The Khurja Thermal Power Project

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Press Release March 24, 2021

Press Release March 24, 2021 Quarterly Review of Nifty Banking and PSU Bond indices NSE Indices Limited, an NSE group company, as part of its periodic review, announces the following changes in Nifty Banking and PSU Bond Indices. These changes shall become effective from April 05, 2021 (close of April 04, 2021) The following companies are being excluded: Sr. Index name ISIN Issuer Maturity No. Date 1 Nifty Banking & PSU Ultra INE556F08JF7 SMALL INDUSTRIES 21-Jun-21 Short Duration Bond Index DEVELOPMENT BANK OF INDIA 2 Nifty Banking & PSU Ultra INE020B08BN4 REC LIMITED 18-Jun-21 Short Duration Bond Index 3 Nifty Banking & PSU Ultra INE134E08DQ6 POWER FINANCE 29-Jun-21 Short Duration Bond Index CORPORATION LIMITED 4 Nifty Banking & PSU Ultra INE752E07MN5 POWER GRID 27-May-21 Short Duration Bond Index CORPORATION OF INDIA LIMITED 5 Nifty Banking & PSU Ultra INE092T08DF7 IDFC FIRST BANK LIMITED 30-Jun-21 Short Duration Bond Index 6 Nifty Banking & PSU Ultra INE114A07810 STEEL AUTHORITY OF 25-May-21 Short Duration Bond Index INDIA LIMITED 7 Nifty Banking & PSU Ultra INE949L08160 AU SMALL FINANCE BANK 19-May-21 Short Duration Bond Index LIMITED 8 Nifty Banking & PSU Low INE134E08IN2 POWER FINANCE 22-Dec-21 Duration Bond Index CORPORATION LIMITED 9 Nifty Banking & PSU Low INE020B08997 REC LIMITED 21-Oct-21 Duration Bond Index 10 Nifty Banking & PSU Low INE053F07942 INDIAN RAILWAY 24-Nov-21 Duration Bond Index FINANCE CORPORATION LIMITED 11 Nifty Banking & PSU Low INE752E07OD2 POWER GRID 21-Dec-21 Duration Bond Index CORPORATION OF INDIA LIMITED 12 Nifty Banking & PSU Low INE906B07FE6 NATIONAL HIGHWAYS 23-Dec-21 Duration Bond Index AUTHORITY OF INDIA 13 Nifty Banking & PSU Low INE556F08JI1 SMALL INDUSTRIES 25-Jan-22 Duration Bond Index DEVELOPMENT BANK OF INDIA 14 Nifty Banking & PSU Low INE092T08DS0 IDFC FIRST BANK LIMITED 21-Dec-21 Duration Bond Index 15 Nifty Banking & PSU INE261F08CA0 NATIONAL BANK FOR 31-Jul-23 Short Duration Bond Index AGRICULTURE AND RURAL DEVELOPMENT Sr. -

Compiled Bulandshahar

ASHA Database Bulandsahar Name of Population S.No. Name of District Name of Block Name of Sub-Centre ID No. of ASHA Name of ASHA Husband's Name Name of Village CHC/BPHC covered 1 2 3 4 5 6 7 8 9 10 1 Bulandshahr BB Nagar BB Nagar Madona 1702001 Anupam Satish Madona 1105 2 Bulandshahr BB Nagar BB Nagar Sehra 1702002 Anupam Ompal Kharkali 1050 3 Bulandshahr BB Nagar BB Nagar Nisurkha 1702003 Archna Satpal Nisurkha 1149 4 Bulandshahr BB Nagar BB Nagar Hingwada 1702004 Asha Rishipal Benipur 1233 5 Bulandshahr BB Nagar BB Nagar Kuchesar 1702005 Babita Harprasad Kuchesar 800 6 Bulandshahr BB Nagar BB Nagar Kuchesar 1702006 Babita Pramod Ugrsain 925 7 Bulandshahr BB Nagar BB Nagar Bhaisroli 1702007 Babita Pramod Bhaisroli 1300 8 Bulandshahr BB Nagar BB Nagar Sehra 1702008 Balbiri Gajendra Sehra 865 9 Bulandshahr BB Nagar BB Nagar Nimchana 1702009 Bilkish Ilyas Nimchana 1100 10 Bulandshahr BB Nagar BB Nagar Bhaisroli 1702010 Birjesh Chandveer Fatehpur 833 11 Bulandshahr BB Nagar BB Nagar Sadharanpur 1702011 Bita Sharma Krishan Sadharanpur 1000 12 Bulandshahr BB Nagar BB Nagar Madona 1702012 Devindri Sanjeev Kumar Madona 1101 13 Bulandshahr BB Nagar BB Nagar Banboi 1702013 Dharmwati Brahm singh Gyastipur 700 14 Bulandshahr BB Nagar BB Nagar Chitsona 1702014 Dulari Naresh kumar Chitsona 1148 15 Bulandshahr BB Nagar BB Nagar Hingwada 1702015 Gajendri Rohtash Hingwada 933 16 Bulandshahr BB Nagar BB Nagar Nikhob 1702016 Geeta Devi Anil Sathla 1000 17 Bulandshahr BB Nagar BB Nagar Potta 1702017 Guddi Devi Rajkumar Chandpura 900 18 Bulandshahr BB Nagar -

