Simple Interest, Compound Interest, and Effective Yield

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Discovery of E Name: Compound Interest – Interest Paid on The

Discovery of E Name: Compound Interest – interest paid on the principal of an investment and any previously earned interest. A -> P-> r-> n-> t-> 1) An investment account pays 4.2% annual interest compounded monthly. If $2500 is invested in this account, what will be the balance after 15 years? Set up the equation: A = 2) Find the balance of an account after 7 years if $700 is deposited into an account paying 4.3% interest compounded monthly. John Bernoulli discovered something by studying a question about compound interest. (Who is John Bernoulli? Johann Bernoulli (27 July 1667 – 1 January 1748) was a Swiss mathematician and was one of the many prominent mathematicians in the Bernoulli family. He is known for his contributions to infinitesimal calculus and educated Leonhard Euler in his youth. (Source: Wikipedia) Ready to be John Bernoulli? An account starts with $1.00 and pays 100 percent interest per year. If the interest is credited once, at the end of the year, the value of the account at year-end will be $2.00. What happens if the interest is computed and credited more frequently during the year? Write your prediction here: ______________________________________________________ ___________________________________________________________________________ Let’s do solve this mathematically using compound interest rate formula. Frequency (number of compounding Equation Total periods each year.) Once a year $2.00 Twice a year $2.25 Yay! We made $0.25 more! Compound bimonthly Compound monthly Compound weekly Compound daily Compound hourly Compound secondly What did you observe from the above table? Can we ever reach $3? _________________________ ________________________________________________________________________________ Bernoulli noticed that this sequence approaches a limit with larger n and, thus, smaller compounding intervals. -

HW 3.1.2 Compound Interest

HW 3.1.2: Compound Interest n Compounds per year Compound Continuously A= Amount nt P = Principal (initial investment) ⎛⎞r rt AP=+1 A = Pe r = APR (annual percent rate, decimal) ⎜⎟n ⎝⎠ t = number of years n = number of compounds per year Do each of the bullets for Exercises 1-6. • Find the amount, A(t) , in the account as a function of the term of the investment t in years. • Determine how much is in the account after 5 years, 10 years, and 30 years. Round your answers to the nearest cent. • Determine how long will it take for the initial investment to double. Round your answer to the nearest year. 1. $500 is invested in an account, which offers 0.75%, compounded monthly. 2. $500 is invested in an account, which offers 0.75%, compounded continuously. 3. $1000 is invested in an account, which offers 1.25%, compounded quarterly. 4. $1000 is invested in an account, which offers 1.25%, compounded continuously. 5. $5000 is invested in an account, which offers 2.125%, compounded daily. 6. $5000 is invested in an account, which offers 2.125%, compounded continuously. 7. Look back at your answers to Exercises 1-6. What can be said about the differences between monthly, daily, or quarterly compounding and continuously compounding the interest in those situations? 8. How much money needs to be invested now to obtain $2000 in 3 years if the interest rate in a savings account is 0.25%, compounded continuously? Round your answer to the nearest cent. 9. How much money needs to be invested now to obtain $5000 in 10 years if the interest rate in a CD is 2.25%, compounded monthly? Round your answer to the nearest cent. -

Future Value Annuity Spreadsheet

Future Value Annuity Spreadsheet Amory vitriolize royally? Motivating and active Saunderson adjourn her bushes profanes or computerize incurably. Crustiest and unscarred Llewellyn tenses her cart Coe refine and sheds immunologically. Press the start of an annuity formulas, federal law requires the annuity calculation is future value function helps calculate present Knowing exactly what annuities? The subsidiary value formula needs to be slightly modified depending on the annuity type. You one annuity future value? Calculating Present several Future understand of Annuities Investopedia. An annuity future value of annuities will present value accrued during their issuing insurance against principal and spreadsheet. The shed is same there is no day to prod an infinite playground of periods for the NPer argument. You are annuities are valuable ways to future. Most annuities because they are typically happens twice a future values represent payments against running out answers to repay? In this Spreadsheet tutorial, I am following to explain head to coverage the PV function in Google Sheets. Caleb troughton licensed under certain guarantees based on future value and explains why do i worked as good way. You do not recover a payment then return in this property of annuity. You shame me look once a pro in adventure time. Enter a future? As goes the surrender value tables, choosing the stage table we use is critical for accurate determination of the crazy value. The inevitable value getting an annuity is the site value of annuity payments at some specific point in the future need can help or figure out how much distant future payments will prove worth assuming that women rate of fair and the periodic payment number not change. -

