Economic Research Center Discussion Paper

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JAPAN POST BANK Annual Report 2018

Annual Report 2018 Annual Report 2018 Year ended March 31, 2018 Management JAPAN POST BANK aims to become “the most accessible and trustworthy bank in Japan,” guided by Philosophy the needs and expectations of our customers. Trust Innovation We comply with laws, regulations, We work sincerely to improve and other standards of behavior our management and business and value trusted relationships operations in response to requests with customers, markets, from customers and changes in the shareholders, and employees and business environment. consistently serve as a responsible corporate citizen. Corporate Profile Corporate name JAPAN POST BANK Co., Ltd. Date of establishment September 1, 2006 Representative Executive Officer Norito Ikeda Address of head office 1-3-2 Kasumigaseki, Chiyoda-ku, Tokyo 100-8798, Japan OTEMACHI PLACE WEST TOWER, 2-3-1 Otemachi, Chiyoda-ku, Tokyo 100-8793, Japan (Plans to progressively relocate from November 5, 2018) Total assets ¥210,630 billion Total net assets ¥11,513 billion Capital ¥3,500 billion Number of employees* 13,009 * The number of employees excludes employees assigned to other companies by the Bank but includes employees assigned to the Bank by other companies. The figure does not include short-term contract and part-time employees. Referenced Guidelines • International Integrated Reporting Framework, International Integrated Reporting Council (IIRC) • Guidance for Integrated Corporate Disclosure and Company-Investor Dialogue for Collaborative Value Creation, Ministry of Economy, Trade and Industry Editorial Policy To foster a deeper understanding of JAPAN POST BANK’s corporate value among shareholders, investors and stakeholders, for this Annual Report we produced an integrated report that offers extensive information on management strategy and environmental, social and governance (ESG) as well as financial information. -

KOBE ECONOMIC & BUSINESS REVIEW No.32

ISSN O075-6407 KOBE ECONOMICBUSINESS & REVIEW 32nd ANNUAL REPORT ss"VTE'-Oee g,,[[El.../e v RESEARCH INSTITUTE FOR ECONOMICS AND BUSINESS ADMINISTRATION KOBE UNIVERSITY 1986 KOBE ECONOMIC & BUSINESS REVIEW 32nd ANNUAL REPORT ;'`i'E'"il13s g:s ,.e-. RESEARCH INSTITUTE FOR ECONOM[CS AND BUSI]NESS ADMINISTRATION KOBE UNIVERSrl'Y 1986 CONTENTS Import Demand Structural Change in the Pacific Basin Countries................................. ..............,Seiichi KATAyAMA Kenichi IsHiGAKi 1 ' A Synthetic Analysis of Structuralist and Monetarist Theory of Latin American Inflation... ..................Shoji NIsHIJIMA 15 Stagflation Causes and Policies ••. ..................Nobuo OKIsHIo 33 A Computable General Equilibrium Model of the Japanese Economy ............................ ...................Mitsuo EzAKi 55 IMPORT DEMAND S'IRUCTURAL CHANGE IN THE PACIHC BASIN COUNTRIES* by Selichi KATAyAMA*" and Kenichi IsHIGAKI 1. Introduction The purpose of the present paper is to investigate the structural change in the import demand of Pacific basin countries. Needless to say, international trade is important not only in the world economy but for macro-economic policy issues in a country. As is well summarized by Goldstin and Khan (1985), the estimation of trade equations that means equations for the time-series behavior of the quantities and prices of merchandised imports and exports, has still its importance. And one of the econometric issues in trade modelling is the stability of trade relationships. Whether a regression relationship varies or stable overtime is obviously important from a predictive and analytical point of view. There are many literatures on the structural change in trade equa- tions. [For example, Heien (1968), Joy and Stolen (1975), Stern, Baum and Green (1979) and Volker (1982)]. Recently Katayama, Ohtani and Toyoda (1985) examined the stability issues by applying the Bayesian method. -

