Partners Group Annual Report 2007

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Private Capital in Switzerland

DOWNLOAD THE DATA PACK PRIVATE CAPITAL IN SWITZERLAND KEY FACTS 52 €632mn €1.9bn Total number of Average size of Average allocation to Switzerland-based Switzerland-based funds private capital among funds in market, closed in 2018 YTD across Switzerland-based targeting an aggregate all private capital. investors. €13bn. Fig. 2: Annual Switzerland-Based Private Capital Fig. 1: Annual Switzerland-Based Private Capital Fundraising by Asset Class, 2008 - 2018 YTD Fundraising, 2008 - 2018 YTD (As at October 2018) (As at October 2018) 39 100% 5 1.2 40 22 5.9 35 34 Natural Resources 35 32 33 30 31 80% 14.6 30 26 36 Private Debt 25 24 24 10.4 19 60% 20 16 Infrastructure 15 14.4 9.3 8.4 9.6 9.5 40% 10 7.8 6.9 6.2 6.8 Real Estate 5.8 212 55.2 5 2.5 Proportion of Total 0 20% Private Equity & 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Venture Capital 0% YTD Year of Final Close No. of Funds Aggregate Capital No. of Funds Closed Aggregate Capital Raised (€bn) Closed Raised (€bn) Source: Preqin Pro Source: Preqin Pro Fig. 3: Switzerland-Based Private Capital: Median Net Fig. 4: Switzerland-Based Private Capital Assets under IRRs by Vintage Year (As at October 2018) Management by Asset Class, 2008 - 2018 18% 17.0%16.7% 50 16% 14.3% 40 14% 11.5% 11.3% 30 12% 10.9% 10.5% 10% 9.2% (€bn) 20 8.1% 8.5% 8% 6.4% 10 6% Assets under Management 4% 0 Median Net IRR since Inception 2% Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 0% Mar-18 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Private Equity Real Estate Infrastructure Vintage Year Private Debt Natural Resources Source: Preqin Pro Source: Preqin Pro 1 ©Preqin Ltd. -

Update on Partners Group

Update on Partners Group February 2021 Gonzalo Fernández Castro Private Equity Americas | Hal Avidano Co-Head Private Equity Integrated Investments Americas UPDATE ON PARTNERS GROUP 2 Table of contents 1 Overview 2 Clients 3 Industry 4 Investments 5 ESG 6 Financials OVERVIEW 3 About us Dedicated to private markets Leveraging strong resources • Our AuM stands at USD 109 billion:1 USD 52 billion in • We have over 1,500 employees worldwide2 across 20 corporate equity & USD 57 billion real assets / financing offices and over 750 private markets professionals • We leverage our database of over 36,000 private markets • Our platform, portfolio and network provide extensive assets to generate attractive deal flow synergies and opportunities for owners and entrepreneurs We have a global presence with 20 offices across key investment regions Tokyo Shanghai Seoul Toronto Dubai Denver London New York Mumbai Guernsey Luxembourg Manila Houston Munich Paris Singapore Zug Milan São Paulo Sydney Americas Europe Asia Pacific For illustrative purposes only. Source: Partners Group (2020). 1 Unaudited, inclusive of all Partners Group affiliates, as of 31 December 2020. 2 As of 31 December 2020. OVERVIEW 4 About our portfolio Partner to business Entrepreneurial ownership Corporate assets (USD 52 billion AuM1) Healthcare Industrials Consumer & services Technology Real assets / financing (USD 57 billion AuM2) Infrastructure Real estate Real asset services Financing We are "responsible for the dreams" of the 200,000+ partners and employees who work alongside us in our portfolio For illustrative purposes only. Source: Partners Group (2019). 1 Corporate equity includes Partners Group's private equity asset under management as of 31 December 2020. -

