VA17.5.395 – Julia Hession

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Introduction

INTRODUCTION 1.1 Under the Local Government (Planning and Development) Acts, each Planning Authority is obliged to prepare a Development Plan for its functional area and review this Development Plan every five years. The Development Plan is the core document of the planning and development process. It presents Sligo County Council’s short to medium term view of the future development of the county and underpins the Council’s overall objectives of promoting and facilitating development, conserving the environment and achieving optimum use of resources. The Development Plan provides a framework for the physical development of the county and allows for sustainable, co-ordinated and orderly growth which respects the county’s natural, built and heritage resources. This County Development Plan reviews and updates the previous County Development Plan adopted by Sligo County Council in 1985. It takes account of the major developments that have occurred since 1985 in terms of population and economic trends, physical infrastructure, growth patterns and social deprivation. It recognises and sets out physical development objectives aimed at redressing the enduring problems of rural depopulation and disadvantage, dereliction, sporadic housing in scenic areas and service deficiencies. Every effort has been made to incorporate significant changes in legislation, Departmental guidelines, European Union directives and socio-economic factors impacting upon the development process; the intention is to present a concise, document which guides and informs the achievement of sustainable development1. Sligo County Council will have regard to the aims of Local Agenda 21 in the formulation and implementation of policies contained within the Development Plan2. Sligo County Council is committed to assisting the community in promoting environmental education, supporting local development group projects, providing local environmental information and engaging in public consultation procedures and partnerships. -

0328 Sligo PPN Community and Voluntary College

Submission to: Ireland 2040, The National Planning Framework Submitted by: Community and Voluntary College, Sligo Public Participation Network Date: 28th March 2017 The Community and Voluntary College of the Sligo Public Participation Network (PPN) consists of 303 Community and Voluntary Organisations, representing the needs of hundreds of residents, working to improve the quality of life for people in Sligo. We welcome this opportunity to feed into the Ireland 2040 Plan. It is our vision that by 2040 Sligo will be an enterprising, inclusive, resilient and environmentally sustainable place, which values and celebrates its unique landscape and rich culture and heritage and where the wellbeing of future generations is central to everything we do (Local Community and Economic Plan 2016) To achieve this vision, Sligo is ready to grow, and should be determined as a specific area of investment as part of the 2040 National Spatial Strategy. 1 Sligo Sligo has a population of approximately 65,000 people, as the gateway to the North West it is situated at a strategically important point. It is 2.5 hours from Dublin and 2 hours from both Galway and Derry. Rich in cultural, natural heritage and coastal amenities, home to two third level colleges, a regional hospital, 22 major multi-national employers and a growing tourism industry – Sligo already has the foundations laid for future growth. Like all areas, some people in Sligo have to deal with poverty, disadvantage and social exclusion – these experiences can be linked to unemployment, disability, ethnicity and caring responsibilities amongst other factors. A more inclusive future for Ireland will consider how growth can promote greater equality between all the diverse people who make up our community. -

Strategic Flood Risk Assessment (SFRA)

Draft Sligo County Development Plan 2017-2023 for public consultation – September 2016 Strategic Flood Risk Assessment (SFRA) Strategic Flood Risk Assessment (SFRA) of the Draft Sligo County Development Plan 2017-2023 This document contains the Strategic Flood Risk Assessment (SFRA) for the Draft Sligo County Development Plan 2017-2023 (hereafter referred to as “the Plan”). The purpose of this SFRA is to support the Strategic Environmental Assessment of the Draft Plan and inform the policies and objectives of the Plan. Its content and format are derived from the guidance provided in The Planning System and Flood Risk Management - Guidelines for Planning Authorities, (DEHLG) November 2009. A two-stage assessment of flood risk was undertaken, as recommended in the above-mentioned Guideline. The first stage involves the identification of flood risk and is based on a variety of data sources, which are detailed in Section 3 of this report. This stage identifies the towns and villages in the County which are susceptible to flooding and for which a Stage 2 SFRA is required. The second stage deals in more detail with the villages where a flood risk has been identified and appraises the adequacy of existing information in order to prepare indicative flood zone maps. This stage also highlights potential development areas that require more detailed assessment on a site- specific level. The flood risk in the towns of Ballymote, Enniscrone, Tobercurry and Sligo town will be addressed in detail in separate strategic flood risk assessments as part of preparing or reviewing the respective Local Area Plans. 1.1 Flooding context Flooding is an environmental phenomenon which, as well as causing economic and social impacts, could, in certain circumstances, pose a risk to human health or even life, as well as to homes and infrastructure. -