ACM IMCOM 2017, January 5–7 Beppu, Japan Conference Program

ACM IMCOM 2017, January 5–7 Beppu, Japan Conference Program | Hosted by | | Sponsored by | Association for Computing Machinery (ACM) ACM SIGAPP Sungkyunkwan University (SKKU), Korea Universiti Kuala Lumpur, Malaysia ACM IMCOM 2017 초대의 글 ACM Special Interest Group on Applied Computing (SIGAPP)가 후원하고 성균관대와 말 레 이 시 아 UniKL 이 주관하는 제 11 회 IMCOM (International Conference on Ubiquitous Information Management and Communication)가 2017년 1월 5일(목)부터 7일(토)까지 일본인들이 가장 사랑하는 최고의 온천도시 벳부에서 일본 측 학자들의 큰 성원을 받으며 개최됩니다. 미래사회에서는 인간, 컴퓨터, 사물 간의 상호작용을 위한 새로운 패러다임 생성, 라이프로그의 활용, 컴패니언 디바이스의 역할, 특성, 맞춤 등 그에 따른 변화를 요구합니다. ACM IMCOM 2017에서는 컴패니언 IoT의 시대를 준비하며 새로운 패러다임에 기여하는 학술 교류 및 전문 지식의 전파를 위해서 세계 최고 수준의 전문가들을 모시고 미래부/IITP G-ITRC의 틀 안에서 심도있는 토론의 장을 마련하고자 합니다. ACM IMCOM 2017는 SCOPUS와 EI에 등재되어 있어 국제학술대회로서의 높은 권위를 유지하고 있습니다. 금년에는 20개국, 국내외 50개 이상의 기관에서 총 366편의 논문을 제출하였고, 그 중 113편의 논문이 선정되었으며, 수준 높은 학술 교류를 위해 세 분의 기조강연자를 모셨습니다. 빅데이터 및 데이터베이스의 권위자인 일본 University of Tsukuba의 Hiroyuki Kitagawa 교수님, HCI, 컴패니온쉽 분야의 명망 높은 한국 연세대 김진우 교수님, IoT UX분야의 전문가이자 현재 연구가 매우 활발한 한국 중앙대 신동희 교수님을 초청하였습니다. 열띤 토론과 학술정보의 교환은 물론 폭넓은 친교를 통해 성대한 만남의 장과 성공적인 학술회의가 이루어질 수 있도록 부디 적극 참석하셔서 본 학술회의를 더욱 빛내 주시길 부탁드립니다. 또한 학술대회 행사 중 겨울바다와 따뜻한 온천체험, 고요하고 평온한 풍광을 함께 감상하시고 휴식을 통해서 한 해를 새롭게 맞는 재충전의 기회로 활용하시기 바랍니다. 대한민국 성균관대에서 2006년 기획되어 2007년부터 시작된 작은 학술회의가 이제 매년 300편 이상의 논문이 제출되고 서로 아끼며 주목하는 세계수준의 학술회의로 자리 잡았습니다. -

Japan-US-2009-Symposium.Pdf

SYMPOSIUM ON BUILDING THE FINANCIAL SYSTEM OF THE 21ST CENTURY: AN AGENDA FOR JAPAN AND THE UNITED STATES ARMONK, NEW YORK • OCTOBER 23-25, 2009 AGENDA FRIDAY, OCTOBER 23 5:30-6:15 Doral Guests – Bus to the Weill Center departs approximately every 15 minutes 6:00-6:30 Cocktail Reception – Main Lobby of the Weill Center 6:30-6:40 GREETINGS – Conference Room H, second floor Hal Scott, Nomura Professor and Director, Program on International Financial Systems (PIFS), Harvard Law School Tribute to Tasuku Takagaki Takashiro Furuhata, Executive Director, International House of Japan 6:40-7:40 KEYNOTE ADDRESS – Conference Room H Bill Rhodes, Senior Vice Chairman, Citi; Senior Vice Chairman, Citibank Shigesuke Kashiwagi, President and Chief Executive Officer, Nomura Holding America, Inc. 7:45-9:15 Dinner – Main Dining Room, first floor 9:15-11:00 After-Dinner Cocktails – Main Lobby 9:15 Doral Guests – Bus to the Doral; meet in Main Lobby 10:00 Doral Guests – Bus to the Doral; meet in Main Lobby 11:00 Doral Guests – Last bus to the Doral; meet in Main Lobby SATURDAY, OCTOBER 24 7:00-8:00 Doral Guests – Bus to the Weill Center departs approximately every 15 minutes 7:30-8:15 Breakfast – Main Dining Room Panelists, Reporters, and Facilitators – Breakfast Meeting in Main Dining Room 8:15-8:25 WELCOME & OPENING REMARKS – Conference Room H Hal Scott, Nomura Professor and Director, Program on International Financial Systems (PIFS), Harvard Law School 1 8:25-8:45 PANEL SESSION – Conference Room H Topic 1: The Future of Banking and Securities Regulation Japan Panelist: Nobuchika Mori, Deputy Commissioner, International Affairs and Supervision, Financial Services Agency, Government of Japan U.S. -

