Table of Contents

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Alameda County Board of Supervisors Personnel, Administration, and Legislation (PAL) Committee LEGISLATIVE POSITION REQUEST FORM

Alameda County Board of Supervisors Personnel, Administration, and Legislation (PAL) Committee LEGISLATIVE POSITION REQUEST FORM Submission deadline is noon on the Monday two weeks prior to the PAL meeting. See FAQ for additional instructions. Title (Bill/Reg. No., Bill/Reg. Title, Author): AB-125 (Rivas) Equitable Economic Recovery, Healthy Food Access, Climate Resilient Farms, and Worker Protection Bond Act of 2022. Version (Date amended): 04/15/2021 Position Requested: Support Current Status of Bill/Regulation (Has the bill been This is a two-year bill currently in the Assembly Committee on referred to committee, or set for hearing? If so, Natural Resources. It has not received a hearing date. when and what committee? Next hearing?) (Where relevant include comment period dates/deadlines): Alignment Shared Visions 10X Goals Operating Principles with Vision ☒ Thriving & Resilient Population ☒ Employment for All ☒ Collaboration 2026: ☐ Safe & Livable Communities ☐ Eliminate Homelessness ☒ Equity ☒ Healthy Environment ☒ Eliminate Poverty and Hunger ☐ Fiscal Stewardship ☐ Prosperous & Vibrant Economy ☐ Crime Free County ☐ Innovation ☐ Healthcare for All ☒ Sustainability ☒ Accessible Infrastructure ☒ Access Alignment with Legislative Platform (i.e. “issue”/plank or Employment for All / “Transition to Circular Economy,” N/A if not in legislative platform) Eliminate Poverty and Hunger / “Food/Nutrition Security,” Accessible Infrastructure / “Climate Change Adaption” Summary (Summary of item, use Legislative Counsel’s Digest, Bill Analysis, -

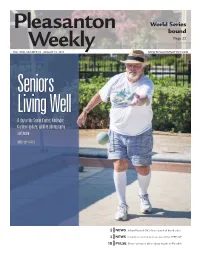

World Series Bound Page 22

World Series bound Page 22 VOL. XVIII, NUMBER 29 • AUGUST 11, 2017 WWW.PLEASANTONWEEKLY.COM Seniors Living Well A day at the Senior Center, Kottinger Gardens update, wildlife photography and more INSIDE THIS ISSUE 5 NEWS School board OKs first round of bond sales 5 NEWS County earns innovation award for STEP-UP 10 PULSE Driver arrested after injury crash on Foothill SIMON COHEN Optical Engineer Severe back pain stopped his life Spine surgery started it again Now he’s back on track Four years ago, Simon injured his back. He tried everything to stop the pain— chiropractors, injections, massage —and nothing worked. After extensive research into spine surgeons and area hospitals, Simon chose a surgeon at Stanford Health Care – ValleyCare, where the team is highly experienced in the latest techniques. His herniated disc was repaired with a small incision and his back pain was gone. Today, his life is back in gear. See his story and find a doctor: ValleyCare.com/Spine Or call: 844-530-0640 Page 2 • August 11, 2017 • Pleasanton Weekly AROUND PLEASANTON PLEASANTON BY JEB BING Rotary: Doing good in Pleasanton he Rotary Club of Pleasanton Winners are invited to attend a Ro- has awarded 12 Pleasanton tary lunch meeting where they are Thigh school students schol- honored for their accomplishment. Life arships totaling $31,950, with an- The two Pleasanton Interact clubs, other $3,000 in scholarship fund- with the one at Amador Valley High ing given to three students by the School sponsored by Downtown Ro- Pleasanton’s annual resource guide coming Rotary Club of Pleasanton North. -

I-680 Sunol SMART Carpool Lane Joint Powers Authority Meeting Agenda Monday, November 4, 2013, 9:30 A.M

