India Banks - Q1FY22 Quarterly Preview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

111Th SLBC Meeting

राज्य स्तरीय बℂक셍स 셍मिती,गोवा राज्य State Level Bankers’ Committee, Goa State Agenda & Background Papers of __________________________________ 111th SLBC Meeting WEB MEETING THROUGH MICROSOFT TEAMS th Date : 24 NOVEMBER 2020 Time : 11.30 AM 셍ंयोजकConvener भारतीयस्टेटबℂक State Bank of India िागसदर्शी बℂक मवभाग, SLBC Department थानीय प्रधान कायासलय, Local Head Office, बांद्रा-कुलास 셍ंकुल, Bandra Kurla Complex, िुंबई – ४०००५१, Mumbai – 400051, INDEX Agenda Particulars Page No. Point No. 1 Confirmation of Minutes of 110th SLBC Meeting dated 21.09.2020 2 - 7 2 Position in respect of Action Points of last meeting 8 Review of Financial Inclusion Initiatives, expansion of banking network and 3 Financial Literacy a. Banking scenario of the State 9 b. Details of Business Correspondents / Customer Service Point (BC/CSP) 9 c. List of Unbanked villages 10 d. Review of Financial literacy initiatives by banks (particularly digital 11 financial literacy). e. Status of Financial Inclusion (PMJDY). 11-12 f. Govt Security Schemes (PMSBY PMJJBY and APY) 13-14 4. Expanding and Deepening of Digital Payments Ecosystem 15-17 Review of Credit disbursement by banks 5 a. Review of Performance under ACP 18-23 b. Review of Priority Sector Lending. 24-27 6 Launching of ACP for the year 2021 -22 28 7 Pradhan Mantri MUDRA Yojana (PMMY) 29 a. Progress in Lending for last four quarters b. Position of NPA in Mudra Accounts as on 30.09.2020 8. Doubling farmers’ income by 2022 a. Measures 30 b. Present Position of Lending to Farmers 31 Government Sponsored Schemes 9 a) Review of Government Sponsored Schemes as on 30.09.2020 32 b) Schematic lending, Certificate Cases and Recovery of NPAs 10 The quarterly meetings of Steering Sub Group of SLBC Goa for Sept 2020 33 11 Timely submission of data by Bank, adhering to the schedule of SLBC meeting. -

Bank of Baroda (BANBAR)

Bank of Baroda (BANBAR) CMP: | 67 Target: | 70 (4%) Target Period: 12 months HOLD January 29, 2021 Business momentum positive; NPA concerns loom Bank of Baroda (BoB) reported a good set of numbers on the operating as well as business front compared to the previous quarter. Asset quality deteriorated marginally. However, rising concerns on stress formation Particulars proved to be a dampener. Particulars Amount NII was up 8.7% YoY to | 7749 crore, on the back of improved margins. Market Capitalisation | 31188 Crore Global NIM improved ~7 bps YoY to 2.87%, while QoQ it was largely flat. GNPA (Q3FY21) 63,182 Domestic margins posted healthy expansion of ~11 bps QoQ to 3.07%. NNPA (Q3FY21) 16,668 Other income growth was miniscule at 5.6% YoY to | 2896 crore, on account NIM (Q3FY21) % 2.87% Update Result of 11% YoY decline in fee income. Provisions remained elevated at | 3957 52 week H/L 94/36 crore; up 31.8% QoQ. The bank said Covid related provisions were worth Networth 73,867.0 | 1709 crore. PAT during the quarter was at | 1061 crore, compared to a loss Face value | 2 of | 1407 crore in the previous quarter last year. DII Holding (%) 11.3 Asset quality performance was a slight disappointment though headline FII Holding (%) 4.3 numbers indicate otherwise. GNPA and NNPA (headline) declined 66 bps and 12 bps to 8.48% and 2.39% vs. 9.14% and 2.51% QoQ, respectively. Key Highlights However, on a proforma basis, GNPA, NNPA ratio increased ~30 bps, 69 Proforma GNPA at 9.63%; guidance bps QoQ to 9.63%, 3.36%, respectively. -

