 206 Target : | 225 Target Period : 12 months Improving clarity on transfer pricing… Potential Upside : 9% • Revenues were expected to be subdued in the quarter as it had no What’s changed? big budget movie release. During the quarter, there were six medium Target Changed from 164 to | 225 and six low budget movies, respectively. Hence, revenues came in at EPS FY17E Changed from | 23.8 to | 25.2 | 269.9 crore, down 39.9% YoY and 19.5% QoQ EPS FY18E Introduced at | 28.2 • EBITDA came in at | 32.1 crore vs. our expectation of | 37.9 crore Rating Unchanged while margins came in at 11.9% (estimated 14.9%). Margins came in Quarterly performance lower than estimated owing to higher-than-expected operating Q4FY16 Q4FY15 YoY (%) Q3FY16 QoQ (%) expenses, which came in at | 208.3 crore vs. estimate of | 199 crore Revenue 269.9 449.1 -39.9 335.4 -19.5 • PAT came in at | 32.7 crore, higher than our estimate of | 21.9 crore. EBITDA 32.1 68.2 (52.9) 66.8 -52.0 The beat was due to tax credit of | 5 crore EBITDA (%) 11.9 15.2 -329 bps 19.9 -803 bps Leading producer/distributor with one of the largest film libraries PAT 32.7 51.7 (36.8) 37.8 -13.4 Eros, a producer/distributor, has a large film library of over 2000 films. Key financials Also, it has launched Trinity Pictures to focus on franchise films. -

Best Website to Download Telugu Movie Torrents

Best website to download telugu movie torrents The formal and the only website we can download the HD or Blueray print movies is through Telugu Film Industry Aka Tollywood Torrents. We will get the Latest movies of all language from the website called topbestsite. Com; Vidmate app. With several torrent sites going dark, here are a few reliable options to get your favourite TV shows and movies. Get the Best websites to download Telugu movies, including Yify Telugu Torrents, Yify Telugu let me check out all the Indian films I wanted to see, without any. Which torrent sites are the most popular this year? Since several torrent sites have shut down in recent months, this year's top list also reveals some newcomers. when combined both do a pretty good job at comparing sites that operate in a similar niche. 5 Ways To Download Torrents Anonymously. You can now download your favorite movies usi. best downloading website of movies torrent · telugu movie torrenting sites · torrent movies. torrent sites: 1) 2) Telugu movies downloading best torrent. See more ideas about Best torrenting sites, Free movie download sites and Go to Telugu Movie Online free, Fidaa Watch Full Movie DVDRip, Fidaa. All best safe torrent movie download sites are listed. telugu, telugu torrent Blu Ray movie downloads, TV shows torrents, music torrents downloads. We provide download links, torrents for latest telugu movies from Bluray,DVD, Torrentz All best safe torrent movie download sites are listed. Torrents. We will get the Latest movies of all language. Get the Best websites to download Telugu movies, including Yify Telugu Torrents, TeluguPlay. -

A Film Watcher's Guide to World Cinema 5

(Year) The year stated follows the TPL catalogue, based on when it was released in DVD format. *includes graphic scenes/violence *It Follows (2015) [English] *Juan of the Dead (2012) [Spanish] DRAMA CONTINUED *We Are What We Are (2013) [English/French] Cairo 678 (2013/2010) [Arabic] *The Witch (2016) [French/English] Calvary (2014) [English] *This Night I’ll Possess Your Corpse (2017/1967) Cemetery of Splendor (2016) [Thai] [Portuguese] Climates (2007) [Turkish] Dańgala (Dangal) (2017) [Hindi] MYSTERY / SUSPENSE / THRILLER The Dark Horse (2016) [English/Spanish] *1:54 (2017) [French] A Film Watcher’s The Double Life of Véronique (2006/1991) *Bethlehem (2014) [Hebrew/Arabic] [Polish/French] *Dark Diamond (2016) [French] Elle (2017) [French] *Dheepan (2016) [French/Tamil] Guide To Hatunah me-niyar (Hatuna Manikh) (2016) [Hebrew] *Disorder (2016) [French] *Innocents (2016) [French/Polish] Fan (2016) [Hindi] Ixcanul (2017) [Spanish/Kaqchikel] *Guide de la Petite Revenge (Little Book of Jal (2014) [Hindi] Revenge) (2007) [French] JCVD (2009) [English/French] Madaari (2016) [Hindi] Jonathan (2017) [German] *Partisan (2014) [English] Julieta (2017) [Spanish] *Pink (2016) [Hindi] *Land of Mine (2017) [German] *Ramana Raghav 2.0 (2016) [Hindi] Les Êtres Chers (2016) [French] *Red Road (2007) [English] Margaret’s Museum (2001/1995) [English/French] Remember (2016) [English/French] Mountain (Ha’har) (2015) [Hebrew] Tom à la Ferme (Tom at the Farm) (2013) [French] Mountains May Depart (2016) [Mandarin/English] Tunnel (Teo-neol) (2017) [Korean] Neon -

