Glossary of Technical Analysis Terms

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Point and Figure Charts

Point and Figure Charts Point-and-figure (P&F) chart is a special type of graphical analysis, which lays stress to prediction of medium-term and long-term trends. Conclusion Let’s single out advantages and disadvantages of Point and Figure charts. Point and Figure Advantages 1. P&F charts send only clear buy or sell signals without any dual nature. 2. P&F charts take into account only “important” price changes and filter out market noise. This being said, the “importance” of changes is set by a trader. 3. P&F charts are not affected by time effect, which sometimes introduces additional element of uncertainty on general charts. 4. P&F charts allow to identify support and resistance levels, and also trend lines. 5. P&F charts are very intelligible. Point and Figure Disadvantages 1. P&F charts send clear signals only for medium-term and long-term periods and are almost not intended for short-term trade. Building Point and Figure Charts The majority of the most popular charts, used for technical analysis, are built in accordance with opening price, closing price, maximum or minimum for a definite period. Only closing price for a period is used for building Point and Figure charts. Point and Figure charts consist of X and O columns, which reflect the filtered price changes. Increase in prices is shown by “X” boxes, and drop in prices is shown by “O” boxes. New boxes are created only in case of price change by the size of a box or more in one of directions. -

Forecasting Direction of Exchange Rate Fluctuations with Two Dimensional Patterns and Currency Strength

FORECASTING DIRECTION OF EXCHANGE RATE FLUCTUATIONS WITH TWO DIMENSIONAL PATTERNS AND CURRENCY STRENGTH A THESIS SUBMITTED TO THE GRADUATE SCHOOL OF NATURAL AND APPLIED SCIENCES OF MIDDLE EAST TECHNICAL UNIVERSITY BY MUSTAFA ONUR ÖZORHAN IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF DOCTOR OF PILOSOPHY IN COMPUTER ENGINEERING MAY 2017 Approval of the thesis: FORECASTING DIRECTION OF EXCHANGE RATE FLUCTUATIONS WITH TWO DIMENSIONAL PATTERNS AND CURRENCY STRENGTH submitted by MUSTAFA ONUR ÖZORHAN in partial fulfillment of the requirements for the degree of Doctor of Philosophy in Computer Engineering Department, Middle East Technical University by, Prof. Dr. Gülbin Dural Ünver _______________ Dean, Graduate School of Natural and Applied Sciences Prof. Dr. Adnan Yazıcı _______________ Head of Department, Computer Engineering Prof. Dr. İsmail Hakkı Toroslu _______________ Supervisor, Computer Engineering Department, METU Examining Committee Members: Prof. Dr. Tolga Can _______________ Computer Engineering Department, METU Prof. Dr. İsmail Hakkı Toroslu _______________ Computer Engineering Department, METU Assoc. Prof. Dr. Cem İyigün _______________ Industrial Engineering Department, METU Assoc. Prof. Dr. Tansel Özyer _______________ Computer Engineering Department, TOBB University of Economics and Technology Assist. Prof. Dr. Murat Özbayoğlu _______________ Computer Engineering Department, TOBB University of Economics and Technology Date: ___24.05.2017___ I hereby declare that all information in this document has been obtained and presented in accordance with academic rules and ethical conduct. I also declare that, as required by these rules and conduct, I have fully cited and referenced all material and results that are not original to this work. Name, Last name: MUSTAFA ONUR ÖZORHAN Signature: iv ABSTRACT FORECASTING DIRECTION OF EXCHANGE RATE FLUCTUATIONS WITH TWO DIMENSIONAL PATTERNS AND CURRENCY STRENGTH Özorhan, Mustafa Onur Ph.D., Department of Computer Engineering Supervisor: Prof. -

An Interview with John Bollinger

® AIQ Opening BellMonthly IN THIS ISSUE VOL. 6 ISSUE 2 FEBRUARY 1997 TRADING TECHNIQUES Feature John Bollinger discusses his Bollinger Bands .................. 1 AN INTERVIEW WITH JOHN BOLLINGER Se ctions account program, what percent of the By David Vomund investments are in equities and what is Price Volume Divergence your average holding period? Report .................................. 5 his month we are pleased to JB: We are primarily equity Market Review ..................... 8 present an interview with John investors. We dont buy any futures. Data Maintenance ............... 8 Bollinger, a keynote speaker at Our growth model is currently allo- Tour March seminar in Dallas. Mr. cated approximately 60% to the stock Bollinger is market, 20% to the president of bond market, and Bollinger Capital 20% to the interna- Management. He tional stock mar- provides money ket. We are management primarily interme- services and diate term traders. publishes the Our research tends Capital Growth to center on a Letter. He is best holding period of known for his three to six months Bollinger Bands, with most of the which is a feature emphasis on six in TradingExpert. months. However, For information on that doesnt Bollinger Capital preclude us from The Opening Bell Monthly Managements John Bollinger, CFA, CMT taking advantage is a publication of products and of short term AIQ Incorporated services, call 310-798-8855 or write to opportunities, for example when we see David Vomund, Chief Analyst P.O. Box 3358, Manhattan Beach, CA an attractive technical non-confirma- P.O. Box 7530 90266. Send e-mail to tion. Incline Village, Nevada 89452 [email protected]. -

