Residential Savills Research

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Appendix Iii Property Valuation

APPENDIX III PROPERTY VALUATION The following is the text of a letter with the summary of values and valuation certificate received from CB Richard Ellis Limited, prepared for the purpose of incorporation in the prospectus, in connection with their valuation as at 31 October 2010 of all the property interests of the Group. 4/F Three Exchange Square 8 Connaught Place Central, Hong Kong T 852 2820 2800 F 852 2810 0830 香港中環康樂廣場八號交易廣場第三期四樓 電話 852 2820 2800 傳真 852 2810 0830 www.cbre.com.hk 地產代理(公司)牌照號碼 Estate Agent’s Licence No: C-004065 15 December 2010 The Board of Directors, China Animal Healthcare Ltd., No. 6 Kangding Street, Yi Zhuang Economic Development Zone, Beijing City, the People’s Republic of China Dear Sirs, In accordance with your instructions for us to value the property interests held by China Animal Healthcare Ltd. (the ‘‘Company’’) and its subsidiaries (hereinafter together know as the ‘‘Group’’)inthePeople’s Republic of China (the ‘‘PRC’’). We confirm that we have carried out inspections, made relevant enquiries and obtained such further information as we consider necessary for the purpose of providing you with our opinion of the capital values of such property interests as at 31 October 2010 (the ‘‘date of valuation’’). Our valuation is our opinion of Market Value which is defined to mean ‘‘the estimated amount for which a property should exchange on the date of valuation between a willing buyer and a willing seller in an arm’s-length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently and without compulsion.’’ Unless otherwise stated, our valuation is prepared in accordance with the ‘‘First Edition of The HKIS Valuation Standards on Properties’’ published by The Hong Kong Institute of Surveyors (‘‘HKIS’’). -

Study on the Spatial Differentiation Pattern of Housing Prices in Chengdu-Chongqing City Cluster

Open Access Library Journal 2021, Volume 8, e7118 ISSN Online: 2333-9721 ISSN Print: 2333-9705 Study on the Spatial Differentiation Pattern of Housing Prices in Chengdu-Chongqing City Cluster Renkang Feng*, Rubing Han School of Civil Engineering and Architecture, Southwest University of Science and Technology, Mianyang, China How to cite this paper: Feng, R.K. and Han, Abstract R.B. (2021) Study on the Spatial Differen- tiation Pattern of Housing Prices in Chengdu- Taking the housing prices of 151 districts and counties in the Cheng- Chongqing City Cluster. Open Access Library du-Chongqing urban agglomeration from 2017 to 2019 as the basic data, the Journal, 8: e7118. housing price data is geospatially expressed in ArcGIS, and the Theil index is https://doi.org/10.4236/oalib.1107118 calculated to analyze the differentiation pattern of the housing prices of the Received: December 28, 2020 Chengdu-Chongqing urban agglomeration, using geo-detector. The effect of Accepted: February 23, 2021 different factors on housing prices in different regions shows that the geo- Published: February 26, 2021 graphical distribution of housing prices in the Chengdu-Chongqing urban agglomeration is basically the same as the city scale and economic develop- Copyright © 2021 by author(s) and Open Access Library Inc. ment of each city. The housing prices of the Chengdu-Chongqing urban ag- This work is licensed under the Creative glomeration show a dual-core dominance and a collapse in the central region. Commons Attribution International The characteristics of industrial structure, housing supply, population scale, License (CC BY 4.0). land cost, economic strength, real estate investment scale, housing policy, and http://creativecommons.org/licenses/by/4.0/ higher education resources have a significant impact on the housing prices of Open Access Chengdu-Chongqing urban agglomeration. -

