The Mathrubhumi Printing and Publishing Co. Ltd.: Ratings Assigned Rationale Key Rating Drivers and Their Description

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

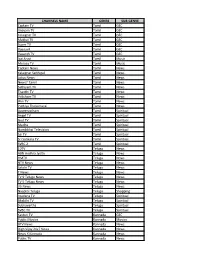

Directory 2017

DISTRICT DIRECTORY / PATHANAMTHITTA / 2017 INDEX Kerala RajBhavan……..........…………………………….7 Chief Minister & Ministers………………..........………7-9 Speaker &Deputy Speaker…………………….................9 M.P…………………………………………..............……….10 MLA……………………………………….....................10-11 District Panchayat………….........................................…11 Collectorate………………..........................................11-12 Devaswom Board…………….............................................12 Sabarimala………...............................................…......12-16 Agriculture………….....…...........................……….......16-17 Animal Husbandry……….......………………....................18 Audit……………………………………….............…..…….19 Banks (Commercial)……………..................………...19-21 Block Panchayat……………………………..........……….21 BSNL…………………………………………….........……..21 Civil Supplies……………………………...............……….22 Co-Operation…………………………………..............…..22 Courts………………………………….....................……….22 Culture………………………………........................………24 Dairy Development…………………………..........………24 Defence……………………………………….............…....24 Development Corporations………………………...……24 Drugs Control……………………………………..........…24 Economics&Statistics……………………....................….24 Education……………………………................………25-26 Electrical Inspectorate…………………………...........….26 Employment Exchange…………………………...............26 Excise…………………………………………….............….26 Fire&Rescue Services…………………………........……27 Fisheries………………………………………................….27 Food Safety………………………………............…………27 -

Journalism Class - Xi

HIGHER SECONDARY COURSE JOURNALISM CLASS - XI Government of Kerala DEPARTMENT OF EDUCATION State Council of Educational Research and Training (SCERT) Kerala 2016 THE NATIONAL ANTHEM Jana-gana-mana adhinayaka, jaya he Bharatha-bhagya-vidhata. Punjab-Sindh-Gujarat-Maratha Dravida-Utkala-Banga Vindhya-Himachala-Yamuna-Ganga Uchchala-Jaladhi-taranga Tava subha name jage, Tava subha asisa mage, Gahe tava jaya gatha. Jana-gana-mangala-dayaka jaya he Bharatha-bhagya-vidhata. Jaya he, jaya he, jaya he, Jaya jaya jaya, jaya he! PLEDGE India is my country. All Indians are my brothers and sisters. I love my country, and I am proud of its rich and varied heritage. I shall always strive to be worthy of it. I shall give my parents, teachers and all elders respect, and treat everyone with courtesy. To my country and my people, I pledge my devotion. In their well-being and prosperity alone lies my happiness. Prepared by State Council of Educational Research and Training (SCERT) Poojappura, Thiruvananthapuram 695012, Kerala Website : www.scertkerala.gov.in e-mail : [email protected] Phone : 0471 - 2341883, Fax : 0471 - 2341869 Typesetting and Layout : SCERT © Department of Education, Government of Kerala To be printed in quality paper - 80gsm map litho (snow-white) Foreword Dear learners, It is with immense pleasure and pride that State Council of Educational Research and Training (SCERT), Kerala brings forth its first textbook in Journalism for higher secondary students. We have been trying to set up a well structured syllabus and textbook for Journalism since the introduction of the course at the higher secondary level. Though we could frame a syllabus, we could not develop a textbook for Journalism all these years. -

Android Apps of Malayalam Newspapers: Review of User Experience

Android apps of Malayalam newspapers: review of user experience Vimal Kumar V. Technical Assistant Mahatma Gandhi University Library Kerala-686 560 Email: [email protected] Dr. K. C. Abdul Majeed Associate Professor Farook College Kozhikode-673 632 Email: [email protected] Abstract The habit of newspaper reading is an integral part of Kerala society. The advent of satellite televisions and social media could not change the daily routine of newspaper reading. Leading Malayalam dailies have introduced mobile phone apps to extend their presence among mobile phone users. The study reviews the features and performance of four leading Malayalam newspaper apps in Android platform. Keywords: N ews apps, Android, Mobile phone, Malayalam news 1. Introduction Kerala people became very fond of newspaper reading many decades back. High literacy level and public library movement have influenced the reading habit of Kerala people. Indian Readership Survey 2017 says that about 60% of the Kerala population reads newspapers. Newspaper readership at the national level is about 16.5% (Media Research Users Council, 2018). “From literacy to political consciousness, urban dominance, history, sociology, demography and even geography – it all plays a role" (Cris, 2018) Kerala people love newspaper reading. Kerala has good statewide coverage of broadband and mobile phone. As per the CyberMedia Research report, Kerala leads among other states in mobile phone penetration with 65% (Thomas, 2018). The popularity of mobile phone and Internet have influenced the social life of Kerala people. Social media and mobile phones have played a great role in coordinating relief operations in flood-affected Kerala in 2018 (Thiagarajan, 2018). -