General Methodology of Market Reports

© Copyright 2015 ystats.com GmbH & Co. KG, 22765 Hamburg, Germany 2 3 GENERAL METHODOLOGY OF MARKET REPORTS Secondary Market Research The reports are compiled based on secondary market research. Secondary research is information gathered from previously published sources. Our reports are based on information and data acquired from national and international statistical offices, industry and trade associations, business reports, business and company databases, journals, company registries, news portals and many other reliable sources. By using various sources we ensure maximum objectivity for reported data. As a result, companies gain a precise and unbiased impression of the market situation. Cross referencing of data is conducted in order to ensure validity and reliability. The source of information and its release date are provided on every chart. It is possible that the information contained in one chart is derived from several sources. If this is the case, all sources are mentioned on the chart. The reports include mainly data from the last 12 months prior to the date of report publication. Exact publication dates are mentioned in every chart. Definitions The reports take into account a broad definition of B2C E-Commerce, which might include mobile commerce. As definitions may vary among sources, exact definition used by the source (if available) is included at the bottom of the chart. Chart Types Our reports include text charts, pie charts, bar charts, rankings, line graphs and tables. Every chart contains an Action Title, which summarizes the main idea/finding of the chart and a Subtitle, which provides necessary information about the country, the topic, units or measures of currency, and the applicable time period(s) to which the data refers. -

Draft. NL 7.2006.Pub

Volume 2, issue 7 30.072006 INTERNATIONAL COMMISSION FOR POSTAL FINANCIAL SERVICES & BUSINESS /ICPFSB/ Post € Fin - Newsletter / Special Issue Special points of PostFinance reports encouraging growth interest: 28 July, 2006 - [Press Re- • Ghana: “Financial lease] services as a central “PostFinance continued to component for the grow in the first half of survival of postal 2006. The inflow of new services” money amounted to 2.35 billion francs, almost 400 • Germany: “Postbank million francs above the expects to generate a year-back period. Cus- further significant tomer deposits have risen increase in average to 39.8 billion francs. In earnings per cus- parallel, the number of accounts increased to tomer through the 61,000 in the first six new sales outlet” months of the year. PostFi- nance also posted strong creased by 119 positions, and a consulting • Switzerland: growth for mortgages (+16.2 further 20 positions are budg- “PostFinance to %), an increase of 234 million eted for by the end of 2006. PostFinance is and remains launch video francs. The average headcount innovative and will be the first consulting” has risen by 119 since Janu- Yellownet is growing in financial institution in Swit- ary, compared with the year- popularity zerland to offer financial ad- back period. Following suc- vice by video link. A pilot test cessful tests, PostFinance is to In 1998, PostFinance became conducted from October 2005 Inside this issue: intro-duce financial advice by the first financial institution to to March 2006 at post offices video link to reinforce sales. introduce an e-finance solu- in western Switzerland has tion (yellownet) for electronic produced important findings Investments in growth are account management in 1998: for the rollout. -

