Earnings Release for the Quarter Ended Dec. 31, 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Zee Entertainment Enterprises Limited Quarter Three Financial Year 2010- Earnings Conference Call January 19 2010, 1300Hrs IST

3Q (October- December 2009) FY 2010 Teleconference January 19, 2010 Zee Entertainment Enterprises Limited Quarter Three Financial Year 2010- Earnings Conference Call January 19 2010, 1300hrs IST Moderator Ladies and gentlemen good afternoon and welcome to the Zee Entertainment Enterprises Ltd. Q3 FY2010 results conference call. Please note that this conference is being recorded. At this time I would like to hand the conference over to Mr. Harshdeep Chhabra from Zee Entertainment. Thank you and over to you sir. Harshdeep Chhabra Ladies and gentlemen, thank you for joining us today. This conference call has been organized to update our investors on the company’s performance in the third quarter of fiscal 2010 and to share with you the outlook of the management of Zee Entertainment Enterprises Limited. We do hope that you had a chance to go through copies of the earnings release and the results, both of which are uploaded on our website www.zeetelevision.com. To discuss the results and performance joining me today is Mr. Punit Goenka, Managing Director and CEO of ZEEL, along with members of the senior management team of the company including Mr. Hitesh Vakil, CFO & Mr. Atul Das, Head- Corporate Strategy & Business Development. We will start with a brief statement from Mr. Punit Goenka on the third quarter performance and will then open the discussion for question and answers. I would like to remind everybody that anything we say during this call that refers to our outlook for the future is a forward-looking statement that must be taken in the context of the risk that we face. -

Management Discussion and ANALYSIS

CORPORATE OVERVIEW OPERATIONAL OVERVIEW 72 BOARD AND MANAGEMENT REPORTS FINANCIAL STATEMENTS Management Discussion and ANALYSIS The figures have been stated in` /million in the MD&A for better readability. Investors are cautioned that this discussion contains forward-looking statements that involve risks and In FY2012, 10.5 million uncertainties including, but not limited to, risks inherent in the Company’s growth strategy, acquisition plans, dependence subscribers have adopted on certain businesses, dependence on availability of qualified and trained manpower and other factors. The satellite based television following discussion with the Company’s financial statements included herein and services via DTH, taking the notes thereto: OVERVIEW Zee Entertainment Enterprises Limited the gross DTH subscriber (ZEE) (BSE Code: 505537, NSE Code: ZEEL.EQ) is one of India’s largest vertically integrated media and entertainment base to 44.6 million company. The Company was formed in 1982. ZEE was the first company to launch a satellite channel in India and strong. from being a single channel for a single geography today operates multiple channels across multiple geographies in different languages and genres. The Company’s programming reaches out to over 650 million viewers across 168 countries. ZEE channel portfolio, across various genres in the Indian market, includes: i. Hindi Entertainment: Zee TV, Zee Smile, 9X ii. Hindi Movies: Zee Cinema, Zee Premier, Zee Action, Zee Classic iii. English Entertainment, Movies and Life style: Zee Studio, Zee Café, Zee Trendz ANNUAL REPORT 2011-12 Notice Directors’ Report Annexure to Directors’ Report Report on Corporate Governance Management Discussion & Analysis 73 The Indian Media and Entertainment Industry 11.7% witnessed steady growth in 2011. -

Extraordinary Together

Experience the Extraordinary ANNUAL REPORT 2017-18 ZEE ENTERTAINMENT ENTERPRISES LIMITED WELCOME TO THE EXTRAORDINARY WORLD OF ZEE! The journey of a thousand miles begins with one step. We took our first Our new brand ideology – ‘Extraordinary Together’, celebrates our step 25 years back with a simple idea - create stories that entertain, belief in the power of working together, that we’re greater than the inspire, and touch hearts. We started small but success fuelled our sum of our parts and from collaboration comes the strength to deliver desires, dreams and ambitions. As we moved ahead, the goals became the exceptional. Our mission to create extraordinary entertainment more audacious and we challenged ourselves to do more. We achieved experiences for our audience could not have been achieved without milestones which were not visible at the beginning and looked the support of our employees, partners and peers, who had the faith impossible even as we progressed. True to the saying, ‘A dream you in our vision and walked alongside us. At the cusp of our dream alone is only a dream, a dream you dream together is reality’, 25th anniversary, we reaffirm our commitment to work tirelessly with our vision materialised only because it was shared by our partners and each of them, to create new benchmarks and deliver the extraordinary. peers. Today, our 1.3 billion strong audience in 170+ countries is a result Mosaic, an art-form made of innumerable elements, each of which is of not only our relentless efforts but also of the countless others who vital to the picture that emerges when they all come together, is thus supported us on the way. -

