Limited Market Value Report: 1999 Assessment Year

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fishery Interim Summary Report Series No. 08-04: Rapid River Fishery Management

FISHERY INTERIM SUMMARY REPORT SERIES NO. 08-04 RAPID RIVER FISHERY MANAGEMENT By David P. Boucher Maine Department of Inland Fisheries and Wildlife Division of Fisheries and Hatcheries Augusta, Maine December 2008 Job F-014 Interim Summary Report No. 4 (2007) Rapid River Fishery Management SUMMARY The Rapid River, located in Township C and Upton in Oxford County, has long been noted for its outstanding brook trout population. Brook trout in the Rapid River are sustained entirely by natural reproduction and support a popular, heavily utilized sport fishery of regional and statewide significance. Landlocked salmon are also present and provide an important ancillary fishery. During the 1980's, smallmouth bass were illegally introduced into Umbagog Lake, where they became well established and have since migrated to the Rapid River. A clerk creel survey was conducted in 2007 to monitor angler use, catch, and harvest subsequent to changes in fishing regulations and flow regimes, and to monitor the impacts of smallmouth bass. Creel survey data suggested that a decline in brook trout production documented earlier (from 2002 to 2004) was at least partially arrested, and that the vigorous expansion of smallmouth bass numbers slowed or declined by 2007. It's likely that increasingly restrictive fishing regulations, beginning in 2004, were partially responsible for the positive trend. Three consecutive years of unfavorable flows for bass spawning (2005- 2007), and the wet, cool conditions that prevailed during those years, were also important factors. By manipulating flows from Middle Dam, we'll maintain a high level of stress to smallmouth bass during their spawning, incubation, and early recruitment periods, and therefore maintain or improve conditions for trout survival. -

Rapid River Fishery Management (PDF)

FISHERY INTERIM SUMMARY REPORT SERIES NO. 11-03 RAPID RIVER FISHERY MANAGEMENT By David P. Boucher Maine Department of Inland Fisheries and Wildlife Division of Fisheries and Hatcheries Augusta, Maine December 2011 Job F-014 Interim Summary Report No. 5 (2008-2010) Rapid River Fishery Management SUMMARY The Rapid River, located in Township C and Upton in Oxford County, has long been noted for its outstanding brook trout population. Brook trout in the Rapid River are sustained entirely by natural reproduction and support a popular, heavily utilized sport fishery of regional and statewide significance. Landlocked salmon are present also and they provide an important ancillary fishery. During the 1980’s, smallmouth bass were illegally introduced into Umbagog Lake, where they became well established and have since migrated to the Rapid River. Intensive creel surveys have been conducted periodically since 1994 to monitor this important fishery. The most recent creel surveys, including in 2010, were intended to monitor angler use, catch, and harvest subsequent to changes in fishing regulations and flow regimes, and to assess the impacts of smallmouth bass on the river’s brook trout and salmon fisheries. Creel survey data suggested that a decline in brook trout production documented earlier (from 2002 to 2004) was at least partially arrested, and that the vigorous expansion of smallmouth bass numbers slowed or declined. We attributed this to improved protection of brook trout provided by more restrictive fishing regulations, beginning in 2004; to wet, cool environmental conditions that prevailed during several years from 2005 to 2010; and to unfavorable river flows for bass spawning and early recruitment during the same period. -

Whitewater Boating Program

Whitewater Boating Program 2020 Annual Warden Corporal Steve Allarie Report Whitewater Boating Specialist Whitewater Boating Program 2020 Annual Report on: Maine Warden Service Whitewater Boating Program Commercial Rafting Industry 130th Legislature – First Regular Session Dated: January 1, 2021 • In Maine, there are approximately 20 licensed Commercial Whitewater Outfitters providing whitewater boating trips among our6 Rapidly Flowing Rivers. The rivers include stretches of the upper Kennebec River, West Branch of the Penobscot River, South Branch of the Penobscot River, Dead River, Rapid River and the Magalloway River. • In Maine, the commercial whitewater industry provided professional services to approximately 24,639 commercial rafting passengers during the 2020 rafting season (January 1, 2020 to December 31, 2020). The low numbers reflect COVID-19 pandemic concerns and restrictions in early spring. The Commercial industry did not receive state approval to operate until the first week in June. The outfitters reported significant cancelations in the spring, which affected commercial numbers throughout the season. • The commercial whitewater rafting industry continues to be a tremendous economic asset to the State of Maine. The industry is complex and requires a significant investment of time by the Department to fulfill the responsibilities required by the State. In 1999, the Department hired a full-time Game Warden to work as a Whitewater Boating Specialist to enforce whitewater rafting rules and regulations and manage the administrative duties associated with the whitewater rafting industry. • Title 12, section 10259-B; states that all money from the Whitewater Rafting Fund shall be expended solely for purposes related to river recreation, with primary emphasis on those activities that relate to whitewater trips, including, but not limited to, administration, regulation, safety education, enforcement, mitigation of environmental and safety problems and mitigation of any adverse effect on competing use of the river. -

