Annual Report 2011 Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Natural Hub for Resource Capital

Sector Profile /Resources A natural hub for resource capital Access capital with confidence, via ASX ASX is a world leader in resource capital raising, with over 145 years’ experience of funding the industry. Today, it provides access to a sophisticated network of investors, analysts and advisers, and an unrivalled depth of knowledge. Listing with ASX allows you to join a powerful peer group, including several of the world’s largest diversified and specialised resource companies such as Rio Tinto, Fortescue Metals Group, BHP and Woodside Petroleum, as well as many successful mid-tier producers and junior miners. Developing exploration projects requires the capital equity markets can provide, and ASX investors have supported over 350 resource listings since 2009. Resource and energy companies typically choose to list From junior explorers to world leaders with ASX because it offers: With over 900 resource companies involved in mineral exploration, x The opportunity to be part of a world-class peer group, alongside development and production in over 80 countries, this is ASX’s largest some of the world’s leading resource companies and a strong group industry sector by number of companies. of junior explorers. Listings from abroad are also popular options. MMG Ltd, a Hong Kong x Access to one of the world’s largest pools of investable funds – based diversified metals and mining company, chose to list on ASX and the largest in Asia – including retail and institutional investors. in 2015 after initially listing on the Hong Kong Stock Exchange (HKEX). x A main board listing, broadening investor reach and credibility. -

Aon Non Executive Director Survey Participating Organisations (Pdf, 181.66Kb)

Proprietary and Confidential Constituent Organisations . Abacus Property Group . Bendigo and Adelaide Bank Limited . Accent Group Limited . BHP Group Limited . Adelaide Brighton Ltd. Bingo Industries Ltd. Afterpay Touch Group Limited . Blackmores Limited . AGL Energy Limited . Blue Sky Alternative Investments Ltd. Alacer Gold Corp. Bluescope Steel Limited . ALS Ltd. Boral Limited . Altium Limited . Brambles Limited . Altura Mining Ltd. Bravura Solutions Limited . Alumina Ltd. Breville Group Limited . AMA Group Ltd. Brickworks Ltd. amaysim Australia Ltd. Bubs Australia Ltd. Amcor Plc . BWX Ltd. AMP Ltd. Caltex Australia Ltd. Ansell Limited . Cardno Limited . APA Group . Carnarvon Petroleum Limited . APN Industria REIT . Carsales.Com Limited . Appen Ltd. Cedar Woods Properties Limited . ARB Corp. Ltd. Centuria Capital Group . Ardent Leisure Group Ltd. Challenger Limited . Arena REIT . Champion Iron Ltd. Aristocrat Leisure Limited . Charter Hall Group . Arq Group Ltd. Charter Hall Long WALE REIT . Asaleo Care Ltd. Charter Hall Retail REIT . ASX Limited . Chorus Ltd. Atlas Arteria . CIMIC Group Ltd. AUB Group Limited . Class Ltd. (Australia) . Auckland International Airport Ltd. Clean Teq Holdings Limited . Audinate Group Ltd. Cleanaway Waste Management Ltd. Aurelia Metals Limited . Clinuvel Pharmaceuticals Limited . Aurizon Holdings Ltd. Coca-Cola Amatil Ltd. AusNet Services Ltd. Cochlear Limited . Austal Limited . Codan Limited . Australia & New Zealand Banking Group . Coles Group Ltd. Ltd. Collins Foods Limited . Australian Agricultural Co. Ltd. Commonwealth Bank of Australia . Australian Pharmaceutical Industries Ltd. Computershare Limited . Australian Scholarships Group . Cooper Energy Limited . Automotive Holdings Group Ltd. Coopers Brewery Ltd . Avanti Finance Limited . Corporate Travel Management Limited . Aventus Group . Costa Group Holdings Ltd. Aveo Group . Credit Corp. Group Ltd. Avita Medical Ltd. Cromwell Property Group . Baby Bunting Group Ltd. -

January 2017

` An overview of securities class action settlements, opt-in litigations and disbursements alongside illustrative indices covering both new cases and historical settlements. January 2017 www.issgovernance.com © 2016 ISS | Institutional Shareholder Services In this Issue: SPOTLIGHT ..................................................................................................................................................... 3 THIRD-PARTY CLASS ACTIONS CONTENT ......................................................................................................... 4 UPCOMING SETTLEMENTS.............................................................................................................................. 5 OPT-IN NON-NORTH AMERICAN LITIGATIONS ................................................................................................. 6 DISBURSEMENTS............................................................................................................................................ 7 MARKET DATA (OCTOBER 2015 – NOVEMBER 2016) ...................................................................................... 8 RESOURCES.................................................................................................................................................. 11 THE RECOVERMAX ADVANTAGE ................................................................................................................... 12 © 2017 ISS | Institutional Shareholder Services 2 of 12 SPOTLIGHT Australia as a Growing Hub of Litigations -

