The Exponent Group of Journals for Shares and Stock Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

LOK SABHA DEBATES (English Version)

Twelfth Series, Vol. VI, No.5 Friday, December 4, 1998 ----------._--_.- Aerabaya.. 13, 1920 (Saka) LOK SABHA DEBATES (English Version) Third Session (Twelfth Lok Sabha) rp~LlII'" ,. ~ 1(2.-.---- 1'" ·-::rl~ , !-\\\.~.e_ .. -.;~~-~. (Vol. VI contains Nos. J to 10) LOK SABIIA SECRETARIAT NEW DELIII p,.ice : Rs. 50.00 EDITORIAL BOARD Shrl S. Gopa'an Secretary-General Lok Sabha Dr. A.K. Pandey Adctltlonal Secretary Lok SabhaSecretariat Shrl Harnam Singh Joint Secretary Lote Sabha Secretariat Shrl P.C. Bhatt Chief Editor Lok Sabha Secretariat Shrl G.P. Thapliyal Senior Editor Shrlmatl Vandana Trivedi Editor (Original English Proceedings Included In English Version and Original Hindi proceedings included In Hindi Version will be treated as authoritative and not the translation thereof.) CONTENTS [Twelfth Series, Vol. VI, Third Session 199811920 (Saka)] No. I, Frld.y, Deoemb.r 4, 1tt8lAg,.h.y.n. 13, 1820 (Selul) SUBJECT COLUMNS OBITUARY REFERENCE 1-2 ORAL ANSWERS TO QUESTIONS • Starred Questions Nos. 81 to 84 . 2-31 WRITTEN ANSWERS TO QUESTIONS Starred Questions Nos. 85 to 100 . 31-85 Unstarred Questions Nos. 921-1150 85-311 PAPERS LAID ON THE TABLE . 311-320 MESSAGE FROM RAJYA SABHA AND BILL AS PASSED BY RAJYA SABHA 320 COMMITTEE ON WELFARE OF SCHEDULED CASTES AND SCHEDULED TRIBES ..... 320-321 Action Taken Reports and Reports on Reservation STANDING COMMITTEE ON COMMERCE 321 Thirty-fifth and Thirty-sixth Reports STANDING COMMITTEE ON TRANSPORT AND TOURISM 321-322 Thirty-fourth Report and Evidence BUSINESS OF THE HOUSE . 322-325 ELECTIONS TO COMMITTEES 325-326 (I) Marine Products Export Development Authority 325 (iI) Central Coordination Commmee for Equal Opportunities for 325-326 Disabled Persons MOTION RE : REPORT OF JOINT COMMITTEE ON ESSENTIAL 326-343 COMMODITIES (AMENDMENT) BILL - EXTENSION OF TIME MOTION RE : SIXTH REPORT OF THE BUSINESS ADVISORY COMMITTEE Shrl Madan LaL Khurana 343-377 PRIVATE MEMBER'S BILLS-INTRODUCED .... -

Answered On:09.03.2001 Bungling by Plantation Companies Bhupendrasinh Prabhatsinh Solanki

GOVERNMENT OF INDIA FINANCE LOK SABHA UNSTARRED QUESTION NO:1883 ANSWERED ON:09.03.2001 BUNGLING BY PLANTATION COMPANIES BHUPENDRASINH PRABHATSINH SOLANKI Will the Minister of FINANCE be pleased to state: (a) whether the Government are aware of the bungling to the tune of Rs.500 crore by the Anubhav Group of Companies in Gujarat; (b) whether the Green Gold Company of Mumbai has also deceived the public by showing seven times enhancement of money within five years; (c) whether the cheques of various schemes of these companies have bounced; (d) whether these companies assured the investors to refund the money immediately; (e) if so, the reasons for not refunding the amount so far; and (f) the action being taken by the Government against these companies ? Answer MINISTER OF STATE IN THE MINISTRY OF FINANCE (BALASAHEB VIKHE PATIL) (a) : The Securities and Exchange Board of India( SEBI), which regulates Collective Investment Schemes (CISs), vide its press release dated December 18, 1997, directed existing schemes to file the details of their schemes with SEBI. According to information filed by M/s Anubhav Plantations Ltd., Chennai with SEBI on 28.01.1998, they have mobilised Rs.127.13 crores from the public under four schemes. The break-up of the amount mobilised in Gujarat is not available with SEBI. (b) M/s Green Gold Agro Development Ltd., M/s Green Gold Forestry Ltd. and M/s. Green Gold Horticulture Ltd. had filed details of their schemes with SEBI. Thereafter, SEBI conducted a special audit of M/s. Green Gold Horticulture Ltd. As per the audit report, the company had launched 8 schemes offering varying returns. -

