Drama Report 2015/16

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Animal Logic Entertainment Launch Australian Based Screenplay Competition

ANIMAL LOGIC ENTERTAINMENT LAUNCH AUSTRALIAN BASED SCREENPLAY COMPETITION Sydney, Australia, 26 August 2020 – Animal Logic Entertainment (ALE), the producing team behind ‘Peter Rabbit’, are excited to launch a new competition to recognise Australian writers in the family entertainment space. The Animal Logic Entertainment Screenplay Competition is open to Australian writers with a feature script in the family animated and family hybrid (live action/animation) space. The Competition offers a prize package of $5,000AUD for the winning entry as well as professional guidance and feedback from Producer Zareh Nalbandian, EVP Development and Production, Jonathan Hludzinski and VP Development & Production, Felicity Staunton. “We have always been committed to leveraging our profile to support and promote Australian talent,” says Nalbandian. “Over the past several years we have had the privilege of working with some of the best writers in the industry to develop entertaining and engaging stories for audiences around the world, and through this program we look forward to opening our doors to Australian writers with a compelling story to tell.” “We are experiencing an incredible time for animation and it has never been more important to uncover new voices in family entertainment”, added Hludzinski and Staunton. “We are looking for talented writers who understand tone and audience, have an original or unexpected perspective, and a lot of heart. We want to hear from Australian writers from all backgrounds and are excited to be able to support projects that we believe can succeed in both the Australian and international markets.” The competition is open to writers of all levels who are current Australian citizens or permanent residents. -

Brenton Goodwin

SUMMARY Brenton Senior Modeller, Sculptor and Character Artist with over 13 years industry Goodwin experience in just about everything, from film VFX, animated features, games, VR, game cinematics, trailers and TV commercials. Senior Modeller/ Sculptor EXPERIENCE / Character Artist Defiant Studios/ Character Artist December 2017 - April 2019, New York [email protected] Real time character and prop asset development, design sculpts, modelling high and low poly assets, baking, texturing and implementation into Unreal Engine 4 for next gen titles. 917 355 0801 Real time character modeling, sculpting and texturing for external clients brenton3d.com In coordination with Technical and Animation departments to develop and implement the character pipeline, ongoing RnD, scheduling and bidding. LinkedIn Titles include: Lords of the Fallen 2, Warframe, Internal pitch work and unannounced projects. ArtStation Dreamsail Games/ Character Artist IMDb June 2017 - December 2017, New York Real time character and environmental asset development, modelling and sculpting high and low poly assets, baking, texturing. Developing and implementing a studio asset pipeline, on going RnD, managing and mentoring junior artists. SKILLS The iOTA Project, a VR Mech combat game using Unreal Engine 4, released on Steam. Animal Logic/ Senior Modeller and Creature Artist Organic and hard surface August 2014 - May 2017, Sydney Australia modelling and sculpting, Photo real character and creature sculpting for feature animations and film VFX. Hard surface and texturing, animation, pre- organic modelling from concept art, set extensions including photogrammetry and scene layout. Working visualization, scene layout, with all department heads to develop scenes from pre-production through to final render. Features include: Peter Rabbit, The LEGO Batman Movie, The LEGO NINJAGO Movie, The Divergent art direction, asset Series: Allegiant Part 1, The Monk Comes Down the Mountain, ACURA TVC’s. -

Doctor Doctor Whyhope

MUDGEE DOCTOR DOCTOR WHYHOPE 4 DAY TOUR Departing: Tuesday 13 August 2019 Returning: Friday 16 August 2019 TOUR COST: $895.00 per person Twin/Double Share $1100.00 Sole Occupancy Please call the office for Direct Deposit details PICK UP TIMES: 7.10am Crawford Street, Queanbeyan 7.50am West Row Bus Stop, City 7.30am Bay 3, Woden Bus Interchange 8.00am Riggall Place, Lyneham The fictional town of Whyhope is home to the ‘Doctor Doctor’ TV series, filmed in part in Mudgee. Our tour will take in some of the famous landmarks as we explore this colonial and charming town and region. Day 1 (LD): CANBERRA TO MUDGEE: Tuesday 13 August Be warmly greeted as we load our luggage onto the Potter Travel coach and settle into our seats. The Doctor Doctor series is now in its third season and has become popular with Australian, and overseas, audiences. Heading to Camden, we are in the vicinity of Denbigh House, the property used as the family home of the ‘Knight family’. Unfortunately, the homestead cannot be seen from the street but we will get a sense of where it was filmed and the cast often stayed in Camden. We have lunch at Camden Park House, the country mansion of John & Elizabeth Macarthur. The property possesses a grand colonnade verandah and is home to Australia's oldest oak tree grown from an acorn given to John Macarthur at Buckingham Palace! The surrounding 30 ha of garden represent a fine and rare surviving example of an early 19th century garden, albeit with later additions and alterations. -

