Effective Rates of Interest: Beware of Inconsistencies

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Discovery of E Name: Compound Interest – Interest Paid on The

Discovery of E Name: Compound Interest – interest paid on the principal of an investment and any previously earned interest. A -> P-> r-> n-> t-> 1) An investment account pays 4.2% annual interest compounded monthly. If $2500 is invested in this account, what will be the balance after 15 years? Set up the equation: A = 2) Find the balance of an account after 7 years if $700 is deposited into an account paying 4.3% interest compounded monthly. John Bernoulli discovered something by studying a question about compound interest. (Who is John Bernoulli? Johann Bernoulli (27 July 1667 – 1 January 1748) was a Swiss mathematician and was one of the many prominent mathematicians in the Bernoulli family. He is known for his contributions to infinitesimal calculus and educated Leonhard Euler in his youth. (Source: Wikipedia) Ready to be John Bernoulli? An account starts with $1.00 and pays 100 percent interest per year. If the interest is credited once, at the end of the year, the value of the account at year-end will be $2.00. What happens if the interest is computed and credited more frequently during the year? Write your prediction here: ______________________________________________________ ___________________________________________________________________________ Let’s do solve this mathematically using compound interest rate formula. Frequency (number of compounding Equation Total periods each year.) Once a year $2.00 Twice a year $2.25 Yay! We made $0.25 more! Compound bimonthly Compound monthly Compound weekly Compound daily Compound hourly Compound secondly What did you observe from the above table? Can we ever reach $3? _________________________ ________________________________________________________________________________ Bernoulli noticed that this sequence approaches a limit with larger n and, thus, smaller compounding intervals. -

Calculating Interest Rates

Calculating interest rates A reading prepared by Pamela Peterson Drake O U T L I N E 1. Introduction 2. Annual percentage rate 3. Effective annual rate 1. Introduction The basis of the time value of money is that an investor is compensated for the time value of money and risk. Situations arise often in which we wish to determine the interest rate that is implied from an advertised, or stated rate. There are also cases in which we wish to determine the rate of interest implied from a set of payments in a loan arrangement. 2. The annual percentage rate A common problem in finance is comparing alternative financing or investment opportunities when the interest rates are specified in a way that makes it difficult to compare terms. One lending source 1 may offer terms that specify 9 /4 percent annual interest with interest compounded annually, whereas another lending source may offer terms of 9 percent interest with interest compounded continuously. How do you begin to compare these rates to determine which is a lower cost of borrowing? Ideally, we would like to translate these interest rates into some comparable form. One obvious way to represent rates stated in various time intervals on a common basis is to express them in the same unit of time -- so we annualize them. The annualized rate is the product of the stated rate of interest per compounding period and the number of compounding periods in a year. Let i be the rate of interest per period and let n be the number of compounding periods in a year. -

HW 3.1.2 Compound Interest

HW 3.1.2: Compound Interest n Compounds per year Compound Continuously A= Amount nt P = Principal (initial investment) ⎛⎞r rt AP=+1 A = Pe r = APR (annual percent rate, decimal) ⎜⎟n ⎝⎠ t = number of years n = number of compounds per year Do each of the bullets for Exercises 1-6. • Find the amount, A(t) , in the account as a function of the term of the investment t in years. • Determine how much is in the account after 5 years, 10 years, and 30 years. Round your answers to the nearest cent. • Determine how long will it take for the initial investment to double. Round your answer to the nearest year. 1. $500 is invested in an account, which offers 0.75%, compounded monthly. 2. $500 is invested in an account, which offers 0.75%, compounded continuously. 3. $1000 is invested in an account, which offers 1.25%, compounded quarterly. 4. $1000 is invested in an account, which offers 1.25%, compounded continuously. 5. $5000 is invested in an account, which offers 2.125%, compounded daily. 6. $5000 is invested in an account, which offers 2.125%, compounded continuously. 7. Look back at your answers to Exercises 1-6. What can be said about the differences between monthly, daily, or quarterly compounding and continuously compounding the interest in those situations? 8. How much money needs to be invested now to obtain $2000 in 3 years if the interest rate in a savings account is 0.25%, compounded continuously? Round your answer to the nearest cent. 9. How much money needs to be invested now to obtain $5000 in 10 years if the interest rate in a CD is 2.25%, compounded monthly? Round your answer to the nearest cent. -