A New Vision Is Blooming

A NEW VISION IS BLOOMING ZEE 4.0 - ANNUAL REPORT 2020-21 Zee Entertainment Enterprises Limited Transformation stems from the natural evolution of every living being. Inside each of us lies a distinctive desire to do something more than the norm, out of the ordinary. This nature of existence flows from people to businesses, leading them from old path to new, creating opportunities for themselves and for the rest of the world. Media and Entertainment landscape is not untouched by this phenomenon. From consumer FINANCIAL behaviour to consumer experiences, the industry has evolved in all shapes and forms over STATEMENTS the last few decades. Today, we are seeing a paradigm shift in the consumption and delivery 03 of entertainment. In this new realm, the alchemy of the consumer experience is one that blends content creation, delivery, and monetization in a seamless manner. This hyper- STANDALONE competitive, digitally accelerated environment demands a unique strategic vision. We at ZEE INDEX Independent Auditor’s Report 107 are preparing to step into this future with a sharper and synergised version, transforming into ZEE 4.0 - a future-ready organisation to gain competitive advantage. ZEE 4.0 is Balance Sheet 115 designed around enhanced customer centricity with levers for capitalizing on Statement of Profit and Loss 116 immense growth opportunities and driving higher profitability. COMPANY Statement of Cash Flow 117 OVERVIEW The 5G pillars - Governance, Granularity, Growth, Goodwill and Gusto, form 01 Statement of Changes in Equity 119 the cornerstone of ZEE 4.0, sharpening our abilities to capture the emerging Notes 121 opportunities across markets, to transform ZEE into South Asia’s leading Media & Key Performance Indicators 04 STATUTORY Entertainment Company. -

Stories for a Global Audience

T:225 mm C A N A D A T:290 mm + Y O U STORIES Talent and stories that are far reaching. = Canada has a wealth of talent, stunning FOR A locations and many funding options to help create stories that appeal to audiences GLOBAL around the world. Work with Canada and leverage business opportunities that can AUDIENCE take your next project to a new place. Discover more at CMF-FMC.CA Brought to you by the Government of Canada and Canada’s cable, satellite and IPTV distributors. WWW.PRENSARIO.TV WWW.PRENSARIO.TV CMF_20128_Prensario_FP_SEPT13_Ad_FNL.indd 1 2019-09-11 4:34 PM Job # CMF_20128 File Name CMF_20128_Prensario_FP_SEPT13_Ad_FNL.indd Modified 9-11-2019 4:34 PM Created 9-11-2019 4:34 PM Station SOS Daniel iMac Client Contact Emmanuelle Publication Prensario CMYK Helvetica Neue LT Std Designer Shravan Insertion Date September 13, 2019 Production Sarah Ad Due Date September 13, 2019 INKS Account Manager Sarah Bleed 235 mm x 300 mm FONTS PERSONNEL Production Artist Daniel SPECIFICATIONS Trim 225 mm x 290 mm Comments None Safety 205 mm x 270 mm 64x60 WWW.PRENSARIO.TV WWW.PRENSARIO.TV Live: 205 Trim: 225 Bleed: 235 //// COMMENTARY NICOLÁS SMIRNOFF Mipcom: Truth or Dare Prensario International ©2018 EDITORIAL PRENSARIO SRL PAYMENTS TO THE ORDER OF EDITORIAL PRENSARIO SRL OR BY CREDIT CARD. REGISTRO NACIONAL DE DERECHO DE AUTOR Nº 10878 Mipcom 2018 is again the main content event Also through this print issue, you will see ‘the Argentina: Lavalle 1569, Of. 405 of the year, with about 13,000 participants, newest of the newest’ about trends: strategies, C1048 AAK 4,000 buyers and almost 2000 digital buyers. -

