Cadbury Beverages' Crush Brand Case Analysis ADV 388K Fall 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Product Information Form

Product Information Form Brand Name Schweppes Flavour Orange Squash Formulation Number OR/B-0973.10-S01 Legal Name Concentrated Orange Soft Drink with Sugar and Sweeteners Ingredient List Ingredients (as Diluted): Water, Orange Juice from Concentrate (5%), Sugar, Citric Acid, Flavourings, Acidity Regulator (Sodium Citrate), Salt, Sweeteners (Sodium Saccharin, Aspartame), Preservatives (Sodium Benzoate, Sodium Metabisulphite), Antioxidant (Ascorbic Acid), Colour (Carotenes). Warning Statements Contains a Source of Phenylalanine Nutrition Claims None Health Claims None Other Claims By Appointment to her Majesty Queen Elizabeth II Schweppes Holdings Ltd Manufacturers of Schweppes and Roses Soft Drinks Durability Best before end: See side of cap or bottle neck for date. Once open consume within 3 to 4 weeks. Storage Instructions Store cool and dry Instructions for Use Best served chilled Dilute 4 parts water to 1 part cordial. If for toddlers add extra water Do not re-use packaging. Number of Servings None Prescribed Quantities Xml or XL plus ‘e’ mark Address Coca-Cola Enterprises Ltd, Uxbridge UB8 1EZ Freephone Number 0800 227711 Website Coca-Cola.co.uk Recycle Symbol Add appropriate symbol Nutrition Information NUTRITION INFORMATION TYPICAL VALUES AS DILUTED Per 100ml Energy 52kJ 12kcal Fat 0g Of which saturates 0g Carbohydrate 2.6g Of which sugars 2.6g Protein 0g Salt 0.09g Reference intakes (FOP) An xml serving contains* Select correct data from table RI Pack size 100 125 150 180 200 250 330 350 375 500 Energy kJ 52 65 78 94 104 130 172 -

Sunrise Beverage 2021 Craft Soda Price Guide Office 800.875.0205

SUNRISE BEVERAGE 2021 CRAFT SODA PRICE GUIDE OFFICE 800.875.0205 Donnie Shinn Sales Mgr 704.310.1510 Ed Saul Mgr 336.596.5846 BUY 20 CASES GET $1 OFF PER CASE Email to:[email protected] SODA PRICE QUANTITY Boylan Root Beer 24.95 Boylan Diet Root Beer 24.95 Boylan Black Cherry 24.95 Boylan Diet Black Cherry 24.95 Boylan Ginger Ale 24.95 Boylan Diet Ginger Ale 24.95 Boylan Creme 24.95 Boylan Diet Creme 24.95 Boylan Birch 24.95 Boylan Creamy Red Birch 24.95 Boylan Cola 24.95 Boylan Diet Cola 24.95 Boylan Orange 24.95 Boylan Grape 24.95 Boylan Sparkling Lemonade 24.95 Boylan Shirley Temple 24.95 Boylan Original Seltzer 24.95 Boylan Raspberry Seltzer 24.95 Boylan Lime Seltzer 24.95 Boylan Lemon Seltzer 24.95 Boylan Heritage Tonic 10oz 29.95 Uncle Scott’s Root Beer 28.95 Virgil’s Root Beer 26.95 Virgil’s Black Cherry 26.95 Virgil’s Vanilla Cream 26.95 Virgil’s Orange 26.95 Flying Cauldron Butterscotch Beer 26.95 Bavarian Nutmeg Root Beer 16.9oz 39.95 Reed’s Original Ginger Brew 26.95 Reed’s Extra Ginger Brew 26.95 Reed’s Zero Extra Ginger Brew 26.95 Reed’s Strongest Ginger Brew 26.95 Virgil’s Zero Root Beer Cans 17.25 Virgil’s Zero Black Cherry Cans 17.25 Virgil’s Zero Vanilla Cream Cans 17.25 Virgil’s Zero Cola Cans 17.25 Reed’s Extra Cans 26.95 Reed’s Zero Extra Cans 26.95 Reed’s Real Ginger Ale Cans 16.95 Reed’s Zero Ginger Ale Cans 16.95 Maine Root Mexican Cola 28.95 Maine Root Lemon Lime 28.95 Maine Root Root Beer 28.95 Maine Root Sarsaparilla 28.95 Maine Root Mandarin Orange 28.95 Maine Root Spicy Ginger Beer 28.95 Maine Root Blueberry 28.95 Maine Root Lemonade 12ct 19.95 Blenheim Regular Ginger Ale 28.95 Blenheim Hot Ginger Ale 28.95 Blenheim Diet Ginger Ale 28.95 Cock & Bull Ginger Beer 24.95 Cock & Bull Apple Ginger Beer 24.95 Double Cola 24.95 Sunkist Orange 24.95 Vernor’s Ginger Ale 24.95 Red Rock Ginger Ale 24.95 Cheerwine 24.95 Diet Cheerwine 24.95 Sundrop 24.95 RC Cola 24.95 Nehi Grape 24.95 Nehi Orange 24.95 Nehi Peach 24.95 A&W Root Beer 24.95 Dr. -