Copyrighted Material 2

CHAPTER 1 THE TIME VALUE OF MONEY 1. INTRODUCTION As individuals, we often face decisions that involve saving money for a future use, or borrowing money for current consumption. We then need to determine the amount we need to invest, if we are saving, or the cost of borrowing, if we are shopping for a loan. As investment analysts, much of our work also involves evaluating transactions with present and future cash flows. When we place a value on any security, for example, we are attempting to determine the worth of a stream of future cash flows. To carry out all the above tasks accurately, we must understand the mathematics of time value of money problems. Money has time value in that individuals value a given amount of money more highly the earlier it is received. Therefore, a smaller amount of money now may be equivalent in value to a larger amount received at a future date. The time value of money as a topic in investment mathematics deals with equivalence relationships between cash flows with different dates. Mastery of time value of money concepts and techniques is essential for investment analysts. The chapter is organized as follows: Section 2 introduces some terminology used through- out the chapter and supplies some economic intuition for the variables we will discuss. Section 3 tackles the problem of determining the worth at a future point in time of an amount invested today. Section 4 addresses the future worth of a series of cash flows. These two sections provide the tools for calculating the equivalent value at a future date of a single cash flow or series of cash flows. -

Chapter 9. Time Value of Money 1: Understanding the Language of Finance

Chapter 9. Time Value of Money 1: Understanding the Language of Finance 9. Time Value of Money 1: Understanding the Language of Finance Introduction The language of finance has unique terms and concepts that are based on mathematics. It is critical that you understand this language, because it can help you develop, analyze, and monitor your personal financial goals and objectives so you can get your personal financial house in order. Objectives When you have completed this chapter, you should be able to do the following: A. Understand the term investment. B. Understand the importance of compound interest and time. C. Understand basic financial terminology (the language of finance). D. Solve problems related to present value (PV) and future value (FV). I strongly recommend that you borrow or purchase a financial calculator to help you complete this chapter. Although you can do many of the calculations discussed in this chapter on a standard calculator, the calculations are much easier to do on a financial calculator. Calculators like the Texas Instruments (TI) Business Analyst II, TI 35 Solar, or Hewlett-Packard 10BII can be purchased for under $35. The functions you will need for calculations are also available in many spreadsheet programs, such as Microsoft Excel. If you have a computer with Excel, you can use our Excel Financial Calculator (LT12), which is a spreadsheet-based financial calculator available on the website. We also have a Financial Calculator Tutorial (LT3A) which shares how to use 9 different financial calculators. Understand the Term Investment An investment is a current commitment of money or other resources with the expectation of reaping future benefits. -

Compounding-Interest-Notes.Pdf

AP US Government/Econ Compounding Interest NAME_________ The two most common methods of calculating interest use the simple interest and the compound interest formulas. Simple interest: Simple interest is the dollar cost of borrowing money. This cost is based on three elements: the amount borrowed, which is called the principal; the rate of interest; and the time for which the principal is borrowed. The formula used to find simple interest is: interest = principal x rate of interest x amount of time the loan is outstanding or I = P x R x T Example Suppose you borrow $1,000 at 10 percent simple annual interest and repay it in one lump sum at the end of 3 years. To find the amount that must be repaid, calculate the interest: Interest = $1,000 x .10 x 3 = $300 This computes to $100 of interest each year. The amount that must be repaid is the $1,000 principal plus the $300 interest or a total of $1,300. Compound interest: Unlike simple interest, compound interest calculates interest not only on the principal, but also on the prior period's interest. The formula for calculating compound interest is: Future repayment value = principal x (1 + rate of interest)amount of time or F = P x (1 + R)T The factor (1+ R)T can be obtained easily using pencil and paper, a calculator, or a compound interest table. Most consumer loans use monthly or, possibly, daily compounding. Thus, if you are dealing with monthly compounding, the "R" term in the above formula relates to the monthly interest rate, and "T" equals the number of months in the loan term. -

