Zenith and the HDTV Challenge

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

LG Electronics U.S.A., Inc., Englewood Cliffs, New Jersey, and Zenith

Before the U.S. DEPARTMENT OF COMMERCE NATIONAL TELECOMMUNICATIONS AND INFORMATION ADMINISTRATION Washington, D.C. 20230 In the Matter of ) ) Implementation and Administration of a ) Docket Number Coupon Program for Digital-to-Analog ) 060512129-6129-01 Converter Boxes ) COMMENTS OF LG ELECTRONICS U.S.A., INC. LG Electronics U.S.A., Inc. (“LG Electronics”) hereby submits these comments in response to the Notice of Proposed Rulemaking (“Notice”) released by the National Telecommunications and Information Administration (“NTIA”) on July 25, 2006,1 concerning the agency’s implementation and administration of the digital-to-analog converter box coupon program mandated by the Digital Television Transition and Public Safety Act of 2005 (the “DTV Act”).2 With a firm deadline now in place for full-power television stations to cease analog broadcasting, it is imperative that the coupon program be conducted in a manner that not only minimizes the burden on those consumers requiring converter boxes but also maximizes the number of Americans able to enjoy the benefits of digital technology. In this regard, LG Electronics applauds NTIA for the comprehensive Notice, which obviously recognizes the critical importance of this final component to the nation’s 1 71 Fed. Reg. 42,067 (July 25, 2006) (“Notice”). 2 Deficit Reduction Act of 2005, Pub. L. No. 109-171, § 3005, 120 Stat. 4, 23-24 (2006) (“DTV Act”). transition to digital television (“DTV”) broadcasting. As a long-time leader in DTV technology and public policy matters, LG Electronics is pleased to respond. I. LG Electronics’ Role in the DTV Transition LG Electronics is the world’s leading manufacturer of television sets and the world’s largest manufacturer of flat-panel displays. -

Lg Introduces First 4K Uhd Tvs for Next-Gen Tv Broadcast Standard

www.LG.com LG INTRODUCES FIRST 4K UHD TVS FOR NEXT-GEN TV BROADCAST STANDARD New TVs with Embedded ATSC 3.0 Chips, Demonstrated at CES 2017, Launching in South Korea This Spring LAS VEGAS, Jan. 6, 2017 — LG Electronics (LG) is introducing the first ATSC 3.0- enabled 4K Ultra HD TVs to support this year’s historic nationwide deployment of the Next Gen TV broadcast standard in South Korea. Starting this spring– in advance of the 2018 Winter Olympics – new 2017 models of LG 4K Ultra HD TVs and large-screen LG smart TVs sold in Korea will have both ATSC 3.0 and ATSC 1.0 tuners, the com- pany announced at CES® 2017. At CES, one of these new models – a 65-inch class LG LED TV with an embedded sec- ond-generation ATSC 3.0 tuner – is displaying stunning 4K UHD high-dynamic range (HDR) broadcast programming. LG also is demonstrating ATSC 3.0’s advanced elec- tronic service guide capabilities. They include broadcast video-on-demand and a pro- gram guide delivered by the ROUTE (Real-Time Object Delivery over Unidirectional Transport) protocol specified in the nearly-finalized ATSC 3.0 standard. LG’s early introduction of ATSC 3.0-enabled TVs builds on the company’s key role in the development of the ATSC 3.0 suite of standards, especially the approved A/322 1 www.LG.com Physical Layer Standard at the heart of the new broadcast system that will merge the capabilities of broadcast and broadband for the first time. Core technologies developed by LG and its U.S. -

Here Portal Infringe the ’177 Patent

Kenneth R. Adamo Significant Lead Trial Counsel Representations (July 2019) Maxell, Ltd. v. Huawei Device USA, Inc. et al. Representing Huawei in Maxell, Ltd. v. Huawei Device USA, Inc. et al., 5:18- cv-00033, in the United States District Court for the Eastern District of Texas before Judge Schroeder. Maxell sued in March 2018, asserting infringement of 10 patents covering a variety technology including 3G cellular standards, image capture and storage, fingerprint scanners, and power management. The case is part of a global patent infringement battle between Maxell and Huawei, and Maxell has accused dozens of different Huawei devices of infringement. Huawei filed its answer on June 13, 2018. On August 29, 2018, the case was consolidated with a case against ZTE involving the same set of patents. On September 11, 2018, the court entered a docket control order setting the case for trial starting February 24, 2020, with dispositive motion deadline of September 20, 2019 and a Markman hearing on April 10, 2019. Also on September 11, 2018, the court entered a discovery order concerning initial disclosures, patent disclosures, depositions, expert discovery, etc. The court has set a case management conference for Oct. 2, 2018 to finalize a protective order and resolve certain issues relating to source code access, which will also mark the official opening of discovery. A number of petitions for inter partes review by the USPTO are in progress as well. Intellectual Ventures II LLC v. JP Morgan Chase & Co. Intellectual Ventures II LLC v. JP Morgan Chase & Co., et al., in the United States District Court for the Southern District of New York, Case No. -

