About DCB A4

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Bank of Baroda (BANBAR)

Bank of Baroda (BANBAR) CMP: | 67 Target: | 70 (4%) Target Period: 12 months HOLD January 29, 2021 Business momentum positive; NPA concerns loom Bank of Baroda (BoB) reported a good set of numbers on the operating as well as business front compared to the previous quarter. Asset quality deteriorated marginally. However, rising concerns on stress formation Particulars proved to be a dampener. Particulars Amount NII was up 8.7% YoY to | 7749 crore, on the back of improved margins. Market Capitalisation | 31188 Crore Global NIM improved ~7 bps YoY to 2.87%, while QoQ it was largely flat. GNPA (Q3FY21) 63,182 Domestic margins posted healthy expansion of ~11 bps QoQ to 3.07%. NNPA (Q3FY21) 16,668 Other income growth was miniscule at 5.6% YoY to | 2896 crore, on account NIM (Q3FY21) % 2.87% Update Result of 11% YoY decline in fee income. Provisions remained elevated at | 3957 52 week H/L 94/36 crore; up 31.8% QoQ. The bank said Covid related provisions were worth Networth 73,867.0 | 1709 crore. PAT during the quarter was at | 1061 crore, compared to a loss Face value | 2 of | 1407 crore in the previous quarter last year. DII Holding (%) 11.3 Asset quality performance was a slight disappointment though headline FII Holding (%) 4.3 numbers indicate otherwise. GNPA and NNPA (headline) declined 66 bps and 12 bps to 8.48% and 2.39% vs. 9.14% and 2.51% QoQ, respectively. Key Highlights However, on a proforma basis, GNPA, NNPA ratio increased ~30 bps, 69 Proforma GNPA at 9.63%; guidance bps QoQ to 9.63%, 3.36%, respectively. -

Everything on BHIM App for UPI-Based Payments

Everything on BHIM app for UPI-based payments BHIM UPI app - From linking bank accounts to sending payments. BHIM is based on UPI, which is the Universal Payments Interface and thus linked directly to a bank account. The new digital payments app calledBHIM is based on the Unified Payments Interface (UPI). The app is currently available only on Android; so iOS, Windows mobile users etc are left out. BHIM is also supposed to support Aadhaar-based payments, where transactions will bepossible just with a fingerprint impression, but that facility is yet to roll out. What can BHIM app do? BHIM is a digital payments solution app based on Unified Payments Interface (UPI) from the National Payments Corporation of India (NPCI). If you have signed up for UPI based payments on your respective bank account, which is also linked to your mobile number, then you’ll be able to use the BHIM app to conduct digital transactions. BHIM app will let you send and receive money to other non-UPI accounts or addresses. You can also send money via IFSC and MMID code to users, who don’t have a UPI-based bank account. Additionally, there’s the option of scanning a QR code and making a direct payment. Users can create their own QR code for a certain fixed amount of money, and then the merchant can scan it and the deduction will be made. BHIM app is like another mobile wallet? No, BHIM app is not a mobile wallet. In case of mobile wallets like Paytm or MobiKwik you store a limited amount of money on the app, that can only be sent to someone who is using the same wallet. -

