Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Richmond Region

SCANDINAVIA Home to more More than Fortune 500 than 60,000 200 foreign company businesses affiliated firms 8 headquarters More than 1,700 More than 70 international More than 20 international students from international clubs and over 115 festivals each year organizations countries Richmond Region, USA A proven location for international business BUSINESS CLUSTERS The Richmond Region is home to more than 60,000 businesses, with everything from Fortune 1000 companies to two-person startups. Our strongest business clusters include: Corporate Information Finance & Advanced Food & BioScience Supply Chain Services Technology Insurance Manufacturing Beverage SCANDINAVIAN OWNED FIRMS IN RICHMOND More than 200 foreign affiliated firms have 210+ facilities in the Richmond Region representing nearly 30 countries. These firms employ over 19,000 workers and provide a wide range of products and services. There are six Scandinavian companies in the region: Alfa Laval AB (Sweden) Plate heat exchanger & high purity pump & valve production Kone Corporation (Finland) Elevator and escalator service and manufacturing MarkBric AB (Sweden) Portable displays; size marking indicators, labels, rack dividers Scandinavian Tobacco Group (Denmark) Manufacturing and distribution of premium cigars Securitas AB (Sweden) Security and related services Swedish Match AB (Sweden) Chewing and smoking tobacco TRANSPORTATION & INFRASTRUCTURE n Richmond is strategically located at the mid-point of the East Coast, less than 160 km (100 mi) from Washington, D.C. 1 Hanover n Three interstate highways converge in the region. 95 n More than 45% of the nation’s consumers are within a one-day drive R R of Richmond. Hanover 301 Airport n Two of the nation’s largest operators, CSX and Norfolk Southern, 64 provide rail freight service and AMTRAK provides passenger rail 295 service. -

Alfa Laval Group P.O

Alfa Laval Group P.O. Box 73 221 00 Lund Lund, Sweden – October 21, 2020 Sweden Visit: Rudeboksvägen 1 Tel: +46 46 36 65 00 Fax: +46 46 30 50 90 www.alfalaval.com THIS STOCK EXCHANGE RELEASE MAY NOT BE RELEASED, PUBLISHED OR OTHERWISE DISTRIBUTED, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO AUSTRALIA, CANADA, HONG KONG SPECIAL ADMINISTRATIVE REGION OF THE PEOPLE’S REPUBLIC OF CHINA, JAPAN, NEW ZEALAND, SOUTH AFRICA, OR ANY OTHER JURISDICTION IN WHICH THE TENDER OFFER WOULD BE PROHIBITED BY APPLICABLE LAW. FOR FURTHER INFORMATION, PLEASE SEE SECTION ENTITLED “IMPORTANT INFORMATION” BELOW. Alfa Laval supplements the tender offer document dated 12 August 2020 regarding the recommended public cash tender offer for all shares in Neles Alfa Laval AB (publ), 21 October 2020 at 3:00 p.m. CEST As previously announced, Alfa Laval AB (publ) (“Alfa Laval” or the “Offeror”) and Neles Corporation (“Neles”) have on 13 July 2020 entered into a combination agreement pursuant to which Alfa Laval has made a voluntary recommended public cash tender offer for all issued and outstanding shares in Neles (the “Tender Offer”). Alfa Laval has published a tender offer document, dated 12 August 2020, concerning the Tender Offer (the “Tender Offer Document”). The acceptance period under the Tender Offer commenced on 13 August 2020 at 9:30 a.m. (Finnish time) and will expire on 30 October 2020 at 4:00 p.m. (Finnish time), unless extended in accordance with the terms and conditions of the Tender Offer and applicable laws and regulations. The Finnish Financial Supervisory Authority has today approved a supplement to the Tender Offer Document (such supplement hereinafter the “Supplement Document”). -

