Powerpoint Print Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Capstone Headwaters Education Technology M&A Coverage Report

Capstone Headwaters EDUCATION TECHNOLOGY 2019 YEAR IN REVIEW TABLE OF CONTENTS MERGER & ACQUISTION OVERVIEW M&A Overview The Education Technology (EdTech) industry has continued to experience rapid consolidation with 195 transactions announced or completed in 2019. Active Buyers Heightened merger and acquisition (M&A) activity has been fueled by Notable Transactions persistent demand for disruptive and scalable technology as industry operators Select Transactions seek to expand product offerings and market share. In addition to robust transaction activity, recent investment patterns have targeted EdTech providers Public Company Data that offer innovative products for classroom teacher support and to streamline Firm Transactions in Market administrative operations in K-12 schools. Funding in the segment has risen Firm Track Record substantially with teacher needs and school operations garnering $95 million and $148 million in 2018, respectively, according to EdSurge.1 Large industry operators have remained acquisitive through year-end, evidenced by Renaissance Learning’s three acquisitions (page three) in 2019. CONTRIBUTORS EdTech providers have also utilized M&A as a means to diversify product offerings and end-markets outside of their core competencies. Notably, Health Jacob Voorhees & Safety Institute, a leader in environmental health and safety software and Managing Director, training services, acquired Martech Media, Inc, a provider of industrial Head of Education Practice, technology e-learning training solutions (December 2019, undisclosed). Head of Global M&A 617-619-3323 Private equity firms have remained active in the industry, accounting for 52% of [email protected] transaction volume. Operators that provide disruptive platforms and institutional business models, selling directly to schools districts, have garnered David Michaels significant investment interest and premium valuations. -

Q2 2016 Venture Capital Deals and Exits Download the Data Pack July 2016

Q2 2016 Venture Capital Deals and Exits Download the Data Pack July 2016 Fig. 1: Global Quarterly Venture Capital Deals*, Q1 2011 - Fig. 3: Number of Venture Capital Deals in Q2 2016 by Q2 2016 Fig. 2: Venture Capital Deals* in Q2 2016 by Region Investment Stage 3,000 50 100% 1.5 187 0.6 Angel/Seed 45 1.0 Aggregate Deal Value ($bn) DealValue Aggregate 90% 53 2,500 237 40 80% 1% 8% Series A/Round 1 1% 3% 35 16.7 Series B/Round 2 2,000 70% 460 2% 30 3% 60% 33% Series C/Round 3 1,500 25 50% 407 7% 20 3.1 Series D/Round 4 and Later No. of Deals 1,000 40% 15 Growth Capital/Expansion Proportion of Total Proportion 30% 10 500 17.5 15% PIPE 5 20% 900 0 0 10% Grant Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 0% 27% Venture Debt 2011 2012 2013 2014 2015 2016 No. of Deals Aggregate Deal Value ($bn) Add-on & Other No. of Deals Aggregate Deal Value ($bn) North America Europe Greater China India Israel Other Source: Preqin Private Equity Online Source: Preqin Private Equity Online Source: Preqin Private Equity Online Fig. 5: Average Value of Venture Capital Deals, 2014 - Fig. 6: Number of US Venture Capital Deals* in Q2 2016 by Fig. 4: Venture Capital Deals* in Q2 2016 by Industry H1 2016 State 35% 120 111 111 31% 30% 96 27% 100 25% 2014 California 80 78 21% 21% 26% 20% 20% 16% 60 2015 New York 15% 13% 13% 44 39 37 Massachusetts 10% 9% 40 30 32 H1 2016 45% 25 Proportion of Total Proportion 5% 23 23 4% 4% Deal Size ($mn) Average 18 18 5% 3% 2% 3% 3% 20 10 12 3% Texas 1% 2% 1% 8 10 1% 1 2 0% 1 4% 0 Washington 8% Other Other Other IT Other Internet Business Services Clean Food & Food Series Series B/ Round 2 Round Round 1 Round Round 3 Round Telecoms Related Series Series A/ Series Series C/ 14% Agriculture Software & Healthcare Consumer Technology Angel/Seed Discretionary Expansion 4 andLater 4 Venture Debt Venture No. -

