(UPI): a Cashless Indian E-Transaction Process

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

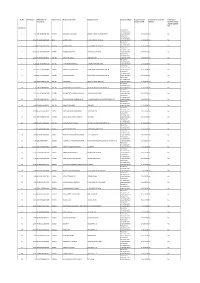

List of Nodal Officers

List of Nodal Officers S. Name of Bank Name of the Nodal Address CPPC Phone/Fax No./e-mail No Officers 1 Allahabad Bank Dr S R Jatav Asstt. General Manager, Office no: 0522 2286378, 0522 Allahabad Bank, CPPC 2286489 Zonal Office Building, Mob: 08004500516 Ist floor,Hazratganj, [email protected] Lucknow UP-226001 2 Andhra Bank Shri M K Srinivas Sr.Manager, Mob: 09666149852,040-24757153 Andhra Bank, [email protected] Centralized Pension Processing Centre(CPPC) 4th floor,Andhra Bank Building,Koti, Hyderabad-500095 3 Axis Bank Shri Hetal Pardiwala, Nodal Officer Mob: 9167550333, AXIS BANK LTD, Gigaplex Bldg [email protected] no.1, 4th floor, Plot No. I.T.5, MIDC, Airoli Knowledge Park, Airoli, Navi Mumbai- 400708 4 Bank of India Shri R. Ashok Chief Manager 0712-2764341, Ph.2764091,92 Nimrani Bank of India, 0712-2764091 (fax) CPPC Branch, Bank of India Bldg. [email protected] 87-A, 1st floor, Gandhibaug, Nagpur-440002. 5 Bank of Baroda Shri S K Goyal, Dy. General Manager, 011-23441347, 011-23441342 Bank of Baroda, [email protected] Central Pension Processing Centre, [email protected] Bank of Baorda Bldg. 16, Parliament Street, New Delhi – 110 001 6 Bank of Shri D H Vardy Manager Ph: 020-24467937/38 Maharashtra Bank of Maharashtra Mob: 08552033043 Central Pension Processing Cell, [email protected] 1177, Budhwar Peth, Janmangal, Bajirao Road Pune-411002 7 Canara Bank Shri K S Hebbar Asstt. General Manager Mob. 08197844215 Canara Bank Ph: 080 26621845 Centralized Pension Processing [email protected] Centre Dwarakanath Bhavan 29, K R Road Basavangudi, Bangalore 560 004 8 Central Bank of Shri V K Sinha Chief Manager Ph: 022-22703216/22703217, India Central Bank of India (CPPC) Fax- 22703218 Central Office, 2nd Floor, [email protected] Central Bank Building, M.G. -

HDFC, Bank of Maharashtra, Vijaya Bank Cut Lending Rate by up to 0.25%

HDFC, Bank of Maharashtra, Vijaya Bank cut lending rate by up to 0.25% Two state-owned lenders Vijaya Bank and Bank of Maharashtra (BoM) as well as the housing finance company HDFC Ltd on Tuesday reduced their benchmark lending rates by up to 0.25 per cent . HDFC reduced benchmark lending rate by 0.1 per cent. Interest rate on home loans up to Rs 30 lakh will come down to 10.15 per cent, while above Rs 30 lakh will be 10.40 per cent. The new rates would be effective from tomorrow, HDFC said in a statement. Vijaya Bank said its base has been reduced by 0.25 per cent to 10.20 per cent with immediate effect. Bank of Maharashtra slashed benchmark lending rate by 0.25 per cent to 10.25 per cent. The base rate or the minimum lending rate of the bank is reduced by 0.25 per cent from 10.50 per cent to 10.25 per cent with effect from February 9, BoM said in a filing on the BSE. A host of lenders, including State Bank of India (SBI), Punjab National Bank, Bank of India, Bank of Baroda and IDBI Bank have cut lending rates following easing of monetary policy by the Reserve Bank. In its third quarter policy review on January 29, RBI had lowered key short-term lending rate by 0.25 per cent and also injected Rs 18,000 crore liquidity through similar reduction of Cash Reserve Ratio. The repo rate, at which RBI lends to banks, was eased after a gap of nine months as the central bank fought the stubbornly high inflation through tight money policy, leading to high interest rate regime. -

