Newquay Town Framework Plan (Background Evidence)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Cornwall. Mar 1433

TRADES DIRECTORY.] CORNWALL. MAR 1433 MAIL CART CONTRACTORS. Brewer A. D. Grampound Road MARINE STORE DEALERS.. , See Contractors. Bullmore Wm. Commercial rd. Penryn Abbot W. Upton slip, Church st.Falmth Carne W. & E. C. Tresillian, Probus Blackmoor H. St.John's,Sithney,Helston MALTSTERS. R.S.O.; office at Truro. See advert Chard John & Son, 29 Market street & Argall John, Church town. St. Columb Champion John, 16, 17 & 18 Causeway Fish strand, Falmouth Minor R.S.O head & 29 Alverton street, Penzance. Cundy Richard, Lerryn, Lostwithiel Bartlett Bryant Edward, Kilkhampton, See advertisement Curnow Mrs. Mary, East end, Redruth Stratton R.S.O Cra,bb H.H.& Co.Ra.ilway wharf,Bodmn Denley Joseph, r Albert st. Penzance Bassett W.F.Mitchll.Nwlyn.Grmpnd.Rd Daniel Hy. 73 Market Jew st. Penzance Geach Mrs. M. Eastbourne rd.St.Austell BateT.Dinhams bridge,St.Mabyn R.S.O Dawe Jabez, Menheniot, Liskeard Harris Joseph, Castle lane, Liskeard BeswarrickJohnArthur,Fore st.Lostwtlll Ed~cumbe Riehard, Sand Place R.S.O Jay Richd. Sont.h quay, Padstow R.S.O Billing John, Priory lane, Bodmin Gilbart Wm. Henry & Son,LelantB..S.O Jones George, To1var street, Launceston BowhayEdwd.&Bros.Albaston,Tavistock Guy Mark, Port Gaverne, St. Endellion, Kit to William, Callingbon R.S. 0 Came W. & E. C. II Princess st. Truro; Wadebridge R.S.O Lavis Peter, Market square, Hayle Market street & Docks Pier head, Fal- Ham, Friend & Luxton, Western road & Mitchell Philip, St. Gluvia~ st. Penryn mouth; Market place, Helston & Railway station, Launceston NichollsCh'ls.Belmont ter.DevoranR.S.O Tresillian, Probus R.S.O. -

CORNWALL. (KELLY's Red Lion Family, Tourist & Commercial Tabb Ell En (Mrs.), Saddler, Fore Street Gavrigan

1074 COLUMB MAJOR. CORNWALL. (KELLY'S Red Lion family, tourist & commercial Tabb Ell en (Mrs.), saddler, Fore street Gavrigan. hotel &posting house ( Chas. Brewer, Tamblyn Thomas, dairyman, Bridg~ The Indian Queens China Clay & Brick proprietor), Forest. See advert TaylorMary(Miss),dress maker,Bank st & Tile Works (A. E. Jonas, propr.), Richards William, surgeon-dentis~ (at- Teagle Thomas, farmer, Tregatillian Postal address, P. 0. Box 8 tends fortnighly), Bank street Tippett William Stacey, mason, Forest Gill John, farmer Rickard Enoder, farmer, Trenouth TonkynArthur,baker &confectr.Fore st Penrose John, blacksmith Rickard Jonathan, farmer, Hall Tonkyn John, butcher, North street Spear Thomas Hicks, farmer Rickard Pascoe, farmer, Pencrennys Tonkyn Murlin, butcher, Union hill . Tamblyn Henry, farmer Rickeard Israel, farmer, Enniswargy Tonkyn William, draper, Fore street Rodliff William, farmer, Rosedinnick TownHall(W.M.Cardell,sec.),Market st Gluvian. Rogers Jn. marine store dlr. Market pl Trebilcock Jas. Pearce, boot m a. Markt. pl Crapp John, jobbing gardener Rogers Mary Jane (Miss), King's Arms Trebilcock Richard, farmer, 'fregaswith Hawkey William, farmer P.H. Fore street Trebilcock Wm. farmr. Lwr.Bospolvans Jenkin Henry Row, mason Rogers Richard J n. tailor, St. Columb rd Tremaine John, auctioneer & valuer Stephens William, farmer Rowe Fredk. farmer, Trevlthick East & yeoman, Fair street Rowe James, farmer, Reterth Tremaine John, farmer & carrier, Lit- Indian Queens. Rowe William, carpenter, Armoury cot tle Retallick .arenton Jas. shopkeeper & shoe maker Rowse Henry Jenkm 1\LA. barrister, Trerise Edward, jun. farmer, Trugo Commons Thomas, farmer Carworgey Truscott Eva (Mrs.), farmer, Treliver Crow le John, farmer Rundle Reuben, farmer, Rosesurrants Truscott John, carpenter, Black Cross Dean Samuel, cowkeeper Rundle Richard, farmer, Tre~oose Truscott Williarn, farmer, Tresaddern Jane Thomas, carpenter St. -

