The New York Stock Exchange and the Transformation of Retirement in America by Paula Kathleen Gajewski Dissertation Submitted To

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Recession of 1797?

SAE./No.48/February 2016 Studies in Applied Economics WHAT CAUSED THE RECESSION OF 1797? Nicholas A. Curott and Tyler A. Watts Johns Hopkins Institute for Applied Economics, Global Health, and Study of Business Enterprise What Caused the Recession of 1797? By Nicholas A. Curott and Tyler A. Watts Copyright 2015 by Nicholas A. Curott and Tyler A. Watts About the Series The Studies in Applied Economics series is under the general direction of Prof. Steve H. Hanke, co-director of the Institute for Applied Economics, Global Health, and Study of Business Enterprise ([email protected]). About the Authors Nicholas A. Curott ([email protected]) is Assistant Professor of Economics at Ball State University in Muncie, Indiana. Tyler A. Watts is Professor of Economics at East Texas Baptist University in Marshall, Texas. Abstract This paper presents a monetary explanation for the U.S. recession of 1797. Credit expansion initiated by the Bank of the United States in the early 1790s unleashed a bout of inflation and low real interest rates, which spurred a speculative investment bubble in real estate and capital intensive manufacturing and infrastructure projects. A correction occurred as domestic inflation created a disparity in international prices that led to a reduction in net exports. Specie flowed out of the country, prices began to fall, and real interest rates spiked. In the ensuing credit crunch, businesses reliant upon rolling over short term debt were rendered unsustainable. The general economic downturn, which ensued throughout 1797 and 1798, involved declines in the price level and nominal GDP, the bursting of the real estate bubble, and a cluster of personal bankruptcies and business failures. -

Finding a Financial Foundation: the First Bank of the United States and the Financial Crisis of 1792

Finding a Financial Foundation: The First Bank of the United States and the Financial Crisis of 1792 Student Who Has Been Moved to the TCU Witness Protection Program ECON X0XX3 XX XXth, 20XX Abstract: As the United States attempted to settle its debts and find stable ground, many political figures came forward with plans of how to overhaul the present system. Alexander Hamilton, long a fan of federalism, wanted the United States to emulate England and create a national bank that would handle the country’s debt. Since the American Revolution destroyed the American economy and a uniform currency failed to exist, the ability to reap financial benefits was limited. Thus, Hamilton generated a detailed plan of a national bank that would function as part of the federal government and would regulate a singular currency, control interest rates, loan money and extend credit and assess the nation’s debt. Though he was met with much contempt, especially from Thomas Jefferson and other states’ rights proponents, Hamilton was able to implement his plan and create the First Bank of the United States, While in its infancy, the First Bank of the United States was rocked by the financial crisis of1 1792, as speculation had risen price levels so high leading the bubble to burst. As the markets struggled, Hamilton employed various tactics, including debt extensions, reduced interest rates and massive lending to dig the country out of potential financial peril. Hamilton’s diligence in regard to both the First Bank of the United States and the response to the financial crisis of 1792 created a foundation for the fiscal infrastructure of the United States that eventually allowed for the Federal Reserve and many of the policies and practices that still exist today. -

