Ajer Volume Ii-July 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Written Evidence (ZAF0049)

London Stock Exchange Group – Written evidence (ZAF0049) Submission on Local Currency Bond Markets for House of Lords International Relations Committee Inquiry “UK and Sub-Saharan Africa - prosperity, peace and development co-operation 1. London Stock Exchange Group (LSEG) is a diversified global financial markets infrastructure business focused on Information Services, Risk and Balance Sheet Management and Capital Formation. The Group supports global financial stability and sustainable economic growth by enabling businesses and economies to fund innovation and manage risk. 2. This submission looks at how raising debt finance from offshore capital pools in local currencies can serve as an important source of investment for African economies, mitigating an issuer’s currency risk associated with borrowing in a hard currency. This topic is especially relevant in light of recent falls in commodity prices and the economic shock of the Covid-19 crisis that has resulted in the appreciation of the US Dollar vis-à-vis emerging market currencies. This submission provides an overview of LSEG’s activity related to the development of local currency bond markets, with a focus on emerging markets. LSEG in Africa: A long-term partnership 3. London Stock Exchange Group has a long history of working in partnership with Africa, supporting the development of African capital markets and investment in African companies and infrastructure. LSEG has a partnership approach and a long- term commitment to the continent. The UK-Africa Investment Summit in January 2020 was an opportunity to deepen and widen links. Associated with the Summit, LSEG commemorated landmark transactions supporting Kenya and Rwanda, described in sections 31 and 32 below. -

A Colonial Genealogy of Violence Against Tutsi Women in The

UNIVERSITY OF CALIFORNIA Los Angeles Gender-Based Violence and Submerged Histories: A Colonial Genealogy of Violence Against Tutsi Women in the 1994 Rwandan Genocide A dissertation submitted in partial satisfaction of the requirements for the degree Doctor of Philosophy in Gender Studies by Helina Asmelash Beyene 2014 ABSTRACT OF THE DISSERTATION Gender-Based Violence and Submerged Histories: A Colonial Genealogy of Violence Against Tutsi Women in the 1994 Rwandan Genocide by Helina Asmelash Beyene Doctor of Philosophy in Gender Studies University of California, Los Angeles, 2014 Professor Sondra Hale, Chair My dissertation is a genealogical study of gender-based violence (GBV) during the 1994 Rwandan genocide. A growing body of feminist scholarship argues that GBV in conflict zones results mainly from a continuum of patriarchal violence that is condoned outside the context of war in everyday life. This literature, however, fails to account for colonial and racial histories that also inform the politics of GBV in African conflicts. My project examines the question of the colonial genealogy of GBV by grounding my inquiry within postcolonial, transnational and intersectional feminist frameworks that center race, historicize violence, and decolonize knowledge production. I employ interdisciplinary methods that include (1) discourse analysis of the gender-based violence of Belgian rule and Tutsi women’s iconography in colonial texts; (2) ii textual analysis of the constructions of Tutsi women’s sexuality and fertility in key official documents on overpopulation and Tutsi refugees in colonial and post-independence Rwanda; and (3) an ethnographic study that included leading anti gendered violence activists based in Kigali, Rwanda, to assess how African feminists account for the colonial legacy of gendered violence in the 1994 genocide. -

