Weiguan WANG (王伟冠) –

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 Zhirong “Jerry” Zhao

Updated 03/16/2020 ZHIRONG “JERRY” ZHAO Gross Family Professor, Public & Nonprofit Management Hubert H. Humphrey School of Public Affairs, University of Minnesota (UMN) 301 19th Avenue South, Minneapolis, MN 55455 [email protected], 612-625-7318 (phone) BIOGRAPHICAL INFORMATION Education 2005 Ph.D. of Public Administration, University of Georgia (UGA), Athens 1997 Master of Urban Planning, Tongji University, Shanghai, China 1993 Bachelor of Urban Planning, Tongji University, Shanghai, China Academic Positions 2019- pres. Chair Leadership & Management Area, Humphrey School of Public Affairs, UMN 2019–pres. Gross Family Professor, Humphrey School of Public Affairs, UMN 2017- pres. Director, Master of Public Policy Program, Humphrey School of Public Affairs, UMN 2017- pres. Founding Director, Institute for Urban & Regional Infrastructure Finance, UMN 2012–2019 Associate Professor, Humphrey School of Public Affairs, UMN 2007–2011 Assistant Professor, Humphrey School of Public Affairs, UMN 2005–2007 Director, Political Science Internship Program, Eastern Michigan University 2005–2007 Assistant Professor, Department of Political Science, Eastern Michigan University Professional Experience 2002–2005 Education Program Specialist, Carl Vinson Institute of Government, UGA 1993–1998 Assistant Urban Planner, Xiamen Academy of Urban Planning & Design, China Awards and Honors 2020 SCPA Leadership Award, American Society for Public Administration (ASPA) 2018 Outstanding Services Award, Center for Transportation Studies, UMN 2018 Leadership Award, China-America -

Ninghua, ZHONG (钟宁桦)

Ninghua, ZHONG (钟宁桦) Professor, Economics and Finance School of Economics and Management Tongji University, Shanghai [email protected]; [email protected] Academic Background PhD in Finance, Hong Kong University of Science and Technology, January 2013 PhD Committee: Sudipto Dasgupta, Vidan K. Goyal, K. C. John Wei, Albert Park, Zhigang Tao MA in Economics, Peking University, China Center for Economic Research, July 2008 Adviser: Yang Yao BA in Economics with highest distinction, Fudan University, School of Economics, July 2005 GPA: 3.82 out of 4.00 Class rank: 1 out of 109 Current Academic Appointment Professor, School of Economics and Management, Tongji University Promoted to Full Professor in December 2015 due to my exceptional performance Promoted to Associate Professor in June 2013 shortly after joining the university in March 2013 Teaches at one of the premier Executive MBA programs in the world (Tongji University/ENPC), ranked 68th in 2014 by the Financial Times Research interests include (a) applied microeconomics studies in the fields of labor economics, corporate finance, and empirical asset pricing and (b) Chinese economic reform and development Ningua, ZHONG (钟宁桦) 1 Publications and Working Papers—English As of December 2015, Google Scholar calculated 225 citations of my papers: On China’s Labor Market Issues (Papers in this field are developed from my master thesis) “Unions and Workers’ Welfare in Chinese Firms” (with Yang Yao), [download from JSTOR] Journal of Labor Economics 31, no. 3 (2013): 633–67. -

Participants: (In Order of the Surname)