Maine Revised Statutes 38 §467

Presented below are water quality standards that are in effect for Clean Water Act purposes. EPA is posting these standards as a convenience to users and has made a reasonable effort to assure their accuracy. Additionally, EPA has made a reasonable effort to identify parts of the standards that are not approved, disapproved, or are otherwise not in effect for Clean Water Act purposes. Maine Revised Statutes 38 §467 Maine Revised Statutes Title 38: WATERS AND NAVIGATION Chapter 3: PROTECTION AND IMPROVEMENT OF WATERS Subchapter 1: ENVIRONMENTAL PROTECTION BOARD Article 4-A: WATER CLASSIFICATION PROGRAM §467. Classification of major river basins All surface waters lying within the boundaries of the State that are in river basins having a drainage area greater than 100 square miles that are not classified as lakes or ponds are classified in this section. [1989, c. 764, §2 (AMD).] 1. Androscoggin River Basin. A. Androscoggin River, main stem, including all impoundments. (1) From the Maine-New Hampshire boundary to its confluence with the Ellis River - Class B. (2) From its confluence with the Ellis River to a line formed by the extension of the Bath-Brunswick boundary across Merrymeeting Bay in a northwesterly direction - Class C. [1989, c. 890, Pt. A, §40 (AFF); 1989, c. 890, Pt. B, §68 (AMD); MRSA T. 38, §467, sub-§1, ¶ A (AMD).] B. Little Androscoggin River Drainage. (1) Little Androscoggin River, main stem. (a) From the outlet of Bryant Pond to the Maine Central Railroad bridge in South Paris - Class A. (b) From the Maine Central Railroad bridge in South Paris to its confluence with the Androscoggin River - Class C. -

THE FLOODS of MARCH 1936 Part 1

If you do jno*-Be <l this report after it has served your purpose, please return it to the Geolocical -"" Survey, using the official mailing label at the end UNITED STATES DEPARTMENT OF THE INTERIOR THE FLOODS OF MARCH 1936 Part 1. NEW ENGLAND RIVERS Prepared in cooperation withihe FEDERAL EMERGENCY ADMINISTRATION OF PUBLIC WORKS GEOLOGICAL SURVEY WATER-SUPPLY PAPER 798 UNITED STATES DEPARTMENT OF THE INTERIOR Harold L. Ickes, Secretary GEOLOGICAL SURVEY W. C. Mendenhall, Director Water-Supply Paper 798 THS^LOODS OF MARCH 1936 PART 1. NEW ENGLAND RIVERS NATHAN C. GROVER Chief Hydraulic Engineer Prepared in cooperation with the FEDERAL EMERGENCY ADMINISTRATION OF PUBLIC WORKS UNITED STATES GOVERNMENT PRINTING OFFICE WASHINGTON : 1937 For sale by the Superintendent of Documents, Washington, D. C. Price 70 cents CONTENTS Page Abstract............................................................. 1 Introduction......................................................... 2 Authorization........................................................ 5 Administration and personnel......................................... 5 Acknowledgments...................................................... 6 General features of the storms....................................... 7 Floods of the New England rivers....................................o 12 Meteorologic and hydrologic conditions............................... 25 Precipitation records............................................ 25 General f>!-................................................... 25 Distr<* '-utlon -

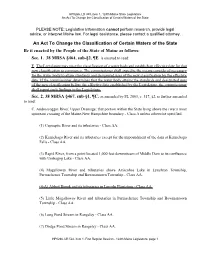

An Act to Change the Classification of Certain Waters of the State

HP0266, LD 330, item 1, 124th Maine State Legislature An Act To Change the Classification of Certain Waters of the State PLEASE NOTE: Legislative Information cannot perform research, provide legal advice, or interpret Maine law. For legal assistance, please contact a qualified attorney. An Act To Change the Classification of Certain Waters of the State Be it enacted by the People of the State of Maine as follows: Sec. 1. 38 MRSA §464, sub-§2, ¶E is enacted to read: E. The Legislature may raise the classification of a water body and establish an effective date for that new classification to commence. The commissioner shall expedite the means considered necessary for the water body to attain standards and designated uses of the new classification by the effective date. If the commissioner determines that the water body attains the standards and designated uses of the new classification before the effective date established by the Legislature, the commissioner shall report such findings to the Legislature. Sec. 2. 38 MRSA §467, sub-§1, ¶C, as amended by PL 2003, c. 317, §2, is further amended to read: C. Androscoggin River, Upper Drainage; that portion within the State lying above the river's most upstream crossing of the Maine-New Hampshire boundary - Class A unless otherwise specified. (1) Cupsuptic River and its tributaries - Class AA. (2) Kennebago River and its tributaries except for the impoundment of the dam at Kennebago Falls - Class AA. (3) Rapid River, from a point located 1,000 feet downstream of Middle Dam to its confluence with Umbagog Lake - Class AA. -

