Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Capital Market Development in Bangladesh* January, 2021

Capital Market Development in Bangladesh* January, 2021 Research Department Bangladesh Bank *Prepared by Special Studies and Fiscal Affairs Division, Research Department, Bangladesh Bank (Central Bank of Bangladesh). Comments on any aspect on the report are highly welcomed and can be sent to the e-mail addresses: [email protected], [email protected] and [email protected] Capital Market Development in Bangladesh January, 2021 Capital market in Bangladesh consists of two full-fledged automated stock exchanges- the Dhaka Stock Exchange (DSE) and the Chittagong Stock Exchange (CSE). Bangladesh Securities and Exchange Commission (BSEC), as the watchdog regulates the stock exchanges of the country. The analysis on capital market development gives some insights to understand overall activities of capital market in Bangladesh. At the end of January 2021, both Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) exhibited upward trend in terms of both index and turnover compared to the end of December 2020. Total turnover value of traded shares of DSE and CSE were BDT 339.59 billion and BDT 17.28 billion respectively at the end of January 2021 which were 57.30 percent and 88.18 percent higher respectively than that of December 2020. Broad index of DSE and all share price index of CSE rose to 5649.86 points and 16474.97 points respectively at the end of January 2021 which were 5402.07 points and 15592.92 points respectively at the end of December 2020. Table : Monthly Trends in Important Indicators of DSE and CSE (BDT -

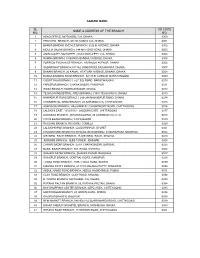

Agrani Bank Sl No. Name & Address of the Branch Ad Code

AGRANI BANK SL AD CODE NAME & ADDRESS OF THE BRANCH NO. NO. 1 HEAD OFFICE, MOTIJHEEL C/A, DHAKA 0000 2 PRINCIPAL BRANCH, 9/D DILKUSHA C/A, DHAKA 0001 3 BANGA BANDHU AVENUE BRANCH, 32 B.B. AVENUE, DHAKA 0002 4 MOULVI BAZAR BRANCH, 144 MITFORD ROAD, DHAKA. 0003 5 AMIN COURT, MOTIJHEEL, 62/63 MOTIJHEEL C/A, DHAKA 0004 6 RAMNA BRANCH, 18 BANGA BANDHU AVENUE, DHAKA 0005 7 FOREIGN EXCHANGE BRANCH, 1/B RAJUK AVENUE, DHAKA 0006 8 SADARGHAT BRANCH,3/7/1&2 JONSON RD,SADARGHAT, DHAKA. 0007 9 BANANI BRANCH, 26 KAMAL ATATURK AVENUE, BANANI, DHAKA. 0008 10 BANGA BANDHU ROAD BRANCH, 32/1 B.B. AVENUE, NARAYANGONJ 0009 11 COURT ROAD BRANCH, 52/1 B.B.ROAD, NARAYANGONJ 0010 12 FARIDPUR BRANCH, CHAWK BAZAR, FARIDPUR 0011 13 WASA BRANCH, KAWRAN BAZAR, DHAKA. 0012 14 TEJGAON INDUSTRIAL AREA BRANCH, 315/A TEJGAON I/A, DHAKA 0013 15 NAWABPUR ROAD BRANCH, 243-244 NAWABPUR ROAD, DHAKA 0014 16 COMMERCIAL AREA BRANCH, 28 AGRABAD C/A, CHITTAGONG 0015 17 ASADGONJ BRANCH, HAJI AMIR ALI CHOWDHURY ROAD, CHITTAGONG 0016 18 LALDIGHI EAST, 1012/1013 - LALDIGHI EAST, CHITTAGONG 0017 19 AGRABAD BRANCH, JAHAN BUILDING, 24 AGRABAD C/A, CTG 0018 20 COX'S BAZAR BRANCH, COX'S BAZAR 0019 21 RAJGANJ BRANCH, RAJGANJ, COMILLA 0020 22 LALDIGHIRPAR BRANCH, LALDIGHIRPAR, SYLHET 0021 23 CHAUMUHANI BRANCH,D.B.ROAD, BEGUMGONJ, CHAUMUHANI, NOAKHALI 0022 24 SIR IQBAL RAOD BRANCH, 25 SIR IQBAL RAOD, KHULNA 0023 25 JESSORE BRANCH, JESS TOWER, JESSORE 0024 26 CHAWK BAZAR BRANCH, 02/01 CHAWK BAZAR, BARISAL 0025 27 BARA BAZAR BRANCH, N.S. -

