Macerich Annual Report 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

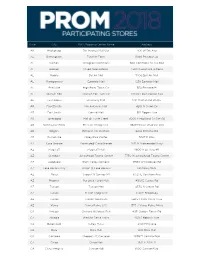

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

Printmgr File

Exhibit 99.2 Supplemental Financial Information For the three months ended March 31, 2019 The Macerich Company Supplemental Financial and Operating Information Table of Contents All information included in this supplemental financial package is unaudited, unless otherwise indicated. Page No. Corporate Overview 1-4 Overview 1-2 Capital Information and Market Capitalization 3 Changes in Total Common and Equivalent Shares/Units 4 Financial Data 5-11 Consolidated Statements of Operations (Unaudited) 5 Consolidated Balance Sheet (Unaudited) 6 Non-GAAP Pro Rata Financial Information (Unaudited) 7-9 2019 Guidance Range 10 Supplemental FFO Information 11 Capital Expenditures 12 Operational Data 13-27 Sales Per Square Foot 13 Sales Per Square Foot by Property Ranking 14-17 Occupancy 18 Average Base Rent Per Square Foot 19 Cost of Occupancy 20 Percentage of Net Operating Income by State 21 Property Listing 22-25 Joint Venture List 26-27 Debt Tables 28-30 Debt Summary 28 Outstanding Debt by Maturity Date 29-30 Development Pipeline 31 Corporate Information 32 This Supplemental Financial Information should be read in connection with the Company’s first quarter 2019 earnings announcement (included as Exhibit 99.1 of the Company’s Current Report on 8-K, event date May 2, 2019) as certain disclosures, definitions and reconciliations in such announcement have not been included in this Supplemental Financial Information. The Macerich Company Supplemental Financial and Operating Information Overview The Macerich Company (the “Company”) is involved in the acquisition, ownership, development, redevelopment, management and leasing of regional shopping centers located in the United States in many of the country’s most attractive, densely populated markets with significant presence on the West Coast, Arizona, Chicago and the Metro New York to Washington, DC corridor. -

Renovation Last Fall

Going Places Macerich Annual Report 2006 It’s more than the end result—it’s the journey. At Macerich®, what’s important isn’t just the destination. It’s the bigger picture, the before and after...the path we take to create remarkable places. For retailers, it’s about collaboration and continual reinvestment in our business and theirs. For the communities we serve, it’s about working together to create destinations that reflect their wants and needs. For investors, it’s about long-term value creation stemming from a clear vision. For consumers, it’s about the total experience our destinations deliver. 0 LETTER TO STOCKHOLDERS Letter to Our Stockholders Macerich continued to create significant value in 2006 by elevating our portfolio and building a sizeable return for our stockholders. Total stockholder return for the year was 33.9%, contributing to a three-year total return of 121.5% and a five-year total return of 326.2%. In 2006, the company increased dividends for the 13th consecutive year. As a company that considers its pipeline a tremendous source of strength BoulderTwenty Ninth is a prime Street example is a prime of howexample 2006 of was how indeed 2006 awas remarkable indeed a yearremark of - and growth, Macerich reached an important milestone in 2006 with the buildingable year netof building asset value net for asset Macerich. value for We Macerich. also completed We also the completed redevelop the- re- opening of Twenty Ninth Street in Boulder, Colorado. Not only is this a mentdevelopment of Carmel of CarmelPlaza in Plaza Northern in Northern California, California, another another excellent excellent model of model terrific new asset in an attractive, affluent community—it represents a sig- valueof value creation, creation, where where we we realized realized a significant a significant return return on onour our investment. -

