CFA Institute Research Challenge Hosted by CFA Society Thailand Chulalongkorn University

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE ROUGH GUIDE to Bangkok BANGKOK

ROUGH GUIDES THE ROUGH GUIDE to Bangkok BANGKOK N I H T O DUSIT AY EXP Y THANON L RE O SSWA H PHR 5 A H A PINKL P Y N A PRESSW O O N A EX H T Thonburi Democracy Station Monument 2 THAN BANGLAMPHU ON PHE 1 TC BAMRUNG MU HABURI C ANG h AI H 4 a T o HANO CHAROEN KRUNG N RA (N Hualamphong MA I EW RAYAT P R YA OAD) Station T h PAHURAT OW HANON A PL r RA OENCHI THA a T T SU 3 SIAM NON NON PH KH y a SQUARE U CHINATOWN C M HA H VIT R T i v A E e R r X O P E N R 6 K E R U S N S G THAN DOWNTOWN W A ( ON RAMABANGKOK IV N Y E W M R LO O N SI A ANO D TH ) 0 1 km TAKSIN BRI DGE 1 Ratanakosin 3 Chinatown and Pahurat 5 Dusit 2 Banglamphu and the 4 Thonburi 6 Downtown Bangkok Democracy Monument area About this book Rough Guides are designed to be good to read and easy to use. The book is divided into the following sections and you should be able to find whatever you need in one of them. The colour section is designed to give you a feel for Bangkok, suggesting when to go and what not to miss, and includes a full list of contents. Then comes basics, for pre-departure information and other practicalities. The city chapters cover each area of Bangkok in depth, giving comprehensive accounts of all the attractions plus excursions further afield, while the listings section gives you the lowdown on accommodation, eating, shopping and more. -

Charoen Nakhon Thailand

NAVARANG ASSET PRESENT CHAROEN NAKHON THAILAND About Best Health & Culture Restaurants Wellness Heritage CHAROEN Instagramable NAKHON Coffee Culture ATTRACTIONS! And more ... VOL. 01 MAY 2021 01 CHAROEN NAKHON How to get there? From 40 Suvarnabhumi international mins airport From 20 Sukhumvit rd mins (Siam-Asoke) From 5 BTS Krung mins Thon Buri Charoen Nakhon is located along Thailand’s most majestic river “The Chao Praya”. Widely regarded as Bangkok’s most popular trade route and cultural heritage site. From cool art and lifestyle hubs, ‘trendy cafes, and superb street eats to iconic riverside hotels, not to forget the unique shopping districts, life on Charoen Nakhon has never been more attractive. With the new BTS Gold Line on rails, Charoen Nakhon is one of the most desirable neighborhoods of Bangkok. 02 CHAROEN NAKHON About Charoen Nakhon There are few places in the world that make it possible for The riverside neighborhood can visitors to see its urban areas via boat. Charoen Nakhon is a be reached via a handful of BTS charming neighborhood situated in the Thonburi community on stations, or by boat, which is the western banks of the Chao Phraya River. Thonburi was the oftentimes a faster and more capital of Thailand for a short time in 1768, after Ayutthaya authentic way to see the city. was destroyed by the Burmese. After the capital was moved While many tourists who venture across the river, Thonburi became a separate city, but now it is this way come to stay in one of one of many districts that make up the city of Bangkok. -

List of ASQ (Alternative State Quarantine) Compiled by Department of Consular Affairs | for More Information, Please Visit Note : 1