Atomic Energy

Abbreviations used in the report AAI Airport Authority of India Ltd. AERB Atomic Energy Regulatory Board AIBP Accelerated Irrigation Benefit Programme AIR All India Radio APW Active Process Water ATU Atomic Treating Unit BCM Billion Cubic Meter BHEL Bharat Heavy Electricals Ltd. BHPV Bharat Heavy Plates & Vessel Ltd. BLU Boiler Light Up BOLT Build , Operate, Lease & Transfer BPST Bureau of Parliamentary Studies & Training CCEA Cabinet Committee on Economic Affairs CCU Catalytic Cracking Unit CDS Crude Distribution System CDU Crude Distillation Unit CEA Central Electricity Authority CEC Central Empowered Committee CHP Coal Handling Plant CLW Chittaranjan Locomotive Works CMPDI Central Mine Planning & Design Institute COS Committee of Secretaries COR Cost Overrun CPP Captive Power Plant CRIS Centre for Railway Information System CRL Cochin Refinery Ltd. CSL Cochin Shipyard Ltd. CTU Crude Topping Unit DAE Department of Atomic Energy DB Dumb Barges DCME Digital Circuit Multiplexiing Equipment DGMS Director General Mines Safety DHDS Diesel Hydro Desulphurisation project DOA Date of Approval DOC Date of Commissioning DOT Department of Telecommunication DVC Damodar Valley Corporation ECL Eastern Coalfields Ltd. EIL Engineers India Ltd. EMP Enivronment Management Plan EOT Electrical Overhead Travelling crane ESP Electrostatic Precipitator FCCU Fluidised Catalytic Cracker Unit ERP Enterprise Resource Planning FE Foreign Exchange FOIS Freight Operation Information System FPU Feed Preparation Unit GAIL Gas Authority of India Ltd. GC Gauge Conversion GDS Gateway Digital Switch GIS Gas Insulated Station GT Gas Turbine GTPP Gas Turbine Power Plant HCU Hydro- cracker Unit HEC Heavy Engineering Corporation HEMM Heavy Equipment & Mining Machinery HEP Hydro Electric Project HPCL Hindustan Petroleum Corporation Ltd. HRT Head Race Tunnel HSCL Hindustan Steel Construction Ltd. -

Annual Report 2018-19

Annual Report 2018-19 Shri Narendra Modi, Hon’ble Prime Minister of India launching “Saubhagya” Yojana Contents Sl No. Chapter Page No. 1 Performance Highlights 3 2 Organisational Set-Up 11 3 Capacity Addition Programme 13 4 Generation & Power Supply Position 17 5 Ultra Mega Power Projects (UMPPs) 21 6 Transmission 23 7 Status of Power Sector Reforms 29 8 5XUDO(OHFWULÀFDWLRQ,QLWLDWLYHV 33 ,QWHJUDWHG3RZHU'HYHORSPHQW6FKHPH ,3'6 8MMZDO'LVFRP$VVXUDQFH<RMDQD 8'$< DQG1DWLRQDO 9 41 Electricty Fund (NEF) 10 National Smart Grid Mission 49 11 (QHUJ\&RQVHUYDWLRQ 51 12 Charging Infrastructure for Electric Vehicles (EVs) 61 13 3ULYDWH6HFWRU3DUWLFLSDWLRQLQ3RZHU6HFWRU 63 14 International Co-Operation 67 15 3RZHU'HYHORSPHQW$FWLYLWLHVLQ1RUWK(DVWHUQ5HJLRQ 73 16 Central Electricity Authority (CEA) 75 17 Central Electricity Regulatory Commission (CERC) 81 18 Appellate Tribunal For Electricity (APTEL) 89 PUBLIC SECTOR UNDERTAKING 19 NTPC Limited 91 20 NHPC Limited 115 21 Power Grid Corporation of India Limited (PGCIL) 123 22 Power Finance Corporation Ltd. (PFC) 131 23 5XUDO(OHFWULÀFDWLRQ&RUSRUDWLRQ/LPLWHG 5(& 143 24 North Eastern Electric Power Corporation (NEEPCO) Ltd. 155 25 Power System Operation Corporation Ltd. (POSOCO) 157 JOINT VENTURE CORPORATIONS 26 SJVN Limited 159 27 THDC India Ltd 167 STATUTORY BODIES 28 Damodar Valley Corporation (DVC) 171 29 Bhakra Beas Management Board (BBMB) 181 30 %XUHDXRI(QHUJ\(IÀFLHQF\ %(( 185 AUTONOMOUS BODIES 31 Central Power Research Institute (CPRI) 187 32 National Power Training Institute (NPTI) 193 OTHER IMPORTANT -