Recreational Fishing Plan March 2020

U.S. Fish & Wildlife Service Umbagog National Wildlife Refuge Recreational Fishing Plan March 2020 Photo Credit: Tom Meredith Appendix A. Compatibility Determination Appendix B. Environmental Assessment Appendix C. Intra-Service Section 7 Evaluation Umbagog National Wildlife Refuge Recreational Fishing Plan March 2020 U.S. Fish and Wildlife Service Umbagog National Wildlife Refuge PO Box 240 Errol, NH 03579 Submitted By: Project Leader ______________________________________________ ____________ Signature Date Concurrence: Refuge Supervisor ______________________________________________ ____________ Signature Date Approved: Regional Chief, National Wildlife Refuge System ______________________________________________ ____________ Signature Date Umbagog NWR Recreational Fishing Plan Recreational Fishing Plan Table of Contents I. Introduction ............................................................................................................................... 2 II. Statement Of Objectives .......................................................................................................... 4 III. Description Of Fishing Program ........................................................................................... 5 A. Where would the use be conducted? ................................................................................... 5 B. Species to be Opened to Fishing ......................................................................................... 6 C. Consultation and Coordination with the State ................................................................... -

Fisheries Order 210.21 Designated Trout Streams for Michigan

FISHERIES ORDER Designated Trout Streams for Michigan Order 210.21 By authority conferred on the Natural Resources Commission and the Department of Natural Resources by Part 487 of 1994 PA 451, MCL 324.48701 to 324.48740, ordered on September 10, 2020, the following section(s) of the Fisheries Order shall read effective April 1, 2021, as follows: The streams and portions of streams in the list which follows are hereby designated as trout streams: Key to Designation List: Unless otherwise described, the location description listed after the stream name indicates the downstream limit of the trout designation. All of the stream and its tributaries, unless excepted, from that point upstream are designated trout waters. Exceptions are italicized. INDEX BY GREAT LAKES BASIN Stream location Page Upper Peninsula Streams Flowing Into Lake Superior ............................................................... 1 Upper Peninsula Streams Flowing Into St. Marys River And Connecting Waters ....................... 7 Upper Peninsula Streams Flowing Into Lake Huron ................................................................... 7 Upper Peninsula Streams Flowing Into Lake Michigan ............................................................... 8 Lower Peninsula Streams Flowing Into Lake Michigan ..............................................................16 Lower Peninsula Streams Flowing Into Lake Huron ..................................................................31 Lower Peninsula Streams Flowing Into Lake St. Clair ...............................................................40 -

LAW and LEGISLATIVE DIGITAL LIBRARY at the Maine State Law and Legislative Reference Library

MAINE STATE LEGISLATURE The following document is provided by the LAW AND LEGISLATIVE DIGITAL LIBRARY at the Maine State Law and Legislative Reference Library http://legislature.maine.gov/lawlib Reproduced from electronic originals (may include minor formatting differences from printed original) 126th MAINE LEGISLATURE SECOND REGULAR SESSION-2014 Legislative Document No. 1671 S.P. 646 In Senate, January 8, 2014 An Act To Prohibit Motorized Recreational Gold Prospecting in Certain Atlantic Salmon and Brook Trout Spawning Habitats (EMERGENCY) Approved for introduction by a majority of the Legislative Council pursuant to Joint Rule 203. Reference to the Committee on Environment and Natural Resources suggested and ordered printed. DAREK M. GRANT Secretary of the Senate Presented by Senator BOYLE of Cumberland. Cosponsored by Representative McCABE of Skowhegan and Senators: MAZUREK of Knox, PATRICK of Oxford, SAVIELLO of Franklin, Representatives: FARNSWORTH of Portland, GATTINE of Westbrook, ROCHELO of Biddeford, SANBORN of Gorham, THERIAULT of Madawaska. Printed on recycled paper 1 Emergency preamble. Whereas, acts and resolves of the Legislature do not 2 become effective until 90 days after adjournment unless enacted as emergencies; and 3 Whereas, motorized recreational gold prospecting may occur without a permit, 4 subject to certain conditions; and 5 Whereas, motorized recreational gold prospecting may negatively affect habitats for 6 aquatic life, including habitats where brook trout and Atlantic salmon spawn; and 7 Whereas, in order -