The Uses of Animation 1

The Uses of Animation 1 1 The Uses of Animation ANIMATION Animation is the process of making the illusion of motion and change by means of the rapid display of a sequence of static images that minimally differ from each other. The illusion—as in motion pictures in general—is thought to rely on the phi phenomenon. Animators are artists who specialize in the creation of animation. Animation can be recorded with either analogue media, a flip book, motion picture film, video tape,digital media, including formats with animated GIF, Flash animation and digital video. To display animation, a digital camera, computer, or projector are used along with new technologies that are produced. Animation creation methods include the traditional animation creation method and those involving stop motion animation of two and three-dimensional objects, paper cutouts, puppets and clay figures. Images are displayed in a rapid succession, usually 24, 25, 30, or 60 frames per second. THE MOST COMMON USES OF ANIMATION Cartoons The most common use of animation, and perhaps the origin of it, is cartoons. Cartoons appear all the time on television and the cinema and can be used for entertainment, advertising, 2 Aspects of Animation: Steps to Learn Animated Cartoons presentations and many more applications that are only limited by the imagination of the designer. The most important factor about making cartoons on a computer is reusability and flexibility. The system that will actually do the animation needs to be such that all the actions that are going to be performed can be repeated easily, without much fuss from the side of the animator. -

Women in Leadership Summit 2020

WOMEN IN LEADERSHIP SUMMIT 2020 Re-ignite! 20th-23rd October 2020, Seymour Centre, Sydney DISCLAIMER: Conferences and events have been severely disrupted due to the uncertainty around Corona Virus (COVID-19). All of our events post March 2020 will be going ahead as scheduled. The Leadership Institute is committed to ensuring that all clients who have purchased tickets will get value for money from our events through credit or live streaming of the events. As a small business experiencing this troubling time, we appreciate and value your ongoing support. WOMEN IN LEADERSHIP SUMMIT 2020 SYDNEY, 20TH-23RD OCTOBER 2020 This event will also be live streamed due to disruption caused by Corona Virus (COVID-19). Live streaming tickets are available at checkout. Re-ignite! Back for its fifth year, the Women in Leadership Summit 2020 is guaranteed to be our best one yet! This year’s theme is Re-Ignite. We’ve had so much to worry about in the last six months that it’s time to re- ignite the passion for diversity and equality in the workplace, re-ignite our desires to move up and be seen, re-ignite the fire for pay equality and shared parental responsibility. Let’s create our own opportunities while helping and inspiring those around us. Let’s face it. A lot of companies say they are more committed to gender equality than ever before. But we’ve just had the most disruptive time in modern history. What will this mean in the fight for equality. We still have a severe lack of women in senior roles, especially the C-Suite. -