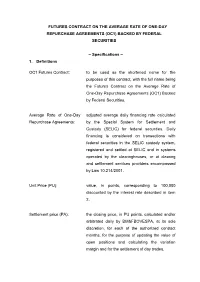

Futures Contract on the Average Rate of One-Day Repurchase Agreements (Oc1) Backed by Federal Securities

FUTURES CONTRACT ON THE AVERAGE RATE OF ONE-DAY REPURCHASE AGREEMENTS (OC1) BACKED BY FEDERAL SECURITIES – Specifications – 1. Definitions OC1 Futures Contract: to be used as the shortened name for the purposes of this contract, with the full name being the Futures Contract on the Average Rate of One-Day Repurchase Agreements (OC1) Backed by Federal Securities. Average Rate of One-Day adjusted average daily financing rate calculated Repurchase Agreements: by the Special System for Settlement and Custody (SELIC) for federal securities. Daily financing is considered on transactions with federal securities in the SELIC custody system, registered and settled at SELIC and in systems operated by the clearinghouses, or at clearing and settlement services providers encompassed by Law 10.214/2001. Unit Price (PU): value, in points, corresponding to 100,000 discounted by the interest rate described in item 2. Settlement price (PA): the closing price, in PU points, calculated and/or arbitrated daily by BM&FBOVESPA, at its sole discretion, for each of the authorized contract months, for the purpose of updating the value of open positions and calculating the variation margin and for the settlement of day trades. Reserve-day: business day for the purposes of financial market transactions, as established by the National Monetary Council. BM&FBOVESPA: BM&FBOVESPA S.A. – Bolsa de Valores, Mercadorias e Futuros. BCB: Central Bank of Brazil 2. Underlying asset The effective interest rate until the contract’s expiration date, defined for these purposes by the accumulation of the daily rates of repurchase agreements in the period as of and including the transaction’s date up to and including the contract’s expiration date. -

Compounding-Interest-Notes.Pdf

AP US Government/Econ Compounding Interest NAME_________ The two most common methods of calculating interest use the simple interest and the compound interest formulas. Simple interest: Simple interest is the dollar cost of borrowing money. This cost is based on three elements: the amount borrowed, which is called the principal; the rate of interest; and the time for which the principal is borrowed. The formula used to find simple interest is: interest = principal x rate of interest x amount of time the loan is outstanding or I = P x R x T Example Suppose you borrow $1,000 at 10 percent simple annual interest and repay it in one lump sum at the end of 3 years. To find the amount that must be repaid, calculate the interest: Interest = $1,000 x .10 x 3 = $300 This computes to $100 of interest each year. The amount that must be repaid is the $1,000 principal plus the $300 interest or a total of $1,300. Compound interest: Unlike simple interest, compound interest calculates interest not only on the principal, but also on the prior period's interest. The formula for calculating compound interest is: Future repayment value = principal x (1 + rate of interest)amount of time or F = P x (1 + R)T The factor (1+ R)T can be obtained easily using pencil and paper, a calculator, or a compound interest table. Most consumer loans use monthly or, possibly, daily compounding. Thus, if you are dealing with monthly compounding, the "R" term in the above formula relates to the monthly interest rate, and "T" equals the number of months in the loan term. -

Decision on the Effective Interest Rate

Pursuant to Article 304, item (1) of the Credit Institutions Act (Official Gazette 159/2013, 19/2015 and 102/2015) and in connection with Article 17 of the Act on Consumer Housing Loans (Official Gazette 101/2017), Article 13, paragraph (3) of the Credit Unions Act (Official Gazette 141/2006, 25/2009 and 90/2011) and Article 43, paragraph (2), item (9) of the Act on the Croatian National Bank (Official Gazette 75/2008 and 54/2013), the Governor of the Croatian National Bank hereby issues the Decision on the effective interest rate I GENERAL PROVISIONS Subject matter Article 1 (1) This Decision prescribes the calculation methodology and elements for the purposes of the uniform calculation of the effective interest rate (hereinafter referred to as 'EIR'). (2) This Decision transposes into the legal system of the Republic of Croatia Directive 2014/17/EU of the European Parliament and of the Council of 4 February 2014 on credit agreements for consumers relating to residential immovable property and amending Directives 2008/48/EC and 2013/36/EU and Regulation (EU) No 1093/2010 (OJ L 60, 28.2.2014). Entities subject to the Decision Article 2 (1) Entities subject to this Decision shall be the following entities that provide services to consumers: 1. credit institutions with head offices in the Republic of Croatia that have been authorised by the Croatian National Bank; 2. credit institutions of the Member States that have established branches within the territory of the Republic of Croatia in accordance with the law governing the operation of credit institutions or that have been authorised to provide mutually recognised services directly within the territory of the Republic of Croatia; 3. -