Buona's Nutritional and Allergen Information

Buona's Nutritional and Allergen Information The nutritional and allergen information contained in our restaurants or on our website (www.buona.com) was prepared by Nutritional Information Services (NIS). The data contained herein was complied from nutritional information, ingredients and allergen listings provided by our suppliers / distributors and by an analysis generated using a software analysis program. This information is meant to serve strictly as a guide for personal use and should not be considered a guarantee, but simply our effort to better inform our valued guests. About Our Nutritional Information The nutritional information listed on the following pages is meant to provide a general estimate of the nutritional values associated with our menu items. The actual values for a menu item may vary from the values listed due to variations in serving sizes, the actual product preparation and / or substitutions of ingredients by our suppliers / distributors. Please check the information contained in our restaurants and on our website frequently to ensure that you have the most up-to-date nutritional and allergen information available. About Our Allergen Information We understand the challenges facing the community of people who struggle with food allergies or have to manage food and beverage sensitivities in their lives. It is important that you are aware that milk, egg, peanut, tree nut, fish, shellfish, soy and wheat allergens are present in our restaurants. We ask that when placing your order you alert our order taker and / or manager to your food allergy or sensitivity. The more information relating to your specific needs you can provide, the better we can attempt to protect you. -

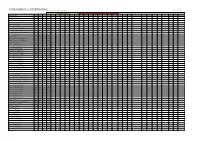

Line Packer Item Number Description

LINE PACKER ITEM NUMBER DESCRIPTION CSD CANDRY CAN003 12/1 LT CLUB SODA CSD CANDRY CAN005 12/1 LT GINGER ALE CSD CANDRY CAN008 12/1 LT TONIC WATER CSD CANDRY CAN015 24/10 OZ CLUB SODA CSD CANDRY CAN016 24/10 OZ GINGER ALE CSD CANDRY CAN017 24/10 OZ ORANGINA CSD CANDRY CAN019 24/10 OZ TONIC WATER CSD CANDRY CAN023 24/11 OZ YOO HOO CSD CANDRY CAN025 24/12 OZ 7-UP CSD CANDRY CAN026 24/12 OZ A & W ROOT BEER CSD CANDRY CAN028 24/12 OZ CLUB SODA CSD CANDRY CAN029 24/12 OZ COUNTRY TIME LEM CSD CANDRY CAN032 24/12 OZ GINGER ALE B.K. Miller Company • 4501 Auth Pl, Camp Springs, MD, 20746, United States • (301) 423-6200 • [email protected] 1 CSD CANDRY CAN033 24/12 OZ HAWAIIAN PUNCH CSD CANDRY CAN041 24/12 OZ SUNKIST ORANGE CSD CANDRY CAN050 24/16 OZ SNAPPLE APPLE CSD CANDRY CAN051 24/16 OZ SNAPPLE DT LEM TEA CSD CANDRY CAN052 24/16 OZ SNAPPLE DT PCH TEA CSD CANDRY CAN053 24/16 OZ SNAPPLE DT RASP T CSD CANDRY CAN058 24/16 OZ SNAPPLE LEMON TEA CSD CANDRY CAN060 24/16 OZ SNAPPLE MANGO MAD CSD CANDRY CAN062 24/16 OZ SNAPPLE PEACH TEA CSD CANDRY CAN064 24/16 OZ SNAPPLE RASP TEA CSD CANDRY CAN066 24/16 OZ SNAPPLE STRAW KIWI CSD CANDRY CAN068 24/15.5 OZ YOO HOO CSD CANDRY CAN082 24/20 OZ A & W CREAM CSD CANDRY CAN083 24/20 OZ A & W ROOT BEER CSD CANDRY CAN085 24/20 OZ COUNTRY TIME LEM CSD CANDRY CAN088 24/20 OZ DIET GINGER ALE CSD CANDRY CAN091 24/20 OZ DT A&W ROOT BEER CSD CANDRY CAN092 24/20 OZ GINGER ALE CSD CANDRY CAN094 24/20 OZ HAWAIIAN PUNCH RED CSD CANDRY CAN095 24/20 OZ ROCK CREEK ALE B.K. -