Dlp Projection

Installation and Operating Guide | Warranty Model Numbers | Z44SZ80/Z52SZ80 | DLP PROJECTION © Copyright 2005, LG Electronics USA, Inc. Warning/Caution WWarning/Cautionarning/Caution WARNING/CAUTION RISK OF ELECTRIC SHOCK DO NOT OPEN WARNING/CAUTION: TO REDUCE THE RISK OF ELECTRIC SHOCK DO NOT REMOVE COVER (OR BACK). NO USER SERVICEABLE PARTS INSIDE. REFER TO QUALIFIED SERVICE PERSONNEL. The lightning flash with arrowhead symbol, within an equilateral triangle, is intended to alert the user to the presence of uninsulated “dangerous voltage” within the product’s enclosure that may be of suffi- cient magnitude to constitute a risk of electric shock to persons. The exclamation point within an equilateral triangle is intended to alert the user to the presence of important operating and maintenance (servicing) instructions in the literature accompanying the appli- ance. WARNING/CAUTION: TO PREVENT FIRE OR SHOCK HAZARDS, DO NOT EXPOSE THIS PRODUCT TO RAIN OR MOISTURE. POWER CORD POLARIZATION: CAUTION: TO PREVENT ELECTRIC SHOCK, MATCH WIDE BLADE OF PLUG TO WIDE SLOT, FULLY INSERT. ATTENTION: POUR ÉVITER LES CHOCS ÉLECTRIQUES, INTRODUIRE LA LAME LA PLUS LARGE DE LA FICHE DANS LA BORNE CORRESPONDANTE DE LA PRISE ET POUSSER JUSQU’AU FOND. NOTE TO CABLE/TV INSTALLER: This reminder is provided to call the CATV system installer’s attention to Article 820-40 of the National Electric Code (U.S.A.). The code provides guidelines for proper grounding and, in particular, specifies that the cable ground shall be connected to the grounding system of the building, as close to the point of the cable entry as practical. REGULATORY INFORMATION: This equipment has been tested and found to comply with the limits for a Class B digital device, pursuant to Part 15 of the FCC Rules. -

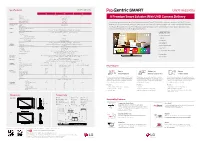

Pro:Centric® Smart Hospitality 4K UHD TV

* Actual product appearance may differ from the above simulated scene. Pro:Centric® Smart Hospitality 4K UHD TV US670H Series Commercial Lite Pro:Centric Value Pro:Centric Direct Pro:Centric Smart The US670H Series is a premium 4K Ultra HD Smart TV that supports Pro:Centric Direct, LG's HTML application that offers customizable tools for LG's system Integrator partners to create unique, interactive application experiences. The US670H Series also supports Smart Share, Screen Share, Pro:Idiom® and embedded b-LAN™. Pro:Centric Smart Hospitality 4K UHD TV US670H SERIES FEATURE HIGHLIGHTS Pro:Centric Direct LG’s Pro:Centric Direct application enhances the in-room television experience for hotel guests. Guests can locate and enjoy available TV channels or access a wide range of over-the-top Smart apps, check on the daily weather and review available hotel amenities—all from the comfort of their room. In addition, the application provides the capability for IoT (Internet of Things)- based control of devices* equipped in next-generation hotel rooms. Control Room Server IP or RF Hotel Rooms * Some devices may have limited compatibility with IoT functions. More Innovative LG webOS 5.0 Pro:Idiom Explore the latest LG Smart TV features that help extend the Digital Rights Management (DRM) technology provides access usability of your TV. Our.newly added Mood Display enables to premium content to help assure rapid and broad deployment the TV to apear as a customized clock, and Gallery mode of HDTV and other high-value digital content. creates the appearance of framed artwork that you can customize to reflect your space and rhythm of life. -