Crown Agents Bank's Currency Capabilities

Crown Agents Bank’s Currency Capabilities September 2020 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Majors Australia Australian Dollar AUD ✓ ✓ - - M Canada Canadian Dollar CAD ✓ ✓ - - M Denmark Danish Krone DKK ✓ ✓ - - M Europe European Euro EUR ✓ ✓ - - M Japan Japanese Yen JPY ✓ ✓ - - M New Zealand New Zealand Dollar NZD ✓ ✓ - - M Norway Norwegian Krone NOK ✓ ✓ - - M Singapore Singapore Dollar SGD ✓ ✓ - - E Sweden Swedish Krona SEK ✓ ✓ - - M Switzerland Swiss Franc CHF ✓ ✓ - - M United Kingdom British Pound GBP ✓ ✓ - - M United States United States Dollar USD ✓ ✓ - - M Africa Angola Angolan Kwanza AOA ✓* - - - F Benin West African Franc XOF ✓ ✓ ✓ - F Botswana Botswana Pula BWP ✓ ✓ ✓ - F Burkina Faso West African Franc XOF ✓ ✓ ✓ - F Cameroon Central African Franc XAF ✓ ✓ ✓ - F C.A.R. Central African Franc XAF ✓ ✓ ✓ - F Chad Central African Franc XAF ✓ ✓ ✓ - F Cote D’Ivoire West African Franc XOF ✓ ✓ ✓ ✓ F DR Congo Congolese Franc CDF ✓ - - ✓ F Congo (Republic) Central African Franc XAF ✓ ✓ ✓ - F Egypt Egyptian Pound EGP ✓ ✓ - - F Equatorial Guinea Central African Franc XAF ✓ ✓ ✓ - F Eswatini Swazi Lilangeni SZL ✓ ✓ - - F Ethiopia Ethiopian Birr ETB ✓ ✓ N/A - F 1 Country Currency Code Foreign Exchange RTGS ACH Mobile Payments E/M/F Africa Gabon Central African Franc XAF ✓ ✓ ✓ - F Gambia Gambian Dalasi GMD ✓ - - - F Ghana Ghanaian Cedi GHS ✓ ✓ - ✓ F Guinea Guinean Franc GNF ✓ - ✓ - F Guinea-Bissau West African Franc XOF ✓ ✓ - - F Kenya Kenyan Shilling KES ✓ ✓ ✓ ✓ F Lesotho Lesotho Loti LSL ✓ ✓ - - E Liberia Liberian -

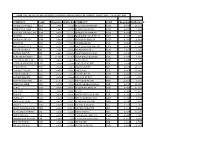

ZIMRA Rates of Exchange for Customs Purposes for Period 24 Dec 2020 To

ZIMRA RATES OF EXCHANGE FOR CUSTOMS PURPOSES FOR THE PERIOD 24 DEC 2020 - 13 JAN 2021 ZWL CURRENCY CODE CROSS RATEZIMRA RATECURRENCY CODE CROSS RATEZIMRA RATE ANGOLA KWANZA AOA 7.9981 0.1250 MALAYSIAN RINGGIT MYR 0.0497 20.1410 ARGENTINE PESO ARS 1.0092 0.9909 MAURITIAN RUPEE MUR 0.4819 2.0753 AUSTRALIAN DOLLAR AUD 0.0162 61.7367 MOROCCAN DIRHAM MAD 0.8994 1.1119 AUSTRIA EUR 0.0100 99.6612 MOZAMBICAN METICAL MZN 0.9115 1.0972 BAHRAINI DINAR BHD 0.0046 217.5176 NAMIBIAN DOLLAR NAD 0.1792 5.5819 BELGIUM EUR 0.0100 99.6612 NETHERLANDS EUR 0.0100 99.6612 BOTSWANA PULA BWP 0.1322 7.5356 NEW ZEALAND DOLLAR NZD 0.0173 57.6680 BRAZILIAN REAL BRL 0.0631 15.8604 NIGERIAN NAIRA NGN 4.7885 0.2088 BRITISH POUND GBP 0.0091 109.5983 NORTH KOREAN WON KPW 11.0048 0.0909 BURUNDIAN FRANC BIF 23.8027 0.0420 NORWEGIAN KRONER NOK 0.1068 9.3633 CANADIAN DOLLAR CAD 0.0158 63.4921 OMANI RIAL OMR 0.0047 212.7090 CHINESE RENMINBI YUANCNY 0.0800 12.5000 PAKISTANI RUPEE PKR 1.9648 0.5090 CUBAN PESO CUP 0.3240 3.0863 POLISH ZLOTY PLN 0.0452 22.1111 CYPRIOT POUND EUR 0.0100 99.6612 PORTUGAL EUR 0.0100 99.6612 CZECH KORUNA CZK 0.2641 3.7860 QATARI RIYAL QAR 0.0445 22.4688 DANISH KRONER DKK 0.0746 13.4048 RUSSIAN RUBLE RUB 0.9287 1.0768 EGYPTIAN POUND EGP 0.1916 5.2192 RWANDAN FRANC RWF 12.0004 0.0833 ETHOPIAN BIRR ETB 0.4792 2.0868 SAUDI ARABIAN RIYAL SAR 0.0459 21.8098 EURO EUR 0.0100 99.6612 SINGAPORE DOLLAR SGD 0.0163 61.2728 FINLAND EUR 0.0100 99.6612 SPAIN EUR 0.0100 99.6612 FRANCE EUR 0.0100 99.6612 SOUTH AFRICAN RAND ZAR 0.1792 5.5819 GERMANY EUR 0.0100 99.6612 -

