View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Credit Insurance Market Survey

CREDIT INSURANCE MARKET SURVEY 2 01 9 CREDIT INSURANCE MARKET 2019 INSURERS & SHARES MARKET SHARE The trade credit insurance market remains very 2018 (source: www.icisa.org). Euler Hermes remains the oligopolistic and the Top 3 «global» insurers represent leading credit insurance carrier with 34.1% of market more than 75% of the total premium. ICISA estimates share followed by Atradius 24.6%, and Coface with a total market size around €6.7 billion in premium in 17.1% as of December 31st 2018. 17,3% 34,1% • Euler Hermes 24,3% • Atradius 24,6% • Others • Coface This calculation is an estimate by AU Group, excluding China Export insurance company which achieved a turnover of approximatively & Credit Insurance Corporation (“Sinosure”), the public Chinese €1.4 bn (2016 figures, total short term premium). TYPES OF INSURERS The International Credit Insurer & Surety Association “Niche” insurers, characterised by expertise in: (ICISA) comprises more than 50 members that provide ➤ particular products: Excess of loss, shared excess Trade Credit Insurance535 402 across the world. However, two cover, top-up, single risk (e.g.: AIG, Chubb, Garant, Nexus, main categories of insurers can be distinguished: “Global” 600000 466 379 Liberty Mutual, Lloyd’s, Markel, QBE, Tokio Marine, XL and “Niche” insurers. Catlin, Zurich etc.) 500000 335 270 ➤ certain geographical areas (e.g.: ATI, Cesce, Credendo, “Global” insurers, characterised by: FCIA, ICIC, QBE, Sace etc.) 400000 ➤ a strong international presence ➤ different types of risk: political risk, non-transfer 300000➤ detailed information on a very large number of buyers (e.g.: Garant, Beazley, Liberty Mutual, Lloyd’s, Zurich...) in their global databases • Atradius 200000➤ global capabilities in providing credit• Coface management services • Euler Hermes 100000 Leading insurers in this category are: Atradius, Coface, Euler 0Hermes. -

EH Re AG) in Its Financial Statements (For 2018 Results: 1 EUR= 1.1269 CHF, for 2017 Results: 1 EUR = 1.17015177 CHF)

Euler Hermes Reinsurance AG Financial Condition Report Based on 31/12/2018 figures Financial Condition Report of Euler Hermes Re AG 2018 Contents Contents ........................................................................................................................... 1 Executive Summary .......................................................................................................... 1 Business activities (A) ............................................................................................................... 1 Company success (B) ................................................................................................................ 2 Governance and risk management (C) ...................................................................................... 2 Risk profile (D) ......................................................................................................................... 3 Valuation (E) ............................................................................................................................ 3 Capital management & Solvency requirements (F&G) ............................................................... 3 A. Business activities ...................................................................................................... 4 A.1. Business overview ......................................................................................................... 4 A.1.1. Business overview ....................................................................................................................... -

Das Nachhaltigkeitsrating Der Oekom Research AG

Das Nachhaltigkeitsrating der oekom research AG Reinhold Windorfer, Analyst TUM Vorlesung Umweltmanagement, 18. Juli 2011 Seite 1 über uns – Corporate & Country Research – Universum umfasst int. wichtigste Aktien und Renten – höchste Qualitätsstandards – Anzahl der Mitarbeiter: 39 – interdisziplinäres 27-köpfiges Analystenteam – Wissenschaftlicher Beirat – Partner von verschiedenen Asset Managern und institu- tionellen Investoren in AT, CH, DE, FR, IE, IT, JP, US – Einfluss auf Fonds und Mandate mit Gesamtvolumen von EUR 90 Mrd. (Dezember 2010) – Markterfahrung seit 1993 – völlige Unabhängigkeit – entstanden aus oekom verlag Seite 3 referenzen Auszug aus unserer Kundenliste Asset Manager, Banken, Fondsgesellschaften Allianz Global Investors France Kaiser Partner AGICAM KD-Bank AmpegaGerling Investment Kepler Fonds Amundi Asset Management Landesbank Baden-Württemberg AXA Investment Managers LBBW Asset Management Baden-Württembergische Bank LIGA Bank Institutionelle Investoren Bank für Orden und Mission MEAG Bank für Sozialwirtschaft Metzler Bayerische Versorgungskammer Bankhaus Jungholz Metzler Asset Management Deutsche Bundesstiftung Umwelt Bankhaus Schelhammer & Schattera Natixis Asset Management Diözese Linz Bank Vontobel NORD/LB Kapitalanlagegesellschaft Diözese Rottenburg-Stuttgart BayernInvest ÖkoWorld Lux Etablissement de Retraite Additionnelle de la BNP Paribas Asset Management Pioneer Investments Fonction Publique (ERAFP) BÖAG Börsen AG Hamburg/Hannover Proventus Evangelisch-Lutherische Kirche in Bayern CM-CIC Asset Management quirin -