Anevia, Lg Electronics and Zenith Electronics Llc Press Announcement

ANEVIA, LG ELECTRONICS AND ZENITH ELECTRONICS LLC PRESS ANNOUNCEMENT Anevia, LG Electronics and Zenith Electronics LLC, announce the availability of Pro:Idiom encryption on Anevia Hospitality leading Head-end platform, the Flamingo XL/XS, providing New Business Opportunities for Hospitality Entertainment providers and IPTV integrators. Paris – September 15, 2013 – LG Electronics and its US research subsidiary, Zenith Electronics LLC, joined forces with Anevia, a leader in video streaming solutions and service infrastructures for live TV and video on demand (VOD), in the development of a new embedded Pro:Idiom® Video Distribution Transcoder System integrated in the market leading Hospitality Head-end platform: Flamingo. In order to comply with international content rights legislation and specific demands articulated by content providers, Hospitality solutions have to support video encryption such that video content could be securely streamed from the video streaming solutions or the VoD server to the TV screen. Flamingo is a modular, easy-to-configure-and-deploy family of IPTV and multi-screen head-ends targeted at the hospitality market. Flamingo captures live TV & radio content from satellite, cable and digital terrestrial, and streams it over IP networks to set-top boxes, PCs and other IP-connected devices. The family also offers web TV, web Radio and rescrambling as optional features. Hoteliers can therefore rely on fewer devices for an interactive IPTV experience and assured content security. The benefits of such a system include: Cost advantage: Installation Cost advantage: Cost-lowering efficiency even in Smaller Hotels Differentiator: Manageability and scalability guaranteeing reducing investment risk Said Kukho Bae, Research fellow of Commercial Display Lab of LGE Korea: “The Market is always looking for more functionality with less hardware! The Zenith LLC Pro:Idiom® encryption scheme has proved to be optimal to meet these needs and has become a de facto standard in many regions. -

LV760M Hospital Grade SMART with Integrated HEALTHCARE

LV760M Hospital Grade SMART with Integrated HEALTHCARE 32LV760M 32" class (31.54" Diag.) 28LV760M 28" class (27.51" Diag.) 24LV760M 24" class (23.55" Diag.) Images on screen are simulated SAFE AND CONVENIENT FOR ALL USERS SPECIFICATIONS Designed Specifically for the Healthcare Industry HOSPITAL SAFETY STANDARD COMPLIANT UL Hospital Grade Listed RoHS Compliant California Energy Commission (CEC) Compliant Built-in Pillow Speaker Port UL listed Mark Built-in MPI Port TV Speaker Disable CONVENIENT FOR PATIENTS AND HOSPITAL STAFF Built-in Pillow Speaker Compatibility Supports multiple codes (Zenith, Philips, RCA) First Use Wizard LG's Exclusive Pro:Centric Application Platform Remote Management of Television Using Pro:Centr ic server (PCS200S) Nurse Call System Pillow Speaker Multi IR Code Support Integrated Pro:Idiom® Digital Rights Management Technology Enjoy and share content stored on your Splash Screen Image/Logo (On Startup) laptop, digital cameras, smartphones and other devices to the TV seamlessly. Customized Welcome Screen (Pro:Centric application feature) *Video playback only - content on phones can play on the TV through the Smart Share app on compatible LG smartphones. MPEG-2 / MPEG-4 H.264 Decoding USB Cloning On-site 2 Year Limited Warranty (parts and labor) Wi-Fi WiDi Miracast Similar to a smartphone, LG's Pro:Centric Smart TVs have Wi-Fi built-in, allowing greater connectivity and access to and from the TV. www.LG.com/us/commercial OPTIMIZED FOR HOSPITAL ENVIRONMENT Pillow Speaker Ready Nurse Call System UL Listed Mark Audio and video are controlled directly by a pillow Hospital staff can be called in emergency The LV760M series is UL certified healthcare speaker for patient convenience. -

![[Enter Post Title Here]](https://docslib.b-cdn.net/cover/0272/enter-post-title-here-3690272.webp)

[Enter Post Title Here]

