MI Chelverton UK Equity Growth Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Excellence in Ventilation

Volution Group plc Group Volution Annual Report 2019 Annual Report Excellence in ventilation Volution Group plc Annual Report 2019 Our purpose Volution Group plc is a leading supplier of ventilation products to the residential and commercial construction markets in the UK, the Nordics, Central Europe and Australasia. We aim for our products to enhance our customers’ experience of ventilation by reducing energy consumption, improving indoor air quality and design and making them easier to use. Monsoon Silence range: Complete home ventilation: The Monsoon Silence range is our latest innovative The political and social drive to become more energy domestic ventilation solution, providing high extraction efficient has made our homes more air tight meaning rates, low energy use and exceptionally quiet running the problem of poor indoor air quality has become levels. This bathroom fan has a long-life ball bearing harder to ignore. This increases the importance motor and a silent back draft shutter. of the vital role ventilation products have to play in maintaining a healthy indoor environment. See residential indoor air quality on page 20 Annual Report 2019 Our Recent History Strategic Report > AAC Capital and Management Team acquires Highlights Volution Holdings 2 2006 4 At a Glance 6 Our Investment Case 7 Our Growth Story > Cable Management division sold 8 Chairman’s Statement 2007 > Manrose Manufacturing acquired 10 Chief Executive Officer’s Review 14 Our Refreshed Strategy 16 Our Recent Acquisitions > Ronnie George joins Volution Holdings -

Xtrackers Etfs

Xtrackers*/** Société d’investissement à capital variable R.C.S. Luxembourg N° B-119.899 Unaudited Semi-Annual Report For the period from 1 January 2018 to 30 June 2018 No subscription can be accepted on the basis of the financial reports. Subscriptions are only valid if they are made on the basis of the latest published prospectus of Xtrackers accompanied by the latest annual report and the most recent semi-annual report, if published thereafter. * Effective 16 February 2018, db x-trackers changed name to Xtrackers. **This includes synthetic ETFs. Xtrackers** Table of contents Page Organisation 4 Information for Hong Kong Residents 6 Statistics 7 Statement of Net Assets as at 30 June 2018 28 Statement of Investments as at 30 June 2018 50 Xtrackers MSCI WORLD SWAP UCITS ETF* 50 Xtrackers MSCI EUROPE UCITS ETF 56 Xtrackers MSCI JAPAN UCITS ETF 68 Xtrackers MSCI USA SWAP UCITS ETF* 75 Xtrackers EURO STOXX 50 UCITS ETF 80 Xtrackers DAX UCITS ETF 82 Xtrackers FTSE MIB UCITS ETF 83 Xtrackers SWITZERLAND UCITS ETF 85 Xtrackers FTSE 100 INCOME UCITS ETF 86 Xtrackers FTSE 250 UCITS ETF 89 Xtrackers FTSE ALL-SHARE UCITS ETF 96 Xtrackers MSCI EMERGING MARKETS SWAP UCITS ETF* 111 Xtrackers MSCI EM ASIA SWAP UCITS ETF* 115 Xtrackers MSCI EM LATIN AMERICA SWAP UCITS ETF* 117 Xtrackers MSCI EM EUROPE, MIDDLE EAST & AFRICA SWAP UCITS ETF* 118 Xtrackers MSCI TAIWAN UCITS ETF 120 Xtrackers MSCI BRAZIL UCITS ETF 123 Xtrackers NIFTY 50 SWAP UCITS ETF* 125 Xtrackers MSCI KOREA UCITS ETF 127 Xtrackers FTSE CHINA 50 UCITS ETF 130 Xtrackers EURO STOXX QUALITY -