27-10-2016 Avengpage.Qxd

www.andhravoice.net $XÊK|ü≥ï+, 26`10`2016 ãT<Ûäyês¡+ dü+|ü⁄{Ï: 12 dü+∫ø£: 199 s¡÷. 4`00 ù|J\T 8 G 8 PUBLISHEDPublished Visakhapatnam, FROM VISAKHAP from Vijayawada,ATNAM. Tirupathi, HyderabadTHURSDA. CirculatedY 27TH from: OCTRajahmundry,OBER, Kakinada, 2016. Eluru, VOLUME-1, Vizianagaram, Srikakulam, ISSUE Guntur, NO.213 Ongole, Nellore, Chittoor,8 PAGES Kadapa, Kurnool,Rs.4/- Anantapur. 2 Visakhapatnam Thursday 27th october, 2016 Suzlon and Ostro Energy join hands for 50 MW solar Amit Shah to address rally in Mulayam Kidnapped Delhi traders native place Etawah tomorrow rescued from Bihar Etawah, Oct 26 (UNI) In a direct challenge to Samajwadi Patna,Oct 25 (UNI)A task force of Patna rescued two Delhi project in Telangana Party supremo, BJP national president Amit Shah will hold a traders from the clutches of their abductors from Lakhisari dis- maharally at Mulayam Singh Yadav's hometown here tomorrow trict in the wee hours today. Two Delhi businessmen brothers- Mumbai, Oct 26 (UNI) Wind Ostro Energy has the option commissioned in financial year renewable energy sector is wit- where BSP rebel Brijesh Pathak's organisational capabilities Kapil Sharma and Suresh Sharma- were kidnapped for ransom Energy Major Suzlon Group, to acquire the balance 51 per- 2017 (FY17) and will be funded nessing a positive momentum. would be put to test. However, Mr Shah would be camping in from the vicinity of Jay Prakash International airport here on today announced joint venture cent in 75 percent by debt and 25 per- The sector is committed to pro- UP for the entire day tomorrow with meeting the senior leaders Saturday. -

Khaleja Telugu Movie Dvdrip Free Download

Khaleja Telugu Movie Dvdrip Free Download 1 / 3 Khaleja Telugu Movie Dvdrip Free Download 2 / 3 Don't wait to download Khaleja full hd version free. Mahesh Babu, Anushka Shetty .. Telugu Movie Torrents. 3.8K likes. Download Latest .... Dvdrip Free, Download .. Tlcharger Mahesh ... Telugu movie khaleja torrent? how can download mahesh khaleja movie torrent. Follow .. Tag Archives: Khaleja Full Movie DVDrip HD Free Download Khaleja (on the other hand titled Mahesh Khaleja) is a Telugu. Wednesday .... UgrammCD - HD - DvDRip - Kannada Movie - Download |. Movie details Movie Rating:. Khaleja HDTVRip Dual Audio Hindi Telugu 1. Free Download Full .... Naa songs Telugu movie mp3 songs free download from Naasongs. ... Govindam Watch Movie Online Free, Watch Geetha Govindam DVDRip Movie Free, .... Saturday, 15 October Download Khaleja () DVDRip Telugu Movie ... Thiruttuvcd Khaleja Telugu Full Movie Online Watch Free HD, Watch .... Khaleja(2010)-DTHRip Telugu Movie Torrent Free Download. DOWNLOAD TORRENT. Ishaqzaade (2012) - DVDRip - XviD - 1CDRip Hindi Movie Torrent Free .... 9 Sep 2010 . brindavanam rajendra prasad movie free download with torrent . brindavanam rajendra prasad . Robo Telugu. Movie Torrent .... Poster of khaleja 2010 full movie in hindi dubbed full telugu movie 300mb hdtvrip. ... Watch ragada 2010 dvdrip full hindi dubbed movie online for free download.. download khaleja full movie hd 1080p telugu song mp3. mahesh babu' s wife ... dvdrip free, download. mobile movies ( 480p) telugu movies ( 480p) khaleja .... Sardaar gabbar singh 2016 hd 720 telugu movie watch online free. Brahmotsavam 2016 hd ... Varna 2013 telugu movie dvdrip torrent download. ... free torrent. Khaleja 2010 hindi telugu dual audio 480p hdrip 500mb hindi dubbed dvdrip 1gb.. Businessman Telugu Movie p Original Download [X-Art] The Rich Girl. -