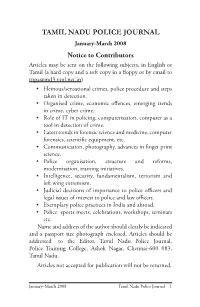

March Working-Pagination Dana

TAMIL NADU POLICE JOURNAL January-March 2008 Notice to Contributors Articles may be sent on the following subjects, in English or Tamil (a hard copy and a soft copy in a fl oppy or by email to [email protected]) • Heinous/sensational crimes, police procedure and steps taken in detection. • Organised crime, economic off ences, emerging trends in crime, cyber crime. • Role of IT in policing, computerisation, computer as a tool in detection of crime. • Latest trends in forensic science and medicine, computer forensics, scientifi c equipment, etc. • Communication, photography, advances in fi nger print science. • Police organisation, structure and reforms, modernisation, training initiatives. • Intelligence, security, fundamentalism, terrorism and left wing extremism. • Judicial decisions of importance to police offi cers and legal issues of interest to police and law offi cers. • Exemplary police practices in India and abroad. • Police sports meets, celebrations, workshops, seminars etc. Name and address of the author should clearly be indicated and a passport size photograph enclosed. Articles should be addressed to the Editor, Tamil Nadu Police Journal, Police Training College, Ashok Nagar, Chennai-600 083, Tamil Nadu. Articles not accepted for publication will not be returned. January–March 2008 Tamil Nadu Police Journal 1 EDITORIAL BOARD Editor in Chief K Natarajan IPS DGP Training Editor T. Rajendran IPS IGP Training Members K. Ramanujam IPS ADGP Training Amit Varma IPS ADGP/PO TNPA K Bhavaneeswari IPS Principal/PTC Disclaimer No part of the Tamil Nadu Police Journal may be used or reproduced in any form without permission from the Editor. Neither the Editor, nor the publisher assumes responsibility for the articles or facts or opinions in the papers printed. -

October 2016 Final.Pmd

Oct. 2016 Vol. XI No. 2 IMPACT FACTOR 4.173 (ISI) 3.860 (COSMOS) ISSN (P) : 0973-4503 (E) : 2454-1702 RNI : UPENG 2006/17831 http://EconPapers.repec.org/RePEc:jct:journl:v:11:y:2016:i:2:p:64-74 Pages 64-74 https://ideas.repec.org/a/jct/journl/v11y2016i2p64-74.html http://jctindia.org/oct2016/v11i2-8.pdf Frauds in Indian Capital Market- A Study Gangineni Dhanaiah Ph.D. Research Scholar, Acharya Nagarjuna University, Guntur(A P) Dr. R. Siva Ram Prasad Head, Department of Commerce and Business Administration, Acharya Nagarjuna University, Guntur (A.P.) Abstract India has witnessed major financial frauds almost every year since 1990s. There is well documented history of frauds in the financial markets starting from the (in)famous securities scam by Harshad Mehta (1992),MS Shoes (1995), CRBhansali(1996),Ketan Parikh Scam(2001),DSQ Software Scam (2001), IPO Demat Scam(2006),Vanishing Companies (2007),Satyam (2008), Home Trade (2010),Sahara India pariwar Investor fraud (2010), Home Trade(2010),ULIP Misselling(2011),Saradha Group Financial Scandal (2013), NSEL Scam (2013), PACL ponzi scheme scam(2014). Scams have led to regulatory reforms, forming new institutions and strengthening the institutional framework. This paper studies the role of stock exchanges and SEBI to protect investor interests and to promote fair and orderly securities markets. The study attempts to examine the role of SEBI by ensuring the integrity of markets by detecting market frauds on a proactive basis, investigating abusive, manipulative or illegal trading practices in Indian Securities Markets. The role of market surveillance in ensuring integrity of markets by enabling a safe and sound environment is further examined in this paper. -