Fishery Interim Summary Report Series No. 14-2 Rapid River Fishery Management

FISHERY INTERIM SUMMARY REPORT SERIES NO. 14-2 RAPID RIVER FISHERY MANAGEMENT By David Howatt and David P. Boucher Maine Department of Inland Fisheries and Wildlife Division of Fisheries and Hatcheries Augusta, Maine December 2014 Job F-014 Interim Summary Report No. 6 (2013) Rapid River Fishery Management SUMMARY The Rapid River, located in Township C and Upton in Oxford County, has long been noted for its outstanding brook trout population. Brook trout in the Rapid River are sustained entirely by natural reproduction and support a popular, heavily utilized sport fishery of regional and statewide significance. Landlocked salmon are present also and provide an important ancillary fishery. During the 1980’s, smallmouth bass were illegally introduced into Umbagog Lake, where they became well established and have since migrated to the Rapid River. Intensive creel surveys have been conducted periodically since 1994 to monitor this important fishery. The most recent creel surveys, including in 2013, were intended to monitor angler use, catch, and harvest subsequent to changes in fishing regulations and flow regimes, and to assess the impacts of smallmouth bass on the river’s brook trout and salmon fisheries. Creel survey data documented a decline in brook trout production documented earlier (from 2002 to 2004) was at least partially arrested, and that the vigorous expansion of smallmouth bass numbers slowed or declined. We attributed this to improved protection of brook trout provided by more restrictive fishing regulations, beginning in 2004; to wet, cool environmental conditions that prevailed during several years from 2005 to 2010; and to unfavorable river flows for bass spawning and early recruitment during the same period. -

Rapid River Fishery Managment

Fishery Interim Summary Report Series No. 17-4 Rapid River Fishery Management By: David Howatt Rangeley Lakes Region May 2017 Maine Department of Inland Fisheries & Wildlife Fisheries and Hatcheries Division Job F-014 Interim Summary Report No. 7 (2016) Rapid River Fishery Management SUMMARY The Rapid River, located in Township C and Upton in Oxford County, has long been noted for its outstanding brook trout population. Brook trout in the Rapid River are sustained entirely by natural reproduction and support a popular, heavily utilized sport fishery of regional and statewide significance. Landlocked salmon are present also and provide an important ancillary fishery. During the 1980’s, smallmouth bass were illegally introduced into Umbagog Lake, where they became well established and have since migrated to the Rapid River. Intensive creel surveys have been conducted periodically since 1994 to monitor this important fishery. The most recent creel surveys, including in 2016, were intended to monitor angler use, catch, and harvest subsequent to changes in fishing regulations and flow regimes, and to assess the impacts of smallmouth bass on the river’s brook trout and salmon fisheries. Creel survey data from 2002 to 2004 documented a decline in brook trout production. This decline has now at least partially abated and the vigorous expansion of smallmouth bass numbers have slowed. We attributed this to improved protection of brook trout provided by more restrictive fishing regulations beginning in 2004, to wet and cool environmental conditions that prevailed during several years from 2005 to 2010, and to unfavorable river flows for bass spawning and early recruitment during the same period. -

Lake Umbagog

New Hampshire’s Lake Umbagog Pronounced Um-‘bay’-gog, the lake name is Abenaki for birds as well as a good place to look for species such as shallow water. The Abenaki were a Native American tribe moose, eagles and osprey. This unique wetland also provides that resided in the area. The lake has an average depth of nesting habitat for loons as well as other waterfowl. 12-14 feet. 4. ANDROSCOGGIN RIVER The Errol dam flooded the area in 1853 to form the lake This is where the Magalloway river and Androscoggin river here today. It appears that there were three separate lakes connected by marshes and swamps prior to the dam. On meet. This area is the source for the Androscoggin before it the north end of the lake there is a “deep hole” with depths travels south to Gorham then cuts east to empty in the Gulf over 40 feet. of Maine. The Abenaki called it Amascogin meaning “fish coming in the spring.” This is the only outlet from Umbagog This flyer highlights a few distinct landmarks on the lake as Lake. This river provided loggers a route to send logs down well as a bit of history about the area (map on backside). to the large mills in Milan and Berlin. The water levels of For more information stop by the Umbagog National the lake are controlled by the Errol dam, located a few miles Wildlife Refuge located at 2756 Dam Road (Rt. 16) Errol, NH. down river. Or the State Park located 7 miles east of Errol, NH on Rt.