3Rd Party Valuation/Appraisal Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Inspection Bukidnon

INSPECTION BUKIDNON Name of Establishment Address No. of Type of Industry Type of Condition Workers 1 AGLAYAN PETRON SERVICE CENTER POB. AGLAYAN, MALAYBALAY CITY 15 RETAIL HAZARDOUS 2 AGT MALAYBALAY PETRON (BRANCH) SAN VICENTE ST., MALAYBALAY CITY 10 RETAIL HAZARDOUS 3 AGT PETRON SERVICE CENTER SAN JOSE, MALAYBALAY CITY 15 RETAIL HAZARDOUS 4 AIDYL STORE POB. MALAYBALAY CITY 13 RETAIL HAZARDOUS 5 ALAMID MANPOWER SERVICES POB. AGLAYAN, MALAYBALAY CITY 99 NON-AGRI NON-HAZARDOUS 6 ANTONIO CHING FARM STA. CRUZ, MALAYBALAY CITY 53 AGRI HAZARDOUS 7 ASIAN HILLS BANK, INC. FORTICH ST., MALAYBALAY CITY 21 AGRI NON-HAZARDOUS 8 BAKERS DREAM (G. TABIOS BRANCH) T. TABIOS ST., MALAYBALAY CITY 10 RETAIL NON-HAZARDOUS 9 BAO SHENG ENTERPRISES MELENDES ST., MALAYBALAY CITY 10 RETAIL NON-HAZARDOUS 10 BELLY FARM KALASUNGAY, MALAYBALAY CITY 13 AGRI HAZARDOUS 11 BETHEL BAPTIST CHURCH SCHOOL FORTICH ST., MALAYBALAY CITY 19 PRIV. SCH NON-HAZARDOUS 12 BETHEL BAPTIST HOSPITAL SAYRE HIWAY, MALAYBALAY CITY 81 HOSPITAL NON-HAZARDOUS NON-HAZARDOUS 13 BUGEMCO LEARNING CENTER SAN VICTORES ST., MALAYBALAY CITY 10 PRIV. SCH GUILLERMO FORTICH ST., 14 BUKIDNON PHARMACY COOPERATIVE MALAYBALAY CITY 11 RETAIL NON-HAZARDOUS 15 CAFE CASANOVA (BRANCH) MAGSAYSAY ST., MALAYBALAY CITY 10 SERVICE NON-HAZARDOUS 16 CASCOM COMMERCIAL POB. AGLAYAN, MALAYBALAY CITY 30 RETAIL NON-HAZARDOUS CASISNG CHRISTIAN SCHOOL OF M NON-HAZARDOUS 17 MALAYBALAY CASISANG, MALAYBALAY CITY 34 PRIV. SCH A 18 CEBUANA LHUILLIER PAWNSHOP FORTICH ST., MALAYBALAY CITY 10 FINANCING NON-HAZARDOUS L 19 CELLUCOM DEVICES -

NO. TENEMENT ID TENEMENT HOLDER DATE DATE AREA (Has

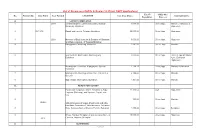

Annex "B" MINING TENEMENT STATISTICS REPORT AS OF MARCH 2019 MGB REGIONAL OFFICE NO. X MINERAL PRODUCTION SHARING AGREEMENT (MPSA) I. Approved and Registered NO. TENEMENT ID TENEMENT HOLDER DATE DATE LOCATION AREA (has.) COMMODITY PREVIOUS STATUS/REMARKS FILED APPROVED Barangay Mun./'City Province HOLDER 1 MPSA - 039-96-X Holcim Resources and Development 8/3/1993 4/1/1996 Poblacion Lugait Misamis Oriental 129.6974 Shale Alsons Cement * On final rehabilitation. Corporation Corporation * Assigned to HRDC effective January 18, 2016. * Order of Approval registered on June 07, 2016. 2 MPSA - 031-95-XII Mindanao Portland Cement Corp. 4/29/1991 12/26/1995 Kiwalan Iligan City Lanao del Norte 323.0953 Limestone/Shale None * Corporate name changed to Republic Cement Iligan, Inc. (changed management to Lafarge Kalubihan * Officially recognized by MGB-X in its letter of March 9, 2016. Mindanao, Inc. and to Republic Cement Taguibo Mindanao, Inc.) 3 MPSA - 047-96-XII Holcim Resources and Development 8/21/1995 7/18/1996 Talacogon Iligan City Lanao del Norte 397.68 Limestone/Shale Alsons Cement * Assigned to HRDC effective January 18, 2016. Corporation Dalipuga Corporation * Order of Approval registered on June 07, 2016. - Lugait Misamis Oriental 4 MPSA-104-98-XII Iligan Cement Corporation 9/10/1991 2/23/1998 Sta Felomina Iligan City Lanao del Norte 519.09 Limestone/Shale None * Corporate name changed to Republic Cement Iligan, Inc. (changed management to Lafarge Bunawan * Officially recognized by MGB-X in its letter of March 9, 2016. Iligan, Inc. and to Republic Cement Kiwalan Iligan, Inc.) 5 MPSA - 105-98-XII MCCI Corporation 6/18/1991 2/23/1998 Kiwalan Iligan City Lanao del Norte and 26.7867 Limestone Maria Cristina * Existing but operation is suspended. -