By Fax, Email And

INTERNATIONAL COMPETITION: TOWNLAND’S RECENT AWARDS TOWNLAND’S MAINLAND CHINA AWARDS . NATIONAL SECOND CLASS AWARD together with the Urban Planning and Design Institute of Shenzhen (UPDIS) for the Shenzhen Metro Phase II Pre-Feasibility Study, Lines 1, 2, 3 and 4 and Lines 1 and 3 Extension, Shenzhen, Guangdong Province. The Project was also recipient of a FIRST CLASS AWARD in the Shenzhen Planning Awards of the Shenzhen Lands Bureau . FIRST PRIZE awarded by Zhoushan Government, Zhejiang (organised by the Urban Planning Society of China) for the Conceptual Masterplan of Zhoushan and Surrounding Islands (72,144 ha), Zhejiang Province; and CERTIFICATE OF MERIT awarded by the Hong Kong Institute of Planners . FIRST PRIZE awarded by the Planning and Construction Bureau of the National Tourist Resort Area of Taihu, Suzhou (19 ha) for the Suzhou Taihu Ecological Recreation Plaza Planning Design, Jiangsu Province . FIRST PRIZE awarded by the Planning Committee of Hechuan City, Chongqing for Conceptual Planning Design at ‘Eastern Peninsula’ (Dong Cheng Ban Dao) (600 ha), Hechuan City, Chongqing . FIRST PRIZE in an International Competition (organized by the Shanghai Planning Bureau) for the Conceptual Master Planning for an Ecology Port Development (15,000 ha) on Chong Ming Island, Shanghai . FIRST PRIZE awarded by Chongqing Land Development Company for Key Projects Demolition and Resettlement for a Residential Master Plan for Xin-Min (62 ha), Xiaoqu, Chongqing . FIRST PRIZE awarded by the Ningbo Planning Bureau for a Master Plan for Science Park Retail/ Commercial Uses and Government Offices in the Core Area (200 ha) of the Higher Education Park, Zhenghai District, Ningbo, Zhejiang Province . -

Five Independent Cases of Human Infection with Avian Influenza H5N6 — Sichuan Province, China, 2021

China CDC Weekly Outbreak Reports Five Independent Cases of Human Infection with Avian Influenza H5N6 — Sichuan Province, China, 2021 Chongkun Xiao1,&; Jianan Xu1,&; Yu Lan2,&; Zhongping Huang1; Lijun Zhou1; Yaxin Guo2; Xiyan Li2; Lei Yang2; George F. Gao2; Dayan Wang2; William J. Liu2,#; Xingyu Zhou1,#; Huiping Yang1,# including 21 deaths. This year, 10 sporadic human Summary infections have been recorded in Sichuan Province, What is known about this topic? Anhui Province, Guangxi Zhuang Autonomous The emerging H5Ny lineages of the avian influenza Region, and Chongqing Municipality ( 8). virus (AIV) with genomic reassortments have posed a continuous threat to animals and human beings. Since INVESTIGATION AND RESULTS the first case of avian influenza A (H5N6) virus infection in 2014, the World Health Organization has Herein, we report the 5 cases infected by AIV H5N6 reported a total of 38 cases by August 6, 2021. in Sichuan Province, China in 2021. These 5 What is added by this report? independent cases occurred in 5 different districts or A total of 5 new cases of H5N6 that occurred from counties from 4 cities (Figure 1A, i.e., Jinjiang District May 2021 to July 2021 in Sichuan Province, China of Chengdu City, Kaijiang County and Xuanhan were reported in this study. Epidemiological and County of Dazhou City, Bazhou District of Bazhong laboratory information of the five cases were City, and Nanxi District of Yibin City). All four cities investigated. The genomic analysis of the H5N6 are located in the east of Sichuan Province, China genomes showed the features of AIV genomic (Figure 1A). A case was sampled by nasopharyngeal reassortments and key residue substitutions. -