Morning Briefings Monday, February 15, 2016

Morning Briefings Monday, February 15, 2016 MACRO Cos must go by 36 provisos to operate container ports Private entrepreneurs seeking to obtain customs bond licence for operating private inland water container terminal (IWCT) will have to comply with a multipronged set of guidelines, including one on adequate facilities for external trade. Officials said customs wing of the National Board of Revenue (NBR) recently issued the policy with the comprehensive guidelines with some 36 conditions binding private IWCT ventures. They said the policy was framed under 'The Customs Act 1969, section 12 and section 219 (B)'. Link: http://print.thefinancialexpress-bd.com/2016/02/15/134118 Financial management strategy in the offing A new public financial management strategy is in the final stages of making as attaining fiscal discipline and its transparency now comes into government policy focus. Officials said the strategies in vogue do not fit in government planning and priorities, leading to delay in execution of projects. The one now in the making is expected to help synchronise government planning, execution of budget and modern accounting to avoid abuse of public money. The finance division has already prepared the draft. It also organised a two- day national seminar in Habiganj that ended on February 13. Link: http://print.thefinancialexpress-bd.com/2016/02/15/134116 Spl fund to back mega projects in the offing The government, for the first time, is set to create a special fund to finance its mega projects for their smooth implementation, officials said. The Ministry of Finance (MoF) will sit today (Monday) to discuss the pros and cons of creating the proposed fund. -

Evidence from Dhaka Stock Exchange

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by International Institute for Science, Technology and Education (IISTE): E-Journals Research Journal of Finance and Accounting www.iiste.org ISSN 2222-1697 (Paper) ISSN 2222-2847 (Online) Vol 3, No 2, 2012 Cash Dividend Announcement Effect: Evidence from Dhaka Stock Exchange Md. Shehub Bin Hasan 1* Sabrina Akhter 2 Hussain Ahmed Enamul Huda 2 1. School of Business, Ahsanullah University of Science & Technology, 141-142 Love Road, Tejgaon Industrial Area, Tejgaon, Dhaka-1208, Bangladesh 2. Faculty of Business & Economics, Daffodil International University, 4/2, Sobhanbagh, Prince Plaza, Mirpur Road, Dhaka-1207, Bangladesh * E-mail of the corresponding author: [email protected] Abstract The sole motive of the paper is to investigate cash dividend announcement effect of the stocks traded in the Dhaka Stock Exchange from 2006 to 2010. Classic event study methodology was used to analyze the data. It was found that in 2006, 2007 and 2009 market has reacted over the announcement in the event date. Some sectors like Food & Auxiliary, Fuel and Miscellaneous have impacted the market both in the event and post event date across the years considered. All the efforts were given to discover reaction therefore the underlying reasoning of such impact are set aside. Keywords: Cash dividend, Dhaka stock exchange, Event study, Announcement effect 1. Introduction Securities, to be more specific stocks are not traded in a vacuum, rather amidst the complex interaction of many variables – some explainable and some not manageable. Thousands, perhaps even more variables can exert influence over stock price and dividend isthe prime variable. -

An Analysis of Retail Banking Products of the City Bank Limited

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by BRAC University Institutional Repository An Analysis of Retail Banking Products of The City Bank Limited Internship Report On An Analysis of Retail Banking Products of The City Bank Limited Submitted To: Mr. Jabir Al Mursalin Senior Lecturer BRAC Business School BRAC University Submitted By: Syeda Najifa Wareesa Id: 10104130 Date Of Submission: 10th June 2014 Letter of Transmittal 10th June 2014 Mr. Jabir Al Mursalin Senior Lecturer BRAC Business School BRAC University Subject: Submission of Internship report Dear Sir, I would like to submit my report titled ‘An Analysis of Retail Banking Products of The City Bank Limited prepared as a part of the requirement for BBA program of BRAC Business School. I have successfully completed my internship program in The City Bank Limited and I worked there as an intern for three months. Working on this report was a great learning experience for me as I got to learn the differences between practical and theoretical work. I hope you will find the report to be systematic and reliable. I would like to take this opportunity to thank you for all the support and guidelines that you have provided, which I hope to continue getting in the future. Sincerely yours, Syeda Najifa Wareesa Id: 10104130 BRAC Business School BRAC University Acknowledgements First I want to pay my gratitude to almighty Allah for enabling us to prepare the report successfully. Then I would like to express my sincere gratitude and cordial thanks to some specific persons who helped me to organize this report and for their kind opinion, suggestions, instructions and support and appropriate guidelines for this. -