Description Iresscode Exchange Current Margin New Margin 3I

Description IRESSCode Exchange Current Margin New Margin 3I INFRASTRUCTURE PLC 3IN LSE 20 20 888 HOLDINGS PLC 888 LSE 20 20 ASSOCIATED BRITISH ABF LSE 10 10 ADMIRAL GROUP PLC ADM LSE 10 10 AGGREKO PLC AGK LSE 20 20 ASHTEAD GROUP PLC AHT LSE 10 10 ANTOFAGASTA PLC ANTO LSE 15 10 ASOS PLC ASC LSE 20 20 ASHMORE GROUP PLC ASHM LSE 20 20 ABERFORTH SMALLER COM ASL LSE 20 20 AVEVA GROUP PLC AVV LSE 20 20 AVIVA PLC AV LSE 10 10 ASTRAZENECA PLC AZN LSE 10 10 BABCOCK INTERNATIONAL BAB LSE 20 20 BARR PLC BAG LSE 25 20 BARCLAYS PLC BARC LSE 10 10 BRITISH AMERICAN TOBA BATS LSE 10 10 BAE SYSTEMS PLC BA LSE 10 10 BALFOUR BEATTY PLC BBY LSE 20 20 BARRATT DEVELOPMENTS BDEV LSE 10 10 BARING EMERGING EUROP BEE LSE 50 100 BEAZLEY PLC BEZ LSE 20 20 BH GLOBAL LIMITED BHGG LSE 30 100 BOWLEVEN PLC BLVN LSE 60 50 BANKERS INVESTMENT BNKR LSE 20 20 BUNZL PLC BNZL LSE 10 10 BODYCOTE PLC BOY LSE 20 20 BP PLC BP LSE 10 10 BURBERRY GROUP PLC BRBY LSE 10 10 BLACKROCK WORLD MININ BRWM LSE 20 65 BT GROUP PLC BT-A LSE 10 10 BRITVIC PLC BVIC LSE 20 20 BOVIS HOMES GROUP PLC BVS LSE 20 20 BROWN GROUP PLC BWNG LSE 25 20 BELLWAY PLC BWY LSE 20 20 BIG YELLOW GROUP PLC BYG LSE 20 20 CENTRAL ASIA METALS PLC CAML LSE 40 30 CLOSE BROTHERS GROUP CBG LSE 20 20 CARNIVAL PLC CCL LSE 10 10 CENTAMIN PLC CEY LSE 20 20 CHARIOT OIL & GAS LTD CHAR LSE 100 100 CHEMRING GROUP PLC CHG LSE 25 20 CONYGAR INVESTMENT CIC LSE 50 40 CALEDONIA INVESTMENTS CLDN LSE 25 20 CARILLION PLC CLLN LSE 100 100 COMMUNISIS PLC CMS LSE 50 100 CENTRICA PLC CNA LSE 10 10 CAIRN ENERGY PLC CNE LSE 30 30 COBHAM PLC -

Rotork Annual Report 2006

2006 Annual Report & Accounts Rotork 2006 Annual Report & Accounts Rotork p.l.c. Rotork House Brassmill Lane Bath BA1 3JQ www.rotork.com Celebrating fifty years of innovation 2006 Annual Report & Accounts Rotork 2006 Annual Report & Accounts Rotork p.l.c. Rotork House Brassmill Lane Bath BA1 3JQ www.rotork.com Celebrating fifty years of innovation FINANCIAL HIGHLIGHTSRotork Annual Report & Accounts 2006 01. Financial Highlights Order Intake The fifties: page 05 • Order intake up 19% at £223m • Revenue up 18% at £206.7m £223m • Operating profit up 23% at £45.1m up 19% The sixties: page 07 • Recommended final dividend of 11.65p, up 18% • £8m additional interim dividend during 2007 Order book Operational Highlights £76m The seventies: page 08 up 19% • Continued strong growth achieved in Rotork Fluid System The eighties: page 11 • Chinese market still buoyant • New Shanghai manufacturing plant commenced production on schedule in the year • Increased focus on Service and Support with new @ management structure The nineties: page 12 The Noughties: page 15 Financial Highlights 01 Revenue (£m) Chairman’s Statement 02 Business Review 04 Geographical Review 16 206.7 Operating Profit - (£m) (£m) Rotork Marketing 18 continuing operations Board of Directors 20 Order Input 223.4 174.8 45.1 Report of the Directors 21 136.0 146.9 Corporate Governance 23 7.7 133.5 18 36.5 Corporate Social Responsibility 26 Remuneration Report 28 30.4 151.8 28.4 Independent Auditors’ Report 35 136.9 26.6 131.3 Consolidated Income Statement 36 Consolidated Balance Sheet 37 Consolidated Statement of Cash Flows 38 Consolidated Statement of Recognised Income and Expense 39 Notes to the Group Financial Statements 40 02 03 04 05 06 Rotork p.l.c. -