Corporate Governance

Report of the Board of Directors Corporate governance ASSA ABLOY is a Swedish public limited liability company Shareholders with registered office in Stockholm, Sweden, whose Series B At year-end, ASSA ABLOY had 22,232 shareholders share is listed on the Nasdaq Stockholm. 1 (17,720). The principal shareholders are Investment The Group’s corporate governance is based on the Swedish AB Latour (9.5 percent of the share capital and 29.5 percent Companies Act, the Annual Accounts Act, the Nasdaq of the votes) and Melker Schörling AB (3.9 percent of the Stockholm Rule Book for Issuers and the Swedish Code of share capital and 11.4 percent of the votes). Foreign share- Corporate Governance, as well as other applicable external holders accounted for around 64 percent (65) of the share laws, regulations and recommendations, and internal rules capital and around 44 percent (44) of the votes. The ten largest and regulations. shareholders accounted for around 38 percent (35) of the This Corporate Governance Report has been prepared as share capital and 58 percent (56) of the votes. For further part of ASSA ABLOY’s application of the Swedish Code of information on shareholders, see page 123. Corporate Governance. The report is audited by A shareholders’ agreement exists between Gustaf Douglas, ASSA ABLOY’s auditor. Melker Schörling and related companies and includes an ASSA ABLOY’s objective is that its activities should gener- agreement on right of first refusal if any party disposes of ate good long-term returns for its shareholders and other Series A shares. The Board of Directors of ASSA ABLOY is not stakeholders. -

ALFA LAVAL TREASURY INTERNATIONAL AB (PUBL) (Incorporated with Limited Liability in the Kingdom of Sweden)

BASE PROSPECTUS ALFA LAVAL TREASURY INTERNATIONAL AB (PUBL) (incorporated with limited liability in The Kingdom of Sweden) Guaranteed by ALFA LAVAL AB (PUBL) (incorporated with limited liability in The Kingdom of Sweden) EUR 1,500,000,000 Euro Medium Term Note Programme Under this EUR 1,500,000,000 Euro Medium Term Note Programme (the "Programme") Alfa Laval Treasury International AB (publ) (the "Issuer") may from time to time issue notes (the "Notes") denominated in any currency agreed between the Issuer and the relevant Dealer (as defined below). The payments of all amounts due in respect of the Notes will be unconditionally and irrevocably guaranteed by Alfa Laval AB (publ) (the "Guarantor"). This base prospectus (the "Base Prospectus") has been approved by the Central Bank of Ireland (the "Central Bank"), as competent authority for the purposes of Directive 2003/71/EC, as amended or superseded (the "Prospectus Directive"). The Central Bank only approves this Base Prospectus as meeting the requirements imposed under Irish and EU law pursuant to the Prospectus Directive. This Base Prospectus comprises a Base Prospectus for the purposes of Article 5.4 of the Prospectus Directive. Such approval relates only to Notes that are to be admitted to trading on the regulated market of the Irish Stock Exchange plc trading as Euronext Dublin ("Euronext Dublin") or on another regulated market for the purposes of Directive 2014/65/EU (as amended, "MiFID II"), and/or that are to be offered to the public in any member state of the European Economic Area in circumstances that require the publication of a prospectus. -

Corporate Governance Report 2020

CORPORATE GOVERNANCE CORPORATE GOVERNANCE REPORT 2020 Trelleborg is a publicly traded Swedish limited liability company listed on Nasdaq Stockholm Large Cap. Trelleborg applies the Swedish Corporate Governance Code and presents its 2020 Corporate Governance Report in this section. The auditor’s review was conducted in accordance with FAR’s auditing standard RevU 16 The auditor’s examination of the corporate governance statement. Annual General Meeting 2020. The 2020 Annual General Meeting Susanne Pahlén Åklundh and Jan Ståhlberg. Panu Routila took place on April 23, 2020 in Trelleborg. At the meeting, 20 declined re-election. shareholders were in attendance, personally or by proxy, representing » Re-election of Hans Biörck as Chairman of the Board. about 70 percent of votes in Trelleborg. The Chairman of the Board, Re-election of Deloitte AB as auditor. Hans Biörck, was elected Chairman of the Meeting. The number » of Board members was limited to the Chairman together with the » Remuneration for the Board members and the auditor. President and CEO due to the Coronavirus pandemic. A union » Principles for remuneration and other employment terms for employee representative also attended as did the Chairman of the President and other senior executives. the Nomination Committee and Trelleborg’s auditor. For information on shareholders and the Trelleborg share, refer to The Annual General Meeting was livestreamed in its entirety pages 134–136 and www.trelleborg.com. Trelleborg’s 2021 Annual to the general public. General Meeting will be held on April 22, 2021 in Trelleborg. Shareholders were given the opportunity to submit written questions to Trelleborg’s management before the Meeting. -