1860 Cornwall Quarter Sessions and Assizes

1860 Cornwall Quarter Sessions and Assizes Table of Contents 1. Epiphany Sessions .......................................................................................................... 1 2. Lent Assizes .................................................................................................................. 19 3. Easter Sessions ............................................................................................................. 64 4. Midsummer Sessions ................................................................................................... 79 5. Summer Assizes ......................................................................................................... 102 6. Michaelmas Sessions.................................................................................................. 125 Royal Cornwall Gazette 6th January 1860 1. Epiphany Sessions These Sessions opened at 11 o’clock on Tuesday the 3rd instant, at the County Hall, Bodmin, before the following Magistrates: Chairmen: J. JOPE ROGERS, ESQ., (presiding); SIR COLMAN RASHLEIGH, Bart.; C.B. GRAVES SAWLE, Esq. Lord Vivian. Edwin Ley, Esq. Lord Valletort, M.P. T.S. Bolitho, Esq. The Hon. Captain Vivian. W. Horton Davey, Esq. T.J. Agar Robartes, Esq., M.P. Stephen Nowell Usticke, Esq. N. Kendall, Esq., M.P. F.M. Williams, Esq. R. Davey, Esq., M.P. George Williams, Esq. J. St. Aubyn, Esq., M.P. R. Gould Lakes, Esq. W.H. Pole Carew, Esq. C.A. Reynolds, Esq. F. Rodd, Esq. H. Thomson, Esq. Augustus Coryton, Esq. Neville Norway, Esq. Harry Reginald -

Environmental Protection Final Draft Report

Environmental Protection Final Draft Report ANNUAL CLASSIFICATION OF RIVER WATER QUALITY 1992: NUMBERS OF SAMPLES EXCEEDING THE QUALITY STANDARD June 1993 FWS/93/012 Author: R J Broome Freshwater Scientist NRA C.V.M. Davies National Rivers Authority Environmental Protection Manager South West R egion ANNUAL CLASSIFICATION OF RIVER WATER QUALITY 1992: NUMBERS OF SAMPLES EXCEEDING TOE QUALITY STANDARD - FWS/93/012 This report shows the number of samples taken and the frequency with which individual determinand values failed to comply with National Water Council river classification standards, at routinely monitored river sites during the 1992 classification period. Compliance was assessed at all sites against the quality criterion for each determinand relevant to the River Water Quality Objective (RQO) of that site. The criterion are shown in Table 1. A dashed line in the schedule indicates no samples failed to comply. This report should be read in conjunction with Water Quality Technical note FWS/93/005, entitled: River Water Quality 1991, Classification by Determinand? where for each site the classification for each individual determinand is given, together with relevant statistics. The results are grouped in catchments for easy reference, commencing with the most south easterly catchments in the region and progressing sequentially around the coast to the most north easterly catchment. ENVIRONMENT AGENCY 110221i i i H i m NATIONAL RIVERS AUTHORITY - 80UTH WEST REGION 1992 RIVER WATER QUALITY CLASSIFICATION NUMBER OF SAMPLES (N) AND NUMBER -