Macerich Unveils Updated South Plains Mall

Macerich Unveils Updated South Plains Mall November 22, 2016 -New Experiences and Amenities Enhance Market-Dominant West Texas Shopping Center- SANTA MONICA, Calif., Nov. 22, 2016 /PRNewswire/ -- Macerich (NYSE: MAC), one of the nation's leading owners, operators and developers of one-of-a-kind retail properties in top markets, will today officially unveil a series of key updates to South Plains Mall in Lubbock, Texas. This property has been the region's dominant retail destination for more than 100 miles in any direction for more than 40 years. South Plains Mall is home to more than one million square feet of shopping, dining and entertainment as well as over 150 popular brands including Dillard's, JCPenney, Sears, Bealls and Premiere Cinemas with IMAX. During the past year, the center has updated all three entrances, added new lighting and flooring throughout the shopping center, and added new amenities including center-wide Wi-Fi, charging stations, soft and comfortable seating and new restrooms located on the north side of the center. Other additions designed to deliver an enhanced shopping experience include a new outdoor monument sign, new wayfinding signs both indoor and outdoor, and a refreshed outdoor landscape. "South Plains Mall is a true destination shopping center," said Randy Brant, Executive Vice President, Real Estate, Macerich. "Our targeted investments in this well-known and well-loved property deliver a fresh look, new retail concepts and elevated amenities – all designed to ensure the continued strong performance of this established regional favorite." Large crowds are expected for the official re-opening ceremony taking place this afternoon in the newly renovated Grand Court. -

5Mar200719253705

Exhibit 99.2 5MAR200719253705 Supplemental Financial Information For the three and twelve months ended December 31, 2008 The Macerich Company Supplemental Financial and Operating Information Table of Contents All information included in this supplemental financial package is unaudited, unless otherwise indicated. Page No. Corporate overview ....................................................... 1-3 Overview .............................................................. 1 Capital information and market capitalization ................................... 2 Changes in total common and equivalent shares/units .............................. 3 Financial data .......................................................... 4-5 Supplemental FFO information .............................................. 4 Capital expenditures ...................................................... 5 Operational data ........................................................ 6-9 Sales per square foot ..................................................... 6 Occupancy ............................................................. 7 Rent................................................................. 8 Cost of occupancy ....................................................... 9 Balance sheet information ................................................. 10-13 Summarized balance sheet information ........................................ 10 Debt summary .......................................................... 11 Outstanding debt by maturity date ........................................... -

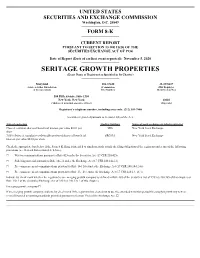

SERITAGE GROWTH PROPERTIES (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of Report (Date of earliest event reported): November 5, 2020 SERITAGE GROWTH PROPERTIES (Exact Name of Registrant as Specified in Its Charter) Maryland 001-37420 38-3976287 (State or Other Jurisdiction (Commission (IRS Employer of Incorporation) File Number) Identification No.) 500 Fifth Avenue, Suite 1530 New York, New York 10110 (Address of principal executive offices) (Zip code) Registrant’s telephone number, including area code: (212) 355-7800 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbols Name of each exchange on which registered Class A common shares of beneficial interest, par value $0.01 per SRG New York Stock Exchange share 7.00% Series A cumulative redeemable preferred shares of beneficial SRG-PA New York Stock Exchange interest, par value $0.01 per share Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). -