Contents – Corporate Governance Report

Corporate Governance Report Contents – Corporate Governance Report Introduction by the Chairman of the Board 56 Corporate Governance Report 2020 57 Share and ownership structure 58 Annual General Meeting 58 Annual General Meeting for the 2019 fiscal year 58 Nominating Committee 60 Board of Directors 61 Committees 63 The company’s auditors 63 Remuneration to auditors 63 Board of Directors and auditors 64 President and Group management 66 Areas of responsibility 66 Remuneration to senior executives 66 Operational control 67 Group management meetings in 2020 68 Board of Directors’ report on internal control 68 Control environment 68 Risk assessment 68 Control structures 68 Information and communication 69 Follow-up 69 Auditor’s statement on the Corporate Governance Report 70 55 Introduction by the Chairman of the Board Alfa Laval talization, including connected equipment and remote diagnostics, Little did I know, entering my first year as Chairman of the Alfa Laval were accelerated to better service and support many of our cus- Board, what a different and challenging year this would be. By early tomers during a difficult year. 2020 employees all over the world were forced to contend with a new normal; lockdowns, travel bans and challenges of different The ultimate goal of transforming the service business is for Alfa kinds. Despite this Alfa Laval remained resilient and adjusted rapidly Laval to be able to fully leverage its installed base, improve and to the new situation while maintaining employee’s safety and expand the customer base and simultaneously improve the cus- customers business continuity in focus. During the year, I have been tomer experience, thereby supporting the Alfa Laval brand. -

View Annual Report

Financial information Alfa Laval uses a number of channels to provide information about the information that could have an effect on the share price that is not yet publicly company’s operations and financial development. Information published in the known is never disclosed at these types of meetings or contacts. Alfa Laval in brief 2008 Report Annual form of annual reports, quarterly reports and press releases is presented on Alfa Laval also arranges a so-called capital markets day each year, at which Contents an ongoing basis on the company’s website at www.alfalaval.com/investors. representatives for financial markets are offered more in-depth information Alfa Laval is a leading global provider of Presentation material from capital markets days, press conferences and analyst regarding the company’s operations. specialized products and engineered Under the flap sustainability report 2008 meetings is also available for downloading at the site. Alfa Laval employs a so-called silence period of three weeks. This Alfa Laval in two minutes The annual report is sent to those shareholders who have notified the implies that the President and Chief Financial Officer do not meet or speak solutions. 36 Sustainability efforts must be company that they wish to receive a copy. Annual reports and interim reports to representatives from the financial market during the three weeks prior to a The company’s equipment, a natural feature of daily business 1 Highlights 2008 can be ordered at www.alfalaval.com or by calling +46 (0)40-36 65 00. quarterly report. systems and services are dedicated to Alfa Laval arranges press conferences and analyst meetings following In accordance with the company’s Articles of Association, notice of the • 38 Accelerated work on reducing publication of the company’s quarterly reports. -

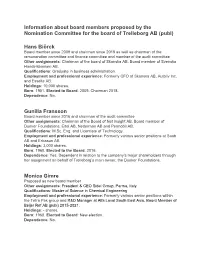

Information About Board Members Proposed by the Nomination Committee for the Board of Trelleborg AB (Publ)

