Asia Pacific Strategy Commentary 4Q20 for Institutional Investors Only

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CK HUTCHISON HOLDINGS LIMITED (“CK Hutchison”) And

HUTCHISON WHAMPOA INTERNATIONAL (03/33) LIMITED (the “Issuer”) US$1,500,000,000 7.45% Guaranteed Notes due 2033 (the “Notes”) (ISIN: US44841SAC35/CUSIP: 44841SAC3/Common Code: 018124572 for Rule 144A Notes) (ISIN: USG4672CAC94/CUSIP: G4672CAC9/Common Code: 018124629 for Regulation S Notes) unconditionally and irrevocably guaranteed by CK HUTCHISON HOLDINGS LIMITED (“CK Hutchison”) and HUTCHISON WHAMPOA LIMITED In accordance with Regulation (EU) No. 596/2014 on market abuse and the law of 11 January 2008 on transparency requirements, as amended, the Issuer is filing with the Commission de Surveillance du Secteur Financier, storing with the Officially Appointed Mechanism and publishing the attached unaudited results for the six months ended 30 June 2019 of CK Hutchison, a guarantor of the Notes issued by the Issuer. The attached document was also published by CK Hutchison at 4:31 pm and 4:32 pm (Hong Kong time), 1 August 2019 on the websites of Hong Kong Exchanges and Clearing Limited and CK Hutchison, respectively. Hutchison Whampoa International (03/33) Limited Edith Shih Director and Company Secretary 1 August 2019 Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. UNAUDITED RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2019 HIGHLIGHTS -

Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD

UOB KAY HIAN (SINGAPORE) PRIVATE LIMITED MARGIN STOCK LIST - HONG KONG MARKET 1 April 2021 Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD. SA HK 2 CLP HOLDINGS LTD. A HK 3 HONG KONG AND CHINA GAS CO. LTD. A HK 4 WHARF (HOLDINGS) LTD. A HK 5 HSBC HOLDINGS PLC SA HK 6 POWER ASSETS HOLDINGS LTD. SA HK 8 PCCW LTD. C HK 10 HANG LUNG GROUP LTD. A HK 11 HANG SENG BANK LTD. SA HK 12 HENDERSON LAND DEVELOPMENT CO. LTD. A HK 14 HYSAN DEVELOPMENT CO. LTD. B HK 16 SUN HUNG KAI PROPERTIES LTD. SA HK 17 NEW WORLD DEVELOPMENT CO. LTD. A HK 19 SWIRE PACIFIC LTD. 'A' A HK 23 BANK OF EAST ASIA, LTD. A HK 27 GALAXY ENTERTAINMENT GROUP LTD. A HK 38 FIRST TRACTOR CO LTD. - H SHARES D HK 41 GREAT EAGLE HOLDINGS LTD. C (Max Net Loan H$10M) HK 45 HONGKONG AND SHANGHAI HOTELS, LTD. B (Max Net Loan H$10M) HK 53 GUOCO GROUP LTD. B (Max Net Loan H$10M) HK 56 ALLIED PROPERTIES (HK) LTD. D HK 62 TRANSPORT INTERNATIONAL HOLDINGS LTD. D (Max Net Loan H$1M) HK 66 MTR CORPORATION LTD. SA HK 69 SHANGRI-LA ASIA LTD. A HK 81 CHINA OVERSEAS GRAND OCEANS GROUP LTD. C HK 83 SINO LAND CO. LTD. A HK 86 SUN HUNG KAI & CO. LTD. D HK 87 SWIRE PACIFIC LTD. 'B' A (Max Net Loan H$10m) HK 101 HANG LUNG PROPERTIES LTD. A HK 107 SICHUAN EXPRESSWAY CO. -

