Study of Share Price Variations of Publicly Traded Football Clubs

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Adidas Select 2019

Exclusive benefit for top adidas U.S. youth soccer clubs which includes West-Mont United S.A. As a premier pillar of the generation adidas platform, the top adidas clubs nationwide have the exclusive opportunity to nominate players for the Olympique Lyonnais Select, Real Madrid Foundation Select and A.F.C. Ajax Select. Generation adidas international is proud to offer West-Mont United S.A. an exclusive soccer experience in Europe through its partnership with three of the most famous soccer clubs in the world. AFC Ajax Ajax is the most successful club in the Netherlands and has always played in the highest league, the Eredivisie, since its foundation in 1956. They have won 33 Eredivisie League titles, 18 Dutch Cups, and 8 Dutch Super Cups, as well as 4 UEFA Champions League titles, 1 UEFA Cup, 3 European Super Cups, 1 European Winners’ Cup, and 1 FIFA Club World Cup. 2019 Selected West-Mont United Player – Ryan Woolley Real Madrid C.F. Real Madrid C.F., or ‘Los Blancos’ as they are affectionately called by Madridistas, was founded in 1902. One of the most successful clubs in history, Real Madrid C.F. has won 33 La Liga titles and a record 12 UEFA Champions League titles. The club is famous for both its rich tradition and also its talented roster, including names like Gareth Bale, Cristiano Ronaldo, and Toni Kroos. 2019 Selected West-Mont United Player – Shane Gleason Olympique Lyonnais Having won fourteen Women’s Champions of France titles, as well as three Women’s Champions League titles, Olympique Lyonnais is one of the most successful clubs in women’s soccer, both nationally and internationally. -

Audit ADO Den Haag - AFC Ajax D.D

Audit ADO Den Haag - AFC Ajax d.d. 9 november 2003 Den Haag, 16 maart 2004 Inhoudsopgave 1 Inleiding 3 1.1 Opdracht 3 1.2 Werkwijze 3 1.3 Opbouw rapport 4 2 Reconstructie 5 2.1 Inleiding 5 2.2 Voorbereidingen ADO Den Haag 6 2.3 Voorbereidingen politie 7 2.4 Voorbereidingen Gemeentebestuur en Openbaar Ministerie 9 2.5 De wedstrijddag 9 3 Beschouwingen, conclusies en aanbevelingen 12 3.1 De voorbereidingen 12 3.2 De rellen, omvang en duur 12 3.3 De politie-inzet 13 Bijlagen Bijlage 1 Samenstelling auditteam 17 Bijlage 2 Bronnen 18 Bijlage 3 Protocol incidentenonderzoek 20 Pagina 2 Audit ADO Den Haag - AFC Ajax d.d. 9 november 2003 DSP - groep 1 Inleiding 1.1 Opdracht Het auditteam voetbalvandalisme, dat is ingesteld door de minister van Bin- nenlandse Zaken en Koninkrijksrelaties (BZK), heeft tot taak onderzoek te doen naar ingrijpende incidenten van voetbalvandalisme in Nederland. Doel van het onderzoek is snel en praktisch inzicht te krijgen in de aanleiding en oorzaak van ingrijpende incidenten, onder meer door de geconstateerde feiten te relateren aan de in het Beleidskader Bestrijding Voetbalvandalisme en Voetbalgeweld 2003 gestelde afspraken en verantwoordelijkheden. Op grond van de bevindingen doet het auditteam aanbevelingen aan de Minister van Binnenlandse Zaken en de betrokken burgemeesters. In bijlage 1 is de samenstelling van het auditteam opgenomen. Twaalf jaar lang hebben ADO Den Haag en Ajax niet meer tegen elkaar gespeeld. Vijftien jaar geleden werd een wedstrijd tussen beide clubs in Den Haag gestaakt wegens ernstige rellen. Tegen het licht van dit beladen verle- den maar ook gelet op de dreiging van kwetsende spreekkoren en een con- frontatie tussen beide supportersgroepen, was de wedstrijd vooraf met veel zorg en aandacht omkleed. -