Investing with Bollinger Bands

Investing with Bollinger Bands This article was written some years ago, but is very relevant to today. The charts used to illustrate the text are now somewhat dated, but still relevant for the present purpose of teaching a technique. As moving averages became more popular, some analysts noticed that when prices were moving upward, they had a tendency to rise only so far above the moving average. When prices were falling they tended to fall only so far below the moving average. How far they rose or fell seemed to vary from stock to stock and also from time to time. However, the tendency was so consistent that it could be useful to both traders and investors. These early analysts hit on the idea of drawing lines a certain percentage of the moving average above and below the moving average line. They selected the percentage stock-by-stock so that it seemed to catch most of the price action on the chart, typically 90% or more of the price action. GWT - GWA INTERNATIONAL > -2 to 291 D @ D 020103-070604 320 MOV AVS 22(0) 5 band 310 300 290 280 270 260 250 240 230 JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MAR APR MAY JUN 03 04 Chart 1: Daily Line Chart of GWA International with a 22-day Moving Average and 5% Bands The result was something like Chart 1, where we have a daily line chart, on which is drawn a 22-day moving average, with 5% bands above and below it. -

Course Content

Course Content Basic Forex Education (12 Topics) Lesson Content 12 Steps Why Trade Forex When to Trade Forex Trading Terminology Or Where Am I Going Long How To Trade With Leverage Whats a PIP How To Place a Trade in Forex Types of Forex Orders Technical Analysis in Forex Fundamental Analysis in Forex Types of Forex Charts Support and Resistance in Forex Trendlines Fibonacci (4 Topics) Lesson Content 4 Steps Fibonacci Forex Fibonacci Extensions Learn Forex Fibonacci Fan and Arcs Learn Forex Combining Fibonacci With Other Technical Analysis Tools Understanding Candlesticks (13 Topics) Lesson Content 13 Steps Candlesticks Doji Candlestick in Forex Marubazu Candlestick in Forex Hammer and Hanging Man Candlesticks Shooting Star and Inverted Hammer Candlestick Bullish Piercing Pattern Dark Cloud Cover Pattern Bullish and Bearish engulfing patterns Tweezer Tops and Bottoms Morning and Evening Star Patterns 3 White Soldiers 3 Black Crows 3 Inside Up 3 Inside Down Pattern Rising and Falling Three Methods Chart Formation Patterns (13 Topics) Lesson Content 13 Steps Forex Double Top and Double Bottom Formation Patterns Learn Forex Head and Shoulders Pattern Forex Inverse Head and Shoulders Pattern Forex Bull Flag Formation Patterns Forex Bear Flag Patterns Forex Bullish and Bearish Pennant Formation Forex Falling Wedge Pattern Forex Ascending and Descending Triangle Formations Forex Symmetrical Triangle Pattern Forex Box Range Forex Cup and Handle Formation Pattern Forex Inverse Cup and Handle Pattern Forex Rising Wedge Pattern Forex Indicators -

Point and Figure Relative Strength Signals

February 2016 Point and Figure Relative Strength Signals JOHN LEWIS / CMT, Dorsey, Wright & Associates Relative Strength, also known as momentum, has been proven to be one of the premier investment factors in use today. Numerous studies by both academics and investment ABOUT US professionals have demonstrated that winning securities continue to outperform. This phenomenon has been found Dorsey, Wright & Associates, a Nasdaq Company, is a in equity markets all over the globe as well as commodity registered investment advisory firm based in Richmond, markets and in asset allocation strategies. Momentum works Virginia. Since 1987, Dorsey Wright has been a leading well within and across markets. advisor to financial professionals on Wall Street and investment managers worldwide. Relative Strength strategies focus on purchasing securities that have already demonstrated the ability to outperform Dorsey Wright offers comprehensive investment research a broad market benchmark or the other securities in the and analysis through their Global Technical Research Platform investment universe. As a result, a momentum strategy and provides research, modeling and indexes that apply requires investors to purchase securities that have already Dorsey Wright’s expertise in Relative Strength to various appreciated quite a bit in price. financial products including exchange-traded funds, mutual funds, UITs, structured products, and separately managed There are many different ways to calculate and quantify accounts. Dorsey Wright’s expertise is technical analysis. The momentum. This is similar to a value strategy. There are Company uses Point and Figure Charting, Relative Strength many different metrics that can be used to determine a Analysis, and numerous other tools to analyze market data security’s value. -