Public Investment Memorandum Summit Partners Growth Equity

COMMONWEALTH OF PENNSYLVANIA PUBLIC SCHOOL EMPLOYEES’ RETIREMENT SYSTEM Public Investment Memorandum Summit Partners Growth Equity Fund X, L.P. Private Equity Fund Commitment Darren C. Foreman, CAIA Senior Manager, Private Markets Patrick G. Knapp, CFA Senior Investment Professional, Private Markets December 19, 2018 COMMONWEALTH OF PENNSYLVANIA PUBLIC SCHOOL EMPLOYEES’ RETIREMENT SYSTEM Recommendation: Staff, together with Hamilton Lane Advisors, L.L.C. (“Hamilton Lane”), recommends to the Board a commitment of up to $150 million to Summit Partners Growth Equity Fund X, L.P. (“Summit Growth Equity X” or the “Fund”). Summit Partners, L.P. (“Summit” or the “Firm”) is forming the Fund to continue its long history of investing in U.S. growth equity opportunities which spans nine U.S. growth equity funds with aggregate committed capital of $13.6 billion. Firm Overview: Summit Partners, L.P. is a global alternative investment firm managing investment vehicles focused primarily on growth companies. The Firm was founded in 1984 with a commitment to partner with exceptional entrepreneurs and management teams, providing capital and strategic support to help them achieve their growth objectives. Since inception, Summit has raised and managed more than $22 billion in capital dedicated to growth equity, fixed income, and public equity strategies, including 15 growth equity and venture capital funds with combined committed capital of approximately $17.4 billion and eight fixed income funds with combined committed capital of approximately $4.1 billion. Over the last three decades, Summit has invested in more than 475 companies in technology, healthcare and life sciences, and other growth industries — including more than 430 companies from the U.S. -

GROWTHCAP INSIGHTS 2016 Top 40 Under 40 Growth Investors

GrowthCap 40 Under 40 | November 2016 GROWTHCAP INSIGHTS 2016 Top 40 Under 40 Growth Investors It gives us great pleasure to announce GrowthCap’s 2016 40 Under 40 Growth Investors list. Those appearing in this year’s list were first nominated by their firm, their peers or by GrowthCap. They were then evaluated based on breadth of experience (volume of completed deals, capital invested, number of exits, and realized returns, among other factors) as well as qualitative aspects contributing to their overall effectiveness working with peers, CEOs, LPs and deal professionals. We realized after the publication of our 2014 and 2015 lists, the influence the list can have on LPs evaluating new fund investments or CEOs deciding on prospective capital partners. In particular, the list has been helpful to large family offices in identifying talented investors in the growth equity asset class. The large majority of this year’s nominees provided information on their professional background and investment experience, which played a key role in our selection process and ranking methodology. GrowthCap also conducted interviews with select nominees and in some cases, has had the benefit of direct experience working with nominated individuals and/or represented firms. - RJ Lumba, Managing Partneraaaaa Clockwise from top left: Kapil Venkatachalam (Technology Crossover Ventures), Jason Werlin (TA Associates), Mohamad Makhzoumi (New Enterprise Associates), Chris Adams (Francisco Partners) Page 1 GrowthCap 40 Under 40 | November 2016 Kapil Venkatachalam joined Technology Crossover Ventures in 2006 as an 1 associate and now works as a general partner for the firm. Reflecting on his experience with TCV, Kapil remarks, “Technology is the heart of our business. -

1Q 2019 Relationship Management Purpose-Built for Finance Learn More at Affinity.Co

Co-sponsored by Global League Tables 1Q 2019 Relationship Management Purpose-Built for Finance Learn more at affinity.co IMPROVE ELIMINATE SUPPORT DISCOVER PROPIERTARY CROSSING YOUR NEW EXECUTIVE DEAL FLOW WIRES PORTFOLIO CONNECTIONS Learn why 500+ firms use Affinity's patented technology to leverage their network and increase deal flow “Within weeks of moving “The biggest problems Affinity “Let’s be honest, no one wants to Affinity, we were able to helps me solve are how to to use Salesforce reporting. easily discover and manage track all of my activity and how Affinity isn’t just better for most the 1,000s of entrepreneur to prioritize my time. It makes teams, it’ll make the difference and venture community me a better investor. All of the between managing your relationships already latent things I need to do on a day-to- pipeline to success, versus not within our team." day basis I now do in Affinity.” tracking it at all.” ERIC EMMONS KYLE LUI KEVIN ZHANG Managing Director Partner Principal MassMutual Ventures DCM Ventures Bain Capital Ventures [email protected]@affinity.co AffinityAffinity is a relationship is a relationship intelligence intelligence platform platform built to builtexpand to expandand evolve and theevolve traditional the traditional CRM. AffinityCRM. Affinityinstantly instantly surfaces surfaces all all www.affinity.cowww.affinity.co of yourof team’s your team’sdata to data show to you show who you is bestwho issuited best tosuited make to the make crucial the crucialintroductions introductions you need you to need close to your close next your big next deal. big deal. -