Fund Fact Sheet

Franklin Templeton Funds GB00B3ZGH246 FTF Franklin UK Mid Cap Fund - A 31 July 2021 (inc) Fund Fact Sheet For Professional Client Use Only. Not for distribution to Retail Clients. Fund Overview Performance Base Currency for Fund GBP Performance over 5 Years in Share Class Currency (%) Total Net Assets (GBP) 1.16 billion FTF Franklin UK Mid Cap Fund A (inc) FTSE 250 ex-Investment Trusts Index Fund Inception Date 17.10.2011 180 Number of Issuers 36 Benchmark FTSE 250 ex-Investment 160 Trusts Index IA Sector UK All Companies 140 ISA Status Yes 120 Summary of Investment Objective The Fund aims to grow in value by more than the FTSE 250 100 (ex-Investment Trusts) Index, from a combination of income and investment growth over a three to five-year period after all fees and costs are deducted. 80 07/16 01/17 07/17 01/18 07/18 01/19 07/19 01/20 07/20 01/21 07/21 Fund Management Discrete Annual Performance in Share Class Currency (%) Richard Bullas: United Kingdom 07/20 07/19 07/18 07/17 07/16 Mark Hall: United Kingdom 07/21 07/20 07/19 07/18 07/17 Dan Green, CFA: United Kingdom A (inc) 36.52 -12.79 -1.25 9.89 23.81 Marcus Tregoning: United Kingdom Benchmark in GBP 42.85 -15.10 -4.98 8.39 17.21 Ratings - A (inc) Performance in Share Class Currency (%) Cumulative Annualised Overall Morningstar Rating™: Since Since Asset Allocation 1 Mth 3 Mths 6 Mths YTD 1 Yr 3 Yrs 5 Yrs Incept 3 Yrs 5 Yrs Incept A (inc) 4.45 5.93 20.14 16.83 36.52 17.58 59.90 821.63 5.55 9.84 10.60 Benchmark in GBP 3.24 3.01 16.86 15.60 42.85 15.25 46.41 622.69 4.84 7.92 9.38 Prior to 7 August 2021, the Fund was named Franklin UK Mid Cap Fund. -

Morningstar Report

Report as of 23 Sep 2021 FTF Franklin UK Mid Cap Fund W (acc) Morningstar® Category Morningstar® Benchmark Fund Benchmark Morningstar Rating™ UK Mid-Cap Equity FTSE 250 Ex Investment Trust TR GBP FTSE 250 Ex Investment Trust TR GBP QQQ Used throughout report Investment Objective Performance The Fund aims to grow in value by more than the FTSE 250 192 (ex-Investment Trusts) Index, from a combination of 169 income and investment growth over a three to five-year 146 period after all fees and costs are deducted. The Fund will 123 invests at least two thirds (but typically significantly more) 100 in the shares of medium-sized companies that are 77 constituents of the FTSE 250 (ex-Investment Trusts) Index and that are incorporated/domiciled in the UK or which 2016 2017 2018 2019 2020 2021-08 have significant business operations in the UK. This will -0.23 26.43 -13.46 42.30 -14.19 23.11 Fund typically be around 30–50 companies. 5.08 18.24 -15.15 30.79 -8.48 22.42 Benchmark 5.27 19.55 -14.94 30.83 -2.93 19.16 Category Risk Measures Trailing Returns % Fund Bmark Cat Quarterly Returns % Q1 Q2 Q3 Q4 3Y Alpha 1.27 3Y Sharpe Ratio 0.45 3 Months 7.81 6.09 6.44 2021 5.67 6.24 - - 3Y Beta 1.03 3Y Std Dev 23.59 6 Months 16.57 13.73 13.19 2020 -34.73 13.41 -3.15 19.70 3Y R-Squared 95.57 3Y Risk Avg 1 Year 48.84 50.23 43.80 2019 10.97 6.77 5.53 13.81 3Y Info Ratio 0.27 5Y Risk Avg 3 Years Annualised 8.30 6.82 8.43 2018 -2.73 6.70 -3.28 -13.79 3Y Tracking Error 5.02 10Y Risk abv avg 5 Years Annualised 10.37 7.88 10.12 2017 6.51 6.02 4.41 7.23 Calculations -

