Community Benefits of Type a Funds

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Corpus Christi

Golf Texas A&M University - Corpus Christi Padre Isles Northshore Oso Beach Texas A&M University-Corpus Christi is a four-year university Country Club Country Club Golf Course that offers numerous bachelor, master and doctoral degrees in five colleges: Business, Education, Liberal Arts, Nursing & Health Sciences and Science & Engineering. L.E. Ramey Texas A&M University-Corpus Christi, located on its own 240-acre Sinton River Hills island, features state-of-the-art learning centers, support Golf Course Municipal Country facilities, student apartments and its own beach. Surrounded by Golf Course Club the Corpus Christi and Oso Bays, the campus is approximately ten miles from downtown Corpus Christi. Population Average Home Prices Del Mar College Corpus Corpus Nueces 12 County 2010 $152,200 Del Mar is a two-year community college that offers academic, Christi Christi MSA County Region 2011 $156,600 occupational and non-credit courses. Associate of Art, Science and 2012 $168,300 Applied Science degrees in over 50 university transfer majors are 2000 277,451 403,208 319,645 549,012 2013 $179,700 awarded at Del Mar, as well as Enhanced Skills Certificates and 2010 305,215 393,177 340,223 536,979 2014 $201,750 Certificates of Achievement in more than 80 occupational fields. 2013 316,381 442,600 352,107 546,877 Source: Texas A&M University Real Estate Center Both non-credit and credit students have Regional Age Distribution - 2013 access to classes, laboratories and the latest Age Group 2014 Building Permits Issued technology that upgrade their current skills, (City of Corpus Christi) 19 or Under 28.3% Corpus Christi prepare them for further study or train them for immediate employment in the Coastal Bend 20 – 29 14.3% New Residential 1,134 was ranked 5t h New Commercial 294 Most Desirable area. -

Arena Study Volume I

CITY OF SAVANNAH, GEORGIA PROPOSED ARENA FEASIBILITY STUDY VOLUME I OF II Prepared by: Barrett Sports Group, LLC Gensler JE Dunn Construction Thomas and Hutton May 6, 2016 TABLE OF CONTENTS VOLUME I OF II I. EXECUTIVE SUMMARY II. MARKET ANALYSIS III. PRELIMINARY FACILITY CHARACTERISTICS IV. SITE CONSIDERATIONS V. PRELIMINARY CONSTRUCTION COST ESTIMATES VI. FINANCIAL ANALYSIS VII. ECONOMIC IMPACT ANALYSIS VIII. CIVIC CENTER OVERVIEW IX. SUBCOMMITTEE REPORTS Page 1 TABLE OF CONTENTS VOLUME II OF II APPENDIX A: MARKET DEMOGRAPHICS APPENDIX B: DEVELOPMENT CASE STUDIES APPENDIX C: PROJECT SUMMARY WORKSHEETS: COST ESTIMATES APPENDIX D: WATER RESOURCE ANALYSIS APPENDIX E: WETLANDS APPENDIX F: ENVIRONMENTAL REVIEW REPORT APPENDIX G: STORMWATER MANAGEMENT APPROACH APPENDIX H: ARENA WATER & SEWER APPENDIX I: SUMMARY OF TRAFFIC ASSESSMENT APPENDIX J: BUILDING AND FIRE CODE CONSULTATION SERVICES LIMITING CONDITIONS AND ASSUMPTIONS Page 2 I. EXECUTIVE SUMMARY I. EXECUTIVE SUMMARY Introduction The Consulting Team (see below) is pleased to present our Proposed Arena Feasibility Study. The Consulting Team consists of the following firms . Barrett Sports Group (BSG) . Gensler . JE Dunn Construction . Thomas and Hutton . Coastline Consulting Services . Ecological Planning Group, LLC . Resource & Land Consultants . Terracon The City of Savannah, Georgia (City) retained the Consulting Team to provide advisory services in connection with evaluating the feasibility of replacing and/or redesigning Martin Luther King, Jr. Arena The Consulting Team has completed a comprehensive evaluation of the proposed site and potential feasibility and demand for a new arena that would host athletic events, concerts, family shows, and other community events The Consulting Team was tasked with evaluating the Stiles Avenue/Gwinnett Street site only and has not evaluated any other potential sites Page 4 I. -