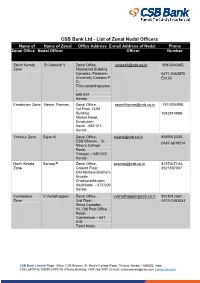

CSB Bank Ltd - List of Zonal Nodal Officers Name of Name of Zonal Office Address E-Mail Address of Nodal Phone Zonal Office Nodal Officer Officer Number

CSB Bank Ltd - List of Zonal Nodal Officers Name of Name of Zonal Office Address E-mail Address of Nodal Phone Zonal Office Nodal Officer Officer Number South Kerala Sri Aneesh V Zonal Office, [email protected] 8943344365, Zone Malankara Building Complex, Palayam, 0471-2463570 University Campus P Ext.33 O, Thiruvananthapuram - 695 034 Kerala Ernakulam Zone Newin Thomas Zonal Office, [email protected] 7510304998, 1st Floor, DJM Building, 7042814998 Market Road, Ernakulam, Kochi - 682 011 Kerala Thrissur Zone Sajan K Zonal Office, [email protected] 8589072330, CSB Bhavan, St 0487-6619214 Mary’s College Road, Thrissur – 680 020 Kerala North Kerala Sanooj P Zonal Office, [email protected] 8157047144, Zone Ground Floor, 8921897007 CM Mathew Brothers Arcade, Chakkorathkulam, Kozhikode – 673 006 Kerala Coimbatore V Varadhappan Zonal Office, [email protected] 9578012367, Zone 2nd Floor, 0422-2383053 Shiva Complex, 54, Old Post Office Road, Coimbatore – 641 018 Tamil Nadu CSB Bank Limited Regd. Office: CSB Bhavan, St. Mary's College Road, Thrissur, Kerala – 680020, India. CIN: L65191KL1920PLC000175 | Phone Banking :1800 266 9090 | E-mail: [email protected] | www.csb.co.in Chennai Zone Saranya R Zonal Office, [email protected] 9942063813 603, Rani Seethai Hall, 044-28294078 Anna Salai, Extn: 22 Chennai – 600 006 Tamil Nadu Western Zone Shoby John Zonal Office, [email protected] 9222104047, Jolly Maker Chambers - 022-22821636 II, 4th Floor, Vinay K Shah Marg, Nariman Point, Mumbai - 400 021 Maharashtra Northern Zone Jagdeep Sharma Zonal Office, [email protected] 9871892299, G- 36, Mezzanine Floor, 011-23733543 Connaught Place, New Delhi -110 001 Deccan Zone Namitha Ponnanna CSB Bank Ltd., Zonal [email protected] 8277093654 Office Unit No. -

Everything on BHIM App for UPI-Based Payments

Everything on BHIM app for UPI-based payments BHIM UPI app - From linking bank accounts to sending payments. BHIM is based on UPI, which is the Universal Payments Interface and thus linked directly to a bank account. The new digital payments app calledBHIM is based on the Unified Payments Interface (UPI). The app is currently available only on Android; so iOS, Windows mobile users etc are left out. BHIM is also supposed to support Aadhaar-based payments, where transactions will bepossible just with a fingerprint impression, but that facility is yet to roll out. What can BHIM app do? BHIM is a digital payments solution app based on Unified Payments Interface (UPI) from the National Payments Corporation of India (NPCI). If you have signed up for UPI based payments on your respective bank account, which is also linked to your mobile number, then you’ll be able to use the BHIM app to conduct digital transactions. BHIM app will let you send and receive money to other non-UPI accounts or addresses. You can also send money via IFSC and MMID code to users, who don’t have a UPI-based bank account. Additionally, there’s the option of scanning a QR code and making a direct payment. Users can create their own QR code for a certain fixed amount of money, and then the merchant can scan it and the deduction will be made. BHIM app is like another mobile wallet? No, BHIM app is not a mobile wallet. In case of mobile wallets like Paytm or MobiKwik you store a limited amount of money on the app, that can only be sent to someone who is using the same wallet. -