Meeting Notice Commission Chair Supervisor Scott Haggerty, District 1 I-680 Sunol Smart Carpool Commission Vice Chair Councilmember Rebecca Kaplan, City of Oakland Lane Joint Powers Authority AC Transit Director Elsa Ortiz Monday, November 4, 2013, 9:30-10:30 a.m. Alameda County 1111 Broadway, Suite 800 Supervisor Richard Valle, District 2 Supervisor Wilma Chan, District 3 Supervisor Nate Miley, District 4 Oakland, CA 94607 Supervisor Keith Carson, District 5 BART Director Thomas Blalock City of Alameda Mission Statement Mayor Marie Gilmore City of Albany The mission of the Alameda County Transportation Commission Mayor Peggy Thomsen (Alameda CTC) is to plan, fund and deliver transportation programs and City of Berkeley projects that expand access and improve mobility to foster a vibrant Councilmember Laurie Capitelli and livable Alameda County. City of Dublin Mayor Tim Sbranti City of Emeryville Public Comments Councilmember Ruth Atkin City of Fremont Public comments are limited to 3 minutes. Items not on the agenda are Mayor William Harrison covered during the Public Comment section of the meeting, and items City of Hayward specific to an agenda item are covered during that agenda item Councilmember Marvin Peixoto discussion. If you wish to make a comment, fill out a speaker card, hand City of Livermore Mayor John Marchand it to the clerk of the Commission, and wait until the chair calls your City of Newark name. When you are summoned, come to the microphone and give Councilmember Luis Freitas your name and comment. City of Oakland Vice Mayor Larry Reid Reminder City of Piedmont Mayor John Chiang Please turn off your cell phones during the meeting. -

BOS Health Committee

ALAMEDA COUNTY BOARD OF SUPERVISORS' HEALTH COMMITTEE Monday, September 14, 2015 9:30 a.m. Supervisor Wilma Chan, Chair Location: Board of Supervisors Chambers – Room 512 5th floor Supervisor Keith Carson County Administration Building 1221 Oak Street, Oakland, CA 94612 Summary/Action Minutes I. “Shoo the Flu” Update Attachment Dr. Erica Pan, Director, Division of Communicable Disease Control & Prevention, Alameda County Public Health Department, presented a PowerPoint presentation on “Shoo the Flu”, a program to prevent flu and the spread of flu among children in Alameda County. In Alameda County, there are over 100,000 flu-related illnesses per year, and between 200 to 500 hospitalizations due to the flu. Expenses for flu-related illness in Alameda County are approximately $120 million annually. The flu is preventable thru vaccination. “Shoo the Flu” is a program provided by the Public Health Department in partnership with several other agencies to provide flu vaccination to school children from Pre-K to 5th grade, in select schools across Oakland. The program is free and it requires parental consent. The benefits to vaccinating children at school include: •Increased vaccine coverage in school-aged kids •Decreased community-wide transmission •Reduced absenteeism •Cost savings: direct health care costs and indirect: work days lost •Safe and convenient for parents This program is made possible through grant funding from the Page Foundation and this is the second year of a three-year grant. The State Department of Public Health provides the flu vaccines. Other partners include the UC Berkeley School of Public Health, the California Emerging Infections Program and the Oakland Unified School District. -

BOARD of SUPERVISORS' MEETING, TUESDAY, OCTOBER 29, 2019- PAGE 1 Week Not a : the Alameda County Internet Address Is Is Address Internet County Alameda the : LAMEDA

SUMMARY ACTION MINUTES BOARD OF SUPERVISORS Regular Meeting Tuesday, October 29, 2019 COUNTY ADMINISTRATION BUILDING SCOTT HAGGERTY DISTRICT 1 SUPERVISORS’ CHAMBERS RICHARD VALLE, PRESIDENT DISTRICT 2 1221 OAK STREET WILMA CHAN DISTRICT 3 FIFTH FLOOR, ROOM 512 NATE MILEY DISTRICT 4 OAKLAND, CALIFORNIA KEITH CARSON, VICE-PRESIDENT DISTRICT 5 SUSAN S. MURANISHI DONNA ZIEGLER COUNTY ADMINISTRATOR COUNTY COUNSEL MISSION TO ENRICH THE LIVES OF ALAMEDA COUNTY RESIDENTS THROUGH VISIONARY POLICIES AND ACCESSIBLE, RESPONSIVE, AND EFFECTIVE SERVICES. VISION ALAMEDA COUNTY IS RECOGNIZED AS ONE OF THE BEST COUNTIES IN WHICH TO LIVE, WORK AND DO BUSINESS. The Board of Supervisors welcomes you to its meetings and your interest is appreciated. If you wish to speak on a matter on the agenda or during public input, please fill out a speaker slip at the front of the Chambers and turn it in to the Clerk as soon as possible. When addressing the Board, please give your name for the record prior to your presentation. If you wish to speak on a matter not on the agenda, please wait until the President calls for public input at the end of the Regular Calendar. NOTE: Only matters within the Board of Supervisors’ jurisdiction may be addressed. Time limitations shall be at the discretion of the President of the Board. Pursuant to Board Policy: (1) Signs or demonstrations are prohibited during Board meetings; (2) Any Board Member may request a two-week continuance on any item appearing for the first time; (3) All agenda items shall be received by the County Administrator prior to 3 p.m. -

