Tata Power Trading 100%

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Trent Hypermarket Ties up with Future Consumer Enterprise Ltd to Retail a Wide Range of Products ~A First of Its Kind Tie-Up

Trent Hypermarket ties up with Future Consumer Enterprise Ltd to retail a wide range of products ~A first of its kind tie-up that aims to bring customers of Star Bazaar, a unique product-price proposition~ Mumbai, 3rd March, 2016: Star, a TATA & TESCO enterprise, has tied up with Future Consumer Enterprise Ltd. (FCEL), to launch a wide range of food and non-food products across Star Bazaar stores. Star Bazaar aims to launch close to 148 SKUs across 10 FCEL brands with a view to provide their customers a unique product price proposition. FCEL’s portfolio includes popular consumer brands in the food category like ‘Sunkist’, ‘Tasty Treat’, “Karmiq” “Desi Atta” and ‘Fresh & Pure’; while “Think Skin”, ‘Clean Mate’ and ‘Care Mate’ constitute the non-food category. The FCEL range will be made available across large format hypermarkets of Star Bazaar in its initial phase. While this alliance offers customers a unique advantage of accessing everyday products at a great price, the launch will also see exclusive offers and promotions for Star’s Club card loyalty members. This association aims to serve the customers an unmatched array of products and introduce services that will see the store as a one stop destination for all daily household needs. Speaking on the launch, Mr. Jamshed Daboo, Managing Director, Trent Hypermarket Ltd. said, “We are excited about our collaboration with Future Consumer Enterprise to retail their flagship brands. With this tie- up, we will be bringing our customers an extensive range of high quality food products and non-food merchandise. Our objective is to enhance our existing range and ensure we address the growing needs of customers to access unique products at affordable price points” Mr. -

Presentation Title ( Arial, Font Size 28 )

PresentationThe Tata Power Title (Company Arial, Font size Ltd. 28 ) Date, Venue, etc ..( Arial, January Font size 18 2013 ) …Message Box ( Arial, Font size 18 Bold) Disclaimer •Certain statements made in this presentation may not be based on historical information or facts and may be “forward looking statements”, including those relating to The Tata Power Company Limited’s general business plans and strategy, its future outlook and growth prospects, and future developments in its industry and its competitive and regulatory environment. Actual results may differ materially from these forward-looking statements due to a number of factors, including future changes or developments in The Tata Power Company Limited’s business, its competitive environment, its ability to implement its strategies and initiatives and respond to technological changes and political, economic, regulatory and social conditions in India. •This presentation does not constitute a prospectus, offering circular or offering memorandum or an offer to acquire any Shares and should not be considered as a recommendation that any investor should subscribe for or purchase any of The Tata Power Company Limited’s Shares. Neither this presentation nor any other documentation or information (or any part thereof) delivered or supplied under or in relation to the Shares shall be deemed to constitute an offer of or an invitation by or on behalf of The Tata Power Company Limited. •The Company, as such, makes no representation or warranty, express or implied, as to, and do not accept any responsibility or liability with respect to, the fairness, accuracy, completeness or correctness of any information or opinions contained herein. -

Sustainability Report Fy 2018-19 Empowering

SUSTAINABILITY REPORT FY 2018-19 EMPOWERING CONSUMERS OF THE FUTURE SUSTAINABILITY REPORT FY 2018-19 INTRODUCTION FROM CEO & MD Introduction GRI 102-14, 54 What comes from the people and the planet should go back to them, many times over - J R D Tata Dear Stakeholders, It gives me immense pleasure in presenting Tata Power Company Limited’s ninth Sustainability Report for FY 19. It has been a journey that has witnessed significant milestones in the Company’s aspiration to be a global exemplar in Sustainability. India had made a commitment to achieve 40 percent of total energy demand from non-fossil fuel sources by 2030 at the 2015 United Nations Climate Change Conference (COP 21). India continues to add record volumes of solar and wind energy capacities even as the net capacity additions in the coal sector remain stunted. According to government data, India added just under 6 Gigawatts (GW) of solar power capacity upto FY 18. Around 1.4 GW of wind energy capacity was also added during this period. Along with other technologies, the total renewable energy capacity added was 8.5 GW. In line with the commitment to the Paris Agreement and strategic intent of having 40-50% generation capacity from non–fossil fuel sources, Tata Power has made significant progress with a present capacity of 10,957MW and 33% renewable portfolio of the present installed capacity and is continuing to grow exponentially. Right now, we are 2.6 million consumers and we could become 10 million in 3-5 years. In addition, the report includes United Nations Sustainable Development Goals prioritization and roadmap with action plans for a five-year horizon. -