Partners Group Global Value Sicav

PARTNERS GROUP GLOBAL VALUE SICAV Monthly report as of 31 October 2019 NAV eased by 0.4% in October This Fund might restrict outflows in the future. IMPORTANT INFORMATION: We would like to remind investors that redeeming ● New private equity direct transaction Nestlé Skin Health their holdings in the Fund is subject to restrictions as set out in the Fund's constitu- ent documents. Redemptions are generally subject to a maximum per dealing day ● Private equity direct investment Guardian Childcare & Education closed expressed as a percentage of the net asset value. These percentages may be lowered further (limited to a maximum of 2 consecutive years) if this is deemed an add-on acquisition in the best interest of the Fund. In certain circumstances redemptions may also be suspended. In October, Partners Group Global Value SICAV I EUR recorded, with a NAV development of -0.4%, the first negative month in 2019 and closed at a Key figures share price of EUR 259.40. The lower share price was the result of an unfa- In EUR 30.09.2019 31.10.2019 YTD vorable development of the FX movements that more than offset the slightly positive performance of the portfolio. Notwithstanding this, the Fund con- NAV per share 260.53 259.40 9.7% tinued to build out the underlying portfolio by completing the investment Total fund size (in million) 3'429.09 3'568.06 in Nestlé Skin Health and the funding of an add-on acquisition by Guardian Investment level 96.4% 93.8% Childcare & Education. Performance (since inception) 160.5% 159.4% Monthly volatility (since inception) 4.5% 4.5% The largest transaction of the reporting month was Partners Group's invest- ment in Nestlé Skin Health. -

Offense Remains the Best Defense

Offense remains the best defense Private Markets Navigator Outlook 2021 Tina Jessop Senior Economist | Charles Rees Private Equity Europe Table of contents Private markets outlook 04 Private equity 10 The industry view 18 Private real estate 21 Private debt 27 Private infrastructure 32 Liquid private markets 37 Portfolio perspectives 38 Contacts 46 Important information This material has been prepared solely for purposes of illustration and Partners Group expressly disclaims any obligation or undertaking to discussion. Under no circumstances should the information contained update or revise any projections, forecasts, or estimates contained in herein be used or considered as an offer to sell or solicitation of an offer this material to reflect any change in events, conditions, assumptions, to buy any security. The information contained herein is proprietary and or circumstances on which any such statements are based unless so may not be reproduced or circulated in whole or in part. required by applicable law. All information, including performance information, has been prepared Private markets investments are speculative and involve a substantial in good faith; however, Partners Group makes no representation or degree of risk. Private markets investments are highly illiquid and are warranty, express or implied, as to the accuracy or completeness of not required to provide periodic pricing or valuation information to the information, and nothing herein shall be relied upon as a promise investors with respect to individual investments. There is no secondary or representation as to past or future performance. This material may market for the investors’ interest, and none is expected to develop. In include information that is based, in part or in full, on hypothetical addition, there may be certain restrictions on transferring interests. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS CTIVP® – Lazard International Equity Advantage Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 97.6% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Australia 6.9% Finland 1.0% AGL Energy Ltd. 437,255 4,269,500 Metso OYJ 153,708 2,078,669 ASX Ltd. 80,181 4,687,834 UPM-Kymmene OYJ 36,364 1,106,808 BHP Group Ltd. 349,229 9,021,842 Valmet OYJ 469,080 11,570,861 Breville Group Ltd. 153,867 2,792,438 Total 14,756,338 Charter Hall Group 424,482 3,808,865 France 9.5% CSL Ltd. 21,611 4,464,114 Air Liquide SA 47,014 7,452,175 Data#3 Ltd. 392,648 1,866,463 Capgemini SE 88,945 11,411,232 Fortescue Metals Group Ltd. 2,622,808 30,812,817 Cie de Saint-Gobain(a) 595,105 24,927,266 IGO Ltd. 596,008 1,796,212 Cie Generale des Etablissements Michelin CSA 24,191 2,596,845 Ingenia Communities Group 665,283 2,191,435 Electricite de France SA 417,761 4,413,001 Kogan.com Ltd. 138,444 2,021,176 Elis SA(a) 76,713 968,415 Netwealth Group Ltd. 477,201 5,254,788 Legrand SA 22,398 1,783,985 Omni Bridgeway Ltd. 435,744 1,234,193 L’Oreal SA 119,452 38,873,153 REA Group Ltd. 23,810 1,895,961 Orange SA 298,281 3,106,763 Regis Resources Ltd. -