1999-2000 Rwanda Burundi

COUNTRY PROFILE Rwanda Burundi This Country Profile is a reference tool, which provides analysis of historical political, infrastructural and economic trends. It is revised and updated annually. The EIU’s quarterly Country Reports analyse current trends and provide a two-year forecast The full publishing schedule for Country Profiles is now available on our web site at http://www.eiu.com/schedule. 1999-2000 The Economist Intelligence Unit 15 Regent St, London SW1Y 4LR United Kingdom The Economist Intelligence Unit The Economist Intelligence Unit is a specialist publisher serving companies establishing and managing operations across national borders. For over 50 years it has been a source of information on business developments, economic and political trends, government regulations and corporate practice worldwide. The EIU delivers its information in four ways: through subscription products ranging from newsletters to annual reference works; through specific research reports, whether for general release or for particular clients; through electronic publishing; and by organising conferences and roundtables. The firm is a member of The Economist Group. London New York Hong Kong The Economist Intelligence Unit The Economist Intelligence Unit The Economist Intelligence Unit 15 Regent St The Economist Building 25/F, Dah Sing Financial Centre London 111 West 57th Street 108 Gloucester Road SW1Y 4LR New York Wanchai United Kingdom NY 10019, US Hong Kong Tel: (44.20) 7830 1000 Tel: (1.212) 554 0600 Tel: (852) 2802 7288 Fax: (44.20) 7499 9767 Fax: -

Countries Codes and Currencies 2020.Xlsx

World Bank Country Code Country Name WHO Region Currency Name Currency Code Income Group (2018) AFG Afghanistan EMR Low Afghanistan Afghani AFN ALB Albania EUR Upper‐middle Albanian Lek ALL DZA Algeria AFR Upper‐middle Algerian Dinar DZD AND Andorra EUR High Euro EUR AGO Angola AFR Lower‐middle Angolan Kwanza AON ATG Antigua and Barbuda AMR High Eastern Caribbean Dollar XCD ARG Argentina AMR Upper‐middle Argentine Peso ARS ARM Armenia EUR Upper‐middle Dram AMD AUS Australia WPR High Australian Dollar AUD AUT Austria EUR High Euro EUR AZE Azerbaijan EUR Upper‐middle Manat AZN BHS Bahamas AMR High Bahamian Dollar BSD BHR Bahrain EMR High Baharaini Dinar BHD BGD Bangladesh SEAR Lower‐middle Taka BDT BRB Barbados AMR High Barbados Dollar BBD BLR Belarus EUR Upper‐middle Belarusian Ruble BYN BEL Belgium EUR High Euro EUR BLZ Belize AMR Upper‐middle Belize Dollar BZD BEN Benin AFR Low CFA Franc XOF BTN Bhutan SEAR Lower‐middle Ngultrum BTN BOL Bolivia Plurinational States of AMR Lower‐middle Boliviano BOB BIH Bosnia and Herzegovina EUR Upper‐middle Convertible Mark BAM BWA Botswana AFR Upper‐middle Botswana Pula BWP BRA Brazil AMR Upper‐middle Brazilian Real BRL BRN Brunei Darussalam WPR High Brunei Dollar BND BGR Bulgaria EUR Upper‐middle Bulgarian Lev BGL BFA Burkina Faso AFR Low CFA Franc XOF BDI Burundi AFR Low Burundi Franc BIF CPV Cabo Verde Republic of AFR Lower‐middle Cape Verde Escudo CVE KHM Cambodia WPR Lower‐middle Riel KHR CMR Cameroon AFR Lower‐middle CFA Franc XAF CAN Canada AMR High Canadian Dollar CAD CAF Central African Republic -