Application for Remittance (REM-I) INDIVIDUALS

REM – I Guidance for Completing the Remittance Application form If you do not have the Remittance Registration number, please submit the Application for Remittance Registration RRF -1 and obtain Registration number before filling up this Application for Remittance Step 1 Please fill remittance application form in block letters after reading terms and conditions and rules governing remittances printed on the form and then sign the form. Ensure Valid Remitter Registration Number and SSN are correctly filled in. All columns must be filled in. If not applicable, mark N/A Step 2 How to Deposit Funds for remittance By cash - You can visit our branch and deposit cash (maximum US$2,500.00 within 30 day period) By Cashier’s/Official Check. Ensure check is payable to Bank of Baroda. Registered Remitter’s name should be printed on the Cashier’s check as purchaser By personal checks – Ensure check is drawn by the Registered remitter from his/her account By wire transfer to Bank of Baroda, New York, ABA Routing No 026005322 for credit to Sundry Deposit Remittance Account 93010200000091. Your Remittance Registration Number with us should be mentioned in the Wire transfer. Fax the filled up and signed Application for Remittance to 212 578 4578. Remittance will be effected only after receipt of the application form. Step 3 You can cancel (in writing) for a full refund before our lodgment of check in Clearing – ie. 3.00 pm ET (where payment is made by check) / within 30 minutes from tendering the application for remittance over counter / within 30 minutes from receipt of fax in respect of payment made by wire transfer . -

The Institute of Cost Accountants of India

THE INSTITUTE OF Telephones : +91-33- 2252-1031/1034/1035 COST ACCOUNTANTS OF INDIA + 91-33-2252-1602/1492/1619 (STATUTORY BODY UNDER AN ACT OF PARLIAMENT) + 91-33- 2252-7143/7373/2204 CMA BHAWAN Fax : +91-33-2252-7993 12, SUDDER STREET, KOLKATA – 700 016. +91-33-2252-1026 +91-33-2252-1723 Website : www.icmai.in DAILY NEWS DIGEST BY BFSI BOARD, ICAI July 4, 2021 EDs in Public Sector Banks: Banks Board Bureau recommends 10 candidates in 2021-22: The Banks Board Bureau (BBB) has recommended ten candidates to the panel that will be used for filling vacancies of Executive Directors in various Public Sector Banks (PSBs) in the year 2021-22. These names have been shortlisted after the BBB, which is the head hunter for the government for filling top level posts in PSBs, insurance companies and other financial institutions, interfaced with 40 candidates (chief general managers and general managers) from various PSBs on July 2 and 3 for the position of Executive Directors, sources close to the development said. The ten names that have been recommended (in the order of merit) for the Panel are Rajneesh Karnatak; Joydeep Dutta Roy; Nidhu Saxena, Kalyan Kumar; Ashwani Kumar; Ramjass Yadav, Asheesh Pandey, Ashok Chandra; A V Rama Rao and Shiv Bajrang Singh. This panel will be operated in the financial year 2021–22, subject to availability of vacancies in the panel year 2021–22, sources said. https://www.thehindubusinessline.com/money-and-banking/eds-in-public-sector-banks-banks-board- bureau-recommends-10-candidates-in-2021-22/article35125016.ece Supreme Court seeks response of Centre, RBI on plea of PNB against disclosure of info under RTI: The Supreme Court has refused to grant interim stay on the RBI’s notice asking Punjab National Bank to disclose information such as defaulters list and its inspection reports under the RTI Act, and sought responses from the Centre, federal bank and its central public information officer. -