2019 Switzerland Spencer Stuart Board Index

2019 Switzerland Spencer Stuart Board Index About Spencer StuArt Spencer Stuart has had an uninterrupted presence in Switzerland since 1959, when it opened its Zurich office. Spencer Stuart is one of the world’s leading executive search consulting firms. We are trusted by organisations around the world to help them make the senior-level leadership decisions that have a lasting impact on their enterprises. Through our executive search, board and leadership advisory services, we help build and enhance high-performing teams for select clients ranging from major multinationals to emerging companies to nonprofit institutions. Privately held since 1956, we focus on delivering knowledge, insight and results though the collaborative efforts of a team of experts — now spanning more than 60 offices, over 30 countries and more than 50 practice specialties. Boards and leaders consistently turn to Spencer Stuart to help address their evolving leadership needs in areas such as senior-level executive search, board recruitment, board effectiveness, succession planning, in-depth senior management assessment and many other facets of organisational effectiveness. For more information on Spencer Stuart, please visit www.spencerstuart.com. Social Media @ Spencer Stuart Stay up to date on the trends and topics that are relevant to your business and career. @Spencer Stuart © 2020 Spencer Stuart. All rights reserved. For information about copying, distributing and displaying this work, contact: [email protected]. 1 spencer stuart Contents 3 Foreword -

List of Authorised Fund Management Companies, Managers of Collective Assets and Representatives of Foreign Collective Investment Schemes

List of authorised fund management companies, managers of collective assets and representatives of foreign collective investment schemes Name City Fund management company Representatives Managers of collective assets 1741 Fund Solutions AG St. Gallen X X 1875 Finance SA Genève X 2Xideas AG Küsnacht ZH X 3V Asset Management AG Zürich X Abaris Investment Management AG Bäch SZ X ACE & COMPANY SA Genève X X ACOLIN Fund Services AG Zürich X Acoro Asset Management AG Zürich X Active Niche Funds SA Lausanne X Akara Funds AG Zug X ALATUS CAPITAL SA Genève X Albin Kistler AG Zürich X Allianz Global Investors (Schweiz) AG Zürich X Alpha Associates AG Zürich X Alpinum Investment Management AG Zürich X Alprime Capital AG Zürich X Alpstone Capital (Suisse) SA Genève X Altrafin Advisory AG Zürich X AMG Fondsverwaltung AG Zug X ANREPA Asset Management AG Baar X Apex Asset Management AG Freienbach X Aquamarine Zürich AG Zürich X Aquila Asset Management ZH AG Zürich X ARDIAN Investment Switzerland AG Zürich X Aretas Capital Management AG Zürich X Arete Ethik Invest AG Zürich X Arfina Capital SA Zürich X ARM Swiss Representatives SA Gland X Artico Partners AG Zürich X X Arvernus Capital AG Zürich X ARVEST Funds AG Zürich X AS Investment Management SARL Genève X Asia Green Real Estate AG Zürich X 24.09.2021 / 03:31 1/11 List of authorised fund management companies, managers of collective assets and representatives of foreign collective investment schemes Name City Fund management company Representatives Managers of collective assets Asteria Investment Managers SA Genève X Atlanticomnium SA Genève X AtonRâ Partners SA Genève X AUTONOMY CAPITAL RESEARCH TWO LIMITED, (St. -

Stimmverhalten Der Pensionskasse Der Dätwyler Holding AG, Generalversammlungen 2021