Energy Projects in Region X

Energy Projects in Region X Lisa S. Go Chief, Investment Promotion Office Department of Energy Energy Investment Briefing – Region X 16 August 2018 Cagayan De Oro City, Misamis Oriental Department of Energy Empowering the Filipino Energy Projects in Northern Mindanao Provinces Capital Camiguin Mambajao Camiguin Bukidnon Malaybalay Misamis Oriental Cagayan de Oro Misamis Misamis Misamis Occidental Oroquieta Occidental Gingoog Oriental City Lanao del Norte Tubod Oroquieta CIty Cagayan Cities De Oro Cagayan de Oro Highly Urbanized (Independent City) Iligan Ozamis CIty Malaybalay City Iligan Highly Urbanized (Independent City) Tangub CIty Malayabalay 1st Class City Bukidnon Tubod 1st Class City Valencia City Gingoog 2nd Class City Valencia 2nd Class City Lanao del Ozamis 3rd Class City Norte Oroquieta 4th Class City Tangub 4th Class City El Salvador 6th Class City Source: 2015 Census Department of Energy Empowering the Filipino Energy Projects in Region X Summary of Energy Projects Per Province Misamis Bukidnon Camiguin Lanao del Norte Misamis Oriental Total Occidental Province Cap. Cap. Cap. Cap. No. No. No. No. Cap. (MW) No. No. Cap. (MW) (MW) (MW) (MW) (MW) Coal 1 600 4 912 1 300 6 1,812.0 Hydro 28 338.14 12 1061.71 8 38.75 4 20.2 52 1,458.8 Solar 4 74.49 1 0.025 13 270.74 18 345.255 Geothermal 1 20 1 20.0 Biomass 5 77.8 5 77.8 Bunker / Diesel 4 28.7 1 4.1 2 129 6 113.03 1 15.6 14 290.43 Total 41 519.13 1 4.10 16 1,790.74 32 1,354.52 6 335.80 96 4,004.29 Next Department of Energy Empowering the Filipino As of December 31, 2017 Energy Projects in Region X Bukidnon 519.13 MW Capacity Project Name Company Name Location Resource (MW) Status 0.50 Rio Verde Inline (Phase I) Rio Verde Water Constortium, Inc. -

Integrated Natural Resources and Environmental Management Project Rehabilitation and Improvement of Liguron Access Road in Talakag, Bukidnon

Initial Environmental Examination January 2018 PHI: Integrated Natural Resources and Environmental Management Project Rehabilitation and Improvement of Liguron Access Road in Talakag, Bukidnon Prepared by Municipality of Talakag, Province of Bukidnon for the Asian Development Bank. i CURRENCY EQUIVALENTS (as of 30 November 2017 Year) The date of the currency equivalents must be within 2 months from the date on the cover. Currency unit – peso (PhP) PhP 1.00 = $ 0.01986 $1.00 = PhP 50.34 ABBREVIATIONS ADB Asian Development Bank BDC Barangay Development Council BUB Bottom-Up Budgeting CDORB Cagayan De Oro River Basin CNC Certificate of Non-Coverage CSC Construction Supervision Consultant CSO Civil Society Organization DED Detail Engineering Design DENR Department of Environment And Natural Resources DILG Department of Interior and Local Government DSWD Department of Social Welfare and Development ECA Environmentally Critical Area ECC Environmental Compliance Certificate ECP Environmentally Critical Project EHSM Environmental Health and Safety Manager EIA Environmental Impact Assessment EIS Environmental Impact Statement EMB Environmental Management Bureau ESS Environmental Safeguards Specialist GAD Gender and Development IEE Initial Environmental Examination INREMP Integrated Natural Resources and Environment Management Project IP Indigenous People IROW Infrastructure Right of Way LIDASAFA Liguron-Dagundalahon-Sagaran Farmers Association LGU Local Government Unit LPRAT Local Poverty Reduction Action Team MKaRNP Mt. Kalatungan Range Natural -