Statement of Unpaid and Unclaimed Dividend Amount for FY 2018-19

SR. No. Due Amount DPID-Client ID- Instrument No Name of the Payee Registered Bank Investment Type Propose date of Is the Investment under Is the shares Account No transfer to IEPF litigation transferred from unpaid suspense A/c FY 2018-19 Amount for unclaimed and 1 0.12 1203320005311836 103833 MANMOHAN KUMAR ORIENTAL BANK OF COMMERCE unpaid dividend 27-10-2026 No No Amount for unclaimed and 2 12.00 IN30236510307646 103777 GURMIT RAM STATE BANK OF PATIALA unpaid dividend 27-10-2026 No No Amount for unclaimed and 3 0.60 IN30114310890533 103834 KARAN SINGLA STATE BANK OF PATIALA unpaid dividend 27-10-2026 No No Amount for unclaimed and 4 60.00 1201320000425029 103779 PURNIMA MISHRA . STATE BANK OF INDIA unpaid dividend 27-10-2026 No No Amount for unclaimed and 5 12.00 IN30011810990050 103780 RICHH PAL SINGH IDBI BANK LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 6 1.20 1202420000605238 103781 VIJAY MOHAN PAINULI PUNJAB NATIONAL BANK unpaid dividend 27-10-2026 No No Amount for unclaimed and 7 18.00 1202420000168896 103782 TARSEM LAL MAHAJAN STATE BANK OF BIKANER & JAIPUR unpaid dividend 27-10-2026 No No Amount for unclaimed and 8 6.00 1201210100496051 103784 VIKAS MAHARISHI STATE BANK OF BIKANER & JAIPUR unpaid dividend 27-10-2026 No No Amount for unclaimed and 9 3.60 1301760000657165 103785 REENA JAIN BANK OF RAJASTHAN LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 10 1.20 1203320000858515 103786 MAHAVEER CHAND CHHAJED BALOTRA URBAN CO OP BANK LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 11 -

Retail User Guide

Retail User Guide User Guide for Retail Internet Banking Users Punjab National Bank introduces the upgraded version of Internet Banking for its esteemed Retail Customers. Experience a convenient, simple and secure way of banking & e-commerce at your comfort with PNB Internet Banking Services. Start using now!!! Page 1 CONTENTS Topic Page 1. How to get user ID/Password 3 2. How to use internet banking 3 3. My Accounts 4 4. Transactions 5 5. Value Added Services 6 6. Personal Settings 7 7. Other Services 8 8. Mail and Messages 9 9. Security Features 9 10. Safeguard 10 11. Contact Us 10 Page 2 1. How to get User ID/Password 1.1 On-line Registration for Internet Banking facility: Customers can avail Retail Internet Banking facility by getting themselves registered online using debit card credentials. Follow the steps as under: Visit http://www.netpnb.com On Home Page, Click on the link –> Register Here Enter Account Number & Select Registration Type. Select Type of facility View Only or View & Transaction Both Click on “Verify” Enter OTP received on Registered Mobile Number in “One Time Password” field. After verification of OTP, enter account details/ ATM credentials. On successful validation of entered details, you can set the passwords. Once these processes are successfully completed, you will be shown success message with regard to your registration process. After completing this process, user will be enabled immediately. 1.2 Registration through PNB ATMs: Customers can submit request for Internet Banking registration through PNB ATMs: 1.3 Submitting request on Form no. PNB-1063 in branch: Customers may download the IBS Registration form from the link DownloadFormsPNB 1063 and submit the same to any PNB branch after entering required details. -

Bank of Baroda (BANBAR)

Bank of Baroda (BANBAR) CMP: | 67 Target: | 70 (4%) Target Period: 12 months HOLD January 29, 2021 Business momentum positive; NPA concerns loom Bank of Baroda (BoB) reported a good set of numbers on the operating as well as business front compared to the previous quarter. Asset quality deteriorated marginally. However, rising concerns on stress formation Particulars proved to be a dampener. Particulars Amount NII was up 8.7% YoY to | 7749 crore, on the back of improved margins. Market Capitalisation | 31188 Crore Global NIM improved ~7 bps YoY to 2.87%, while QoQ it was largely flat. GNPA (Q3FY21) 63,182 Domestic margins posted healthy expansion of ~11 bps QoQ to 3.07%. NNPA (Q3FY21) 16,668 Other income growth was miniscule at 5.6% YoY to | 2896 crore, on account NIM (Q3FY21) % 2.87% Update Result of 11% YoY decline in fee income. Provisions remained elevated at | 3957 52 week H/L 94/36 crore; up 31.8% QoQ. The bank said Covid related provisions were worth Networth 73,867.0 | 1709 crore. PAT during the quarter was at | 1061 crore, compared to a loss Face value | 2 of | 1407 crore in the previous quarter last year. DII Holding (%) 11.3 Asset quality performance was a slight disappointment though headline FII Holding (%) 4.3 numbers indicate otherwise. GNPA and NNPA (headline) declined 66 bps and 12 bps to 8.48% and 2.39% vs. 9.14% and 2.51% QoQ, respectively. Key Highlights However, on a proforma basis, GNPA, NNPA ratio increased ~30 bps, 69 Proforma GNPA at 9.63%; guidance bps QoQ to 9.63%, 3.36%, respectively. -