Capital Market Deregulation, Stock Returns and Volatility In

Market Efficiency, Time-Varying Volatility and Equity Returns in Bangladesh Stock Market M. Kabir Hassan, Ph.D. University of New Orleans Anisul M. Islam, Ph.D. University of Houston-Downtown Syed Abul Basher York University Contact Author M. Kabir Hassan, Ph.D. Associate Professor of Finance Associate Chair Department of Economics and Finance University of New Orleans New Orleans, LA 70148 Phone: 504-280-6163 Fax: 504-280-6397 Email: [email protected] First Draft: December 1999 Second Draft: February, 2000 Third Draft: May, 2000 This Draft: June, 2000 Market Efficiency, Time-Varying Volatility and Equity Returns in Bangladesh Stock Market Abstract This paper empirically examines the issue of market efficiency and time-varying risk return relationship for Bangladesh, an emerging equity market in South Asia. The study utilizes a unique data set of daily stock prices and returns compiled by the authors which was not utilized in any previous study. The Dhaka Stock Exchange (DSE) equity returns show positive skewness, excess kurtosis and deviation from normality. The returns display significant serial correlation, implying stock market inefficiency. The results also show a significant relationship between conditional volatility and the stock returns, but the risk-return parameter is negative and statistically significant. While this result is not consistent with the portfolio theory, it is possible theoretically in emerging markets as investors may not demand higher risk premia if they are better able to bear risk at times of particular volatility (Glosten, Jagannathan and Runkle, 1993). While circuit breaker overall did not have any impact on stock volatility, the imposition of the lock-in period has contributed to the price discovery mechanism by reverting an overall negative risk- return time-varying relationship into a positive one. -

Bangladesh: Gender Equality Diagnostic of Selected Sectors

Bangladesh Gender Equality Diagnostic of Selected Sectors Over the last 2 decades, Bangladesh has made progress in women’s participation in the labor force, gender parity in primary education, and women’s political representation. Areas of concern include the high prevalence of violence against women, obstacles to women’s access to resources and assets, unequal terms of their labor engagement, and impact of their overwhelming responsibility for care work. The Government of Bangladesh has made policy commitments toward gender equality and established an institutional framework to fulfill these. This publication intends to support the government in its attempt to address persisting gender inequalities and gaps through a multisector approach across policies, programs, and projects. It provides insights into gender issues in urban; transport; energy; and skills, vocational, and tertiary education, and gives suggestions for strengthening gender mainstreaming in projects. About the Asian Development Bank ADB’s vision is an Asia and Pacific region free of poverty. Its mission is to help its developing member countries reduce poverty and improve the quality of life of their people. Despite the region’s many successes, it remains home to a large share of the world’s poor. ADB is committed to reducing poverty through inclusive economic growth, environmentally sustainable growth, and regional integration. Based in Manila, ADB is owned by 67 members, including 48 from the region. Its main instruments for helping its developing member countries are -

INTERNATIONAL FINANCE INVESTMENT and COMMERCE BANK LIMITED Audited Financial Statements As at and for the Year Ended 31 December 2019