THDC INDIA LIMITED (Schedule “A” Mini Ratna Government PSU)

THDC INDIA LIMITED (Schedule “A” Mini Ratna Government PSU) Dated: 08.02.2021 Advt. No. 01/2021 Recruitment for the post of Jr. Engineer Trainee in Civil Engineering , Electrical Engineering, Mechanical Engineering , Electronics Engineering and Information Technology (IT) Discipline (s) THDCIL is Schedule “A” Mini Ratna Government Public Sector Undertaking (PSU). It is one of the premier power generators in the country with installed capacity of 1587 MW with commissioning of Tehri Dam & HPP (1000MW), Koteshwar HEP (400MW), Dhukwan Small HEP (24 MW) and Wind Power Projects of 50MW at Patan ,63MW at Dwarka and 50MW Solar Power Project Kasargod. The Equity of company is shared between NTPC and GoUP. The Company was incorporated on 12th July 1988 to develop, operate and maintain the 2400MW Tehri Hydro Power Complex and other Hydro Projects. The Company has an authorized share capital of Rs.4000Cr. THDCIL is a Mini Ratna Category-I and Schedule “A” PSU. Presently, THDCIL has three operational hydro power plants namely Tehri HPP (1000 MW), Koteshwar HEP (400 MW), Dhukwan Small HEP (24 MW), two operational Wind Power Plants namely Patan Wind Farm (50 MW) and Devbhumi Dwarika Wind Farm (63 MW) and one solar project (50 MW). Presently, two hydro power projects namely Tehri PSP (1000 MW) & VPHEP (444 MW) and one Thermal Project namely Khurja STPP (1320 MW) are under construction. THDCIL is consistently profit making company since the commissioning of Tehri Dam & HPP in the year 2006-07. THDCIL invites applications from bright result oriented, energetic and dynamic young Junior Engineer Trainees of Uttarakhand and Uttar Pradesh domicile with bright academic record to join the organization as JUNIOR ENGINEER TRAINEE in Civil Engineering, Electrical Engineering, Mechanical Engineering, Electronics Engineering & Information Technology (IT) Discipline:- DISCIPLINE , STATE-WISE AND CATEGORY-WISE VACANCIES Sl.No. -