Bromilow, Belinda Biography

BELINDA BROMILOW TRAINING 1995 – 1997 Bachelor of Arts, Curtin University 1997 – 1999 Advanced Diploma of Performing Arts W.A. Academy of Performing Arts (WAAPA) FILM & TELEVISION THE GREAT S2 Aunt Elizabeth THE GREAT Aunt Elizabeth Dir: Matt Shakman DOCTOR DOCTOR S5 Betty Dir: Lisa Matthews DOCTOR DOCTOR S4 Betty Dir: Geoff Bennett DOCTOR DOCTOR S3 Betty Dir: Geoff Bennett RAKE Patrice Dir: Rowan Woods DOCTOR DOCTOR S2 Betty Dir: Geoff Bennett FELONY Accident Site Cop Dir: Matt Saville NOT SUITABLE FOR CHILDREN Claire Dir: Peter Templeman HAPPY FEET Norwegian Ambassador Warner Bros. Dir: George Miller THE RAGE IN PLACID LAKE Nurse Doreen Rapacious Pictures Dir: Tony McNamara DOCTOR DOCTOR Betty Essential Media MR & MRS MURDER Cate McVeigh Fremantle Media SPIRITED Series 1 & 2 Jonquil (series lead) Southern Star PACKED TO THE RAFTERS Libby (recurring) Seven Network TALK TO ME Nicole ITV Dir: Derabhla Walsh MDA Sally Delaney ABC TV Dir: Sally Kerr McLEOD’S DAUGHTERS Ashleigh Redstaff Millennium TV ALL SAINTS (TV) Fiona Bannock Network Seven SHAKESPEARE OUT LOUD Actor ABC CoastToCoast THEATRE THIS YEAR’S ASHES Ellen Griffin Theatre Dir: Shannon Murphy THE GRENADE Sally McTavish MTC/STC Dir: Peter Evans MY NAME IS RACHEL CORRIE Rachel Corrie B Sharp, Belvoir Dir: Shannon Murphy SEVEN BLOWJOBS Dot B Sharp, Belvoir Dir: Lee Lewis BOY GETS GIRL Harriet Sydney Theatre Company Dir: Robyn Nevin P.O BOX 7766 BONDI BEACH NSW PHONE: : + 61 412 591 049 E: sarah@ linstenmanagement.com LITTLE BOY Peta Tamarama Rock Surfers & Under the Hood Productions -

The Feather in the Web

THE FEATHER IN THE WEB GRIFFIN THEATRE COMPANY PRESENTS THE FEATHER IN THE WEB Production Partner BY NICK COYLE 5 OCTOBER-17 NOVEMBER GRIFFIN THEATRE COMPANY PRESENTS THE FEATHER IN THE WEB NICK COYLE 5 OCTOBER- 17 NOVEMBER Director Ben Winspear Designer Sophie Fletcher Assistant Designer Ella Butler Composer / Sound Designer Steve Toulmin Lighting Designer Trent Suidgeest AV Designer Mic Gruchy Stage Manager Samuel Johnson With Tina Bursill, Gareth Davies, Michelle Lim Davidson, Claire Lovering SBW Stables Theatre Preview 5–10 October Season 13 October–17 November Production Partner Government Partners Supported by Griffin acknowledges the generosity of the Seaborn, Broughton & Walford Foundation in allowing it the use of the SBW Stables Theatre rent free, less outgoings, since 1986. S ’ Have you ever been listening to someone tell a story and been overcome with the urge to scream SHUT UP!? Have you ever been so bored at a work event you wanted to kick someone in the groin? Have you ever been in a car travelling very fast on a highway and thought about jerking the steering wheel to the side? Me neither. That would be crazy. But a character who follows through on those impulses and doesn’t give a damn about the consequences was the starting point of this play. Kimberly is dangerous because she is fearless. She pours petrol over banality and sets it on fire, figuratively and literally. She doesn’t laugh unless there’s something funny. She knows she’s not the PLAYWRIGHT NOTE architect of the body and face she was given. She refutes the falsehoods we’re trained to accept. -

Drama Report 2013/2014

Drama Report Production of feature films and TV drama in Australia 2013/14 Highlights $837 million total production expenditure Up 11 per cent on last year 35 Australian features $297 million Up 18 per cent on last year 49 Australian TV dramas $343 million Down 8 per cent on last year 26 foreign projects $197 million Up 50 per cent on last year Producer Offset total value $137 million © Screen Australia 2014 ISBN: 978-1-920998-29-5 The text in this report is released subject to a Creative Commons BY licence (Licence). This means, in summary, that you may reproduce, transmit and distribute the text, provided that you do not do so for commercial purposes, and provided that you attribute the text as extracted from Screen Australia’s Drama Report 2013/14. You must not alter, transform or build upon the text in this report. Your rights under the Licence are in addition to any fair dealing rights which you have under the Copyright Act 1968 (Cwlth). For further terms of the Licence, please see http://creativecommons.org/ licenses/by-nc-nd/3.0/ Screen Australia is grateful to all those who contributed data to the compilation of this report. The data provided has been drawn from a number of sources. While Screen Australia has undertaken all reasonable measures to ensure its accuracy, we cannot accept responsibility for inaccuracies and omissions. Cover image: The Code Contents Key terms 4 OVERVIEW 5 ALL DRAMA PRODUCTION 6 AUSTRALIAN FEATURE SLATE – DOMESTIC AND CO-PRODUCTION TITLES 8 Feature budget ranges 8 Sources of finance for Australian features 9 AUSTRALIAN TV DRAMA SLATE – DOMESTIC AND CO-PRODUCTION TITLES 10 Programs for adults 12 Programs for children 13 Sources of finance for Australian TV drama 14 FOREIGN PRODUCTION 15 Features 15 TV drama 15 DRAMA PRODUCTION BY LOCATION 16 Expenditure by state 16 Location of production company 17 TITLES IN THE 2013/14 SLATE 18 PDV SERVICES – FOR FEATURES AND TV DRAMA PRODUCTION 21 METHODOLOGY 25 ABOUT THE REPORT activity in Australia and the Offset’s Australia. -

