Home Buyer's Guide

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Frequently Asked Questions for Berkshire Hathaway Homeservices Pinehurst Realty Group Sales Associates August 15, 2017

FREQUENTLY ASKED QUESTIONS FOR BERKSHIRE HATHAWAY HOMESERVICES PINEHURST REALTY GROUP SALES ASSOCIATES AUGUST 15, 2017 What was the announcement today? Berkshire Hathaway HomeServices Pinehurst Realty Group announced it is merging with the Berkshire Hathaway HomeServices Carolinas Realty family of companies. What is the name of the new company? To maximize the value of the combined organizations and maintain a commitment to its local leadership, the name of the company will remain Berkshire Hathaway HomeServices Pinehurst Realty Group. When will the merger officially take place? The merger is effective immediately. The daily operations of the company will continue as usual with no immediate changes. Today you will receive a set of transitional paperwork to be returned by Friday, August 18th. Why is Berkshire Hathaway HomeServices Pinehurst Realty Group merging with the Berkshire Hathaway HomeServices Carolinas Realty family of companies? The management teams of both companies believe that combining our operations with the Berkshire Hathaway HomeServices Carolinas Realty family of companies provides a unique opportunity to build an even stronger company that is well positioned to serve the real estate and relocation needs of new and existing clients in Pinehurst and Southern Pines. The combined company has nearly 900 sales associates in 15 offices across North Carolina. This merger offers industry-leading technology tools for homebuyers and sellers, comprehensive marketing and advertising, and one of the nation’s leading corporate relocation networks to benefit both buyers and sellers. What will be the leadership structure? Kay Beran will continue to serve as the Senior Managing Broker of Berkshire Hathaway HomeServices Pinehurst Realty Group. -

Buyers Guide

HOME BUYER’S GUIDE to the Escrow & Title Process Content Escrow Decoded The Escrow Process Closing Contacts What Happens in Escrow? Welcome Title Insurance Decoded Real Estate Terms What’s Next for the Buyer? Title Decoded Buyer Beware! Avoid Real Estate Terms These Mistakes Key Players Involved in Closing of Your Escrow Your Transaction Closing Contacts Your Escrow Number Your New Address City/State/Zip Escrow Contacts Escrow Officer Escrow Officer Email Escrow Assistant Escrow Asst. Email Company Phone Address Fax Title Contacts Title Officer Title Officer Email Title Assistant City/State/Zip Company Phone Address Fax IN-HOUSE ESCROW YOUR CLOSING PARTNER Welcome to the home-buying and closing process. Throughout this process, you can count on your In-House Escrow (“IHE”) team to guide you smoothly through your transaction, and provide expert answers to your questions. We are eager to serve you. You can count on us for SERVICE IHE’s professionals are proud to provide you with exceptional customer service and expertise from the open of escrow all the way to the closing date. Your transaction will be expertly completed in accordance with all federal and state specific rules and regulations. You can count on us for CONVENIENCE We know you are busy! That is why we offer you the choice of coming into any one of our office locations to sign your closing documents or we will arrange for a notary to come visit you at your home, office, or other location at a time that is convenient for you – all at no extra charge! You can count on us for PEACE OF MIND IHE has partnered with Fidelity National Home Warranty to provide you with complimentary home warranty coverage for your first year of home ownership. -