Box O' Sandwiches

Name ___________________________________________________________ 300 Ren Center , Ste 1304 Page of (Renaissance Center) Company _________________________________________________________ Address __________________________________________________________ (313) 566-0028 (313) 567-6527 City ___________________________ Phone ____________________________ Fax your order, then call to confirm your order. Fax your order ahead for pick-up. No need to wait in line — go right to the register. Desired date __________ Desired time ________ am / pm PICK-UP or DELIVERY Order online at * Payment: Cash Credit (please have credit card info ready when calling to confirm) *Delivery varies by location, call your local shop for more info. Potbelly.com ORIGINALS SKINNYS Drinks Shakes /Malts /Smoothies Turkey Breast CANNED SODA LOW_FAT A Wreck® How many of FLAVOR ShAKE MALT Circle your choice Less meat & cheese Coke Diet SmoothIE 1 Italian on“Thin-Cut” bread 2 each sandwich? Box O’ Sandwiches Chocolate Roast Beef with 25% less fat REGULAR OR Wheat BOTTLED DRINKS of Box below Meatball than Originals 20oz Coke Diet Chicken Salad Strawberry T-K-Y TURKEY BREAST ______R _____ W Smoked Ham 20oz Coke Zero Mushroom Melt ® Tuna Salad A WRECK ______R _____ W Vanilla Hammie 20oz Sprite Vegetarian italian ______R _____ W 500ml Crystal Geyser Water Pizza Sandwich Banana Grilled Chicken ROAST BEEF ______R _____ W 750ml Crystal Geyser Water MeatbaLL ______R _____ W Boylan Black Cherry Oreo® FULL BELLY CHICKEN SALAD ______R _____ W If you ordered IBC Cream Soda Sandwich, Deli -

Symbols & Indies Planogram 1/1.25M England & Wales

SYMBOLS & INDIES PLANOGRAM 1/1.25M ENGLAND & WALES DRINK NOW SYMBOLS & INDIES PLANOGRAM 1/1.25M ENGLAND & WALES DRINK NOW SYMBOLS & INDIES PLANOGRAM 1/1.25M ENGLAND & WALES DRINK NOW SHELF SHELF 11 SHELF SHELF 22 SHELF SHELF 33 SHELF SHELF 44 SHELF SHELF 55 Shelf 1 Shelf 2 Shelf 3 Shelf 4 Shelf 5 FantaShelf 1Orange Pm 65p 330ml DrShelf Pepper 2 Drink Pm 1.09 / 2 For 2.00 500ml FantaShelf 3Orange Pm 1.09 / 2 For 2.00 500ml FantaShelf 4Lemon 500ml SpriteShelf 5Std 500ml IrnFanta Bru OrangeDrink Pm Pm 59p 65p 330ml 330ml MountainDr Pepper Dew Drink Drink Pm Pm1.09 1.19 / 2 For500ml 2.00 500ml FantaFanta FruitOrange Twist Pm Pm 1.09 1.09/2 / 2 For For 2.00 2.00 500ml 500ml FantaFanta ZeroLemon Grape 500ml 500ml IrnSprite Bru StdDrink 500ml Pm 99p 500ml DrIrn PepperBru Drink Std Pm Pm 59p 65p 330ml 330ml CocaMountain Cola Dew Std PmDrink 1.25 Pm 500ml 1.19 500ml DietFanta Coke Fruit Std Twist Pm Pm 1.09 1.09/2 / 2 For For 2.00 2.00 500ml 500ml PepsiFanta MaxZero Std Grape Nas 500mlPm 1.00 / 2 For 1.70 500ml PepsiIrn Bru Max Drink Cherry Pm 99p Nas 500ml Pm 1.00 / 2 F 1.70 500ml CocaDr Pepper Cola StdStd CanPm 65pPm 79p330ml 330ml CocaCoca ColaCola CherryStd Pm Pm 1.25 1.25 500ml 500ml CocaDiet Coke Cola StdZero Pm Std 1.09 Nas / Pm2 For 1.09 2.00 / 2 500ml For 2.00 500ml PepsiPepsi StdMax Pm Std 1.19 Nas 500ml Pm 1.00 / 2 For 1.70 500ml DietPepsi Pepsi Max Std Cherry Pm 1.00Nas Pm/ 2 For1.00 1.70 / 2 F 500ml 1.70 500ml DietCoca Coke Cola Std Std Can Can Pm Pm 69p 79p 330ml 330ml MonsterCoca Cola Energy Cherry Original Pm 1.25 Pm 500ml 1.35 -