INTERNATIONAL FINANCE INVESTMENT AND COMMERCE BANK LIMITED Audited Financial Statements as at and for the year ended 31 December 2019 INTERNATIONAL FINANCE INVESTMENT AND COMMERCE BANK LIMITED Consolidated Balance Sheet as at 31 December 2019 Amount in BDT Particulars Note 31 December 2019 31 December 2018 PROPERTY AND ASSETS Cash 18,056,029,773 16,020,741,583 Cash in hand (including foreign currency) 3.a 2,872,338,679 2,899,030,289 Balance with Bangladesh Bank and its agent bank(s) (including foreign currency) 3.b 15,183,691,094 13,121,711,294 Balance with other banks and financial institutions 4.a 5,637,834,204 8,118,980,917 In Bangladesh 4.a(i) 4,014,719,294 6,823,590,588 Outside Bangladesh 4.a(ii) 1,623,114,910 1,295,390,329 Money at call and on short notice 5 910,000,000 3,970,000,000 Investments 47,216,443,756 32,664,400,101 Government securities 6.a 41,369,255,890 27,258,506,647 Other investments 6.b 5,847,187,866 5,405,893,454 Loans and advances 232,523,441,067 210,932,291,735 Loans, cash credit, overdrafts etc. 7.a 221,562,693,268 198,670,768,028 Bills purchased and discounted 8.a 10,960,747,799 12,261,523,707 Fixed assets including premises, furniture and fixtures 9.a 6,430,431,620 5,445,835,394 Other assets 10.a 9,606,537,605 9,003,060,522 Non-banking assets 11 373,474,800 373,474,800 Total assets 320,754,192,825 286,528,785,052 LIABILITIES AND CAPITAL Liabilities Borrowing from other banks, financial institutions and agents 12.a 8,215,860,335 9,969,432,278 Subordinated debt 13 2,800,000,000 3,500,000,000 Deposits and other -

BRANCHES Dhaka Region Opening Sl

BRANCHES Dhaka Region Opening Sl. Branch Address Tel/Fax Email Date Market Complex (1st Floor), Amin Bazar Tel: 900 8998 March 01 Amin Bazar Jame Mosque, 780, [email protected] Branch Begun Bari Union, Fax: 905 5118 15, 2001 Amin Bazar, Savar, Dhaka 73/B, Kemal Ataturk Tel: 986 2942, 988 October 02 Banani Branch Avenue, Banani, 1582 (Dir.), 988 2324-5 [email protected] 07, 1996 Dhaka Fax: 883 3481 88, Shahid Syed Tel: 711 0463, 711 Bangshal Nazrul Islam December 03 Branch 3748, 717 5275 [email protected] Sharani, (1st & 2nd 06, 1995 Fax: 955 8451 flr), Dhaka 1100 House: 23, Block: K, Baridhara Shahid Shuhrawardi Tel: 88320635(Dir.) November 04 [email protected] Branch Avenue, Baridhara, Fax: 883 2068 14, 2006 Dhaka 1229 Nilachal (1st floor), Tel: 839 6420, 839 Plot# 14, Block# B, July 05 Banashree 6421 [email protected] Branch Main Road, 18, 2012 Banashree, Dhaka Fax: 839 6426 Eleven Square, Holding No. #01, Road Banani Road No. #11, Ward No. December 06 Cell: 01714 097763 [email protected] No. 11 Branch #19/5, Banani R/A, 27, 2017 Thana - Banani, District - Dhaka Board Bazar, Tel: 929 3595-6 November 07 Board Bazar Gazipur Gazipur [email protected] Branch 1704 Fax: 929 3595-106 08, 2006 Zone Service Building, Room # Tel: 778 9671 April 08 DEPZ Branch 48-51, DEPZ, [email protected] Ganakbari Savar, Fax: 778 9672 12, 2001 Dhaka 1349 House No. 500, Tel: 911 1537, 912 Road: 07, August 09 Dhanmondi 2278 (Dir.) [email protected] Branch Dhanmondi R/A, 01, 2000 Dhaka 1205 Fax: 812 5481 Ground floor, Plot Tel: 910 3651(Dir.) June 10 Dhanmondi [email protected] Model Branch No. -