These Comments Are Submitted by Allianz of America,1 Munich

a ALLIANZ OF AMERICA CORPORATION MUNICH REINSURANCE AMERICA CORPORATION SWISS RE AMERICA HOLDING CORPORATION These comments are submitted by Allianz of America,1 Munich Reinsurance America,2 and Swiss Re America.3 For the past three years, the Administration’s Budget has included a proposal to deny the deduction for property-casualty reinsurance premiums placed with a foreign affiliate by a U.S. insurer.4 The Administration proposal was introduced in the 112th Congress by Rep. Richard Neal (H.R. 3157) and by Sen. Robert Menendez (S. 1693). These comments demonstrate that the Administration proposal would disrupt essential risk distribution practices followed by domestic and foreign insurers, alike; increase premiums and reduce coverage available to U.S. consumers, particularly in catastrophe prone areas along the coastlines; and violate U.S tax treaty obligations and commitments to the World Trade Organization. In addition, the Administration errs in characterizing routine affiliate transactions with treaty partners with significant corporate tax regimes as erosion of the U.S. tax base. BACKGROUND Under current law, a U.S. insurer may deduct the premium for reinsurance placed with another company, whether affiliated, unaffiliated, domestic or foreign. A current deduction for this crucial expense ensures that there is a proper matching of income and expense. The U.S. insurer will include in income any ceding commission received from the reinsurer, and, when it 1 Allianz S.E., a German company, owns Fireman’s Fund Insurance Company, Allianz Global Corporate and Specialty Insurance, Euler Hermes-USA, and Allianz Global Assistance –USA. Together, Allianz’s property- casualty insurance subsidiaries in the U.S. -

Euler Hermes Group Announces CEO Leadership Change

Euler Hermes Group announces CEO leadership change ● Wilfried Verstraete to step down as CEO on December 31st, 2020 ● Clarisse Kopff is appointed CEO of Euler Hermes Group starting January 1st, 2021 ● Wilfried Verstraete remains as advisor to the new CEO though 2021 PARIS, 1 October 2020 – Euler Hermes Group, the worldwide leader in trade credit insurance, announces today that Wilfried Verstraete, CEO and Chairman of the Board of Management has decided to step down from his operational duties after twelve successful years in the role. Clarisse Kopff will succeed him as CEO and Chairperson of the Board of Management as of January 1st, 2021. The change is subject to regulatory approval. Wilfried Verstraete joined Euler Hermes in 2009 where he steered the group through the global financial crisis. Under his leadership, he transformed the traditional, century-old credit insurer into a data-driven, customer-centric Fintech leader with market leading, real-time digital solutions for its clients. He will continue to serve Euler Hermes Group as an advisor to the new CEO through 2021. He will also retain board positions in Euler Hermes SA, Euler Hermes North America, Solunion and Euler Hermes Reinsurance AG. Clarisse Kopff (47) is a graduate of ESCP Business School and holds a postgraduate degree from Université Paris Dauphine and the German Diplom Kaufmann. She is currently Chief Financial Officer of Allianz France. She began her career in debt origination at Lehman Brothers in London, then as an auditor with PricewaterhouseCoopers in Paris before joining Euler Hermes in 2001 as controller for the company’s French entity in Paris. -