“INITIAL REPORT of SIP” by Saurabh Srivastava (Reg No- 5116

“INITIAL REPORT OF SIP” BY Saurabh Srivastava (Reg No- 5116) Of Vishwa Vishwani Institute of Systems and Management Under the guidance of (Mrs.Sunita Ratnamakar) Prof- Marketing A Project Report Submitted to the Faculty of Business Management In partial fulfillment of the requirements For the award of the Post Graduate Diploma in Management July 2010 Boston House, Thumkunta, Hakimpet(Via), Hyderabad 500078 Phone: 08418- 247222,247522,247622, Fax: 08418- 247166 www.vishwavishwani.ac.in ORIGIN OF A COMPANY:- It can be said with absolute certainty that the RKJ Group has carved out a special niche for itself. Its services touch different aspects of commercial and civilian domains like those of bottling, Food Chain and Education. Headed by Mr. R. K. Jaipuria, the group as on today can laid claim to expertise and leadership in the fields of education, food and beverages. The business of the company was started in 1991 with a tie-up with Pepsi Foods Limited to manufacture and market Pepsi brand of beverages in geographically pre-defined territories in which brand and technical support was provided by the Principals viz., Pepsi Foods Limited. The manufacturing facilities were restricted at Agra Plant only. Varun Beverages Ltd. is the flagship company of the group. The group also became the first franchisee for Yum Restaurants International [formerly PepsiCo Restaurants (India) Private Limited] in India. It has exclusive franchise rights for Northern & Eastern India. It has total 46 Pizza Hut Restaurants & 1 KFC Restaurant under its company. It diversified into education by opening our first school in Gurgaon under management of Delhi Public School Society. -

Ladurée to Go Menu

LADURÉE TO GO MENU Available on our website www.laduree.us @ladureeus AVOCADO TOAST Gourmand Avocado Toast, guacamole, smoked salmon, homemade brioche, radish $13.00 Veggie Avocado Toast, goat cheese, chive, avocado, homemade brioche, radish $13.00 SALAD Chicken Caesar Salad, parmesan, croutons, romaine lettuce, free-range egg, caesar sauce $15.00 Melrose Salad, quinoa, frisée lettuce, portobello lardon, almond, flowers, avocado $17.00 Pokè Bowl Salmon, quinoa, carrot, cucumber, avocado, edamame, radish, mango, tomato mayonaise sauce $16.00 CLUBS & CROISSANTS Club Salmon, smoked salmon, lettuce, cucumber, free range egg, salmon cream cheese $13.00 Club Ladurée, organic chicken, lettuce, free-range egg, tomato, bacon, mayonnaise $11.00 Parisian Croissant, turkey ham, Swiss cheese, mustard seed mayonnaise $7.50 Vegetarian Croissant, roasted vegetables, sun-dried tomato, mozzarella cheese, baby spinach, pesto sauce $7.50 Salmon Croissant, organic smoked salmon, lemon dill cheese cream, cucumber, fresh herbs $8.00 QUICHES Quiche Lorraine, bacon, onion, nutmeg, eggs, cream $8.00 Vegetarian Quiche, asparagus, green peas, zucchini, fresh herbs, onion, nutmeg $8.00 BREAKFAST Chia Pudding Berries $8.00 Chia seeds, almond milk, raspberries, blueberries, blackberries and strawberries Yogurt Granola Choco $8.00 Organic European-style yogurt, homemade granola chocolate Fresh Fruits Salad $8.00 Raspberries, blueberries, strawberries, blackberries and mint syrup VIENNOISERIES Ladurée Croissant $3.15 Raspberry Brunette $5.00 Rose Croissant $3.60 Chocolate -