Tata Steel Limited - Investor Presentation

61 126 219 0 131 169 0 43 69 190 185 166 52 178 51 237 41 57 90 36 90 Tata Steel Limited - Investor Presentation 153 153 153 1 255 161 0 Stock Code: BSE - 500470 NSE- TATASTEEL Bloomberg-: TATA IN / TTST LI / TATA LX Reuters- TISC.BO / TISC.NS / TISCq.L 1 Disclaimer Not for release, distribution or publication, whether directly or indirectly and whether in whole or part, into or in the United States, Australia, Canada or Japan or any other jurisdiction in which such release, distribution or publication would be unlawful. These materials have been prepared by Tata Steel Limited (the “Company”), and have not been independently verified. No representation or warranty, expressed or 61 126 219 implied, is made and no reliance should be placed on the accuracy, fairness or completeness of the information contained in these materials. Neither the Company nor any of its affiliates, advisers or representatives accepts any liability whatsoever for any actual or consequential loss or damages howsoever arising from the provision or use of any information contained in these materials. 0 131 169 The statements contained in this document speak only as at the date as of which they are made, and the Company expressly disclaims any obligation or undertaking to supplement, amend or disseminate any updates or revisions to any statements contained herein to reflect any change in events, conditions or circumstances on which any such statements are based. By preparing this presentation, none of the Company, its management, and their respective advisers undertakes any obligation to provide the recipient with access to any additional information or to update this presentation or any additional information or to correct any inaccuracies in any such information which 0 43 69 may become apparent. -

Tata Power: “Renewables to Power Growth” an Exemplar of the Indian Energy Transition

Simon Nicholas, Energy Finance Analyst 1 Tim Buckley, Director of Energy Finance Studies April 2019 Tata Power: “Renewables to Power Growth” An Exemplar of the Indian Energy Transition Executive Summary Tata Power recently made it publicly clear that it will not be building any new coal- fired power capacity going forward. Furthermore, the company has committed to driving the great majority of its power capacity expansion via lower cost renewable energy. The majority of Tata Power’s thermal capacity is centred on its Mundra coal-fired power plant which is financially unviable and making consistent, significant losses that are dragging back the company’s overall financial performance. Since the Mundra plant was commissioned in fiscal year (FY) 2012-13, thermal power has made up only 3% of net capacity additions whilst wind and solar make up 87% and hydro 11%. This represents a significant departure from the accepted wisdom of just a few years ago that a major expansion of coal-fired power would be required to serve India’s growing electricity demand. Figure 1: Renewables and Hydro Will Dominate Tata Power’s Future Capacity Additions (MW) Source: Tata Power Strategic Intent 2025. Tata Power: “Renewables to Power Growth” 2 Tata Power’s shift mirrors the transition underway within the Indian power sector as a whole, driven by least cost renewable energy. Over the first 11 months of FY2018- 19, only 20 megawatts (MW) (net) Tata Power’s shift mirrors of thermal power has been added in the transition underway within India after taking closures into account. Renewable energy the Indian power sector, driven additions over the same period by least cost renewable energy. -

Results Presentation Financial Quarter and Nine Months Ended December 31, 2020 February 10, 2021