Adelaide Brighton Ltd ACN 007 596 018

Level 1 Telephone (08) 8223 8000 157 Grenfell Street International +618 8223 8000 Adelaide SA 5000 Facsimile (08) 8215 0030 GPO Box 2155 www.adbri.com.au Adelaide SA 5001 Adelaide Brighton Ltd ACN 007 596 018 21 April 2016 The Manager ASX Market Announcements Australian Securities Exchange Limited Exchange Centre 20 Bridge Street SYDNEY NSW 2000 Dear Sir/Madam We attach the 2015 Adelaide Brighton Ltd Annual Report which will be dispatched to shareholders today. Yours faithfully Marcus Clayton Company Secretary Adelaide Brighton Ltd Annual Report 2015 Company profile Adelaide Brighton is a leading integrated construction materials 1 Performance summary and industrial lime producer which supplies a range of products 2 Chairman’s report into building, construction, infrastructure and mineral processing 4 Managing Director and Chief Executive Officer review markets throughout Australia. The Company’s principal activities 8 Finance report include the production, importation, distribution and marketing 10 Map of operations of clinker, cement, industrial lime, premixed concrete, construction 11 Review of operations aggregates and concrete products. Adelaide Brighton originated 12 Cement and Lime in 1882 and is now an S&P/ASX100 company with 1,400 employees 14 Concrete and Aggregates and operations in all Australian states and territories. 16 Concrete Products 18 Joint ventures Cement 19 Sustainability Adelaide Brighton is the second largest supplier of cement and 20 Sustainability report clinker products in Australia with major production facilities and 25 People, health and safety market leading positions in the resource rich states of South 28 Directors Australia and Western Australia. It is also market leader in the 30 Diversity report Northern Territory. -

Issue 183 Western Australian Index a Review of Western Australian Listed Companies on the Australian Securities Exchange

Issue 183 Western Australian Index A review of Western Australian listed companies on the Australian Securities Exchange March, 2019 00 WA’s top 100 listed companies WA’s top 100 listed companies – at 28 February 2019 This Last ASX Company Mkt Cap Mkt Cap Last High Low EPS Month Month 28 Feb 19 31 Jan 19 Price Price Price (PoAb) (mth) (yr) (yr) 1 1 WES Wesfarmers Limited 37,620.81 36,520.99 33.18 52.77 30.40 4.89 2 2 WPL Woodside Petroleum Ltd. 33,935.49 32,128.72 36.25 39.38 28.41 1.48 3 3 S32 South32 Limited 19,609.60 17,828.61 3.91 4.28 3.00 0.28 4 4 FMG Fortescue Metals Group Limited 18,649.37 17,389.21 6.06 6.83 3.52 0.27 5 5 NST Northern Star Resources Limited 5,914.96 5,608.02 9.25 9.97 6.08 0.32 6 6 ILU Iluka Resources Ltd. 3,867.17 3,674.63 9.17 12.20 7.02 0.72 7 10 IGO Independence Group NL 2,881.53 2,586.29 4.88 5.74 3.56 0.09 8 7 MIN Mineral Resources Ltd 2,818.16 2,968.84 15.05 20.70 12.39 0.65 9 9 RRL Regis Resources Limited 2,711.78 2,640.06 5.34 5.82 3.65 0.33 10 11 BWP BWP Trust 2,376.82 2,338.28 3.70 3.83 2.91 0.25 11 8 SAR Saracen Mineral Holdings Limited 2,124.50 2,764.32 2.59 3.47 1.62 0.09 12 12 NVT Navitas Limited 2,020.54 2,016.95 5.64 5.68 3.87 (0.17) 13 13 MND Monadelphous Group Limited 1,676.81 1,390.70 17.81 18.18 12.51 0.69 14 14 PLS Pilbara Minerals Limited 1,299.66 1,133.93 0.75 1.13 0.57 (0.01) 15 17 ASL Ausdrill Ltd. -

