Cash-Flow Based Dynamic Inventory Management (Authors’ Names Blinded for Peer Review)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chapter 3 CT 1. A. If Inventory Is Purchased with Cash, Then There Is

Chapter 3 CT 1. a. If inventory is purchased with cash, then there is no change in the current ratio. If inventory is purchased on credit, then there is a decrease in the current ratio if it was initially greater than 1.0. b. Reducing accounts payable with cash increases the current ratio if it was initially greater than 1.0. c. Reducing short-term debt with cash increases the current ratio if it was initially greater than 1.0. d. As long-term debt approaches maturity, the principal repayment and the remaining interest expense become current liabilities. Thus, if debt is paid off with cash, the current ratio increases if it was initially greater than 1.0. If the debt has not yet become a current liability, then paying it off will reduce the current ratio since current liabilities are not affected. e. Reduction of accounts receivables and an increase in cash leaves the current ratio unchanged. f. Inventory sold at cost reduces inventory and raises cash, so the current ratio is unchanged. g. Inventory sold for a profit raises cash in excess of the inventory recorded at cost, so the current ratio increases. 3. A current ratio of 0.50 means that the firm has twice as much in current liabilities as it does in current assets; the firm potentially has poor liquidity. If pressed by its short-term creditors and suppliers for immediate payment, the firm might have a difficult time meeting its obligations. A current ratio of 1.50 means the firm has 50% more current assets than it does current liabilities. -

Cost of Goods Sold

Cost of Goods Sold Inventory •Items purchased for the purpose of being sold to customers. The cost of the items purchased but not yet sold is reported in the resale inventory account or central storeroom inventory account. Inventory is reported as a current asset on the balance sheet. Inventory is a significant asset that needs to be monitored closely. Too much inventory can result in cash flow problems, additional expenses and losses if the items become obsolete. Too little inventory can result in lost sales and lost customers. Inventory is reported on the balance sheet at the amount paid to obtain (purchase) the items, not at its selling price. Cost of Goods Sold • Inventory management Involves regulation of the size of the investment in goods on hand, the types of goods carried in stock, and turnover rates. The investment in inventory should be kept at a minimum consistent with maintenance of adequate stocks of proper quality to meet sales demand. Increases or decreases in the inventory investment must be tested against the effect on profits and working capital. Standard levels of inventory should be established as adequate for a given volume of business, and stock control procedures applied so as to limit purchase as required. Such controls should not preclude volume purchase of nonperishable items when price advantages may be obtained under unusual circumstances. The rate of inventory turnover is a valuable test of merchandising efficiency and should be computed monthly Cost of Goods Sold • Inventory management All inventories are valued at cost which is defined as invoice price plus freight charges less discounts. -

SWOSU Business Affairs Capital Asset Inventory Review

SWOSU Business Affairs Capital Asset Inventory Review Scope and Objectives The scope of the inventory review includes all equipment purchased, owned, leased, or on loan to the university; regardless of the location of the equipment. The object is to maintain accurate records regarding cost, location, and disposition of the inventory. The objects are to: Assure all capital assets are properly located. Assure all capital assets are recorded with correct descriptions and dates acquired. Assure all capital assets are recorded at the correct amount or invoice cost. Assure that additions, deletions, and changes to capital asset inventories are recorded accurately and timely. Risk Assessment Inaccurate records regarding capital asset equipment can lead to loss and misuse of state equipment. Equipment Inventory Policy The policy is posted on the SWOSU website under Equipment Inventory Policy and is Attachment A to this document. Procedures In an effort to maintain accurate capital asset control, the following procedures will be administered by the Business Affairs staff. The Purchasing Coordinator/Inventory Control Clerk (ICC) will spend approximately 24 hours per month physically documenting the inventory in each building or department in this order: a) Comptroller will send an email to department head and administrative assistant to set up a date and time for the review. b) ICC will be furnished a list of capital assets for the department or building and a list of inventory assets for all grants. c) ICC will work with Administrative Assistants or others to locate the equipment. All notes on the equipment list will be initialed by the ICC and Administrative Assistant (Ref Attachment B). -

Using Throughput Accounting for Cost Management and Performance Assessment: Constraint Theory Approach