Everything on BHIM App for UPI-Based Payments

Everything on BHIM app for UPI-based payments BHIM UPI app - From linking bank accounts to sending payments. BHIM is based on UPI, which is the Universal Payments Interface and thus linked directly to a bank account. The new digital payments app calledBHIM is based on the Unified Payments Interface (UPI). The app is currently available only on Android; so iOS, Windows mobile users etc are left out. BHIM is also supposed to support Aadhaar-based payments, where transactions will bepossible just with a fingerprint impression, but that facility is yet to roll out. What can BHIM app do? BHIM is a digital payments solution app based on Unified Payments Interface (UPI) from the National Payments Corporation of India (NPCI). If you have signed up for UPI based payments on your respective bank account, which is also linked to your mobile number, then you’ll be able to use the BHIM app to conduct digital transactions. BHIM app will let you send and receive money to other non-UPI accounts or addresses. You can also send money via IFSC and MMID code to users, who don’t have a UPI-based bank account. Additionally, there’s the option of scanning a QR code and making a direct payment. Users can create their own QR code for a certain fixed amount of money, and then the merchant can scan it and the deduction will be made. BHIM app is like another mobile wallet? No, BHIM app is not a mobile wallet. In case of mobile wallets like Paytm or MobiKwik you store a limited amount of money on the app, that can only be sent to someone who is using the same wallet. -

Dcb Bank Regional Heads

DCB BANK REGIONAL HEADS Centre Contact Details of the Area of Operation DCB Regional Nodal Office of the Banking Officer Ombudsman Ahmedabad C/o Reserve Bank of India Gujarat, Union Mr. Chetan Bahl La Gajjar Chambers, Territories of Dadra Regional Head Ashram Road, and Nagar Haveli, Retail Banking Ahmedabad-380 009 Daman and Diu 8th Floor, Pariseema STD Code: 079 Annexe Tel.No.26582357/2658671 Opp IFC Bhawan, C.G. 8 Road Fax No.26583325 Ellisbridge, Ahmedabad Email: 380 006 [email protected] Tel: (079) 66052582 Mob: 09227529999 E-mail : [email protected] Bengaluru C/o Reserve Bank of India Karnataka Mr. Rajagopal T K 10/3/8, Nrupathunga Road Regional Head Bengaluru -560 001 Retail Banking (South II) STD Code: 080 Old No 37/1, New No 2/1 Tel.No.22210771/2227562 Jumbulingam Street, 9 Nungambakam, Chennai Fax No.22244047 600 034 Email: Tel: (044) 3072 7607 [email protected] Mobile: 9952209997 Email: [email protected] m Bhopal C/o Reserve Bank of India Madhya Pradesh and Mr. Sunil Girdhar Hoshangabad Road, Chattisgarh Regional Head Post Box No.32, Bhopal- Agri & Inclusive Banking 462 011 1st Floor, Devashish STD Code: 0755 Complex, Tel.No.2573772/2573776 Plot No:-160 , Zone 1 Fax No.2573779 ,M.P.Nagar, Email: Bhopal - 62011 [email protected] Madhya Pradesh Tel: (0755) 4901122 Mob: 8225001362 Email id:[email protected] om Bhubaneswar C/o Reserve Bank of India Odisha Mr. Durga Prasad Rath Pt. Jawaharlal Nehru Marg Regional Head Bhubaneswar-751 001 Agri & Inclusive Banking STD Code: 0674 Laxmisagar, Cuttack Road Tel.No.2396207/2396008 Near Falcon House Fax No. -