3I Group PLC 3M Co 58.Com Inc A2A Spa AAC Technologies Holdings

3i Group PLC 3M Co 58.com Inc A2A SpA AAC Technologies Holdings Inc ABB Ltd Abbott Laboratories AbbVie Inc Accenture PLC Accton Technology Corp ACS Actividades de Construccio Activision Blizzard Inc Acuity Brands Inc Adani Ports & Special Economic Adaro Energy Tbk PT Adecco Group AG Adelaide Brighton Ltd adidas AG Adient PLC Adobe Systems Inc Advance Auto Parts Inc Advanced Ceramic X Corp Advanced Micro Devices Inc Advanced Semiconductor Enginee Aegon NV AES Corp/VA Aetna Inc Affiliated Managers Group Inc Aflac Inc Aga Khan Fund for Economic Dev AGFA-Gevaert NV Agilent Technologies Inc AGL Energy Ltd Agnaten SE AIA Group Ltd Air Products & Chemicals Inc AirAsia Bhd Airtac International Group Akamai Technologies Inc Akbank Turk AS Akzo Nobel NV Alaska Air Group Inc Albemarle Corp Alcoa Corp Alexandria Real Estate Equitie Alexion Pharmaceuticals Inc Alibaba Group Holding Ltd Align Technology Inc ALK-Abello A/S Allegion PLC Allergan PLC Alliance Data Systems Corp Alliant Energy Corp Allianz SE Allstate Corp/The Ally Financial Inc Alphabet Inc ALS Ltd Altaba Inc/Fund Family Altice NV Altran Technologies SA Altria Group Inc Alumina Ltd Amadeus IT Group SA Amazon.com Inc Amcor Ltd/Australia Ameren Corp America Movil SAB de CV American Airlines Group Inc American Axle & Manufacturing American Electric Power Co Inc American Express Co American International Group I American Tower Corp American Water Works Co Inc Ameriprise Financial Inc AmerisourceBergen Corp AMETEK Inc Amgen Inc Amorepacific Corp AMOREPACIFIC Group AMP Ltd Amphenol Corp ams AG -

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

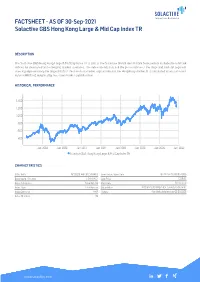

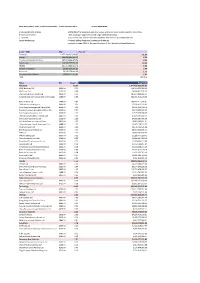

FACTSHEET - AS of 30-Sep-2021 Solactive GBS Hong Kong Large & Mid Cap Index TR

FACTSHEET - AS OF 30-Sep-2021 Solactive GBS Hong Kong Large & Mid Cap Index TR DESCRIPTION The Solactive GBS Hong Kong Large & Mid Cap Index TR is part of the Solactive Global Benchmark Series which includes benchmark indices for developed and emerging market countries. The index intends to track the performance of the large and mid cap segment covering approximately the largest 85% of the free-float market capitalization in the Hong Kong market. It is calculated as a totalreturn index in HKD and weighted by free-float market capitalization. HISTORICAL PERFORMANCE 1,400 1,200 1,000 800 600 400 Jan-2008 Jan-2010 Jan-2012 Jan-2014 Jan-2016 Jan-2018 Jan-2020 Jan-2022 Solactive GBS Hong Kong Large & Mid Cap Index TR CHARACTERISTICS ISIN / WKN DE000SLA4H36 / SLA4H3 Base Value / Base Date 462.12 Points / 08.05.2006 Bloomberg / Reuters / .SHKLMCT Last Price 1256.93 Index Calculator Solactive AG Dividends Reinvested Index Type Total Return Calculation 8:00 am to 10:30 pm (CET), every 15 seconds Index Currency HKD History Available daily back to 08.05.2006 Index Members 52 FACTSHEET - AS OF 30-Sep-2021 Solactive GBS Hong Kong Large & Mid Cap Index TR STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -6.80% -10.27% -11.73% 9.67% -4.51% 171.99% Performance (p.a.) - - - - - 6.71% Volatility (p.a.) 21.54% 18.63% 16.63% 17.91% 18.51% 20.09% High 1364.34 1419.58 1482.24 1493.61 1493.61 1493.61 Low 1228.29 1228.29 1228.29 1115.51 1228.29 287.41 Sharpe Ratio -2.67 -1.91 -1.34 0.55 -0.32 0.33 Max. -