Lay out Pdf.Pmd

Developing the Local Natural Resource Management Plan A Guide to Facilitators Delia C Catacutan Eduardo E Queblatin Caroline E Duque Lyndon J Arbes To more fully reflect our global reach, as well as our more balanced research and development agenda, we adopted a new brand name in 2002 ‘World Agroforestry Centre’. Our legal name - International Centre for Research in Agroforestry - remains unchanged, and so our acronym as a Future Harvest Centre remains the same. Views expressed in this publication are those of the authors and do not necessarily reflect the views of the World Agroforestry Centre. All images remain the sole property of their source and may not be used for any purpose without written permission of the source. About this manual: Developing the Local Natural Resource Management Plan is a guide for facilitators and development workers, from both government and non-government organizations. The content of this guidebook outlines ICRAF’s experiences in working with different local governments in Mindanao in formulating and implementing NRM programs. Citation: Catacutan D, Queblatin E, Duque C, Arbes L. 2006. Developing the Local Natural Resource Management Plan: A Guide to Facilitators. Bukidnon, Philippines: World Agroforestry Centre (ICRAF). ISBN: 978-971-93135-3-9 Copyright 2006 by the World Agroforestry Centre ICRAF - Philippines 2/F College of Forestry and Natural Resources Administration Building PO Box 35024, UPLB, College, Laguna 4031, Philippines Tel.: +63 49 536 2925; +63 49 536 7645 Fax: +63 49 536 4521 Email: [email protected] -

Enhancing the Role of Local Government Units in Environmental Regulation

Working Paper No. 04-06 ENHANCING THE ROLE OF LOCAL GOVERNMENT UNITS IN ENVIRONMENTAL REGULATION D.D. Elazegui, M.V.O. Espaldon, and A.T. Sumbalan Institute of Strategic Planning and Policy Studies (formerly Center for Policy and Development Studies) College of Public Affairs University of the Philippines Los Baños College, Laguna 4031 Philippines Telephone: (63-049) 536--3455 Fax: (63-049) 536-3637 E-mail address: [email protected] Homepage: www.uplb.edu.ph The ISPPS Working Paper series reports the results of studies conducted by the Institute faculty and staff. These have not been reviewed and are being circulated for the purpose of soliciting comments and suggestions. The views expressed in the paper are those of the author and do not necessarily reflect those of ISPPS and USAID through the SANREM CRSP/SEA.. Please send your comments to: The Director Institute of Strategic Planning & Policy Studies (formerly CPDS) College of Public Affairs University of the Philippines Los Baños College, Laguna 4031 Philippines ABOUT THE AUTHORS Ms. Dulce D Elazegui is a University Researcher, Institute of Strategic Planning and Policy Studies, College of Public Affairs, University of the Philippines Los Baños. Dr. Ma. Victoria Espaldon is an Associate Professor at the Department of Geography, University of the Philippines-Diliman, Quezon City. Dr. Antonio T. Sumbalan serves as Consultant to the Protected Area Management Board (PAMB) of the Mt. Kitanglad RangeNatural Park and Consultant to the Office of the Governor, Province of Bukidnon. ii ACKNOWLEDGEMENT This publication was made possible through support provided by the Office of Agriculture, Bureau for Economic Growth, Agriculture and Trade, U.S. -