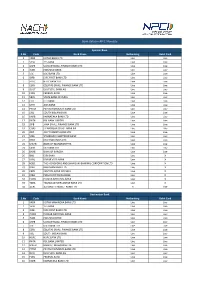

Dcb Bank Regional Heads

DCB BANK REGIONAL HEADS Centre Contact Details of the Area of Operation DCB Regional Nodal Office of the Banking Officer Ombudsman Ahmedabad C/o Reserve Bank of India Gujarat, Union Mr. Chetan Bahl La Gajjar Chambers, Territories of Dadra Regional Head Ashram Road, and Nagar Haveli, Retail Banking Ahmedabad-380 009 Daman and Diu 8th Floor, Pariseema STD Code: 079 Annexe Tel.No.26582357/2658671 Opp IFC Bhawan, C.G. 8 Road Fax No.26583325 Ellisbridge, Ahmedabad Email: 380 006 [email protected] Tel: (079) 66052582 Mob: 09227529999 E-mail : [email protected] Bengaluru C/o Reserve Bank of India Karnataka Mr. Rajagopal T K 10/3/8, Nrupathunga Road Regional Head Bengaluru -560 001 Retail Banking (South II) STD Code: 080 Old No 37/1, New No 2/1 Tel.No.22210771/2227562 Jumbulingam Street, 9 Nungambakam, Chennai Fax No.22244047 600 034 Email: Tel: (044) 3072 7607 [email protected] Mobile: 9952209997 Email: [email protected] m Bhopal C/o Reserve Bank of India Madhya Pradesh and Mr. Sunil Girdhar Hoshangabad Road, Chattisgarh Regional Head Post Box No.32, Bhopal- Agri & Inclusive Banking 462 011 1st Floor, Devashish STD Code: 0755 Complex, Tel.No.2573772/2573776 Plot No:-160 , Zone 1 Fax No.2573779 ,M.P.Nagar, Email: Bhopal - 62011 [email protected] Madhya Pradesh Tel: (0755) 4901122 Mob: 8225001362 Email id:[email protected] om Bhubaneswar C/o Reserve Bank of India Odisha Mr. Durga Prasad Rath Pt. Jawaharlal Nehru Marg Regional Head Bhubaneswar-751 001 Agri & Inclusive Banking STD Code: 0674 Laxmisagar, Cuttack Road Tel.No.2396207/2396008 Near Falcon House Fax No. -

ACCUMULATE DCB Bank

Q2FY21 Result Review TP Rs88 Key Stock Data DCB Bank ACCUMULATE CMP Rs77 Bloomberg / Reuters DCBB IN / DCBA.BO Potential upside / downside 14% Sector Banking Asset quality stable; Collection efficiency at 87.5% for LAP Previous Rating HOLD Shares o/s (mn) 310 Summary V/s Consensus Market cap. (Rs mn) 23,938 DCB Bank’s asset quality remains stable on proforma basis with GNPA at 2.39% vs EPS (Rs) FY21E FY22E FY23E Market cap. (US$ mn) 323 2.44% QoQ led by better recoveries. Bank’s credit growth further slowed down to 0.3% IDBI Capital 6.1 7.7 9.9 3-m daily avg Trd value (Rs mn) 143.4 vs 4% (Q1FY21). NII grew by 7% YoY while PAT de-grew by 10% YoY led by higher provisions Consensus 7.3 10.4 14.1 52-week high / low Rs205/58 (up 161% YoY; Rs.480mn for Covid-19 provisions). Cost-to-income ratio on a QoQ basis has % difference (16.9) (26.3) (29.6) Sensex / Nifty 39,614 / 11,642 declined by 300bps to 47.3% on account of decline in staff expenses sequentially. Bank reported collection efficiency for key portfolios – LAP/Home loans/CV loans at 87.5%/91.3%/ Shareholding Pattern (%) Relative to Sensex (%) 77.1% (Sept data) from low of 51.6%/56.9%/30.1% (April data) respectively which is the quite Promoters 14.9 115.0 encouraging. Also, collection efficiency improved further in October month. We introduce FII 14.4 100.0 FY23 estimates in this report. We roll-over to FY23E and change our rating to DII 27.0 85.0 ACCUMULATE (earlier HOLD) with new TP of Rs.88 (earlier Rs.85) valuing it at 0.7x Public 43.7 70.0 P/ABV FY23. -