Dhaka Bank Limited and Its Subsidiary Consolidated Balance

Dhaka Bank Limited and its Subsidiary Consolidated Balance Sheet As at 31 March 2014 31.03.2014 31.12.2013 Taka Taka PROPERTY AND ASSETS Cash 13,291,336,562 11,900,762,425 Cash in Hand (including foreign currencies) 1,639,689,695 1,609,002,280 Balance with Bangladesh Bank & Sonali Bank (including foreign 11,651,646,867 10,291,760,145 currencies) Balance With Other Banks & Financial Institutions 3,167,753,956 2,692,952,439 In Bangladesh 1,937,169,093 1,927,287,468 Outside Bangladesh 1,230,584,863 765,664,971 Money at Call and Short Notice 718,900,000 338,900,000 Investments 21,488,401,455 20,240,852,234 Government 17,141,287,206 16,009,301,980 Others 4,347,114,249 4,231,550,254 Loans & Advances 101,331,332,253 100,364,424,555 Loans, Cash Credit & Over Draft etc. 99,308,138,204 98,150,571,358 Bills Discounted and Purchased 2,023,194,049 2,213,853,197 Premises and Fixed Assets 2,600,391,551 2,538,497,507 Other Assets 8,112,917,336 7,300,718,533 Non-Banking Assets 23,166,033 23,166,033 Total Assets 150,734,199,146 145,400,273,725 LIABILITIES & CAPITAL Liabilities Borrowings from other banks, financial institutions 5,752,046,372 3,649,917,871 and agents Deposits and Other Accounts 118,588,027,088 115,981,165,413 Current Accounts & Other Accounts 11,200,677,886 10,171,783,633 Bills Payable 1,076,546,533 991,276,689 Savings Bank Deposits 9,258,356,453 8,870,151,906 Term Deposits 97,052,446,216 95,947,953,185 Non Convertible Subordinated Bond 2,000,000,000 2,000,000,000 Other Liabilities 12,183,588,071 11,724,374,595 Total Liabilities 138,523,661,531 -

And Consumer Credit in the United States in the 1960S

Christine Zumello The “Everything Card” and Consumer Credit in the United States in the 1960s First National City Bank (FNCB) of New York launched the Everything Card in the summer of 1967. A latecomer in the fi eld of credit cards, FNCB nonetheless correctly recognized a promising business model for retail banking. FNCB attempted not only to ride the wave of mass consumption but also to cap- italize on the profi t-generating potential of buying on credit. Although the venture soon failed, brought down by the losses that plagued the bank due to fraud, consumer discontent, and legislative action, this fi nal attempt by a major single commer- cial bank to launch its own plan did not signify the end of credit cards. On the contrary, the Everything Card was a har- binger of the era of the universal credit card. irst National City Bank (FNCB) of New York (now Citigroup), one F of the oldest leading commercial banks in the United States, intro- duced the Everything Card in the summer of 1967.1 FNCB was a pioneer in fostering consumer fi nance in the United States. The bank saw an opportunity to increase business by creating an innovative system that would enable masses of consumers to purchase a variety of goods and services on credit. By becoming the principal tool of consumer credit, credit cards revolutionized the banking business. Indeed, “where it couldn’t gain territory with bricks and mortar, Citibank tried to do so 2 with plastic.” The author wishes to express her gratitude to Lois Kauffman of the Citigroup Archives, Citi’s Center for Heritage and Strategy, New York City. -

Flood Risk Management in Dhaka a Case for Eco-Engineering

Public Disclosure Authorized Flood Risk Management in Dhaka A Case for Eco-Engineering Public Disclosure Authorized Approaches and Institutional Reform Public Disclosure Authorized People’s Republic of Bangladesh Public Disclosure Authorized • III contents Acknowledgements VII Acronyms and abbreviations IX Executive Summary X 1 · Introduction 2 Objective 6 Approach 8 Process 9 Organization of the report 9 2 · Understanding Flood Risk in Greater Dhaka 10 disclaimer Demographic changes 13 This volume is a product of the staff of the International Bank for River systems 13 Reconstruction and Development/ The World Bank. The findings, interpretations, and conclusions expressed in this paper do not necessarily Monsoonal rain and intense short-duration rainfall 17 reflect the views of the Executive Directors of The World Bank or the Major flood events and underlying factors 20 governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and Topography, soil, and land use 20 other information shown on any map in this work do not imply any judgment Decline of groundwater levels in Dhaka on the part of The World Bank concerning the legal status of any territory or the 27 endorsement or acceptance of such boundaries. Impact of climate vulnerability on flood hazards in Dhaka 28 copyright statement Flood vulnerability and poverty 29 The material in this publication is copyrighted. Copying and/or transmitting Summary 33 portions or all of this work without permission may be a violation of applicable law. The International Bank for Reconstruction and Development/ The World Bank encourages dissemination of its work and will normally grant permission to 3 · Public Sector Responses to Flood Risk: A Historical Perspective 34 reproduce portions of the work promptly.