Sligo County Council

DATE : 06/01/2017 Sligo County Council TIME : 10:00:13 PAGE : 1 P L A N N I N G A P P L I C A T I O N S PLANNING APPLICATIONS RECEIVED FROM 20/12/16 TO 01/01/17 under section 34 of the Act the applications for permission may be granted permission, subject to or without conditions, or refused; The use of the personal details of planning applicants, including for marketing purposes, maybe unlawful under the Data Protection Acts 1988 - 2003 and may result in action by the Data Protection Commissioner, against the sender, including prosecution FILE APP. DATE DEVELOPMENT DESCRIPTION AND LOCATION EIS PROT. IPC WASTE NUMBER APPLICANTS NAME TYPE RECEIVED RECD. STRU LIC. LIC. 12/141 David Collery E 22/12/2016 construction of a dwelling house, garage, proprietary effluent treatment (PET) system and percolation area Kiltycahill Calry Co Sligo 16/499 6th Irish Forestry Fund PLC P 21/12/2016 for development consisting of the construction of a new forestry access entrance to an existing mature forestry and all ancillary works Knockadoo Coolaney Co. Sligo 16/500 Michael Hargadan P 21/12/2016 for development consisting of the erection of a sun room extension to the rear (west) elevation of the existing dwelling house, together with all associated site works 27 Carrowhubbock Holiday Village Carrowhubbuck South Enniscrone Co. Sligo DATE : 06/01/2017 Sligo County Council TIME : 10:00:13 PAGE : 2 P L A N N I N G A P P L I C A T I O N S PLANNING APPLICATIONS RECEIVED FROM 20/12/16 TO 01/01/17 under section 34 of the Act the applications for permission may be granted permission, subject to or without conditions, or refused; The use of the personal details of planning applicants, including for marketing purposes, maybe unlawful under the Data Protection Acts 1988 - 2003 and may result in action by the Data Protection Commissioner, against the sender, including prosecution FILE APP. -

15 – Cloonacool Mini-Plan

County Development Plan 2017-2023 Consolidated Draft + Adopted Amendments – August 2017 Volume 2, Chapter 15 – Cloonacool Mini-Plan 15. Cloonacool Mini-Plan Village profile Cloonacool is located approximately 6 km to the north-west of Tobercurry, in a designated Rural Area in Need of Regeneration, on lands classified as normal rural landscape. It is identified as a village sustaining the rural community in the County settlement hierarchy (see Section 3.2 of this Plan). The village is situated between the River Moy and the foothills of the Ox Mountains. The Mad River runs to the east of Cloonacool and joins the River Moy to the south of the village. The rivers and the mountainous backdrop contribute significantly to the character and amenity of the village setting. Population and housing There are no specific population statistics available for the village itself. According to 2011 Census information, the Cloonacool/Loughill Electoral District had a population of 352 persons in 2011 (8.3% higher than the 2006 population of 325). A survey carried out by Council planners in 2015 counted 44 occupied houses (equivalent to c. 114 persons) within the development limit. Census 2016 recorded 352 persons in the Cloonacool/Loughill ED and 284 persons in the statistical Small Area which contains Cloonacool (extending outside the mini-plan limits). Before the 2000s, residential development in the area consisted mostly of one-off houses along the approach roads, creating a dispersed settlement pattern. More recently, several housing schemes were built by the Sligo County Council and by private developers. (Cloonacool was not included within the Rural Renewal Tax Incentive Scheme area). -

