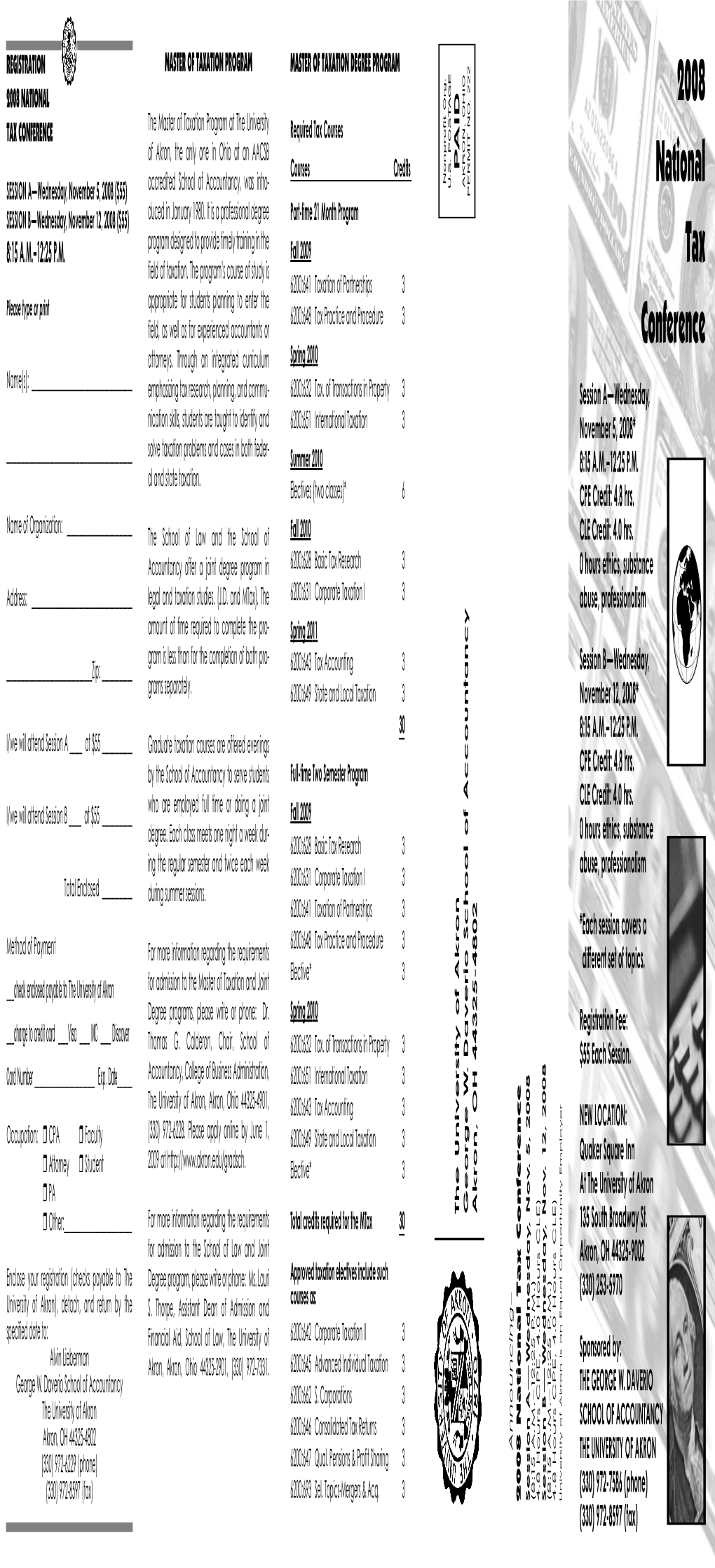

2008 National Tax Conference Session A—Wednesday, Nov

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2020-2021 GGU Catalog

GOLDEN GATE UNIVERSITY CATALOG 2020–2021 Golden Gate University Catalog 2020-2021 Contents Contents .............................................................................................. 1 Content Disclaimer About GGU ........................................................................................ 2 The content in this document was published on June 05, 2020. For School of Undergraduate Studies ....................................................... 4 the most current catalog information, see catalog.ggu.edu School of Accounting ....................................................................... 53 Edward S. Ageno School of Business ............................................... 64 Bruce F. Braden School of Taxation .............................................. 132 School of Law ................................................................................ 138 Libraries ......................................................................................... 140 Admission ....................................................................................... 141 Financial Planning .......................................................................... 151 Enrollment ...................................................................................... 167 Academic Requirements ................................................................. 181 Student Services ............................................................................. 185 Graduation and Commencement ................................................... -