Province of Bukidnon

Department of Environment and Natural Resources MINES & GEOSCIENCES BUREAU Regional Office No. X Macabalan, Cagayan de Oro City DIRECTORY OF PRODUCING MINES AND QUARRIES IN REGION 10 CALENDAR YEAR 2017 PROVINCE OF BUKIDNON Head Office Mine Site Mine Site Municipality/ Head Office Mailing Head Office Fax Head Office E- Head Office Mine Site Mailing Mine Site Type of Date Date of Area Municipality, Year Region Mineral Province Commodity Contractor Operator Managing Official Position Telephone Telephone Email Permit Number Barangay Status TIN City Address No. mail Address Website Address Fax Permit Approved Expirtion (has.) Province No. No. Address Commercial Sand and Gravel San Isidro, Valencia San Isidro, Valencia CSAG-2001-17- Valencia City, Non-Metallic Bukidnon Valencia City Sand and Gravel Abejuela, Jude Abejuela, Jude Permit Holder City 0926-809-1228 City 24 Bukidnon Operational 2017 10 CSAG 12-Jul-17 12-Jul-18 1 ha. San Isidro Manolo Manolo JVAC & Damilag, Manolo fedemata@ya Sabangan, Dalirig, CSAG-2015-17- Fortich, 931-311- 2017 10 Non-Metallic Bukidnon Fortich Sand and Gravel VENRAY Abella, Fe D. Abella, Fe D. Permit Holder Fortich, Bukidnon 0905-172-8446 hoo.com Manolo Fortich CSAG 40 02-Aug-17 02-Aug-18 1 ha. Dalirig Bukidnon Operational 431 Nabag-o, Valencia agbayanioscar Nabag-o, Valencia Valencia City, 495-913- 2017 10 Non-Metallic Bukidnon Valencia City Sand and Gravel Agbayani, Oscar B. Agbayani, Oscar B. Permit Holder City 0926-177-3832 [email protected] City CSAG CSAG-2017-09 08-Aug-17 08-Aug-18 2 has. Nabag-o Bukidnon Operational 536 Old Nongnongan, Don Old Nongnongan, Don CSAG-2006- Don Carlos, 2017 10 Non-Metallic Bukidnon Don Carlos Sand and Gravel UBI Davao City Alagao, Consolacion Alagao, Consolacion Permit Holder Calrlos Carlos CSAG 1750 11-Oct-17 11-Oct-18 1 ha. -

Project Contract ID No. 20KC0025 - Road Widening Along Sayre Highway K1464+160-K1464+508, K1464+667 – K1464+820, Manolo Fortich, Bukidnon

Project Contract ID No. 20KC0025 - Road Widening Along Sayre Highway K1464+160-K1464+508, K1464+667 – K1464+820, Manolo Fortich, Bukidnon Project Contract ID No. 20KC0026 - Road Widening Along Misamis Oriental-Bukidnon-Agusan Road K1431+470-K1432+295, K1432+320-K1432+765, Malitbog, Bukidnon Project Contract ID No. 20KC0027 - Road Widening Along Maramag-Maradugao Road K1585+1027.60- K1587+102.60, Pangantucan, Bukidnon Project Contract ID No. 20KC0029 - Road Widening Along Kalilangan-Lampanusan Road K1606+634-K1608+435, Kalilangan, Bukidnon Project Contract ID No. 20KC0031 - Road Widening Along Kibawe-Kadingilan-Kalilangan Road K1605+(-401)-K1605+756, K1605+790-K1606+759, K1608+113-K1608+702, Pangantucan, Bukidnon Project Contract ID No. 20KC0032 - Road Widening Along Kibawe-Kadingilan-Kalilangan Road K1608+702- K1611+103, Pangantucan, Bukidnon Project Contract ID No. 20KC0033 - Paving of Unpaved Roads along Jct. Maradugao-Camp Kibaritan-Dominorog Road K1626+(-579)-K1626+(-139), Kalilangan, Bukidnon Project Contract ID No. 20KC0034 - Construction of Road Network with Curb and Gutter of Mindanao Army Training Reservation, Kalilangan, Bukidnon Group TRADOC, PA, Kibaritan Military Reservation, Kalilangan, Bukidnon Project Contract ID No. 20KC0038 - Construction (Completion) of Multi-Purpose Building Libona National High School, Brgy. Crossing, Libona, Bukidnon Project Contract ID No. 20KC0040 - Construction of Road, Brgy. Dalirig, Manolo Fortich, Bukidnon Project Contract ID No. 20KC0044 - Construction of Water Supply – Level II Brgy. Sta. Fe, Libona, Bukidnon Project Contract ID No. 20KC0045 - Construction of Water Supply – Level II Brgy. Capihan, Libona, Bukidnon Project Contract ID No. 20KC0046 - Rehabilitation of Water Supply – Level II Brgy. Omagling, Malitbog, Bukidnon Project Contract ID No. 20KC0047 - Cluster “A” (1) Construction (Completion) of Water Supply -Level II, Brgy. -