TEM Journal. Volume 9, Issue 2, Pages 763‐769, ISSN 2217‐8309, DOI: 10.18421/TEM92-45, May 2020. Using Throughput Accounting for Cost Management and Performance Assessment: Constraint Theory Approach Hatem Karim Kadhim, Karar Jasim Najm, Hayder Neamah Kadhim Department of Accounting, Faculty of Administration and Economics, University of Kufa, Najaf, Iraq Abstract – The paper aims to use throughput This approach provides management cost accounting as an approach for developing cost information in line with the current manufacturing accounting systems in the modern manufacturing environment and limited resources to improve the environment to evaluate the organization performance. operational performance of origination. It reduces The sample consists of (60) persons in organization for throughput time, operating costs and inventory. The examining the hypotheses. The findings show that information provided by throughput accounting helps beginning of the transition period is in the mid- in measuring costs and evaluate the efficiency and seventies from the last century in the area of finance effectiveness of performance in the organization. This and administrative science inside Goldratt's writings. approach supports planning and control processes to In the early 1990s, Throughput Accounting emerged maximize throughput and reduce inventory levels. The as a result of the development of the Theory of use of Throughput Accounting under the Theory of Constraint. Management needs knowledge in the Constraints leads to finding solutions to bottlenecks modern manufacturing environment. Throughput that affect the efficiency and effectiveness of Accounting is one of the modern approaches to cost performance. measurement and performance assessment. This Keywords – Throughput Accounting, Theory of approach provides a comprehensive vision of the Constraints, origination’s performance. -

Publication 538, Accounting Periods and Methods

Userid: CPM Schema: tipx Leadpct: 100% Pt. size: 10 Draft Ok to Print AH XSL/XML Fileid: … ons/P538/201901/A/XML/Cycle04/source (Init. & Date) _______ Page 1 of 21 15:46 - 28-Feb-2019 The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. Department of the Treasury Contents Internal Revenue Service Future Developments ....................... 1 Publication 538 Introduction .............................. 1 (Rev. January 2019) Photographs of Missing Children .............. 2 Cat. No. 15068G Accounting Periods ........................ 2 Calendar Year .......................... 2 Fiscal Year ............................. 3 Accounting Short Tax Year .......................... 3 Improper Tax Year ....................... 4 Periods and Change in Tax Year ...................... 4 Individuals ............................. 4 Partnerships, S Corporations, and Personal Methods Service Corporations (PSCs) .............. 5 Corporations (Other Than S Corporations and PSCs) .............................. 7 Accounting Methods ....................... 8 Cash Method ........................... 8 Accrual Method ........................ 10 Inventories ............................ 13 Change in Accounting Method .............. 18 How To Get Tax Help ...................... 19 Future Developments For the latest information about developments related to Pub. 538, such as legislation enacted after it was published, go to IRS.gov/Pub538. What’s New Small business taxpayers. Effective for tax years beginning -

Costs Associated with Inventory Three Groups of Costs Are Associated with Inventory

ggar24903_app9a_001-015.inddar24903_app9a_001-015.indd PagePage 1 18/08/1418/08/14 2:092:09 PMPM user1user1 //207/MHR00249/gar24903_disk1of1/1259024903/gar24903_pagefiles207/MHR00249/gar24903_disk1of1/1259024903/gar24903_pagefiles APPENDIXA INVENTORYDECISIONS Inventory planning and control decisions are an important aspect of the manage- ment of many organizations and, as discussed in Chapter 9, play an integral role in LEARNINGOBJECTIVE 6 preparing the master budget. Inventory levels are not left to chance but rather are Compute the optimal carefully planned. The major issues that must be addressed are as follows: How does inventory level and order size. the manager know what inventory level is appropriate for the firm? Will the appro- priate level vary from organization to organization? Specifically, inventory decisions involve how much to order—the economic order quantity —when to order, the amount of safety (backup) stock to keep on hand, and special considerations associated with perishable products. Cost factors, uncer- tainty, and revenues all contribute to the decision analysis. The purpose of this appendix is to examine the inventory control methods available to the manager to manage inventory levels, and the costs related to these decisions. These methods are relevant both in preparing the master budget and in managing inventory levels throughout the year. Costs Associated with Inventory Three groups of costs are associated with inventory. The first group, inventory Inventory ordering costs ordering costs , consists of costs associated with the acquisition of inventory. Costs associated with the Examples are acquisition of inventory, such as clerical costs and transportation 1. Clerical costs. costs. 2. Transportation costs. The second group, inventory carrying costs , consists of costs that arise from Inventory carrying costs having inventory on hand. -