River Water Quality 1992 Classification by Determinand

N f\A - S oo-Ha (jO$*\z'3'Z2 Environmental Protection Final Draft Report RIVER WATER QUALITY 1992 CLASSIFICATION BY DETERMINAND May 1993 Water Quality Technical Note FWS/93/005 Author: R J Broome Freshwater Scientist NRA CV.M. Davies National Rivers A h ority Environmental Protection Manager South West Region RIVER WATER QUALITY 1992 CLASSIFICATION BY DETERMINAND 1. INTRODUCTION River water quality is monitored in 34 catchments in the region. Samples are collected at a minimum frequency of once a month from 422 watercourses at 890 locations within the Regional Monitoring Network. Each sample is analysed for a range of chemical and physical determinands. These sample results are stored in the Water Quality Archive. A computerised system assigns a quality class to each monitoring location and associated upstream river reach. This report contains the results of the 1992 river water quality classifications for each determinand used in the classification process. 2. RIVER WATER QUALITY ASSESSMENT The assessment of river water quality is by comparison of current water quality against River Quality Objectives (RQO's) which have been set for many river lengths in the region. Individual determinands have been classified in accordance with the requirements of the National Water Council (NWC) river classification system which identifies river water quality as being one of five classes as shown in Table 1 below: TABLE 1 NATIONAL WATER COUNCIL - CLASSIFICATION SYSTEM CLASS DESCRIPTION 1A Good quality IB Lesser good quality 2 Fair quality 3 Poor quality 4 Bad quality The classification criteria used for attributing a quality class to each criteria are shown in Appendix 1. -

The Cubert and Crantock Community Benefit Trust

à{à{à{ exÑÉÜà Éy à{x ctÜctÜ||||á{á{ VÉâÇv|Ä `xxà|Çz jxwÇxáwtç DKDKDK bvàÉbvàÉuxÜuxÜuxÜuxÜ ECDECDECDJECD JJJ PRESENT: Cllrs. R.L.B. Spencer, N. Bradder, P. Wallis, C.W. Longden, A. Percy, Thomas Hulbert and the Clerk: D. Hawken. Cornwall Councillor Adrian Dennis Harvey APOLOGIES: Cllrs. D. Hopkinson, A. Ratcliffe-Marshall and K. Cox. Police Report - None MINUTES OF THE MEETINGS HELD ON 20th September 2017: The Minutes were approved and signed as True Records MATTERS ARISING FROM THE MINUTES OF THE MEETING HELD ON 20th September 2017- The clerk informed the meeting that he contacted Cornwall Council with regard to Fly Tipping in the Lay by near the A3075. Cllr. W.C. Longden reported in fly tipping just the other side of the Smugglers Den. It was decided to report it in to Highways. We have received a further quote for the Defibrillator. Proposed by Cllr. A. Percy, seconded by Cllr. R.L.B. Spencer Resolved to purchase the internet enabled Defibrillator package from Fleet. Cllr. A. Percy reported that in the QEII park 2 fence panels have been kicked out. Cllr. A. Percy reported that for the Monkey Tree Windfarm Turbine we await the results of the appeal. PLANNING: Decisions made by Cornwall Council: PA17/07692 Erection of 2 bedroom dwelling - Land North Of Cargy Close, Cargy Close, Cubert Cornwall for Mr John Clegg - WITHDRAWN PA17/05887 Certificate of lawfulness for existing use of land as residential curtilage to dwelling - 2 Park Allen - upper area next to garage as a vegetable garden comprising a large square plot for growing vegetables and surrounding borders for fruit bushes, a greenhouse, composting area and two garden sheds - 2 Park Allen, Lewannick Road, Cubert TR8 5HL for Miss Merryll Johnson - WITHDRAWN PA17/06987 Proposed ground floor extension & Loft Conversion to include a first floor rear dormer with balcony & Internal Alterations - 15 Ellenglaze Meadow, Cubert, TR8 5QU for Mr & Mrs Ashman - APPROVED PA17/07262 Alteration to approved planning application ref: PA17/02044. -