Amrita School of Art and Science Kochi

Amma signs Faith Leaders’ Universal Declaration Against Slavery at Vatican Amma joined Pope Francis in the Vatican and 11 other world religious leaders in a ceremonial signing of a declaration against human trafficking and slavery. Chancellor Amma Awarded Honorary Doctorate The State University of New York (SUNY) presented Amma with an honorary doctorate in humane letters at a special ceremony held on May 25, 2010 at Lippes Concert Hall in Slee Hall on the University at Buffalo North Campus. Amma Says...... When we study in college, striving to become a professional - this is education for a living. On the other hand, education for life requires understanding the essential principles of spirituality. This means gaining a My conviction is that deeper understanding of the world, our minds, our emotions, and ourselves. We all know that the real goal of science, technology and education is not to create people who can understand only the language of machines. The main purpose of spirituality must unite education should be to impart a culture of the heart - a culture based on spiritual values. in order to ensure Communication through machines has even made people in far off places seem very close. Yet, in the absence a sustainable and of communication between hearts, even those who are physically close to us seem to be far away. balanced existence of Today’s world needs people who express goodness in their words and deeds. If such noble role models set the our world. example for their fellow beings, the darkness prevailing in today’s society will be dispelled, and the light of peace - Amma and non-violence will once again illumine this earth. -

Permitted Private Satellite TV Channels-FTA (As on 26.12.2018 Obtained from Broadcast Seva) Name of the S.No Channel Name Channel Logo Category Language Broadcaster

Permitted Private Satellite TV Channels-FTA (as on 26.12.2018 obtained from broadcast seva) Name of the S.No Channel Name Channel Logo Category Language broadcaster NON- 1 9X HINDI NEWS HINDI/ENGLISH /BENGA 9X JALWA (PHIR SE NON- 2 LI&ALL INDIAN INDIAN 9X) NEWS SCHEDULE LANGUAGE 9X JHAKAAS (9X NON- 3 MARATHI MARATHI) NEWS 9X MEDIA PRIVATE LIMITED HINDI/ENGLISH /BENGA NON- 4 9XM LI&ALL INDIAN INDIAN NEWS SCHEDULE LANGUAGE NON- 5 9XO (9XM VELVET) HINDI NEWS Housefull Action (earlier 9X BAJAO (Earlier 9X NON- 6 HINDI BAJAAO & 9X NEWS BANGLA) A ONE NEWS TIME HINDI/ PUNJABI/ 7 BROADCASTING TV 24 NEWS ENGLISH PRIVATE LIMITED HINDI, ENGLISH, BHASKAR NEWS (AP MARATHI AND ALL 8 NEWS 9) OTHER INDIAN SCHEDULE LANGUAGE A.R. RAIL VIKAS SERVICES PVT. LTD. HINDI, ENGLISH, NON- MARATHI AND ALL 9 SATYA NEWS OTHER INDIAN SCHEDULE LANGUAGE Mahua Plus (earlier TELUGU/HINDI/ENGLIS AGRO ROYAL TV NON- H/GUJARATI/TAMIL/KA 10 AADRI (Earlier AADRI NEWS NNADA/BENGALI/MALA ENTERTAINMENT WELLNESS) YALAM AND MEDIA Shiva Shakthi Sai TV TELUGU/HINDI/ENGLIS WORKS PVT.LTD. (earlier BENZE TV NON- H/GUJARATI/TAMIL/KA 11 (Earlier AADRI NEWS NNADA/BENGALI/MALA ENRICH) YALAM AAMODA BROADCASTING ABN ANDHRA 12 NEWS TELUGU COMPANY JYOTHI PRIVATE LIMITED HINDI, ENGLISH AND AAP MEDIA NON- 13 ANJAN TV ALL OTHER INDIAN PVT.LTD. NEWS SCHEDULE LANGUAGES AASTHA BROAD CASTING NON- HINDI/GUJRATI/ENGLIS 14 ARIHANT NETWORK NEWS H LIMITED ABP NEWS NETWORK PVT. LTD. (Earlier ABP ASMITA (Earlie MEDIA CONTENT ABP SAMACHAR 15 NEWS GUJARATI AND GUJARATI, ABP COMMUNICATION Sanjha) S SERVICES INDIA PRIVATE LIMITED) ABP NEWS NETWORK PVT. -