March 21, 2018

Guaranteed Home Loan Program March 21, 2018 USDA Rural Development Guaranteed Home Loan Program Requires Itemization of Loan Discount Points and Origination Fees USDA Rural Development’s guaranteed home loan program requires that loan discount points and loan origination fees be itemized separately on the settlement statement so the amount of the loan used for loan discount points can be accurately identified. Also, loan discount points, other than to reduce the effective interest rate, cannot be financed as part of the loan. Discount points must be reasonable and customary for the area and cannot be more than those charged other applicants for comparable transactions. Permissible discount points financed may not exceed two percentage points of the loan amount for a non-streamlined refinance. Loan discount points representing fees other than to reduce the effective interest rate, such as to compensate for a low credit score or low loan amount, are ineligible loan purposes. Lenders must begin with an eligible interest rate prior to reducing the effective interest rate. Last year 2,100 rural Iowa families and individuals purchased homes by accessing more than $230 million in USDA Rural Development guaranteed loans. Please call (515) 284-4667, email [email protected] or visit www.rd.usda.gov/ia for more information. USDA Guaranteed Home Loan Program - Additional Information and Resources Stay informed of guaranteed home loan program changes by signing up for alerts at https://public.govdelivery.com/accounts/USDARD/subscriber/new?qsp=USDARD_25 USDA Rural Development's current 3555 Lender Handbook can be found at http://www.rd.usda.gov/publications/regulations-guidelines/handbooks. -

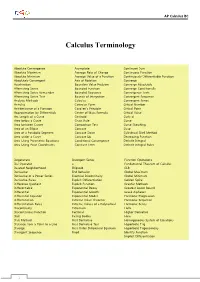

Calculus Terminology

AP Calculus BC Calculus Terminology Absolute Convergence Asymptote Continued Sum Absolute Maximum Average Rate of Change Continuous Function Absolute Minimum Average Value of a Function Continuously Differentiable Function Absolutely Convergent Axis of Rotation Converge Acceleration Boundary Value Problem Converge Absolutely Alternating Series Bounded Function Converge Conditionally Alternating Series Remainder Bounded Sequence Convergence Tests Alternating Series Test Bounds of Integration Convergent Sequence Analytic Methods Calculus Convergent Series Annulus Cartesian Form Critical Number Antiderivative of a Function Cavalieri’s Principle Critical Point Approximation by Differentials Center of Mass Formula Critical Value Arc Length of a Curve Centroid Curly d Area below a Curve Chain Rule Curve Area between Curves Comparison Test Curve Sketching Area of an Ellipse Concave Cusp Area of a Parabolic Segment Concave Down Cylindrical Shell Method Area under a Curve Concave Up Decreasing Function Area Using Parametric Equations Conditional Convergence Definite Integral Area Using Polar Coordinates Constant Term Definite Integral Rules Degenerate Divergent Series Function Operations Del Operator e Fundamental Theorem of Calculus Deleted Neighborhood Ellipsoid GLB Derivative End Behavior Global Maximum Derivative of a Power Series Essential Discontinuity Global Minimum Derivative Rules Explicit Differentiation Golden Spiral Difference Quotient Explicit Function Graphic Methods Differentiable Exponential Decay Greatest Lower Bound Differential -

11.8 Compound Interest and Half Life.Notebook November 08, 2017

11.8 Compound interest and half life.notebook November 08, 2017 Compound Interest AND Half Lives Nov 21:43 PM What is compound interest?? This is when a bank pays interest on both the principal amount AND on accrued interest. **This is different from simple interest....how is that? • Simple interest is interest earned solely on the principal amount. • Remember I=prt?? Nov 21:43 PM 1 11.8 Compound interest and half life.notebook November 08, 2017 Let's take a look at a chart when interest is compound at an annual rate of 8% Interest Rate Time Periods in a Earned Per Compounded Year Period annually 1 8% per year 8% / 2 periods so..... semiannually 2 4% every 6 months 8% / 4 periods so...... quarterly 4 2% every 3 months 8% / 12 periods so..... monthly 12 0.6% every month Nov 21:47 PM How do we find compound interest? Nov 21:53 PM 2 11.8 Compound interest and half life.notebook November 08, 2017 $1,500 at 7% compounded annually for 3 years Nov 22:08 PM Suppose your parents deposited $1500 in an account paying 6.5% interest compounded quarterly when you were born. Find the account balance after 18 years. Nov 38:29 AM 3 11.8 Compound interest and half life.notebook November 08, 2017 You deposit $200 into a savings account earning 5% compounded semiannually. How much will it be worth after 1 year? After 2 years? After 5 years? Nov 38:29 AM What is a halflife? A halflife is the length of time it takes for one half of the substance to decay into another substance. -