An Tordú Logainmneacha (Lárionaid Daonra Agus Dúichí) 2005 2

An tOrdú Logainmneacha (Lárionaid Daonra agus Dúichí) 2005 2 Ordaímse, ÉAMON Ó CUÍV, TD, Aire Gnóthaí Pobail, Tuaithe agus Gaeltachta, i bhfeidhmiú na gcumhachtaí a tugtar dom le halt 32(1) de Achta na dTeangacha Oifigiúla 2003 (Uimh. 32 de 2003), agus tar éis dom comhairle a fháil ón gCoimisiún Logainmneacha agus an chomhairle sin a bhreithniú, mar seo a leanas: 1. (a) Féadfar An tOrdú Logainmneacha (Lárionaid Daonra agus Dúichí) 2005 a ghairm den Ordú seo. (b) Tagann an tOrdú seo i ngníomh ar 28 Márta 2005. 2. Dearbhaítear gurb é logainm a shonraítear ag aon uimhir tagartha i gcolún (2) den Sceideal a ghabhann leis an Ordú seo an leagan Gaeilge den logainm a shonraítear i mBéarla i gcolún (1) den Sceideal a ghabhann leis an Ordú seo os comhair an uimhir tagartha sin. 3. Tá an téacs i mBéarla den Ordú seo (seachas an Sceideal leis) leagtha amach sa Tábla a ghabhann leis an Ordú seo. 3 TABLE I, ÉAMON Ó CUÍV, TD, Minister for Community, Rural and Gaeltacht Affairs, in exercise of the powers conferred on me by section 32(1) of the Official Languages Act 2003 (No. 32 of 2003), and having received and considered advice from An Coimisiún Logainmneacha, make the following order: 1. (a) This Order may be cited as the Placenames (Centres of Population and Districts) Order 2005. (b) This Order comes into operation on 28 March 2005. 2. A placename specified in column (2) of the Schedule to this Order at any reference number is declared to be the Irish language version of the placename specified in column (1) of the Schedule to this Order opposite that reference number in the English language. -

List of Groups Registered with Sligo Ppn (325)

LIST OF GROUPS REGISTERED WITH SLIGO PPN (325) Contact Phone Person nominated to attend PPN Name Of Community Group Address Contact Email Address Number Meetings 11th Sligo Benbulben Scout Group Drumcliffe Co. Sligo 086 2079427 [email protected] Gillian Watters 12th Sligo Ballintrillick Ballintrillick Ballintrillick 087 2412498 [email protected] Freda McGowan 13 Sligo Ballisodare Scouts Corhownagh Ballisodare 071 9167553 [email protected] Tbc 2nd, 3rd & 10th Sligo Scout Group 8 Knocknarea Villas Ballydoogan Road 087 2067474 [email protected] Tbc 4th Sligo (Calry) Scout Group Faughts Lane Calry 085 7312862 [email protected] Mairead Bartley Abbeyquarter Men's Group 1a Cranmore Road Cranmore 087 2441745 [email protected] Joe McDonagh /Gary Kelly Aclare Development Council Lislea Aclare 086 8263974 [email protected] Fintan Kennedy Aclare Tidy Towns Aclare Co. Sligo 087 9671339 [email protected] Maeve Fallon Acquired Brain Injury Ireland Contact Details Not Available Steve Orme Ahamlish Burial Ground Committee Cliffoney Co. Sligo 087 4161757 [email protected] Frank Kielty Area 4 Art Studios Lower Quay Street Sligo 071 9142552 [email protected] Leslie Ryan Arrow Community Enterprise Ltd Ballinafad N/A 086 8440541 [email protected] Michael Keville Arrow Harps Fc Riverstown Co Sligo 0863966779 [email protected] John Devaney Ashbury Lawn / Mulberry Park Residents Contact Details Not Available Kathleen Clancy Assoc Aughanagh Parish Council Limited C/O Sean Scott, Ballaghboy, Ballinafad 0863899696 [email protected] Seán Scott Aylesbury Park Residents Association 35 Whitestrand, Aylesbury Park Sligo 0868505665 [email protected] Ita Lyster Ballinacarrow Community Group Contact Details Not Available Joan Mullen Ballinafad Active Retirement Ballinafad, Co. -

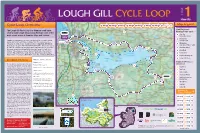

Lough Gill Cycle Loop

LOUGH GILL CYCLE LOOP STAGE 1 Sligo City Map Legend Cycle Loop Overview 1 6.5km 2 4.0km 3 8.5km 4 9.9km 5 2.3km 6 2.5km 7 3.6km8 2.7km 1 Start/Finish and The Lough Gill Cycle Loop is a 40km on-road cycle B Viewing/Picnic Spots route around Lough Gill, passing through some of the Sligo City 1 Sligo City most scenic areas of Counties Sligo and Leitrim. START & Train & Bus Station FINISH 2 Viewing Area A number of viewing/picnic spots are located along the route which include at Colga Lough lay-bys and Coillte Forest Walks and Nature Trails. The route passes close YOU ARE HERE 1 to Hazelwood, on the shores of Lough Gill, which is immortalised by William 3 Viewing Area 2 Sligo side of Parke’s Castle Butler Yeats in his poem ‘The Song of Wandering Aengus’. Close to the route is the Lake Isle of Innisfree Viewing Area, which looks out at the Isle of Innisfree, 4 Dromahair Village the retreat wished for in William Butler Yeats Yeats’ poem ‘The Lake Isle of 8 3 C 5 Slish Wood Innisfree’. The route passes close to the Court Tomb Trail at Deer Park, the restored 17th century Parkes Castle, the ruins of the Franciscan Creevelea 6 Dooney Rock Friary, Coillte’s forest trails at Union Wood, Cairns Hill and Tobernalt Holy Well. A 7 Holy Well Road Lay-By H 8 Cleveragh Pontoon Description of the Loop Start: Train / Bus Station, Sligo City Distance: 40 km Suggested Places The route, which is signposted at all junctions and 7 of Interest marked every kilometre, begins at the Train & Bus Estimated Time: 3-4 Hours G E Station in Sligo City and loops around Lough Gill in A Hazelwood a clockwise direction. -