As of 17 November 2020 List of ASQ (Alternative State Quarantine) Compiled by Department of Consular Affairs | For more information, please visit www.hsscovid.com Note : 1. Passengers arrived at Suvarnabhumi Airport/ Don Mueang International Airport can be quarantined in ASQ and ALQ located in Chonburi and Prachinburi. 2. Passengers arrived at Phuket International Airport can be quarantined in ALQ located in Phuket. 3. For travellers entering Thailand via Ban Klong Luek (Aranyaprathet) Border Checkpoint can be quarantined in ALQ located in Prachinburi. 4. For travellers entering Thailand via 2nd Thai–Lao Friendship Bridge can be quarantined in ALQ located in Mukdahan. Price range (Baht) Total No Name Partnered Hospital /person per 14-16 days Room 1 Movenpick BDMS Wellness Resort Bangkok Hospital 60,300 – 180,000 280 2 Qiu Hotel Sukumvit Hospital 32,000 – 35,000 105 3 The Idle Residence Samitivej Hospital 50,000 – 60,000 125 4 Grand Richmond Hotel Vibhavadi Hospital 55,000 300 5 Royal Benja Hotel Sukumvit Hospital 45,000 247 6 Anantara Siam Bangkok Bumrungrad International Hospital 89,000 – 280,000 218 7 Grande Centerpoint Hotel Sukumvit Hospital 62,000 – 73,000 364 Sukhumvit 55 Family Packages are available. 8 AMARA Hotel Sukumvit Hospital 50,000 – 99,000 117 9 The Kinn Bangkok hotel Vibharam Hospital 30,000 – 50,000 61 Family Packages are available. 10 Siam Mandarina Hotel Suvarnabhumi Chularat 9 Airport Hospital 45,000 – 55,000 135 Airport 11 Two Three A Homely Hotel Vibhavadi Hospital 45,000 – 75,000 50 12 Anantara Riverside Bangkok BPK 9 International Hospital 75,000 – 87,000 370 13 Avani+ Riverside Bangkok Hotel BPK 9 International Hospital 65,000 – 100,000 100 14 Grande Centre Point Terminal 21 Bumrungrad International Hospital 65,000 – 79,000 240 15 O2 Luxury Hotel Chularat 3 International Hospital 38,000 – 42,000 350 16 Three Sukhumvit Hotel Vejthani Hospital 40,000 55 17 Princeton Hotel Bangkok Vibhavadi Hospital 27,000 – 38,000 150 Family Packages are available. -

State Room Flyer

SIMPLY EXCEPTIONAL The State Room crowning Tower Club at lebua on the 67th floor, boasts an unbroken chain of floor-to-ceiling windows and provides stunning 360 degree panoramic views of the city and the majestic Chao Praya River. Sweeping views, outstanding technological infrastructure and gourmet cuisine catered from The Dome’s premium restaurants, ensure that events, will be unmatched elsewhere. The Perfect venue for various types of Events: • Press Conference • Product Launching • Fashionable Event • Meeting • Gala Dinner For groups, events, and corporate Sales: • Exclusive Events [email protected] • Wedding 1055 Silom Road, Bangrak, Bangkok 10500, ailand T : +66 (0)2 624 9999 | F : +66 (0)2 624 9988 www.lebua.com Room Dimension Diameter 28.8 m. Total Area 650 sq.m. Ceiling Height 16.0 m. Function Space 450 sq.m. Room Capacity Cocktail 200 - 250 Set menu 150 - 180 Sit down Sit down Buffet 150 Class room 50 - 80 Theatre 100 - 150 U-shape 50 Board Room 50 สถานีสามยาน Sam Yan รพ.จุฬาลงกรณ MRT Chulalongkorn Station Hospital Si Phraya Road วัดหัวลำโพง ถนนสี่พระยา Hua Lamphong Temple สถานีสีลม ทาเรือริเวอรซิตี้ Si Lom River City Station ทาเรือคลองสาน MRT Klong San สถานีศาลาแดง ถนนเจริญกรุง ถนนมเหสักข รพ.กรุงเทพคริสเตียน Sala Daeng Station Bangkok Christian EXPRESS WAY Hospital สีลมคอมเพล็กซ Mahesak Road ถนนคอนแวนต Silom Complex ไอคอน สยาม Charoen Krung Road Surawong Road ICONSIAM ไปรษณียบางรัก Post Office ถนนสุรวงศ เซ็นทรัล สีลม Central Silom CHAO PHRAYA RIVER Convent Road Chong Nonsi Station แมน้ำเจาพระยา รพ.บีเอ็นเอช BNH Hospital วัดแขก สถานีชองนนทรี Silom Road ถนนปน Si Maha ถนนสีลม Uma Devi Temple Pun Road ถนนประมวล ถนนสุรศักดิ์ จิวเวอรี่เทรด รพ.เลิดสิน เซ็นเตอร Lerdsin Pramuan Road Jewery Trade North Sathorn Road Hospital Center Surasak Road ถนนสาทรเหนือ South Sathorn Road . -

Thailand, a Beauty Hub for Everyone?