Graduate Programs and Courses

GRADUATE PROGRAMS AND COURSES Graduate Programs and Courses All graduate degree programs and certificate programs sional accounting, corporate accounting and finance, man- are organized alphabetically by the name of the major or agement consulting, and information systems. This program certificate with only a few exceptions; for example, French, is also designed to meet the 150-hour requirement for earn- German, and Spanish are found under “Languages and Lit- ing the CPA certification. eratures,” page 253. The faculty participate in offering the program leading to the Master of Business Administration (see “Master of Business Administration,” page 138) and Ph.D. in Business Administration (see “Doctor of Philosophy,” page 139). Accountancy MASTER OF ACCOUNTANCY AND INFORMATION Certificate Program SYSTEMS Admission. Applicants must submit scores from the Gradu- ate Management Admissions Test (GMAT) exam. All appli- ASU West offers a postbaccalaureate certificate in cants are also required to submit the supplemental applica- Accountancy. For information, see the ASU West Catalog, tion materials required by the school. International appli- call 602/543-4567, or access www.west.asu.edu on the Web. cants whose native language is not English must submit scores from the Test of English as a Foreign Language (TOEFL) and Test of Spoken English (TSE) exams. Prefer- ence in admission is given to those with degrees in account- Accountancy and ing and business, although other exceptional candidates are considered. Complete application instructions may be Information Systems obtained from the school’s Web site at wpcarey.asu.edu/acc. Master’s Program Prerequisites. Applicants must complete program prerequi- wpcarey.asu.edu/acc sites. -

Lisa-Ann Polack

LISA-ANN POLACK Department of Accounting 4353 TAMU Mays Business School College Station, Texas 77843 Texas A&M University [email protected] Telephone: 954-551-2855 EDUCATION Texas A&M University, College Station, TX June 2013 – Present Mays Business School Ph.D. in Accounting, May 2017 (Expected) Major Area: Taxation Florida Atlantic University, Boca Raton, FL Master of Taxation 2008 Bachelor of Business Administration, Accounting, (Minor: Finance) 2006 PROFESSIONAL EXPERIENCE AND CERTIFICATION Texas A&M University, College Station, TX Graduate Research Assistant June 2013 – Present Deutsche Post DHL, Plantation, FL Senior Tax Analyst June 2010 – January 2013 KPMG LLP, Fort Lauderdale, FL June 2006 – June 2010 Assistant Tax Manager (Hong Kong, SAR), Federal Tax Services Senior Tax Associate, Federal Tax Services Tax Associate, Federal Tax Services Tax Intern, Federal Tax Services Certified Public Accountant, Florida WORK IN PROCESS Dissertation Polack, Lisa-Ann. 2016. “Politically Connected Directors and Tax Avoidance.” Committee Members: Michael Kinney (chair), Sean McGuire, Sarah Rice, and Thomas Wehrly RESEARCH INTERESTS tax policy; corporate tax avoidance and firm behavior TEACHING INTERESTS taxation; financial accounting; managerial accounting PRESENTATIONS American Accounting Association (AAA) Annual Meeting, 2016 – Discussant The PhD Project Accounting Doctoral Students Association Annual Meeting, 2015, 2016 – Presenter PROFESSIONAL SERVICE Member: American Taxation Association (ATA) Tax Manuscript Award Committee, 2013 – -

Golden Gate University at a Glance

2014-2016 CATALOG Golden Gate University Catalog 2014-2016 President’s Message President’s Message “Each is given a bag of tools A shapeless mass, A book of rules; And each must make… Ere life has flown… A stumbling block Or a stepping-stone” — R.L. Sharpe Finding your place in this rapidly changing world can be a daunting task. Some futurists estimate sixty percent of the jobs that will exist in ten years have yet to be invented. The only way to ready yourself for the ever-changing job market is to learn a set of unassailable skills that will serve you throughout your lifetime. Your education must help you leverage your natural abilities and ignite your passions, so you can succeed – on your terms. Our alumni range from superior court judges to vintners to venture capitalists to non-profit humanitarians. At Golden Gate University, we prepare you for today’s and tomorrow’s world. Our focus on real-life scenarios, professional ethics and practice-based learning means that our students can make immediate, measurable contributions in their chosen field. But we don’t stop there. Those who graduate with a degree from GGU are equipped with the ability to think critically, collaborate effectively, and lead confidently. GGU has a long, proud history of providing higher education to adults like you, who power the Bay Area and beyond by determining what only they can bring to the world – and then delivering it. We look forward to helping you develop your unique talents and make your mark. President Dan Angel Golden Gate University 1 Table of Contents — Locations Golden Gate University Catalog 2014-2016 Contents Locations Golden Gate University At a Glance . -