AAC TECHNOLOGIES HOLDINGS INC. 2020 1Q Results

AAC TECHNOLOGIES HOLDINGS INC. (Incorporated in the Cayman Islands with limited liability) (Stock code: 2018 HK) 2020 1Q Results 15 May 2020 1Q 2020 Highlights (RMB million) Revenue Gross Profit GP Net Margin Profit 1Q2020 3,560 823 23.1% 53 1Q2019 3,753 1,129 30.1% 432 YoY -5.1% -27.1% - 7.0 p.p -87.8% 1Q20 Revenue Breakdown Impact of COVID-19 outbreak: operation and production RMB(million) significantly affected during Q1; Optics , 245 , 7% Others , 4 , 0% Full resumption of operation and production by mid-March: Comprehensive checks for all employees; frequent communication MEMS, 199 , 6% with customers and suppliers; Acoustics, 1,421 , 40% Continue to focus on R&D: R&D expenses at RMB489 million, +18.7% YOY, amounted to 13.7% of revenue; Positive on 5G outlook: Rapid 5G development and higher ED&PM, penetration of 5G smartphones will bring new opportunities . 1,691 , 47% 1 Effective Financial Management & Solid Cash Position Operating cash inflow of RMB1.08 billion for 1Q2020, well covered the capital expenditure of RMB1.01 billion; The Group remained prudent in the financial management, and proactively managed the cashflow and liquidity by rigorously reviewing the budgets for capital expenditure and R&D. Net gearing remains healthy at 8.7% as at 31 March 2020 (10.5% as at Dec 2019). Cash position of the Group was RMB5.81 billion. Net gearing remains at low level; RMB Million Ample gross cash on hand 7,000 12.0% RMB million 1Q 2020 1Q 2019 5,512 5,811 (1 Jan - 31 Mar 2020) (1 Jan - 31 Mar 2019) 6,000 10.0% Cash & bank bal. -

BOCI ASIA LIMITED (Incorporated in Hong Kong with Limited Liability)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. NON-COLLATERALISED STRUCTURED PRODUCTS Notice of Valuation of Residual Value of European Style (Cash Settled) Category R Callable Bull/Bear Contracts (the “CBBCs”) issued by BOCI ASIA LIMITED (Incorporated in Hong Kong with limited liability) ANNOUNCEMENT BOCI Asia Limited (the “Issuer”) gives notice that under the terms and conditions of the CBBCs (the "Conditions"), following the occurrence of a Mandatory Call Event ("MCE") in respect of the CBBCs described in the table below in the pre-opening session or the continuous trading session or the closing auction session (as the case may be) of the Stock Exchange at the time (the “MCE Time”) and on the date (the “MCE Date”) specified in the table below, the Residual Value in respect of the CBBCs has been determined as follows: Stock Type MCE Date MCE Time Underlying Issue Size Entitlement Number of Board Lot Strike Price Maximum / Residual Value Code (Bull / (CBBCs) CBBCs per (CBBCs) (HK$) Minimum Trade per Board Lot Bear) Entitlement Price (HK$) (HK$) 53812 Bull 16 July 2020 10:13:52 Hong Kong Exchanges and 40,000,000 1 Share 100 10,000 347.980 335.400 0.000 Clearing Limited 55444 Bull 16 July 2020 09:20:00 Meituan Dianping 40,000,000 1 Share 100 10,000 200.880 183.300 0.000 54934 Bull 16 July 2020 09:20:00 Alibaba Group Holding Limited 60,000,000 1 Share 100 10,000 259.280 231.600 0.000 54938 Bull 16 July 2020 09:20:00 Meituan Dianping 40,000,000 1 Share 100 10,000 206.680 183.300 0.000 54785 Bull 16 July 2020 09:20:00 AAC Technologies Holdings 80,000,000 1 Share 100 50,000 53.500 50.700 0.000 Inc. -