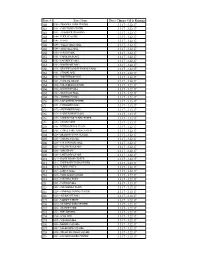

Store # Store Name Dates Clinique Gift Is Running 140 3.3.17

Store # Store Name Dates Clinique Gift Is Running 140 0140 - TRIANGLE TOWN CENTER 3.3.17 - 3.22.17 141 0141 - CARY TOWN CENTER 3.3.17 - 3.22.17 143 0143 - ALAMANCE CROSSING 3.3.17 - 3.22.17 144 0144 - FOUR SEASONS 3.3.17 - 3.22.17 145 0145 - HANES 3.3.17 - 3.22.17 146 0146 - VALLEY HILLS MALL 3.3.17 - 3.22.17 148 0148 - ASHEVILLE MALL 3.3.17 - 3.22.17 150 0150 - SOUTH PARK 3.3.17 - 3.22.17 151 0151 - CAROLINA PLACE 3.3.17 - 3.22.17 152 0152 - EASTRIDGE MALL 3.3.17 - 3.22.17 153 0153 - NORTHLAKE MALL 3.3.17 - 3.22.17 156 0156 - WESTFIELD INDEPENDENCE MALL 3.3.17 - 3.22.17 161 0161 - CITADEL MALL 3.3.17 - 3.22.17 162 0162 - NORTHWOOD MALL 3.3.17 - 3.22.17 163 0163 - COASTAL GRAND 3.3.17 - 3.22.17 164 0164 - COLUMBIANA CENTRE 3.3.17 - 3.22.17 166 0166 - HAYWOOD MALL 3.3.17 - 3.22.17 167 0167 - WESTGATE MALL 3.3.17 - 3.22.17 168 0168 - ANDERSON MALL 3.3.17 - 3.22.17 170 0170 - MACARTHUR CENTER 3.3.17 - 3.13.17 171 0171 - LYNNHAVEN MALL 3.3.17 - 3.13.17 172 0172 - GREENBRIER MALL 3.3.17 - 3.13.17 174 0174 - PATRICK HENRY MALL 3.3.17 - 3.13.17 176 0176 - SHORT PUMP TOWN CENTER 3.3.17 - 3.13.17 179 0179 - STONY POINT 3.3.17 - 3.13.17 201 0201 - INTERNATIONAL PLAZA 3.3.17 - 3.22.17 203 0203 - CITRUS PARK TOWN CENTER 3.3.17 - 3.22.17 204 0204 - BRANDON TOWN CENTER 3.3.17 - 3.22.17 205 0205 - TYRONE SQUARE 3.3.17 - 3.22.17 206 0206 - COUNTRYSIDE MALL 3.3.17 - 3.22.17 207 0207 - GULFVIEW SQUARE 3.3.17 - 3.22.17 208 0208 - WIREGRASS 3.3.17 - 3.22.17 209 0209 - LAKELAND SQUARE 3.3.17 - 3.22.17 210 0210 - EAGLE RIDGE CENTER 3.3.17 - 3.22.17 213 0213 -

The Cheesecake Factory Restaurants in Operation

The Cheesecake Factory® Restaurants in Operation State City Location Address Phone Alabama Birmingham The Summit 236 Summit Boulevard (205) 262-1800 Arizona Chandler Chandler Fashion Center 3111 W. Chandler Boulevard (480) 792-1300 Mesa Superstition Springs Center 6613 East Southern Avenue (480) 641-7300 Peoria Arrowhead Fountains Center 16134 N. 83rd Avenue (623) 773-2233 Phoenix Biltmore Fashion Park 2402 E. Camelback Road (602) 778-6501 Scottsdale Kierland Commons 15230 N. Scottsdale Road (480) 607-0083 Tucson Tucson Mall 60 West Wetmore Road (520) 408-0033 California Anaheim Anaheim Garden Walk 321 Katella Avenue (714) 533-7500 Beverly Hills 364 N. Beverly Drive (310) 278-7270 Brea Brea Mall 120 Brea Mall Way (714) 255-0115 Carlsbad The Shoppes at Carlsbad 2525 El Camino Real (760) 730-9880 Cerritos Los Cerritos Center 201 Los Cerritos Center (562) 402-2906 Chula Vista Otay Ranch Town Center 2015 Birch Road (619) 421-2500 Corte Madera The Village 1736 Redwood Highway (415) 945-0777 Escondido North County Mall 200 E. Via Rancho Parkway (760) 743-2253 Fresno Fashion Fair Mall 639 East Shaw Avenue (559) 228-1400 Glendale Americana at Brand 511 Americana Way (818) 550-7505 Huntington Beach Bella Terra Mall 7871 Edinger Avenue (714) 889-1500 Irvine Irvine Spectrum 71 Fortune Drive (949) 788-9998 Los Angeles The Grove 189 The Grove Drive (323) 634-0511 Marina del Rey 4142 Via Marina (310) 306-3344 Mission Viejo The Shops at Mission Viejo 42 The Shops at Mission Viejo (949) 364-6200 Newport Beach Fashion Island Mall 1141 Newport Center Drive (949) 720-8333 Oxnard The Collection at RiverPark 600 Town Center Drive (805) 278-8878 Pasadena 2 West Colorado Boulevard (626) 584-6000 Pleasanton Stoneridge Mall 1350 Stoneridge Mall Road (925) 463-1311 Rancho Cucamonga Victoria Gardens Mall 12379 N. -