I n t e r n a t i o n a l M a r k e t i n g M a s t e r T h e s i s E F O 7 0 5 Thailand, A Beauty Hub for Everyone? ( Internationalizing Thai Aesthetic Surgery ) D AT E : J u n e 4, 2008 T u t o r : T o b i a s E l t e b r a n d t A u t h o r s G r o u p 2000 : J i t m a n e e P u l l a w a n 7 9 0 9 1 8 K a n t a r a S i n h a n e t i 8 1 0 6 0 8 ABSTRACT Subject / term: Business Studies / VT2008 Title: Thailand a beauty hub for everyone? Internationalizing Thai aesthetic surgery Author(s): Group 2000 Kantara Sinhaneti Jitmanee Pullawan Tutor: Tobias Eltebrandt Abstract: Introduction: Aesthetic surgery becomes another option of beauty. Interested Patients seeking for choices offered outside their homeland for more benefits. Thailand maybe one of those choices people is now interested in. Thai aesthetic industry may prove to be one of the most wanted destinations because of its expertise and relatively low cost with impressive service. Problem: “How should Thailand improve its Aesthetic service attractiveness to drive its potential to the level of internationalization?” Purpose: This thesis aim to understand Thai aesthetic surgery business and expect to conduct the idea of how to improve the attractiveness of aesthetic service in Thailand by find out international demand then analyze advantages of Thai aesthetic surgery and what can be improve to serve international customers’ demand. -

Bumrungrad Hospital Pcl

CFA Institute Research Challenge Hosted by CFA Society of Thailand Chulalongkorn University CFA Institute Research Challenge 9 Dec 2013 Team 01 Student Research [Health Care Services Sector] This report is published for educational purposes only by students competing in the CFAInstitute Research Challenge. BUMRUNGRAD HOSPITAL PCL Date: December 9, 2014 Ticker: SET:BH Recommendation: BUY Exchange rate USD/THB: 32.14 Price: THB 90.0 (USD 2.8) Price Target: THB 105.7 (USD 3.3) Forecast Summary 2010A 2011A 2012A 2013E 2014E 2015E 2016E 2017E 2018E Total revenue (THBmm) 10,020.9 11,388.9 14,135.0 15,040.2 17,678.9 20,562.6 23,937.0 27,691.5 31,222.7 EBIT (THBmm) 1,834.0 2,283.6 3,598.0 3,593.6 4,203.2 4,877.8 5,485.0 5,236.4 6,204.8 EBITDA (THBmm) 1,834.0 2,283.6 3,598.0 4,408.1 5,168.5 5,971.7 6,791.7 6,713.5 7,832.3 Net Income 1,258.5 1,588.0 2,666.7 2,686.0 3,173.7 3,713.4 4,199.1 4,049.8 4,824.6 Earnings per Share (THB) 1.73 2.18 3.66 3.10 3.66 4.28 4.84 4.67 5.56 Dividend per Share (THB) 0.85 0.90 1.10 1.55 1.83 2.14 2.42 2.33 2.78 Return on Assets (%) 14.2% 14.0% 18.2% 16.2% 17.3% 18.1% 18.9% 16.7% 18.2% Return on Equity (%) 21.8% 24.8% 35.3% 29.7% 30.2% 30.3% 29.5% 24.9% 26.1% Source: Company data, team estimates Highlight Market profile 52-week price range (THB) 70.5 – 95.0 Upside potential; Valuation indicates buying opportunity: We are optimistic about future earnings 30-day average daily performance of BH as it continues to benefit from an increase in demand and growth in medical price. -