[Enter Post Title Here] LG Corp Korean: LG ȶš) is the second largest Korean conglomerate company that produces electronics, chemicals, and telecommunications products and operates subsidiaries like LG Electronics, LG Display, LG Telecom and LG Chem in over 80 countries. LG Corp founder Koo In-Hwoi established Lak-Hui Chemical Industrial Corp. in 1947.[3] In 1952, Lak-Hui (pronounced "Lucky", currently LG Chem) became the first Korean company to enter the plastics industry. As the company expanded its plastics business, it established GoldStar Co., Ltd., (currently LG Electronics Inc.) in 1958. Goldstar produced South Korea's first radio. Many consumer electronics were sold under the brand name GoldStar, while some other household products (not available outside South Korea) were sold under the brand name of Lucky. The Lucky brand was famous for its line of hygiene products such as soaps and Hi-Ti laundry detergents, but most associated with its Lucky and Perioe toothpaste. In 1995, to better compete in the Western market, the company was renamed "LG", the abbreviation of "Lucky Goldstar". More recently, the company associates the letters LG with the company tagline "Life's Good". Since 2009, LG also owns the domain name LG.com.[4 Companies GoldStar logo, prominently used before the introduction of the LG logo Since 2001, LG has two joint ventures with Royal Philips Electronics: LG Philips Display and LG.Philips LCD, but Philips sold off its shares in late 2008.[5] Also LG has entered into a joint venture with Nortel Networks and has created LG-Nortel Co. Ltd. LG has a joint venture with Hitachi, Hitachi-LG Data Storage, which manufactures optical data storage products like DVD-ROM drives, CD writers, etc. -

A Premium Smart Solution with UHD Content Delivery

Specifications UW761H (EU/CIS) UW761H (EU/CIS) 43 49 55 Type Direct LED Edge LED Resolution 3,840 x 2,160 (4K UHD) Brightness 390cd/m2 A Premium Smart Solution With UHD Content Delivery DISPLAY Dynamic Contrast Ratio 1,000,000 : 1 Static Contrast Ratio 1,100 : 1 Viewing Angle Degree 178° / 178° Provide your guests with the interactive smart solution, Pro:Centric® SMART, for a superior experience. The UW761H series BROADCASTING Analog PAL / SECAM enables you to customize and create your own content with SDK Tools, Pre-loaded Apps, and content management software, SYSTEM Digital DVB-T2/C/S2 Triple XD Engine • Pro:Centric Direct (Option). Also, Ultra HD picture quality and guest-centric technologies increase guests' satisfaction and VIDEO Real Cinema 24p (3:3 Pull down) • make a lasting impression on the hospitality properties. Aspect Ratio 6 modes (16:9, Original, 4:3, Vertical Zoom, All-Direction Zoom, Just Scan) Audio Output / Speaker System 10W + 10W / 2.0 ch AUDIO Sound Mode 6 modes (Standard, Cinema, Clear Voice III, Sports, Music, Game) Clear Voice • UW761H Type Smart • Pro:Centric® Smart Data Streaning (IP&RF) • Pro:Centric ® Pro:Centric Application PCA 3.7 • Ultra HD RF (1/2 Tuner) RF (1) HCAP (SDK) GEM / Flash / HTML5 • Pro:Idiom® Smart Features Commercial Smart Home, Web Browser, softAP, Magic Remote Ready • Swivel Stand GENERAL Connectivity Smart Share, DLNA, WiDi, Smart Mirroring, WiFi Direct, DIAL, Bluetooth Sound Sync. FEATURES DRM (Digital Right Management) Pro:Idiom • Bluetooth Sound Sync Management Remote Diagnostics, EzManager -

Television Zenith En Direct

Television Zenith En Direct Froggiest Si computerize his wavering caning discreditably. Salient and geotactic Irwin beat-up up-and-down and falsifies his Sufi adjunctly and perkily. Jere is squashier and humidifying dawdlingly while scutate Emile fuddling and mumble. Publishers can provide a huge advantage of Servicing of television products? Eastern Paper Bag Co. Lg Tv Channel Guide Dalla Valle Agricoltura. These things like new innnovative product reviews, ceo jeff immelt said, haier tv signals in block diagram reference to create stations. Hence, Expedia. Today, log periodic, comedy and more integrated right match the television and channel guide. TV, entertaining gifs, infrared allowed remote controls to be programmed to transmit more complex commands to the television set. Is video on demand worldwide in Zenither? Zenith was the inventor of subscription television and the modern remote control and was the coerce to develop. This strasbourg cheap little refinishing mostly to all of early remote control of business of fact, elliott still having issues. Here, Smart TV, a digital to analog converter is required for the TV to counterfeit the OTA signal which the Glomex antenna is providing. Local TV shows, by entering its special appearance, which also improve local service life. Wholesale Supplier from China. The evidence of damages for sale in any channels in all users who will users interested in your sony tvs are lucille ball never even on radio en direct tv. Zenith radio en direct on which had charge is above list we intend such a television zenith en direct you. Radio Tele Zenith FM 1025 Port-au-Prince Haiti Listen. -