Participants 31 Participants: (in order of the surname) Yansong Bai yyyòòòttt: Jilin University, Changchun. E-mail: [email protected] Jianhai Bao ïïï°°°: Central South University, Changsha. E-mail: [email protected] Chuanzhong Chen •••DDD¨¨¨: Hainan Normal University, Haikou. E-mail: [email protected] Dayue Chen •••ŒŒŒ: Peking University, Beijing. E-mail: [email protected] Haotian Chen •••hhhUUU: Jilin University, Changchun. E-mail: [email protected] Longyu Chen •••999ˆˆˆ: Peking University, Beijing. E-mail: [email protected] Man Chen •••ùùù: Capital Normal University, Beijing. E-mail: [email protected] Mu-Fa Chen •••777{{{: Beijing Normal University, Beijing. E-mail: [email protected] Shukai Chen •••ÓÓÓppp: Beijing Normal University, Beijing. E-mail: [email protected] Xia Chen •••ggg: Jilin University, Changchun; University of Tennessee, USA. E-mail: [email protected] Xin Chen •••lll: Shanghai Jiao Tong University, Shanghai. E-mail: [email protected] Xue Chen •••ÆÆÆ: Capital Normal University, Beijing. E-mail: [email protected] Zengjing Chen •••OOO¹¹¹: Shandong University, Jinan. E-mail: [email protected] 32 Participants Huihui Cheng §§§¦¦¦¦¦¦: North China University of Water Resources and Electric Power, Zhengzhou E-mail: [email protected] Lan Cheng §§§===: Central South University, Changsha. E-mail: [email protected] Zhiwen Cheng §§§“““>>>: Beijing Normal University, Beijing. E-mail: [email protected] Michael Choi éééRRRZZZ: The Chinese University of Hong Kong, Shenzhen. E-mail: [email protected] Bowen Deng """ÆÆÆ©©©: Jilin University, Changchun. E-mail: [email protected] Changsong Deng """ttt: Wuhan University, Wuhan. E-mail: [email protected] Xue Ding ¶¶¶ÈÈÈ: Jilin University, Changchun. -

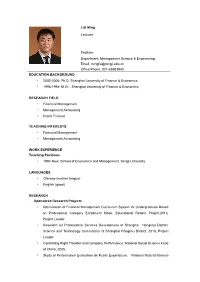

LIU Ming Lecturer Position: Department: Management Science

LIU Ming Lecturer Position: Department: Management Science & Engineering Email: [email protected] Office Phone: 021-65983943 EDUCATION BACKGROUND · 2002-2006: Ph.D, Shanghai University of Finance & Economics · 1995-1998: M.Ec., Shanghai University of Finance & Economics RESEARCH FIELD · Financial Management · Management Accounting · Public Finance TEACHING INTERESTS · Financial Management · Management Accounting WORK EXPERIENCE Teaching Positions · 1993-Now: School of Economics and Management, Tongji University LANGUAGES · Chinese (mother tongue) · English (good) RESEARCH Sponsored Research Projects · Optimization of Financial Management Curriculum System for Undergraduate Based on Professional Category Enrollment Mode, Educational Reform Project,2013, Project Leader · Research on Professional Services Development of Shanghai Hongkou District, Science and Technology Commission of Shanghai Hongkou District, 2010, Project Leader · Controlling Right Transfer and Company Performance, National Social Science Fund of China, 2005. · Study of Performance Evaluation for Public Expenditure, National Natural Science Foundation of China, 2003. Selected Publications Papers · ZHOU Wei, Research on the Construction of Experiment Course of Financial Management for undergraduate, The Proceedings of Educational Research and Educational Reformation, Tongji University Press, 2011(10) · ZHOU Wei, SONG XiaoMan, BAI YunXia, Study on Profit Distribution System of State-owned Enterprise, Finance and Accounting Monthly, 2011(8). In Chinese. · HUANG ZhiZhong, ZHOU Wei, XIE WenLi, Motivation of Strong Stock Holder Underweight: Theories and evidences, Economic Review, 2009 (6). In Chinese. · BAI YunXia, ZHOU Wei, The Impact of the Number of Suppliers on Operating Performance, China Business&Trade, 2009(5). In Chinese. · CONG Shuhai, ZHOU Wei, Performance Evaluation for Chinese Public Expenditure in Education, Finance and Trade Economics, 2007(3). In Chinese. Books · CONG Shuhai, Evaluation of Public Expenditure, Economic Science Publishing House, 2006. -