21KC0062 Location : Manolo Fortich, Bukidnon 2. Contract ID

1. Contract I.D No. : 21KC0062 Contract Name : Rehabilitation/Reconstruction/Upgrading of Damaged Paved Roads along Sayre Highway - K1455+1003-K1457+363.5, K1463+672- Location : Manolo Fortich, Bukidnon 2. Contract I.D No. : 21KC0063 Contract Name : Widening of Bridge Tal-Uban Br. (B01400MN) along CDO City- Dominorog-Camp Kibaritan Rd. Location : Talakag, Bukidnon 3. Contract I.D No. : 21KC0064 Contract Name : Construction/Improvement of Access Road from Cagayan de Oro City Leading to Ultra Winds Mountain Resort Location : Pualas, Baungon, Bukidnon 4. Contract I.D No. : 21KC0065 Contract Name : Construction of Enlisted Personnel Barracks, Camp Kibaritan Location : Brgy. Malinao, Kalilangan, Bukidnon 5. Contract I.D No. : 21KC0066 Contract Name : Typical Construction of Classrooms, Camp Kibaritan Location : Brgy. Malinao, Kalilangan, Bukidnon 6. Contract I.D No. : 21KC0067 Contract Name : Construction of School Building (Damilag Integrated School) Location : Barangay Damilag, Manolo Fortich, Bukidnon 7. Contract I.D No. : 21KC0068 Contract Name : Construction of School Building, 2 CL (Dahilayan Integrated School) Location : Barangay Dahilayan, Manolo Fortich, Bukidnon 8. Contract I.D No. : 21KC0069 Contract Name : Construction of School Building, 2 CL (Tinaytayan Elementary School) Location : Barangay San Miguel, Talakag, Bukidnon 9. Contract I.D No. : 21KC0070 Contract Name : Rehabilitation of School Building (Laturan Elementary School) Location : Barangay Laturan, Libona, Bukidnon 10. Contract I.D No. : 21KC0071 Contract Name : Construction (Improvement) of Multi-Purpose Building (Stage), Palabucan Elementary School Location : Barangay Palabucan, Libona, Bukidnon 11. Contract I.D No. : 21KC0072 Contract Name : Construction of Multi-Purpose Building (Bahay Pag-asa) Location : Manolo Fortich, Bukidnon 12. Contract I.D No. : 21KC0073 Contract Name : Construction of Multi-Purpose Building (Bahay Silangan) Location : Manolo Fortich, Bukidnon 13. -

List of On-Process Cadts in Region 10 (Direct CADT Applications) Est

List of On-process CADTs in Region 10 (Direct CADT Applications) Est. IP CADC No./ No. Petition No. Date Filed Year Funded LOCATION Est. Area (Has.) Claimant ICC/s Population Process A.6. 03/25/95 Kibalagon SURVEY Lot COMPLETED2 (CMU) 601.00 Direct App. Manobo-Talaandig 1. 2004 Central Mindanao University (CMU), Musuan, 3,080.00 Direct App. Manobo, Talaandig & Maramag, Bukidnon Higa-onon 2. 05/13/02 Basak and Lantud, Talakag, Bukidnon 20,000.00 Direct App. Higa-onon 3. 2008 Maecate of Brgy, Laculac & Sagaran of Baungon 5,000.00 Direct App. Higaonon and Dagondalahon of Talakag,Bukidnon 4. Danggawan, Maramag, Bukidnon 1,941.92 Direct App. Manobo 5. Guinawahan, Bontongan, Impasug-ong, 3,000.00 Direct App. Heirs of Apo Bartolome Bukidnon Ayoc (Bukidnon- Higaonon) 6. Merangeran, Lumintao, Kipaypayon, Quezon 7,294.73 Direct App. Manobo-Kulamanen Bukidnon 7. Banlag & Sto. Domingo of Quezon , Valencia & 2,154.00 Direct App. Manobo Quezon 8. San nicolas, Don Carlos, Bukidnon 1,401.00 Direct App. Manobo B. READY FOR SURVEY 1. Palabukan (Tagiptip),Libona, Bukidnon & Brgy. 11,193.54 AO1 Higa-onon Cugman (Malasag), and Agusan, Cag de Oro City 2. 120.00 Direct App. Manobo 1/14/02 Sitio Kiramanon of Brgys. Panalsalan and Sitio Kawilihan Dagumbaan, Mun Maramag, Bukidnon 3. Brgy. Santiago Mun of Manolo Fortich, Bukidnon 1,450.00 Direct App. Bukidnon 4. Brgys. Plaridel, Hinaplanon and Gumaod, Mun. of 10,000.00 Direct App. Higaonon 2012 Claveria, Misamis Oriengtal C. SUSPENDED Page 1 of 6 Est. IP CADC No./ No. Petition No. Date Filed Year Funded LOCATION Est. -