A Case Study of the Sichuan-Tibet Scenic Byway

CONVERTER MAGAZINE Volume 2021, No. 5 Study on the Influence of Road Network on the Spatial Distribution of Tourism Resources – A Case Study of the Sichuan-Tibet Scenic Byway Bo Zhang1,2, Boming Tang1, Liangyu Zhou3, Ke Huang4 1 School of Civil Engineering, Chongqing Jiaotong University, Chongqing, China 2 School of Art Design, Chongqing Jiaotong University, Chongqing, China 3 School of Traffic & Transportation, Chongqing Jiaotong University, Chongqing, China 4 College of Architecture and Urban Planning, Chongqing Jiaotong University, Chongqing, China Abstract Objectives: The Sichuan-Tibet Scenic Byway is one of the most well-known scenic byway in China. Researching on the mechanism of action between the routes and tourism resources nodes of the Sichuan-Tibet Scenic Byway network, will benefit the Sichuan-Tibet Scenic Byway’s development by changing the development patterns of the Scenic Byway from “point-line” to network, and will be helpful to promote the integration of tourism resources along the route, furthermore to construct the Sichuan-Tibet Scenic Byway as a destination of all-for-one tourism. Methods: Based on the spatial design network analysis (sDNA model), GIS spatial analysis and other methods, the current study analyzed regional tourism resources and the spatial characteristics of road network morphology along the Sichuan-Tibet Scenic Byway, and explored the influence of road network forms on the spatial distribution of tourism resources and its spatial spillover effect by combining with spatial econometric model. Results: The distribution pattern of tourism resources along the Sichuan-Tibet Scenic Road is “dense at both ends and sparse in the middle”, and the “Matthew Effect” is significant. -

1 This Research Project Has Been Approved by The

Adaptability Evaluation of Human Settlements in Chengdu Based on 3S Technology Wende Chen Chengdu University of Technology kun zhu ( [email protected] ) Chengdu University of Technology https://orcid.org/0000-0003-2871-4155 QUN WU Chengdu University of Technology Yankun CAI Chengdu University of Technology Yutian LU Chengdu University of Technology jun Wei Chengdu University of Technology Research Article Keywords: Human settlement, Evaluation, 3s technology, Spatial differentiation, Chengdu city Posted Date: February 22nd, 2021 DOI: https://doi.org/10.21203/rs.3.rs-207391/v1 License: This work is licensed under a Creative Commons Attribution 4.0 International License. Read Full License 1 Ethical Approval: 2 This research project has been approved by the Ethics Committee of Chengdu University of Technology. 3 Consent to Participate: 4 Written informed consent for publication was obtained from all participants. 5 Consent to Publish: 6 Author confirms: The article described has not been published before; Not considering publishing elsewhere; Its 7 publication has been approved by all co-authors; Its publication has been approved (acquiesced or publicly approved) by 8 the responsible authority of the institution where it works. The author agrees to publish in the following journals, and 9 agrees to publish articles in the corresponding English journals of Environmental Science and Pollution Research. If the 10 article is accepted for publication, the copyright of English articles will be transferred to Environmental Science and 11 Pollution Research. The author declares that his contribution is original, and that he has full rights to receive this grant. 12 The author requests and assumes responsibility for publishing this material on behalf of any and all co-authors. -

Chengdu Expressway Co., Ltd. 成都高速公路股份有限公司 (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 01785)

B_table indent_3.5 mm N_table indent_3 mm Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Chengdu Expressway Co., Ltd. 成都高速公路股份有限公司 (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 01785) ANNOUNCEMENT ENTERING INTO THE PROJECT INVESTMENT AGREEMENT WITH CHENGDU PIDU DISTRICT PEOPLE’S GOVERNMENT This announcement is made by Chengdu Expressway Co., Ltd. (the “Company”) in accordance with Rule 13.09 of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Listing Rules”) and Part XIVA of the Securities and Futures Ordinance (Chapter 571 of the laws of Hong Kong). The board of directors of the Company (the “Board”) hereby announces that, the Company entered into the Project Investment Agreement with the People’s Government of Pidu District in Chengdu, Sichuan province (“Pidu District Government”) on 4 March 2020, pursuant to which, Pidu District Government shall support the Company to invest in the construction of a Class B expressway service area in proximity to Ande Toll Station (near K22 of Chengguan Expressway) within Pidu District (the “Project”). Details of the Project are as follows: (1) core area (Phase I): to establish -