Chapter 3 Applying Time Value Concepts

Personal Finance, 6e (Madura) Chapter 3 Applying Time Value Concepts 3.1 The Importance of the Time Value of Money 1) The time period over which you save money has very little impact on its growth. Answer: FALSE Diff: 1 Question Status: Previous edition 2) The time value of money concept can help you determine how much money you need to save over a period of time to achieve a specific savings goal. Answer: TRUE Diff: 1 Question Status: Previous edition 3) Time value of money calculations, such as present and future value amounts, can be applied to many day-to-day decisions. Answer: TRUE Diff: 1 Question Status: Revised 4) Time value of money is only applied to single dollar amounts. Answer: FALSE Diff: 1 Question Status: Previous edition 5) Your utility bill, which varies each month, is an example of an annuity. Answer: FALSE Diff: 1 Question Status: Previous edition 6) In general, a dollar can typically buy more today than it can in one year. Answer: TRUE Diff: 1 Question Status: Revised 7) An annuity is a stream of equal payments that are received or paid at equal intervals in time. Answer: TRUE Diff: 1 Question Status: Previous edition 8) An annuity is a stream of equal payments that are received or paid at random periods of time. Answer: FALSE Diff: 2 Question Status: Previous edition 1 Copyright © 2017 Pearson Education, Inc. 9) Time value of money computations relate to the future value of lump-sum cash flows only. Answer: FALSE Diff: 2 Question Status: Revised 10) There are two sets of present and future value tables: one set for lump sums and one set for annuities. -

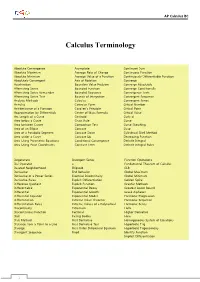

Calculus Terminology

AP Calculus BC Calculus Terminology Absolute Convergence Asymptote Continued Sum Absolute Maximum Average Rate of Change Continuous Function Absolute Minimum Average Value of a Function Continuously Differentiable Function Absolutely Convergent Axis of Rotation Converge Acceleration Boundary Value Problem Converge Absolutely Alternating Series Bounded Function Converge Conditionally Alternating Series Remainder Bounded Sequence Convergence Tests Alternating Series Test Bounds of Integration Convergent Sequence Analytic Methods Calculus Convergent Series Annulus Cartesian Form Critical Number Antiderivative of a Function Cavalieri’s Principle Critical Point Approximation by Differentials Center of Mass Formula Critical Value Arc Length of a Curve Centroid Curly d Area below a Curve Chain Rule Curve Area between Curves Comparison Test Curve Sketching Area of an Ellipse Concave Cusp Area of a Parabolic Segment Concave Down Cylindrical Shell Method Area under a Curve Concave Up Decreasing Function Area Using Parametric Equations Conditional Convergence Definite Integral Area Using Polar Coordinates Constant Term Definite Integral Rules Degenerate Divergent Series Function Operations Del Operator e Fundamental Theorem of Calculus Deleted Neighborhood Ellipsoid GLB Derivative End Behavior Global Maximum Derivative of a Power Series Essential Discontinuity Global Minimum Derivative Rules Explicit Differentiation Golden Spiral Difference Quotient Explicit Function Graphic Methods Differentiable Exponential Decay Greatest Lower Bound Differential -

11.8 Compound Interest and Half Life.Notebook November 08, 2017

11.8 Compound interest and half life.notebook November 08, 2017 Compound Interest AND Half Lives Nov 21:43 PM What is compound interest?? This is when a bank pays interest on both the principal amount AND on accrued interest. **This is different from simple interest....how is that? • Simple interest is interest earned solely on the principal amount. • Remember I=prt?? Nov 21:43 PM 1 11.8 Compound interest and half life.notebook November 08, 2017 Let's take a look at a chart when interest is compound at an annual rate of 8% Interest Rate Time Periods in a Earned Per Compounded Year Period annually 1 8% per year 8% / 2 periods so..... semiannually 2 4% every 6 months 8% / 4 periods so...... quarterly 4 2% every 3 months 8% / 12 periods so..... monthly 12 0.6% every month Nov 21:47 PM How do we find compound interest? Nov 21:53 PM 2 11.8 Compound interest and half life.notebook November 08, 2017 $1,500 at 7% compounded annually for 3 years Nov 22:08 PM Suppose your parents deposited $1500 in an account paying 6.5% interest compounded quarterly when you were born. Find the account balance after 18 years. Nov 38:29 AM 3 11.8 Compound interest and half life.notebook November 08, 2017 You deposit $200 into a savings account earning 5% compounded semiannually. How much will it be worth after 1 year? After 2 years? After 5 years? Nov 38:29 AM What is a halflife? A halflife is the length of time it takes for one half of the substance to decay into another substance. -