FLEXI-B Adult Single Fare

FARES WE’RE HERE Notes: (Exact Fare Required) TO SERVE YOU REGULAR FARES For Information and FLEXI-B Adult Single Fare.................. ......................... 75¢ Reservations Call: 361.749.4111 Reduced Fare * ............................................. 25¢ Reduced Fare * Off Peak .............................. 10¢ (Off peak hours are before 6 a.m., 9 a.m. to 3 p.m. & after 6 p.m. 602 North Staples Street on weekdays only) Corpus Christi, Texas 78401 PREMIUM SERVICE FARES 361.289.2712 FAX 361.903.3579 (Park & Ride/Express/Rural) N Mon-Fri 8am-5pm O Adult Single Fare ........................................ $1.25 I CCRTA Customer Service Center Reduced Fare * ............................................. 25¢ 602 North Staples Street #94 Port Aransas Shuttle ............................... 25¢ T Two hour time limit transfer included with single fare. 90 Corpus Christi, Texas 78401 A 361.883.2287 FAX 361.903.3400 will require difference in fare. M Mon-Fri 7am-6pm FLEXI - B Port Aransas R B-LINE FARES Hearing/Speech Impaired call 7-1-1 O to set up a Texas Relay Call. Regular Fare............................................... $1.25 Surcharge outside 3/4 mile ADA zone ........ $2.00 F The CCRTA Rideline FOR INFORMATION AND N (Automated Telephone) PASSES FLEXI-B RESERVATIONS I 361.289.2600 Day Pass .................................................... $1.75 CALL: 361.749.4111 T 7 Day Pass ................................................. $7.50 B-Line Paratransit Services 31 Day Pass ............................................. $30.00 N Scheduling 361.289.5881 Reduced Fare * (31 Day Pass)..................$11.00 Commuter 11 Trip Pass ............................ $12.50 A Vanpooling B-Line Pass...... ........................................ $50.00 T 1-800-VAN RIDE www.ccrta.org BUY PASSES ONLINE R POINTS OF INTEREST: You can now purchase your CCRTA bus passes O www.ccrta.org online and avoid the lines! Purchase 7, 11 and 31 Del Mar College P day passes on our website at www.ccrta.org. -

Sam Houston State Bearkats 2020 Baseball Preseason Prospectus

SAM HOUSTON STATE BEARKATS 2020 BASEBALL PRESEASON PROSPECTUS 7 SOUTHLAND CONFERENCE CHAMPIONSHIPS | 12 NCAa REGIONALS | 1 SUPER REGIONAL | 64 MLB DRAFT PICKS Bearkat quick facts 2020 SChedule GENERAL INFORMATION COACHING STAFF FEBRUARY Location ......................................................................Huntsville, Texas Head Coach .....................................................Jay Sirianni (1st season) 14 SAINT MARY’S 6:30 p.m. Founded ........................................................................................1879 Alma Mater ..............................................................Nebraska, 2001 15 SAINT MARY’S 3:00 p.m. Enrollment .................................................................................20,477 School Record ......................................................... 0-0 (1st season) 16 SAINT MARY’S 12:00 p.m. 18 RICE 6:30 p.m. Nickname ................................................................................Bearkats Career Record ...........................................................................Same 21 LOYOLA MARYMOUNT 6:30 p.m. Colors ...........................................................................Orange & White Assistant Coach (Recruiting Coord) .................Fuller Smith (1st season) 22 LOYOLA MARYMOUNT 3:00 p.m. Affiliation ......................................................................NCAA Division I Alma Mater ................................................................Ole Miss, 2008 23 LOYOLA MARYMOUNT 1:00 p.m. Conference ...........................................................................Southland -