2013 Consolidated Financial Statement and Management Report

2013 Consolidated Financial Statements and Management Report of Fresenius SE & Co. KGaA, Bad Homburg v. d. H. at December 31, 2013 applying Section 315a HGB in accordance with International Financial Reporting Standards TABLE OF CONTENTS 2 Fundamental information about the Group 38 Outlook 2 The Group‘s business model 38 General and mid-term outlook 3 Management and control 39 Future markets 3 Key products and services 40 Health care sector and markets 4 Important markets and competitive position 42 Group sales and earnings 4 Legal and economic factors 43 Sales and earnings by business segment 4 Capital, shareholders, articles of association 44 Financing 5 Goals and strategy 44 Investments 6 Corporate performance criteria 44 Procurement 7 Research and development 44 Research and development 10 Employees 45 Corporate structure and organization 12 Procurement 45 Planned changes in human resources and the social area 14 Quality management 45 Dividend 16 Responsibility, environmental management, sustainability 19 Sales, marketing, and logistics 46 Opportunities and risk report 46 Opportunities management 20 Report on economic position 46 Risk management 20 Health care industry 47 Risk areas 20 The dialysis market 54 Assessment of overall risk 22 The market for infusion therapy and clinical nutrition, intra- venously administered drugs, medical devices, and transfu- sion technology 55 Consolidated financial statements 23 The German hospital market 56 Consolidated statement of income 24 The market for projects and services for hospitals and -

New Report Finds a Strong Economic Recovery Requires A

PRESS RELEASE Princeton, NJ July 13, 2020 NEW REPORT FINDS A STRONG ECONOMIC RECOVERY REQUIRES A HEALTHY TRADE CREDIT INSURANCE INDUSTRY Report commissioned by leading trade credit insurers proposes government reinsurance policy to support U.S. economy As economic uncertainty due to COVID-19 continues to impact businesses across the country, a new report commissioned by trade credit insurers Euler Hermes, Coface and Atradius found that a lack of support for the trade credit insurance (TCI) industry could disrupt the stability of millions of businesses across the U.S. The report, titled “A Strong Recovery Requires a Healthy Trade Credit Insurance Industry,” outlines the importance of trade credit insurance to the economy, the significant cutbacks in TCI coverage that the COVID pandemic has caused, and the reasons why government support for the TCI industry is vital to the continuity of economic activity. The report conservatively concludes that in the absence of a government response, the cutbacks in coverage will inhibit $46 billion in additional production and the creation of approximately 155,000 U.S. jobs at supplier firms, with additional effects on downstream buyers. Euler Hermes, Coface and Atradius are the world’s three largest trade credit insurers, representing about 60% of the market in the U.S. Last month, the three companies formed a working group to educate the public and the U.S. government on the essential role trade credit insurance plays in supporting U.S. businesses and the economy at large. Statement from James Daly, CEO of Euler Hermes North America, Oscar Villalonga, President and CEO at Coface North America, and Gordon Cessford, President and Regional Director for North America at Atradius: It is not often that you see the main players in a single industry, typically competitors, come together for a common purpose of public interest. -

Press Release

Press release Solunion, joint venture of Euler Hermes and MAPFRE, named best trade credit insurer by ADECOSE MADRID – 8 APRIL 2014 - Solunion, joint venture of Euler Hermes and MAPFRE, was recognized by ADECOSE as the best trade credit insurance company in Spain. ADECOSE is an independent Spanish association founded in 1977 to support the interests of insurance brokers - while respecting and consolidating the values of freedom, independence, objectivity, and ethics - and to provide services to associate members. “This recognition by the ADECOSE study participants highlights the relevance of our offer, our multichannel distribution and our overall competitive position in the market,” said Pascal Personne, CEO of Solunion España. “It further encourages us in our strategy of being the preferred partner for our distribution channel, particularly for brokers.” The ADECOSE barometer, presented in Madrid, is designed to showcase excellence within the business insurance sector and the quality of the services notably for brokers. Ninety-six brokers, representing over 84% of association members, offered their insights in 753 interviews. # # # Media Contacts Euler Hermes Group Media Relations Publicis Consultants Remi Calvet– +33(0)1 84 11 61 41 Romain Sulpice +33 (0)1 44 82 46 21 [email protected] [email protected] Solunion Communication Department Eva Muñoz +34 91 417 80 11 [email protected] Euler Hermes is the global leader in trade credit insurance and a recognized specialist in the areas of bonding, guarantees and collections. With more than 100 years of experience, the company offers business-to-business (B2B) clients financial services to support cash and trade receivables management. -