FOOMI-NET Working Paper No. 1

WILLIAMS, J. (2011), “Women’s Football, Europe and Professionalization 1971-2011: Global Gendered Labor Markets”, foomi-net Working Papers No. 1, http://www.diasbola.com/uk/foomi-source.html FOOMI-NET www.diasbola.com Working Paper No. 1 Author: Jean Williams Title: Women’s Football, Europe and Professionalization 1971-2011: Global Gendered Labour Markets Date: 20.09.2011 Download: http://www.diasbola.com/uk/foomi-source.html Women’s Football, Europe and Professionalization 1971- 2011: Global Gendered Labour Markets Jean Williams Introduction A recently-published survey aimed at Britain's growing number of family historians, had, as its primary aim, to convey 'the range and diversity of women's work spanning the last two centuries - from bumboat women and nail-makers to doctors and civil servants - and to suggest ways of finding our more about what often seems to be a 'hidden history'.i Professional women football players are part of this hidden history. More surprisingly, no athletes were listed among the 300 or so entries, either in a generalist or specific category: perhaps, because of the significance of amateurism as a prevailing ethos in sport until the 1960s. Another newly-released academic survey by Deborah Simonton Women in 1 WILLIAMS, J. (2011), “Women’s Football, Europe and Professionalization 1971-2011: Global Gendered Labor Markets”, foomi-net Working Papers No. 1, http://www.diasbola.com/uk/foomi-source.html European Culture and Society does makes reference to the rise of the female global sports star, beginning with Suzanne Lenglen's rather shocking appearance in short skirt, bandeau and sleeveless dress at Wimbledon in 1919 onwards. -

Curriculum Vitae

Curriculum Vitae Personal Name: André van Meerkerk Address: Martinus Nijhofaan 101 Post Code: 4481 DH City: Kloetinge Country: Netherlands Phone number mobile: +31 6 53342654 Email: [email protected] Date of birth: 17 march 1962 Occupation: Multi-camera Director Company: André van Meerkerk Sport & Media Producties BV Website: www.andrevanmeerkerk.nl LinkedIn profile www.linkedin.com/in/andrevanmeerkerk Pure passion, many years (since 1987) of production and directing experience and a daily shot of adrenaline – nothing more, nothing less. And it works. These are the ingredients behind my successful productions for NOS, FOX Sports, Canal+, RTL, SBS6, Talpa, Ziggo and many other broadcasters. Look further to find out more about my production and directing experience in Sports. Productions This is my daily fare. Every year I take care of the production and direction of over 100 live television sport programmes. These programmes include many sports events, such as the matches in the Dutch Football Leaque, the Dutch National Football Team, the most important baseball tournaments and live coverage of boxing galas and other competitions. Besides this sports-based work, I also take care of the training of new directors. Television programmes I am specialised in live programmes that makes every fibre in your body feel the excitement and tension. It is necessary to react quickly, maintain an overview and to be able to draw on knowledge of the game. And it is always a matter of close collaboration with a strong and experienced crew. Directing It all starts with passion - but that on itself is not enough… Being a good director means understanding how to play the game, both on and of the pitch. -

Overzicht Speler - Club - Intermediair (Seizoen 2018/19)