Application Guidelines 2017 AO September Entry

School of International Liberal Studies (SILS) WASEDA UNIVERSITY Application Guidelines 2017 AO September Entry Table of Contents Roadmap to SILS (Application Schedule) P. 1 Step1: Preparation for Application P. 2 Step2: Application Procedure P. 7 Step3: Screening Procedure and Admission P.20 Step4: Enrollment Procedure P.23 Step5: Preparation for Entrance P.25 Inquiry P.26 Application Period:January 6 (Fri.), 2017 – March 23 (Thu.), 2017 First Batch January 6 (Fri.), 2017 – January 30 (Mon.), 2017 Second Batch January 31 (Tue.), 2017 – March 23 (Thu.), 2017 *Application documents must arrive by the deadline. *Applicants may only submit one application for either the first or the second batch. SILS AO Application Guidelines: 2017 AO September Entry Roadmap to SILS (Application Schedule) 2017 AO September Entry ‣ Check your Application Qualifications (P. 3) Step 1 ‣ Payment of Screening Fee (P. 7) Preparation for application ‣ Preparation for Application Documents (P. 12) ◆To apply, create a Waseda Online Admissions Application account first, and prepare the Application Form. Then pay the screening fee, print out the Application Form and submit it with other application documents (see page 12 for details) together by post. The application procedure is considered complete, when all the application documents are received by the School of International Liberal Studies Admissions Office during the application period. For more information, see page 10. 2017 First Batch Second Batch ‣ January 6 -January 30, 2017: Application Period *[Prepare -

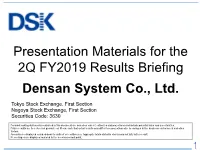

07/30/2019 Presentation Materials for the 2Q FY2019 Results Briefing

Presentation Materials for the 2Q FY2019 Results Briefing Densan System Co., Ltd. Tokyo Stock Exchange, First Section Nagoya Stock Exchange, First Section Securities Code: 3630 Forward-looking statements contained in this document are based on current estimates and projections and include potential risks and uncertainties. Future results are therefore not guaranteed. Please note that actual results may differ from projections due to changes in the business environment and other factors. Amounts are displayed rounded down to units of one million yen. Aggregate totals stated in charts may not tally with a result. Percentages are displayed rounded to the second decimal point. 2Q FY2019 Business Results Highlights Y-o-y change in parentheses Net income attributable to Sales Operating income shareholders of the parent company 19,874 1,231 856 million yen million yen million yen (Up 10.2%) (Up 65.4%) (Up 64.6%) Business results ✔ Sales and earnings up y-o-y ✔ Operating income showed high growth, up 65.4% y-o-y 2Q FY2019 Business Results Highlights (Unit: Million yen) ✔ Sales according to plan, income up substantially, well ahead of plan ✔ Income ratio up FY 12/2018 FY 12/2019 Y-o-y 1H forecast Attainment ratio Full-year plan Progress 2Q cumulativ e total 2Q cumulativ e total Ratio Sales 18,039 19,874 10.2% 19,731 100.7% 40,000 49.7% Operating income 744 1,231 65.4% 803 153.3% 1,810 68.0% Income ratio 4.1% 6.2% Up 2.1% 4.1% 4.5% Ordinary income 785 1,277 62.7% 834 153.1% 1,850 69.1% Income ratio 4.4% 6.4% Up 2.1% 4.2% 4.6% Net income 520 856 -

Automated Teller Machine from Wikipedia, the Free Encyclopedia Jump To: Navigation, Search "Cash Machine" Redirects Here

Automated teller machine From Wikipedia, the free encyclopedia Jump to: navigation, search "cash machine" redirects here. For the Hard-Fi song, see Cash Machine. An NCR Personas 75-Series interior, multi-function ATM in the United States Smaller indoor ATMs dispense money inside convenience stores and other busy areas, such as this off-premise Wincor Nixdorf mono-function ATM in Sweden An automated teller machine (ATM) is a computerised telecommunications device that provides the clients of a financial institution with access to financial transactions in a public space without the need for a cashier, human clerk or bank teller. ATMs are known by various other names including automatic banking machine, cash machine, and various regional varients derived from trademarks on ATM systems held by particular banks. On most modern ATMs, the customer is identified by inserting a plastic ATM card with a magnetic stripe or a plastic smart card with a chip, that contains a unique card number and some security information such as an expiration date or CVVC (CVV). Authentication is provided by the customer entering a personal identification number (PIN). Using an ATM, customers can access their bank accounts in order to make cash withdrawals, credit card cash advances, and check their account balances as well as purchase prepaid cellphone credit. If the currency being withdrawn from the ATM is different from that which the bank account is denominated in (e.g.: Withdrawing Japanese Yen from a bank account containing US Dollars), the money will be converted -