Film and Television Industry Hearings Move to Sydney

HOUSE OF REPRESENTATIVES STANDING COMMITTEE ON Chair: Luke Howarth MP COMMUNICATIONS AND THE ARTS Film and Television Inquiry Public Hearings: 19 and 20 July 2017 Issued: 17 July 2017 Film and television industry hearings move to Sydney The House of Representatives Standing Committee on Communications and the Arts will conduct public hearings over 2 days in Sydney this week as part of its inquiry into factors contributing to the growth and sustainability of Australia’s film and television industry. The Chair of the committee, Mr Luke Howarth MP, stated that ‘we will be hearing from some of the biggest players in the industry this week in Sydney including Australia’s most well-known production companies, commercial television channels, key industry bodies and Screen Australia.’ ‘The Committee is looking forward to hearing from key participants in our film and television industry who make vital contributions to Australia’s economy and culture’ added Mr Howarth. PUBLIC HEARING DETAILS PUBLIC HEARING SYDNEY PUBLIC HEARING SYDNEY DAY 1 DAY 2 Wednesday, 19 July 2017 Thursday, 20 July 2017 Macquarie Room, NSW Parliament Macquarie Room, NSW Parliament 6 Macquarie St , Sydney 6 Macquarie St, Sydney 9.15am Screen Australia 9.15am Create NSW 10.15am Fox Studios Australia 10.00am MEAA 11.00am Warner Bros 10.45am Win, Southern Cross & Prime 11.30am Screen Producers Australia 11.30am Seven West Media 1.15pm Australian Directors’ Guild 12.00pm Network Ten Pty Ltd 1.45pm Australian Screen Editors 1.15pm Nine Entertainment Co. 2.15pm Australian Film and -

ID Nr Titel Vorname Regisseur Name Regisseur Produzent Land Jahr

Länge Vorname Name Inv.for ID Nr Titel Produzent LandJahr Genre in über den Film Sonstiges Regisseur Regisseur mat min. 1469 838 -1250 Stephen Barcelo La fémis F 2002 Dokumentarfilm 13 2002 VHS + 838A 2303 1074 -1250 Stephen Barcelo La fémis F 2002 Dokumentarfilm 13 VHS 11. SaarLorLux Le Lierre, Ville de Dokumentation - Interviews mit: Jochen Senf. Barbara +Nr. 666A, 1186 666 Festival du film et de Thierry Léger F 2000 Dokumentation 10 VHS Thionville Zimmer, Pierre Smal, diversen Gästen. 666B, 666C la vidéo Nutzung der ereignislosen Zeit, "während der ereignislosen Zeit geschieht nichts", "eine Zeit der Untätigkeit". Dieses 11mi Video versucht durch eine plastische und sensible Nutzung 2170 1330 11'33 David Schumann Ecole de l'image d' Epinal F 2003 Experi'video miniDV n33 des Mediums das Gegenteil zu beweisen. Von unproduktiv zu unrentabel definiert sich die ereignislose Zeit auch durch ihr Sein und ihr graphisches Vokabular. Die "saynettes" (Einakter) sind Personenporträts. Man Sophie- nimmt reale Bilder, verändert sie und verwandelt sie in 2654 797 12 saynettes Gautier Sophie-Charlotte Gautier F 2001 Spielfilm 10 VHS Original DV Charlotte Geschichten. Kurze Szenen wie ein Augenblinzeln, so dass jeder seine eigene Geschichte erfinden kann. anderer Titel: Saarländisches Filmbüro, 12 mal 3; 12 x 3 Autoportraits - Selbstportraits von 12 Jugendliche aus Saarbrücken und 2791 1379 Jörg Kattenbeck Centre Social le Lierre D/F 2000 Dokumentarfilm 39 VHS anderer Titel: Selbstporträts Thionville von 12 bis 18 Jahren. Thionville 12 Auto- Portraits anderer Titel: Saarländisches Filmbüro, 12 mal 3; 12 x 3 Autoportraits - Selbstportraits von 12 Jugendliche aus Saarbrücken und 2790 1402 Jörg Kattenbeck Centre Social le Lierre D/F 2000 Dokumentarfilm 39 DV anderer Titel: Selbstporträts Thionville von 12 bis 18 Jahren. -