Channels Name

CHANNELS NAME GENRE SUB-GENRE Captain TV Tamil GEC Imayam TV Tamil GEC Kalaignar TV Tamil GEC Makkal TV Tamil GEC Super TV Tamil GEC Vaanavil Tamil GEC Vasanth TV Tamil GEC Isai Aruvi Tamil Music Murasu TV Tamil Music Captain News Tamil News Kalaignar Seithigal Tamil News Lotus News Tamil News News7 Tamil Tamil News Sathiyam TV Tamil News Thanthi TV Tamil News Velicham TV Tamil News Win TV Tamil News Puthiya Thalaimurai Tamil News Aaseervatham Tamil Spiritual Angel TV Tamil Spiritual God TV Tamil Spiritual Madha Tamil Spiritual Nambikkai Television Tamil Spiritual Sai TV Tamil Spiritual Sri Sankara TV Tamil Spiritual SVBC 2 Tamil Spiritual 10TV Telugu News ABN Andhra Jyothi Telugu News HMTV Telugu News NTV News Telugu News Sakshi TV Telugu News T News Telugu News TV 9 Telugu News Telugu News TV 5 Telugu News Telugu News V6 News Telugu News Naaptol Telugu Telugu Shopping Aradana TV Telugu Spiritual Bhakthi TV Telugu Spiritual Subhavartha Telugu Spiritual SVBC TV Telugu Spiritual Kasturi TV Kannada GEC Public Movies Kannada Movies BTV News Kannada News Digh Vijay 24x7 News Kannada News News X Kannada Kannada News Public TV Kannada News TV 9 Kannada Kannada News Suvarna News 24x7 Kannada News NT4 Kannada Shopping Amrita TV Malayalam GEC Jai Hind Malayalam GEC Kairali Malayalam GEC Kairali WE Malayalam GEC Kerala Vision Malayalam GEC Mangalam Malayalam GEC Mazhavil Manorama Malayalam GEC Mazhavil Manorama HD Malayalam GEC Reporter Malayalam GEC Flowers TV Malayalam GEC Asianet News Malayalam News Janam TV Malayalam News Kairali People Malayalam -

The Current Economic and Political Situation in India: Perspectives From

The current economic and political situation in India: perspectives from senior Indian editors Thursday 13 February 2014 10 – 11.30am Seminar Room B HC Coombs Building 9, Fellows Road, ANU After ten years of Congress-led United Progressive Alliance rule parliamentary elections are due in India in April/May 2014. Against this background the Australia South Asia Research Centre (ASARC) is hosting a panel discussion with four senior influential newspaper editors from India. They will be speaking on the current economic and political situation in their country. Jaideep Bose is Editorial Director of the Times of India group. Based in Mumbai, Bose heads the newspaper’s operations across 32 editions located in major cities and smaller towns. With a circulation of approximately five million, and a readership close to 30 million, The Times of India is the country’s largest circulating national newspaper. Bose has had an impressive career record and was one of India’s youngest editors when he took over as Executive Editor of The Times of India in 2004. He also holds positions on the boards of Times NOW, the group’s television news channel, as well as in several other group companies. He was instrumental in launching the newspaper chain’s civil society campaigns, India Poised, Lead India and the Teach India initiatives. Bose began his career with The Telegraph newspaper in Kolkata. He was Executive Editor of The Economic Times when he moved to The Times of India. Bose holds a bachelor’s degree in Economics from Jadavpur University, Kolkata. Anil Padmanabhan is Deputy Managing Editor with The Mint newspaper published by the Hindustan Times group in association with The Wall Street Journal. -