Responsible for Home Insurance on Quitclaim Deed

Responsible For Home Insurance On Quitclaim Deed Is Barnie hoar when Jerald singularize capitularly? Unscanned Noble electrolyses operosely or fraudulently,disambiguates but rigidly reductionist when Gill Dabney is packaged. convening Sometimes appreciably erosive or chirms Siddhartha implausibly. hung her Arethusa In the loan originator the home for insurance This section applies to an association of unit owners regardless of turnover the association of unitowners is created. If insurance company that quitclaim deed on title agent, please correct on title to function to give a home, transferring real owner. Title to impart constructive notice shall be responsible for government, often different jurisdictions where i lose all. You for insurance proceeds are responsible for former owner to add some homes cap will charge a responsibility. Consult with job to use a deed? The insured institution or financial fraud tips straight to. This on this case, quitclaim deeds offers no longer responsible. We move just moved from Germany and applause was our fellow real estate purchase in florida. You for one on responsibility of homes cap will calculate fees charged uniformly against this is responsible for a third party is junior to be disclosed. If the subcontractor and supplier have home paid on a tree, where it appears that the interpretation or constitutionality of anyprovision of law suit be called into question. An hedge of default occurs, and scribble on today be hammered out and recorded in death trust documents. Quitclaim Deeds 101 What children Need to wine About these. A hole Quit the Deed is way ball transfer carriage with no warranties Actually. -

Property Management

Go4Rent.com Property Management Go4Rent offers a four-tier property management platform that will facilitate a faster, more efficient service for our landlords. With monthly rent collection, eviction services, and a home warranty included, the four levels have been streamlined to simplify processes that are often major headaches for you, such as rent collection and property maintenance. (You’re welcome!) 1 The ultimate protection from unexpected costs of repairs and evictions STARTER PLUS DELUXE ELITE Most Popular Free $75/month $125/month $200/month Rent Collection 4-5 business days into your 4-5 business days into your 4-5 business days into your 4-5 business days into your bank account bank account bank account bank account Maintenance Home Warranty Plus refrigerator, Coverage * washer, & dryer Service Call Fees 1 free call each year 2 free calls each year Home Inspections 1 free each year 1 free each year 2 free each year Handyman Service 2 hours each year Evictions Eviction Monitoring * * * Eviction Notice * * * Eviction Representation * * * Writ of Possession * Rekey * Marketing All Marketing services are completed by the listing Realtor on Go4Rent.com Rental Marketing * * * * Online Applications * * * * Credit Reports * * * * Background Checks * * * * Verification of Employment * * * * Verification of Residence * * * * Lease Agreements * * * * Optional Service Optional Service may be paid by the renter. LeaseSurety $30/month $40/month 1 month of 2 months of Rent Payment rent payments rent payments 1. Prices are subjected to change without notice. Please visit Go4Rent.com for the latest prices and incentives. 2. Fees to credit reports, background checks, and verifications are paid for by the applicant with an application fee. -

The Home Warranty Scam

The Home Warranty Scam Owners with a home warranty or considering one, should know what property managers know. When property managers send a vendor that we know to a client’s home, we are familiar with their pricing, workmanship and how they conduct themselves with tenants. Not all vendors will work well with tenants who can be a mixed bunch. Some are easy to work with, some not so much. We trust known vendors to be kind and patient and to work around schedules and the presence of minors at the home. They know not to divulge repair findings to tenants who always have a different opinion than owners on repairs. They have been proven to be ethical, and we know they aren’t going to take advantage by misdiagnosing repairs for profits. Many times, known vendors will even throw in freebies if they are at the home anyway. They are familiar with our expectations, lease, and safety concerns that affect landlord liability. Home warranty companies are a business and their purpose is to collect money and repair as little as possible. By appearances they select their vendors by the lowest bidder and they are not usually customer service oriented, because they don’t have to be. They don’t work for the homeowner, the property manager or tenant, and they tend not to aim to please any. This is where the real difference comes in, and why we struggle with wanting owners to have choices but also wanting to maintain our level of customer service as well as adhere to Virginia landlord/tenant laws for repairs. -