DCB Bank Online

LEVERAGING VIRTUALIZATION TO POWER GRASS-ROOT BANKING India Customer Showcase | 2019 DCB BANK LIMITED INDUSTRY BANKING, FINANCIAL SERVICES, AND INSURANCE HEADQUARTERS MUMBAI, MAHARASHTRA “VMware’s technology has enabled DCB Bank IT to extend its capability in helping Key Challenges and accelerating the Bank’s business objectives. Having the agility to provision IT • IT infrastructure reliant on physical servers and legacy processes • Underutilization of resources and high operational cost services quickly, automation of data synchronization between DC and DR through • DR manual process a software-defined datacenter is crucial. DCB Bank is evolving with the time to • Provisioning of new resources deliver next-generation banking services.” Abhijit Shah, VMware Solutions Chief Technology Officer, • VMware vSphere® DCB Bank Limited • VMware vRealize® Operations™ • VMware Site Recovery Manager™ Customer Profile DCB Bank is a new generation private sector bank with 323 branches across 19 states and 3 union territories. It is a Business Benefits scheduled commercial bank regulated by the Reserve Bank of India. DCB Bank’s business segments are Retail, Datacenter consolidation leading to cost Automated data synchronization between micro-SME, SME, mid-Corporate, Agriculture, Commodities, Government, Public Sector, Indian Banks, Co-operative savings from lower power consumption DC and DR Banks and Non-Banking Finance Companies (NBFC). DCB Bank has approximately 6,00,000 customers. and freeing up of real-estate space Reduce RPO and RTO by 80% The Challenge Better resource utilization by leveraging DCB Bank’s legacy physical IT infrastructure was faced with challenges associated with gradual obsolescence, insights on IT infrastructure utilization optimum utilization of resources, managing cost of procurement, maintenance and lower downtime for systems. -

DCB Bank (DCB)

DCB Bank (DCB) CMP: | 95 Target: |100 (5%) Target Period: 12 months HOLD August 9, 2021 Slippages elevated, overall recovery to remain gradual About the stock: DCB Bank is a new generation private sector bank offering a comprehensive range of financial products and has a niche in mortgage lending. Particulars Mortgage forms 43% of total loans while SME contributes 10% P articular Am ount The bank has 354 branches, 402 ATMs across 19 states, three UTs in India Market Capitalisation |2987 52 week H/L 126/74 Networth | 3793 Crore F ace value | 10 Update Result Q1FY22 Results: DCB’s PAT was marred by high credit cost and a tepid topline. Shareholding Pattern NII growth flattish YoY at | 309 crore; NIMs fell 15 bps QoQ to 3.31% (in %) June-20 S ep-20 Dec-20 Mar-21 Jun-21 C/I ratio down 81 bps QoQ to 53.1%; provisions elevated at | 155.5 crore P romoter 14.9 14.9 14.9 14.9 14.9 GNPA up 78 bps QoQ to 4.87%, restructured book up ~170 bps at 5.4% F II 15.1 14.4 13.8 13.0 12.2 DII 35.9 37.7 39.0 40.5 38.5 Loans up 1.7% YoY at | 25496 crore; deposits up 4% YoY at | 30602 crore O thers 34.1 33.0 32.4 31.6 34.4 Price Chart What should investors do? DCB’s share price has given ~20% returns over the 300 20000 250 past year. We believe business growth could pick up pace, going ahead. -

DCB Bank Regional Heads

DCB Bank Regional Heads Sr. No. Region Contact Details - Regional Heads Sates 1 Mumbai South Mr. Debashis Das Maharashtra Regional Head Retail Banking 9/Samrat, 314/Lady Jamshedji Road Opp. Vijay Sales Mahim (W), Mumbai 400016 Tel: (022) 6599 2132/ 65992133/ 65268542 (D) Fax: (022) 24326950 Mob: 9819152557 E-mail: [email protected] 2 Mumbai North Mr. Ayon Dutta Gupta Maharashtra Regional Head Retail Banking Shop 1 to 4, Ground Floor, Madhuban CHSL, Next to AKB Baug, Andheri West, Mumbai 400061 Tel: (022) 6599 2106/ 2108 Fax: (022) 26393915 Mob: 9820549608 E-mail: [email protected] 3 Maharashtra, Goa and Mr. Ayon Dutta Gupta Maharashtra, Goa and Madhya Madhya Pradesh Regional Head Retail Pradesh Banking Shop 1 to 4, Ground Floor, Madhuban CHSL, Next to AKB Baug, Andheri West, Mumbai 400061 Tel: (022) 6599 2106/ 2108 Fax: (022) 26393915 Mob: 9820549608 E-mail: [email protected] 4 Gujarat and Eastern Mr. Chetan Bahl Gujarat, Union Territories of Dadra India Regional Head Retail and Nagar Haveli, Daman and Diu, Banking 8th Floor, West Bengal and Sikkim Pariseema Annexe Opp IFC Bhawan, C.G. Road Ellisbridge, Ahmedabad 380 006 Tel: (079) 66052582 Mob: 09227529999 E-mail : [email protected] 5 South Mr. Alok Kapur Andhra Pradesh and Telangana Regional Head Retail Banking (South I) 9-1-125/1 Sidharth Plaza 44, Sarojini Devi Road Secunderabad 500 003 Tel: (040) 66143831 Fax: (040) 66143809 Mobile: 090000 09910 Email: [email protected] 6 South Mr. Rajagopal T K Regional Karnataka, Kerala and Tamil Nadu Head Retail Banking (South II) Old No 37/1, New No 2/1 Jumbulingam Street, Nungambakam, Chennai 600 034 Tel: (044) 3072 7607 Mobile: 9952209997 Email: [email protected] 7 North Mr. -