China Tian Lun Gas Holdings Limited 中國天倫燃氣控股有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 01600)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. China Tian Lun Gas Holdings Limited 中國天倫燃氣控股有限公司 (incorporated in the Cayman Islands with limited liability) (Stock code: 01600) ANNOUNCEMENT OF INTERIM RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2021 Highlights of results for the six months ended 30 June 2021: • Total gas sales volume was 929 million m3, representing an increase of 30.0% as compared with 715 million m3 for the corresponding period of last year. Among the total gas sales volume, total gas retail sales volume was 742 million m3, representing an increase of 30.1% as compared with 571 million m3 for the corresponding period of last year. • Revenue was RMB3,599 million, representing an increase of 20.2% as compared with RMB2,996 million for the corresponding period of last year. • Core profit for the half year amounted to RMB449 million, representing an increase of 5.9% as compared with RMB424 million for the corresponding period of last year. • Basic earnings per share were RMB0.51, representing an increase of 34.2% as compared with RMB0.38 for the corresponding period of last year. • The Board recommends the payment of an interim dividend of RMB13.43 cents per share, representing an increase of 17.8% as compared with RMB11.40 cents for the corresponding period of last year. -

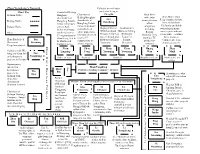

Zhou Yongkang's Network

Zhou Yongkang’s Network Colluded on real estate Chart Key Controlled Beijing project w/ Feng in Sichuan Native Honghan; Chairman of Chengdu Zhou Bin’s Zhan Minli, Zhou shareholder of Beijing Honghan; wife, who Sun Feng’s mother-in-law, Beijing Native Hongfeng Potash shareholder of managed many Jiancheng lives in Southern mines in Sichuan, Hongfeng Potash of his California and holds Jiangsu Native owned Audi mines in Sichuan; companies, ` Deputy Chief of Established A dealer in Jiangsu; controlled real including ownership in many— Wuxi Land and Business Selling Other involved in over estate projects in Beijing some reports indicate Resources Bureau; Wuliangye at least nine—of Zhou 37 corporations w/ Chengdu involved Zhongxu; Also travelled back and Liquor in Bin’s business Zhou Feng; tied to in over 37 started a TV Zhou Bin helped Dai forth to visit Zhou Jiangsu; ventures; she is an Li Hualin and corporations w/ production Dai secure Xiaoming Yonakang Deceased American citizen Kunlun Energy Zhou Lingying company Pengzhou project Zhou Bin’s Business Partners Business Bin’s Zhou Zhou Zhou Zhou Zhou Huang Zhan Colluded with Wu Lingying Feng Yuanqing Yuanxing Wan Minli Guo Bing and Zhou Bin Yongxiang on hydropower Sister-in-Law Nephew Brothers Daughter-in-Law Mother-in-Law projects in Sichuan of Son Businessman, invested in Son Zhou Yongkang hydropower Zhou Politburo Standing Committee Member Wu Bin projects in Bing A soothsayer, who Cao Sichuan with advised Li on urban Zhou Bin; Former Yongzheng projects; chairman of Chairman Major Zhou Surrogates/Secretaries in Sichuan Zhongxu Limited of Beijing Head of PSB in Zhongxu Guo Li Li Wu Jinjiang District, Yangguang Yongxiang Chongxi Chuncheng Tao Chengdu, gave Li Chairman of Petroleum Sichuan Hanlong illegal passports Liu and Natural Former Vice- Former Deputy Mayor of Chengdu; Company. -