2019-Sydney-Law-School-Guide.Pdf

The University of Sydney sydney.edu.ausydney.edu.au/law ContactContact us us sydney.edu.au/ask UndergraduateLaw guide 2018 1800 SYDsydney.edu.au/ask UNI (1800 793 864) Undergraduate and +61 2 86271800 1444 SYD (outside UNI Australia) The University of Sydney Law School postgraduate guide 2019 1800 793 864 We are ranked 1st in Australia and 4th in the world for graduate employability*. Forest Stewardship Council (FSC®) is a globally recognised certification overseeing all fibre sourcing Forest Stewardship Council (FSC®) is a globally recognised certification overseeing all fibre sourcing standards. This provides guarantees for the consumer that products are made of woodchips from well-managed forests and other controlled sources with strict environmental, economical social standards. * QS Graduate Employability Rankings, 2018 Law Undergraduate and postgraduate guide 2019 Join us Careers Law at the Your path to legal practice ....24 University of Sydney .................. 2 Career support ........................ 25 Your study options ....................4 Meet our staff ............................. 5 Postgraduate Where will postgraduate Undergraduate study lead you? ....................... 26 The Sydney Undergraduate Plan your career ...................... 27 Experience ......................... ........ 6 Postgraduate study at Dalyell Scholars Program ......... 8 Sydney Law School ................ 28 Bachelor of Laws (LLB) .............9 Master of Laws (LLM) ............ 30 Combined degrees ................. 10 Master of Business Law -

Accounting (6200) 1

Accounting (6200) 1 6200:601 Financial Accounting (3 Credits) ACCOUNTING (6200) Introductory course for student with no accounting background. Examines accounting principles as applied to financial problems of firm. 6200:520 Advanced Financial Reporting and Analysis (3 Credits) 6200:603 Accounting Decision Support Systems (3 Credits) Prerequisites: 6200:622 or 6200:322 or equivalent. Examination of Introduction to basic financial statement information; coverage of accounting theory and financial reporting practices for business databases, electronic spreadsheets, and other information technology combinations, partnerships, foreign operations, nonprofit entities and tools that support accounting and assurance services. consolidated statements. Covers U.S. GAAP, IFRS, SEC reporting, and corporate financial reporting policy. Emphasizes professional accounting 6200:607 Financial Data Communications & Enterprise Integration (3 research. Includes a research component. Credits) Prerequisites: 6200:601 and 6500:601. In-depth study of contemporary 6200:524 Business Law (3 Credits) methodologies, technologies, and standards used to integrate business Understand business law and concepts dealing with the legal processes and systems, including XML and XBRL. environment of business and their applications, including: business ethics, the American legal system, tort law, contracts, secured 6200:610 Process Analysis & Cost Management (3 Credits) transactions, bankruptcy, real property, business entities, environmental Prerequisites: 6200:601, 6200:621, 6200:321 or equivalent, or permission law, antitrust. of instructor. Investigates management accounting and control systems and the use of accounting information in cost management, risk 6200:531 Business Entity Taxation (3 Credits) assessment, planning, decision making, and performance evaluation. Prerequisite: A minimum of 3 credits of tax. Federal income tax law related to partnerships, corporations, trusts and estates; also includes 6200:615 Professional Colloquium I (3 Credits) an overview of federal estate and gift tax law. -