Lesson 12 Technical Analysis

Lesson 12 Technical Analysis Instructor: Rick Phillips 702-575-6666 [email protected] Course Description and Learning Objectives Course Description Learn what technical analysis entails and the various ways to analyze the markets using this type of analysis Lessons and Learning Objectives ▪ Define technical analysis ▪ Explore the history of technical analysis ▪ Examine the accuracy of technical analysis ▪ Compare technical analysis to fundamental analysis ▪ Outline different types of technical studies ▪ Study tools and systems which provide technical analysis 2 What is Technical Analysis Short Description: Using the past to predict the future Long Description: A way to analyze securities price patterns, movements, and trends to extrapolate the ranges of potential future prices 3 History of Technical Analysis The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amsterdam-based merchant Joseph de la Vega's accounts of the Dutch financial markets in the 17th century. In Asia, technical analysis is said to be a method developed by Homma Munehisa during the early 18th century which evolved into the use of candlestick techniques, and is today a technical analysis charting tool. In the 1920s and 1930s, Richard W. Schabacker published several books which continued the work of Charles Dow and William Peter Hamilton in their books Stock Market Theory and Practice and Technical Market Analysis. In 1948, Robert D. Edwards and John Magee published Technical Analysis of Stock Trends which is widely considered to be one of the seminal works of the discipline. It is exclusively concerned with trend analysis and chart patterns and remains in use to the present. -

Bullish Percent Index – See How to Time Bull and Bear Markets

Bullish percent index – See How to Time Bull and Bear Markets We can all agree that the bullish percent index (BPI) is a market breadth indicator that we can use to gauge market health. But is the indicator something you should use when trading? More importantly, if you do use the indicator when trading, when and how should you place your orders. Wellin this post, we will dissect how the BPI can be used to navigate the waters and some specific techniques you can use to increase your odds. Why Should You Care About the BPI? The BPI indicator is calculated by taking the total number of issues in an index or industry that are generating point and figure buy signals and dividing it by the total number of stocks in that group. The basic rule for using the bullish percent index is when the BPI is above 70%, the market is overbought, and conversely, when the indicator is below 30%, the market is oversold. The most popular BPI is the NYSE Bullish Percent Index, which is the tool of choice for famed point and figure analyst, Thomas Dorsey. The bullish percent index is generally plotted on with a two-point box size. Later in this article, we will cover how to confirm bull and bear markets. Bullish percent index or BPI for short might seem as just another fancy name for a market breadth indicator. Between the BPI and many other similar indicators, one might wonder the need to use this indicator. Well, the BPI is an indicator for the stock markets which is quite unique. -

Technical-Analysis-Bloomberg.Pdf

TECHNICAL ANALYSIS Handbook 2003 Bloomberg L.P. All rights reserved. 1 There are two principles of analysis used to forecast price movements in the financial markets -- fundamental analysis and technical analysis. Fundamental analysis, depending on the market being analyzed, can deal with economic factors that focus mainly on supply and demand (commodities) or valuing a company based upon its financial strength (equities). Fundamental analysis helps to determine what to buy or sell. Technical analysis is solely the study of market, or price action through the use of graphs and charts. Technical analysis helps to determine when to buy and sell. Technical analysis has been used for thousands of years and can be applied to any market, an advantage over fundamental analysis. Most advocates of technical analysis, also called technicians, believe it is very likely for an investor to overlook some piece of fundamental information that could substantially affect the market. This fact, the technician believes, discourages the sole use of fundamental analysis. Technicians believe that the study of market action will tell all; that each and every fundamental aspect will be revealed through market action. Market action includes three principal sources of information available to the technician -- price, volume, and open interest. Technical analysis is based upon three main premises; 1) Market action discounts everything; 2) Prices move in trends; and 3) History repeats itself. This manual was designed to help introduce the technical indicators that are available on The Bloomberg Professional Service. Each technical indicator is presented using the suggested settings developed by the creator, but can be altered to reflect the users’ preference. -