Information about board members proposed by the Nomination Committee for the board of Trelleborg AB (publ) Hans Biörck Board member since 2009 and chairman since 2018 as well as chairman of the remuneration committee and finance committee and member of the audit committee Other assignments: Chairman of the board of Skanska AB. Board member of Svenska Handelsbanken AB. Qualifications: Graduate in business administration. Employment and professional experience: Formerly CFO of Skanska AB, Autoliv Inc. and Esselte AB. Holdings: 10,000 shares. Born: 1951. Elected to Board: 2009. Chairman 2018. Dependence: No. Gunilla Fransson Board member since 2016 and chairman of the audit committee Other assignments: Chairman of the Board of Net Insight AB. Board member of Dunker Foundations, Eltel AB, Nederman AB and Permobil AB. Qualifications: M.Sc. Eng. and Licentiate of Technology. Employment and professional experience: Formerly various senior positions at Saab AB and Ericsson AB. Holdings: 3,000 shares. Born: 1960. Elected to the Board: 2016. Dependence: Yes. Dependent in relation to the company’s major shareholders through her assignment on behalf of Trelleborg’s main owner, the Dunker Foundations. Monica Gimre Proposed as new board member Other assignments: President & CEO Sidel Group, Parma, Italy Qualifications: Master of Science in Chemical Engineering Employment and professional experience: Formerly various senior positions within the Tetra Pak group and R&D Manager at Alfa Laval South East Asia. Board Member of Beijer Ref AB (publ) 2015-2021. Holdings: - shares. Born: 1960. Elected to Board: New election. Dependence: No. Johan Malmquist Board member since 2016 and member of the remuneration committee and the finance committee Other assignments: Chairman of the Board of Arjo AB and Getinge AB. -

Supplement Document 1 October 2020

SUPPLEMENT DOCUMENT TO ALFA LAVAL AB (PUBL)’S TENDER OFFER DOCUMENT DATED 12 AUGUST 2020 RELATING TO THE VOLUNTARY PUBLIC CASH TENDER OFFER FOR ALL ISSUED AND OUTSTANDING SHARES IN NELES CORPORATION 1 October 2020 THE TENDER OFFER IS NOT BEING MADE DIRECTLY OR INDIRECTLY IN ANY JURISDICTION WHERE PROHIBITED BY APPLICABLE LAW AND THE TENDER OFFER DOCUMENT AND RELATED ACCEPTANCE FORMS AND SUPPLEMENT DOCUMENTS ARE NOT AND MAY NOT BE DISTRIBUTED, FORWARDED OR TRANSMITTED INTO OR FROM ANY JURISDICTION WHERE PROHIBITED BY APPLICABLE LAW BY ANY MEANS WHATSOEVER INCLUDING, WITHOUT LIMITATION, MAIL, FACSIMILE TRANSMISSION, E-MAIL OR TELEPHONE. IN PARTICULAR, THE TENDER OFFER IS NOT MADE IN AND THE TENDER OFFER DOCUMENT AND THIS SUPPLEMENT DOCUMENT MUST UNDER NO CIRCUMSTANCES BE DISTRIBUTED INTO CANADA, JAPAN, AUSTRALIA, SOUTH AFRICA, HONG KONG SPECIAL ADMINISTRATIVE REGION OF THE PEOPLE’S REPUBLIC OF CHINA OR NEW ZEALAND OR ANY OTHER JURISDICTION WHERE PROHIBITED BY APPLICABLE LAW. Alfa Laval AB (publ) (the “Offeror” or “Alfa Laval”) supplements the tender offer document dated 12 August 2020 (the “Tender Offer Document”) in accordance with Chapter 11, Section 11, Subsection 4 of the Finnish Securities Market Act (746/2012, as amended) with the following information of this document (the “Supplement Document”): Valmet Corporation (“Valmet”) announced on 29 September 2020 that it had approached the Board of Directors of Neles Corporation (“Neles”) with a proposal to start discussions on a potential statutory merger between the two companies (“Valmet’s Stock Exchange Release”). Pursuant to Valmet’s Stock Exchange Release, Valmet holds 29.5 percent of the shares in Neles. -