Bulandshahar Dealers Of

Dealers of Bulandshahar Sl.No TIN NO. UPTTNO FIRM - NAME FIRM-ADDRESS 1 09167300006 BR0073037 CHAIMPION ELECTRICAL KALA AAM BULANDSHAHAR 2 09167300011 BR0057626 OM ASSOCIATE MOTI BAG BULANDSHAHAR 3 09167300025 BR0072807 JANTA COLD STORAGE AND ICE BHOOR BULANDSHAHAR FACTORY 4 09167300030 BR0063530 S.K.TRADERS KRISHNA NAGAR BULANDSHAHAR 5 09167300039 BR0075244 KRISHI SHEVA KENDRA POST & TEHSIL-SHIKARPUR 6 09167300044 BR0011568 MURARI LAL & CO. MAIN BAZAR POST & TEHSIL-SHIKARPUR 7 09167300058 BR0077653 ABDUL AJIJ RORI BADARPUR DEALER POST & TEHSIL-SHIKARPUR 8 09167300063 BR0077527 NEW RAYAL CYCLE HOUSE DEPUTY GANJ BULANDSHAHAR 9 09167300077 BR0078833 RAJNISH KIRANA KOTHI DEPUTY GANJ BULANDSHAHAR 10 09167300096 BR0077236 SUDHIR KUMAR AGRAWAL AND CO. NEW MANDI BULANDSHAHAR 11 09167300105 BR0026532 RAM KUMAR VINOD KUMAR KACCHA MANDI SHIKARPUR BULANDSHAHAR ADHATI 12 09167300110 BR0082149 MUKESH TRADERS CEMENT DEALER FATHE GANJ BULANDSHAHAR 13 09167300119 BR0083354 GOPI LAL ASHOK KUMAR ADTHAI NEW MANDI BULANDSHAHAR 14 09167300124 BR0082085 SURESH CHANDRA HARI KISHAN SAHKARI NAGAR BULANDSHAHAR PARCHUNI 15 09167300138 BR088693 MOOL CHAND MANOJ KUMAR 36 GURUS GANJ BULANDSHAHAR 16 09167300143 BR0089706 KUMAR ENT UDYOG 3 BY PASS ROAD SHIKARPUR 17 09167300157 BR0092102 ASHOK KUMAR & CO. ARATI NEW MANDI SHIKARPUR 18 09167300162 BR0093355 BASHUDEV PRASAD RAJENDRA KUMAR NEW MANDI BULANDSHAHAR ARAHTI 19 09167300176 BR0094887 SHANKER LAL ASHOK KUMAR GURUS GANJ BULANDSHAHAR 20 09167300181 BR0095323 B.D SALES CORPORATION KRISHNA NAGAR BULANDSHAHAR 21 09167300204 -

Press Release THDC India Limited

Press Release THDC India Limited July 03, 2020 Ratings Amount Facilities/Instruments Rating1 Rating Action (Rs. crore) Long Term Bank Facility- CARE AA; Stable; 375.00 Assigned Cash Credit (Double A; Outlook: Stable) 375.00 Total (Rupees Three Hundred Seventy Five Crore Only) Proposed Long Term 800.00 CARE AA; Stable; Assigned Bonds (Rupees Eight Hundred Crore Only) (Double A; Outlook: Stable) Reaffirmed and 600.00 CARE AA; Stable; Long Term Bonds removed from credit (Rupees Six Hundred Crore only) (Double A; Outlook: Stable) watch Details of instruments/facilities in Annexure-1 Detailed Rationale & Key Rating Drivers CARE had earlier placed the rating of THDC India Limited (THDC) under ‘credit watch with developing implications’ following the announcement by NTPC of an in-principal board approval for the acquisition of the Government of India (GoI) stake in THDC along with the transfer of management control. The removal of ‘credit watch with developing implications’ takes into account the completion of the aforesaid transaction by NTPC for acquisition of 74.50% stake in THDC. Furthermore, CARE has also taken clarity from the management of NTPC with respect to likely funding support to THDC towards under implementation capacity. The rating assigned to the proposed long term bonds and long term bank facilities of THDC India Limited and reaffirmation of rating assigned to outstanding long term bonds derive strength from the majority ownership by NTPC Limited (rated CARE AAA; Stable/CARE A1+) which is the largest thermal power generating company of India, strong operating efficiency of its thermal power and wind assets and healthy financial risk profile of the company. -

Year : 2015-16

LIST OF RTI Nodal Officers Year : 2015-16 Sr.No Ministry/Department/Organisation Nodal Officer Contact Address Phone No/Fax/ Email Name/Designation 1 Cabinet Secretariat Shri Sunil Mishra Rashtrapati Bhawan Director & CPIO New Delhi 1 Cabinet Secretariat 110001 23018467 2 Department of Atomic Energy Shri P Ramakrishnan Central Office, Western Chief Administrator Anushaktinagar, 1 Atomic Energy Education Society Mumbai - 400 094 02225565049 [email protected] Dr. Pankaj Tandon Niyamak Bhavan, Scientific Officer F Anushaktinagar, 2 Atomic Energy Regulatory Board Mumbai- 400 094 25990659 [email protected] Shri M.B. Verma Atomic Minerals Atomic Minerals Directorate for Additional Director (Op 1-10-153/156, AMD 3 Exploration and Research Hyderabad - 500 016 04027766472 [email protected] Dr. P.M. Satya Sai Head, Commissioning 04427480044 Scientific Officer (H) Nuclear Recycle Group 4427480252 4 BARC Facilities, Kalpakkam Kalpakkam, [email protected] Shri Sanjay Pradhan TNRPO, NRB, BARC, 02525244299 Chief Superitendent Ghivali Post, Palghar 2525244158 5 Bhabha Atomic Resarch Centre (Tarapur) Pin 401502 [email protected] Shri. B. P. Joshi Central Complex, 3rd 02225505330 Chief Administrative Trombay, 2225505151 6 Bhabha Atomic Research Centre Mumbai - 400 085 [email protected] Smt. K. Malathi BHAVINI 04427480915 Bharatiya Nabhikiya Vidhyut Nigam Ltd. Senior Manager (HR) Kalpakkam - 603 102 4427480640 7 (BHAVINI) Kancheepuram Dist. [email protected] Shri M.C. Dinakaran BRIT, Project House, 02225573534 Board of Radiation and Isotope General Manager (PIO) Anushakti Nagar 2225562161 8 Technology Mumbai- 400 094. [email protected] Deputy Secretary Anushakti Bhavan 22839961 Deputy Secretary CSM Marg, 22048476 9 Department of Atomic Energy Mumbai-400001 [email protected] Shri V.K. -