Multi-Generational Families, Single-Parent Families, Same-Sex Couple Families, Blended Families, Older Parent with Young Children Families, and Boomerang Families

The Allianz LoveFamilyMoney® Study Changing family dynamics create new financial needs How the evolution of the American family is creating new challenges – and revealing new opportunities – for the financial services industry ENT-1677 Page 1 of 16 Study overview Over the past 40 years, shifting demographics and profound attitudinal changes have helped redefine the concept of “family” for many Americans. In fact, the very structure of the American family is changing dramatically: According to the U.S. Census Bureau, almost half of adults today do not live with a spouse – compared to approximately 30% in 1967.1 To understand how this evolving family structure is changing Americans’ relationship with money and financial planning, Allianz commissioned the 2014 LoveFamilyMoney study. The study sought to explore exactly how American families are changing, and to answer one fundamental question: “How does the evolving family structure change Americans’ relationship with money and financial services?” This white paper summarizes the study’s key findings. Today’s modern family Families today come in so many shapes and sizes that there is no longer a single definition of what constitutes a “modern family.” But although the definition of family may be both broad and diverse, the Allianz LoveFamilyMoney Study identified six distinct modern family types2 with unique characteristics: multi-generational families, single-parent families, same-sex couple families, blended families, older parent with young children families, and boomerang families. We also surveyed traditional family households so we could compare their responses. 1 U.S. Census Bureau, Current Population Survey Annual Social and Economic Supplement, 1967 – 2015. 2 For the purposes of our study, a type is defined as a group or social class. -

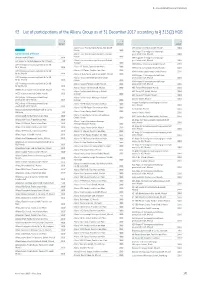

43 List of Participations of the Allianz Group As of 31 December 2017 According to § 313 (2) HGB

D _ Consolidated Financial Statements 43 _ List of participations of the Allianz Group as of 31 December 2017 according to § 313 (2) HGB % % % owned1 owned1 owned1 Allianz Leben Private Equity Fonds 2008 GmbH, APK Infrastrukturfonds GmbH, Munich 100.0 GERMANY Munich 100.0 APK-Argos 75 Vermögensverwaltungs- Consolidated affiliates Allianz Leben Private Equity Fonds Plus GmbH, gesellschaft mbH, Munich 100.0 Munich 100.0 abracar GmbH, Munich 100.0 APK-Argos 85 Vermögensverwaltungs- ACP GmbH & Co. Beteiligungen KG II, Munich 0.0 2 Allianz Lebensversicherungs-Aktiengesellschaft, gesellschaft mbH, Munich 100.0 Stuttgart 100.0 APKV Direkt Infrastruktur GmbH, Munich 100.0 ACP Vermögensverwaltung GmbH & Co. KG 3 Allianz LFE Fonds, Frankfurt am Main 100.0 Nr. 4, Munich 100.0 APKV Infrastrukturfonds GmbH, Munich 100.0 Allianz L-PD Fonds, Frankfurt am Main 100.0 3 ACP Vermögensverwaltung GmbH & Co. KG APKV Private Equity Fonds GmbH, Munich 100.0 Nr. 4a, Munich 100.0 Allianz of Asia-Pacific and Africa GmbH, Munich 100.0 APKV-Argos 74 Vermögensverwaltungs- ACP Vermögensverwaltung GmbH & Co. KG Allianz Pension Direkt Infrastruktur GmbH, gesellschaft mbH, Munich 100.0 Nr. 4c, Munich 100.0 Munich 100.0 APKV-Argos 84 Vermögensverwaltungs- ACP Vermögensverwaltung GmbH & Co. KG Allianz Pension Partners GmbH, Munich 100.0 gesellschaft mbH, Munich 100.0 Nr. 4d, Munich 100.0 Allianz Pension Service GmbH, Munich 100.0 ARE Funds APKV GmbH, Munich 100.0 ADEUS Aktienregister-Service-GmbH, Munich 79.6 Allianz Pensionsfonds Aktiengesellschaft, ARE Funds AZL GmbH, -