Of 2 BEFORE the APPELLATE AUTHORITY

BEFORE THE APPELLATE AUTHORITY (Under the Right to Information Act, 2005) SECURITIES AND EXCHANGE BOARD OF INDIA Appeal No. 1502 of 2012 D. D. Mahajan : Appellant Vs. CPIO, SEBI, Mumbai : Respondent ORDER 1. The appellant had filed an application dated June 7, 2012 under the Right to Information Act, 2005 (“RTI Act”). The respondent vide letter dated July 5, 2012, responded to the appellant. Aggrieved by the respondent's response, the appellant has filed this appeal dated July 26, 2012. I have carefully considered the application, the response and the appeal and find that the matter can be decided based on the material available on record. 2. From the appellant's application, I note that he and his family had made investments in 4 plantation companies viz. Greenworld Resorts Ltd, Timberworld Resorts and Plantations India Ltd, Anubhav Plantations Ltd and Perutek Services Ltd. I note that the appellant had sought information regarding these 4 companies stating "Under RTI, I want to know which of the above company has made the refund and when and why I and my family have not got any refund". 3. In his response, the respondent had informed the appellant that the information in respect of refund to investors by the companies viz. M/s Greenworld Resorts Ltd., M/s Timberworld Resorts and Plantations Ltd. and M/s Perutek Services Ltd, was not available with the concerned department of SEBI. In the matter of M/s Anubhav Plantations Ltd, the appellant was informed that the Hon'ble High Court, Chennai has appointed Shri M. Ravindran as the Official Liquidator and he was advised to approach the Liquidator for matters related to refund of money from the said company. -

Commercial Crime Investigation Wing.Cid

COMMERCIAL CRIME INVESTIGATION WING.CID, 1. ORGANISATION Commercial Crime Investigation Wing, C.I.D., was constituted in G.O.Ms.No.170, H/O dated: 20.01.1971 to investigate offences relating to defalcation of funds in Co-operative Societies and the offences in the following 12 departments are being investigated by the C.C.I.Wing. 1. Registrar of Co-operative Society 2. Director of Handloom and Textiles 3. Director of Sugar 4. Director of Khadi and Village Industries 5. Registrar of Housing 6. Director of Fisheries 7. Director of Industries and Commerce 8. Director of Animal Husbandry 9. Commissioner of Milk Production and Diary Development 10. Director of Oil Seeds 11. Director of Agro Engineering 12. Director of Sericulture and Agriculture 13. Director of Social Welfare 14. Director of Co-operative Audit 15. Director of Rural Development .2. 2. Superintendent of Police, CCIW-CID is assisted at the field level by seven Deputy Superintendents of Police in seven C.C.I.W. Sub-divisions with headquarters at Chennai, Villupuram, Salem, Thanjavur, Coimbatore, Madurai and Tirunelveli, supervising the functioning of the following 34 District Units, each headed by an Inspector of Police with supporting strength of 34 Inspectors and 65 Sub-Inspectors of Police and other ranks. 3. STRENGTH PARTICULARS Strength DSP Insprs. SIs. Others Total Sanctioned 7 34 65 236 342 Actual 7 30 60 216 313 Vacancies - 4 5 20 29 4. FUNCTIONING OF CCIW-CID As per the GO MS No. 260 of Cooperation Food and Consumer Protection Dept dated 8.12.98 Cooperative cases involving misappropriation of funds exceeding Rs. -

Univerzita Karlova V Praze Fakulta Humanitních

UNIVERZITA KARLOVA V PRAZE FAKULTA HUMANITNÍCH STUDIÍ Katedra obecné antropologie Virginia Vargolskaia Alternativní ekonomické chování v rurálním Rusku Alternative economies in rural Russia Diplomová práce Vedoucí práce: doc. Mgr. Tereza Stöckelová, Ph.D. Praha 2018 „Prohlašuji, že jsem tuto diplomovou práci vypracovala samostatně a s použitím pramenů a literatury řádně citovaných a uvedených v seznamu literatury. Práci jsem nevyužila k získání jiného nebo stejného titulu.” V Praze dne 29.6.2018 Virginia Vargolskaia 1 I would like to thank Mikhail and his family for letting me stay at their farm, Tereza Stockelova for her patience and valuable comments on this thesis, Brandon Wint for dedicating his time on explaining how financial trading operates, Rebecca Solomon and Benjamin Ariel Markus for editing and proofreading, and Rares Musina for his help and support throughout my research and writing. 2 Key words: alternative economies, post-socialism, cryptocurrencies, algorithms, sociomateriality 4 Introduction 5 1.1 Theoretical inspirations 8 1.2 On methodology and ethics 9 1.3 Chapters summary 11 2. Field Description: The Post-Apocalyptic Village 13 2.1 The structure and economic activity of the farm 18 2.1.1 Exchange 19 2.1.2 Monetary exchange 20 2.1.3 Non-monetary exchange and favors 25 2.1.3 Koliony and cryptocurrencies 28 2.2 Distribution: sociability turned into economy 34 3. Post-Socialist Networks: Between Gift and Commodity 39 4. How Blockchain Came to the Farm: Closing the Circuit 58 4.1 What are cryptocurrencies 58 4.2 Naming and movement 60 4.3 The other side of the coin 67 5. -