Communityconnection March/April2016 a Community Newsletter from the Alameda County Administrator’S Office

Alameda County CommunityConnection March/April2016 A Community Newsletter from the Alameda County Administrator’s Office CAO’s Corner By Susan S. Muranishi County Administrator Inside This Issue Welcome to our first edition of Alameda County Community Connection, our redesigned community newsletter! We launched Community Connection to bring a fresh, more streamlined look to our newsletter, which we hope will ap- peal to our readers. CAO’s Corner 1 Community Connection will strive to provide you with important information about Alameda County’s activities, along with interesting stories about our employees and departments. We hope you will enjoy this newsletter. Your comments and ideas are always welcome. Please submit any and all com- ments to Guy Ashley at [email protected] or call him at (510) 272-6569. First Responders Praised 1 Quick-Thinking Crucial in Response to Niles Canyon Train Derailment Alameda County Sheriff’s deputies and firefighters take pride in always being ready 12 Inducted into to provide assistance in some of the County’s loneliest and most remote stretches - even in the dead of night. The derailment of a commuter train in Niles Canyon on Women’s Hall of Fame 2 March 7 made it very clear why we are glad they’re out there. County public safety personnel led the emergency response to the incident involv- ing nearly 200 passengers, which turned a routine rainy Monday evening into a composure-testing, adrenaline-surging night shift they will never forget. Firefighter’s Picture Gets “That’s a call that comes over the radio once in a lifetime,’’ said Sheriff’s Deputy Anthony King, one of the first emergency responders to reach the Altamont Com- Worldwide Audience 3 muter Express (ACE) train that was knocked off its tracks by a landslide and sent tumbling into rain-swollen Alameda Creek. -

Alameda CTC Commission Resolution

Commission Chair Mayor Pauline Russo Cutter ALAMEDA COUNTY TRANSPORTATION COMMISSION City of San Leandro Resolution No. 20-007 Commission Vice Chair Councilmember John Bauters City of Emeryville Resolution of the Alameda County Transportation Commission AC Transit Amending the 2014 Transportation Expenditure Plan to Delete the Board Vice President Elsa Ortiz BART to Livermore Project and add the Valley Link Project Alameda County Supervisor Scott Haggerty, District 1 Supervisor Richard Valle, District 2 WHEREAS, by action of the governing body (“Commission”) of Supervisor Wilma Chan, District 3 Supervisor Nate Miley, District 4 Alameda County Transportation Commission (“Alameda CTC”) at a Supervisor Keith Carson, District 5 regular Commission meeting on January 23, 2014, Alameda CTC BART approved the 2014 Transportation Expenditure Plan (“2014 TEP”), and Director Rebecca Saltzman in November 2014, the voters of Alameda County approved City of Alameda Mayor Marilyn Ezzy Ashcraft Measure BB, a sales tax measure intended to provide funding for the 2014 TEP. City of Albany Mayor Nick Pilch WHEREAS, the 2014 TEP allocated $400 million to a project identified City of Berkeley Mayor Jesse Arreguin as “BART to Livermore,” constituting the first phase of a San Francisco City of Dublin Bay Area Rapid Transit District (“BART”) extension within the I-580 Mayor David Haubert Corridor to serve residents and businesses in that Corridor. City of Fremont Mayor Lily Mei WHEREAS, on May 24, 2018, the BART Board certified the Final City of Hayward Environmental Impact Report for the BART to Livermore project, but Mayor Barbara Halliday declined to approve the project as proposed nor any alternative for City of Livermore Mayor John Marchand the project. -