Comprehensive Annual Financial Report Fiscal Year Ended August 31, 2015

Del Mar College Del Mar College historical photos selected from the 1940s - 1960s. Comprehensive Annual Financial Report Fiscal Year Ended August 31, 2015 Del Mar College • 101 Baldwin Blvd • Corpus Christi, TX 78404-3897 This page intentionally left blank. Comprehensive Annual Financial Report Fiscal Year Ended August 31, 2015 Prepared by John Johnson Comptroller Catherine West, CPA, Ed.D. Budget Officer and Director of Accounting Lenora Keas Vice President, Workforce Development and Strategic Initiatives Interim Provost and Vice President, Instruction and Student Services Del Mar College 101 Baldwin Blvd., Corpus Christi, Texas 78404-3897 www.delmar.edu Front cover photo: In recognition of 80 Years of Del Mar College history, a variety of photos from editions of the Cruiser yearbook. Clockwise from top left: East Campus entrance in 1941, Nursing student ca. 1940s, Students on campus in 1939, Student with teacher in 1966, West Campus entrance (then called Del Mar Technical Insti- tute) in 1960, construction of Memorial Classroom Building in 1942. Del Mar College COMPREHENSIVE ANNUAL FINANCIAL REPORT FISCAL YEAR ENDED AUGUST 31, 2015 Table of Contents Page No. INTRODUCTORY SECTION Transmittal Letter .......................................................................................................................... 1 Board of Regents and Administration .......................................................................................... 17 Certificate of Excellence in Financial Reporting ........................................................................ -

Daily Growl Game Wrap 08

Daily Growl G A M E W R A P & P R E V I E W S O F C O M I N G A T T R A C T I O N S Monday, August 12 H O D G E T O W N A M A R I L L O , T X Amarillo Sod Poodles 2 RockHounds 2 Rocky’s Game suspended, mid-6 Corner The Cowardly Lion Said It Nicely When the Wicked Witch of the West blocked the path of Dorothy & Company to Oz by putting them to sleep in a fi eld of poppies, the Good Witch (Glinda) woke them up with some unexpected snowfall. Upon awakening, the Cowardly Lion yawned and (in that terrifi c voice) said “Peculiar weather we’re havin’, ain’t it?” This may be the fi rst time in recorded history that the words “Cowardly Lion” and “Sod Poodle” have been mentioned in the same sentence, but we had some pretty “peculiar” weather in Amarillo Monday, too. Much to the surprise of pretty much everyone … including weather forecasters (!) … Monday night’s game between the RockHounds and Sod Poodles was suspended due to rain in the middle of the sixth inning at A Statewide Road Trip... Hodgetown in Amarillo. The RockHounds took a 2-0 lead in the second on doubles from Tyler Ramirez and Taylor Motter and RBI singles A Playoff Race ... and from Greg Deichmann and Mickey McDonald. One more time around Matt Milburn tossed four scoreless innings … backed by excellent defense, including three double plays … before at Rocky Town! the Sod Poodles evened the game in the fi fth on three singles and a throwing error by fi rst baseman Chase Cala- buig. -

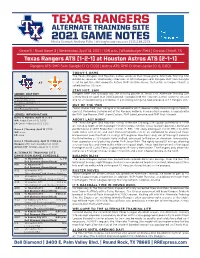

TEXAS RANGERS ALTERNATE TRAINING SITE 2021 GAME NOTES Media Contact: Andrew Felts | [email protected] | 512.238.2213