INVITATION BERENBERG Is Delighted to Invite You to Its

INVITATION BERENBERG is delighted to invite you to its USA CONFERENCE 2021 on Tuesday, May 18th – Thursday, May 20th 2021 Virtual Conference Conference calls will be scheduled throughout the day. Our Events Team will be providing technical support and facilitating all calls. LIST OF ATTENDING COMPANIES (SUBJECT TO CHANGE) Aerospace & Defence and Automotives Capital Goods & Industrial Engineering Construction, Metals & Mining and Utilities BAE Systems plc Alfen NV Breedon Group plc CONTINENTAL AG Alstom SA CRH plc RHEINMETALL AG Aluflexpack AG RWE AG Rolls-Royce Holdings plc Ceres Power Holdings plc Travis Perkins plc Schaeffler AG Diploma plc Victoria plc Vitesco Technologies GmbH Exponent Inc. Volution Group plc FASTNED B.V. Wienerberger AG Jungheinrich AG Knorr-Bremse AG Business Services, Leisure and Transport Marel hf Consumer Accor SA McGrath RentCorp AB InBev Applus Services SA Rational AG ASOS Plc Basic-Fit Schindler Holding AG Boozt AB Befesa SA Stabilus S.A Carlsberg A/S Borussia Dortmund GmbH & Co. KGaA Trex Company, Inc. Chr. Hansen A/S Brenntag AG va-Q-tec AG Essity Compass Group PLC VARTA AG Fevertree Drinks plc CTS Eventim AG & Co KGaA XP Power Ltd FIELMANN AG Dalata Hotel Group plc Zebra Technologies Glanbia plc Deutsche Post AG Global Fashion Group Henkel AG & Co KGaA doValue SpA Chemicals Entain PLC home24 SE Air Liquide SA Fluidra S.A. JD Sports Plc Ambercycle Hapag-Lloyd AG J Sainsbury Akzo Nobel NV IMCD N.V. Kerry Group plc BASF SE JTC plc Marley Spoon Bayer AG National Express Nestlé SA Evonik Industries AG Rubis SCA Reckitt Benckiser Group plc Fuchs Petrolub SE RWS Holdings plc Shop Apotheke Europe NV Kemira Oyj SGS SA Westwing Group AG LANXESS AG SIXT SE Linde plc Solutions 30 SE Novozymes A/S LIST OF ATTENDING COMPANIES (SUBJECT TO CHANGE) Financials Healthcare Healthcare Barclays plc AbCellera Biologics Inc Novo Nordisk A/S Brewin Dolphin Holdings plc Align Technology, Inc. -