Overzicht speler - club - intermediair (seizoen 2018/19) Voornaam Tussen- Achternaam Naam club speler voegsel speler Naam intermediair Naam rechtspersoon Sparta Rotterdam Dirk Abels Hoogewerf, J.L. Willem II Atakan Akkaynak Akan, E. Vitesse Oskur Aktas Mutlu, U.T. Sparta Rotterdam Suently Alberto Veldman J.F. Premium Stars Sportsmanagement N.E.C. Norbert Alblas Albers, G. Almere City FC Ilias Alhaft Lens, S.G. Pro Athlete FC Utrecht Oussama Alou Hoogewerf, J.L. NAC Breda Pele van Anholt Olivieira, K.C. FC Emmen Jafar Arias Gorré, G.M. FC Utrecht Jonas Arweiler Syha, J. Willem II Donis Avdijaj Schmidt, K. Feyenoord Yassin Ayoub Veldman J.F. Premium Stars Sportsmanagement Go Ahead Eagles Roland Baas Schouten, F.R. De Graafschap Nabil Bahoui Kulüp, S. AZ Mees Bakker Laros, L.P. De Graafschap Erik Bakker Schilperoort, H. ADO Den Haag Danny Bakker Tuit, D. Go Ahead Eagles Istvan Bakx Schouten, F.R. sc Heerenveen Filip Bednarek Vrouwe, T. Vitesse Mike de Beer Gorré, G.M. sc Heerenveen Jan Bekkema Posthumus, L.J. FC Den Bosch Stefano Beltrame Belloni, C.A. De Graafschap Charlison Benschop Noack, M. Heracles Almelo Jelle van Benthem Poldervaart, P. Vitesse Martijn Berden Hoogewerf, J.L. FC Volendam Anthony Berenstein Delden, S.G. van N.E.C. Joey van den Berg Ginkel, H. van sc Heerenveen Mitchell van Bergen Kolk, S. FC Eindhoven Menno Bergsen Patel, S.J. AZ Leon Bergsma Vries, P.R. de FC Utrecht Emil Bergstrom Malenovic, M. ADO Den Haag Tommie Beugelsdijk Schouten, F.R. FC Emmen Glenn Bijl Eslik, M. Feyenoord Justin Bijlow Bijlow, J. -

The Northwest Nationals Academy Will Concentrate on Fundamental Skill

NW Nationals Premier Soccer Club invites you to the Fall 2012 Player Development Youth Academy Have Fun & Learn! Academy Details The Fall 2012 Northwest Nationals Academy, for WHO: Boys and Girls, Ages 7-11 (Fall U8-U12) all players in the U8-U12 age groups, provides an WHEN: Sundays Sep 16, 23, 30, Oct 7, 14 & 21. outstanding opportunity for serious and dedicated TIME: 6:30-8:00pm young soccer players to challenge themselves and WHERE: Lynnwood High School Field #2 develop the skills necessary for higher level 18218 North Road, Bothell competition. Through games and drills focused on dribbling, ball mastery, passing and receiving, shooting and small sided tactical games, players Academy Director will develop the fundamental skills & techniques essential to moving their game to the next level. The Academy is open to all players: recreational, Eugene Poublon, NWN Youth Director select or premier. Played 6 years in the AFC Ajax Youth Academy, Netherlands. The Northwest Nationals curriculum will be Played 2 years for AZ Alkmaar Eredevisie, delivered by our most technical coaching staff and Netherlands. directed by Technical Director Eugene Poublon. Won National Championship „88/‟89 Indoor This will ensure that each player will not only learn Soccer in Haarlem, Netherlands. from the best coaches around, but will also benefit Played for Seattle Sounders 1998. from the passion, care and dedication that only the Played in the Men‟s Open National Northwest Nationals staff can provide. Championship in 2002. USSF National “A” Coaching License. Come on out and spend some time with us! Current NW Nationals Youth Director. -