The Macerich Company

2 THE MACERICH 0 COMPANY 0 0 Annual Report For additional information about Macerich, our Form 10-K for the year ended December 31, 2000 is included in this Annual Report for your review. (All amounts in thousands, except per share and property data) 2000 1999 1998 1997 1996 1995 Operating Data: Total revenues $ 320,092 $ 327,444 $ 283,861 $ 221,214 $ 155,059 $ 102,469 Shopping center expenses $ 101,674 $ 100,327 $ 89,991 $ 70,901 $ 50,792 $ 31,580 REIT general and administrative expenses $ 5,509 $ 5,488 $ 4,373 $ 2,759 $ 2,378 $ 2,011 Earnings before interest, income taxes, depreciation, amortization, minority interest, equity in income (loss) of unconsolidated entities, extraordinary items, gain (loss) on sale of assets and preferred dividends (EBITDA) – includes joint ventures at their pro rata share $ 314,628 $ 301,803 $ 230,362 $ 154,140 $ 109,266 $ 76,241 Net Income $ 56,929 $ 129,011 $ 44,075 $ 22,046 $ 18,911 $ 11,303 Net Income per share – diluted $ 1.11 $ 2.99 $ 1.06 $ 0.85 $ 0.89 $ 0.73 Other Data: FFO – diluted (1) $ 167,244 $ 164,302 $ 120,518 $ 83,427 $ 62,428 $ 44,938 Cash distributions declared per common share $ 2.06 $ 1.965 $ 1.865 $ 1.78 $ 1.70 $ 1.66 FFO per share – diluted (1) $ 2.82 $ 2.698 $ 2.426 $ 2.172 $ 1.874 $ 1.669 Portfolio occupancy at year end 93.3% 92.8% 93.2% 91.8% 91.6% 92.0% Average tenant sales per square foot - mall & freestanding stores $ 349 $ 336 $ 319 $ 317 $ 290 $ 284 Balance Sheet Data: Investment in real estate (before accumulated depreciation) $ 2,228,468 $ 2,174,535 $ 2,213,125 $ 1,607,429 -

Customer Appreciation Participating List

Pretzelmaker Customer Appreciation Day 2018 Participating Stores ADDRESS I ADDRESS II CITY STATE ZIP PHONE NUMBER Village Mall Auburn 1627 Opelika Road,#10 Auburn AL 36830 (334) 821‐8368 Brookwood Village 724 Brookwood Village Birmingham AL 35209 (205) 871‐1333 Regency Mall 301 Cox Creek Parkway,Space #1302 Florence AL 35630 (256) 760‐1980 Parkway Place Mall 2801 Memorial Parkway SW Huntsville AL 35801 (205) 539‐3255 The Shoppes at EastChase 7048 EastChase Parkway Montgomery AL 36117 (334) 356‐8111 Central Mall 5111 Rogers Avenue Fort Smith AR 72903 (479) 452‐2525 Flagstaff Mall 4650 Northe Highway 89 Flagstaff AZ 86004 Desert Sky Mall 7611 West Thomas Rd. Phoenix AZ 85033 (623) 873‐1540 Foothills Mall ‐ Bakery Cafe 7401 N La Cholla Blvd #155 Tucson AZ 85741 (520) 531‐8404 Tucson Mall 4500 N Oracle Rd Suite 212 Tucson AZ 85705 Park Place Mall 5870 East Broadway, #K‐9 Tuscon AZ 85711 Sunrise Mall 6138 Sunrise Mall Citrus Heights CA 95610 (916) 723‐7197 Bayshore Mall 3300 Broadway Spc #304A Eureka CA 95501 (707) 444‐9595 Solano Town Center 1350 Travis Blvd, Space FC98 Fairfield CA 94533 Folsom Premium Outlet 13000 Folsom Blvd.,Suite 210 Folsom CA 95630‐0002 (916) 351‐1448 Del Monte Mall 520 Del Monte Center, U‐526 Monterey CA 93940 (831) 646‐0243 Moreno Valley Mall 22500 Town Cir Ste 1205 Moreno Valley CA 92553 (951) 653‐2557 Antelope Valley Mall 1233 kW. Rancho Vista Blvd., #1111 Palmdale CA 93551 (661) 947‐8444 Galleria at Roseville 1151 Galleria Blvd.,#276 Roseville CA 95678 (916) 878‐5418 Fashion Square at Sherman 14006 Riverside Drive,Space #86 Sherman Oaks CA 91423‐6300 (818) 990‐7161 The Oaks Mall 378 W. -