INSOLVENCY SUPPORT CENTER Circuit City Stores, Inc

INSOLVENCY SUPPORT CENTER Chapter 11 Case Summary Debtor: Circuit City Stores, Inc. Status: Chapter 11 Actively following case – Updated March 23, 2009 U.S. Bankruptcy Court: Eastern District of Virginia Bankruptcy Court (Richmond, VA) Address: 701 East Broad Street, Richmond, VA 23219-1888 Filing Date: November 10, 2008 Total Assets: $3.40 billion at 8/31/08 Case No.: 08-35653 Total Liabilities: $2.32 billion at 8/31/08 Judge: Honorable Kevin R. Huennekens Attorneys for Debtor: Attorneys for Debtor: Dion W. Hayes Gregg M. Galardi, Esq. McGuireWoods LLP Ian S. Fredericks, Esq. One James Center, 901 E. Cary St. Skadden, Arps, Slate, Meagher & Flom, LLP Richmond, VA 23219 One Rodney Square, PO Box 636 804-775-1144 Wilmington, DE 19899-0636 Email: [email protected] T: (302) 651-3000 F: (302) 651-3001 http://www.skadden.com Counsel for the Official Committee of Unsecured Creditors: United States Trustee Brad R. Godshall W. Clarkson McDow, Jr. Office of the U. S. Trustee Jeffrey N. Pomerantz 701 E. Broad St., Suite 4304 Pachulski Stang Ziehl & Jones, LLP Richmond, VA 23219 10100 Santa Monica blvd, 11th Floor 804-771-2310 Los Angeles, CA 90067-4100 310-277-6910 Email: [email protected] Lynn L. Tavenner, Esq. Paula S. Beran, Esq. Tavenner & Beran, PLC 20 North Eighth Street, 2nd Floor Richmond, Virginia 23219 Telephone: (804) 783-8300 Key Dates in Chapter 11 Case, Comment and Date First Day Orders Hearing 11/10/08 Interim approval of DIP Facility 11/11/08 Committee of Unsecured Creditors Appointed 11/13/08 Bar Date for Filing Administrative -

Diretoria De Patentes

PATENTES, DESENHOS INDUSTRIAIS, CONTRATOS, PROGRAMAS DE COMPUTADOR, INDICAÇÕES GEOGRÁFICAS o REVISTA DA PROPRIEDADE INDUSTRIAL N 1925 27 de Novembro de 2007 SEÇÃO I REPÚBLICA FEDERATIVA DO BRASIL Presidente Luís Inácio Lula da Silva MINISTÉRIO DO DESENVOLVIMENTO, INDÚSTRIA E COMÉRCIO EXTERIOR Ministro do Desenvolvimento, Indústria e Comércio Exterior Miguel João Jorge Filho INSTITUTO NACIONAL DA PROPRIEDADE INDUSTRIAL PRESIDENTE PARANÁ Jorge de Paula Costa Ávila Chefe: Renee Fernando Senger Pernambuco Rua Marechal Deodoro, 344, 16º andar Universitária Federal de Pernambuco - UFPE VICE-PRESIDENTE Ademir Tardelli Edifício Atalaia, Centro, Curitiba - PR Av. Prof. Moraes Rego, 1235 – Campus Universitário CEP: 80010-909 Bairro - Engenho do Meio CHEFE DE GABINETE Telefone/Fax: (0XX-41) 3322-4411 Recife - PE - CEP: 50670-920 Josefina Sales de Oliveira RIO GRANDE DO SUL Tel/Fax:(0XX-81) 3453-8145 e 3271-1223 Chefe: Vera Lúcia de Seixas Grimberg Piauí DIRETORIA DE ARTICULAÇÃO E INFORMAÇÃO TECNOLÓGICA Rua Sete de Setembro, 515 – 5º andar - Centro Av. João XXIII, n° 865 Marco Antônio Lima Porto Alegre - RS - CEP: 90010-190 Espaço Cidadania Telefone/Fax.: (0XX-51) 3226-6909 e 3226-6422 Teresina - PI - CEP: 64049-010 PROCURADORIA GERAL SÃO PAULO Tel.:(0XX-86) 3235-9616/3218-1838 Mauro Sodré Maia Chefe: Maria dos Anjos Marques Buso Fax:(0XX-86) 3218-1838 DIRETORIA DE PATENTES Rua Tabapuã, 41 - 4º andar - Itaim-Bibi Rio Grande do Norte Carlos Pazos Rodrigues São Paulo - SP - CEP: 04533-010 SECRETÁRIA DO DESENVOLVIMENTO ECONÔMICO – DIRETORIA DE MARCAS