Annual Report

This year, even as we sell 1 billion servings of our products daily, the world will still consume 47 billion servings of other beverages every day. We’re just getting started. 1997 Annual Report Financial Highlights Percent Year Ended December 31, 1997 1996 Change (In millions except per share data and ratios, as reported) Total return (share price appreciation plus dividends) 27.8% 43.1% Closing market price per share $ 66.69 $ 52.63 27 % Total market value of common stock $ 164,766 $ 130,575 26 % Net operating revenues $ 18,868 $ 18,673 1 % Operating income $ 5,001 $ 3,915 28 % Net income $ 4,129 $ 3,492 18 % Basic net income per share $ 1.67 $ 1.40 19 % Diluted net income per share $ 1.64 $ 1.38 19 % Cash dividends per share $ 0.56 $ 0.50 12 % Average shares outstanding 2,477 2,494 (1)% Average shares outstanding assuming dilution 2,515 2,523 0 % Share owners’ equity at year end $ 7,311 $ 6,156 19 % Return on capital 39.4% 36.7% Contents 33 Financial Review 3 A Business in Its Infancy 42 Selected Financial Data A Message from M. Douglas Ivester 44 Consolidated Financial Statements 9 Why Is a Billion Just the Beginning? 49 Notes to Consolidated Financial Statements A Look at the Other 47 Billion 64 Management and Board of Directors 20 The Next Billion Our Opportunity. Our Ability. Our Mindset. 66 Share-Owner Information 23 Operating Group Reviews 67 Glossary Dear Fellow Share Owners, The pioneers who built this Company scarcely could and to you, its owners. -

DR PEPPER SNAPPLE GROUP ANNUAL REPORT DPS at a Glance

DR PEPPER SNAPPLE GROUP ANNUAL REPORT DPS at a Glance NORTH AMERICA’S LEADING FLAVORED BEVERAGE COMPANY More than 50 brands of juices, teas and carbonated soft drinks with a heritage of more than 200 years NINE OF OUR 12 LEADING BRANDS ARE NO. 1 IN THEIR FLAVOR CATEGORIES Named Company of the Year in 2010 by Beverage World magazine CEO LARRY D. YOUNG NAMED 2010 BEVERAGE EXECUTIVE OF THE YEAR BY BEVERAGE INDUSTRY MAGAZINE OUR VISION: Be the Best Beverage Business in the Americas STOCK PRICE PERFORMANCE PRIMARY SOURCES & USES OF CASH VS. S&P 500 TWO-YEAR CUMULATIVE TOTAL ’09–’10 JAN ’10 MAR JUN SEP DEC ’10 $3.4B $3.3B 40% DPS Pepsi/Coke 30% Share Repurchases S&P Licensing Agreements 20% Dividends Net Repayment 10% of Credit Facility Operations & Notes 0% Capital Spending -10% SOURCES USES 2010 FINANCIAL SNAPSHOT (MILLIONS, EXCEPT EARNINGS PER SHARE) CONTENTS 2010 $5,636 NET SALES +2% 2009 $5,531 $ 1, 3 21 SEGMENT +1% Letter to Stockholders 1 OPERATING PROFIT $ 1, 310 Build Our Brands 4 $2.40 DILUTED EARNINGS +22% PER SHARE* $1.97 Grow Per Caps 7 Rapid Continuous Improvement 10 *2010 diluted earnings per share (EPS) excludes a loss on early extinguishment of debt and certain tax-related items, which totaled Innovation Spotlight 23 cents per share. 2009 diluted EPS excludes a net gain on certain 12 distribution agreement changes and tax-related items, which totaled 20 cents per share. See page 13 for a detailed reconciliation of the Stockholder Information 12 7 excluded items and the rationale for the exclusion. -