REVISED Team Roster

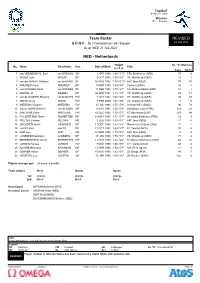

Football サッカー / Football Women 女子 / Femmes Team Roster REVISED 登録選手一覧 / Composition de l’équipe 22 JUL 0:48 As of WED 21 JUL 2021 NED - Netherlands Height Int. "A" Matches No. Name Shirt Name Pos. Date of Birth Club m / ft in Caps Goals 1 van VEENENDAAL Sari van VEENENDAAL GK 3 APR 1990 1.80 / 5'11" PSV Eindhoven (NED) 74 0 2 WILMS Lynn WILMS DF 3 OCT 2000 1.76 / 5'9" VfL Wolfsburg (GER) 12 1 3 van der GRAGT Stefanie van der GRAGT DF 16 AUG 1992 1.78 / 5'10" AFC Ajax (NED) 75 10 4 NOUWEN Aniek NOUWEN DF 9 MAR 1999 1.74 / 5'9" Chelsea (ENG) 16 1 5 van DONGEN Merel van DONGEN DF 11 FEB 1993 1.70 / 5'7" CA Atlético Madrid (ESP) 51 1 6 ROORD Jill ROORD MF 22 APR 1997 1.75 / 5'9" VfL Wolfsburg (GER) 64 11 7 van de SANDEN Shanice van de SANDEN FW 2 OCT 1992 1.68 / 5'6" VfL Wolfsburg (GER) 85 19 8 SMITS Joelle SMITS FW 7 FEB 2000 1.68 / 5'6" VfL Wolfsburg (GER) 4 0 9 MIEDEMA Vivianne MIEDEMA FW 15 JUL 1996 1.75 / 5'9" Arsenal WFC (ENG) 96 73 10 van de DONK Danielle van de DONK MF 5 AUG 1991 1.60 / 5'3" Olympique Lyon (FRA) 114 28 11 MARTENS Lieke MARTENS FW 16 DEC 1992 1.70 / 5'7" FC Barcelona (ESP) 123 49 12 FOLKERTSMA Sisca FOLKERTSMA DF 21 MAY 1997 1.71 / 5'7" Girondins Bordeaux (FRA) 12 0 13 PELOVA Victoria PELOVA MF 3 JUN 1999 1.63 / 5'4" AFC Ajax (NED) 11 0 14 GROENEN Jackie GROENEN MF 17 DEC 1994 1.65 / 5'5" Manchester United (ENG) 71 7 15 van ES Kika van ES DF 11 OCT 1991 1.69 / 5'7" FC Twente (NED) 70 0 16 KOP Lize KOP GK 17 MAR 1998 1.73 / 5'8" AFC Ajax (NED) 6 0 17 JANSSEN Dominique JANSSEN DF 17 JAN 1995 1.75 / 5'9" VfL Wolfsburg -

BMO Management Strategies of Football Clubs in the Dutch Eredivisie

BSc-Thesis – BMO Management strategies of football clubs in the Dutch Eredivisie Name Student: Mylan Pouwels Registration Number: 991110669120 University: Wageningen University & Research (WUR) Study: BBC (Business) Thesis Mentor: Jos Bijman Date: 1-23-2020 Chair Group: BMO Course Code: YSS-81812 Foreword From an early age I already like football. I like it to play football by myself, to watch it on television, but also to read articles about football. The opportunity to combine my love for football with a scientific research for my Bachelor Thesis, could not be better for me. During an orientating conversation about the topic for my Bachelor Thesis with my thesis mentor Jos Bijman, I mentioned that I was always interested in the management strategies of organizations. What kind of choices an organization makes, what kind of resources an organization uses, what an organization wants to achieve and its performances. Following closely this process in large organizations is something I like to do in my leisure time. My thesis mentor Jos Bijman asked for my hobbies and he mentioned that there was a possibility to combine my interests in the management strategies of organizations with my main hobby football. In this way the topic Management strategies of football clubs in the Dutch Eredivisie was created. The Bachelor Thesis Management strategies of football clubs in the Dutch Eredivisie is executed in a qualitative research, using a literature study. This Thesis is written in the context of my graduation of the study Business-and Consumer Studies (specialization Business) at the Wageningen University and Research. From October 28 2019 until January 23 I have been working on the research and writing of my Thesis. -