REGION 10 Address: Baloy, Cagayan De Oro City Office Number: (088) 855 4501 Email: [email protected] Regional Director: John Robert R

REGION 10 Address: Baloy, Cagayan de Oro City Office Number: (088) 855 4501 Email: [email protected] Regional Director: John Robert R. Hermano Mobile Number: 0966-6213219 Asst. Regional Director: Rafael V Marasigan Mobile Number: 0917-1482007 Provincial Office : BUKIDNON Address : Capitol Site, Malaybalay, Bukidnon Office Number : (088) 813 3823 Email Address : [email protected] Provincial Manager : Leo V. Damole Mobile Number : 0977-7441377 Buying Station : GID Aglayan Location : Warehouse Supervisor : Joyce Sale Mobile Number : 0917-1150193 Service Areas : Malaybalay, Cabanglasan, Sumilao and Impsug-ong Buying Station : GID Valencia Location : Warehouse Supervisor : Rhodnalyn Manlawe Mobile Number : 0935-9700852 Service Areas : Valencia, San Fernando and Quezon Buying Station : GID Kalilangan Location : Warehouse Supervisor : Catherine Torregosa Mobile Number : 0965-1929002 Service Areas : Kalilangan Buying Station : GID Wao Location : Warehouse Supervisor : Catherine Torregosa Mobile Number : 0965-1929002 Service Areas : Wao, and Banisilan, North Cotabato Buying Station : GID Musuan Location : Warehouse Supervisor : John Ver Chua Mobile Number : 0975-1195809 Service Areas : Musuan, Quezon, Valencia, Maramag Buying Station : GID Maramag Location : Warehouse Supervisor : Rodrigo Tobias Mobile Number : 0917-7190363 Service Areas : Pangantucan, Kibawe, Don Carlos, Maramag, Kitaotao, Kibawe, Damulog Provincial Office : CAMIGUIN Address : Govt. Center, Lakas, Mambajao Office Number : (088) 387 0053 Email Address : [email protected] -

Technical Assistance Layout with Instructions

Initial Environmental Examination May 2018 PHI: Integrated Natural Resources and Environmental Management Project Rehabilitation of Impahanong – Bayawa – Linabo Access Road Prepared by Municipality of Malitbog, Province of Bukidnon for the Asian Development Bank. CURRENCY EQUIVALENTS (as of 30 April 2018 Year) The date of the currency equivalents must be within 2 months from the date on the cover. Currency unit – peso (PhP) PhP 1.00 = $ 0.01937 $1.00 = PhP 51.6072 ABBREVIATIONS ADB Asian Development Bank AFMA Agricultural and Fisheries Management Plan BDC Barangay Development Council BUB Bottom-Up Budgeting BAWASA Barangay Waterworks and Sanitation Association CNC Certificate of Non-Coverage CSC Construction Supervision Consultant CSO Civil Society Organization DED Detail Engineering Design DENR Department of Environment and Natural Resources DILG Department of Interior and Local Government DSWD Department of Social Welfare and Development ECA Environmentally Critical Area ECC Environmental Compliance Certificate ECP Environmentally Critical Project EHSM Environmental Health and Safety Manager EIA Environmental Impact Assessment EIS Environmental Impact Statement EMB Environmental Management Bureau ESS Environmental Safeguards Specialist GAD Gender and Development IEE Initial Environmental Examination INREMP Integrated Natural Resources and Environment Management Project IP Indigenous People IROW Infrastructure Right of Way LGU Local Government Unit LPRAT Local Poverty Reduction Action Team MDC Municipal Development Council MPN Most Probable