DCB Bank Announces Fourth Quarter Results FY2020 21 Mumbai May 08

Press Release for Immediate Circulation DCB Bank announces Full Year FY 2021 Results May 08, 2021, Mumbai: The Board of Directors of DCB Bank Ltd. (BSE: 532772; NSE: DCB) at its meeting in Mumbai on May 08, 2021, took on record the audited financial results of the Fourth Quarter (Q4 FY 2021) and the Year ended March 31, 2021 (FY 2021). Highlights: 1) Profit After Tax The Bank’s Profit After Tax was at INR 336 Cr. in FY 2021 as against INR 338 Cr. in FY 2020. 2) Operating Profit The Operating Profit for FY 2021 was INR 898 Cr. as against INR 753 Cr. for the same period to last year, an increase of 19%. 3) Net Interest Income The Bank earned Net Interest Income of INR 1,287 Cr. as against INR 1,265 Cr. for the same period last year, an increase of 2%. In Q4 FY 2021, the Bank derecognised Interest of INR 37 Cr. on account of NPA recognition post Honorable Supreme Court Order dated March 23, 2021. The Bank has created a liability of INR 10 Cr. towards interest on interest payable to eligible customers as per Honorable Supreme Court Order and reduced the same from the Interest Income. 4) Non-Interest Income Non-Interest Income of INR 458 Cr. as against INR 391 Cr. for the same period as last year, an increase of 17%. The Bank benefited from one-time treasury gain in FY 2021 on account of Interest Rate movements. 5) Cost Income Ratio Cost Income Ratio for FY 2021 was at 48.51% as compared to 54.53% in FY 2020. -