PUBLIC RELATIONS in CENTRAL PUBLIC SECTOR ENTERPRISES: MAHARATNA, NAVRATNA and MINIRATNA Cpses

International Journal of Research in Social Sciences Vol. 8 Issue 4, April 2018, ISSN: 2249-2496 Impact Factor: 7.081 Journal Homepage: http://www.ijmra.us, Email: [email protected] Double-Blind Peer Reviewed Refereed Open Access International Journal - Included in the International Serial Directories Indexed & Listed at: Ulrich's Periodicals Directory ©, U.S.A., Open J-Gage as well as in Cabell’s Directories of Publishing Opportunities, U.S.A PUBLIC RELATIONS IN CENTRAL PUBLIC SECTOR ENTERPRISES: MAHARATNA, NAVRATNA AND MINIRATNA CPSEs Dr. Ramesh Chandra Pathak1 ABSTRACT In the wake of accomplishing autonomy, the policy makers of our nation embraced the blended economy. The essential target of embracing a blended economy was to give level with significance to the public and private enterprises, to guarantee the social commitments towards the nation. It was that the accumulation of property should not be in the hand of few people, classes and bourgeoisie the country is heading towards improvement. The public relations have been instrumental in the advancement of CPSEs. PR of CPSEs has fused new patterns, in this manner influencing the working and structure of the public relations framework. The public relation departments of CPSEs are likewise not protected from these progressions. Globalization, industrialization, showcasing and coordinate remote venture energized the public relation departments to be outfitted with best in class assets and there have been across the board changes in the working and structure of PRD of CPSEs. Keyword: Public, CPSEs, PR, PRD, HR 1 Associate Professor, Amity School of Communication, Amity University Rajasthan 413 International Journal of Research in Social Sciences http://www.ijmra.us, Email: [email protected] ISSN: 2249-2496 Impact Factor: 7.081 INTRODUCTION The public sector enterprises have been given the most astounding significance; endeavored liberality in the approach system. -

Top Public Sector Companies

Top Public Sector Companies Air India Bharat Coking Coal Limited Bharat Dynamics Limited Bharat Earth Movers Limited Bharat Electronics Limited Bharat Heavy Electricals Ltd. Bharat Petroleum Corporation Bharat Refractories Limited Bharat Sanchar Nigam Ltd. Bongaigaon Refinery & Petrochemicals Ltd. Broadcast Engineering Consultants India Ltd Cement Corporation of India Limited Central Warehousing Corporation Chennai Petroleum Corporation Limited Coal India Limited Cochin Shipyard Ltd. Container Corporation Of India Ltd. Cotton Corporation of India Ltd. Dredging Corporation of India Limited Engineers India Limited Ferro Scrap Nigam Limited Food Corporation of India GAIL (India) Limited Garden Reach Shipbuilders & Engineers Limited Goa Shipyard Ltd. Gujarat Narmada Valley Fertilizers Company Limited Haldia Petrochemicals Ltd Handicrafts & Handloom Exports Corporation of India Ltd. Heavy Engineering Corp. Ltd Heavy Water Board Hindustan Aeronautics Limited Hindustan Antibiotics Limited Hindustan Copper Limited Hindustan Insecticides Ltd Hindustan Latex Ltd. Hindustan Petroleum Corporation Ltd. Hindustan Prefab Limited HMT Limited Housing and Urban Development Corporation Ltd. (HUDCO) IBP Co. Limited India Trade Promotion Organisation Indian Airlines Indian Oil Corporation Ltd Indian Rare Earths Limited Indian Renewable Energy Development Agency Ltd. Instrumentation Limited, Kota Ircon Internationl Ltd. ITI Limited Kochi Refineries Ltd. Konkan Railway Corporation Ltd. Krishna Bhagya Jala Nigam Ltd Kudremukh Iron Ore Company Limited Mahanadi -