Virtue, Vice, and the Globalization of World Economies

Scholars Crossing Faculty Publications and Presentations School of Business September 2012 Virtue, Vice, and the Globalization of World Economies Stephen Preacher Liberty University, [email protected] Follow this and additional works at: https://digitalcommons.liberty.edu/busi_fac_pubs Part of the Business Law, Public Responsibility, and Ethics Commons, Business Organizations Law Commons, Finance and Financial Management Commons, and the International Business Commons Recommended Citation Preacher, Stephen, "Virtue, Vice, and the Globalization of World Economies" (2012). Faculty Publications and Presentations. 12. https://digitalcommons.liberty.edu/busi_fac_pubs/12 This Article is brought to you for free and open access by the School of Business at Scholars Crossing. It has been accepted for inclusion in Faculty Publications and Presentations by an authorized administrator of Scholars Crossing. For more information, please contact [email protected]. SYNESIS A JOURNAL OF SCIENCE, TECHNOLOGY, ETHICS, AND POLICY Virtue, Vice, and the Globalization of Market Economies Stephen P. Preacher, DBA1 1. Liberty University, 1971 University Boulevard, Lynchburg, VA, 24502, USA, Email: [email protected] Abstract This study postulates that the recent world fi nancial crisis, symptomatically manifested in the fi nancial markets, is more fundamentally the result of a systemic disregard for moral constraints. This has occurred at macroeconomic levels within the industrialized nations and has pervaded the global economy. Moral relativ- ism has become the dominant ethical system in society and government, and has undermined the virtuous ideals and self-restraint that foster the benefi ts of capitalism. Coupled with advances in technology and glo- balization, the effect of vices such as avarice, irresponsibility, excessive risk tolerance and criminal activities have been exacerbated. -

Every Avenue Available Lessons from Monetary History for Tackling Climate Change

EVERY AVENUE AVAILABLE LESSONS FROM MONETARY HISTORY FOR TACKLING CLIMATE CHANGE Rens van Tilburg and Aleksandar Simić February 2021 Every Avenue Available “I WANT TO EXPLORE EVERY AVENUE AVAILABLE 2 IN ORDER TO COMBAT CLIMATE CHANGE” Christine Lagarde, president of the European Central Bank, July 2020 Sustainable Finance Lab Every Avenue Available 3 Utrecht, February 2021. The Sustainable Finance Lab (SFL https://sustainablefinancelab.nl/en) is an academic think tank whose members are mostly professors from different universities in the Netherlands. The aim of the SFL is a stable and robust financial sector that contributes to an economy that serves humanity without depleting its environment. To this end the SFL develops ideas and provides a platform to discuss them, thus bridging science and practice. This paper has been drafted by Rens van Tilburg, Director of the Sustainable Finance Lab at Utrecht University ([email protected]) and Aleksandar Simić, researcher of the SFL. The authors wish to thank Roben Kloosterman for his excellent research support and Alexander Barkawi, Simon Dikau, Maarten Kavelaars, Jens van ‘t Klooster, Cormac Petit, Rick van der Ploeg, Dirk Schoenmaker and Roland Uittenbogaard Sustainable Finance Lab for their comments. The views expressed in this publication are those of the authors and do not necessarily reflect those of all members of the Sustainable Finance Lab. This paper was commissioned by the Council on Economic Policies and supported by the European Climate Foundation. Every Avenue Available KEY TAKEAWAYS Insufficient action to limit climate change The costs of runaway climate change are much higher than those of limiting it. -

Monetary Policy and the Dollar Peter L. Rousseaua 1. Introduction Twenty

Monetary Policy and the Dollar Peter L. Rousseaua 1. Introduction Twenty-first century Americans take for granted that a dollar is worth a dollar, meaning that a given Federal Reserve note at a point in time carries a fixed purchasing power regardless of who tenders it or where it is tendered. And though one may rightfully say that prices of goods with identical physical characteristics can and do differ across localities and that a dollar may therefore not purchase the same quantities of goods everywhere, an apple in New York is a distinct economic good from an apple in Cleveland. This again just means that a dollar is worth a dollar with no questions asked of its holder. When the United States adopted the dollar as a common currency shortly after the ratification of the Federal Constitution in 1788, it represented the birth of the monetary system that for the most part continues to the present day―a system that eventually led to the dollar’s universal acceptance and rise to its position as the world’s leading currency. With it came a central bank, a mint, the start of modern banking operations and securities markets, and a newly- found confidence among investors in the ability of the young nation to service its financial obligations. The new system and its specie standard represented a marked improvement over the fiat paper money systems that had operated in the British North American colonies prior to their independence in 1776, and an enormous improvement over the rapidly-deteriorating monetary conditions that existed during the during the Revolutionary War (1776-1781) and under the Articles of Confederation (1781-1788). -