Banking Annual DATABASE

bank-datatable-2021-revised.qxd 29/01/2021 07:00 PM Page 2 Banking Annual DATABASE (In ~ crore) FY 2019 FY 2020 % chg (In ~ crore) FY 2019 FY 2020 % chg PRIVATE BANKS FOREIGN BANKS City Union Bank 32,673 33,927 3.8 J P Morgan Chase 13,800 14,683 6.4 CSB Bank 10,615 11,366 7.1 Societe Generale 1,495 1,574 5.3 DCB Bank 23,568 25,345 7.5 Standard Chartered Bank 66,838 76,214 14.0 Dhanlaxmi Bank 6,289 6,496 3.3 Sumitomo Mitsui 6,920 10,920 57.8 Federal Bank 1,10,223 122,268 10.9 HDFC Bank 8,19,401 993,703 21.3 ICICI Bank 5,86,647 645,290 10.0 GROWTH: DEPOSITS IDBI Bank 1,46,790 129,842 -11.5 IDFC First Bank 86,302 85,595 -0.8 PUBLIC SECTOR BANKS IndusInd Bank 1,86,394 206,783 10.9 Bank of Baroda 9,15,159 9,45,984 3.4 Jammu and Kashmir Bank 66,272 64,399 -2.8 Bank of India 5,20,862 5,55,505 6.7 Karnataka Bank 54,828 56,964 3.9 Bank of Maharashtra 1,40,650 1,50,066 6.7 Karur Vysya Bank 48,581 46,098 -5.1 Canara Bank 5,99,033 6,25,351 4.4 Kotak Mahindra Bank 2,05,695 219,748 6.8 Central Bank of India 2,99,855 3,13,763 4.6 Nainital Bank 3,516 3,829 8.9 Indian Bank 2,42,076 2,60,226 7.5 RBL Bank 54,308 58,019 6.8 Indian Overseas Bank 2,22,534 2,22,952 0.2 South Indian Bank 62,694 64,439 2.8 Punjab & Sind Bank 98,558 89,668 -9.0 Tamilnad Mercantile Bank 26,488 27,716 4.6 Punjab National Bank 6,76,030 7,03,846 4.1 Yes Bank 2,41,500 171,443 -29.0 State Bank of India 29,11,386 32,41,621 11.3 UCO Bank 1,97,907 1,93,203 -2.4 SMALL FINANCE BANKS Union Bank of India 4,15,915 4,50,668 8.4 AU Small Finance Bank 22,819 26,992 18.3 Equitas Small Finance Bank -

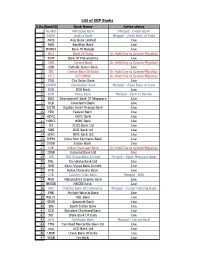

Live Banks in API E-Mandate

Bank status in API E-Mandate Sponsor Bank S.No Code Bank Name Netbanking Debit Card 1 KKBK KOTAK BANK LTD Live Live 2YESB YES BANK Live Live 3 USFB UJJIVAN SMALL FINANCE BANK LTD Live Live 4 INDB INDUSIND BANK Live Live 5 ICIC ICICI BANK LTD Live Live 6 IDFB IDFC FIRST BANK LTD Live Live 7 HDFC HDFC BANK LTD Live Live 8 ESFB EQUITAS SMALL FINANCE BANK LTD Live Live 9 DEUT DEUTSCHE BANK AG Live Live 10FDRL FEDERAL BANK Live Live 11 SBIN STATE BANK OF INDIA Live Live 12CITI CITI BANK Live Live 13UTIB AXIS BANK Live Live 14 PYTM PAYTM PAYMENTS BANK LTD Live Live 15 SIBL SOUTH INDIAN BANK Live Live 16 KARB KARNATAKA BANK LTD Live Live 17 RATN RBL BANK LIMITED Live Live 18 JSFB JANA SMALL FINANCE BANK LTD Live Live 19 CHAS J P MORGAN CHASE BANK NA Live Live 20 JIOP JIO PAYMENTS BANK LTD Live Live 21 SCBL STANDARD CHARTERED BANK Live Live 22 DBSS DBS BANK INDIA LTD Live Live 23 MAHB BANK OF MAHARASHTRA Live Live 24CSBK CSB BANK LTD Live Live 25BARB BANK OF BARODA Live Live 26IBKL IDBI BANK Live X 27KVBL KARUR VYSA BANK Live X 28 HSBC THE HONGKONG AND SHANGHAI BANKING CORPORATION LTD Live X 29BDBL BANDHAN BANK LTD Live X 30 CBIN CENTRAL BANK OF INDIA Live X 31 IOBA INDIAN OVERSEAS BANK Live X 32 PUNB PUNJAB NATIONAL BANK Live X 33 TMBL TAMILNAD MERCANTILE BANK LTD Live X 34 AUBL AU SMALL FINANCE BANK LTD X Live Destination Bank S.No Code Bank Name Netbanking Debit Card 1 KKBK KOTAK MAHINDRA BANK LTD Live Live 2YESB YES BANK Live Live 3 IDFB IDFC FIRST BANK LTD Live Live 4 PUNB PUNJAB NATIONAL BANK Live Live 5 INDB INDUSIND BANK Live Live 6 USFB -