Results Presentation Financial quarter and nine months ended December 31, 2020 February 10, 2021 1 Safe harbor Statements in this presentation describing the Company’s performance may statement be “forward looking statements” within the meaning of applicable securities laws and regulations. Actual results may differ materially from those directly or indirectly expressed, inferred or implied. Important factors that could make a difference to the Company’s operations include, among others, economic conditions affecting demand/supply and price conditions in the domestic and overseas markets in which the Company operates, changes in or due to the environment, Government regulations, laws, statutes, judicial pronouncements and/or other incidental factors 2 Key performance highlights Revenue EBITDA Free cashflow Deleveraging ▪ Consolidated revenue ▪ Highest ever consolidated Generated free cash flow of ▪ Deleveraged sharply; Net improved 7%QoQ and EBITDA; up by 53%QoQ and Rs.20,588 crores in 9MFY21 debt reduced by Rs.18,609 11%YoY to Rs.39,594 crores 161%YoY to Rs.9,540 crores and Rs.12,078 crores in crores in 9MFY21 and ▪ India1 revenue improved ▪ Highest ever India1 EBITDA; up 3QFY21; driven by strong Rs.10,325 crores in 3QFY21 9%QoQ and 18%YoY to by 46%QoQ and 114%YoY to operating performance and ▪ Additional deleveraging Rs.25,211 crores Rs.8,811 crores better working capital planned in 4QFY21 including management ~Rs.6,400 crores repaid till date Disciplined capital Marketplace Sustainable Reorganization allocation initiatives operations -

Titan Company Limited Jewellery Business Back on Track

Titan Company Limited Jewellery business back on track Powered by the Sharekhan 3R Research Philosophy Consumer Discretionary Sharekhan code: TITAN Result Update Update Stock 3R MATRIX + = - Summary Right Sector (RS) ü Titan’s standalone business recovered to 89% (consolidated recovered to 98%) with the jewellery business growing by 9% in Q2FY2021; watches and eyewear Right Quality (RQ) ü business recoveredto 56% and 61%, respectively. Consolidated OPM declined 433 bps to 6.9%, affected by hedging loss and lower operating leverge. Operating profit was down 40% to Rs. 313 crore. Right Valuation (RV) ü Higher demand during the festive season and improving wedding demand will help Titan post sustained recovery in the jewellery business going ahead. + Positive = Neutral - Negative We have fine-tuned our estimates for FY2021 to factor in lower-than-expected OPM. We have maintained them for FY2022/FY2023E. We maintain Buy with a Reco/View Change revised PT of Rs. 1,350. Reco: Buy Titan Company’s (Titan) consolidated revenue decreased by 2.3% to Rs. 4,553 crore as against our expectation of Rs. 4175.7 crore. This is including the gold-ingots sale of CMP: Rs. 1,218 Rs. 391 crore. Revenue of the jewellery business grew by 9%, while watches and eye wear businesses recovered to 56% and 61%, respectively, in Q2 (both the businesses Price Target: Rs. 1,350 á recovered to 70% each in September 2020). Operating profit margin (OPM) decreased by 433 bps to 6.9% as against our expectation of 7.5%. During the quarter, the company á Upgrade Maintain â Downgrade has recognised loss of Rs. -

Live Billers on Bharat Billpay As on May 15, 2018

LIVE BILLERS ON BHARAT BILLPAY AS ON MAY 15, 2018 National/State Sr. No Category Name Biller Name 1 DTH National Dish TV 2 DTH National Tata Sky Ltd 3 DTH National SUN Direct 4 Electricity Maharashtra Maharashtra State Electricity Distribution Co. Ltd. Southern Power Distribution Company of Andhra Pradesh 5 Electricity Andhra Pradesh Ltd. 6 Electricity Delhi TATA Power North Delhi Power Limited Eastern Power Distribution Company of Andhra Pradesh 7 Electricity Andhra Pradesh Ltd. Madhya Pradesh Paschim Kshetra Vidyut Vitaran Company 8 Electricity Madhya Pradesh Ltd. 9 Electricity Rajasthan Jaipur Vidyut Vitran Nigam Limited 10 Electricity Gujarat Torrent Power 11 Electricity West Bengal Calcutta Electricity Supply Corporation 12 Electricity Maharashtra Reliance Energy Ltd.- Mumbai 13 Electricity Delhi BSES Rajdhani Power Limited 14 Electricity Uttarakhand Uttarakhand Power Corporation Ltd 15 Electricity Delhi BSES Yamuna Power Limited North Eastern Electricity Supply Company of Orissa 16 Electricity Odisha Limited 17 Electricity Odisha Southern Electricity Supply Company Of Orissa Limited 18 Electricity Maharashtra SNDL Nagpur 19 Electricity Meghalaya Meghalaya Electricity Board 20 Electricity Tripura Tripura State Electricity Corporation Ltd 21 Electricity West Bengal India Power Corporation 22 Electricity Bihar Muzzafurpur Vidyut Vitran Ltd. 23 Electricity Uttar Pradesh Noida Power Company Ltd. 24 Electricity Jharkand Jamshedpur Utilities and Services Company 25 Electricity Rajasthan Kota Electricity Distribution Limited 26 Electricity Rajasthan Bharatpur Electricity Service Limited 27 Electricity Uttar Pradesh UttarᅠPradesh Power Corporation-Urban (4) 28 Electricity Daman and Diu Daman and Diu Electricity Department 29 Electricity Rajasthan Bikaner Electricity Supply Ltd 30 Electricity Maharashtra The Tata Power Company Ltd.-Mumbai 31 Electricity Rajasthan Tata Power Ajmer 32 Electricity Bihar North Bihar Power Distribution Company Ltd. -