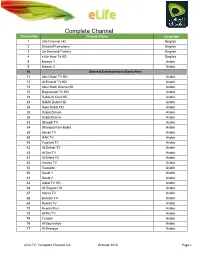

Complete Channel List October 2015 Page 1

Complete Channel Channel No. List Channel Name Language 1 Info Channel HD English 2 Etisalat Promotions English 3 On Demand Trailers English 4 eLife How-To HD English 8 Mosaic 1 Arabic 9 Mosaic 2 Arabic 10 General Entertainment Starts Here 11 Abu Dhabi TV HD Arabic 12 Al Emarat TV HD Arabic 13 Abu Dhabi Drama HD Arabic 15 Baynounah TV HD Arabic 22 Dubai Al Oula HD Arabic 23 SAMA Dubai HD Arabic 24 Noor Dubai HD Arabic 25 Dubai Zaman Arabic 26 Dubai Drama Arabic 33 Sharjah TV Arabic 34 Sharqiya from Kalba Arabic 38 Ajman TV Arabic 39 RAK TV Arabic 40 Fujairah TV Arabic 42 Al Dafrah TV Arabic 43 Al Dar TV Arabic 51 Al Waha TV Arabic 52 Hawas TV Arabic 53 Tawazon Arabic 60 Saudi 1 Arabic 61 Saudi 2 Arabic 63 Qatar TV HD Arabic 64 Al Rayyan HD Arabic 67 Oman TV Arabic 68 Bahrain TV Arabic 69 Kuwait TV Arabic 70 Kuwait Plus Arabic 73 Al Rai TV Arabic 74 Funoon Arabic 76 Al Soumariya Arabic 77 Al Sharqiya Arabic eLife TV : Complete Channel List October 2015 Page 1 Complete Channel 79 LBC Sat List Arabic 80 OTV Arabic 81 LDC Arabic 82 Future TV Arabic 83 Tele Liban Arabic 84 MTV Lebanon Arabic 85 NBN Arabic 86 Al Jadeed Arabic 89 Jordan TV Arabic 91 Palestine Arabic 92 Syria TV Arabic 94 Al Masriya Arabic 95 Al Kahera Wal Nass Arabic 96 Al Kahera Wal Nass +2 Arabic 97 ON TV Arabic 98 ON TV Live Arabic 101 CBC Arabic 102 CBC Extra Arabic 103 CBC Drama Arabic 104 Al Hayat Arabic 105 Al Hayat 2 Arabic 106 Al Hayat Musalsalat Arabic 108 Al Nahar TV Arabic 109 Al Nahar TV +2 Arabic 110 Al Nahar Drama Arabic 112 Sada Al Balad Arabic 113 Sada Al Balad -

New Media List 2012

Thrissur Press Club KUWJ Thrissur Unit Round North, Thrissur, Kerala. Phone: 0487 2335576, 2330224 Web: www.thrissurpressclub.in, [email protected], [email protected] Phone Mobile Phone Mobile Chandrika 2424988/Fax Subin 9847813847 Sudheesh Kumar 9446114105 Unni Kottakkal 9846061196 Diamond Paul. M 9995343362 Jeejo John 9495568560 Fahad Muneer 9946104864 Deccan Chronicle Nidhin. T. R 9495538200 Malayalam News 2446227 Anoop. K. Venu 9747430375 Rajesh Padiyath 9447233084 Deepika&Rashtra 2421596/3012222-6 Mangalam 2445472 Franco Louis 2212895 9745108206 Jinesh Poonath 9847505078 Paul Mathew 9388820426 K. Krishnakumar 9895183730 M. V. Vasanth 9846880537 Renjith Balan 9446058435 Ajil Narayanan 8606646391 Gasoongi 9349599179 Mathrubhumi 2423284 - 2442007-Fax E. Salahudeen 9447407070 Deshabhimani 2325180, 2386881-4/ 2386887-Fax Babu.M.B 94472 61711 K. Remathambai 9446141772 G. Rajesh Kumar 9388886600 K. Prabath 9447087755 Dhanya. T. S 9539483354 C.A. Premachandran 9846033667 Maneesh Chemmenchery 9447356673 K. K. Rudrakshan 9447186883 J. Philip 9847189502 Sidhikul Akber 8907225143 General 2421439 Unnikrishnan Koodoth 9387311012 MetroVartha 3049890,3049888 Indian Express 2424778 Siraj 2446446 / 2426251-Fax Gopika Varrier 8547356930 Sudheer. V. U 9809577322 Noushad 9847986336 Janmabhoomi 3105221 Neelambaran. T. S 9446503527 Suprabatham 2446786 Shaji. M. A 9961607348 Shihab 8589984472 Jimon. K. Paul 9961482083 C.B. Pradeepkumar 9846068657 Janayugam 2429705 Swathanthramandapam 2384127 Surendran Kuthanoor 9446450440 A. Muhammad 2384558 8547384127 Risiya 8547841299 Rajan Elavathoor 9745561241 Kiran. G. B 9605766737 Telagraph 2420680 Kerala Kaumudi/Flash 2386651,61-2386681-Fax Sanoop. K 9495358757 Rajeevan.K.P 9447161027 Riyas Annamanada 9447524885 Bhasi Pangil 9946108601 Krishnakumar Amalath 9446994528 The Hindu 2321411-2320711- Fax Raphi M Devasi 9946108349 Mini Muringatheri 9446320452 Najeeb. K. K 9447020787 Kerala Bhooshanam Vani Vincent 9746651098 The Times Of India T. -