September 29, 2020

Plymouth County Retirement Association September 29, 2020 Meeting Materials BOSTON CHICAGO LONDON MIAMI NEW YORK PORTLAND SAN DIEGO MEKETA.COM Plymouth County Retirement Association Agenda Agenda 1. Estimated Retirement Association Performance As of August 31, 2020 2. Performance Update As of July 31, 2020 3. Current Issues Non-Core Real Estate RFP Respondent Review Non-Core Infrastructure Finalist Presentations 4. Disclaimer, Glossary, and Notes 2 of 129 Estimated Retirement Association Performance As of August 31, 2020 3 of 129 Plymouth County Retirement Association Estimated Retirement Association Performance Estimated Aggregate Performance1 August2 QTD YTD 1 YR 3 YR 5 YR 10 YR (%) (%) (%) (%) (%) (%) (%) Total Retirement Association 2.7 6.3 0.5 7.8 5.0 6.4 7.9 Policy Benchmark 3.1 6.8 3.0 10.1 6.9 7.7 8.5 Benchmark Returns August QTD YTD 1 YR 3 YR 5 YR 10 YR (%) (%) (%) (%) (%) (%) (%) Russell 3000 7.2 13.3 9.4 21.4 14.0 13.9 14.9 MSCI EAFE 5.1 7.6 -4.6 6.4 2.3 4.7 5.9 MSCI Emerging Markets 2.2 11.3 0.5 14.5 2.8 8.7 3.8 Barclays Aggregate -0.8 0.7 6.9 6.5 5.1 4.3 3.7 Barclays TIPS 1.1 3.4 9.6 9.0 5.7 4.6 3.7 Barclays High Yield 1.0 5.7 1.7 4.7 4.9 6.5 6.9 JPM GBI-EM Global Diversified (Local Currency) -0.3 2.7 -4.4 1.7 0.7 4.6 1.3 S&P Global Natural Resources 4.0 7.6 -13.0 -1.9 -0.1 5.6 1.5 Estimated Total Assets Estimate Total Retirement Association $1,106,611,546 1 The August performance estimates are calculated using index returns as of August 31, 2020 for each asset class. -

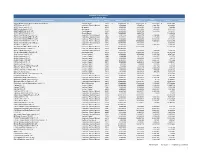

HIERS Performance Report by Investment

Statement of Investments (1) As of June 30, 2017 Total Investment Name Investment Strategy Vintage Committed Paid-In Capital (2) Valuation Net IRR Distributions Abraaj Global Growth Markets Strategic Fund, L.P. Growth Equity 2015 $ 45,000,000 $ 30,442,233 $ 6,226,973 $ 34,191,582 ABRY Partners VII, L.P. Corporate Finance/Buyout 2011 3,500,000 3,569,519 3,861,563 2,239,428 ABRY Senior Equity III, L.P. Mezzanine 2010 5,000,000 4,618,602 7,138,392 322,958 ABRY Senior Equity IV, L.P. Mezzanine 2012 6,503,582 6,227,869 1,900,948 6,205,777 ABS Capital Partners VI, L.P. Growth Equity 2009 4,000,000 3,906,193 1,775,815 1,812,911 ABS Capital Partners VII, L.P. Growth Equity 2012 10,000,000 9,054,134 - 11,860,984 Advent International GPE V-B, L.P. Corporate Finance/Buyout 2012 2,801,236 2,583,570 3,290,856 248,977 Advent International GPE V-D, L.P. Corporate Finance/Buyout 2005 3,179,324 3,038,405 7,175,404 245,538 Advent International GPE VI-A, L.P. Corporate Finance/Buyout 2008 9,500,000 9,500,000 14,172,848 5,876,065 Advent International GPE VII-B, L.P. Corporate Finance/Buyout 2012 30,000,000 27,000,000 11,400,028 32,412,380 Advent International GPE VIII-B, L.P. Corporate Finance/Buyout 2016 36,000,000 8,424,000 - 8,986,703 Alta Partners VIII, L.P. -