Gresham Mining & Infrastructure Services Quarterly

Gresham Mining & Infrastructure Services Quarterly We are pleased to present Edition 24 of the Gresham Mining and Infrastructure Services Quarterly (GMISQ), a snapshot of the performance, news and trends across the resources and infrastructure services sectors. The Gresham Mining and Infrastructure Services Index (GMISI) fell 6% during the September quarter, compared to a 2% increase in the broader equity market. This was driven by share prices decreases from several of the largest companies in the index, including a 30% decline in CIMIC’s price. Excluding the 5 largest constituents, the GMISI would have increased by 3%, with 33 of the 50 companies seeing share price appreciation. In this edition we review the FY19 reporting season across the sector, which was characterised by generally strong performance. Around two thirds of participants recorded double digit revenue and earnings growth, with companies exposed to mining production well represented in the top half of the group. The outlook also remains positive, evidenced by most companies providing outlook statements guiding towards continued growth in FY20, and favourable demand noted across both resources and infrastructure. This is consistent with significant contract award activity observed during in the quarter, and median consensus forecast revenue growth of 10% pa over the next two years. Despite the positive FY19 reporting season, the market reaction was mixed across the sector, reflecting high expectations heading into results. Valuation multiples have generally strengthened slightly, driven by increasing share prices across the majority of smaller constituents. The median FY20 PE and EV/EBIT ratios sit at 12.4x and 8.2x respectively, both above long term averages. -

Remuneration Report (Australasia) Participating Organisations | October 2019 Proprietary and Confidential

Remuneration Report (Australasia) Participating organisations | October 2019 Proprietary and Confidential Participating organisations 1. Aeris Resources Limited 37. Karara Mining Ltd 2. Alcoa of Australia Limited 38. Kirkland Lake Gold 3. Alkane Resources Limited 39. Macmahon Holdings Limited 4. AngloGold Ashanti Australasia 40. Metals X Limited Limited 41. Mid West Ports Authority 5. Aurelia Metals Ltd 42. Millennium Minerals Limited 6. Beatons Creek Gold Pty Ltd 43. Mineral Resources Limited 7. BGC Contracting Pty Ltd 44. Minjar Gold Pty Ltd 8. BHP Group Limited 45. Minotaur Exploration Limited 9. Billabong Gold Pty Ltd 46. Mitsui & Co. (Australia) Ltd 10. Bis Industries 47. MMG Limited 11. Breaker Resources NL* 48. Mount Isa Mines Ltd 12. Byrnecut Australia Pty Ltd 49. Nautilus Minerals Inc 13. Calibre Group Ltd 50. Newcrest 14. Capricorn Copper Pty Ltd 51. Newmont Australia 15. Carey Mining 52. Northern Star Resources Limited 16. Castlemaine Goldfields Limited 53. Northparkes Mines 17. CBH Resources Limited 54. Norton Gold Fields Limited 18. CBH Resources Operations 55. NRW Pty Ltd 19. Centrex Metals Limited 56. NT Mining Operations Pty Ltd 20. CITIC Pacific Mining Management (Kirkland Gold) Pty Ltd 57. OceanaGold Corporation 21. Cobar Management Pty Ltd 58. Oz Minerals Limited 22. Copper Mines of Tasmania 59. Pacifico Minerals 23. Covalent Lithium Pty Ltd 60. PanAust Limited 24. Downer EDI Mining Pty Ltd 61. Panoramic Resources 25. Evolution Mining Limited 62. Perenti Group 26. Fortescue Metals Group Ltd 63. Perilya Limited 27. Glencore Australia Holdings 64. Pilbara Minerals Limited 28. Global Advanced Metals Pty Ltd 65. PT Agincourt Resources 29. Gold Fields Australia Pty Ltd 66. -

New Era, New Opportunities for Coal (But You’Re Gonna Have to Fight for Them!)

Central Highlands Development Corporation Turning the corner in coal Emerald, 25 July 2014 New era, new opportunities for coal (but you’re gonna have to fight for them!) Michael Roche Chief Executive Who is the Queensland Resources Council? > The Queensland Resources Council (QRC) is a not-for-profit peak industry association representing the commercial developers of Queensland’s minerals and energy resources > 81 full members – explorers, miners, mineral processors, site contractors, oil and gas producers, electricity generators > 169 service members - providers of goods or services to the sector > Building a network of regional partners around the state, including CHDC Aberdare Collieries Civil Mining and Construction Kalimati Coal Company Rockland Resources Adani Mining Coalbank Leighton Contractors Santos/TOGA 81 Allegiance Coal Cockatoo Coal Linc Energy Senex Energy full Altona Mining ConocoPhillips Australia Lucas Group Shell Development (Australia) Anglo American Downer EDI Mining Macmahon Holdings Sibelco Australia members Anglo American Exploration Eagle Downs Coal Management Mastermyne Sojitz Coal Mining Aquila Resources Ensham Resources Metallica Minerals Stanmore Coal Areva Resources Australia ERM Power MetroCoal Summit Resources Arrow Energy Evolution Mining Millmerran Power Management Thiess 169 Bandanna Energy Exco Resources Minerals and Metals Group U & D Mining Industry service (Australia) Beach Energy Glencore Coal Mitsubishi Development Vale members Bengal Coal Glencore Copper New Hope Group Valiant Resources BHP Billiton -