Hamilton's First Bank of the United States

Hamilton's First Bank of the United States Jes´usFern´andez-Villaverde1 June 9, 2021 1University of Pennsylvania The Bank of England 1 2 The Bank of England • Modern central banking starts when the Bank of England opens on July 30, 1694 (some predecessors in Italy, Dutch Republic, and Sweden). • Its creation is closely related with the institutional changes brought by the Glorious Revolution of 1688. • Its initial business is to fund the government with £1.2 million during the War of the Grand Alliance (1688-1697). • It does so by printing paper notes rather than in specie. • Thus, the Bank of England is an engine of credit from the start. 3 4 The Bank of England and public debt • Later, the Bank of England lent to the government either directly or through the purchase of government debt (discounting). • The Bank helped establishing credible commitment on the part of the government by originating most of the loans. • It thus provided oversight of the government, especially with respect to payment of interest on the debt. • Eventually, the Bank started managing the government debt directly as well as a range of government securities. • By 1770s, the Bank handled 3/4 of the government debt for a fee and held about £11.7 million. 5 The Bank of England and private businesses • In addition to lending to the government, the Bank of England made commercial loans, took deposits, and issued notes aiding and deepening financial intermediation in Great Britain. • Its short-term commercial lending grew in importance over time. • In London, payments dominated by Bank of England notes. -

The Effects of Crytocurrencies on the Banking Industry and Monetary Policy Gannon Leblanc

Eastern Michigan University DigitalCommons@EMU Senior Honors Theses Honors College 2016 The effects of crytocurrencies on the banking industry and monetary policy Gannon LeBlanc Follow this and additional works at: http://commons.emich.edu/honors Part of the Economics Commons Recommended Citation LeBlanc, Gannon, "The effects of crytocurrencies on the banking industry and monetary policy" (2016). Senior Honors Theses. 499. http://commons.emich.edu/honors/499 This Open Access Senior Honors Thesis is brought to you for free and open access by the Honors College at DigitalCommons@EMU. It has been accepted for inclusion in Senior Honors Theses by an authorized administrator of DigitalCommons@EMU. For more information, please contact lib- [email protected]. The effects of crytocurrencies on the banking industry and monetary policy Degree Type Open Access Senior Honors Thesis Department Economics First Advisor James W. Saunoris Subject Categories Economics This open access senior honors thesis is available at DigitalCommons@EMU: http://commons.emich.edu/honors/499 Running head: THE EFFECTS OF CRYTOCURRENCIES ON THE BANKING INDUSTRY AND MONETARY POLICY THE EFFECTS OF CRYPTOCURRENCIES ON THE BANKING INDUSTRY AND MONETARY POLICY By Gannon LeBlanc A Senior Thesis Submitted to the EasternMichigan University Honors College In Partial Fulfillment of the Requirements forGraduation With Honors in Economics Approved at Ypsilanti, Michigan on this date 07/12/2016 THE EFFECTS OF CRYPTOCURRENCIES ON THE BANKING INDUSTRY AND MONETARY POLICY Table of Contents Section I: An Introduction and History of the Modem Banking Industry and Monetary Policy..................................................................... ......................Page 4 -Original Purpose of a Bank................................................ .................Page 4 - The Federal Reserve........................................................................ Page 8 - The Gold Standard...................................................... -

Do You Have a Downturn Defense?