The Cheesecake Factory Company-Owned

The Cheesecake Factory® Company-Owned Restaurants in Operation State City Location Address Phone Alabama Birmingham The Summit 236 Summit Boulevard (205) 262-1800 Arizona Chandler Chandler Fashion Center 3111 W. Chandler Boulevard (480) 792-1300 Mesa Superstition Springs Center 6613 East Southern Avenue (480) 641-7300 Peoria Arrowhead Fountains Center 16134 N. 83rd Avenue (623) 773-2233 Phoenix Biltmore Fashion Park 2402 E. Camelback Road (602) 778-6501 Scottsdale Kierland Commons 15230 N. Scottsdale Road (480) 607-0083 Tucson Tucson Mall 60 West Wetmore Road (520) 408-0033 California Anaheim Anaheim Garden Walk 321 Katella Avenue (714) 533-7500 Beverly Hills 364 N. Beverly Drive (310) 278-7270 Brea Brea Mall 120 Brea Mall Way (714) 255-0115 Carlsbad The Shoppes at Carlsbad 2525 El Camino Real (760) 730-9880 Cerritos Los Cerritos Center 201 Los Cerritos Center (562) 402-2906 Chula Vista Otay Ranch Town Center 2015 Birch Road (619) 421-2500 Corte Madera The Village 1736 Redwood Highway (415) 945-0777 Escondido North County Mall 200 E. Via Rancho Parkway (760) 743-2253 Fresno Fashion Fair Mall 639 East Shaw Avenue (559) 228-1400 Glendale Americana at Brand 511 Americana Way (818) 550-7505 Huntington Beach Bella Terra Mall 7871 Edinger Avenue (714) 889-1500 Irvine Irvine Spectrum 71 Fortune Drive (949) 788-9998 Los Angeles The Grove 189 The Grove Drive (323) 634-0511 Marina del Rey 4142 Via Marina (310) 306-3344 Mission Viejo The Shops at Mission Viejo 42 The Shops at Mission Viejo (949) 364-6200 Newport Beach Fashion Island Mall 1141 Newport Center Drive (949) 720-8333 Oxnard The Collection at RiverPark 600 Town Center Drive (805) 278-8878 Pasadena 2 West Colorado Boulevard (626) 584-6000 Pleasanton Stoneridge Mall 1350 Stoneridge Mall Road (925) 463-1311 Rancho Cucamonga Victoria Gardens Mall 12379 N. -

Texas Times West

COMP SOUTHWEST COLLECT ION Lubbock's Home Owned Thursday, TEXAS TECH April 18, 1974 LUEEOCK , TEXAS 79409 Twelve Pages WEST (Week of April 18-24) TEXAS TIMES Dedicated to Informing the Citizens of West Texas Reynell Parkins to Speak to Teachers Here Reynell Monsell Parkins, pro- Twenty-fourth Annual Convention of fessor of the School of Architecture and Graduate Pro- Women's Clubs Set Here Friday-Sunday gram in Community and Regional for the University of Texas, will be Members from throughout the Club members in making this an the keynote speaker for the state will be in the Hub City this interesting confab for those in Lubbock Classroom Teachers' week to attend the 24th annual attendance. Association Public Relations convention of the Stokes-Parker Activities will include a Banquet on Monday evening, April District Texas Association of debutante ball and dance on 22nd, at 7 p.m. in the Coronado Statue For King Proposed Womens Clubs. The three day Saturday evening, tickets are on High School cafeteria. Washington — (NBNS) — More meeting, April 19 through 21, will sale for $5.00; workshops and a With a theme: "Involvement", than 140 members of the U.S. be held at the Red Raider gathering of the women at Bethel several awards will also be House of Representatives have Convention Center, 6025 Avenue A.M.E. Church Sunday morning. presented by the association. sponsored legislation to commis- A. Mrs. Long told the Times that Those awards include: "The sion a statue of Dr. Martin Luther With a theme of "Black Women they are expecting 200 women to Friend of Education Award", King Jr.