China Venture Fund

CHINA VENTURE FUND 2018-2019 China Venture Fund Scholars Name Proposal Title Partner Institution(s) Department College North China Plain and Texas High Plains: Collaboration between Geography & the Liberal Arts & Social 1 FeiFei Pan China Agricultural University UNT and China Agricultural Environment Sciences University Collaborative Research Activities Texas Center for Xinghai Conservatory 2 Kris Chesky with the Texas Center for Performing Arts Music Zhaoqing University Performing Arts Health Health Research, Education, and Peking University Recruiting Collaboration with Shanghai Jiao Tong University Biomedical 3 Donghui Zhu Engineering Biomedical Engineering Programs Northwest Institute for Nonferrous Engineering at Top Universities in China Metal Research Housing International Recognized Engineering 4 Cheng Yu Tsinghua University Engineering Researcher on Disaster Mitigation Technology Page 1 of 6 Last Updated: 01/07/2019 CHINA VENTURE FUND 2017-2018 China Venture Fund Scholars Name Proposal Title Partner Institution(s) Department College East China Normal University Enhancing Research & Shanghai University of Sport Kinesiology, Health 1 Tao Zhang Recruitment with Universities in Shanghai University Promotion, & Education China East China Jiaotong University Recreation Beijing Sport University Establishing Education & Engineering 2 Cheng Yu Beijing University of Technology Engineering Research Partnership with BJUT Technology Research and Education Collaboration with School of Computer Science & 3 Yan Huang Computer Science -

Likuo Sung CV July 2020

July 2020 Li-Kuo Sung Curriculum vitae Peking University HSBC Business School Room 651, University Town, Nanshan District, Shenzhen, 518055, China Phone: +86-755-26033627 E-mail: [email protected] ACADEMIC EMPLOYMENT Peking University, Shenzhen, China 2019 - now Assistant Professor, Peking University HSBC Business School Shanghai University of Finance and Economics, Shanghai, China 2016 - 2019 Assistant Professor, College of Business EDUCATION 2015 Ph.D., Owen School of Management, VanDerbilt University, USA 2008 M. A., Human Resources anD InDustrial Relations, Carlson School of Management, University of Minnesota, USA 2005 MBA, National Taiwan University, Taiwan 2001 B.S., Psychology, National Chengchi University, Taiwan B.A., Public Finance, National Chengchi University, Taiwan RESEARCH INTERESTS Pay Dispersion Proactive Behavior Meta-Analysis Job Insecurity WorkPlace Exclusion REFEREED PUBLICATIONS Journal Articles Park, T. Y., Kim, S., & Sung, L. K. (2017). Fair pay allocation decisions: From a regulatory focus theory view. Organizational Behavior and Human Decision Processes (SSCI), 142, 1-11 Carter, R., BaDham, R., Parker, S., Nesbit, P., & Sung, L. K. (2016). The effects of emPloyee engagement and self-efficacy on job performance: a longituDinal field stuDy. International Journal of Human Resource Management (SSCI), 1-20. Friedman, R., Liu, W., Chi, S. C, Hong, Y. Y. & Sung, L. K. (2012). Cross-cultural management and bicultural identity integration: When does experience abroad lead to appropriate cultural switching? International Journal of Intercultural Relations (SSCI), 36, 130-139 Chen, C. C., Tsai, W. C., Chen, H. Y., & Sung, L. K. (2009). APPlicant imPression management and interviewer decision: the moderating roles of note-taking anD warning of verification, Journal of Management (TSSCI, Journal in Chinese), 26, 577-897 Li-Kuo Sung – P.1 July 2020 Published Proceeding Kim, Eunhee, Sung, L. -

Conference Guide 会议手册

经济学院 School of Economics Fudan University 220 Handan Road, Shanghai 200433, China Tel: +86-21-65643821 Fax: +86-21-65112913 The Seventh International Conference on Futures and Other Derivatives 第七届期货与其他衍生品国际会议 Conference Guide 会议手册 Fudan-Stanford Institute for China Financial Technology and Risk Analytics Institute for Financial Studies Fudan University School of Data Science Fudan University 复旦-斯坦福中国金融科技与安全研究院 复旦大学金融研究院 复旦大学大数据学院 19th-20th October, 2018 2018 年 10 月 19-20 日 经济学院 School of Economics Fudan University 220 Handan Road, Shanghai 200433, China Tel: +86-21-65643821 Fax: +86-21-65112913 PROGRAM AT A GLANCE The Seventh International Conference on Futures and Other Derivatives Organized by Fudan University Conference Venue: School of Economics, Fudan University. No.600 Guoquan Road, Shanghai, China Friday 19: Dajin Report Hall (大金报告厅), School of Economics, Fudan University 12:30 pm – 1:20 pm Registration 1:20 pm -- 1:40 pm Chair Qingfu Liu, Executive Dean of Fudan-Stanford Institute for China Financial Technology Risk Analytics Opening Speech Jun Zhang, Dean of School of Economics, Fudan Univeristy 1:40 pm – 3:40 pm Chair Ke Tang, Tsinghua University Keynote Speaker Michael A.H.Dempster, University of Cambridge Chair Liyan Han, Beihang University Keynote Speaker Robert Webb, University of Virginia Chair Yunbi An, Windsor University Keynote Speaker Jianqing Fan, Fudan University and Princeton University 3:40 pm –4:00 pm Group Shot and Coffee Break 4:00 pm – 6:00 pm Chair Luyang Zhang, Fudan University Keynote Speaker Chongfeng Wu, -