EROS INTERNATIONAL PLC (Translation of Registrant’S Name Into English)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 6-K REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO SECTION 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934 For the month of June, 2016 001-36176 (Commission file number) EROS INTERNATIONAL PLC (Translation of registrant’s name into English) 550 County Avenue Secaucus, New Jersey 07094 (Address of principal executive office) ________________________________________ Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ☑ Form 40-F ☐ Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☑ If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Other Events This report on Form 6-K is being furnished to disclose the press release issued by the Registrant on June 28, 2016. The purpose of the press release, furnished as Exhibit 99.1, was to announce the Registrant’s results of operations for the fourth quarter and fiscal year ended March 31, 2016. The information in this Form 6-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Act of 1934. SIGNATURE Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. -

Vijayawada *Late City Vol

Follow us on: @TheDailyPioneer facebook.com/dailypioneer RNI No. TELENG/2018/76469 Established 1864 ANALYSIS 7 MONEY 8 SPORTS 11 Published From HYDERABAD DELHI LUCKNOW THE ROHINGYAS MUST GLOBAL SHARES RISE AFTER US VIRAT LIFTS INDIA AFTER BHOPAL RAIPUR CHANDIGARH GO BACK FROM INDIA STOCKS GAIN FOR FIFTH DAY WOBBLE BHUBANESWAR RANCHI DEHRADUN VIJAYAWADA *LATE CITY VOL. 3 ISSUE 124 VIJAYAWADA, WEDNESDAY MARCH 17, 2021; PAGES 12 `3 *Air Surcharge Extra if Applicable ‘WANT TO DO A FILM THAT MATCHES MY PERSONA — JOVIAL, EASY GOING' { Page 12 } www.dailypioneer.com FUNDS UNDER MP' LAD SCHEME FOR CHINA TO GIVE VISA TO VISITORS NOKIA ANNOUNCES RESTRUCTURING: TO SADDAM HUSSEIN, GADDAFI USED TO 2019-20 CLEARED, SAYS FINANCE MINISTER ONLY IF THEY TAKE CHINESE VACCINE SLASH UP TO 10,000 JOBS IN 24 MONTHS WIN ELECTIONS TOO: RAHUL GANDHI inance Minister Nirmala Sitharaman hina is poised to ease border restrictions innish telecoms equipment maker Nokia ongress leader Rahul Gandhi on today said in the Rajya Sabha that to allow some foreigners -- including announced on Tuesday it will slash up to Tuesday said that Iraq's dictator Ffund under the Members of Cfrom the US, India and Pakistan -- F11 percent of its workforce within two CSaddam Hussein and Libya's Parliament Local Area Development back in, provided they have taken a years, as part of a 600-million-euro ($715- Muammar Gaddafi used to win Scheme (MPLADS) for 2019-20 have Chinese-made Covid-19 vaccine. million) cost-cutting programme. elections as well, as he scaled up his been cleared. TRS MP B Lingaiah The country has been closed to most Announcing the wide-ranging attack on Prime Minister Narendra Yadav had raised the matter during the foreigners since last March to stem the restructuring led by new chief executive Modi for India's dwindling status in Zero Hour in the House. -