How Mpos Helps Food Trucks Keep up with Modern Customers

FEBRUARY 2019 How mPOS Helps Food Trucks Keep Up With Modern Customers How mPOS solutions Fiserv to acquire First Data How mPOS helps drive food truck supermarkets compete (News and Trends) vendors’ businesses (Deep Dive) 7 (Feature Story) 11 16 mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved TABLEOFCONTENTS 03 07 11 What’s Inside Feature Story News and Trends Customers demand smooth cross- Nhon Ma, co-founder and co-owner The latest mPOS industry headlines channel experiences, providers of Belgian waffle company Zinneken’s, push mPOS solutions in cash-scarce and Frank Sacchetti, CEO of Frosty Ice societies and First Data will be Cream, discuss the mPOS features that acquired power their food truck operations 16 23 181 Deep Dive Scorecard About Faced with fierce eTailer competition, The results are in. See the top Information on PYMNTS.com supermarkets are turning to customer- scorers and a provider directory and Mobeewave facing scan-and-go-apps or equipping featuring 314 players in the space, employees with handheld devices to including four additions. make purchasing more convenient and win new business ACKNOWLEDGMENT The mPOS Tracker™ was done in collaboration with Mobeewave, and PYMNTS is grateful for the company’s support and insight. PYMNTS.com retains full editorial control over the findings presented, as well as the methodology and data analysis. mPOS Tracker™ © 2019 PYMNTS.com All Rights Reserved February 2019 | 2 WHAT’S INSIDE Whether in store or online, catering to modern consumers means providing them with a unified retail experience. Consumers want to smoothly transition from online shopping to browsing a physical retail store, and 56 percent say they would be more likely to patronize a store that offered them a shared cart across channels. -

FAQ 1. What Is Sovereign Gold Bond (SGB)? Who Is the Issuer

स륍मान आपके वि�िास का HONOURS YOUR TRUST (Government of India Undertaking) FAQ 1. What is Sovereign Gold Bond (SGB)? Who is the issuer? SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by Reserve Bank on behalf of Government of India. 2. Why should I buy SGB rather than physical gold? What are the benefits? The quantity of gold for which the investor pays is protected, since he receives the ongoing market price at the time of redemption/ premature redemption. The SGB offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated. Investors are assured of the market value of gold at the time of maturity and periodical interest. SGB is free from issues like making charges and purity in the case of gold in jewellery form. The bonds are held in the books of the RBI or in demat form eliminating risk of loss of scrip etc. 3. Are there any risks in investing in SGBs? There may be a risk of capital loss if the market price of gold declines. However, the investor does not lose in terms of the units of gold which he has paid for. 4. Who is eligible to invest in the SGBs? Persons resident in India as defined under Foreign Exchange Management Act, 1999 are eligible to invest in SGB. Eligible investors include individuals, HUFs, trusts, universities, charitable institutions, etc. -

भारतीय जीवन बीमा ननगम Life Insurance Corporation of India

भारतीय जीवन बीमा ननगम LIFE INSURANCE CORPORATION OF INDIA प्रधानमंत्री जन धन योजना के तहत जन-धन ख़ाताधारकⴂ के लिये 셁.30,000/- के जीवन बीमा सरु क्षा के दावा ननपटारा हेतु प्रक्रिया PRADHAN MANTRI JAN DHAN YOJANA (PMJDY) PROCEDUREFOR CLAIM SETTLEMENT UNDER LIFE INSURANCE COVER OF Rs.30,000/- FOR PMJDY ACCOUNT HOLDER 1 CLAIM PROCESSING PROCEDURE FOR BANKS UNDER PRADHAN MANTRI JAN DHAN YOJANA ववषय सूची / CONTENTS A. Preamble B. Definitions C. Benefits under the Scheme D. Basic Eligibility Conditions E. Ineligible Categories F. Exit from Scheme G. Claim Settlement Procedure H. Procedure to be followed by Banks on receipt of Death Claim Intimation I. Procedure to be followed by LIC on receipt of claim intimation. J. List of Annexures 2 PMJDY claim procedure A. PREAMBLE The Hon’ble Prime Minister in his Independence Day Speech on 15th August, 2014 announced a comprehensive program of Financial Inclusion targeting the large number of people who are currently deprived of even rudimentary financial services. The PradhanMantri Jan DhanYojana (PMJDY) sets out to provide a basic Bank account to every family who till now had no account. The bank account comes with a RuPay debit card with a built-in accidental cover of Rs 1 lakh. During the launch of the PMJDY scheme on 28.08.14 in New Delhi, Hon’ble Prime Minister announced a life cover of Rs. 30,000/- with the RuPay Card for all those who subscribe to a bank account for the first time during the period 15th August, 2014 to 26th January, 2015.