The Corran Herald Issue 47, 2014

COMPILED AND PUBLISHED BY BALLYMOTE HERITAGE GROUP CELEBRATING 30 YEARS 1984-2014 ISSUE NO.47 2014/2015 PRICE €8.00 The Corran Herald Annual Publication of Ballymote Heritage Group Compiled and Published by Ballymote Heritage Group Editor: Stephen Flanagan Design, Typesetting and Printing: Orbicon Print, Collooney Cover Design and Artwork: Brenda Friel Issue No 47 2014/2015 ––––––––––––––– The Corran Herald wishes to sincerely thank all those who have written articles or contributed photographs or other material for this issue Ballymote 25th Annual Heritage Weekend Thursday 31st July The Teagasc Centre, to (Right over railway bridge on Tubbercurry Road) Monday 4th August 2014 Ballymote, Co. Sligo Organised by Ballymote Heritage Group - Celebrating 30 Years (1984 - 2014) Thursday 31st Sunday 3rd Classic Film at 3 pm. Afternoon Tea at Temple The Art Deco Theatre & Cinema House with Classical & The Sound Of Music Baroque Music 7:30pm Tickets €12.50 Admission, Adults €6,Children €3, (Accompanied children free) Tickets from Tighe’s Shop, Ballymote must be purchased in advance from Tighe’s Shop, st Ballymote. Remaining tickets Friday 1 available on opening night 8.30pm. Official Opening 8.30 pm. Lecture: Sligo’s Hidden Mary Kenny, Author & Journalist Bridges Gary Salter, Conservation Lecture: Poets and Priests of Ireland Engineer Senior inWorld War 1 Executive Engineer, Mary Kenny, Author & Journalist Sligo County Council Saturday 2nd Monday 4th 9 am. Outing: Derek Hill 9 am. Outing: Westport House & House and Glebe Gallery, guided walking tour of Churchill, Co.Donegal, historic town and Raphoe Heritage Town 8.30 pm. Lecture: Family Names in Guide: Martin Timoney, BA FRSAI the Place-names of Sligo MIAI Research Archaeologist & Author Dr. -

This Is Ireland: Mayo, Sligo, Leitrim and Roscommon” by Richard Hayward, Published by Arthur Baker Ltd., London 1955

Cover drawing of Coolaney Bridge by Raymond Piper, published in “This is Ireland: Mayo, Sligo, Leitrim and Roscommon” by Richard Hayward, published by Arthur Baker Ltd., London 1955. To: Winifred, Fiona, Oisín, Sinéad and Aisling. First printed 1985. This electronic edition 2005 Copyright Michael Farry 1985 & 2005 The Voice. The wind blows out of the gates of the day, The wind blows over the lonely of heart, And the lonely of heart is withered away. While the faeries dance in a place apart, Shaking their milk-white feet in a ring, Tossing their milk-white arms in the air; For they hear the wind laugh and murmur and sing Of a land where even the old are fair, And even the wise are merry of tongue; But I heard a reed of Coolaney say, 'When the wind has laughed and murmured and sung The lonely of heart is withered away!' from "The Land of Heart's Desire" (1894) by W.B.Yeats "The Collected Plays of W.B.Yeats" - London Macmillan, 1966 More Recent Books by Michael Farry: A Chronicle of Conflict; Sligo 1914-1921. (Trim, 1992) (Out of print, an electronic version will be available later this year.) The Aftermath of Revolution: Sligo 1921-23. (UCD Press, Dublin, 2000) ACKNOWLEDGEMENTS I wish to express my gratitude to the following who provided valuable advice and assistance in the compilation and writing of this book: Tadhg O'Ceallaigh, lecturer St. Patrick's Training College, under whose guidance the work was begun. The late John J. McDonagh, Carrowclooneen, who shared his vast store of local wisdom and knowledge with me over ten years. -