FTSE Factsheet

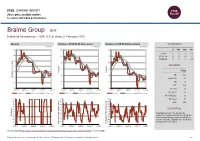

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 21 February 2020 Braime Group BMT Industrial Engineering — GBP 17.5 at close 21 February 2020 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 21-Feb-2020 21-Feb-2020 21-Feb-2020 26 110 120 1D WTD MTD YTD Absolute 0.0 0.0 6.1 -5.4 24 100 110 Rel.Sector 0.8 0.4 4.7 -1.1 Rel.Market 0.4 0.1 4.1 -3.9 22 90 100 VALUATION 20 80 90 Trailing 18 RelativePrice RelativePrice 70 80 PE 10.9 Absolute(localPrice currency) 16 EV/EBITDA 6.0 60 70 14 PB 1.7 PCF 10.7 12 50 60 Div Yield 0.7 Feb-2019 May-2019 Aug-2019 Nov-2019 Feb-2020 Feb-2019 May-2019 Aug-2019 Nov-2019 Feb-2020 Feb-2019 May-2019 Aug-2019 Nov-2019 Feb-2020 Price/Sales 0.7 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 0.2 100 90 100 Div Payout 7.0 90 80 90 ROE 17.4 80 70 80 70 Index) Share 70 Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 40 The principal activities of the group are the 40 40 RSI RSI (Absolute) 30 manufacture of metal presswork and the distribution 30 30 of bulk material handling components, trading from 20 20 20 locations in Australia, England, France, South Africa, 10 10 10 Thailand and the United States. -

Underthebonnet

JOHCM UK DYNAMIC FUND UNDER THE BONNET 2019 ANNUAL REVIEW Alex Savvides, Senior Fund Manager Tom Matthews, Analyst INVESTMENT BACKGROUND Global equity markets continued to move higher in December as economic indicators showed a pick-up in global growth, there was further progress in US-China trade discussions and the UK’s Conservative party won an overall majority in the general election. The JP Morgan Global Composite PMI ticked up from the previous month’s 44-month low following a steepening in China’s composite PMI growth rate and a strengthening in US business activity. US equities had a remarkable year, capped by President Trump announcing he would sign a phase one trade deal with China in January and move to negotiations on phase two. The S&P 500, Dow Jones Industrial Average and NASDAQ 100 total return indices all reached new all-time highs in December, with gains of 32%, 25% and 40% respectively for the year. We wrote the following in August’s ‘Under the Bonnet’: “When we come to reflect on 2019, July will likely be seen as a decisive… a month in which geopolitical brinkmanship came to a head, leading government and central bank policies to be reappraised which ultimately may lead to a new market narrative.” The progress in the US-China trade deal marked a clear de-escalation in this brinkmanship globally, but starker still were the final quarter’s developments in the UK: a new withdrawal agreement negotiated with the EU and - in December alone - the Conservative Party winning an historic majority in the general election and the withdrawal agreement subsequently being passed by parliament more than 13 months after Theresa May’s cabinet first backed her deal. -

Electrocomponents Plc Annual Report and Accounts 2009

International Management Centre plc Electrocomponents 8050 Oxford Business Park North The leading high service distributor to engineers worldwide Oxford OX4 2HW United Kingdom t: (44) (0) 1865 204000 f: (44) (0) 1865 207400 w: www.electrocomponents.com Annual Report and Accounts 2009 ELECTROCOMPONENTS PLC ANNUAL REPORT AND ACCOUNTS 2009 Cert no. SGS-COC-1732 Published by Black Sun Plc +44 (0)20 7736 0011 Electrocomponents plc Printed at St Ives Westerham Press Ltd Contents MORE INFORMATION IFC Highlights of theYear 38 Group Cash Flow Statement 1 Chairman’s Statement 39 Group Significant Accounting Policies 3 Chief Executive’s Review 43 Notes to the Group Accounts 6 Strategic overview 71 Company Balance Sheet 12 Business Review 72 Company Significant 21 Board of Directors Accounting Policies 22 Directors’ Report 74 Notes to the Company Accounts 24 Corporate Governance Report 81 FiveYear Record 28 Remuneration Report 82 Additional Information for 34 Statement of Directors’ Responsibilities Electrocomponents plc Shareholders GET MORE ONLINE 35 Independent Auditors’ Report 83 Registered Office, Advisers 36 Group Income Statement and Financial Calendar 37 Group Balance Sheet 84 Principal Locations WWW.ELECTROCOMPONENTS.COM HIGHLIGHTS OF THE YEAR ACCESS THE LATEST – 10% GROWTH IN E-COMMERCE SALES Revenue 1 SHAREHOLDER – LEADERSHIP TEAMS IN EUROPE AND INFORMATION ELECTRONICS STRENGTHENED £974.6m • Updates via email • Latest share price – ELECTRONICS OFFER EXPANDED • Corporate governance – SUCCESSFUL LAUNCH OF ELECTRONICS Headline profit before tax -