Dcb Bank Regional Heads

DCB BANK REGIONAL HEADS Centre Contact Details of the Area of Operation DCB Regional Nodal Office of the Banking Officer Ombudsman Ahmedabad C/o Reserve Bank of India Gujarat, Union Mr. Chetan Bahl La Gajjar Chambers, Territories of Dadra Regional Head Ashram Road, and Nagar Haveli, Retail Banking Ahmedabad-380 009 Daman and Diu 8th Floor, Pariseema STD Code: 079 Annexe Tel.No.26582357/2658671 Opp IFC Bhawan, C.G. 8 Road Fax No.26583325 Ellisbridge, Ahmedabad Email: 380 006 [email protected] Tel: (079) 66052582 Mob: 09227529999 E-mail : [email protected] Bengaluru C/o Reserve Bank of India Karnataka Mr. Rajagopal T K 10/3/8, Nrupathunga Road Regional Head Bengaluru -560 001 Retail Banking (South II) STD Code: 080 Old No 37/1, New No 2/1 Tel.No.22210771/2227562 Jumbulingam Street, 9 Nungambakam, Chennai Fax No.22244047 600 034 Email: Tel: (044) 3072 7607 [email protected] Mobile: 9952209997 Email: [email protected] m Bhopal C/o Reserve Bank of India Madhya Pradesh and Mr. Sunil Girdhar Hoshangabad Road, Chattisgarh Regional Head Post Box No.32, Bhopal- Agri & Inclusive Banking 462 011 1st Floor, Devashish STD Code: 0755 Complex, Tel.No.2573772/2573776 Plot No:-160 , Zone 1 Fax No.2573779 ,M.P.Nagar, Email: Bhopal - 62011 [email protected] Madhya Pradesh Tel: (0755) 4901122 Mob: 8225001362 Email id:[email protected] om Bhubaneswar C/o Reserve Bank of India Odisha Mr. Durga Prasad Rath Pt. Jawaharlal Nehru Marg Regional Head Bhubaneswar-751 001 Agri & Inclusive Banking STD Code: 0674 Laxmisagar, Cuttack Road Tel.No.2396207/2396008 Near Falcon House Fax No. -

ACCUMULATE DCB Bank

Q2FY21 Result Review TP Rs88 Key Stock Data DCB Bank ACCUMULATE CMP Rs77 Bloomberg / Reuters DCBB IN / DCBA.BO Potential upside / downside 14% Sector Banking Asset quality stable; Collection efficiency at 87.5% for LAP Previous Rating HOLD Shares o/s (mn) 310 Summary V/s Consensus Market cap. (Rs mn) 23,938 DCB Bank’s asset quality remains stable on proforma basis with GNPA at 2.39% vs EPS (Rs) FY21E FY22E FY23E Market cap. (US$ mn) 323 2.44% QoQ led by better recoveries. Bank’s credit growth further slowed down to 0.3% IDBI Capital 6.1 7.7 9.9 3-m daily avg Trd value (Rs mn) 143.4 vs 4% (Q1FY21). NII grew by 7% YoY while PAT de-grew by 10% YoY led by higher provisions Consensus 7.3 10.4 14.1 52-week high / low Rs205/58 (up 161% YoY; Rs.480mn for Covid-19 provisions). Cost-to-income ratio on a QoQ basis has % difference (16.9) (26.3) (29.6) Sensex / Nifty 39,614 / 11,642 declined by 300bps to 47.3% on account of decline in staff expenses sequentially. Bank reported collection efficiency for key portfolios – LAP/Home loans/CV loans at 87.5%/91.3%/ Shareholding Pattern (%) Relative to Sensex (%) 77.1% (Sept data) from low of 51.6%/56.9%/30.1% (April data) respectively which is the quite Promoters 14.9 115.0 encouraging. Also, collection efficiency improved further in October month. We introduce FII 14.4 100.0 FY23 estimates in this report. We roll-over to FY23E and change our rating to DII 27.0 85.0 ACCUMULATE (earlier HOLD) with new TP of Rs.88 (earlier Rs.85) valuing it at 0.7x Public 43.7 70.0 P/ABV FY23. -