SUPREME COURT of INDIA Page 1 of 19 CASE NO.: Writ Petition (Crl.) 245-246 of 2000

http://JUDIS.NIC.IN SUPREME COURT OF INDIA Page 1 of 19 CASE NO.: Writ Petition (crl.) 245-246 of 2000 PETITIONER: NARINDERJIT SINGH SAHNI AND ANR. RESPONDENT: UNION OF INDIA AND ORS. DATE OF JUDGMENT: 12/10/2001 BENCH: G.B. PATTANAIK & UMESH C. BANERJEE & S.N. VARIAVA JUDGMENT: JUDGMENT 2001 Supp(4) SCR 114 The Judgment of the Court was delivered by BANERJEE, J. This batch of writ petitions under Article 32 of the Constitution by reason of supposed infraction of Article 21, were moved before this Court for the grant of an order for bail in the nature as prescribed under Section 438 Cr. P. Code, and in line with the orders dated 28.3.2000 in W.P. (Crl.) No. 256 of 1999 and dated 5.5.2000 in W.P. (Crl.) Nos. 72-75 of 2000 passed earlier by this Court. To crystalize the issue, the orders as passed earlier ought to be noticed at this juncture. The first of the two orders read as below : (JVG Group of Companies : Writ Petition (Crl.) No. 256 of 1999) "It is not possible for us to order that all his cases pending in different States should be consolidated into one and brought before one court. That would impose unwarranted and unnecessary hardships on the witness and investigating agency spread over to those different States. Nor are we inclined to order the Central Bureau of Investigation to take up the investigation in respect of all cases, and further that he would make himself available on any date when his presence is imperatively needed in that court. -

Finanza the Rupee Matters

BHARATI VIDYAPEETH (DEEMED TO BE UNIVERSITY) INSTITUTE OF MANAGEMENT & RESEARCH, NEW DELHI “A” GRADE UNIVERSITY STATUS AWARDED BY MHRD, GOVT. OF INDIA RE-ACCREDITED WITH “A+GRADE BY NAAC FINANZA THE RUPEE MATTERS FINNOVATION The Finance Society of BVIMR VOLUME: 3, ISSUE - I JANUARY- JUNE, 2020 From the Editor’s Desk I am delighted to present the latest issue of Finanza. We thank our readers for their word of appreciation and encouragement. We have been continuously receiving participation from budding as well as experienced authors. This issue contains the valuable contribution by a student of 12th grade on the topic of negative interest rates. Presently our country is fighting with COVID-19 pandemic. It has changed the way we worked in the past. Adoption of digital modes has replaced physical delivery system in all types of industry, including education. All the sectors of the economy are affected in one way or the other. I am convinced that lot of efforts are required by each one of us to get back on the growth trajectory. This edition contains article suggesting measures to deal with current situation. Further, articles focusing on role of FINTECH and REGTECH will capture your interest as a reader. I would like to thank our readers and authors for their contribution. The valuable feedback and word of encouragement will help improve forthcoming issues. DR. MANPREET KAUR Editor REVIVING INDIAN ECONOMY AMIDST SLOWDOWN AND CORONA VIRUS OUTBREAK Author: CA Tanvi Sawant & CA Jatin Chawda (IIM Bangalore PGP 2019-21) he global economy experienced a synchronized slowdown in 2019 due to various reasons such as trade barriers, growing geopolitical tensions, delay in Brexit deal, oil-market disruptions, etc. -