FTF Franklin UK Equity Income Fund August 31, 2021

FTF - FTF Franklin UK Equity Income Fund August 31, 2021 FTF - FTF Franklin UK Equity August 31, 2021 Income Fund Portfolio Holdings The following portfolio data for the Franklin Templeton funds is made available to the public under our Portfolio Holdings Release Policy and is "as of" the date indicated. This portfolio data should not be relied upon as a complete listing of a fund's holdings (or of a fund's top holdings) as information on particular holdings may be withheld if it is in the fund's interest to do so. Additionally, foreign currency forwards are not included in the portfolio data. Instead, the net market value of all currency forward contracts is included in cash and other net assets of the fund. Further, portfolio holdings data of over-the-counter derivative investments such as Credit Default Swaps, Interest Rate Swaps or other Swap contracts list only the name of counterparty to the derivative contract, not the details of the derivative. Complete portfolio data can be found in the semi- and annual financial statements of the fund. Security Security Shares/ Market % of Coupon Maturity Identifier Name Positions Held Value TNA Rate Date 0673123 ASSOCIATED BRITISH FOODS PLC 795,000 £15,741,000 1.75% N/A N/A 0989529 ASTRAZENECA PLC 526,000 £44,783,640 4.98% N/A N/A 0263494 BAE SYSTEMS PLC 2,560,000 £14,551,040 1.62% N/A N/A BH0P3Z9 BHP GROUP PLC 927,000 £20,927,025 2.33% N/A N/A B3FLWH9 BODYCOTE PLC 1,340,000 £12,924,300 1.44% N/A N/A 0798059 BP PLC 10,175,000 £30,214,662 3.36% N/A N/A 0176581 BREWIN DOLPHIN HOLDINGS PLC 3,442,000 -

Quarterly Commentary—Artisan Non-U.S. Small

QUARTERLY Artisan Non-U.S. Small-Mid Growth Strategy FactCommentary Sheet As of 30 June 2020 Investment Process We seek long-term investments in high-quality businesses exposed to structural growth themes that can be acquired at sensible valuations in a contrarian fashion and are led by excellent management teams. Investing with Tailwinds We identify structural themes at the intersection of growth and change with the objective of investing in companies having meaningful exposure to these trends. Themes can be identified from both bottom-up and top-down perspectives. High-Quality Businesses We seek future leaders with attractive growth characteristics that we can own for the long term. Our fundamental analysis focuses on those companies exhibiting unique and defensible business models, high barriers to entry, proven management teams, favorable positions within their industry value chains and high or improving returns on capital. In short, we look to invest in small companies that have potential to become large. A Contrarian Approach to Valuation We seek to invest in high-quality businesses in a contrarian fashion. Mismatches between stock price and long-term business value are created by market dislocations, temporary slowdowns in individual businesses or misperceptions in the investment community. We also examine business transformation brought about by management change or restructuring. Manage Unique Risks of International Small- and Mid-Cap Equities International small- and mid-cap equities are exposed to unique investment risks that require managing. We define risk as permanent loss of capital, not share price volatility. We manage this risk by having a long-term ownership focus, understanding the direct and indirect security risks for each business, constructing the portfolio on a well-diversified basis and sizing positions according to individual risk characteristics.