Li Ka-Shing's Flagship Is Looking Like a Bargain

Li Ka-shingʼs Flagship Is Looking Like a Bargain - Barron's 28.05.18, 1359 This copy is for your personal, non-commercial use only. To order presentation-ready copies for distribution to your colleagues, clients or customers visit http://www.djreprints.com. https://www.barrons.com/articles/li-ka-shings-flagship-is-looking-like-a-bargain-1527292801 FEATURE Li Ka-shing’s Flagship Is Looking Like a Bargain By Andrew Bary May 26, 2018 Victor Li, right, recently took over as chairman of the Hong Kong–based conglomerate CK Hutchison Holdings from his father, Li Ka-shing. PHOTO: ZHANG WEI/CHINA NEWS SERVICE/VCG VIA GETTY IMAGES; DALE DE LA REY/BLOOMBERG VIA GETTY IMAGES; ILLUSTRATION BY JOEL ARBAJE Over 68 years, Li Ka-shing assembled an enormous Hong Kong–based empire. Now, with the reins having passed to his son, Victor Li, a big chunk of it is languishing on the stock market. Known as “superman” in Hong Kong, Li Ka-shing, 89, became one of the Asia’s wealthiest men with an estimated net worth of $34 billion. He drew comparisons to Warren Buffett because of his success in buying, developing, and periodically selling a wide range of assets. Li Ka-shing’s company, CK Hutchison Holdings (ticker: 1.Hong Kong), controls the world’s largest port business and has operations in Rotterdam, the Netherlands, Europe’s largest container port. It owns 3 Group, a leading European wireless company; several Asian and European drugstore chains; and a 40% stake in oil-and-gas producer Energy (HSE.Canada). -

(1969 Nov)The Index Includes the Largest and Most Liquid Stocks Listed in Hong Kong

Hang Seng Index | Index Constituents Analysis | Thomson Reuters Eikon 15-Aug-2016 08:29 Index Constituents Analysis - (1969 Nov)The index includes the largest and most liquid stocks listed in Hong Kong Report: Index Sector - 10% capping is applied to avoid single stock domination 1 - 50 of 50 - Four sector sub-indexes are also available Sub-indexes: (see table below) Sector Market Cap - Finance; Utility; Properties; Commerce & Industry - represent about 58% of the capitalisation of the Hong Kong Stock Exchange Sector - TRBC USD Percent Financials 1,477,418,432,940.93 61.67 Energy 388,919,496,168.72 6.76 Telecommunications Services 287,167,406,479.74 8.94 Technology 236,946,991,592.06 10.45 Utilities 103,353,908,003.74 6.02 Consumer Cyclicals 55,503,276,570.23 2.48 Industrials 50,240,279,801.09 1.76 Consumer Non-Cyclicals 31,116,477,725.85 1.91 Total -- 100.00% Name RIC Weight % Mcap(USD) Financials 61.67 1,477,418,432,940.93 HSBC Holdings PLC 0005.HK 9.73 140,216,593,956.09 AIA Group Ltd 1299.HK 8.08 76,668,842,578.97 China Construction Bank Corp 0939.HK 6.51 184,114,982,866.54 Industrial and Commercial Bank of China Ltd 1398.HK 4.80 236,531,316,123.03 Bank of China Ltd 3988.HK 3.67 153,437,411,763.61 CK Hutchison Holdings Ltd 0001.HK 3.51 47,648,815,932.83 Hong Kong Exchanges and Clearing Ltd 0388.HK 3.10 30,937,262,168.73 Ping An Insurance Group Co of China Ltd 2318.HK 2.77 92,179,858,049.49 Sun Hung Kai Properties Ltd 0016.HK 2.19 41,545,598,968.05 Cheung Kong Property Holdings Ltd 1113.HK 2.01 27,194,797,037.17 China Life Insurance -

Watsons Experience Launches in Russia Focus Story

103 Watsons Experience Launches in Russia Focus Story Watsons Experience Launches in Russia Watsons is delighted to have opened its first Russian store in St.Petersberg. The launch of Asia’s No.1 health and beauty brand will deliver an unprecedented range of world-class products to the increasingly sophisticated Russian market. This is a country where people take great care over their appearance, and by introducing the products and advanced skincare regimens of Asia, Watsons taps into what it sees as huge market potential. WatsON 103 • Quarter 2 • 2018 01 Focus Story Russia will be the 12th market to host Watsons stores. In every market where it operates, Watsons sets the highest global standards in the health, wellness and beauty market. Putting customers first is what Watsons is all about. It offers customers real value, good service and expert advice – and St.Petersberg this is what Watsons will present to Russian customers. The launch of the first store in Russia is a significant step in the expansion of the Watsons brand. Watsons “cares deeply about its customers around the globe, addressing their health and beauty needs both instore and online. We are dedicated to making our customers Look Good and Feel Great and putting a smile on their faces. Andrei Melnikov ” General Manager Watsons Russia WatsON 103 • Quarter 2 • 2018 02 Focus Story Emerging Market, Golden Opportunity Russian customers are seeking out both new experiences Beauty trends from Asia and especially from Korea and new products in health and beauty. Russian is a – hugely popular across Asia but underdeveloped in Russia magnet for sophisticated travellers from across Europe, Digital and eCommerce solutions, which are well and it has significant potential for future growth. -