Cornwall. Creed

DIRECTORY.] CORNWALL. CREED. 1077 register of baptisms dates from the year 1563; marriages, picturesque and interesting; it is the property of Francis 1679 ; burials, I559· The living is a vicarage, average Granville Gregor esq .lord of the manor and chief landowner. tithe rent-charge £I~ 10s., net yearly value £36, including The soil is shelf; subsoil, shelf. The chief crops are wheat, 10 acres of glebe, m the gift of the vicar of Probus, and held barley, oats and turnips. The area is 1,297 acres; rateable since 1868 by the Rev. Lewis Morgan Peter M.A. of Exeter value, £1,235; the population in 1891 was 84. College, Oxford, who is also rector of Ruan Lanihorne, and Sexton, John Corkhill. resides at Treviles. 'l'rewarthenick House, a plain stone Letters from Gramponnd Road via Tregony arrive at 9.30 building (now unoccupied), is a commodious mansion, on a.m. The nearest money order & telegraph office is at the western side of the river Fal, in grounds of about 50 Tregony acres in extent ; the various plantations and lawns and the This place is included in Tregony United School Board windings of the ri\·er combine to make the scenery highly district, formed Sept. 28, 1875 Alien Hy. gamekpr. to F. G. Gregor esq I Evans John, Gregor Arms P.H Pascoe William. gardener to F. G · Bennetto Thomas, farmer, Penpoll Hotten John, farmer Gregor esq. Trewarthenick Elliott John, farmer, Killiow, Penvose Pascoe Stephen, farmer, Grogarth SleemanThomas,farmer,Trewarthenick & Trelaska Y elland J ames, farmer, Mellingoose CRANTOCK (or ST. CRA~TOCK) is a parish and village on propriator, and held since 1878 by the Rev. -

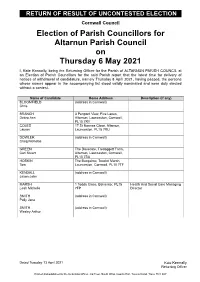

Election of Parish Councillors for Altarnun Parish Council on Thursday 6 May 2021

RETURN OF RESULT OF UNCONTESTED ELECTION Cornwall Council Election of Parish Councillors for Altarnun Parish Council on Thursday 6 May 2021 I, Kate Kennally, being the Returning Officer for the Parish of ALTARNUN PARISH COUNCIL at an Election of Parish Councillors for the said Parish report that the latest time for delivery of notices of withdrawal of candidature, namely Thursday 8 April 2021, having passed, the persons whose names appear in the accompanying list stood validly nominated and were duly elected without a contest. Name of Candidate Home Address Description (if any) BLOOMFIELD (address in Cornwall) Chris BRANCH 3 Penpont View, Five Lanes, Debra Ann Altarnun, Launceston, Cornwall, PL15 7RY COLES 17 St Nonnas Close, Altarnun, Lauren Launceston, PL15 7RU DOWLER (address in Cornwall) Craig Nicholas GREEN The Dovecote, Tredoggett Farm, Carl Stuart Altarnun, Launceston, Cornwall, PL15 7SA HOSKIN The Bungalow, Trewint Marsh, Tom Launceston, Cornwall, PL15 7TF KENDALL (address in Cornwall) Jason John MARSH 1 Todda Close, Bolventor, PL15 Health And Social Care Managing Leah Michelle 7FP Director SMITH (address in Cornwall) Polly Jane SMITH (address in Cornwall) Wesley Arthur Dated Tuesday 13 April 2021 Kate Kennally Returning Officer Printed and published by the Returning Officer, 3rd Floor, South Wing, County Hall, Treyew Road, Truro, TR1 3AY RETURN OF RESULT OF UNCONTESTED ELECTION Cornwall Council Election of Parish Councillors for Antony Parish Council on Thursday 6 May 2021 I, Kate Kennally, being the Returning Officer for the Parish of ANTONY PARISH COUNCIL at an Election of Parish Councillors for the said Parish report that the latest time for delivery of notices of withdrawal of candidature, namely Thursday 8 April 2021, having passed, the persons whose names appear in the accompanying list stood validly nominated and were duly elected without a contest. -