Do you have a downturn defense? Learn how stock market volatility can impact your retirement income. Can your retirement strategy take a beating? Since March 2009 when stocks bottomed out during the financial crisis, the S&P 500® has gone up 332%1. This historic rebound currently stands as the longest bull run in history. On March 12, 2020, however, this bull market ended. After over a decade of market growth like this, it’s easy to forget about any looming financial threats. But financial markets can quickly change. When market conditions head south, will your current retirement strategy withstand the opposing market forces? Your answer will depend on a number of factors, including how you’re invested, your age, whether you’re still working, and if you’ve already started withdrawing money set aside for your retirement. 1 As of October 9, 2019 Let’s take a closer look There are three types of financial patterns that may affect your retirement. A bull market is when stock market indices A bear market occurs when those same A recovery is represented as the number of like the S&P 500 and Dow Jones Industrial types of indices drop 20% or more from months from the bottom of a market decline Average steadily go up by at least 20%. their previous peak over a period of at least to when the market reaches the level of its When markets rise, investors may see the two months. When bear markets occur, previous peak again. value of their retirement account increase some investors may see the value of their over time as well. -

The Panic of 1796-1797

The Panic of 1796-1797 The first major financial crisis in the United States What came to be later known as the Panic of 1796-1797 was a series of cross-Atlantic economic slumps which hit the United States and Great Britain. History records that the primary cause for the crisis was a land speculation bubble which burst in 1796. In the run up to the crisis, wealthy people had invested a lot of their money in real estate, only to end up incarcerated in debtors’ prison after things went downhill. Perhaps the most prominent investor to meet this fate is Robert Morris Jr., a Founding Father and financier of American troops during the American War of Independence and a former U.S. Superintendent of Finance. A similar fall from grace as that of Morris came from another Founding Father, Henry Lee III, who, too, ended up in debtor’s prison. James Wilson, also a Founding Father, was also briefly locked up, until his son paid his debt. But luckily for Morris and Lee, they had friends in high circles, in the U.S. Congress. Both men were released under the Bankruptcy Act of 1800 that Congress passed, and repealed years later in 1803. Events such as these stimulated charges of nepotism and corruption in nascent U.S. politics. The crisis worsened under the Bank Restriction Act of 1797 after the Bank of England suspended specie payments, thus placing the Bank of England under no obligation to convert depositors’ banknotes into gold or silver coinage. This Act of Parliament had been necessitated because bank notes were overprinted, which goes to show the evils of fractional reserve lending. -

The History and Remedy of Financial Crises and Bank Failures

The author Michael Schemmann Michael Sche is a professional banker, certified public accountant, and university professor of accounting and finance. The book reviews a long litany of financial crises and bank failures since the 3rd century right up to the ongoing Global Financial Crisis. The author analyzes the financial statement mmann of a large international commercial bank in Frankfurt, Germany, and concludes that IFRS accounting principles and standards are not followed but violated, rendering the statements rather false and misleading. The book contains a remedy to end the Global Financial Crisis and prevent future crises, calling on the European Central Bank to step in and take over the role of money Money creator which is currently done by the private commercial banks, and allow governments to buy-back their general Breakdown and government debt theld by the banks, thereby reducing the MON outstanding sovereign debt of the euro area by 32% while improving the banks' liquidity sevenfold in a way that is Breakthrough completely inflation-neutral (sterile). The misconceived EY austerity programs 'to save the euro' can then be rolled back and abandoned. Br iicpa eak do The History and Remedy IICPA Publications wn and Br 1st Edition - 31 October 2013 of Financial Crises and ISBN 978-1492920595 eak Bank Failures thr ough IICPA PUBLICATIONS Money. Breakdown and Breakthrough. The History and Modern states gave control of monetary policy and markets to the Remedy of Financial Crises and Bank Failures. (1st Edition.) barons of global finance. The experiment has resulted in the same By Michael Schemmann disastrous outcomes as before. -

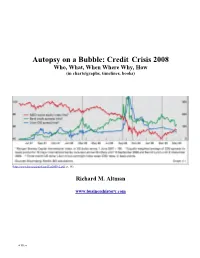

Autopsy on a Bubble: Credit Crisis 2008 Who, What, When Where Why, How (In Charts/Graphs, Timelines, Books)