Marking the Ballot on Election Day

DEPARTMENT OF ELECTIONS JOHN ARNTZ City and County of San Francisco Director September 12, 2004 Dear San Francisco Voter: The November 2, 2004 General Election will be a historic election for San Francisco because it will be the first time San Franciscans use “ranked-choice voting” to elect local officials. Voters amended the City Charter in March 2002 to require the use of ranked-choice voting, also called “instant run-off elections” to elect most local officials. This November, voters in seven of the City’s eleven districts –districts 1, 2, 3, 5, 7, 9 and 11 – will elect supervisors using this new voting method. Please turn to page 7 to view a district map if you are unsure if your district will have a contest for Supervisor. The ballot card that lists candidates for Supervisor will look very different from the ballots San Francisco has used in the past and will have different voting instructions. Ballots for contests using ranked-choice voting will have three columns, side-by-side, and each column will have a complete list of the district candidates. The voter will be instructed to select a first-choice candidate in the first column, a second-choice candidate in the second column, and a third-choice candidate in the third column. For specific information about how to mark the ranked-choice ballot, please turn to page 10. I recommend that voters familiarize themselves with the ranked-choice ballot in advance of the election, and share this information with other voters. I also encourage voters to attend one of the Department of Elections’ weekly presentations on ranked-choice voting. -

Countywide Pedestrian Plan in 2006

• Art Dao, Executive Director • Chair: Mayor Mark Green, City of Union City • Beth Walukas, Deputy Director of Planning • Vice Chair: Supervisor Scott Haggerty, Alameda • Tess Lengyel, Deputy Director of Policy, Public County, District 1 Affairs and Legislation • Supervisor Richard Valle, Alameda County, • Rochelle Wheeler, Bicycle and Pedestrian District 2 Coordinator (consultant to Alameda CTC) • Supervisor Wilma Chan, Alameda County, District 3 • Diane Stark, Senior Transportation Planner • Supervisor Nate Miley, Alameda County, District 4 (former) • Supervisor Keith Carson, Alameda County, District 5 • Vice Mayor Rob Bonta, City of Alameda • Mayor Farid Javandel, City of Albany • Councilmember Laurie Capitelli, City of Berkeley • Mayor Tim Sbranti, City of Dublin • Midori Tabata (Chair) • Councilmember Ruth Atkin, City of Emeryville • Ann Welsh (Vice-chair) • Councilmember Suzanne Chan, City of Fremont • Mike Ansell • Councilmember Marvin Peixoto, City of Hayward • Mike Bucci • Mayor John Marchand, City of Livermore • Alexander Chen • Councilmember Luis Freitas, City of Newark • Lucy Gigli • Councilmember Larry Reid, City of Oakland • Jeremy Johansen • Councilmember Rebecca Kaplan, City of Oakland • Preston Jordan • Mayor John Chiang, City of Piedmont • Diana LaVigne • Mayor Jennifer Hosterman, City of Pleasanton • Heath Maddox • Vice Mayor Michael Gregory, City of San Leandro • Sara Zimmerman • Director Greg Harper, AC Transit • David Boyer (former member) • Director Tom Blalock, BART • Marcy Greenhut (former member) • Gil Johnson -

Oh2004-01-Bates.Pdf

California State Archives State Government Oral History Program Oral History Interview with TOM BATES California State Assemblyman 1977 1996 Alameda County Supervisor 1973 1976 January 13 February 1 23 April 26 May 10 17 31 June 7 14 September25 Octobers 26 November 14 2000 and February 8 2001 Berkeley California By Leah McGarrigle Regional Oral History Office University ofCalifornia Berkeley Cataloging information BATES TOM(b 1938) State assemblyman California State Assemblyman 1977 1996 Alameda County Supervisor 1973 1976 2004 n 577 pp Childhood and family background southern California UC Berkeley BA 1961 and Rose Bowl football team US Army Special Services 1962 1963 real estate with Coldwell Banker Bedford Associates Democratic election campaigns 1968 2001 staff for California Assemblyman Ken Meade with mentions ofDon Mulford Jeffrey Cohelan Ronald Dellums Alameda County Board of Supervisors 1973 1976 reapportionment and Phillip Burton alternative health centers fluondation land use issues Calfomia State Assembly 1977 1996 workers compensation independent living centers and Edward Roberts rent control mental and community health legislation motor voter law funding for libraries public schools and the University ofCalifornia challenging term limits Proposition 140 (1990) comments on Speakers Willie Brown and Leo McCarthy Governors Deukmejian and Wilson Berkeley city politics Mayor Loni Hancock and relations with the university working with Dion Aroner and Art Agnos East Bay Public Safety Corridor Oakland Hills fire 1991 and vegetation -