Prospects for a Monetary Union in the East Africa Community: Some Empirical Evidence

Department of Economics and Finance Working Paper No. 18-04 , Guglielmo Maria Caporale, Hector Carcel Luis Gil-Alana Prospects for A Monetary Union in the East Africa Community: Some Empirical Evidence May 2018 Economics and Finance Working Paper Series Paper Working Finance and Economics http://www.brunel.ac.uk/economics PROSPECTS FOR A MONETARY UNION IN THE EAST AFRICA COMMUNITY: SOME EMPIRICAL EVIDENCE Guglielmo Maria Caporale Brunel University London Hector Carcel Bank of Lithuania Luis Gil-Alana University of Navarra May 2018 Abstract This paper examines G-PPP and business cycle synchronization in the East Africa Community with the aim of assessing the prospects for a monetary union. The univariate fractional integration analysis shows that the individual series exhibit unit roots and are highly persistent. The fractional bivariate cointegration tests (see Marinucci and Robinson, 2001) suggest that there exist bivariate fractional cointegrating relationships between the exchange rate of the Tanzanian shilling and those of the other EAC countries, and also between the exchange rates of the Rwandan franc, the Burundian franc and the Ugandan shilling. The FCVAR results (see Johansen and Nielsen, 2012) imply the existence of a single cointegrating relationship between the exchange rates of the EAC countries. On the whole, there is evidence in favour of G-PPP. In addition, there appears to be a high degree of business cycle synchronization between these economies. On both grounds, one can argue that a monetary union should be feasible. JEL Classification: C22, C32, F33 Keywords: East Africa Community, monetary union, optimal currency areas, fractional integration and cointegration, business cycle synchronization, Hodrick-Prescott filter Corresponding author: Professor Guglielmo Maria Caporale, Department of Economics and Finance, Brunel University London, Uxbridge, Middlesex UB8 3PH, UK. -

Rwanda | School of Education Travel Details & Resources

Rwanda | School of Education Travel Details & Resources VACCINATIONS We recommend using resources such as the Center for Disease Control as you consult with your home doctor or other trusted medical sources, in order to make the best possible decision regarding your health. Here is a little more information on Rwanda If you reside in the Central Virginia Region, below are local medical offices that you may consider consulting. Keep in mind some vaccinations require a minimum amount of time to take effect before entering a destination. Communicate when and where you will be traveling. Lynchburg Health Department: Phone: 434‐947‐6785 Address: 307 Alleghany Ave. Liberty University Health Center: Phone: 434‐338-7774 Address: located in Green Hall. Rustburg Family Pharmacy: Phone: 434‐332‐1730 Address: 925 Village Hwy Suite B. Box 1005 Rustburg, VA 24588 Map: http://goo.gl/maps/1BC1M INTERNATIONAL TRAVEL INSURANCE International travel insurance is included within your trip costs, covering you from March 6th – 17th, 2019. The policy is comprehensive in nature and is used throughout the university for all international travel. If you would like coverage for additional aspects of travel beyond what is highlighted in the policy, please feel free to purchase separate third party insurance as a supplement to what is already provided. CURRENCY & CREDIT CARDS The Rwandan Franc is the currency of Rwanda. Currency rankings show that the most popular Rwanda Franc exchange rate is the USD to RWF rate. The currency code for Francs is RWF. Below, you'll find Rwandan Franc rates and a currency converter. https://www.xe.com/currency/rwf-rwandan-franc Make sure to contact your bank a few weeks before departure to alert them to your international travel dates and locations. -