Accuracy Rate of Bankruptcy Prediction Models for the Dutch Professional Football Industry

MASTER THESIS BUSINESS ADMINISTRATION – FINANCIAL MANAGEMENT ACCURACY RATE OF BANKRUPTCY PREDICTION MODELS FOR THE DUTCH PROFESSIONAL FOOTBALL INDUSTRY PATRICK GERRITSEN S0118869 UNIVERSITY OF TWENTE, THE NETHERLANDS 1st SUPERVISOR: prof. dr. R. KABIR 2nd SUPERVISOR: dr. X. HUANG September 2015 MANAGEMENT SUMMARY Bankruptcy and financial distress are chronicle problems for the Dutch professional football industry. Since the establishment of Dutch’s professional football in 1954 nine clubs have been declared bankrupt (four since 2010) and many others were facing financial distress last few years. Club failure identification and early warnings of impending financial crisis could be very important for the Dutch football association in order to maintain a sound industry and to prevent competition disorder. As financial ratios are key indicators of a business performance, different bankruptcy prediction models have been developed to forecast the likelihood of bankruptcy. Because bankruptcy prediction models are based on specific industries, samples and periods it remains a challenge to predict with a high accuracy rate in other settings. Therefore, the aim of this study is to assess the accuracy rate of bankruptcy prediction models to an industry and period outside those of the original studies namely, the Dutch professional football industry. The study draws on the information from financial statements (e.g. annual report and season reports) as publicly provided by the Dutch professional football clubs since 2010. The accuracy rate of three best suitable (i.e. commonly used and applicable to the Dutch football industry) accounting-based bankruptcy prediction models of Ohlson (1980), Zmijewski (1984), and Altman (2000) were tested on Dutch professional football clubs between the seasons of 2009/2010 - 2013/2014. -

Women's Football, Europe and Professionalization 1971-2011

Women’s Football, Europe and Professionalization 1971-2011 A Project Funded by the UEFA Research Grant Programme Jean Williams Senior Research Fellow International Centre for Sports History and Culture De Montfort University Contents: Women’s Football, Europe and Professionalization 1971- 2011 Contents Page i Abbreviations and Acronyms iii Introduction: Women’s Football and Europe 1 1.1 Post-war Europes 1 1.2 UEFA & European competitions 11 1.3 Conclusion 25 References 27 Chapter Two: Sources and Methods 36 2.1 Perceptions of a Global Game 36 2.2 Methods and Sources 43 References 47 Chapter Three: Micro, Meso, Macro Professionalism 50 3.1 Introduction 50 3.2 Micro Professionalism: Pioneering individuals 53 3.3 Meso Professionalism: Growing Internationalism 64 3.4 Macro Professionalism: Women's Champions League 70 3.5 Conclusion: From Germany 2011 to Canada 2015 81 References 86 i Conclusion 90 4.1 Conclusion 90 References 105 Recommendations 109 Appendix 1 Key Dates of European Union 112 Appendix 2 Key Dates for European football 116 Appendix 3 Summary A-Y by national association 122 Bibliography 158 ii Women’s Football, Europe and Professionalization 1971-2011 Abbreviations and Acronyms AFC Asian Football Confederation AIAW Association for Intercollegiate Athletics for Women ALFA Asian Ladies Football Association CAF Confédération Africaine de Football CFA People’s Republic of China Football Association China ’91 FIFA Women’s World Championship 1991 CONCACAF Confederation of North, Central American and Caribbean Association Football CONMEBOL -