Oz Minerals Annual Report 2009 Oz Minerals Limited Abn 40 005 482 824 Oz Minerals Annual Report 2009 Contents

OZ MINERALS ANNUAL REPORT 2009 OZ MINERALS LIMITED ABN 40 005 482 824 OZ MINERALS ANNUAL REPORT 2009 ANNUAL REPORT CONTENTS 1 Results for announcement to the market 2 Chairman’s letter 4 Managing Director & CEO’s letter 6 Corporate Governance 13 Directors’ report 27 Remuneration Overview 29 Remuneration Report 47 Auditor’s Independence Declaration 48 Consolidated income statements 49 Consolidated statements of comprehensive income 50 Consolidated statements of changes in equity 52 Consolidated balance sheets 53 Consolidated statements of cash flows 54 Notes to the financial statements 119 Directors’ declaration 120 Independent audit report 122 Shareholder information 124 Contact details RESULTS FOR ANNOUNCEMENT TO THE MARKET The key information for the consolidated entity is set out below: 12 months 12 months Movement Movement ended ended $m % 31 December 31 December Consolidated entity results 2009 2008 Revenue from continuing operations – A$m 608.5 – 608.5 n.a. Revenue from discontinued operations – A$m 764.9 1,218.4 (453.5) (37%) Consolidated revenue – A$m 1,373.4 1,218.4 155.0 13% (Loss) after tax attributable to equity holders of OZ Minerals Limited – A$m (517.3) (2,501.7) 1,984.4 (79%) Net tangible assets per share – cents 82.2 103.3 Dividends paid on: Cents per share Record date 29 September 2008 – 156.1 5.0 3 September 2008 9 April 2008 – 61.8 4.0 19 March 2008 Since there are no retained earnings or profit for 2009, the Directors do not propose to pay any dividends for the year ended 31 December 2009. -

Seagate Crystal Reports

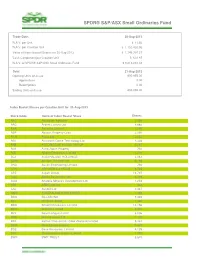

SPDR® S&P/ASX Small Ordinaries Fund Trade Date: 20-Aug-2013 1N.A.V. per Unit $ 11.50 2N.A.V. per Creation Unit $ 1,150,430.96 Value of Index Basket Shares for 20-Aug-2013 $ 1,149,797.51 3Cash Component per Creation Unit $ 633.45 4N.A.V. of SPDR® S&P/ASX Small Ordinaries Fund $ 9,213,283.88 Date: 21-Aug-2013 Opening Units on Issue 800,855.00 Applications 0.00 Redemptions 0.00 5Ending Units on Issue 800,855.00 Index Basket Shares per Creation Unit for 21-Aug-2013 Stock Code Name of Index Basket Share Shares AAC Australian Agricultu 3,058 AAD Ardent Leisure Ltd 4,883 AAX Ausenco Limited 1,279 ABP Abacus Property Grou 3,250 ACR Acrux Ltd 2,062 AGI Ainsworth Game Technology Ltd 1,338 AHE AUTOMOTIVE HLDGS GROUP 2,167 AJA Astro Japan Property 793 ALK Alkane Resources Limited 3,734 ALZ AUSTRALAND HOLDINGS 3,063 AMM Amcom Telecom Ltd 2,168 ANG Austin Engineering Limited 790 APN APN NEWS & MEDIA 6,725 APZ Aspen Group 16,797 AQA Aquila Resources Lim 2,499 AQG Anatolia Minerals Development Ltd 1,259 ARP ARB Corp Ltd 832 ASL Ausdrill Ltd 3,467 AWE AUSTRALIAN WORLDWIDE 7,429 BBG BILLABONG 5,485 BCI BC Iron Limited 1,060 BDR Beadell Resources Limited 10,156 BKN Bradken Limited 2,073 BLY Boart Longyear Limit 6,006 BRG Breville Group Ltd 1,105 BRL Bathurst Resources (New Zealand) Limited 9,434 BRU Buru Energy Limited 2,615 BSE Base Resources Limited 6,128 BTR Blackthorn Resources Limited 1,973 BWP BWP TRUST 5,573 SPDR® S&P/ASX Small Ordinaries Fund Stock Code Name of Index Basket Share Shares CAB Cabcharge Australia 1,458 CCP Credit Corp Group Limited 559 CCV Cash Converters International 3,779 CDA Codan Limited 1,288 CDD CARDNO 1,760 CDI Challenger Diversified Property Group 1,648 CDU Cudeco Limited 2,035 CHC Charter Hall Group 2,787 CLO Clough Ltd 3,346 CMW Cromwell Property Group 14,906 CNU Chorus Ltd. -