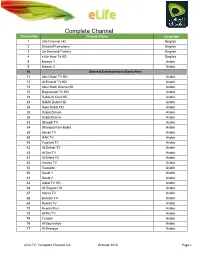

Complete Channel List October 2015 Page 1

Complete Channel Channel No. List Channel Name Language 1 Info Channel HD English 2 Etisalat Promotions English 3 On Demand Trailers English 4 eLife How-To HD English 8 Mosaic 1 Arabic 9 Mosaic 2 Arabic 10 General Entertainment Starts Here 11 Abu Dhabi TV HD Arabic 12 Al Emarat TV HD Arabic 13 Abu Dhabi Drama HD Arabic 15 Baynounah TV HD Arabic 22 Dubai Al Oula HD Arabic 23 SAMA Dubai HD Arabic 24 Noor Dubai HD Arabic 25 Dubai Zaman Arabic 26 Dubai Drama Arabic 33 Sharjah TV Arabic 34 Sharqiya from Kalba Arabic 38 Ajman TV Arabic 39 RAK TV Arabic 40 Fujairah TV Arabic 42 Al Dafrah TV Arabic 43 Al Dar TV Arabic 51 Al Waha TV Arabic 52 Hawas TV Arabic 53 Tawazon Arabic 60 Saudi 1 Arabic 61 Saudi 2 Arabic 63 Qatar TV HD Arabic 64 Al Rayyan HD Arabic 67 Oman TV Arabic 68 Bahrain TV Arabic 69 Kuwait TV Arabic 70 Kuwait Plus Arabic 73 Al Rai TV Arabic 74 Funoon Arabic 76 Al Soumariya Arabic 77 Al Sharqiya Arabic eLife TV : Complete Channel List October 2015 Page 1 Complete Channel 79 LBC Sat List Arabic 80 OTV Arabic 81 LDC Arabic 82 Future TV Arabic 83 Tele Liban Arabic 84 MTV Lebanon Arabic 85 NBN Arabic 86 Al Jadeed Arabic 89 Jordan TV Arabic 91 Palestine Arabic 92 Syria TV Arabic 94 Al Masriya Arabic 95 Al Kahera Wal Nass Arabic 96 Al Kahera Wal Nass +2 Arabic 97 ON TV Arabic 98 ON TV Live Arabic 101 CBC Arabic 102 CBC Extra Arabic 103 CBC Drama Arabic 104 Al Hayat Arabic 105 Al Hayat 2 Arabic 106 Al Hayat Musalsalat Arabic 108 Al Nahar TV Arabic 109 Al Nahar TV +2 Arabic 110 Al Nahar Drama Arabic 112 Sada Al Balad Arabic 113 Sada Al Balad -

Hindi Movie Cluster Niche Channels

ANNUAL REPORT 2016-17 A TO ZEE OF CONTENT LEADERSHIP CORPORATE OVERVIEW STATUTORY REPORTS 01 02 ZEEL At A Glance 02 46 Management Discussion And Analysis 04 Events And Milestones 66 Notice 06 Message From The Chairman 70 Directors’ Report 08 Key Performance Indicators 76 Annexures to Directors’ Report 10 Message From The MD & CEO 88 Secretarial Audit Report 12 All You Can See 90 Report on Corporate Governance 14 We Speak Your Language 104 Business Responsibility Report 16 We Are Where You Want To Be 109 Certification of Financial Statements 18 All The World Is A Stage 20 More. Much More Than TV. 22 Business Overview FINANCIAL STATEMENTS 30 Strategy For Sustainable Growth 03 STANDALONE 32 Q&A With Amit Goenka - CEO (International Business) 110 Independent Auditor’s Report 34 Q&A With Chief Finance and Strategy Officer 114 Balance Sheet 36 Board Of Directors 115 Statement of Profit and Loss 38 Leading With People 116 Statement of Changes in Equity 40 Leading With Thought. Growing Through Engagement 117 Statement of Cash Flow 42 Corporate Social Responsibility 119 Notes 43 Caring For The Environment 162 Last Five Years Financial Highlights 44 Corporate Information 163 Performance Ratios - An Analysis CONSOLIDATED 164 Independent Auditor’s Report 168 Balance Sheet 169 Statement of Profit and Loss 170 Statement of Changes in Equity 171 Statement of Cash Flow 173 Notes ATTENDANCE SLIP & ROUTE MAP FOR VENUE OF AGM PROXY FORM ON THE COVER Forward-looking statement In this Annual Report, we have disclosed forward-looking information to enable investors to comprehend our A TO ZEE OF CONTENT prospects and take investment decisions. -