Financial Report 2008 Financial Report 2008

Financial Report 2008 Financial Report 2008 Financial Calendar 2009 Apr 28, 2009 Interim Report as of March 31, 2009 May 26, 2009 Annual General Meeting in the Festhalle Frankfurt am Main (Exhibition Center) May 27, 2009 Dividend payment Jul 29, 2009 Interim Report as of June 30, 2009 Oct 29, 2009 Interim Report as of September 30, 2009 2010 Feb 4, 2010 Preliminary results for the 2009 financial year Mar 12, 2010 Annual Report 2009 and Form 20-F Apr 27, 2010 Interim Report as of March 31, 2010 May 27, 2010 Annual General Meeting in the Festhalle Frankfurt am Main (Exhibition Center) May 28, 2010 Dividend payment Jul 28, 2010 Interim Report as of June 30, 2010 Oct 28, 2010 Interim Report as of September 30, 2010 Deutsche Bank Deutsche Bank The Group at a Glance 2008 2007 Share price at period end € 27.83 € 89.40 Share price high € 89.80 € 118.51 Share price low € 18.59 € 81.33 Basic earnings per share € (7.61) € 13.65 1 Diluted earnings per share € (7.61) € 13.05 Average shares outstanding, in m., basic 504 474 Average shares outstanding, in m., diluted 504 496 Return on average shareholders’ equity (post tax) (11.1) % 17.9 % Pre-tax return on average shareholders’ equity (16.5) % 24.1 % 2 Pre-tax return on average active equity (17.7) % 29.0 % Book value per basic share outstanding3 € 52.59 € 79.32 4 Cost/income ratio 134.6 % 69.6 % Compensation ratio5 71.2 % 42.7 % 6 Noncompensation ratio 63.4 % 26.9 % in € m. -

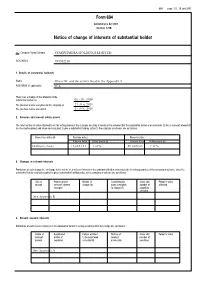

Change in Substantial Holding

604 page 1/2 15 July 2001 Form 604 Corporations Act 2001 Section 671B Notice of change of interests of substantial holder To Company Name/Scheme STARPHARMA HOLDINGS LIMITED ACN/ARSN 078532180 1. Details of substantial holder(1) Name Allianz SE and the entities listed in the Appendix A ACN/ARSN (if applicable) N/A There was a change in the interests of the substantial holder on 06 / 10 / 2020 The previous notice was given to the company on 21 / 05 / 2020 The previous notice was dated 21 / 05 / 2020 2. Previous and present voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate (2) had a relevant interest (3) in when last required, and when now required, to give a substantial holding notice to the company or scheme, are as follows: Class of securities (4) Previous notice Present notice Person's votes Voting power (5) Person's votes Voting power (5) Ordinary shares 18,648,131 5.01% 28,632,065 7.11% 3. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate in voting securities of the company or scheme, since the substantial holder was last required to give a substantial holding notice to the company or scheme are as follows: Date of Person whose Nature of Consideration Class and Person's votes change relevant interest change (6) given in relation number of affected changed to change (7) securities affected See Appendix B 4.