Master of Taxation 2016 Nova Southeastern University

Nova Southeastern University NSUWorks Huizenga Postgraduate Course Catalogs NSU Course Catalogs and Course Descriptions 2016 Master of Taxation 2016 Nova Southeastern University Follow this and additional works at: https://nsuworks.nova.edu/hsb_pgcoursecatalogs Part of the Business Commons NSUWorks Citation Nova Southeastern University, "Master of Taxation 2016" (2016). Huizenga Postgraduate Course Catalogs. 45. https://nsuworks.nova.edu/hsb_pgcoursecatalogs/45 This Course Catalog is brought to you for free and open access by the NSU Course Catalogs and Course Descriptions at NSUWorks. It has been accepted for inclusion in Huizenga Postgraduate Course Catalogs by an authorized administrator of NSUWorks. For more information, please contact [email protected]. Master of Taxation Course Descriptions 2016 Course Descriptions Full-Time professionals are available to discuss the Master of Taxation curriculum with you in greater detail. Simply call 800.672.7223 Ext. 25168 or contact our Enrollment Services Staff. ACTP 5711 Internet Technology (0 cr.) A one-week, non-credit course in utilizing the Internet for classroom purposes, research, (including the use of the library), and other skills needed to successfully complete the graduate accounting and taxation program. Required for any student taking a course in the MACC or MTAX programs. TXX 5761 Taxation of Individuals (3 cr.) An in-depth analysis of the federal income tax structure, use of tax services, and the concept of taxable income for individuals. Prerequisite: ACTP 5001 or equivalent and ACTP 5711. TXX 5763 Tax of Estates, Trusts & Gifts (3 cr.) Advanced study of, and research in, tax law with emphasis on estate, trust, and gift taxes. Prerequisite: TXX 5762 or TXX 5775 and ACTP 5711. -

Sydney Law School Handbook 2011

SYDNEY LAW SCHOOL HANDBOOK 2011 Handbooks online: sydney.edu.au/handbooks Acknowledgements Acknowledgements The Arms of the University Sidere mens eadem mutato Though the constellations change, the mind is universal Copyright Disclaimers This work is copyright. No material anywhere in this work may be 1. The material in this handbook may contain references to persons copied, reproduced or further disseminated ± unless for private use who are deceased. or study ± without the express and written permission of the legal 2. The information in this handbook was as accurate as possible at holder of that copyright. The information in this handbook is not to be the time of printing. The University reserves the right to make used for commercial purposes. changes to the information in this handbook, including prerequisites for units of study, as appropriate. Students should Official course information check with faculties for current, detailed information regarding Faculty handbooks and their respective online updates, along with units of study. the University of Sydney Calendar, form the official legal source of Price information relating to study at the University of Sydney. Please refer to the following websites: The price of this handbook can be found on the back cover and is in Australian dollars. The price includes GST. sydney.edu.au/handbooks sydney.edu.au/calendar Handbook availability Handbooks are available as a website, PDF download and print on Amendments demand. See the handbooks website at sydney.edu.au/handbooks All authorised amendments to this handbook can be found at for more information. sydney.edu.au/handbooks/handbooks_admin/updates2011 Production Resolutions Web and Print Production Website: sydney.edu.au/web_print The Coursework Clause Printing Resolutions must be read in conjunction with the University of Sydney SOS Print and Media (Coursework) Rule 2000 (as amended), which sets out the requirements for all undergraduate courses, and the relevant Handbook enquiries resolutions of the Senate. -

The University of Sydney Law School Postgraduate Lecture Timetable 2018

The University of Sydney Law School intensive units will not be available until the end of the semester in which the unit is held. Postgraduate Lecture Timetable 2018 The release date of results of intensive units held in the later Conditions of enrolment part of the semester will be determined by Sydney Law Despite any publication or announcement, the University may School. change or cancel arrangements for courses or units of study, including in respect of staffing, content or location. The Enrolment after the last day to add University will use reasonable endeavours to update the It will not be possible to add a unit in Sydney timetable with respect to any cancellation or change. The Student https://sydneystudent.sydney.edu.au/sitsvision/wrd/ University will not be liable to any student for any siw_lgn after the last day to add (see below). To request consequential loss suffered as a result of cancellation or permission to enrol in a unit of study after the enrolment change, including travel or other costs incurred. Please consult deadline, please email Faculty Services https://sydney.edu.au/law/study-law/postgraduate-units-of- E: [email protected] well in advance of classes. study.html for the latest information Last day to withdraw from a unit of study Semester dates 100% tuition fee liability or FEE-HELP debt will be incurred (please see inside for dates of intensive units of study) after the relevant withdrawal census date below. No refund is Semester Semester start date Last day of semester payable for withdrawal requests received subsequent to these 1 Monday 5 March Saturday 30 June dates. -

Faculty of Law: Taxation Postgraduate Programmes 2018 Master of Taxation Studies (Mtaxs)