Finance Case Catalog

Contents Finance The Tata - Tetley Leveraged Buyout E-1 The WorldCom Accounting Scandal E-6 Life Insurance Corporation’s Future Prospects E-1 Bangladesh Grameen Bank - Pioneers in Microfinance E-6 The US - 64 Controversy E-1 Takeover Tussle - Grasim Vs L & T E-6 The GTB - UTI Bank Merger E-1 The Fall of Barings Bank E-7 The ITC Classic Story E-2 Derivatives Trading in India E-7 The Ketan Parekh Scam E-2 MRPL and RPL - Analyzing Risk and Returns E-7 The JVG Scandal E-2 Parmalat - The Fall of a Dairy Giant E-7 CRB Scam E-2 Sumitomo Corporation of Japan - The Commodity Derivatives… E-8 The Anubhav Plantations Scam E-3 The Polaris Orbitech Merger E-8 Coimbatore Bypass Road Project E-3 Valuing Sify’s Acquisition of Indiaworld E-8 Arvind Mills’ Restructuring Plan E-3 Allied Irish Banks - The Currency Derivatives Fiasco E-8 Film Insurance & Financing in India E-3 Daiwa Bank - Lessons in Risk Management E-9 The Gucci - LVMH Battle E-4 Godrej Consumer Products Limited - Implementing EVA E-9 The Case of Insider Trading ( HLL - BBLIL Merger) E-4 TISCO - The EVA Journey E-9 Modi Rubber Vs the Financial Institutions E-4 Securities and Exchange Board of India… E-9 Reliance Petroleum TOCD Issue (A) E-4 The Google IPO E-10 Reliance Petroleum TOCD Issue (B) E-5 The Rise and Fall of Global Trust Bank E-10 Buyback of Shares and MNCs E-5 The Lucent Accounting Scandal E-10 The Indian Housing Finance Industry at the Crossroads E-5 SHARE Microfin Limited E-10 Essar Steel’s FRN Controversy E-5 ICICI Bank - Innovations in Microfinance E-11 Co-operative Bank Scams in India E-6 The Microfinance Industry in India E-11 Finance The Tata – Tetley Leveraged Buyout The US – 64 Controversy Abstract Abstract The case ‘The Leveraged Buyout Deal of Tata & Tetley’ provides The case ‘The US-64 Controversy’ provides insight into the insights into the concept of Leveraged Buyout (LBO) and its use problems faced by the Indian mutual fund major UTI’s flagship as a financial tool in acquisitions, with specific reference to Tata scheme US-64. -

How Have the Ponzi Schemes/Udss/Ciss Duped the Investors in India

How Have The Ponzi Schemes/UDSs/CISs Duped the Investors in India 1 Preface Though the nature of duping the public by promising unrealistic returns on their investment has been practiced since ages, in independent India, especially in the last few decades, there have been several such scams related to Ponzi scheme/unregulated deposit scheme (UDS)/illegal Collective Investment scheme (CIS) which have duped millions of gullible persons and have fraudulently collected billions of Rupees from them. Although the basic premise of these scams have remained same: collect money promising very high returns, pay the initial investors out of proceeds collected from subsequent investors till the scam/schemes bust, etc., the modus operandi has been evolving over the years. The idea for writing a book like this came up in discussion between teams of IEPFA and IICA, when it was discussed and decided to bring to the attention of public various Ponzi schemes/UDSs/CISs which have taken place in India over the years. To spread the message of such defrauding financial scams far and wide this book is being kept as an open source resource. In preparation of this book, active assistance was provided in terms of carrying out research, writing of cases, etc. by the research associate Shubhasree Bhadra. We are also thankful to the teams at IICA and IEPFA for their valuable comments on the subject. It is hoped that analysis of the cases contained in this booklet would prove useful to not only the public in saving them from similar defrauding schemes but also those institutions and agencies which impart financial/investor education as well as those who carry out research in this area. -

Plantation Scam – Your Money Grows Along with the Growth of Teak Tree!

Creating awareness - Investor education and Protection Series (Beware of Ponzi schemes and unregulated Deposit/Collective Investment schemes – 3) Plantation scam – Your money grows along with the growth of teak tree! Kamakhya Nr Singh1, The message was clear: a) Investment in plantation can be a money spinner! b) If you have money and don’t know where and how to make investment in plantation, we will guide you. If you also thought that plantation requires huge investment, we will simplify it for you by arranging only small investment by you! c) What is the solution provided by us for meeting your investment goal while making investment in the plantation sector – you can start with low amount of investment and still earn from the growth in the value of teak tree d) Additional avenue – not keen on investment in plantation – no problem. Keep the investment simple – get back your principle and 150% of your invested amount after 6 years. This was how gullible investors were lured by the schemes of one of the most prominent plantation operator, Anubhav Plantation. Anubhav group had floated three major schemes for investors. These were: a) Anubhav Teak Farm Scheme – Option A, b) Anubhav Teak Farm Scheme – Option B and c) Good Earth Unit Scheme. Details of the schemes are given below: Scheme Detail of the scheme Anubhav Teak Tenure of the scheme- 20 years Farm Scheme – Minimum amount of investment – INR 6000 Option A Maximum amount of investment – INR 60000 Rate of return – investor would get 300 sq feet land with three teak saplings for each INR 6000 investment Schedule of return – investors were promised to be paid INR 1000 in each year for first 6 years and additional INR 6000 at end of 6th year and INR 12000 at end of 12th year.