Thdc India Limited Annual Report 2019-2020

Annual Report 2019-20 ANNEXURE -I THDC INDIA LIMITED ANNUAL REPORT 2019-2020 *Pictures will be changed as per designs finalised during designing and printing 1 |Directors’ Report Annual Report 2019-20 Table of Contents Corporate Overview Board of Directors Reference Information Key Financial Performance Highlights Chairman’s Speech Director’s Brief Profile Directors’ Report 2019-20 and Annexures Directors ‘Report 2019-20 Annexure-I Report on Corporate Governance Annexure-II Corporate Social Responsibility Report Annexure-III Management Discussion and Analysis Report Annexure-IV Energy conservation measures, Technology Adaptation, absorption and foreign exchange earnings and outgo Annexure-V Business Responsibility Report Annexure-VI Form No. MGT-9 Extract of Annual Return Annexure-VII Secretarial Audit Report Financial Statements 2019-20 Significant Accounting Policies2019-20 Balance Sheet Statement of Profit & Loss Cash Flow Statement Notes on Accounts Independent Auditors’ Report on the Financial Statement. Comments of the C&AG of India 2 |Directors’ Report Annual Report 2019-20 CORPORATE OVERVIEW BOARD OF DIRECTORS REFERENCE INFORMATION VISION AND MISSION KEY FINANCIAL PERFORMANCE HIGHLIGHTS CHAIRMAN’S SPEECH DIRECTOR’S BRIEF PROFILE 3 |Directors’ Report Annual Report 2019-20 BOARD OF DIRECTORS Shri D. V. Singh Chairman & Managing Director Shri Rajpal Shri T. Venkatesh Economic Adviser, MoP, Addnl. Chief Secretary, (Irrigation)Govt. Nominee Director GoUP. Nominee Director Shri Vijay Goel Shri J. Behera Shri R.K. Vishnoi Director (Personnel) Director (Finance) Director (Technical) Shri Anand Kumar Gupta Shri Ujjwal Kanti Bhattacharya Shri Anil Kumar Gautam Nominee Director Nominee Director Nominee Director NTPC Limited (till 31.07.2020) NTPC Limited NTPC Limited 4 |Directors’ Report Annual Report 2019-20 REFERENCE INFORMATION Registered Office Company Secretary & Compliance Officer THDC India Limited Mrs. -

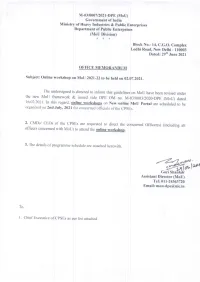

OM for Online Workshop on Mou 2021-22 to Be Held on 02.07

M-03/0007/2021-DPE (MoU) Government of India Ministry of Heavy Industries & Public Enterprises Department of Public Enterprises (MoU Division) * * * Block No.- 1 4 , C.G.O. Complex Lodhi Road, New Delhi - 110003 Dated: 29"" June 2021 OFFICE MEMORANDUM Subject: Online workshop on MoU 2021-22 t o be h e l d on 02.07.2021. The undersigned is directed to inform that guidelines o n MoU h a v e b e e n revised u n d e r t h e new MoU framework & issued vide DPE OM n o . M-03/0003/2020-DPE (MoU) dated 16.02.2021. I n t h i s regard, online workshops on New online MoU Portal a r e scheduled to b e organized on 2nd J u l y , 2021 f o r concerned officials of t h e CPSEs. 2. CMDs/ CEOs of t h e CPSEs a r e requested to d i r e c t t h e concerned O f f i c e r ( s ) ( including all officers concerned with MoU) to attend t h e online workshop. 3 . T h e d e t a i l s of programme schedule a r e attached herewith. Go ae: Fa). oto |2™ Gori Shankar Assistant Director (MoU) Tel: 011-24363720 Email: [email protected] To, 1 . C h i e f Executive of CPSEs as p e r list attached Department of Public Enterprises MoU 2021-22 Schedule of Online Workshop on New online MoU portal Venue: Conference Room No.