1 the Nomination Committee's Proposal for Decisions

CONVENIENCE TRANSLATION The Nomination Committee’s proposal for decisions, motivated statement and information on proposed members of the Board of Directors The Nomination Committee prior to the 2019 Annual General Meeting comprises Chairman Carl Douglas (Investment AB Latour), Mikael Ekdahl (Melker Schörling AB), Liselott Ledin (Alecta), Marianne Nilsson (Swedbank Robur fonder) and Anders Oscarsson (AMF and AMF fonder). The five owner-representatives represent approximately 44 per cent of the votes of all shares in ASSA ABLOY AB. The Nomination Committee proposes the 2019 Annual General Meeting resolves as follows. Items 10-12 – Determination of the number of members of the Board of Directors, determination of fees to the Board of Directors and the Auditor as well as election of the Board of Directors, Chairman of the Board of Directors, Vice Chairman of the Board of Directors and the Auditor - The number of members of the Board of Directors shall be seven. - Fees to the Board of Directors shall amount to a total of SEK 6,675,000 (remuneration for committee work not included) to be distributed among the members of the Board of Directors as follows; SEK 2,350,000 to the Chairman, SEK 900,000 to the Vice Chairman and SEK 685,000 to each of the other members of the Board of Directors elected by the Annual General Meeting. As remuneration for the committee work, the Chairman of the Audit Committee is to receive SEK 275,000, the Chairman of the Remuneration Committee SEK 150,000, members of the Audit Committee (the Chairman excluded) SEK 200,000 each, and member of the Remuneration Committee (the Chairman excluded) SEK 75,000. -

The "Final Terms") You Agree to Be Bound by the Following Terms and Conditions

IMPORTANT NOTICE In accessing the attached final terms (the "Final Terms") you agree to be bound by the following terms and conditions. The information contained in the Final Terms may be addressed to and/or targeted at persons who are residents of particular countries only as specified in the Final Terms and/or in the Base Prospectus (as defined in the Final Terms) and is not intended for use and should not be relied upon by any person outside those countries and/or to whom the offer contained in the Final Terms is not addressed. Prior to relying on the information contained in the Final Terms, you must ascertain from the Final Terms and/or the Base Prospectus whether or not you are an intended addressee of the information contained therein. Neither the Final Terms nor the Base Prospectus constitutes an offer to sell or the solicitation of an offer to buy securities in the United States or in any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration, exemption from registration or qualification under the securities law of any such jurisdiction. The securities described in the Final Terms and the Base Prospectus have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the "Securities Act") and may not be offered or sold directly or indirectly within the United States or to, or for the account or benefit of, U.S. persons or to persons within the United States of America (as such terms are defined in Regulation S under the Securities Act ("Regulation S")). -

Board-Of-Directors-And-Auditors.Pdf

52 Corporate Governance Report Board of Directors and auditors Appointed by the Annual General Meeting Anders Narvinger Ulf Wiinberg Margareth Øvrum Henrik Lange Chairman since 2003. Board member since 2013. Board member since 2015. Board member since 2018. Born: 1948 Born: 1958 Born: 1958 Born: 1961 Formerly President of President of X-Vax Inc. Formerly Executive Vice President and President and CEO of Gunnebo AB. Teknikföretagen and President CEO of H. Lundbeck A/S, Director member of Group management Previously held several senior and CEO of ABB Sweden. of Wyeth Pharmaceuticals, at Equinor ASA. positions within the SKF Group, Education: BSc. Eng. from the EMEA/Canada & BioPharma, Previously held senior positions in including Industry Division Faculty of Engineering at Lund and a number of other senior a number of areas at Equinor Manager and CFO, and served University, BSc. Econ from positions in Wyeth. (formerly Statoil), including tech- as CEO of Johnson Pump AB. Uppsala University. Chairman of the Board: Hansa nology, projects, production, Education: BSc. Econ. from the Chairman of the Board: ÅF AB. Medical AB and Sigrid maintenance, health, safety, envi- Gothenburg School of Business, Therapeutics. ronment and purchasing. Independent of the company Economics and Law and major shareholders. Board member: UCB Pharma Education: Master’s degree in Board member: Velux A/S. and Agenus Inc. Technical Physics from the Number of shares in Alfa Laval: Norwegian University of Science Independent of the company 40,000* (40,000**) Independent of the company and major shareholders. and major shareholders. and Technology in Trondheim. Board member: FMC Corporation. Number of shares in Alfa Laval: Number of shares in Alfa Laval: 4,000* (–**) 20,000* (20,000**) Independent of the company and major shareholders.