About Ck Hutchison Holdings Limited

ABOUT CK HUTCHISON HOLDINGS LIMITED The CK Hutchison Group (the “Group”) is a multinational conglomerate committed to development, innovation and technology in four core businesses: ports and related services, retail, infrastructure, and telecommunications. The Group operates in about 50 countries around the world with over 300,000 employees. Ports and related services Infrastructure As the world’s leading port investor, developer and operator, the The Group’s Infrastructure division includes its shareholding in Group’s Ports division holds interests in 52 ports comprising 283 CK Infrastructure Holdings Limited (“CKI”) and interests in six operational berths in 26 countries, including container terminals infrastructure assets that are co-owned with CKI. CKI is a global operating in six of the 10 busiest container ports in the world. infrastructure company with diversified investments in energy In 2020, the division handled a total throughput of 83.7 million infrastructure, transportation infrastructure, water infrastructure, twenty-foot equivalent units. It also engages in river trade, cruise waste management, waste-to-energy, household infrastructure terminal operations and ports related logistic services. and infrastructure related businesses. Its investments and operations span Hong Kong, Mainland China, the United Kingdom, Retail Continental Europe, Australia, New Zealand, Canada and the The Group’s Retail division is the world’s largest international United States. health and beauty retailer, with over 16,000 stores in 27 markets worldwide. Its diverse retail portfolio comprises health and beauty Telecommunications products, supermarkets, as well as consumer electronics and A pioneer in mobile data communication technologies, the electrical appliances. It also manufactures and distributes bottled Group’s Telecommunications division is a leading global operator water and beverage products in Hong Kong and Mainland China. -

Treatment for (I) Merger Proposal of Ck Hutchison Holdings and Hutchison Whampoaand (Ii) Spin-Off Proposal of Cheung Kong Property Holdings

TECHNICAL NOTICE 4 May 2015 INDEX TREATMENT FOR (I) MERGER PROPOSAL OF CK HUTCHISON HOLDINGS AND HUTCHISON WHAMPOAAND (II) SPIN-OFF PROPOSAL OF CHEUNG KONG PROPERTY HOLDINGS Further to the announcement regarding index adjustments with respect to Cheung Kong (Holdings) and Hutchison Whampoa Reorganisation, dated 13 February 2015, this notice provides details of the index treatments for the merger of CK Hutchison Holdings (SEHK Stock Code: 0001) and Hutchison Whampoa (SEHK Stock Code: 0013) and the spin-off of Cheung Kong Property Holdings. The expected timetable for the merger proposal of CK Hutchison Holdings and Hutchison Whampoa and the spin-off proposal of Cheung Kong Property Holdings is as follows: Date Details 26 May 2015 • Last trading day of Hutchison Whampoa (Tuesday) • Last day of dealing in the shares of CK Hutchison Holdings on a cum-entitlement basis to the distribution in specie of Cheung Kong Property Holdings 27 May 2015 • Dealing in the shares of Hutchison Whampoa on the Stock Exchange of (Wednesday) Hong Kong (SEHK) to cease • First day of dealing in the shares of CK Hutchison Holdings on an ex-entitlement basis to the distribution in specie of Cheung Kong Property Holdings 3 June 2015 • Withdrawal of the listing of the shares of Hutchison Whampoa on the (Wednesday) SEHK • Expected date of commencement of dealing in shares of Cheung Kong Property Holdings on the SEHK more… INDEX TREATMENT FOR (I) MERGER PROPOSAL OF CK HUTCHISON HOLDINGS AND HUTCHISON WHAMPOAAND (II) SPIN-OFF PROPOSAL OF CHEUNG KONG PROPERTY HOLDINGS/2 Accordingly, expected index adjustments in the Hang Seng Family of Indexes (including the Hang Seng Index) are as follows: Effective Date of Details Adjustments 27 May 2015 • Hutchison Whampoa will be removed from all relevant indexes*.