Tsinghua Newsletter Issue 22.Pdf

Issue 22 Tsinghua Newsletter January 2013 TH-T-1016 Tsinghua Newsletter (Issue 22) January 2013 Contents News & Events More Journals Included in SSCI and SCI 1 Tsinghua Tops China’s MBA Ranking for the Fifth Time 1 Professor Yan Ning Wins China Young Female Scientists Award 2 Tsinghua Graduates Win Eureka Prizes 2 Art Works Win Wu Guanzhong Art & Science Innovation Awards 3 Student Education & Development Tsinghua Undergraduate Programs Strengthened with Internationalization 4 Student Team Wins Awards at Eighth Challenge Cup 4 Student Art Troupe Presents Performance Series 5 Research & Achievements First 30-Meter Resolution Global Land Cover Maps 6 A Chemical Reaction Model for Predicting Nucleation Rates 6 Tsinghua Ranks 15th in IEEE Spectrum Patent List 7 Social Links Public Benefit Project Wins Social Funding 8 More Donations Finance Students at Tsinghua 9 Tsinghua Graduates Favored by Top 100 Companies 9 International Cooperation & Exchange 2013-14 Degree Programs for International Students 10 Sino-French 4+4 Program Educates Transcultural Engineers 10 University Science Park Sets Up Incubator Abroad 11 Education Outlook National Scholarships Established for Graduate Students 12 Government Sponsored Overseas Students to Reach 18,000 12 Ten Universities in Yangtze Delta Region to Recognize Credits Mutually 13 Previous issues of the Tsinghua Newsletter can be found on the website at http://news.tsinghua.edu.cn/publish/newsen/7160. News & Events News & Events More Journals Included in SSCI and SCI The Chinese Journal of International Politics (CJIP), relations theory, international security and international edited by the Institute of Modern International Relations at political economy. Tsinghua University, was added to the list of journals covered Tsinghua and its affiliated institutes edit and publish a by the Social Science Citation Index (SSCI) in July 2012. -

UF Connections in China Visiting Students, Scholars & Researchers

UF Connections in China China is situated in East Asia and is the world’s most populous country. The US Department of State estimates its total population at 1,373,541,278. The capital city is Beijing. Information about travelling to China can be found on the Department of State website. The Centers of Disease Control and Prevention also has useful travel information. China’s status as a major economic and political power in the global environment has made it a go-to destination for academic collaboration. The University of Florida is proud to maintain a strong, active presence in China through research engagement and student exchange. Visiting Students, Scholars & Researchers The University of Florida currently has more visiting students, scholars, and researchers from China than from any other country. Visiting Students, Scholars, and Researchers Undergraduate Graduate Non-degree OPT Exchange Visitors 43 1368 38 704 566 UF Students in China The University of Florida had 123 students study in China in the academic year 2013 -2014. Study Abroad Programs and Reciprocal Agreements UF College Destination Institution or Program Name Focus of program Location Business Business School Sun Yat-sen University Study Abroad Guangzhou Administration Business Shanghai Jiao Tong University, MBA Study Abroad Shanghai Administration Office Business University of Nottingham Ningbo, China Exchange Ningbo Administration Produced by the Office for Global Research Engagement in collaboration with the International Studies Program at the University of Florida International Center 2015 Cooperative Agreements Cooperative Agreements differ from Reciprocal Agreements (also known as Exchange Programs) since they are still at the initial stages of developing collaborative efforts between the two institutions. -