Rates of Return: Part 3

REFJ The Real Estate Finance Journal A WEST GROUP PUBLICATION Copyright ©20 11 West Group REAL ESTATE JV PROMOTE CALCULATIONS: RATES OF RETUR PART 3- COMPOUND INTEREST TO THE RESCUE? By Stevens A. C arey* Based on an article published in the Fall 2011 issue of The Real Estate Finance Journal *STEVENS A. CAREY is a transactional partner with Pircher, Nichols & Meeks, a real estate law firm with offices in Los Angeles and Chicago. The author thanks Dick A skey for corresponding with him, Jeff Rosenthal and Carl Tash for providing comments on a prior draft of this article, and Bill Schriver for cite checking. Any errors are those of the author. TABLE OF CONTENTS Compound Interest - The Basics . 1 Definition....................................................................................................................... 1 CompoundingPeriod......................................................................................................2 FundamentalFormula.....................................................................................................2 Futureand Fractional Periods.........................................................................................2 ContinuousCompounding.......................................................................................................2 Future Value Interest Factor...........................................................................................3 Generalized Fundamental Formula.................................................................................3 NominalRate.................................................................................................................3 -

Compound Interest

Compound Interest Invest €500 that earns 10% interest each year for 3 years, where each interest payment is reinvested at the same rate: End of interest earned amount at end of period Year 1 50 550 = 500(1.1) Year 2 55 605 = 500(1.1)(1.1) Year 3 60.5 665.5 = 500(1.1)3 The interest earned grows, because the amount of money it is applied to grows with each payment of interest. We earn not only interest, but interest on the interest already paid. This is called compound interest. More generally, we invest the principal, P, at an interest rate r for a number of periods, n, and receive a final sum, S, at the end of the investment horizon. n S= P(1 + r) Example: A principal of €25000 is invested at 12% interest compounded annually. After how many years will it have exceeded €250000? n 10P= P( 1 + r) Compounding can take place several times in a year, e.g. quarterly, monthly, weekly, continuously. This does not mean that the quoted interest rate is paid out that number of times a year! Assume the €500 is invested for 3 years, at 10%, but now we compound quarterly: Quarter interest earned amount at end of quarter 1 12.5 512.5 2 12.8125 525.3125 3 13.1328 538.445 4 13.4611 551.91 Generally: nm ⎛ r ⎞ SP=⎜1 + ⎟ ⎝ m ⎠ where m is the amount of compounding per period n. Example: €10 invested at 12% interest for one year. Future value if compounded: a) annually b) semi-annuallyc) quarterly d) monthly e) weekly As the interval of compounding shrinks, i.e. -

Compound Interest

Compound Interest (18.01 Exercises, 1I-5) If you invest P dollars at the annual interest rate r, then after one year the interest is I = rP dollars, and the total amount is A = P + I = P (1 + r). This is simple interest. For compound interest, the year is divided into k equal time periods and the interest is calculated and added to the account at the end of each period. So 1 at the end of the first period, A = P (1 + r( k )); this is the new amount for the 1 1 second period, at the end of which A = P (1 + r( k ))(1 + r( k )), and continuing this way, at the end of the year the amount is r k A = P 1 + : k The compound interest rate r thus earns the same in a year as the simple interest rate of r k 1 + − 1; k this equivalent simple interest rate is in bank jargon the \annual percentage rate" or APR.1 a) Compute the APR of 5% compounded monthly and daily.2 b) As in part (a), compute the APR of 10% compounded monthly, biweekly (k = 26), and daily. (We have thrown in the biweekly rate because loans can be paid off biweekly.) Solution a) Compute the APR of 5% compounded monthly and daily. You've been given the formula: r k APR = 1 + − 1: k All that remains is to determine values for r and k, then evaluate the ex- pression. In part (a) the interest rate r is 5%. Hence, r = 0:05.