CARBINIDAE of CORNWALL Keith NA Alexander

CARBINIDAE OF CORNWALL Keith NA Alexander PB 1 Family CARABIDAE Ground Beetles The RDB species are: The county list presently stands at 238 species which appear to have been reliably recorded, but this includes • Grasslands on free-draining soils, presumably maintained either by exposure or grazing: 6 which appear to be extinct in the county, at least three casual vagrants/immigrants, two introductions, Harpalus honestus – see extinct species above two synathropic (and presumed long-term introductions) and one recent colonist. That makes 229 resident • Open stony, sparsely-vegetated areas on free-draining soils presumably maintained either by exposure breeding species, of which about 63% (147) are RDB (8), Nationally Scarce (46) or rare in the county (93). or grazing: Ophonus puncticollis – see extinct species above Where a species has been accorded “Nationally Scarce” or “British Red Data Book” status this is shown • On dry sandy soils, usually on coast, presumably maintained by exposure or grazing: immediately following the scientific name. Ophonus sabulicola (Looe, VCH) The various categories are essentially as follows: • Open heath vegetation, generally maintained by grazing: Poecilus kugelanni – see BAP species above RDB - species which are only known in Britain from fewer than 16 of the 10km squares of the National Grid. • Unimproved flushed grass pastures with Devil’s-bit-scabious: • Category 1 Endangered - taxa in danger of extinction Lebia cruxminor (‘Bodmin Moor’, 1972 & Treneglos, 1844) • Category 2 Vulnerable - taxa believed -

Newquay Community Network Area Pharmacy Profile

Newquay - Pharmacy Profile 2017 GP Practices1 Dis - Name Address Town Post Code pensing Narrowcliff Surgery Narrowcliff Newquay TR7 2QF Newquay Health Centre St Thomas Road Newquay TR7 1RU Petroc Group Practice Trekenning Road St.Columb Major TR9 6RR Pharmacies2 Note: See Appendix 1 and 2 for detailed maps Boots Boots Day Lewis Narrowcliff pharmacy pharmacy Pharmacy Pharmacy 15 Bank St Union Square Health Centre, Narrowcliff Address St Thomas Rd surgery NEWQUAY ST COLUMB NEWQUAY NEWQUAY Town MAJOR The Newquay and St Columb Community Postcode TR7 1DH TR9 6AP TR7 1RU TR7 2QF Network Area (CNA) is made up of five Telephone 01637 872014 01637 880251 01637 851844 01637 872957 parishes; Colan, Mawgan-in-Pydar, Newquay, MONDAY 0900-1730 0900-1800 0830-1830 0830-1830 St Columb, and St Wenn. It covers an area extending from the west coast to St Wenn on TUESDAY 0900-1730 0900-1800 0830-1830 0830-1830 the border with the Bodmin CNA. A non- 0900-1730 0900-1800 0830-1830 0830-1830 controlled locality boundary exists around the WEDNESDAY town of Newquay. THURSDAY 0900-1730 0900-1800 0830-1830 0830-1830 FRIDAY 0900-1730 0900-1800 0830-1830 0830-1830 0900-1730 0900-1330 Closed 0900-1700 SATURDAY 1400-1700 SUNDAY 1030-1630 Closed Closed Closed Location Access FutureDevelopment Services Newquay - Pharmacy Access 2017 Walking Access3 Walking Distance: 4 minutes 8 minutes 12 minutes 16 minutes 20 minutes 2 pharmacies have onsite parking, on average there is parking within 5 minutes and 2 have a nearby bus service. The nearest pharmacy to a railway station is 6 minutes away. -