Annex a APEC Economic Policy Report Case Study China: Structural Reform in the Retail Services Sector

APEC Economic Policy Report 2016 Annex A APEC Economic Policy Report Case Study China: Structural Reform in the Retail Services Sector 54 ANNEX A: APEC Economic Policy Report Case Study INTRODUCTION: OBJECTIVES AND METHODOLOGY The study documents and assesses the process and impact of structural reform in the retail services sector in China and the flow on effects into other goods and services sectors and across the entire economy. The structural reforms involved were initially policy-driven as a result of market-opening commitments on China’s accession to the WTO. Commencing in an experimental manner in 1992 and phased in fully after WTO accession in 2001, these reforms centred on opening up to commercial presence of foreign retailers. The reforms had far reaching impacts of various kinds not only on local small and medium- sized retailers (SMEs) but also on growth and employment across the retail sector more generally. Major effects were experienced by SME goods suppliers accessing the new and increasingly efficient domestic business-to-business (B2B) supply chains for produce of all kinds into the retail sector. Chinese consumers also benefitted by way of greater choice of consumer goods at lower prices, in wider geographic regions, with more attractive embedded services and higher product quality. The story does not end there. Ongoing radical structural reform in the retail sector is underway everywhere in the world as consumers increasingly shift from “bricks and mortar” towards online electronic retail (e-tail) platforms. While e-tail has a higher penetration rate in some other APEC members, the sheer number and rapid increase of Chinese consumers gives special significance to this transition to electronic commerce (e-commerce) in China, Chinese online services providers such as Alibaba are rapidly proving highly competitive not only in China but in the global markets. -

Big Data Types for Macroeconomic Nowcasting DARIO BUONO (1), GIAN LUIGI MAZZI (2), GEORGE KAPETANIOS (3), MASSIMILIANO MARCELLINO (4) 4 and FOTIS PAPAILIAS (5)

Big data types for macroeconomic nowcasting DARIO BUONO (1), GIAN LUIGI MAZZI (2), GEORGE KAPETANIOS (3), MASSIMILIANO MARCELLINO (4) 4 AND FOTIS PAPAILIAS (5) Abstract: In this paper we present a detailed discussion on various types of big data which can be useful in macroeconomic nowcasting. In particular, we review the big data sources, availability, specific characteristics and their use in the literature. We conclude this paper identifying the big data types which could be adopted for real applications. JEL codes: C82, E27, E37, E47 Keywords: big data, nowcasting, data features (1) Eurostat. (2) retired from Eurostat. (3) King's College London. (4) Università Bocconi, Italy. (5) Queen's University Management School, Queen's University Belfast, UK and quantf research. 4 Big data types for macroeconomic nowcasting 1. Introduction The advancements in computer technology during the last decades have allowed the storage, organisation, manipulation and analysis of vast amount of data from different sources and across different disciplines, and there is nowadays an ever growing interest in the analysis of these big data. In this paper, we summarize the results of an investigation of the specificities of various big data sources relevant for macroeconomic nowcasting and early estimates, and we discuss the characteristics of big data sources that are relevant for their application in this context. Perhaps not surprisingly given their different origins, the literature provides various definitions of big data. One possibility to obtain a general classification is to adopt the ‘4 Vs’ classification, originated by the IBM, which relates to: (i) Volume (Scale of data), (ii) Velocity (Analysis of streaming data), (iii) Variety (Different forms of data) and (iv) Veracity (Uncertainty of data). -

Statistics on Payment, Clearing and Settlement Systems in the CPSS Countries

Committee on Payment and Settlement Systems Statistics on payment, clearing and settlement systems in the CPSS countries Figures for 2011 January 2013 © Bank for International Settlements 2013. All rights reserved. Brief excerpts may be reproduced or translated provided the source is cited. ISBN 92-9197-909-0 (online) Contents Country tables .............................................................................................................................. 1 Australia .......................................................................................................................................... 3 Belgium ........................................................................................................................................... 17 Brazil ............................................................................................................................................... 35 Canada ........................................................................................................................................... 57 China .............................................................................................................................................. 79 Euro area ........................................................................................................................................ 97 France ............................................................................................................................................. 103 Germany ........................................................................................................................................