Table of Codes for Each Court of Each Level

Table of Codes for Each Court of Each Level Corresponding Type Chinese Court Region Court Name Administrative Name Code Code Area Supreme People’s Court 最高人民法院 最高法 Higher People's Court of 北京市高级人民 Beijing 京 110000 1 Beijing Municipality 法院 Municipality No. 1 Intermediate People's 北京市第一中级 京 01 2 Court of Beijing Municipality 人民法院 Shijingshan Shijingshan District People’s 北京市石景山区 京 0107 110107 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Haidian District of Haidian District People’s 北京市海淀区人 京 0108 110108 Beijing 1 Court of Beijing Municipality 民法院 Municipality Mentougou Mentougou District People’s 北京市门头沟区 京 0109 110109 District of Beijing 1 Court of Beijing Municipality 人民法院 Municipality Changping Changping District People’s 北京市昌平区人 京 0114 110114 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Yanqing County People’s 延庆县人民法院 京 0229 110229 Yanqing County 1 Court No. 2 Intermediate People's 北京市第二中级 京 02 2 Court of Beijing Municipality 人民法院 Dongcheng Dongcheng District People’s 北京市东城区人 京 0101 110101 District of Beijing 1 Court of Beijing Municipality 民法院 Municipality Xicheng District Xicheng District People’s 北京市西城区人 京 0102 110102 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Fengtai District of Fengtai District People’s 北京市丰台区人 京 0106 110106 Beijing 1 Court of Beijing Municipality 民法院 Municipality 1 Fangshan District Fangshan District People’s 北京市房山区人 京 0111 110111 of Beijing 1 Court of Beijing Municipality 民法院 Municipality Daxing District of Daxing District People’s 北京市大兴区人 京 0115 -

The Analysis of Coordinated Development

Journal of Sustainable Development Vol. 3, No. 2; June 2010 The Analysis of Coordinated Development between Land Intensive Use and Land Ecological Security: A Case of Chengdu City Wei-zhong Zeng (Corresponding author) College of Economic & Management, Sichuan Agricultural University No.46 Xin Kang Road, Ya’an, 625014, China Tel: 86-139-0816-0293, 86-835-288-2728 E-mail: [email protected], [email protected] Li Li, Xi Cai & Cheng-yi Huang College of Economic& Management, Sichuan Agricultural University No.46 Xin Kang Road, Ya’an, 625014, China Tel: 86-151-8121-5210 E-mail: [email protected];[email protected] The paper is financed by Key Project of the National Eleventh-Five Year Research Program of China. No.2006BAJ05A13(Sponsoring information) Abstract This study has been performed in order to analyze the coordinated degree and evolving trends of the land intensive use and land eco-security based on the statistical data from 1998 to 2007 in Chengdu city by Synergetios theory and dynamic coordinated degrees model. Results show that during the study period, the level of land intensive use and land ecological security both rose in Chengdu, the former continuing to raise, the overall increasing but some fluctuations in the latter. Dynamic coordinated degree in 10 years is between 8.99°~57.71° with a trend of rising firstly then dropping, undergoing the process from a relatively harmonious development to the best coordinated development, then to less coordinated development. From 2005, the coordinated degree between the two systems began to decline. Keywords: Urban land intensive-use, Urban land ecological security, Coordinated degree 1. -

An Analysis of Urban Green Landscape Pattern in Chengdu City

Proceedings of 14th Youth Conference on Communication An Analysis of Urban Green Landscape Pattern in Chengdu City Based on CBERS/CCD 1 2 3 3 DAN Bo , DAN Shang-ming , XU Hui-xi , XUE Wan-rong 1. Sichuan Provincial Meteorological Observatory, Chengdu 610072, P.R.China 2. Sichuan Province Agrimeteorological Center, Chengdu 610072, P.R.China 3. Institute of Engineering Surveying, Sichuan College of Architectural Technology, Deyang 618000, P.R.China [email protected] Abstract: Based on GIS and CBERS/CCD which was obtained on June 16, 2006, patches of urban green in the main urban areas of Chengdu are extracted using many quantitative indicators and by method of decision tree classification, according to principles and methods of landscape ecology. Patches of urban green are divided into four grades, and they are respectively small-scale patch, medium-scale patch, large-scale patch and special large-scale patch. The area pro- portion of small-scale patch is 3.8%, and that of medium-scale patch is 11.1%, that of large-scale patch is 22.3% and that of special large-scale patch is 62.8%.The results of fragmentation, contagion, diversity index, dominance and evenness are obtained. They are 0.854, 0.600, 0.657, 0.730 and 0.690 respectively. The research results think that scal- ability characteristics and divisional differences of green patches are obvious. A little number of green whose area is bigger mainly is composed of scenic spots, gardens and universities. There are many problems, for example, connec- tivity of urban green is low, structure of landscape is single, and spatial distribution is unbalanced.