TEXAS RANGERS ALTERNATE TRAINING SITE 2021 GAME NOTES Media Contact: Andrew Felts | [email protected] | 512.238.2213 Game 5 | Road Game 3 | Wednesday, April 14, 2021 | 1:05 p.m. | Whataburger Field | Corpus Christi, TX Texas Rangers ATS (1-2-1) at Houston Astros ATS (2-1-1) Rangers ATS: RHP Sam Gaviglio (1-0, 0.00) | Astros ATS: RHP Cristian Javier (0-0, 0.00) TODAY’S GAME The Texas Rangers and Houston Astros wrap up their three-game Alternate Training Site exhibition series on Wednesday afternoon at Whataburger Field. Rangers RHP Sam Gaviglio AT is set to get the start opposite Astros RHP Cristian Javier. First pitch in Corpus Christi is scheduled for 1:05 p.m. STAY HOT, SAM SERIES HISTORY Rangers RHP Sam Gaviglio was the winning pitcher in Texas’ first Alternate Training Site Overall: 1-2-1 victory back on April 8 at Dell Diamond. Gaviglio held the Houston Astros scoreless on just In Round Rock: 1-1 one hit while recording a strikeout in 2.0 strong innings to help preserve a 4-1 Rangers win. In Corpus Christi: 0-1-1 Streak: T1 OUT OF THE ‘PEN One-Run Games: 0-0 Texas starter RHP Sam Gaviglio is scheduled to pitch approximately four innings in today’s contest. Following Gaviglio out of the Rangers bullpen, in no particular order, is expected to SERIES INFORMATION be RHP Joe Barlow, RHP Jharel Cotton, RHP Jake Lemoine and RHP Nick Vincent. Game 1 | Monday, April 12 | L 9-3 WP: Ralph Garza (1-0, 0.00) ABOUT LAST NIGHT LP: Drew Anderson (0-1, 3.00) The Texas Rangers and Houston Astros Alternate Training Site squads battled to a 1-1 tie on Tuesday night at Whataburger Field in Corpus Christi. -

FY15-16 Del Mar College Distinguished Budget Document

Del Mar College Del Mar College historical photos selected from the 1940s - 1960s. Budget Document Fiscal Year 2015-2016 Del Mar College • 101 Baldwin Blvd • Corpus Christi, TX 78404-3897 Table of Contents Introductory Section ………………………………….… 1 Statistics Section ………………………………….….….. 46 Profile of the College …………………………...……...… 3 Revenues by Source …………………………………..….. 47 Vision, Mission, Core Values and Guiding Principles.…… 4 Program Expenses by Function …………………….….…. 48 Strategic Planning ……………………………………..…. 5 Net Assets ……………………………………………..…. 49 Board of Regents …………………………………….…... 8 Tuition and Fees ……………………………………..…… 50 Administration …………………………………………… 9 Assessed Value and Taxable Value of Property ………… 51 2015-2016 Budget Committee ……………………….….. 10 Property Tax Levies and Collections ………………..……. 52 Organization Chart …………………………………….…. 11 Principal Taxpayers …………………………………...….. 53 Budget Structure and Functions State Appropriations per FTSE and Contact Hour ….……. 54 Basis of Budgeting ……………………………….…... 12 Annual Contact Hours by Division ………………….…… 55 Revenue Sources ……………………………….…….. 13 Contact Hours Not Funded by State Appropriations ….…. 56 Expense Functions ……………………………………. 14 Ratios of Outstanding Debt …………………………….… 57 Expenditure Objects …………………………….…….. 15 Legal Debt Margin ………………………………….……. 58 Budget Development Process ……………………………. 16 Faculty, Staff, and Administrators Statistics …………..…. 59 Budget Calendar …………………………………………. 18 Enrollment Details ………………………………….……. 60 Student Profile ………………………………………..….. 61 Budget Section ……………………………………….…. -