DCB Bank Online

LEVERAGING VIRTUALIZATION TO POWER GRASS-ROOT BANKING India Customer Showcase | 2019 DCB BANK LIMITED INDUSTRY BANKING, FINANCIAL SERVICES, AND INSURANCE HEADQUARTERS MUMBAI, MAHARASHTRA “VMware’s technology has enabled DCB Bank IT to extend its capability in helping Key Challenges and accelerating the Bank’s business objectives. Having the agility to provision IT • IT infrastructure reliant on physical servers and legacy processes • Underutilization of resources and high operational cost services quickly, automation of data synchronization between DC and DR through • DR manual process a software-defined datacenter is crucial. DCB Bank is evolving with the time to • Provisioning of new resources deliver next-generation banking services.” Abhijit Shah, VMware Solutions Chief Technology Officer, • VMware vSphere® DCB Bank Limited • VMware vRealize® Operations™ • VMware Site Recovery Manager™ Customer Profile DCB Bank is a new generation private sector bank with 323 branches across 19 states and 3 union territories. It is a Business Benefits scheduled commercial bank regulated by the Reserve Bank of India. DCB Bank’s business segments are Retail, Datacenter consolidation leading to cost Automated data synchronization between micro-SME, SME, mid-Corporate, Agriculture, Commodities, Government, Public Sector, Indian Banks, Co-operative savings from lower power consumption DC and DR Banks and Non-Banking Finance Companies (NBFC). DCB Bank has approximately 6,00,000 customers. and freeing up of real-estate space Reduce RPO and RTO by 80% The Challenge Better resource utilization by leveraging DCB Bank’s legacy physical IT infrastructure was faced with challenges associated with gradual obsolescence, insights on IT infrastructure utilization optimum utilization of resources, managing cost of procurement, maintenance and lower downtime for systems. -

Banks Doing Salary Transactions Through Wage

BANKS DOING SALARY TRANSACTIONS THROUGH WAGE PROTECTION SYSTEM Sl No Name of Bank Rating . 1 For WPS Queries Related to State Bank of India : 8921303221 (Jithin),9496096832(Anju Mohan) 2 For WPS Queries Related to Union Bank Pls Contact : 9495590075 (Nidhin) 3 For WPS Queries Related to Federal Bank: 0484-2412125,9746094636(Sita S) 4 For WPS Queries Related to South Indian Bank Pls Contact : 8547389016 (Deepthi),9446373267(Premjith) 5 For WPS Queries Related to ICICI Bank: 9846339935 (Renjith Das) 6 For WPS Queries Related to Canara Bank Pls Contact :8281991598,0471-2471222(Shini) 7 For WPS Queries Related to Dhanlaxmi Bank: 09539003879 ,0487 6617207/211 (Gireesh Nair P) 8 For WPS Queries Related to IDBI Bank: 9047080044,0471-2321168,69 (Manoj A) 8 For WPS Queries Related to Punjab National Bank: 8882345254, 0484-2384625 (Anish) 10 For WPS Queries Related to Andhra Bank: 9912659777(Ashish), 9700835875(Rakesh) 11 For WPS Queries Related to AXIS Bank: 8589008686(Dhanya R); 9847998098(Vivek Sarathy) 12 For WPS Queries Related to CSB Bank: 9620237305,0487-6619283 (Sanilkumar) 13 For WPS Queries Related to HDFC Bank Pls Contact : 9388 302 673 (Sandeepkumar) 14 For WPS Queries Related to Indian Bank Pls Contact : 9446534258 (Ramesh) 15 For WPS Queries Related to Central Bank of India: 4712471294 16 For WPS Queries Related to Bank of India Pls Contact : 8891003310 (Gayathri.J.) 17 For WPS Queries Related to UCO Bank Pls Contact : 0484 2788608 (Unnikrishnan, Manager) 18 For WPS Queries Related to Corporation Bank Pls Contact : 0471-2338260,9446451958(Juny Sam) 19 20 For WPS Queries Related to Indian Overseas Bank Pls Contact : 0471-2461397(Nithin) 21 For WPS Queries Related to IndusInd Bank Pls Contact :9840871992(Mathavan C) 22 23 Note:- *Support Person details of some banks are not included in this document as that are not provided by the bank. -