B93b0392-755A-11Eb-9704-Be4e50b181d4.Pdf

CONDENSED CONSOLIDATED INTERIM FINANCIAL REPORT For the six months ended 31 December 2020 Contents Directors’ report 3 Lead auditor’s independence declaration 7 Independent auditor’s review report 8 Directors’ declaration 10 Condensed consolidated statement of profit or loss and other comprehensive income 11 Condensed consolidated statement of financial position 12 Condensed consolidated statement of changes in equity 13 Condensed consolidated statement of cash flows 14 Notes to the condensed consolidated interim financial statements 15 Corporate directory 23 2 DIRECTORS’ REPORT For the six months ended 31 December 2020 The Directors present their report, together with the condensed consolidated interim financial statements, of Macmahon Holdings Limited and its controlled entities (the Group or Macmahon) for the six months ended 31 December 2020 including the review report thereon. DIRECTORS The Directors of the Company at any time during or since the end of the interim period are: E Skira (Non-Executive Chair) A Ramlie (Non-Executive Director) A Sidarto (Non-Executive Director) V Vella (Non-Executive Director) B Munro (Non-Executive Director) H Tyrwhitt (Non-Executive Director) M Finnegan (Managing Director and Chief Executive Officer) PRINCIPAL ACTIVITIES Macmahon is an ASX listed company that has been offering mining and construction services to clients for more than 55 years. We seek to develop strong relationships with our clients in which both parties can work together in an open, flexible and transparent way. Our approach to doing business, together with our capabilities in surface and underground mining, civil design and construction, performance enhancement, and mine site maintenance and rehabilitation services, has established Macmahon as a trusted partner on resources projects throughout Australia and internationally. -

Australia's Identified 2002 M I N E R a L 2002 Resources

AIMR_2002_layout 10/22/02 1:18 PM Page 1 GEOSCIENCE AUSTRALIA AUSTRALIA’S IDENTIFIED 2002 MINERAL 2002 RESOURCES 2002 2AUSTRALIA’S0 IDENTIFIED MINERAL0 RESOURCES2 AIMR_2002_layout 10/22/02 1:18 PM Page 3 AUSTRALIA’S IDENTIFIED MINERAL RESOURCES Geoscience Australia Industry, Tourism & Resources Portfolio Minister for Industry, Tourism & Resources: The Hon. Ian Macfarlane, MP. Parliamentary Secretary: The Hon. Warren Entsch, MP Geoscience Australia* Chief Executive Officer: Dr Neil Williams © Commonwealth of Australia 2002 This work is copyright. Apart from any fair dealings for the purposes of study, research, criticism, or review, as permitted under the Copyright Act 1968, no part may be reproduced by any process without written permission. Copyright is the responsibility of the Chief Executive Officer, Geoscience Australia. Requests and enquiries should be directed to the Chief Executive Officer, Geoscience Australia, GPO Box 378, Canberra, ACT 2601. ABN: 80 091 799 039. Geoscience Australia has tried to make the information in this product as accurate as possible. However, it does not guarantee that the information is totally accurate or complete. THEREFORE, YOU SHOULD NOT RELY SOLELY ON THIS INFORMATION WHEN MAKING COMMERCIAL DECISIONS. ISSN 1327-1466 Bibliographic reference, Geoscience Australia 2002. Australia’s identified mineral resources 2002. Geoscience Australia, Canberra. Front cover Ranger uranium processing plant, Alligator Rivers region, Kakadu National Park, Northern Territory (Energy Resources of Australia) Design & layout Karin Weiss, Geospatial Applications & Visualisation (GAV), Geoscience Australia * Geoscience Australia grew out of the Bureau of Mineral Resources (BMR) and the Division of National Mapping, both of which were founded soon after World War 2. BMR became the Australian Geological Survey Organisation (AGSO) in 1992, several years after the Division of National Mapping had become the Australian Surveying and Land Information Group (AUSLIG).