Corpus Christi

1 2 EXPERIENTIAL EVOLUTION The 1-million-square-foot La Palmera is the result of a $50M transformation of the former Padre Staples Mall into a LEED-certified, contemporary shopping and dining destination. La Palmera continues its transformation as it adds retail, hospitality, restaurants and additional amenities. MARKET LEADER Located in Corpus Christi, Texas, La Palmera is the premier retail destination in the state’s Coastal Bend region, attracting close to 8 million visitors annually, and offering more than 100 retail and dining options. As the only super- regional mall within 140+ miles, La Palmera has maintained its position as a market leader in sales – seeing an increase of 58% since 2010. 3 DRIVE TIMES TO CORPUS CHRISTI Dallas Fort Worth 6.2 hours 6.1 hours El Paso 9 hours TEXAS Austin 3 hours San Antonio 2 hours Houston 3 hours Corpus Christi Laredo 2.3 hours McAllen 2.2 hours Brownsville 2.3 hours 4 OAKLAND, CA (#45) 426,410 TAMPA, FL (#48) 403,178 NEW ORLEANS, LA (#50) 396,766 LEXINGTON, KY (#59) 329,495 CORPUS CHRISTI, TX (#60) 329,408 PITTSBURGH, PA (#64) 302,908 ST. LOUIS, MO (#65) 300,991 ORLANDO, FL (#68) 297,243 PLANO, TX (#70) 294,478 DURHAM, NC (#74) 279,501 U.S. CITIES RANKED BY ST. PETERSBURG, FL (#76) 273,968 POPULATION SCOTTSDALE, AZ (#79) 266,961 (2019) 5 THREE CALIHAM RIVERS BEE 238 72 LIVE OAK 183 SEADRIFT 37 BEEVILLE 77 185 281 202 239 AUSTWELL 59 35 GEORGE WEST REFUGIO 181 MIKESKA SWINNEY SKIDMORE WOODSBORO SWITCH ARANSAS 359 HOLIDAY BEACH TYNAN MT LUCAS MATAGORDA 59 BONNIE VIEW LAMAR ISLAND WEST ST PAUL MATHIS LAKE CITY BAYSIDE COPANO VILLAGE SAN JOSE ISLAND 188 SAN PATRICIO JIM WELLS SINTON 188 37 ROCKPORT DUVAL TAFT SAN PATRICIO 77 ORANGE GROVE ODEM GREGORY 35 BLUNTZER 359 181 ARANSAS PASS 361 CALALLEN PORTLAND INGLESIDE 37 INGLESIDE 69E ON THE BAY PORT ARANSAS AGUA DULCE ROBSTOWN 44 SAN DIEGO Corpus Christi SOUTH PADRE ISLAND DR. -

CORPUS CHRISTI ICERAYS Proud Member of the 2019-20 REGULAR SEASON SCHEDULE North American Hockey League # DATE TIME OPPONENT ARENA CITY 1 Friday, Sept

CORPUS CHRISTI ICERAYS Proud Member of the 2019-20 REGULAR SEASON SCHEDULE North American Hockey League # DATE TIME OPPONENT ARENA CITY 1 Friday, Sept. 13 7:05 PM Topeka Pilots Kansas Expocentre Topeka, KS 2 Saturday, Sept. 14 7:05 PM Topeka Pilots Kansas Expocentre Topeka, KS 3 Wednesday, Sept. 18* 8:00 PM St. Cloud Blizzard *H Schwan Super Rink #4 Blaine, MN 4 Thursday, Sept. 19* 1:30 PM Chippewa Steel *A Schwan Super Rink #2 Blaine, MN 5 Friday, Sept. 20* 7:30 PM Minnesota Wilderness *H Schwan Super Rink #2 Blaine, MN 6 Saturday, Sept. 21* 3:30 PM Springfield Jr. Blues *A Schwan Super Rink #1 Blaine, MN 7 Friday, Sept. 27 7:30 PM Lone Star Brahmas NYTEX Sports Centre North Richland Hills, TX 8 Saturday, Sept. 28 7:30 PM Lone Star Brahmas NYTEX Sports Centre North Richland Hills, TX 9 Friday, Oct. 4 7:15 PM Odessa Jackalopes Ector County Coliseum Odessa, TX 10 Saturday, Oct. 5 7:15 PM Odessa Jackalopes Ector County Coliseum Odessa, TX 11 Sunday, Oct. 6 5:00 PM Odessa Jackalopes Ector County Coliseum Odessa, TX 12 THURSDAY, OCT. 10 7:05 PM ODESSA JACKALOPES AMERICAN BANK CENTER CORPUS CHRISTI, TX 13 FRIDAY, OCT. 11 7:05 PM ODESSA JACKALOPES AMERICAN BANK CENTER CORPUS CHRISTI, TX 14 SATURDAY, OCT. 12 7:05 PM ODESSA JACKALOPES AMERICAN BANK CENTER CORPUS CHRISTI, TX 15 Friday, Oct. 18 7:11 PM Shreveport Mudbugs Hirsch Memorial Coliseum Shreveport, LA 16 Saturday, Oct. 19 7:11 PM Shreveport Mudbugs Hirsch Memorial Coliseum Shreveport, LA 17 FRIDAY, OCT. -