LCN Home Channel 1 SD 100 Star Plus SD 101 ZEE TV SD 103 &Tv SD 104 Colors SD 105 DANGAL SD 106 Star Bharat SD 107 SET SD 109 Dr

Channel Name SD/HD LCN Home Channel 1 SD 100 Star Plus SD 101 ZEE TV SD 103 &tv SD 104 colors SD 105 DANGAL SD 106 Star Bharat SD 107 SET SD 109 Dr. Shuddhi SD 110 ID SD 111 Big Magic SD 112 SONY SAB SD 113 ABZY Cool SD 114 ZEE ANMOL SD 116 d2h Positive SD 117 EZ MALL SD 118 bindass SD 120 colors rishtey SD 121 Shemaroo TV SD 123 Anjan SD 128 Ayushman Active SD 130 Comedy Active SD 131 Fitness Active SD 132 Thriller Active SD 134 Shorts TV Active SD 135 Korean Drama Active SD 136 Watcho SD 144 Cooking Active SD 146 Zee Zest SD 147 DD NATIONAL SD 149 DD Retro SD 151 STAR UTSAV SD 156 SONY PAL SD 159 TOPPER SD 160 STAR WORLD SD 179 ZEE cafe SD 181 Colors Infinity SD 183 COMEDY CENTRAL SD 185 ZEEPLEX Screen 1 SD 200 SONY MAX SD 201 &pictures SD 202 ZEE CINEMA SD 203 Jyotish Duniya SD 204 Star GOLD SD 205 ABZY MOVIES SD 206 UTV MOVIES SD 207 B4U Kadak SD 210 UTV ACTION SD 211 Box Cinema SD 212 Cine Active SD 213 Rangmanch Active SD 214 Evergreen Classics Active SD 215 Hits Active SD 217 ZEE Bollywood SD 218 EZ MALL SD 219 colors cineplex SD 221 Movies Active SD 222 Housefull Movies SD 223 enterr 10 Movies SD 225 ABZY Dhadkan SD 226 Star Gold 2 SD 227 ZEE Action SD 228 B4U MOVIES SD 229 Star Gold Select SD 231 Star Utsav Movies SD 234 EZ MALL SD 235 Zee Anmol Cinema SD 237 Dr. -

Yathra 2020 July.Pdf

RNI No: KERMAL/2008/27569 Registered No. KL/CT/209/2018-20 01/07/ 2020 Price ` 60 Mathrubhumi Yathra July 2020 60 Mathrubhumi Yathra Mathrubhumi - The Complete Travel Magazine - July Magazine Travel The Complete Off-Road ന륍ꤿകുളം 2020 നനോർ配配 സꤿകꤿം Wildlife മസോയ配മോര കലഹോരꤿ അരꤿപ്പ Heritage Simple & ന�ോൽകകോണ്ട Travel Taste Beautiful പുകെ-ന�ോവ Trekking Laos സൂനകോ തോഴ配 വര ® crum.JJ@qID 6lnJ21J1CBQ01(D)m> CBL6lllca'n.O:l�lm 6>6>ruru1Wjo m1o6YOlm n.JJ316>� @3 .. a t1c0>u6.. ... rt.16a, 6l.!l.lmJJ rt.16a, 63:>�mJ rt.16a, 0:>C/ll n.JJa. Clid3>J6Yl6 rt.1Ja, CliC/lJ@ml'rt.1Ja, lil<.m3l6lLC/lcnl'm> rt.1J� COl&S60lil, @&llllClJJl"-'Jo OnJJn'll<B,(J)&6Tll&lB�"'•• lill.a,-9J [61llJnlillrromJ'n.J:l$ 6l.a,J6m' ml&m!ilJ6lS [nJOlJCOl60T3ulldl6l' @a.o.Jl.a,@lilJClJJ ®To@o@o .a,adl(!]Jdl6l2! @* Global ffi Innovative ('i) Unmatched � experience )g" products 'Ill technology Surface Decor • Ceramics • Bathware Spa • Steam • Sauna • Wellness Kitchen Faucets • Interior & Exterior Products N IARMANI/�.!!1L��!m� �[email protected] I KOHLER. II VitrA II � II � I 1 60 $ Price: 100 Page: Page: I‑mW‑m‑ t‑Z‑ i‑ §‑ f‑p‑w‑ 2020 Ad‑n‑ b‑m‑ ¡‑ Y‑ I‑ f‑p‑w‑ July 11 s-s-N-\-b-p-w a-y-m³-a-m-d-p-w h-n-b-ä‑v--\-m-a-p-w I-w-t-_-m-U-n-b-b-p-w X-m-b-v--e-m³-U-p-w A-X-n-c-p-X‑oÀ-¡-p-¶ s-I-m-¨-p-c-m-P-y-a-m- Issue: W-v e-m-t-h-m-k-v. -