A Guide to Health & Wellness Holidays in Thailand

HEALING HARMONY A Guide to Health & W ellness Holidays in T hailand HEALING HARMONY A Guide to Health & Wellness Holidays in Thailand Chiva-Som International Health Resort CREDITS Published by born Distinction Co., Ltd. 2044/20 New Petchburi Road, Bangkapi, Huay Kwang, Bangkok 10310 Thailand www.borndistinction.com Working Team for This Book Editor in Chief: Nuengnimmarn Na Nakorn Project Director: Jidapa Julakasilp Project Manager: Wanida Tirapas Advisor: Dr. Prapa Wongphaet, Dr. Anthony Perillo, Todd A. Nagle Content Editor: Jeff Petry, Todd A. Nagle, Jeremy Kempler-Johanson Proofreader: James Haft, Bonita Rose-Aimee Kennedy, Susanne Robinson Designer: Chira CH., J. Janjaturonrasamee, Asana Yuman Illustrations Assistant: Sasithorn Namamaka Editorial Assistant: Manatsawee Ketudat, Nipattra Weerathong, Santi Ngamlert, Kanyapak Chaipun, Sawarin Siriyong, Researcher: Sansanee Khurana, Panhathai Khaosawee Copyright © 2011 born Distinction Co., Ltd. All rights reserved. Reproduction in whole or in part by any means without prior written permission by the publisher is strictly prohibited. Printed in Bangkok, Thailand Healing Harmony: A Guide to Health and Wellness Holidays in Thailand ISBN: 978-616-90997-1-0 Chiva-Som International Health Resort MESSAGE FROM PUBLISHER It’s proven that smiling relieves stress, eases anxiety, boosts the immune system and lowers blood pressure, as well as releasing natural biological chemicals within our bodies that help reduce pain while boosting our mood and increasing happiness. The stress- free environment of our ‘Land of Smiles’ is the perfect place to not only recuperate from procedures, but also achieve better results through faster healing processes. Not only can you find a multitude of medical/wellness solutions in major cities such as Bangkok, Phuket and Pattaya, but also throughout the country with therapies available in smaller cities like Chiang Rai, or island paradises like Koh Chang. -

APRIL Outpatient Direct Billing General Network

APRIL Outpatient Direct Billing General Network INTRODUCTION AND TERMS OF USE APRIL’s Outpatient Direct Billing Network is designed to provide our members with a service that makes claiming for outpatient services quick and convenient. When members with outpatient benefits and holding a valid APRIL Member Card (or eCard) use medical facilities within our network, APRIL will settle eligible medical expenses incurred directly with the medical provider. Only members without coinsurance can use direct billing services. Please note that Moratorium policies are not eligible to this service. Use of this list is governed by your Policy’s Terms and Conditions and is also subject to the guidelines, exclusions and remarks listed below. Download our Easy Claim app on your smartphone to search and locate healthcare providers within our Asia network: With the app, you can: ✓ Search a healthcare practitioner by name, location, or specialty. ✓ Check whether you are eligible for direct billing in the displayed facilities. To verify your eligibility for direct billing, log in to the app and click on the “E-card” button: • If the code “DB” is displayed on your card, you are eligible for direct billing within our whole Asia General Network. • If the code “PNW” is displayed, you can enjoy direct billing within our Asia Panel Network (please refer to this listing). If you encounter any issues why using direct billing or have any questions about the service, please contact your local APRIL office. You may find your contacts below your eCard on your Easy Claim app. Inpatient Direct Billing For inpatient treatment, APRIL can arrange direct billing if proper notification and documentation are provided and subject to the hospital’s agreement. -