Evaluates and Plans for the Transportation Needs of the Nueces and San Patricio County Areas

CSJ 0101-06-095 Affected Environment 3.0 AFFECTED ENVIRONMENT 3.1 LAND USE 3.1.1 History and Development Trends Permanent settlement in the area that would eventually become Corpus Christi began in the 1840s when Henry L. Kinney and William P. Aubrey established a trading post on the west shore of what is now called Corpus Christi Bay. In 1846, Corpus Christi became the county seat of newly formed Nueces County, and by the 1850s the city was laid out with numbered streets. After the Civil War, the city emerged as an important shipping center when the main ship channel was dredged to accommodate large steam ships. The first railroad arrived in 1875, with three more rail lines following by 1914 (Long 2012a). Mayor Roy Miller adopted an aggressive modernization program in 1913. In three years, the City had paved 12 miles of existing streets, constructed two miles of new streets, laid 26 miles of sanitary and storm sewers, built a garbage incinerator, and installed a new water system (WPA 1942, 169). Though travelers crossing Nueces Bay had utilized a raised oyster reef between the Nueces and Corpus Christi Bays since the 1840s, a reinforced concrete causeway was completed in 1915 (Givens and Moloney 2011, 11; 195). A hurricane in 1919 destroyed much of North Beach and the downtown area. The city was rebuilt quickly, and in 1926 a deep water port was opened to accommodate large vessels, ushering in a period of growth and prosperity for the area. The following year, a bascule bridge (drawbridge) was constructed over the Inner Harbor and opened to the traveling public. -

Whataburger 2021 Press

PRESS KIT 2021 A simple goal: to serve a burger OUR STORY so big it took two hands to hold On Aug. 8, 1950, an adventurous and determined entrepreneur named Harmon Dobson opened up the world’s first Whataburger on Ayers Street in Corpus Christi, Texas. He had a simple goal: to serve a burger so big it took two hands to hold and so good that with one bite customers would say, “What a burger!” He succeeded on both counts and turned that one little burger stand into a legend loved throughout Texas and the South. Today, each and every Whataburger is made to order, right when it’s ordered, never frozen. And they’re still made with 100 percent pure beef and served on a big toasted five-inch bun with all “the extras” to suit your taste. Grilled jalapeños, extra bacon, three slices of cheese, no tomatoes, extra pickles? No problem. Your Whataburger will be made just like you like it, 24 hours a day, seven days a week. Whataburger’s following has grown exponentially in its 70-year history, thanks to a number of features, including its famous burgers and growing list of menu items; its iconic orange-and-white-striped A-Frame restaurants established in the early 1960s; its Fancy Ketchup that even has its own Facebook fan page; and its on-screen presence in every- thing from “King of the Hill” to “Friday Night Lights.” Whataburger is more than a burger chain. It is a place that feels like home to more than 50,000 employees, called Family Members, and millions of customers.