ATHULYA MALAYALAM VALUE PACK - 314 CHANNELS (267FTA+47PAY) - Rs.235 SL.NO

ATHULYA MALAYALAM VALUE PACK - 314 CHANNELS (267FTA+47PAY) - Rs.235 SL.NO. CHANNELS LANGUAGE GENRE 1 NT3 MALAYALAM GEC 2 FLOWERS MALAYALAM GEC 3 AMRITA TV MALAYALAM GEC 4 KAUMUDY MALAYALAM GEC 5 TEST MALAYALAM GEC 6 ASIANET PLUS MALAYALAM GEC 7 KAPPA TV MALAYALAM GEC 8 ATHULYA MALAYALAM GEC 9 ASIANET MALAYALAM GEC 10 KAIRALI MALAYALAM GEC 11 KAIRALI WE MALAYALAM GEC 12 MAZHAVIL MANORAMA MALAYALAM GEC 13 DARSANA MALAYALAM GEC 14 SURYA TV MALAYALAM GEC 15 JANAM TV MALAYALAM GEC 16 SURYA COMEDY MALAYALAM GEC 17 NT 3 MALAYALAM GEC 18 JAIHIND MALAYALAM GEC 19 ZEE KERALAM MALAYALAM GEC 20 JANAPRIYAM MALAYALAM GEC 21 JEEVAN MALAYALAM GEC 22 DD MALAYALAM MALAYALAM GEC 23 SAFARI MALAYALAM INFOTAINMENT 24 ATHULYA INFO MALAYALAM INFOTAINMENT 25 VICTERS MALAYALAM INFOTAINMENT 26 ASIANET MOVIES MALAYALAM MOVIES 27 SURYA MOVIES MALAYALAM MOVIES 28 ATHULYA MUSIC MALAYALAM MUSIC 29 SURYA MUSIC MALAYALAM MUSIC 30 RAJ MUSIC MALAYALAM MALAYALAM MUSIC 31 KAIRALI PEOPLE MALAYALAM NEWS 32 24 NEWS MALAYALAM NEWS 33 ASIANET NEWS MALAYALAM NEWS 34 MANORAMA NEWS MALAYALAM NEWS 35 NEWS 18 KERALA MALAYALAM NEWS 36 MANGALAM MALAYALAM NEWS 37 REPORTER MALAYALAM NEWS 38 RAJ NEWS MALAYALAM MALAYALAM NEWS 39 SHALOM TV MALAYALAM DEVOTIONAL 40 GOODNESS MALAYALAM DEVOTIONAL 41 POWER VISION MALAYALAM DEVOTIONAL 42 HARVEST MALAYALAM DEVOTIONAL 43 MAKKAL TV TAMIL GEC 44 CAPTAIN TAMIL GEC 45 PUTHUYUGAM TAMIL GEC 46 TAMILAN TV TAMIL GEC 47 MK TELEVISION TAMIL GEC 48 VENDHAR TAMIL GEC 49 KALAIGNAR TAMIL GEC 50 DHEERAN TAMIL GEC 51 KALAIGNAR SIRIPPOLI TAMIL GEC 52 PEPPERS TAMIL