Wedz-Magazine.Pdf

SHAADI BARAATI INDIAN WEDDING MAGAZINE FOR BRIDE & GROOM JULY 2020 | ISSUE 1 RS. 100 #Intimate Ways to Impress Wedding Checklist New Family Real Wedding Heirlooms Stories #LovewithLegacy Budget Bride ? e timat In ing Wedd Exclusive Shaadi Postponed ? W A Y S T O H O N O U R O R I G I N A L W E D D I N G D A Y VARMALA WEDDING WEDDING MOMENT SONGS GUIDE www.wedzmagazine.com 02 S H A A D I B A R A A T I SHAADI BARAATI INDIAN WEDDING MAGAZINE FOR BRIDE & GROOM Publisher & Managing Director Pargat Singh Sidhu Editor in Chief Vishal Malhotra Creative Director Shefali Singh Managing Editor Shweta Style Director Rajveer Singh Sidhu Associate Editor Mukul Kumar Editorial Assistant Anju Features Editor Kamal Malhotra Style Editor Mehak Kaur Art Director Yogita Bali Senior Designer Shweta Moon Illustrator Sonam Gandhi Circulation Satheesh K / Deepmala Sharma Sales & Marketing Manjula G/Preety S/Nazreen/Sonam/Poonam/Draksha Feature Writers Sree Lakshmy Mannadiar/ Annu / Mythili B For inquiries or suggestions, contact us at: 1800 4199 456 [email protected] No 60, Old No, 32/1, 2nd Floor, Rukmini Colony, St John Road, Near Lavanya Theatre, Ulsoor, Bangalore - 560042 , Karnataka, India 03 S H A A D I B A R A A T I S U B S C R I B E T O O U R N E W S L E T T E R Subscribe to Shaadi Baraati and Get access to our latest Blogs, Wedding Ideas and get the best quotes from trusted Wedding Vendors. -

1 Final.Qxd (Page 3)

SUNDAY, JANUARY 01, 2017 (PAGE 4) Bollywood 2016: Alpha star-spotting As the year almost draws to a close, Supriyo Hazra reviews the past 12 months to check how the leading stars of the dazzling B-town fared this year Aamir Khan: The superstar took two years break and he is ence one major hit movie every year during the festive season of back once again as a wrestler in his upcoming release ‘Dangal’. Eid. Salman Khan was back again on the small screen hosting the Aamir Khan Productions 'Dangal' produced by Aamir Khan, Kiran tenth edition of popular reality show Bigg Boss. He will be back Rao & Siddharth Roy Kapur and directed by Nitesh Tiwari is slat- next year again on the big screen with ‘Tubelight’. However, 2016, ed to release on Dec 23. Dangal trailer, having a high dose of emo- also saw the actor once again triggering a major controversy when tions has been winning accolades from across quarters. The crux "raped woman" comment had earned him immense criticisms. Sal- of Mahaveer Phogat's biopic, the Father-Daughter story has struck im Khan, father of Salman Khan, even issued an apology for his chords with the masses worldwide.Apart from the movie, Aamir son's controversial remark in which he compared his hectic shoot- Khan’s physical transformation into the character also earned atten- ing schedule for movie ‘Sultan’ with a “raped woman”. tion of his fans. Christmas is surely going to be different this year Shraddha Kapoor: Delivering a hit with Tiger Shroff in with Aamir promising to deliver with his new release. -

Eros International (EROINT) | 235 Target : | 311 Target Period : 12 Mont Hs Effort Needed to Resurrect Investor Confidence Potential Upside : 32%

Result Update November 20, 2015 Rating matrix Rating : Buy Eros International (EROINT) | 235 Target : | 311 Target Period : 12 mont hs Effort needed to resurrect investor confidence Potential Upside : 32% • The topline came in at | 504.9 crore against our estimate of | 495.4 What’s changed? crore driven by movies like Bajrangi Bhaijaan (net domestic box Target Changed from UR to | 311 office collection of over | 300 crore), Welcome Back (gross collection EPS FY16E Changed from | 32.4 to | 31.3 of over | 100 crore) and Srimanthudu (regional movie, which went EPS FY17E Changed from | 38.2 to | 31.1 on to become all-time second highest Telugu grosser) Rating From Under Review to Buy • The EBITDA margin at 26.9% was lower than our estimate of 31.7% Quarterly performance mainly due to higher operating expenses, which can largely be Q2FY16 Q2FY15 YoY (%) Q1FY16 QoQ (%) attributed to higher marketing costs due to a mix of films comprising Revenue 504.9 239.9 110.5 472.5 6.9 more of high and medium budget movies EBITDA 135.8 73.4 85.0 89.5 51.8 • PAT came in at | 90.4 crore against our estimate of | 112 crore EBITDA (%) 26.9 30.6 -371 bps 18.9 795 bps mainly due to lower operating margins, which led to a PAT miss PAT 90.4 50.1 80.3 53.4 69.4 Leading producer/distributor with one of the largest film libraries Eros, producer/distributor with a large film library of over 2000 films, has Key financials entered into partnerships with three Chinese film companies to explore | Crore FY14 FY15 FY16E FY17E joint opportunities.