Life Sciences and Health in Thailand

Life Sciences and Health in Thailand KoreaLatviaLithuaniaakuBrusselsGuangzhouKabulMuscatPortOfSpainStockholmTripoliBamakoBratislavaHanoiJubaakuBrusselsGuangzhouKabulMuscatPortOfSpainStockholmTripoliBamakoBratislavaHanoiJuba Thailand is the Southeast Asian leader in the healthcare sector and well positioned to be the medical hub of Asia. The country offers premium medical services, qualified healthcare specialists and various internationally accredited medical facilities. It is also one of the world’s leading destinations for medical tourism, with rising demand. The has been to a great degree Developments responsible for an increase in the demand for medical services Thailand has more than 25,000 health facilities nationwide, and medicines in Thailand since it was established by the govern- including over 1,000 public and 300 private hospitals and 10,000 ment in 2002. It provides a comprehensive health services from clinics. With over 50,000 well-trained physicians, the country ante-natal care and child delivery to dental services, diagnosis, offers a wide range of services, from primary care to advanced medicines listed under the national essential drug list and other level, as well as specialised services such as dentistry. preventive healthcare services as well as rehabilitation services. Growing Healthcare Market Another catalyst is Thailand’s . The World Bank Healthcare is one of the fastest growing sectors in Thailand and analysis reveals that as of 2016, 11% of the Thai population (about will be a driving force of the Thai economy in the future. According 7.5 million people) are 65 years or older, compared to 5% in 1995. to BMI Research, total healthcare expenditure in Thailand By 2040, it is projected that 17 million Thais will be 65 years or amounted to US$25.3 billion in 2016 and is expected to increase older – more than a quarter of the population. -

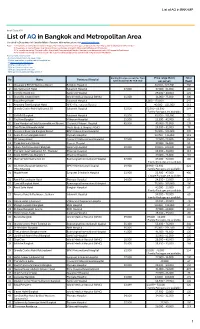

List of AQ in Bangkok and Metropolitan Area Compiled by Department of Consular Affairs | for More Information, Please Visit Note : 1

List of AQ in BKK+MP As of 5 July 2021 List of AQ in Bangkok and Metropolitan Area Compiled by Department of Consular Affairs | For more information, please visit www.hsscovid.com Note : 1. Passengers arrived at Suvarnabhumi Airport/ Don Mueang International Airport can be quarantined in AQ located in Chonburi and Prachinburi. 2. Passengers arrived at Phuket International Airport can be quarantined in AQ located in Phuket and Phang-nga. 3. For travellers entering Thailand via Ban Klong Luek (Aranyaprathet) Border Checkpoint can be quarantined in AQ located in Prachinburi. 4. For travellers entering Thailand via 2nd Thai–Lao Friendship Bridge can be quarantined in AQ located in Mukdahan. How to make a reservation? - Contact a hotel directly for reservation - Make a reservation on authorized online platforms (1) https://entrythailand.go.th/ (2) https://asqthailand.com/ (3) https://asq.locanation.com/ (4) https://asq.ascendtravel.com/ (5) https://www.agoda.com/quarantineth Starting Price (per person) for Thais Price range (Baht) Total No Name Partnered Hospital (with discount on RT-PCR-test) per person Room 1 Movenpick BDMS Wellness Resort Bangkok Hospital 66,500 - 222,500 280 2 Qiu Sukhumvit Hotel Sukumvit Hospital 27,000 27,000 - 35,000 105 3 The Idle Residence Samitivej Hospital 29,000 – 43,000 125 4 Grand Richmond Hotel World Medical Hospital (WMC) 31,000 31,000 - 75,000 300 5 Royal Benja Hotel Sukumvit Hospital 18,000 - 170,000 247 6 Anantara Siam Bangkok Hotel BPK 9 International Hospital 40,000 – 321,000 218 7 Grande Centre Point Sukhumvit 55 Sukumvit Hospital 53,500 53,500 - 66,500 364 Family Packages are available. -