Faculty of Law: Taxation Postgraduate Programmes 2018 Master of Taxation Studies (MTaxS) The Master of Taxation Studies (MTaxS) programme is designed for both law and commerce graduates who intend to make tax advocacy or tax consulting their career and who wish to extend their understanding of the theoretical issues and legal structures that underpin the taxation system. Programme Structure The MTaxS is a 120-point degree. Students must complete a compulsory 30-point course and either a 90-point thesis or 90 points of courses chosen from a list of options. Research Masters • 30 points: COMLAW 740 • 90 points: COMLAW 794 Thesis or Taught Masters • 30 points: COMLAW 740 • Up to 90 points from COMLAW 741, 746- 756, 789, 790 The MTaxS has been designed so students can study full-time or part-time to allow flexibility for those with other professional or personal commitments. The programme is normally completed within two consecutive semesters (full-time), or up to eight consecutive semesters (part-time). It is also possible for students The programme is an opportunity for graduates Entry Requirements to take individual MTaxS courses towards to develop their tax skills and for practitioners any of Auckland Law School's postgraduate to update and hone their knowledge of tax. Applications for MTaxS will be considered from programmes. Courses are scheduled to take into account work those who: commitments and are all taught intensively over • Have completed the requirements for three consecutive days of instruction (normally a Bachelor of Commerce (Honours) 180pt option Thursday to Saturday). (BCom(Hons)), Bachelor of Laws (LLB) or A new 180pt MTaxS degree is planned for Bachelor of Laws (Honours) (LLB(Hons)), The focus of the MTaxS programme is on 2018, awaiting approval. -

KPMG-Data-Analytics-New-Masters

Patterson School Launches New Master’s Programs KPMG partnership the driving force in creating two new data analytics master’s programs at UM By Edwin Smith The University of Mississippi’s Patterson School of Accountancy launched two new master’s degree programs in fall 2018. The new degree programs include the Master of Accountancy and Data Analytics (MADA) and the Master of Taxation and Data Analytics (MTDA). The school now offers four master’s degrees with the others being the traditional Master of Accountancy and Master of Taxation. The impetus for moving quickly to create new degree programs was KPMG’s selection of the Patterson School as a partner in delivering graduate education in data analytics. KPMG LLP is one of the world’s largest international professional services providing audit, tax and advisory services to clients globally. After a rigorous selection process, the University of Mississippi became one of only nine universities in the nation to be selected by KPMG as a partner in this prestigious program in accounting and data analytics. The other schools include Arizona State University, Baylor University, Ohio State University, University of Georgia, University of Missouri, University of Southern California, Virginia Tech State University and Villanova University. The Patterson School is the only university selected by KPMG to team up in the area of tax and data analytics. KPMG is paying full cost of attendance for 135 students across the country to pursue graduate education in data analytics at one of the nine partner universities. These students will do a four- month internship during the program and have signed contracts to work full time with KPMG upon graduation. -

Volume 4, Issue 1--Saqib.Pub

SJSU MST Program News Volume 4, Issue 1 Fall 2016 N EW FACULTY Scheduled Conferences Welcome new faculty members, Caroline Chen and Kelly Gaffaney • 33rd Annual TEI-SJSU High Caroline Chen Tech Tax Institute— November 13 & 14, 2017 Before starting at SJSU this fall, Caroline was the Director of the Low Income Tax Clinic at Santa Clara Law, where she supervised students providing pro bono services and For more information, visit representation before the IRS for low-income taxpayers for the 5 years. She was also www.tax-institute.com an Assistant Clinical Professor of Law and taught Federal Income Tax, International Tax and Tax Practice & Procedure. Before creating the Tax Clinic, Caroline was a senior attorney at the Office of Chief Prospective Students Counsel of the Internal Revenue Service in San Jose for 13 years, primarily with the Large Business & Inter- national Division, specializing in international corporate tax. She has also been an adjunct professor at Gold- en Gate University, where she taught Federal Tax Practice and Procedure, and worked at Ernst & Young as a tax consultant before joining the IRS. Caroline received her LL.M in Taxation from Georgetown University Law Center, her Juris Doctor from Wash- ington College of Law, American University, and her B.S. from Rutgers, The State University of New Jersey. After receiving her J.D., she clerked for the Honorable Deborah Robinson of the United States District Court http://www.sjsu.edu/lucasgsb/prog for the District of Columbia. rams/mst/prospective/index.html Kelly Gaffaney—Business Technology Partner Technology Sector Leader - West Deloitte Tax LLP Kelly has been providing innovative tax solutions and quality client service to taxpayers Connect with us: for 20 years.