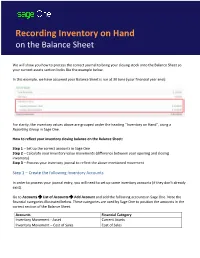

Recording Inventory on Hand

Recording Inventory on Hand on the Balance Sheet We will show you how to process the correct journal to bring your closing stock onto the Balance Sheet so your current assets section looks like the example below. In this example, we have assumed your Balance Sheet is run at 30 June (your financial year end): For clarity, the inventory values above are grouped under the heading “Inventory on Hand”, using a Reporting Group in Sage One. How to reflect your inventory closing balance on the Balance Sheet: Step 1 – Set up the correct accounts in Sage One Step 2 – Calculate your inventory value movements (difference between your opening and closing inventory) Step 3 – Process your inventory journal to reflect the above mentioned movement Step 1 – Create the following Inventory Accounts In order to process your journal entry, you will need to set up some inventory accounts (if they don’t already exist). Go to Accounts List of Accounts Add Account and add the following accounts in Sage One. Note the financial categories illustrated below. These categories are used by Sage One to position the amounts in the correct section of the Balance Sheet. Accounts Financial Category Inventory Movement - Asset Current Assets Inventory Movement – Cost of Sales Cost of Sales Step 2 – Calculate the Inventory Value Assume you began using Sage One at the beginning of the current year. You would have created your inventory items with their related opening balances – both quantity and value. Sage One automatically puts this balance in a System Account called Inventory Opening Balance on the Balance Sheet. -

PROCEDURE: 3.3.9P.L1 WGTC Asset and Inventory Management Adopted

PROCEDURE: 3.3.9p.L1 WGTC Asset and Inventory Management Adopted: April 8, 2020 Purpose Wiregrass Georgia Technical College (WGTC) utilizes the following procedure to manage the acquisition entry, reconciliation, verification, and disposal of assets. Accounting and Reconciliation Procedures Before an asset enters the pre-interface of the Asset Management module of PeopleSoft, the following must occur: • When processing the Purchase Order, the Purchasing Director determines if an item is an asset, flags it, and assigns a profile ID. • The Director of Accounting assigns the correct coding in PeopleSoft. • Once the asset of $1000 or more is physically received, the invoice is verified to have all supporting documentation by the Accounting Coordinator • The Accounting Coordinator sends the invoice to the Accounting Technician to receive the Purchase order in the PeopleSoft module. After the Purchase order has been verified and received in the PeopleSoft Purchasing module, a payment voucher is entered by the Accounting Technician. Once that voucher is paid, the invoice enters the pre-interface of the Asset Management PeopleSoft module. Asset Management Pre-interface/Interface The Accounting Coordinator manages the tasks related to the pre-interface. • The pre-interface is reviewed weekly to determine if the information has been recorded correctly in PeopleSoft. • A decision must be made to determine if an item flagged in Purchasing should be “errored” due to either not being an asset item or needing corrections that cannot be made in the pre- interface. If it must be errored out, this item may need to be “Express Added” to the PeopleSoft Asset Management module or it may simply have been a mistake and is not an asset. -

Interpretive Guidance on Inventory (March 2018)

Life Sciences Accounting and Financial Reporting Update — Interpretive Guidance on Inventory March 2018 Inventory On the Horizon Background In January 2017, the FASB issued a proposed ASU that would modify or eliminate certain disclosure requirements related to inventory as well as establish new requirements. Comments on the proposed ASU were due by March 13, 2017. The proposal is part of the FASB’s disclosure framework project, which, as explained on the Board’s related Project Update Web page, is intended to help reporting entities improve the effectiveness of financial statement disclosures “by clearly communicating the information that is most important to users of each entity’s financial statements.” In March 2014, the FASB issued a proposed Concepts Statement on its conceptual framework for financial reporting. The Board later decided to test the guidance in that proposal by considering the effectiveness of financial statement disclosures related to inventory, income taxes, fair value measurements, and defined benefit pension and other postretirement plans. The proposed ASU is the result of the application of the guidance in the proposed Concepts Statement to inventory. For more information about the proposed ASU, see Deloitte’s January 12, 2017, Heads Up. Connecting the Dots Also as part of its disclosure framework project, the FASB proposed guidance in July 2016, January 2016, and December 2015 that would amend disclosure requirements related to income taxes, defined benefit pension and other postretirement plans, and fair value measurement. See Deloitte’s July 29, 2016; January 28, 2016; and December 8, 2015, Heads Up newsletters for more information. Objective of Inventory Disclosures The proposed ASU notes that the objective of the inventory disclosures in ASC 330 is to give financial statement users information that would help them assess how future cash flows may be affected by: • Different types of inventory. -