Stimmverhalten der Pensionskasse der Dätwyler Holding AG, Generalversammlungen 2021 Die Pensionskasse der Dätwyler Holding AG hat vom 1.1. bis 31.8.2021 ihre Stimm- und Wahl- rechte an allen Generalversammlungen von Schweizer Gesellschaften wahrgenommen, bei welchen sie direkte Aktien hält. Bei allen Traktanden wurde im Sinne des Verwaltungsrates abgestimmt, ausser bei den nachfol- gend aufgeführten: Unternehmen Traktandum Stimmabgabe Lafarge-Holcim 1.2 Konsultativabstimmung über den Entschädigungs- abgelehnt bericht Lafarge-Holcim 5.1.1 Wiederwahl von Dr. Beat Hess als Mitglied des abgelehnt Verwaltungsrates und Wiederwahl zum Präsidenten des Verwaltungsrates Lafarge-Holcim 5.1.7 Wiederwahl von Adrian Loader als Mitglied des abgelehnt Verwaltungsrates Lafarge-Holcim 5.2.1 Wahl von Jan Jenisch als Mitglied des abgelehnt Verwaltungsrates Lafarge-Holcim 5.3.2 Wiederwahl von Adrian Loader als Mitglied des abgelehnt Nomination, Compensation & Covernance Committee Lafarge-Holcim 6.1 Vergütung des Verwaltungsrates für die nächste abgelehnt Amtszeit LafargeHolcim 6.2 Vergütung der Geschäftsleitung für das Geschäfts- abgelehnt jahr 2022 UBS 2. Konsultativabstimmung über den Vergütungs- abgelehnt bericht 2020 der UBS Group AG UBS 8.1 Genehmigung des maximalen Gesamtbetrages der abgelehnt Vergütung der Mitglieder des Verwaltungsrates für den Zeitraum von der ordentlichen Generalver- sammlung 2021 bis zur ordentlichen Generalver- sammlung 2022 UBS 8.2 Genehmigung des Gesamtbetrags der variablen abgelehnt Vergütung der Mitglieder der Konzernleitung für das Geschäftsjahr 2020 UBS 8.3 Genehmigung des maximalen Gesamtbetrags der abgelehnt fixen Vergütung der Mitglieder der Konzernleitung für das Geschäftsjahr 2022 Credit Suisse 1.1 Konsultativabstimmung über den Vergütungsbe- abgelehnt richt 2020 Credit Suisse 5.1.9 Wiederwahl von Kai S. Nargolwala als Mitglied des abgelehnt Verwaltungsrates Credit Suisse 5.1.11Wiederwahl von Severin Schwan als Mitglied des abgelehnt Verwaltungsrates Credit Suisse 5.2.4 Wiederwahl von Kai S. -

2010 | Investment Management Industry Review

2010 | Investment Management Industry Review accounts. The British and French negotiated similar deals. In September, Switzerland also completed the last double- taxation treaty required to remove its name from the OECD’s list of nations failing to comply with tax-sharing the Right Places information. In Italy, the government raided the local Lookin’ for Dough in All on a tax treaty grew testy. Meanwhile, a tax amnesty led When governments in the U.S. and Europe take Italiansoffices of to Swiss declare banks $115 and billion talks in between assets held the twooutside nations the a moment to consider their future pension country, though estimates for the total amount run six and health care obligations to baby boomers, times as high. Lichtenstein, with 35,000 people and per it doubtless quickens the pulse. In the U.S., capita GDP over $100,000, cut a deal with the U.K. to close the Peterson Foundation, a fiscal watchdog, the accounts of British citizens who do not comply with figures the nation has $56 trillion in unfunded their government’s demand for full disclosure. The small obligations up the road, primarily involving principality has also engaged in similar discussions with Medicare. Among European Union nations, Germany. generous national state pension and health So it was that in 2009 the worst economic crisis since the care benefits face similar funding challenges. Depression continued to play out. It engulfed Europe’s lucrative offshore banking industry, remade banks and In the U.S., states and localities are falling behind on their own promises to boomer public employees, having watched hundreds of billions of dollars in assets disappear in 2008-2009. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Growth Fund, March 31, 2021 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 98.4% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Argentina 0.9% Sartorius Stedim Biotech 30,884 12,710,261 MercadoLibre, Inc.(a) 8,451 12,441,055 Teleperformance SA 30,119 10,981,253 Australia 3.0% Total SE 137,200 6,396,233 Aristocrat Leisure Ltd. 664,347 17,429,567 Total 165,752,414 Cochlear Ltd. 25,500 4,101,802 Germany 4.0% CSL Ltd. 103,017 20,820,136 Adidas AG(a) 20,400 6,372,775 Total 42,351,505 Infineon Technologies AG 592,181 25,195,879 Canada 2.8% Rational AG 15,392 11,956,544 Alimentation Couche-Tard, Inc., Class B 216,700 6,987,096 SAP SE 53,900 6,611,196 (a) Canadian National Railway Co. 275,350 31,954,360 TeamViewer AG 143,772 6,148,594 Total 38,941,456 Total 56,284,988 China 6.2% Hong Kong 4.1% Alibaba Group Holding Ltd.(a) 901,220 25,606,027 AIA Group Ltd. 2,518,000 30,812,188 NetEase, Inc. 909,175 18,695,307 CLP Holdings Ltd. 603,000 5,871,227 TAL Education Group, ADR(a) 267,889 14,425,823 Hang Lung Properties Ltd. 2,855,000 7,452,245 Tencent Holdings Ltd. 349,100 27,860,817 Hong Kong & China Gas Co., Ltd. 2,771,500 4,394,460 Total 86,587,974 Jardine Matheson Holdings Ltd. -