Autopsy on a Bubble: Credit Crisis 2008 Who, What, When Where Why, How (in charts/graphs, timelines, books) (http://www.bis.org/publ/arpdf/ar2009e2.pdf, p, 16) Richard M. Altman www.businesshistory.com «URLs» Credit Crisis and the Stock Market D I K P P Data - Becomes Information When Interpreted Information - Becomes Knowledge When Understood Knowledge - Becomes Power When Used Power - Becomes Progress When Measured Progress - Becomes Data When Analyzed «URLs» Credit Crisis and Capitalism (http://www.scribd.com/doc/37263162/0061788406, p. 92) «URLs» Credit Crisis and Capitalism (http://www.scribd.com/doc/37263162/0061788406, p. 93) «URLs» Table of Contents 1. Introduction p. 6 a) Cash and Risk p. 6 b) History’s Bubbles p. 7 c) Four Phases of a Bubble p. 8 d) Key Dates p. 12 2. What Happened: Four Stages - Cash, Risk (2) and Rescue p. 13 a) Historical Perspective p. 14 b) Stage 1: 2000-2003 - Cash Grew p. 26 c) Stage 2: 2003-2007 - Credit Risk p. 44 d) Stage 3: 2007-2009 - Market Risk (Event Risk) p. 69 e) Stage 4: 2009-2010 - Rescue: Liquidity and Solvency p. 95 3. People: Who Was Involved p. 115 4. Government/Corporate: When, What, Where (Descriptive) p. 125 a) Government Timeline p. 126 b) Corporate Timeline p. 141 5. Books: Why, How (Interpretive): p. 156 a) Credit Crisis Books (Year, Author) p. 157 b) Credit Crisis: Related Books (Author) p. 180 c) Credit Crisis: Films - (Year, Director) p. 188 d) Wall Street Books (Firm, Year, Author) p. 189 e) Wall Street: Related Books (Author) p. -

Robert E. Wright's C.V

Robert E. Wright Nef Family Chair of Political Economy & Director of the Thomas Willing Institute for the Study of Financial Markets, Institutions, and Regulations Augustana University 2001 South Summit Ave. Sioux Falls, South Dakota 57197 Office: 1-605-274-5312 Email: [email protected] Web: http://faculty.augie.edu/~rwright Twitter: robertewright ORCID: 0000-0003-3792-3506 EDUCATION 1. B.A., History, Summa Cum Laude, Buffalo State College, 1990. 2. M.A., History, State University of New York at Buffalo, 1994. 3. Ph.D., History, State University of New York at Buffalo, 1997. TEACHING, RESEARCH, AND EDITORIAL POSITIONS Current Augustana University, Sioux Falls, South Dakota: Nef Family Chair of Political Economy, Division of Social Sciences, 2009-. Director of the Thomas Willing Institute for the Study of Financial Markets, Institutions, and Regulations, Augustana University, 2011-. Augustana Research Institute (ARI) Advisory Board Member, 2016-. Other: Editorial Board Member, Financial History, Museum of American Finance, New York, New York, 2008-. Board Member, Historians Against Slavery, St. Paul, Minnesota, 2012-. Treasurer, 2016-. Federal Reserve Archive (FRASER) Advisory Board Member, St. Louis Federal Reserve, St. Louis, Missouri, 2015-. Trustee, Economic and Business History Society, 2018-. Senior Fellow, American Institute for Economic Research, Great Barrington, Mass., 2019-. Previous Senior Analyst, Wikistrat, 2016-17. Associate Editor, Moral Cognition & Communication, John Benjamins, Amsterdam, Netherlands, 2016-17. Last updated: 10/27/2019 1 Series Editor, Slaveries Since Emancipation, Cambridge University Press, New York, New York, 2013-15. Series Editor, Pickering & Chatto (now Taylor and Francis) Perspectives in Economic and Social History Series, London, UK, 2008-2012. Series Editor, Pickering & Chatto (now Taylor and Francis) Financial History Monograph Series, London, UK, 2005-2012.