A Roadmap to the Preparation of the Statement of Cash Flows

A Roadmap to the Preparation of the Statement of Cash Flows May 2020 The FASB Accounting Standards Codification® material is copyrighted by the Financial Accounting Foundation, 401 Merritt 7, PO Box 5116, Norwalk, CT 06856-5116, and is reproduced with permission. This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication. The services described herein are illustrative in nature and are intended to demonstrate our experience and capabilities in these areas; however, due to independence restrictions that may apply to audit clients (including affiliates) of Deloitte & Touche LLP, we may be unable to provide certain services based on individual facts and circumstances. As used in this document, “Deloitte” means Deloitte & Touche LLP, Deloitte Consulting LLP, Deloitte Tax LLP, and Deloitte Financial Advisory Services LLP, which are separate subsidiaries of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of our legal structure. Copyright © 2020 Deloitte Development LLC. All rights reserved. Publications in Deloitte’s Roadmap Series Business Combinations Business Combinations — SEC Reporting Considerations Carve-Out Transactions Comparing IFRS Standards and U.S. -

Behavioural Analysis of Inventory Turnover

INTERNATIONAL JOURNAL OF SCIENTIFIC & TECHNOLOGY RESEARCH VOLUME 9, ISSUE 03, MARCH 2020 ISSN 2277-8616 Behavioural Analysis Of Inventory Turnover Dr. P. Vidhyapriya, Dr. M. Mohanasundari, Dr. P. Sundharesalingam, Ms. R. Mughil Abstract: The study involves the econometric analysis of the inventory behavior by investing the inventory turnover. The investigation lies on the sample set of 302 top notching blue chip manufacturing firms in India for the period 2011- 2018. The analysis starts with the basic estimation of the inventory proportion in the total and current assets. Followed by the panel data analysis of the inventory turnover ratio through the explanatory variables of the inventory like gross margin, capital intensity and sales. Finally, the variance decomposition is carried out to find the dominating determinant of the inventory returns. The log linear models are used for the estimation and the results shows that the inventory turnover is inversely correlated with the gross margin and positively correlated with the capital intensity and sales surprise.The variance decomposition involves segregating and finding the proportion of variation in the inventory turnover due to the industry specific effect, firm specific effect and year to year effect. Also, the reaction of the inventory turnover due to changes in the investment intensity and sales growth rate was also observed. Finally, by decomposing the variance as per the components defined, the highest variability in inventory is accounted by the firm specific effect. The model is applicable for the various different analysis to find the determinants and track the behavior. Index Terms: Inventory turnover ratio, gross margin, sales growth, capital intensity, correlation, fixed effect and variance decomposition, —————————— —————————— 1 INTRODUCTION before the stage of finished goods which enables the smooth helps in fulfilling some sales orders, even if the supply of raw- run of the production process run.In most of manufacturing materials have stopped. -

Managing Inventory in the Supply Chain

Chapter 9 Managing Inventory in the Supply Chain Inventory is an asset on the balance sheet and inventory cost is an expense on the income statement. Inventories impacts return on asset (ROA) Inventory is important to sales and customer service Inventory is also important to sourcing and production Inventory in US Economy Rationale for Holding Inventory Batching Economies Procurement Production Transportation Uncertainty/Safety Stocks All organizations are faced with uncertainty. On the demand side, there is uncertainty in the quantity and timing of customer orders On the supply side, there is uncertainty about getting what is needed from suppliers and order fulfillment time Rationale for Holding Inventory In-Transit and Work-in-Process (WIP) Stocks Time required for transportation means that even while goods are moving, an inventory cost is incurred. The longer the transit time, the higher the inventory cost. WIP stock inventory cost can be significant while they sits in a manufacturing facility. Rationale for Holding Inventory Seasonal Stocks Seasonality can occur in the supply of raw materials, in the demand for finished product, or in both. Those faced with seasonality issues are constantly challenged when determining how much inventory to accumulate. Seasonality can impact transportation. Anticipatory Stocks A fifth reason to hold inventory arises when an organization anticipates that an unusual event might occur that will negatively impact its source of supply. The Importance of Inventory in Other Functional Areas Inventory is more prominent in the interface of logistics with other functional areas Finance (both balance sheet & income statement) Marketing (sales growth, customer service, market share) Manufacturing (production runs, seasonality) Inventory Costs Inventory Carrying Costs Cost of capital tied up in inventory lost of opportunity from investing that capital elsewhere hurdle rate weighted average cost of capital (WACC).