Cross Border Project Nr

Turkish Journal of Physiotherapy and Rehabilitation; 32(3) ISSN 2651-4451 | e-ISSN 2651-446X DOJI BASED INTRADAY STRATEGY FOR INDIAN STOCK ANALYSIS [AN EXPERIMENTAL STUDY ON NSE-INDIA DURING COVID19] Srinu madem1, D. Suryachandra Rao2, Dr. Ch. Harigovindarao, Dr. P. Sanyasi Rao4, Dr. N ramya5 1Research Scholar, Department of Commerce and Management Studies, KrishnaUniversity, Machilipatnam, A.P,India,[email protected] (Corresponding author) 2Professor, Department of Commerce and Management Studies, Krishna University, Machilipatnam, A.P, India, [email protected] 3Assoc. Professor, Department of Management Studies, Vignan’s Institute of Information Technology, Duvvada, Visakhapatnam A.P, India,[email protected] 4Assoc. Professor, Department of Management Studies, Vignan’s Institute of Information Technology, Duvvada,Visakhapatnam A.P, India,[email protected] 5Assoc. Professor, Department of basic sciences and Humanities, Vignan’s Institute of Information Technology, Duvvada,Visakhapatnam A.P, India., [email protected] ABSTRACT In the past few days, Indian Stock markets are continuously falling due to the COVID-19 outbreak pandemic, and other global economic factors connected it. During this time, not only the Small but also the big player's wealth was affected. But Stock markets are wealth creators for long term investors, can be a small player like a trader or a big player like HNIs. Margin money is supplied by almost all the Stockbrokers including discount brokers in India to enable the intraday traders with a high level of leverage in the stock market with the small capital available with the traders. Margin money opportunity can be treated as a double-edged sword which can be used to win over the rival else it can kill ourselves if not used properly. -

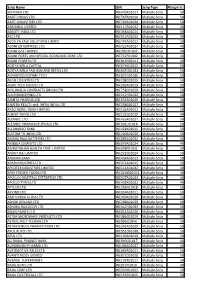

Scrip Name ISIN Scrip Type Margin % 3M INDIA LTD INE470A01017

Scrip Name ISIN Scrip Type Margin % 3M INDIA LTD INE470A01017 Multiple Scrip 50 AARTI DRUGS LTD INE767A01016 Multiple Scrip 50 AARTI INDUSTRIES LTD INE769A01020 Multiple Scrip 50 ABB INDIA LIMITED INE117A01022 Multiple Scrip 40 ABBOTT INDIA LTD INE358A01014 Multiple Scrip 50 ACC LTD INE012A01025 Multiple Scrip 40 ACCELYA KALE SOLUTIONS LIMITD INE793A01012 Multiple Scrip 50 ADANI ENTERPRISES LTD INE423A01024 Multiple Scrip 40 ADANI GAS LIMITED INE399L01023 Multiple Scrip 40 ADANI PORTS AND SPECIAL ECONOMIC ZONE LTD INE742F01042 Multiple Scrip 40 ADANI POWER LTD INE814H01011 Multiple Scrip 40 ADITYA BIRLA CAPITAL INE674K01013 Multiple Scrip 50 ADITYA BIRLA FASHION AND RETAIL LTD INE647O01011 Multiple Scrip 50 ADVANCED ENZYME TECH INE837H01020 Multiple Scrip 50 AEGIS LOGISTICS LTD INE208C01025 Multiple Scrip 50 AGRO TECH FOODS LTD INE209A01019 Multiple Scrip 50 AHLUWALIA CONTRACTS (INDIA) LTD INE758C01029 Multiple Scrip 50 AIA ENGINEERING LTD INE212H01026 Multiple Scrip 50 AJANTA PHARMA LTD INE031B01049 Multiple Scrip 50 AJMERA REALTY and INFRA INDIA LTD INE298G01027 Multiple Scrip 50 AKZO NOBEL INDIA LIMITED INE133A01011 Multiple Scrip 50 ALBERT DAVID LTD INE155C01010 Multiple Scrip 40 ALEMBIC LTD INE426A01027 Multiple Scrip 50 ALEMBIC PHARMACEUTICALS LTD INE901L01018 Multiple Scrip 50 ALLAHABAD BANK INE428A01015 Multiple Scrip 50 ALSTOM TD INDIA LTD INE200A01026 Multiple Scrip 50 AMARA RAJA BATTERIES LTD INE885A01032 Multiple Scrip 50 AMBUJA CEMENTS LTD INE079A01024 Multiple Scrip 40 AMRUTANJAN HEALTH CARE LIMITED INE098F01031 Multiple -