PPFASMFSIP I-SIP Bank List 26.07.2021

List of iSIP Banks S.No BankID Bank Name Active status 1 ALHBD Allahabad Bank Merged - Indian Bank 2 ANDH Andhra Bank Merged - Union Bank of India 3 AXIS Axis Bank Limited Live 4 BDB Bandhan Bank Live 5BOB03 Bank Of Baroda Live 6 BOI Bank Of India On Hold Due to System Migration 7 BOM Bank Of Maharashtra Live 8 CNB Canara Bank On Hold Due to System Migration 9 CSB Catholic Syrian Bank Live 10 CBI Central Bank Of India On Hold Due to System Migration 11 CITI CITI BANK On Hold Due to System Migration 12 CUB City Union Bank Live 13 CORPB Corporation Bank Merged - Union Bank of India 14 DCB DCB Bank Live 15 DEN Dena Bank Merged - Bank of Baroda 16 DBS Development Bank Of Singapore Live 17 DLB Dhanlaxmi Bank Live 18 EQTS Equitas Small Finance Bank Live 19 FED Federal Bank Live 20 HDFC HDFC Bank Live 21HSBCI HSBC Bank Live 22 ICI ICICI Bank Ltd Live 23 IDBI IDBI Bank Ltd Live 24 IDFC IDFC Bank Ltd Live 25 IPPB1 India Post Payments Bank Live 26 INDB Indian Bank Live 27 IOB Indian Overseas Bank On Hold Due to System Migration 28 IDSB Indusind Bank Ltd Live 29 IVS ING Vysya Bank Limited Merged - Kotak Mahindra Bank 30 KBL Karnataka Bank Ltd Live 31 KVB Karur Vysya Bank Limited Live 32 KTK Kotak Mahindra Bank Live 33 LVB Lakshmi Vilas Bank Merged - DBS 34 MGB Maharashtra Gramin Bank Live 35 NKGSB NKGSB Bank Live 36 OBC Oriental Bank Of Commerce Merged - Punjab National Bank 37 PNB Punjab National Bank Live 38 RBL01 RBL Bank Live 39SRSB Saraswat Bank Live 40 SIB South Indian Bank Live 41 SCB Standard Chartered Bank Live 42 SBI State Bank Of India Live 43 SYD Syndicate Bank Merged - Canara Bank 44 TMB Tamilnad Mercantile Bank Ltd Live 45 uco UCO BanK Ltd Live 46 UBIB Union Bank Of India Live 47 YESB Yes Bank Live. -

Euronet to Deploy and Operate Atms for DCB Bank in India

Euronet to deploy and operate ATMs for DCB Bank in India LEAWOOD, KANSAS and MUMBAI, INDIA—Feb. 17, 2004—Euronet Worldwide, Inc (Nasdaq EEFT), a leading electronic payments provider, today announced a multiyear ATM outsourcing agreement with Development Credit Bank (DCB), a leading, medium-sized bank in India with a fully computerized network of 66 branches. DCB currently has 64 ATMs in its network across India in cities including Mumbai, Ahmedabad and Hyderabad. As part of the strategic alliance, Euronet will provide DCB with comprehensive ATM outsourcing and deployment solutions; value-added services, such as mobile top-up; and shared ATM network solutions through Cashnet, the largest national shared ATM network in India, promoted by Euronet Services India Pvt. Ltd. Initially, Euronet will drive and perform day-to-day management for DCB's 64 ATMs. DCB will deploy an additional 36 ATMs to bring the total ATM network of DCB to 100 by March 31, 2004. In this new innovative outsourcing model for India, the ATMs will be DCB-branded but Euronet-owned as part of Euronet's bank-branded ATM deployment program, which allows banks to deploy ATMs much faster with an attractive monthly operating cost business model. DCB will also connect its ATMs to Cashnet, the multilateral shared network of ATMs spread across more than 200 cities in India. Through the membership of leading banks including IDBI Bank, UTI Bank, Citibank, Standard Chartered Bank and Corporation Bank, which was the first public sector bank to join the network recently, the Cashnet network now includes approximately 2,500 ATMs.