Extraordinary Living

CONCEPT NEIGHBORHOODS FACILITIES URBAN LIVING EXTRAORDINAIRE SPLENDID SURROUNDINGS BEYOND EXPECTATION SWIMMING POOL (IMAGES ARE FOR ADVERTISING PURPOSE ONLY) EXTRAORDINARY LIVING CLASSIC INSPIRED MODERN TWIST About URBAN LIVING EXTRAORDINAIRE THE BLUEPRINT OF PERFECTION Crafted on the concept of luxurious European classic blended with a sense of modern elegant, to result in a well utilized space that comes with specific selected furniture topped with multi-purpose balcony raising your living boundary to the next level. Innovative lighting and ventilation plan that bring living comfort to a new height. PROJECT DETAILS Project Name : MAESTRO 01 SATHORN-YENAKAT Location : Yenakat Road Land Area : Approximately 1-0-4 Rais Project Type : Low-Rise Condominium Building Type : 1 Residential Building of 8 Storey with 2 basements No. of Total Unit : 88 Units Unit Type : 1-Bedroom : 33.56 - 50.36 sq.m. 2-Bedroom : 67.76 - 70.82 sq.m. 2-Bedroom Duplex : 112.66 sq.m. 3-Bedroom Duplex : 135.04 - 182.18 sq.m. IMAGES ARE FOR ADVERTISING PURPOSE ONLY YOGA LAWN (IMAGES ARE FOR ADVERTISING PURPOSE ONLY) 2 The Location SITUATED IN THE HEART SPLENDID OF A METROPOLIS Maestro 01 is the ideal location, surrounded by an SURROUNDINGS unmatched arrays of conveniences • Can be reached by 4 major roads Sathorn, Rama III, Rama IV and Naradhiwas Rajanagarindra. • Close to Lumpini MRT Station as well as the “ THE UNMATCHED Expressway PEACE AND PRIVACY ” • Only 5 minutes away from Silom-Sathorn business district. THE NEIGHBORHOODS SHOPPING MALL HOTEL EMBASSY AND SUPERMARKET -

Chief Quality Officer, Bumrungrad International Hospital, Bangkok, Thailand

BIOGRAPHICAL SKETCH NAME: KORPONG ROOKKAPAN POSITION TITLE: ASSISTANT PROFESSOR AFFILIATION: CHIEF QUALITY OFFICER, BUMRUNGRAD INTERNATIONAL HOSPITAL, BANGKOK, THAILAND E-mail: [email protected] CONTACT +66898131389 +66 2667 9765 EXT. EDUCATION: INSTITUTION AND LOCATION DEGREE YEAR FIELD OF STUDY Prince of Songkla University, Thailand MD 1986-1992 Medicine Prince of Songkla University, Thailand Certificate 1992-1996 Otolaryngology Board Head and Neck Surgery Children’s Hospital Medical Center, Research 1999-2000 Pediatric University of Cincinnati, OH, USA Fellow Laryngology St. Louis Children Hospital, Visiting 2000 Pediatric Washington University, MO, USA Fellow Rhinology Prince of Songkla University, Thailand Certificate 2002 Clinical Epidemiology (International) ASSUMPTION UNIVERSITY, BANGKOK Certificate 2003 Advanced Management Program for HealthCare Executives INSTITUTE OF HEALTH AND SOCIAL Certificate 2008 Peaceful Conflict RESOURCES DEVELOPMENT Management INSTITUTE OF TRAINING AND DEVELOPMENT Certificate 2008 Building the (JOHN C. MAXWELL) Leadership Team for Outstanding Results INSTITUTE OF TRAINING AND DEVELOPMENT Certificate 2008 Strategic HR & PENNSYLVANIA STATE UNIVERSITY Transformation (WILLIAM ROTHWELL) and Organization Development INNOVATION IN HEALTHCARE ORGANIZATION Certificate 2012 Bangkok Hospital Group of Hospitals ADVANCES IN ANTIAGING Certificate 2012 Mae Fah Luang School of Anti Aging and Regenerative Medicine HUMAN RESOURCE MANAGEMENT: EAST & Certificate 2012 College of WEST International Exchange Shanghai