List of Currencies of All Countries

The CSS Point List Of Currencies Of All Countries Country Currency ISO-4217 A Afghanistan Afghan afghani AFN Albania Albanian lek ALL Algeria Algerian dinar DZD Andorra European euro EUR Angola Angolan kwanza AOA Anguilla East Caribbean dollar XCD Antigua and Barbuda East Caribbean dollar XCD Argentina Argentine peso ARS Armenia Armenian dram AMD Aruba Aruban florin AWG Australia Australian dollar AUD Austria European euro EUR Azerbaijan Azerbaijani manat AZN B Bahamas Bahamian dollar BSD Bahrain Bahraini dinar BHD Bangladesh Bangladeshi taka BDT Barbados Barbadian dollar BBD Belarus Belarusian ruble BYR Belgium European euro EUR Belize Belize dollar BZD Benin West African CFA franc XOF Bhutan Bhutanese ngultrum BTN Bolivia Bolivian boliviano BOB Bosnia-Herzegovina Bosnia and Herzegovina konvertibilna marka BAM Botswana Botswana pula BWP 1 www.thecsspoint.com www.facebook.com/thecsspointOfficial The CSS Point Brazil Brazilian real BRL Brunei Brunei dollar BND Bulgaria Bulgarian lev BGN Burkina Faso West African CFA franc XOF Burundi Burundi franc BIF C Cambodia Cambodian riel KHR Cameroon Central African CFA franc XAF Canada Canadian dollar CAD Cape Verde Cape Verdean escudo CVE Cayman Islands Cayman Islands dollar KYD Central African Republic Central African CFA franc XAF Chad Central African CFA franc XAF Chile Chilean peso CLP China Chinese renminbi CNY Colombia Colombian peso COP Comoros Comorian franc KMF Congo Central African CFA franc XAF Congo, Democratic Republic Congolese franc CDF Costa Rica Costa Rican colon CRC Côte d'Ivoire West African CFA franc XOF Croatia Croatian kuna HRK Cuba Cuban peso CUC Cyprus European euro EUR Czech Republic Czech koruna CZK D Denmark Danish krone DKK Djibouti Djiboutian franc DJF Dominica East Caribbean dollar XCD 2 www.thecsspoint.com www.facebook.com/thecsspointOfficial The CSS Point Dominican Republic Dominican peso DOP E East Timor uses the U.S. -

International Payments Currency List

Appendix 1: International Payments Currency List CURRENCY CURRENCY CURRENCY TT OUTGOING DRAFT OUTGOING CHEQUE FOREIGN INCOMING TT INCOMING TT OUTGOING DRAFT OUTGOING CHEQUE FOREIGN INCOMING TT INCOMING TT OUTGOING DRAFT OUTGOING CHEQUE FOREIGN INCOMING TT INCOMING Africa Asia continued Middle East Algerian Dinar – DZD Kyrgyzstani Som – KGS Ukrainian Hryvnia – UAH Angola Kwanza – AOA Korean Won – KRW Bahrain Dinar – BHD Botswana Pula – BWP Laos Kip – LAK Israeli Shekel – ILS Burundi Franc – BIF Macau Pataca – MOP Jordanian Dinar – JOD Cape Verde Escudo – CVE Malaysian Ringgit – MYR Kuwaiti Dinar – KWD Central African States – XOF Maldives Rufiyaa – MVR Lebanese Pound – LBP Central African States – XAF Nepal Rupee – NPR Omani Rial – OMR Comoros Franc – KMF Pakistan Rupee – PKR Qatari Rial – QAR DJibouti Franc – DJF Philippine Peso – PHP Saudi Arabian Riyal – SAR Egyptian Pound – EGP Singapore Dollar – SGD Turkish Lira – TRY Eritrea Nakfa – ERN Sri Lanka Rupee – LKR UAE Dirham – AED Ethiopia Birr – ETB Taiwanese Dollar – TWD Yemeni Rial – YER Gambian Dalasi – GMD Thai Baht – THB North America Ghanian Cedi – GHS Uzbekistan Sum – UZS Canadian Dollar – CAD Guinea Republic Franc – GNF Vietnamese Dong – VND Mexican Peso – MXN Kenyan Shilling – KES Oceania United States Dollar – USD Lesotho Malati – LSL Australian Dollar – AUD South and Central America, The Caribbean Madagascar Ariary – MGA FiJi Dollar – FJD Argentine Peso – ARS Malawi Kwacha – MWK New Zealand Dollar – NZD Bahamian Dollar – BSD Mauritanian Ouguiya – MRO Papua New Guinea Kina – -