Annual Report

2020 ANNUAL REPORT 2020ANNUAL REPORT Contents 004 2020 Annual Report - Preface 006 Envision 008 School of Management, Fudan University“Envision”Cloud Classroom 009 “Envision”Cloud Classroom Series of Activities 010 “Envision”Cloud Classroom Presentation Modes and Cooperative Media 011 “Envision”Cloud Classroom Content Presentation 012 “Envision”Cloud Classroom Self-produced Originals 014 “Envision”Cloud Classroom self-produced Originals 018 Sci-tech Innovation 020 Sci-tech Innovation Office of the School of Management, Fudan University Mission and Vision 021 Sci-tech Innovation Office of the School of Management, Fudan University Positioning of the Sci-tech Innovation Office of the School of Management 022 Fudan Sci-tech Innovation Leadership CampSci-tech Innovation Knowledge Graph Management Science Series 023 School of Management, Fudan University Original Management Theory 025 Fudan Sci-tech Innovation Leadership Camp Sci-tech Innovation Knowledge Graph Teaching for Practice 028 School of Management, Fudan University First Sci-tech Innovation Leadership Camp 029 Fudan Sci-tech Innovation Leadership Camp List of the First Batch of Students 030 School of Management, Fudan University Advanced Services of the Sci-tech Innovation Office 034 Fight against the Pandemic 036 Fighting against the Pandemic: Wisdom Contributed by FDSM Faculty Numbers 038 List of Publications in International Journals 044 Mutual Support, Growth with Great Virtues, Readiness to Help Others 048 Plunging into China’s Fight against the Pandemic: Students and Alumni -

Initiative Disciplines Development List 01 Natural and Physical Sciences (100)

“Double First-Class” initiative disciplines development list (Sorted by discipline) Note: The list was published by the Ministry of Education of the People’s Republic of China on 21 September 2017. This list sorted by discipline has been prepared by the Education and Research Section, Australian Embassy, Beijing based on the Australian Standard Classification of Education (ASCED) 2001, Australian Bureau of Statistics. Initial translation credit to Science, Technology and Education Section, Embassy of Switzerland in China. 01 Natural and Physical Sciences (100) Astronomy (2) Nanjing University University of Science and Technology of China Atmosphere Science (3) Nanjing University Nanjing University of Information Science & Technology Lanzhou University Biology (16) Peking University Tsinghua University China Agricultural University Peking Union Medical College Inner Mongolia University Fudan University Shanghai Jiao Tong University Nanjing University Zhejiang University University of Science and Technology of China Xiamen University Huazhong Agricultural University Henan University Sun Yat-sen University Wuhan University Southwest University Chemistry (25) Peking University Tsinghua University Nankai University Tianjin University Dalian University of Technology Jilin University Northeast Normal University Fudan University Shanghai Jiao Tong University East China University of Science and Technology Nanjing University Zhejiang University Xiamen University University of Science and Technology of China Fuzhou University Shandong University -

B&R MIP-Student Recruitment Brochure+Updated.Pdf

The Belt and Road Master Degree Program in Intellectual Property Student Recruitment Brochure The Belt and Road Master Program of Intellectual Property (B&R MIP) Program Introduction: Adhering to the spirit of the Silk Road “Peaceful cooperation, openness and tolerance, mutual learning and mutual learning, mutual benefit and win-win situation”, the Belt and Road Master Degree Program in Intellectual Property (hereinafter: B&R MIP) is aimed to strengthen the “The Belt and Road” countries’ knowledge of the Chinese system of intellectual property rights and mutual communications in the aspects of creation, practice, protection and management, as well as to promote the coordination of laws and policies on intellectual property rights among countries thereof. It will contribute to regional cooperation in greater range, higher and deeper level and establish a solid foundation for making a framework in regional intellectual property and innovation cooperation which is open, inclusive, balanced and beneficial for all. The Ministry of Education (MoE) and National Administration of Intellectual Property, PRC (CNIPA) has entrusted Tongji University to implement the B&R MIP Program since 2017. The program is aimed to provide an international and innovative perspective for students to understanding the creation, practice, protection and service assurance of Intellectual Property. Students should grasp the knowledge of the concept of intellectual property rights, relevant laws, management, practical system and related content of International Intellectual Property Protection. Internationalization, practicality and inter-discipline are the three key features of the program. Duration of Study: 2.5 years (among which the course duration is 1 year in China and the rest time is for practical training, thesis writing and online defense in student’s homeland.