List-Of-Public-Sector-Banks-In-India

1 List of Public Sector Banks in India Anchor Bank Merged Bank Established Headquarter Vijaya Bank Bank of Baroda 1908 Vadodara, Gujarat Dena Bank Bank of India 1906 Mumbai, Maharashtra Bank of Maharashtra 1935 Pune Maharashtra Canara Bank Syndicate Bank 1906 Bengaluru, Karnataka Central Bank of India 1911 Mumbai, Maharashtra Indian Bank Allahabad Bank 1907 Chennai, Tamil Nadu Indian Overseas Bank 1937 Chennai, Tamil Nadu Punjab & Sind Bank 1908 New Delhi, Delhi Oriental Bank of Commerce Punjab National Bank 1894 New Delhi, Delhi United Bank of India State Bank of Bikaner & Jaipur State Bank of Hyderabad State Bank of Indore State Bank of India 1955 Mumbai, Maharashtra State Bank of Mysore State Bank of Patiala State Bank of Travancore Bhartiya Mahila Bank UCO Bank 1943 Kolkata, West Bengal Andhra Bank Union Bank of India 1919 Mumbai, Maharashtra Corporation Bank List of Private Sector Banks in India Bank Name Established Headquarters HDFC Bank 1994 Mumbai, Maharashtra Axis Bank 1993 Mumbai, Maharashtra Bandhan Bank 2015 Kolkata, West Bengal CSB Bank 1920 Thrissur, Kerala City Union Bank 1904 Thanjavur, Tamil Nadu DCB Bank 1930 Mumbai, Maharashtra Dhanlaxmi Bank 1927 Thrissur, Kerala Federal Bank 1931 Aluva, Kerala 2 Bank Name Established Headquarters ICICI Bank 1994 Mumbai, Maharashtra IDBI Bank 1964 Mumbai, Maharashtra IDFC First Bank 2015 Mumbai, Maharashtra IndusInd Bank 1994 Mumbai, Maharashtra Jammu & Kashmir Bank 1938 Srinagar, Jammu and Kashmir Karnataka Bank 1924 Mangaluru, Karnataka Karur Vysya Bank 1916 Karur, Tamil Nadu Kotak -

DCB Bank (DCB)

DCB Bank (DCB) CMP: | 95 Target: |100 (5%) Target Period: 12 months HOLD August 9, 2021 Slippages elevated, overall recovery to remain gradual About the stock: DCB Bank is a new generation private sector bank offering a comprehensive range of financial products and has a niche in mortgage lending. Particulars Mortgage forms 43% of total loans while SME contributes 10% P articular Am ount The bank has 354 branches, 402 ATMs across 19 states, three UTs in India Market Capitalisation |2987 52 week H/L 126/74 Networth | 3793 Crore F ace value | 10 Update Result Q1FY22 Results: DCB’s PAT was marred by high credit cost and a tepid topline. Shareholding Pattern NII growth flattish YoY at | 309 crore; NIMs fell 15 bps QoQ to 3.31% (in %) June-20 S ep-20 Dec-20 Mar-21 Jun-21 C/I ratio down 81 bps QoQ to 53.1%; provisions elevated at | 155.5 crore P romoter 14.9 14.9 14.9 14.9 14.9 GNPA up 78 bps QoQ to 4.87%, restructured book up ~170 bps at 5.4% F II 15.1 14.4 13.8 13.0 12.2 DII 35.9 37.7 39.0 40.5 38.5 Loans up 1.7% YoY at | 25496 crore; deposits up 4% YoY at | 30602 crore O thers 34.1 33.0 32.4 31.6 34.4 Price Chart What should investors do? DCB’s share price has given ~20% returns over the 300 20000 250 past year. We believe business growth could pick up pace, going ahead. -