Clarity on Mergers & Acquisition

on • An iti ni d ve E r y s r a a r s y r e E v d i i t n th i o n n A • • 10 A n n o i n t i i v d e E r s y r Clarity on a Mergers & Acquisitions Switzerland holds back amid global M&A boom January 2016 22 Meet the tourism leaders Heads of major Swiss tourism bodies share insights into the current and future states of the industry 26 Activity and outlook by sector A sector-by-sector review of M&A in 2015 and expectations for 2016 68 Swiss deals in 2015 Summary of transactions announced in 2015 involving Swiss buyers, sellers or targets METHODOLOGY This study is based on the University of St. The M&A REVIEW and the M&A DATABASE are Gallen’s M&A DATABASE and KPMG desktop two valuable sources of merger & acquisition research, focusing on deals announced in 2015 information from the Institute of Management at but also providing historical data drawn from the University of St. Gallen. previous editions of the Clarity on Mergers & Acquisitions (formerly M&A Yearbook). The The M&A REVIEW is a professional monthly consideration of individual transactions and their journal founded in 1990 by Prof. Günter Müller- allocation to specific industry segments are Stewens and deals with company takeovers and based on our judgment and are thus subjective. mergers, divestments and strategic alliances in We have not been able to extensively verify all Germany, Austria and Switzerland. The M&A data and cannot be held responsible for the REVIEW has two parts. -

This Is the Message

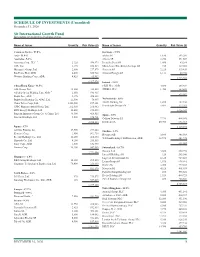

SCHEDULE OF INVESTMENTS (Unaudited) December 31, 2020 Sit International Growth Fund Investments are grouped by geographic region. Name of Issuer Quantity Fair Value ($) Name of Issuer Quantity Fair Value ($) Common Stocks - 97.0% Germany - 5.9% Asia - 31.8% adidas AG * 1,630 593,205 Australia - 5.0% Allianz SE 2,250 551,667 Atlassian Corp., PLC * 2,125 496,974 Deutsche Post AG 1,400 69,268 CSL, Ltd. 1,175 256,523 Muenchener Rueckversicherungs AG 435 129,028 Macquarie Group, Ltd. 2,600 277,579 Siemens AG 2,225 319,439 Rio Tinto, PLC, ADR 4,400 330,968 Siemens Energy AG * 1,112 40,754 Westpac Banking Corp., ADR 4,425 65,932 1,703,361 1,427,976 Ireland - 2.0% China/Hong Kong - 11.5% CRH, PLC, ADR 4,800 204,384 AIA Group, Ltd. 32,200 394,585 STERIS, PLC 1,950 369,603 Alibaba Group Holding, Ltd., ADR * 2,350 546,915 573,987 Baidu, Inc., ADR * 2,175 470,322 Budweiser Brewing Co. APAC, Ltd. 21,500 70,997 Netherlands - 3.6% China Tower Corp., Ltd. 1,342,000 197,341 ASML Holding NV 1,450 707,194 * CSPC Pharmaceutical Group, Ltd. 262,960 268,982 Koninklijke Philips NV 5,866 317,761 ENN Energy Holdings, Ltd. 18,400 270,098 1,024,955 Ping An Insurance Group Co. of China, Ltd. 33,500 410,515 Spain - 3.9% Tencent Holdings, Ltd. 9,000 654,761 Cellnex Telecom SA 7,733 464,038 3,284,516 Iberdrola SA 45,900 656,063 Japan - 9.7% 1,120,101 Astellas Pharma, Inc.