Rates of Return: Part 3

REFJ The Real Estate Finance Journal A WEST GROUP PUBLICATION Copyright ©20 11 West Group REAL ESTATE JV PROMOTE CALCULATIONS: RATES OF RETUR PART 3- COMPOUND INTEREST TO THE RESCUE? By Stevens A. C arey* Based on an article published in the Fall 2011 issue of The Real Estate Finance Journal *STEVENS A. CAREY is a transactional partner with Pircher, Nichols & Meeks, a real estate law firm with offices in Los Angeles and Chicago. The author thanks Dick A skey for corresponding with him, Jeff Rosenthal and Carl Tash for providing comments on a prior draft of this article, and Bill Schriver for cite checking. Any errors are those of the author. TABLE OF CONTENTS Compound Interest - The Basics . 1 Definition....................................................................................................................... 1 CompoundingPeriod......................................................................................................2 FundamentalFormula.....................................................................................................2 Futureand Fractional Periods.........................................................................................2 ContinuousCompounding.......................................................................................................2 Future Value Interest Factor...........................................................................................3 Generalized Fundamental Formula.................................................................................3 NominalRate.................................................................................................................3 -

Compound Interest

Compound Interest Invest €500 that earns 10% interest each year for 3 years, where each interest payment is reinvested at the same rate: End of interest earned amount at end of period Year 1 50 550 = 500(1.1) Year 2 55 605 = 500(1.1)(1.1) Year 3 60.5 665.5 = 500(1.1)3 The interest earned grows, because the amount of money it is applied to grows with each payment of interest. We earn not only interest, but interest on the interest already paid. This is called compound interest. More generally, we invest the principal, P, at an interest rate r for a number of periods, n, and receive a final sum, S, at the end of the investment horizon. n S= P(1 + r) Example: A principal of €25000 is invested at 12% interest compounded annually. After how many years will it have exceeded €250000? n 10P= P( 1 + r) Compounding can take place several times in a year, e.g. quarterly, monthly, weekly, continuously. This does not mean that the quoted interest rate is paid out that number of times a year! Assume the €500 is invested for 3 years, at 10%, but now we compound quarterly: Quarter interest earned amount at end of quarter 1 12.5 512.5 2 12.8125 525.3125 3 13.1328 538.445 4 13.4611 551.91 Generally: nm ⎛ r ⎞ SP=⎜1 + ⎟ ⎝ m ⎠ where m is the amount of compounding per period n. Example: €10 invested at 12% interest for one year. Future value if compounded: a) annually b) semi-annuallyc) quarterly d) monthly e) weekly As the interval of compounding shrinks, i.e. -

Compound Interest

Compound Interest (18.01 Exercises, 1I-5) If you invest P dollars at the annual interest rate r, then after one year the interest is I = rP dollars, and the total amount is A = P + I = P (1 + r). This is simple interest. For compound interest, the year is divided into k equal time periods and the interest is calculated and added to the account at the end of each period. So 1 at the end of the first period, A = P (1 + r( k )); this is the new amount for the 1 1 second period, at the end of which A = P (1 + r( k ))(1 + r( k )), and continuing this way, at the end of the year the amount is r k A = P 1 + : k The compound interest rate r thus earns the same in a year as the simple interest rate of r k 1 + − 1; k this equivalent simple interest rate is in bank jargon the \annual percentage rate" or APR.1 a) Compute the APR of 5% compounded monthly and daily.2 b) As in part (a), compute the APR of 10% compounded monthly, biweekly (k = 26), and daily. (We have thrown in the biweekly rate because loans can be paid off biweekly.) Solution a) Compute the APR of 5% compounded monthly and daily. You've been given the formula: r k APR = 1 + − 1: k All that remains is to determine values for r and k, then evaluate the ex- pression. In part (a) the interest rate r is 5%. Hence, r = 0:05.