First 5 Alameda County Commission Meeting Agenda

FIRST 5 ALAMEDA COUNTY COMMISSION MEETING AGENDA Thursday, October 15, 2020 Members of the public may access this meeting via: 9:00 AM – 11:30 AM Zoom Meeting: https://zoom.us/j/94777803880 Meeting ID: 947 7780 3880 Commissioners: Chair: Renee Herzfeld, Vice Chair: Cecilia Echeverría, Wilma Chan, Scott Coffin, Lori Cox, Tomás A. Magaña M.D., Karina Moreno, Kimi Watkins-Tartt Alternates: Vanessa Cedeño, Aneeka Chaudhry, Anissa Basoco-Villarreal 1. Public Comment (for items not listed on the agenda) - Limited to 3 minutes per speaker 2. Approval of Minutes from June 18, 2020 3. Staff Announcements a. Children’s Health and Child Care Initiative for Alameda County Update b. General Staff Announcements c. COVID-19 Response Update 4. 2021 Commission Draft Calendar 5. FY 2019-20 Financial Audit Presentation 6. Biennial Conflict of Interest Code 7. Employee Handbook Revisions 8. Personnel Benefits Recommendation 9. Help Me Grow Presentation 10. State Commission and Association Updates 11. Legislation and Public Policy Update 12. Communication from Commissioners 13. Adjournment Commission Meeting Agenda October 15, 2020 Information about access: Please contact Julia Otani at [email protected] or (510) 227- 6987 three business days in advance if you need special assistance or translation/interpretation support so we can make reasonable arrangements to ensure accessibility. We will swiftly resolve any requests for accommodation to resolve any doubt whatsoever in favor of accessibility. AGENDA ITEM 2 First 5 Alameda County Commission Meeting June 18, 2020, 9:00 AM – 11:30 AM Zoom Webinar Meeting ID: 939 4738 1925 Commissioners Present: Chair: Renee Herzfeld, Vice Chair: Cecilia Oregon Echeverría, Scott Coffin, Tomás A. -

Grievances to Alameda County and Its Sheriff’S Office Page 2

GRIEVANCES TO: Alameda County Board of Supervisors District 1 – Scott Haggerty District 2 - Richard Valle, President District 3 – Wilma Chan District 4 – Nate Miley District 5 – Keith Carson, Vice-President Alameda County Sheriff’s Office Sheriff Gregory Ahern Assistant Sheriff D. Houghtelling Commander Tom Madigan Captain D. Hesselein From: Inmates at Santa Rita Jail Date: February __, 2020 Re: Unbearable Conditions at Santa Rita Jail We are all inmates under the custody of the Alameda County Sheriff’s Office: Santa Rita Jail. Our ultimate goal is to improve the overall conditions unto which all inmates of this institution are subject. We therefore, as inmates, affirm our consensus that the issues we list in this grievance, are common to all of us, and are the most significant issues we all endure. We are filing a group grievance because of the difficulty with filing grievances within Santa Rita Jail. The Alameda County Sheriff’s Office provides no information or guidance on the grievance process. There is an inmate handbook, but most inmates do not receive an inmate handbook. And the information in the handbook is very limited. There is no posted information on grievances or the grievance process, and what information inmates have is through transmission from another inmate, or experience at another facility. Blank grievances are difficult to obtain. Sheriff deputies discourage and pressure inmates not to file grievances. Even when grievances are submitted, the process is such that the jail itself often does not follow its own process, and a carbon copy of the grievance with a tracking number is not returned to the filing inmates.