Challenges and Strategies to Knowledge Management: Case Studies of Selected Companies

Symbiosis Centre for Management & Human Resource Development Online access @ www.publishingindia.com Challenges and Strategies to Knowledge Management: Case Studies of Selected Companies Jeet Singh Moradabad Institute of Technology, Moradabad-244001, Uttar Pradesh Preeti Yadav Institute of Rural Management, Jaipur-302018, Rajasthan Abstract We are in a knowledge economy. Individuals compete with people all over the world. In the private sector, t is no longer necessary to belong to any particular race, caste or creed. To impact the bottom-line of an organization and an individual's goals and aspirations, the very basic necessity is to provide them with the basic requirements. And yes, knowledge management is as important as food, water and air. There is no one size fits all way to effectively tap a firm’s intellectual capital. To create value, companies must focus on how knowledge is used to build critical capabilities. Knowledge management is complex and multifaceted; item compasses everything the organisation does to make knowledge available to the business, such as embedding key information in systems and processes, applying incentives to motivate employees and forging alliances to infuse the business with new knowledge. Effective knowledge management requires a combination of many organisational elements – people, process and technology – in order to ensure that the right knowledge is brought to bear at the right time. As Peter Drucker put it, “Knowledge is and will be the basic economic resource.” In simple words, the key function of management is to engineer and manage knowledge. Management must encourage new knowledge to come forward. Everyone’s knowledge must be tapped. -

Tata Power Announces Exclusive Offer for Consumers in Mumbai In

Tata Power announces exclusive offer for consumers in Mumbai in association with Voltas AC Offers savings up to 50% on MRP with a special package of 5-year comprehensive warranty for Tata Power customers Mumbai, 11th September 2019: India is a well-established consumer durables market. It is thus, crucial for brands to create energy efficient products. With an aim to promote energy conservation and provide consumers with green & efficient choices, Tata Power has announced an exclusive offer for its consumers in Mumbai where they can save up to 50% on the purchase of Voltas 5 Star Inverter AC. Moreover, consumers can also avail a special package of 5 year comprehensive warranty on the entire range of Voltas ACs. The offer will be limited till 31st December 2019. Voltas’ 5 Star Inverter ACs ensure higher energy saving with distinctive advantages. Scheme details: • Savings: A handsome saving of upto 50% available on the products • Capacity: Models of 1, 1.5 & 2 Ton capacity are available under the program • Flexible Warranty Options: Manufacturer standard warranty of 1 year & choice of purchasing warranty for additional years at discounted rates • Exchange & New purchase Option: Can exchange old AC in working condition or buy a new AC by paying additional Rs. 2500 • Eligibility: A residential consumer is eligible to purchase a maximum of 1 Split AC whereas a Commercial consumer is eligible for a maximum of 2 Split ACs • Latest 5-Star Ratings: All the models offered under this program have the latest 5-Star Rating from BEE (Bureau of Energy Efficiency) • Free Standard Installation: Free standard installation (as per manufacturer conditions) Mr.