CRANTOCK BEACH the Gannel Beaches & Vugga Cove

North Coast – Central Cornwall CRANTOCK BEACH The Gannel Beaches & Vugga Cove Crantock Beach is yet another exceptional North Coast beach but with the added distinction of being part of the Gannel Estuary. Set between Pentire Point West and Pentire Point East, Crantock Beach sweeps around from Vugga Cove in the west to the mouth of The expanse of beach at low water; the River Gannel is on the right the River Gannel in the east, a distance of nearly 1km at low water. It is very close to Newquay and the Road and after 500m there are two car parks, the first village of Crantock and is backed by an area of sand on the right (capacity 200+ cars) some 250m from the dunes known as Rushy Green. Because of its size and Beach and the National Trust car park (capacity 200+) the nature of the Estuary there are a number of very right next to the Beach. Access on to the main beach different access points to the beaches which all link up is a sandy walkway across a short length of dunes at low water. The main beach faces north-west and is which is very difficult for pushchairs. However, in the corner of the National Trust car park there is a fairly flat path that leads to part of the Estuary Beach which is suitable for pushchairs. Many people favour accessing the main area of Beach and Vugga Cove from West Pentire -TR8 5SE - which is signposted from Crantock village. There is a car park below the pub (capacity 100+cars). -

CORNWALL. FAR 1259 Hocking S

TRADES DIRECTORY.] CORNWALL. FAR 1259 Hocking S. Trerice,St.Dennis,St.Austell HooperJ.Pennock's hl.St.Neot,Liskeard Hosking William, Tremenheere, Ludg Hocking Samuel, Trevadlock, Lewan- Hooper J.Trelaske,Cubert,Grampnd.Rd van, Penzance nick, Launceston Hooper James, Kenwyn, Truro Hosking W.Wooda,St. Veep, Lostwithiel Hocking Samuel, Welltown wood, St. Hooper Mrs. John, East Downs, St. Hosking William Lory, Tredennick, Dominick, St. Mellion R.S.O Alien, Truro Veryan, Grampound Road Hocking Thomas Henry, Tregoneggy, Hooper J n. Meadows, St.Neot, Liskeard Hoskings J. Tremoderate, Roche R S.0 Budock, Falmouth Hooper John,Tremabin,Lanivet,Bodmin Hoskins Charles, Wadebridge RS.O Hocking Thomas Ro we,TheLizardRS.0 Hooper John, jun. Pennock's hill, Elt. Hoskins Nicholas, St. Alien, Truro Hocking William Henry, Berepper, Neot, Liskeard Hoskins Paul, Hands, St. Allen, Truro Gunwalloe, Helston HooperJ.G.Conce,Luxulyan,Lostwithiel Hotten Cornelius, William & James Hocking Wm. Grade,Ruan Minor R.S.O HooperPhilip,Lng.lake,St.Neot,Liskeard Henry, Trenerry, St. Alien, Truro Hocking William, Halwell, Linkinhorne, HooperT.Hewas water,St.Ewe,St.Austell Hotten Henry, Penpell, Cornelly, Callington RS.O Hooper Thomas, St. Neot, Liskeard Gramponnd Road Hocking William, Nanjulian, St. Just- Hooper WiHiam, Park Colley, Redruth Hotten Henry, Venton, Pool park, in-Penwith, Penzance Hooper William, Pelynt, Duloe RS.O Ladock, Grampound Road Hocking William, Pengenna, St. Kew, Hooper William, Woodman's tenement, Hotten Jas. Bodwen, Helland, Bodmin Wadebridge RS.O Ladock, Grampound Road Hotten In. Cornelly, Grampound Road Hocking Wm.Raftra,St.Levan,Penzance Hooper Wm. Hy. Trezare, Fowey R.S.O Hotten John, Shepherds, Newlyn, Hocking William, Tregerthen, Zennor, Hopper Titus, Old Warren, Ladock, Grampound Road St.