Investment Report

THE UNIVERSITY OF MICHIGAN REGENTS COMMUNICATION ITEM FOR INFORMATION Subject: Annual Report of Investments Background and Summary: The Annual Report of Investments, enclosed under separate cover, describes the investments of the University's financial assets. It is designed to provide meaningful context to the Board of Regents as they are asked to consider investment opportunities presented in the course of the year. ubmitted, · vi . Hegarty xecutive Vice President and Chief Financial Officer October 2015 REPORT OF INVESTMENTS 2015 1 16 INTRODUCTION Alternative Assets (Illiquid) 4 17 LONG TERM PORTFOLIO Venture Capital Background 18 6 Private Equity Asset Allocation 19 7 Real Estate Model Portfolio 20 10 Natural Resources Investment Performance 22 12 DAILY AND MONTHLY Marketable Securities PORTFOLIOS/SHORT TERM POOL Asset Allocation 13 Investment Performance Market Traded Equities 23 VERITAS 14 Asset Allocation Investment Performance Fixed Income 15 25 CONCLUSION Absolute Return 28 BENCHMARK DEFINITIONS A-1 APPENDIX: MANAGER DEFINITIONS The pictures in the report depict innovation at the University of Michigan. Cover: An MSE/BSE student runs a cylinder combustion simulation in the Michigan Immersive Digital Experience Nexus (MIDEN) at U-M’s 3D Lab. This page: The Medical Chemistry Lab in the College of Pharmacy uses specialized disciplinary approaches to focus on the ultimate Report ofgoal Investments of drug discovery. 2015 | 1 INTRODUCTION The University invests its financial assets in pools with The market value of the University’s combined cash distinct risk and liquidity characteristics based on and investments totaled $11.7 billion at June 30, 2015, specific needs, with the large majority of its financial compared to $11.6 billion at June 30, 2014, primarily assets invested in two such pools. -

From Startup to Scaleup

From startup to scaleup An overview of the Danish financial ecosystem for entrepreneurs and scaleups, 2019 Executive summary Danish venture funds increased their activities in Denmark VENTURE MARKET The Danish venture funds had a record-breaking year of investments in 2018. With existing funds increasing their investment activities, as well as an • Danish funds increased influx of new funds entering the market, Danish investments increased by DKK 1,5 bn to a total of DKK 4,5 bn. This activity increase also benefitted investments by DKK 1.5 bn. • Danish startups attracted twice Ønsker du Danish startups: they attracted almost twice as much capital from Danish funds as they did the year before. Furthermore, corporate venture capital as much capital from Danish funds as the year before. Overskrift-stil vælg Fed is seeing a resurgence not only globally, but also in Denmark. Tech and life sciences remain the most prominent Danish investment sectors, • Life sciences and IT secured skrift og grøn skriftfarve more than 80 pct. of the invested securing more than 80 pct. of 2018’s invested venture capital. capital. Danish companies attracted more than DKK 20 bn in buyout capital Not just the venture market experienced high levels of growth in 2018 — the Danish buyout market did too. The Danish buyout funds had a busy BUYOUT MARKET year, increasing both their number of investments and their amount of invested capital. Danish companies attracted more than DKK 20 bn in buyout • Danish companies attracted capital in 2018, almost double the capital raised the previous year. It is Interesting to note that the share of buyout capital from foreign funds DKK +20 bn. -

Private Equity Analyst

PRIVATE EQUITY ANALYST NOVEMBER 2020 Women to Private Equity’s Top Female Talent of Today and Tomorrow p. 7 10 VCs Grooming Game-Changing Startups p. 13 Watch LP Cycles Ad HFA+PEA-Ltr DR080420.pdf 1 8/4/20 5:43 PM Private equity investing has its cycles. Work with a secondary manager who’s C experienced them all. M Y CM MY As leaders of the secondary market, the Lexington Partners team CY draws on more than 400 years of private equity experience. CMY Through all types of business cycles, we have completed over K 500 secondary transactions, acquiring more than 3,000 interests managed by over 750 sponsors with a total value in excess of $53 billion. Our team has excelled at providing customized alternative investment solutions to banks, financial institutions, pension funds, sovereign wealth funds, endowments, family offices, and other fiduciaries seeking to reposition their private investment portfolios. If you have an interest in the secondary market, our experience is second to none. To make an inquiry, please send an email to [email protected] or call us at one of our offices. Innovative Directions in Alternative Investing New York • Boston • Menlo Park • London • Hong Kong • Santiago • Luxembourg www.lexingtonpartners.com Includes information regarding six funds managed by Lexington’s predecessor formed during the period 1990 to 1995. This information is provided for informational purposes only and is not an offer to sell or solicitation of offers to purchase any security. Private Equity Analyst November 2020 contents Volume XXX, Issue 11 Fund News u The Roundup Comment Clayton Dubilier Collects About $14B for Latest Buyout Fund 26 H.I.G. -