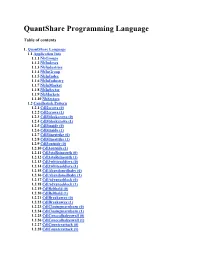

Timeframeset

QuantShare Programming Language Table of contents 1. QuantShare Language 1.1 Application Info 1.1.1 NbGroups 1.1.2 NbIndexes 1.1.3 NbIndustries 1.1.4 NbInGroup 1.1.5 NbInIndex 1.1.6 NbInIndustry 1.1.7 NbInMarket 1.1.8 NbInSector 1.1.9 NbMarkets 1.1.10 NbSectors 1.2 Candlestick Pattern 1.2.1 Cdl2crows (0) 1.2.2 Cdl2crows (1) 1.2.3 Cdl3blackcrows (0) 1.2.4 Cdl3blackcrows (1) 1.2.5 Cdl3inside (0) 1.2.6 Cdl3inside (1) 1.2.7 Cdl3linestrike (0) 1.2.8 Cdl3linestrike (1) 1.2.9 Cdl3outside (0) 1.2.10 Cdl3outside (1) 1.2.11 Cdl3staRsinsouth (0) 1.2.12 Cdl3staRsinsouth (1) 1.2.13 Cdl3whitesoldiers (0) 1.2.14 Cdl3whitesoldiers (1) 1.2.15 CdlAbandonedbaby (0) 1.2.16 CdlAbandonedbaby (1) 1.2.17 CdlAdvanceblock (0) 1.2.18 CdlAdvanceblock (1) 1.2.19 CdlBelthold (0) 1.2.20 CdlBelthold (1) 1.2.21 CdlBreakaway (0) 1.2.22 CdlBreakaway (1) 1.2.23 CdlClosingmarubozu (0) 1.2.24 CdlClosingmarubozu (1) 1.2.25 CdlConcealbabyswall (0) 1.2.26 CdlConcealbabyswall (1) 1.2.27 CdlCounterattack (0) 1.2.28 CdlCounterattack (1) 1.2.29 CdlDarkcloudcover (0) 1.2.30 CdlDarkcloudcover (1) 1.2.31 CdlDoji (0) 1.2.32 CdlDoji (1) 1.2.33 CdlDojistar (0) 1.2.34 CdlDojistar (1) 1.2.35 CdlDragonflydoji (0) 1.2.36 CdlDragonflydoji (1) 1.2.37 CdlEngulfing (0) 1.2.38 CdlEngulfing (1) 1.2.39 CdlEveningdojistar (0) 1.2.40 CdlEveningdojistar (1) 1.2.41 CdlEveningstar (0) 1.2.42 CdlEveningstar (1) 1.2.43 CdlGapsidesidewhite (0) 1.2.44 CdlGapsidesidewhite (1) 1.2.45 CdlGravestonedoji (0) 1.2.46 CdlGravestonedoji (1) 1.2.47 CdlHammer (0) 1.2.48 CdlHammer (1) 1.2.49 CdlHangingman (0) 1.2.50 -

Rising Wedge, Falling Wedge (PDF)

RISING WEDGE, FALLING WEDGE Rewarding patterns…provided you stay disciplined! Introduction The wedge is a very usual chartist pattern which is made of two converging trendlines that go in the same direction, both upwards or both downwards. As such, it can be immediately distinguished from a triangle. This pattern can be found on every timeframe, from the monthly charts to intraday price action. There are two sorts of wedges that have opposite consequences: Falling wedges, mostly completed following a sharp slump and which have a bullish implication, Rising wedges, which foreshadow a violent, downwards reversal phase. Their bearish bias is all the more pronounced since they are completed after a long period of time, and following a clear uptrend. But regarding most wedges as reversal patterns are just an opinion on our own. Many authors, however, consider that following the examples of triangles, pennants and flags, wedges are essentially continuation patterns, sloped against the trend. True, you can find falling wedges just in the middle of a bullish trend, or rising wedges within a bearish trend. A perfect example of continuation rising wedge made on the Japanese Topix index in 2007 is shown on the chart below. 1 Setting up precise figures on the continuation or reversal nature of wedges is hard and useless, we think. What is of more interest is that continuation wedges tend to complete in a generally shorter lapse of time than reversal wedges. Furthermore, the debate over the reversal/continuation nature of wedges is of minor importance as these patterns are overwhelmingly broken in the "natural" sense: downwards for a rising wedge, upwards for a falling wedge. -

Technical Analysis Explained by Martin J

Contents Contents ........................................................................................................................................................ 1 Introduction .................................................................................................................................................. 3 Chapter I ........................................................................................................................................................ 4 What is Technical Analysis?....................................................................................................................... 4 1.1 Definition of Technical Analysis ...................................................................................................... 4 1.2. Philosophy of Technical Analysis .................................................................................................... 4 1.3. Technical Analysis vs. Fundamental Analysis ................................................................................. 5 1.4. Technician or Chartist? Is There Any Difference? .......................................................................... 6 1.5. Different Theories on Technical Analysis ....................................................................................... 6 Chapter II ....................................................................................................................................................... 8 Trend In Terms of Technical Analysis .......................................................................................................