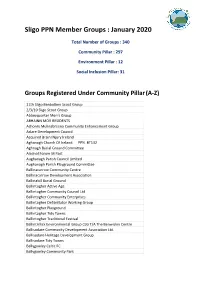

Sligo PPN Member Groups : January 2020

Sligo PPN Member Groups : January 2020 Total Number of Groups : 340 Community Pillar : 297 Environment Pillar : 12 Social Inclusion Pillar: 31 Groups Registered Under Community Pillar (A-Z) 11th Sligo Benbulben Scout Group 2/3/10 Sligo Scout Group Abbeyquarter Men’s Group ABHAINN MÓR RESIDENTS Achonry Mulinabreena Community Enhancement Group Aclare Development Council Acquired Brain INjury Ireland Aghanagh Church Of Ireland. PPN. BT132 Aghnagh Burial Ground Committee Alcohol Forum M Pact Aughanagh Parish Council Limited Aughanagh Parish Playground Committee Ballinacarrow Community Centre Ballinacarrow Development Association Ballinakill Burial Ground Ballintogher Active Age Ballintogher Community Council Ltd Ballintogher Community Enterprises Ballintogher Defibrillator Working Group Ballintogher Playground Ballintogher Tidy Towns Ballintogher Traditional Festival Ballintrillick Environmental Group CLG T/A The Benwiskin Centre Ballisodare Community Development Association Ltd. Ballisodare Heritage Development Group Ballisodare Tidy Towns Ballygawley Celtic FC Ballygawley Community Park Ballymote Celtic FC Ballymote Community Enterprise Ltd Ballymote Community Games Ballymote Community Parks Sports Ballymote defibrillator group Ballymote Family Resource Centre Ballymote Tidy Towns and Tourism Limited Ballyrush Burial Ground Ballyrush Community Childcare Ltd Ballytivnan Community Partnership Banada Abbey Hall Development Co. Ltd Banada Community Centre Committee Banada Development Agency CLG Beltra Country Market Belt Torc Dev Co LTD, Benbulben -

An Tordú Logainmneacha (Contae Shligigh) Dréacht

An tOrdú Logainmneacha (Contae Shligigh) (The Placenames (County Sligo) Order) Dréacht (Draft) Sceideal (Schedule) Roinn A (Section A) Aonaid riaracháin (Administrative units) Caibidil 1 (Chapter 1) Bailte Fearainn (Townlands) (Tugtar an toghroinn [ED], agus an paróiste dlí [P] nuair is gá, chun idirdhealú idir logainmneacha den litriú céanna) (The electoral division [ED] is given, and the civil parish [P] when necessary, to distinguish placenames with the same spelling) Colún 1 Colún 2 Béarla Gaeilge (Column 1 (Column 2 English Language) Irish language) 1 Abbeyquarter North Ceathrú na Mainistreach Thuaidh 2 Abbeyquarter South Ceathrú na Mainistreach Theas 3 Abbeytown Baile na Mainistreach 4 Abbeyville or Ardlaherty Ard Fhlaitheartaigh 5 Achonry Achadh Conaire 6 Aderavoher Eadar Dhá Bhóthar 7 Aghagad Achadh Gaid 8 Aghalenane Achadh Lingeáin 9 Aghamore Far Achadh Mór Theas 10 Aghamore Near Achadh Mór Thuaidh 11 Aghanagh Eachanach 12 Agharrow Achadh Choradh 13 Aghoo Achadh 14 Altanelvick Allt Ó nOilmhic 15 Altans Na hAlltáin 16 Alternan Park Allt Fharannáin 17 Altvelid Allt Bhéalada 18 Andresna Ionra Snámha 19 Annagh [ED: Banada] An tEanach 20 Annagh [ED: Killaraght] An tEanach 21 Annagh [ED: Lakeview] An tEanach 22 Annagh Beg An tEanach Beag 23 Annagh More An tEanach Mór 24 Annaghbeg or Monasterredan An tEanach Beag 25 Annaghcarthy Eanach Uí Charthaigh 26 Annaghcor Eanach Cora 27 Annaghgowan Eanach Dhubháin 28 Annaghgowla Island Eanach Gabhla 29 Annaghloy Eanach Lughaidh 30 Annaghmore [ED: Annagh] An tEanach Mór 31 Annaghmore [ED: Kilfree]