Investment Review November 27, 2018

FUND EVALUATION REPO RT Plymouth County Retirement Association Investment Review November 27, 2018 MEKETA INVESTMENT GROUP B OSTON C HICAGO M IAMI P ORTLAND S AN D IEGO L ONDON M ASSACHUSETTS I LLINOIS F LORIDA O REGON C ALIFORNIA U N IT E D K INGDOM www.meketagroup.com Plymouth County Retirement Association Agenda 1. Interim Update as of October 31, 2018 2. Short Duration Fixed Income RFP Respondent Review 3. Private Equity Manager Finalist Overview 4. Appendices Private Markets – First Quarter 2018 Review Disclaimer, Glossary, and Notes Prepared by Meketa Investment Group Page 2 of 112 Interim Update As of October 31, 2018 DRAFT Page 3 of 112 Plymouth County Retirement Association Total Retirement Association As of October 31, 2018 Asset Class Net Performance Summary Market Value % of 1 Mo YTD 1 Yr 3 Yrs 5 Yrs 10 Yrs Inception Inception ($) Portfolio (%) (%) (%) (%) (%) (%) (%) Date _ Total Retirement Association 982,922,002 100.0 -5.5 -3.6 -1.2 5.9 5.2 8.1 7.7 Nov-89 Custom Benchmark - Policy Benchmark (Net) -4.5 -0.6 2.2 6.9 6.0 8.7 -- Nov-89 Domestic Equity Assets 235,459,886 24.0 -9.6 2.0 5.8 -- -- -- 12.9 Jan-16 Russell 3000 -7.4 2.4 6.6 11.3 10.8 13.3 12.6 Jan-16 International Developed Market Equity Assets 145,284,750 14.8 -9.0 -13.2 -11.0 -- -- -- 4.3 Jan-16 MSCI EAFE -8.0 -9.3 -6.9 3.6 2.0 6.9 4.9 Jan-16 International Emerging Market Equity Assets 82,487,586 8.4 -9.9 -17.4 -14.1 -- -- -- 7.1 Jan-16 MSCI Emerging Markets -8.7 -15.7 -12.5 6.5 0.8 7.8 9.3 Jan-16 Global Equity Assets 93,513,210 9.5 -5.2 -- -- -- -- -- -7.7 Feb-18 -

PRIT Fund Managers Domestic Equity INTECH Investment Management

PRIT Fund Managers Private Equity 1818 Fund II, LP (The) Domestic Equity Advent International INTECH Investment Management, LLC Alchemy Partners Pacific Investment Management Company (PIMCO) Alta Communications State Street Global Advisors American Securities International Equities APA German European Ventures Baillie Gifford APAX Partners & Co. Marathon Asset Management, Ltd Apollo Investments Management Mondrian Investment Partners Asia Pacific Trust State Street Global Advisors Austin Ventures Core Fixed Income Bain Capital Access Capital Strategies, LLC Battery Ventures Partners AFL-CIO Housing Investment Trust Belmont Capital Partners BlackRock, Inc. Berkshire Partners, LLC Community Capital Management Blackstone Group Loomis Sayles & Company, LP Boston Ventures Pacific Investment Management Company (PIMCO) Bridgepoint Capital Limited Value-Added Fixed Income Brown Brothers Ashmore Investment Management Ltd Candover Eaton Vance Institutional Funds Capital Resource Partners Fidelity Mnagement Trust Company Carlyle Partners ING Investment Management Castile Ventures Loomis, Sayles & Company, L.P. Centerbridge Capital Partners Pacific Investment Management Company (PIMCO) Charles River Ventures Shenkman Capital Management Charlesbank Capital Partners Distressed Debt Managers Charterhouse Capital Partners Angelo, Gordon & Co. Chesquers Capital Avenue Capital Group Code Hennessey & Simmons Crescent Capital Group Commonwealth Capital Ventures GSO Capital Partners Crossroads Capital Oaktree Capital Management Crossroads Group Trust Company of the West CVC European Equity Partners Wayzata Investment Partners Cypress Group LLC Emerging Markets Equity Managers Cypress Merchant Banking Ashmore EMM, L.L.C. DLJ Merchant Banking GMO LLC El Dorado Ventures State Street Global Advisors Equitable Capital Management T. Rowe Price Essex Woodlands Natural Resources Ethos Private Equity Denham Capital Management Exponent Partners Jennison Associates First Reserve Corporation Quantum Energy Partners Flagship Ventures T. Rowe Price Forstmann, Little & Co.