Allergen Information | All Soft Drinks & Minerals

ALLERGEN INFORMATION | ALL SOFT DRINKS & MINERALS **THIS INFORMATION HAS BEEN RECORDED AND LISTED ON SUPPLIER ADVICE** DAYLA WILL ACCEPT NO RESPONSIBILITY FOR INACCURATE INFORMATION RECEIVED Cereals containing GLUTEN Nuts Product Description Type Pack ABV % Size Wheat Rye Barley Oats Spelt Kamut Almonds Hazelnut Walnut Cashews Pecan Brazil Pistaccio Macadamia Egg Crustacean Lupin Sulphites >10ppm Celery Peanuts Milk Fish Soya Beans Mollusc Mustard Sesame Seeds Appletiser 24x275ml Case Minerals Case 0 275ml BG Cox's Apple Sprkl 12x275ml Minerals Case 0 275ml BG Cranberry&Orange Sprkl 12x275ml Minerals Case 0 275ml BG E'flower CorDial 6x500ml Minerals Case 0 500ml BG E'flower Sprkl 12x275ml Minerals Case 0 275ml BG Ginger&Lemongrass Sprkl 12x275ml Minerals Case 0 275ml BG Ginger&Lemongrass Sprkl SW 12X275ml Minerals Case 0 275ml BG Pomegranate&E'flower Sprkl 12X275ml Minerals Case 0 275ml BG Strawberry CorDial 6x500ml Minerals Case 0 500ml Big Tom Rich & Spicy Minerals Case 0 250ml √ Bottlegreen Cox's Apple Presse 275ml NRB Minerals Case 0 275ml Bottlegreen ElDerflower Presse 275ml NRB Minerals Case 0 275ml Britvic 100 Apple 24x250ml Case Minerals Case 0 250ml Britvic 100 Orange 24x250ml Case Minerals Case 0 250ml Britvic 55 Apple 24x275ml Case Minerals Case 0 275ml Britvic 55 Orange 24x275ml Case Minerals Case 0 275ml Britvic Bitter Lemon 24x125ml Case Minerals Case 0 125ml Britvic Blackcurrant CorDial 12x1l Case Minerals Case 0 1l Britvic Cranberry Juice 24x160ml Case Minerals Case 0 160ml Britvic Ginger Ale 24x125ml Case Minerals Case -

Island Oasis Drink Guide

Frozen Drink Guide “The World’s Finest Frozen DrinkTM” Island Oasis, the leader in the frozen beverage industry, provides outstanding customer service, 24 hour response to all technical service issues and the most innovative and reliable equipment for frozen and “rocks” drinks. Generic and Customized POS such as banners, posters, table tents and menus are available to all customers. Storage & Handling: Store our products frozen for up to two years. Keep refrigerated after thawing. Refrigerated Shelf Life: Unopened: 60 days Opened: 21 days Dairy: 1 yr frozen, 15 days refrigerated Contact Us: We care about your business. Call us today at 1-800-999-5674 or visit our web site at www.islandoasis.com. Classic Cocktails Alcoholic Strawberry Toasted Blue Margarita Daiquiri Almond 4oz Margarita or Sour 4oz Strawberry 3.5oz Ice Cream 1oz Tequila 1.25oz Rum .75oz Amaretto .5oz Blue Curacao .75oz Coffee Liqueur Piña Colada Tropicolada 4oz Piña Colada Strawberry 2oz Piña Colada 1.25oz Dark Rum Shortcake 1oz Banana 4oz Strawberry 1oz Mango Margarita 1.25oz Amaretto 1.25oz Coconut Rum 4oz Margarita or Sour Mix Bushwacker Banana 1.25oz Tequila 3oz Piña Colada Daiquiri 1oz Ice Cream 4oz Banana Mudslide .75oz Coffee Liqueur 1.25oz Rum 3.5oz Ice Cream .75oz Rum .5oz Vodka .5oz Irish Cream .5oz Coffee Liqueur Smoothies Non-Alcoholic Strawberry Mango Colada Tropicolada Smoothie 3oz Piña Colada 1oz Mango 5oz Strawberry 2oz Mango 3oz Piña Colada 1oz Banana Strawberries Kookie Monster n’ Cream 5oz Ice Cream Blended Mocha 3oz Strawberry 2 Crushed Cookies 3oz Ice