International Business Overview

ZEEL INTERNATIONAL BUSINESS OVERVIEW Oct 2015 ZEEL – Evolution into a global player Zee TV Zee TV ZEE Zee Aflam Zee Alwan Dubbed and launched in: launched in launches launched in launched in subtitled channels . USA Africa Zee Variasi ME: movie ME: GEC launched in . MENAP in Malaysia channel dubbed in • Indonesia - (subtitled dubbed in Arabic Hiburan and dubbed Arabic • South Africa - in Malay) Zee World • Francophone Africa – Zee Magic 1992 1995 1996 2004 2006 2007 2008 2010 2012 2014 2015 Zee TV Zee TV Zee TV Ten Cricket ZEE launches dubbed launched in launched in launched in launched in and subtitled movie Europe APAC Russia ME and channel in: USA . Indonesia – Bioskop . Thailand - Nung Expanding across territories and product portfolio: from South Asian diaspora to mainstream audience 2 ZEEL – Comprehensive International Offerings 37 channels 5 continents 169 countries 14 languages ~ 210,000 hrs of content 3 Zee Entertainment – Global Reach Europe Key Territories – UK, France, Germany, Russia 16 Platforms 29 employees in 2 offices APAC Key Territories – Singapore, Malaysia, Thailand, Americas Indonesia Australia Key Territories – USA, 48 Platforms Canada, Carribean Islands 22 employees in 6 offices 41 Platforms across APAC 36 employees in 2 offices in USA Africa MENAP Key Territories – UAE, Saudi Key Territories – South Arabia, Oman, Qatar, Africa, Mauritius, Kenya, Pakistan Nigeria 9 Platforms 8 Platforms 70 employees in 1 office in 25 employees in 2 offices in UAE South Africa and Mauritius ZEEL Channels reach more than 360 Mn viewers across the world in 168 countries 4 International Revenue Sources – FY 2015 Revenue (USD Mn) Others, 48 , 30% Subscription, 69 , 44% Advertisement, 40 , 26% Total Revenue – USD 157 Mn 5 Digital Presence . -

Zee Entertainment

Detailed Report | 21 July 2015 Sector: Media Zee Entertainment Also called the Habitable Zone or Life Zone, the Goldilocks Zone is an area of space in which a planet is just the right distance from its home star so that its surface is neither too hot nor too cold. The Earth, of course, fills that bill, while Venus roasts in a runaway greenhouse effect and Mars exists as a frozen, arid world. In between, the conditions are just right so that liquid water remains on the surface of the planet without freezing or evaporating out into space. In other words, the conditions are such that life can thrive. In the Goldilocks Zone… Shobhit Khare ([email protected]); +91 22 3982 5428 Jay Gandhi ([email protected]); +91 22 3089 6693 Zee Entertainment Contents Summary ............................................................................................................. 3 Story in charts ...................................................................................................... 4 All set to ride the ad tailwind ................................................................................ 9 24% domestic susbcription revenue CAGR........................................................... 13 Sharp margin rebound in FY17/18 ....................................................................... 16 Sports investments to continue .......................................................................... 18 Premium valuations to sustain ........................................................................... -

Zeel's Mission Goal

ANNUAL REPORT 2016-17 A TO ZEE OF CONTENT LEADERSHIP CORPORATE OVERVIEW STATUTORY REPORTS 01 02 ZEEL At A Glance 02 46 Management Discussion And Analysis 04 Events And Milestones 66 Notice 06 Message From The Chairman 70 Directors’ Report 08 Key Performance Indicators 76 Annexures to Directors’ Report 10 Message From The MD & CEO 88 Secretarial Audit Report 12 All You Can See 90 Report on Corporate Governance 14 We Speak Your Language 104 Business Responsibility Report 16 We Are Where You Want To Be 109 Certification of Financial Statements 18 All The World Is A Stage 20 More. Much More Than TV. 22 Business Overview FINANCIAL STATEMENTS 30 Strategy For Sustainable Growth 03 STANDALONE 32 Q&A With Amit Goenka - CEO (International Business) 110 Independent Auditor’s Report 34 Q&A With Chief Finance and Strategy Officer 114 Balance Sheet 36 Board Of Directors 115 Statement of Profit and Loss 38 Leading With People 116 Statement of Changes in Equity 40 Leading With Thought. Growing Through Engagement 117 Statement of Cash Flow 42 Corporate Social Responsibility 119 Notes 43 Caring For The Environment 162 Last Five Years Financial Highlights 44 Corporate Information 163 Performance Ratios - An Analysis CONSOLIDATED 164 Independent Auditor’s Report 168 Balance Sheet 169 Statement of Profit and Loss 170 Statement of Changes in Equity 171 Statement of Cash Flow 173 Notes ATTENDANCE SLIP & ROUTE MAP FOR VENUE OF AGM PROXY FORM ON THE COVER Forward-looking statement In this Annual Report, we have disclosed forward-looking information to enable investors to comprehend our A TO ZEE OF CONTENT prospects and take investment decisions. -