Download the Programme Here

DUNDALK FC CLUB DIRECTORY Honorary Club President Des Casey Chairman Bill Hulsizer Board Bill Hulsizer, James Baboulas, David Samhat and Des Donleavy Sporting Director Jim Magilton Secretary Padraig McGowan Finance Officer Elaine Duffy Stadium Manager Aaron Lawless Office Manager Ailish Kelly DFC MAGAZINE: ISSUE 13 Media Officer Gavin McLaughlin Community Officer Liam Burns 06: FROM THE DUGOUT Academy Manager Stephen McDonnell Ground Staff John Moore, Jimmy Fisher, Cyril Moore and Stephen Fisher 10: FIRST-LEG REVIEW Commercial Manager Ronan Shields Marketing Consultant Paddy Casey Player Liaison Officer Des Donleavy 16: PLAYER REACTION Press Officer Darren Crawley Club Ambassadors Paul Brown and Andy Connolly 20: INTRO TO VITESSE Event Controller Regina O’Hare Bar Manager Kevin Carthy Office Admin Karen Travers 22: PLAYER PROFILES DUNDALK FC TEAM MANAGEMENT 26: RIP TOMMY CONNOLLY Head Coach Vinny Perth Goalkeeping Coach Graham Byas S&C Coach Graham Norton 34: RETRO: 1990 UEFA CUP Physio Sean Tiernan Doctor Dr Dualtach MacColgáin Sports Science Lorcan Mason 40: EUROPA CONFERENCE Video Analyst Dominic Corrigan Kit Manager Noel Walsh 42: EURO PROGRAMMES DUNDALK FC MAGAZINE 44: FOOTBALL ORANJE Editors Gavin McLaughlin and Paul Dunne Contributors David Farrelly, Tom 46: ARNHEM AWAY O’Connor, Sean De Loughry, Martyn Hindley, Padraig McGowan, Colm Murphy, Jim Murphy (RIP), Gerard 48: GIRLS ACADEMY Mooney Photography Sportsfile, Ciaran Culligan, Mick Slevin (RIP), Derry Journal, The 56: CLUB PARTNERS Argus Artwork Shane Doyle Printers Anglo Printers -

Communicatie Over Wedstrijden Tussen ADO Den Haag En AFC Ajax Algemeen

Communicatie over wedstrijden tussen ADO Den Haag en AFC Ajax Algemeen - In algemene zin moeten we realistisch communiceren. Er worden risico’s genomen en daar zijn we ons van bewust. Het is geen goed nieuws show gezien de bestaande sentimenten. Om de regie te houden over de berichtgeving zijn we het eens dat we vooraf een bericht moeten uitsturen vanuit de KNVB dat vervolgens 1 op 1 door de clubkanalen en gemeentensites wordt overgenomen. Verdere communicatie laten we afhangen van verzoeken en reacties vanuit de landelijke en lokale media waarbij uitgangspunt is dat bericht zodanig duidelijk is dat toelichting feitelijk niet of nauwelijks nodig hoeft te zijn. Leden van directies, MT, wethouders en BM’ers zal nadrukkelijk verzocht worden geen toelichting te geven anders dan het persbericht; - Het hoofdbericht zal zijn dat de wedstrijden tussen ADO Den Haag en AFC Ajax vanaf dit seizoen weer door beide supportersgroepen te bezoeken zijn. Beide clubs hebben zich hier samen met de KNVB voor ingezet, aangezien we ervan overtuigd zijn dat voetbal voor iedereen toegankelijk moet zijn. De aanwezigheid van uitsupporters komt de sfeer in het stadion, onder normale omstandigheden, ten goede. In de berichtgeving zal verder ingegaan worden: o Er is heel veel begrip voor alle emoties; o Alle betrokkenen spreken het vertrouwen uit over het proces; o Het is een regelgeving waar aan voldaan wordt; - We gaan de eerste berichtgeving op een zondag publiceren of een andere dag waarop veel voetbalnieuws is, waardoor dit bericht niet dé headliner wordt. Dit zal door de KNVB worden opgepakt en integraal worden doorgezet op de websites van de clubs en gemeenten; - We werken niet mee aan docu’s, maar verstrekken hen wel informatie voor items of documentaires.