DCB Bank Regional Heads

DCB Bank Regional Heads Sr. No. Region Contact Details - Regional Heads Sates 1 Mumbai South Mr. Debashis Das Maharashtra Regional Head Retail Banking 9/Samrat, 314/Lady Jamshedji Road Opp. Vijay Sales Mahim (W), Mumbai 400016 Tel: (022) 6599 2132/ 65992133/ 65268542 (D) Fax: (022) 24326950 Mob: 9819152557 E-mail: [email protected] 2 Mumbai North Mr. Ayon Dutta Gupta Maharashtra Regional Head Retail Banking Shop 1 to 4, Ground Floor, Madhuban CHSL, Next to AKB Baug, Andheri West, Mumbai 400061 Tel: (022) 6599 2106/ 2108 Fax: (022) 26393915 Mob: 9820549608 E-mail: [email protected] 3 Maharashtra, Goa and Mr. Ayon Dutta Gupta Maharashtra, Goa and Madhya Madhya Pradesh Regional Head Retail Pradesh Banking Shop 1 to 4, Ground Floor, Madhuban CHSL, Next to AKB Baug, Andheri West, Mumbai 400061 Tel: (022) 6599 2106/ 2108 Fax: (022) 26393915 Mob: 9820549608 E-mail: [email protected] 4 Gujarat and Eastern Mr. Chetan Bahl Gujarat, Union Territories of Dadra India Regional Head Retail and Nagar Haveli, Daman and Diu, Banking 8th Floor, West Bengal and Sikkim Pariseema Annexe Opp IFC Bhawan, C.G. Road Ellisbridge, Ahmedabad 380 006 Tel: (079) 66052582 Mob: 09227529999 E-mail : [email protected] 5 South Mr. Alok Kapur Andhra Pradesh and Telangana Regional Head Retail Banking (South I) 9-1-125/1 Sidharth Plaza 44, Sarojini Devi Road Secunderabad 500 003 Tel: (040) 66143831 Fax: (040) 66143809 Mobile: 090000 09910 Email: [email protected] 6 South Mr. Rajagopal T K Regional Karnataka, Kerala and Tamil Nadu Head Retail Banking (South II) Old No 37/1, New No 2/1 Jumbulingam Street, Nungambakam, Chennai 600 034 Tel: (044) 3072 7607 Mobile: 9952209997 Email: [email protected] 7 North Mr. -

DCB Bank Announces Fourth Quarter Results FY2020 21 Mumbai May 08

Press Release for Immediate Circulation DCB Bank announces Full Year FY 2021 Results May 08, 2021, Mumbai: The Board of Directors of DCB Bank Ltd. (BSE: 532772; NSE: DCB) at its meeting in Mumbai on May 08, 2021, took on record the audited financial results of the Fourth Quarter (Q4 FY 2021) and the Year ended March 31, 2021 (FY 2021). Highlights: 1) Profit After Tax The Bank’s Profit After Tax was at INR 336 Cr. in FY 2021 as against INR 338 Cr. in FY 2020. 2) Operating Profit The Operating Profit for FY 2021 was INR 898 Cr. as against INR 753 Cr. for the same period to last year, an increase of 19%. 3) Net Interest Income The Bank earned Net Interest Income of INR 1,287 Cr. as against INR 1,265 Cr. for the same period last year, an increase of 2%. In Q4 FY 2021, the Bank derecognised Interest of INR 37 Cr. on account of NPA recognition post Honorable Supreme Court Order dated March 23, 2021. The Bank has created a liability of INR 10 Cr. towards interest on interest payable to eligible customers as per Honorable Supreme Court Order and reduced the same from the Interest Income. 4) Non-Interest Income Non-Interest Income of INR 458 Cr. as against INR 391 Cr. for the same period as last year, an increase of 17%. The Bank benefited from one-time treasury gain in FY 2021 on account of Interest Rate movements. 5) Cost Income Ratio Cost Income Ratio for FY 2021 was at 48.51% as compared to 54.53% in FY 2020.