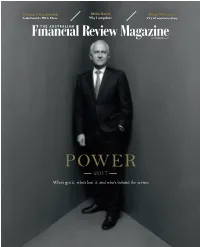

Who's Got It, Who's Lost It, and Who's Behind the Scenes

Trump v the swamp Mike Baird Ninja Warriors Leaks flood the White House Why I quit politics TV’s hit machine brothers OCTOBER 2017 POWER 2017 Who’s got it, who’s lost it, and who’s behind the scenes 8 LEAH PURCELL Actor, playwright, director Because: She allows white audiences to see from an Aboriginal perspective. Her radical adaptation of Henry Lawson’s The Drover’s Wife broke new ground for Australian theatre. Among its string of awards was the NSW Premier’s Literary Award for best drama, whose judges described it as “a declaration of war on Australia’s wilful historical amnesia”. Purcell, a Goa-Gunggari-Wakka Wakka Murri woman, uses the full arsenal of drama to tell new stories. In 2016 she co-directed Cleverman, which screened on ABC TV and meshed Aboriginal dreamtime stories into contemporary sci-fi genre. She also co-directed The Secret Daughter, which screened on Seven Network last year and has now been signed for a second series. Starring Jessica Mauboy, it marks the first time a commercial network has put an Indigenous Australian as the lead in a drama series. Season one was the second-highest rating drama for the year. What the panel says: She’s an Indigenous woman with a very political view. The Drover’s Wife was an incredible achievement and will make for a brilliant film. She also has two mainstream TV series on air and she’s winning every single award. – Graeme Mason The Drover’s Wife told the story in a completely different way to which it has been told before. -

Gabrielle Mckinlay

GABRIELLE MCKINLAY ( (04)19 675 006 * [email protected] PRODUCER/DIRECTOR/WRITER With a proven track record in the Film and TV industry, I exhibit an "up for anything” attitude, an excellent eye for detail and a great ability to work well under pressure. I possess the knowledge and skills that is gained through experience and provide new and creative solutions to any problems or issues that a production may face. I am conscientious, hard working and have a sunny disposition. Forever passionate about the journey that is Film and TV Production, I am always eager to find challenging roles that utilize my talents and skill set. KEY SKILLS ASSESSMENT Production 4 Controlling budget and allocating resources. 4 Building and developing a network of contacts. 4 Shooter/Producer & Producer/Director 4 Location sourcing/scouting/permits as required. 4 Talent sourcing & casting. 4 Troubleshooting as required. 4 Fantastic eye for detail 4 Excellent Communication Skills 4 Great Creative Vision Communication 4 Utilises the computer programs Microsoft Word, Excel and MYOB. PROFESSIONAL EXPERIENCE Producer Credits ITV 2017 ‘Keeping Australia Safe’• Observational Documentary • Story - Self-Defence • Executive Producer - Elle Gibbons • Training in Post-Producing ITV 2017 (TBA Working Title) • Pilot for Observational Documentary Series • Producer/Director of Sizzle Reel-Teaser BAY FILMS 2015 ‘The Closet’ Pilot for Reality Television Series • Producer/Co-Director RUBY SNOW FILMS ‘All Or Nothing’ Pilot for Comedy Television Series • Producer/Director 2015 AMVI 2012 ‘Share A Lunch’ TVC • Salvation Army • Directed by Lucy Hayes • Producer JDTV Worked with ‘Jewellery Direct Television’ (on Channel 9’s Shopping Channel & TVSN) • Producer/Director • Vision Switcher Roles.