Parta-Contractualterms

Final Terms dated 25 February 2015 and amended and restated on 18 February 2016 International Finance Corporation Issue of RWF 3,511,000,.000 9.00 per cent. Notes due February 27,2018 payable in United States Dollars under its Global Medium-Term Note Program PARTA-CONTRACTUALTERMS Terms used herein shall be deemed to be defined as such for the purposes of the Conditions set forth in the Prospectus dated June 3, 2008. This document constitutes the Final Terms of the Notes described herein and must be read in conjunction with the Prospectus. Full information on International Finance Corporation (the "Corporation") and the offer of the Notes is only available on the basis of the combination of this Final Terms and the Prospectus. The Prospectus may be obtained (without charge) from the office of the Corporation at International Finance Corporation, 2121 Pennsylvania Avenue, N.W., Washington D.C. 20433 and is available for viewing at the website of the Corporation (www.ifc.org) and copies may be obtained from the website of the Luxembourg Stock Exchange (www.bourse.lu). THE NOTES ARE NOT AN OBLIGATION OF THE INTERNATIONAL BANK FOR RECONSTRUCTION AND DEVELOPMENT OR OF ANY GOVERNMENT. 1 Issuer: International Finance Corporation 2 (i) Series Number: 1403 (ii) Tranche Number: 3 Specified Currency or Currencies: Rwandan Franc ("RWF") provided that all payments in respect of the Notes will be made in United States Dollars ("USD") 4 Aggregate Nominal Amount: (i) Series: RWF 3,511,000,000 (ii) Tranche: RWF 3,511,000,000 5 Issue Price: 100 per cent. of the Aggregate Nominal Amount 6 (i) Specified Denominations: RWF 1,000,000 (ii) Calculation Amount: RWF 1,000,000 7 (i) Issue Date: February 27, 2015 (ii) Interest Commencement Date: February 27,2015 8 Maturity Date: February 27, 2018, subject to adjustment in accordance with the Modified Following Business Day Convention 9 Interest Basis: 9.00 per cent. -

Foreign Currency Exchange Service Instructions and Enrollment Form

Foreign Currency Exchange Service Instructions and Enrollment Form Company Name: Amount Number: Company Number: LT Number: ➊ Payment Instructions Check the box to receive your payment in connection with the transaction associated with the enclosed Letter of Transmittal in a foreign currency (not in U.S. dollars). Note: The Foreign Currency Exchange Service does not apply to any other types of payments (for example, dividends) issued by the above company (the “Company”), any other company, or American Stock Transfer & Trust Company, LLC (“AST”). ➋ Requested Currency for Payment Refer to the Foreign Currency Codes listed on the enclosed “Foreign Currency Exchange Service” section, and enter the three-letter code of your preferred payment. If the currency you selected is not allowed for the country, or if there are any legal restrictions within the country where your bank is located, we will be unable to enroll you for the Foreign Currency Exchange Service. Please contact your local bank with any questions. ➌ Contact Information Clearly print your email address and phone numbers where you can be reached regarding your enrollment. ➍ Indicate if you wish to receive your proceeds in the form of a check (mailed to the address above), or in the form of a wire transfer. ➎ Sign the Authorization and Return this form along with your Letter of Transmittal Print and sign your name exactly as it appears on your account, and exactly as signed on the Letter of Transmittal. If more than one name is listed, all parties must sign. Your signature authorizes the action and agrees to the terms and conditions detailed in the Foreign Currency Exchange Service Agreement Foreign Currency Exchange Service Enrollment Form ➊ Payment Instructions I wish to receive my payment in foreign currency (non-USD).