Indian Reality Television Shows: Ordinary People, Celebrity and the Fame Cycle

Journal of Xi'an University of Architecture & Technology Issn No : 1006-7930 Indian Reality Television Shows: Ordinary People, Celebrity and the Fame Cycle Taranjeet Kaur Chawla Research Scholar Department of Journalism and Mass Communication Manipal University Jaipur, Rajasthan, India Email- [email protected] Dr. Rayaz Hassan Associate Professor & Head of the Department Department of Journalism and Mass Communication Manipal University Jaipur, Rajasthan. India Dr. Oinam Bedajit Meitei Assistant Professor Department of Mass Communication and Journalism Central University of Karnataka, India Abstract- In this paper, we discuss the phenomenon of Indian reality television shows explore its function for those participating in it. Drawing on the success of their talent hunt programmes such as Sa Re Ga Ma Pa, Indian Idol and Dance India Dance, this research work argues that reality television appeals in different ways to participants and celebrities at different points in the fame cycle. ‘Ordinary’ people seeking to become known through using reality television as an opportunity. To understand the importance of Indian reality television shows for ordinary people and considering fame as a cyclical process, a survey of opinions has been conducted through questionnaire among students of media and communication studies. The present study explores how a successful reality television show cast ordinary people who are at a range of points in the fame cycle as seek to develop their own image and those whose careers are in a period of ‘post-celebrity’ who seek to renew their fame and to prove a key attraction for audiences. Keywords - Celebrity, Fame, Indian reality television, Ordinary people I. INTRODUCTION When television expanded in India, it also provided the space for genre of reality television. -

Management Discussion and Analysis and Discussion Management

investing in tomorrow management discussion and analysis OVERVIEW Zee Entertainment Enterprises Limited (ZEE) (BSE Code: 505537, NSE Code: ZEEL.EQ) is one of India’s largest vertically integrated media and entertainment company. The Company was formed in 1982. ZEE was the first private company to launch a satellite channel in India and from being a single channel for a single geography today operates multiple channels across multiple geographies in different languages and genres. The Company’s programming reaches out to over 959 million viewers across 169 countries globally. ZEE channel portfolio, across various genres in the Indian market, includes: i. Hindi Entertainment: Zee TV, Zee Smile, Zee Anmol, Zindagi, &tv ii. Hindi Movies: Zee Cinema, Zee Action, Zee Classic, &pictures iii. English Entertainment, Movies and Life style: Zee Studio, Zee Café iv. Regional Language Entertainment: Zee Marathi, Zee Talkies, Zee Bangla, Zee Bangla Cinema, Zee Telegu, Zee Kannada, Zee Tamil v. Sports: TEN Sports, TEN Cricket, TEN Action, TEN Golf vi. Religious and Alternate Lifestyle: Zee Salaam vii. Music: Zing, ETC Bollywood 104 viii. Niche and Special Interest: Zee Khana Khazana, Zee Q ix. HD: Zee TV HD, Zee Cinema HD, Zee Studio HD, TEN HD, &pictures HD, &tv HD Apart from the channels listed above which are available in India, the Company also broadcasts 36 dedicated channels in the international markets. MEDIA AND ENTERTAINMENT INDUSTRY The Indian Media and Entertainment Industry witnessed a moderate growth in 2014. The industry grew from ` 918 billion in 2013 to ` 1,026 billion in 2014, registering a growth rate of 12%. Television sector grew from ` 417 billion in 2013 to ` 475 billion in 2014, registering a growth of 14%.