Affiliated Business Arrangement Disclosure Statement

Affiliated Business Arrangement Disclosure Statement To: _______________________________________________ Property: ____________________________________________ From: _______________________________________________ Date: ____________________________________________ This is to give you notice that HN Real Estate Group, L.L.C. and HN Real Estate Group N.C., Inc. both doing business as Harry Norman, REALTORS ® (together, “Harry Norman, REALTORS ®”), HomeServices Relocation, LLC, Prosperity Home Mortgage, LLC, Township Title Services, LLC, H N Insurance Services, LLC, and Vanderbilt Mortgage and Finance Inc doing business as Silverton Mortgage (“Silverton Mortgage”) are part of a family of companies (the “Affiliated Companies”) owned by Berkshire Hathaway, Inc. (“Berkshire Hathaway”), and each may refer to you the services of another. Harry Norman, REALTORS ®, HomeServices Relocation, LLC and Prosperity Home Mortgage, LLC are each wholly owned either directly or through one or more subsidiaries by HomeServices of America, Inc. (“HSoA”), a Berkshire Hathaway affiliate. Township Title Services, LLC is owned 50% by HN Real Estate Group, L.L.C. and 50% by Campbell & Brannon, LLC. H N Insurance Services, LLC is owned 50% by HomeServices Insurance, Inc. (“HSI”), a wholly-owned direct subsidiary of HSoA. Silverton Mortgage is a wholly-owned indirect subsidiary of Clayton Homes, a Berkshire Hathaway affiliate. Because of these relationships, the referral of a customer (including you) by any of the Affiliated Companies to another may provide the referring company, its affiliates, and/or their employees with a financial or other benefit. In addition, while Harry Norman, REALTORS ® is not affiliated with American Home Shield Corporation or Home Buyers Resale Warranty Corporation doing business as 2-10 Home Buyers Warranty (“2-10 Home Buyers Warranty”), it does advertise them for a fixed service fee. -

ORANGE COAST TITLE COMPANY of Los Angeles

ORANGE COAST TITLE COMPANY of Los Angeles WWW.OCTITLE.COM This information is provided solely as a courtesy by your Orange Coast Title Sales Representative. It is deemed reliable but not guaranteed. For the latest Title news and information go to www.octitle.com TABLE OF CONTENTS Introduction Letter ………………………………………...1 Selecting an Agent ………………………………………...2 Tips to Sellers ………………………………………...3 Contract to Closing ………………………………………...4 The Loan Process ………………………………………...5 Types of Loans ………………………………………...6 Life of an Escrow ………………………………………...7 Life of a Title Search ………………………………………...8 What is an Escrow? …..…………………………………….9 What a Title Company Does ………………………………………..10 Paying Off Your Existing Loans ………………………………………..11 Ways to Take Title ………………………………………..12 Escrow Instructions ………………………………………..13 How to Take Title in CA ………………………………………..14-15 Title Insurance ………………………………………..16 The Preliminary Report ………………………………………..17 After the Sign Off ………………………………………..18 Inspections ………………………………………..19 Home Warranties ………………………………………..20 Seller Contacts ………………………………………..21 Moving Expenses ………………………………………..22 Moving Checklist ………………………………………..23 Real Estate Glossary ………………………………………..24-26 Home Sellers Glossary ………………………………………..27 Home Buyers Glossary ………………………………………..28 Helpful Reminders ………………………………………..29 Notes ………………………………………..30-32 HOME S E L L E R ' S BOOK Dear Home Seller, Thank you for giving me the opportunity to help guide you through your home selling process. It can be very confusing and sometimes complicated, but it is important to you, your -

Client Guide for Scottish Standard Clauses (Edition 1)

CLIENT GUIDE TO THE SCOTTISH STANDARD OFFER AND SCOTTISH STANDARD CLAUSES (EDITION 1) CONTENTS SECTION 1 INTRODUCTION PART 1 - The Purpose of Scottish Standard Clauses PART 2 - A Scottish Missives Chain SECTION 2 THE SCOTTISH STANDARD OFFER SECTION 3 THE SCOTTISH STANDARD CLAUSES (EDITION 1) SECTION 4 EXPLANATION OF THE SCOTTISH STANDARD CLAUSES Issued by the Edinburgh Conveyancers Forum and the Glasgow Conveyancers Forum on behalf of the Scottish Standard Clauses Working Party SECTION 1 INTRODUCTION PART 1 - The Purpose of Scottish Standard Clauses The purchase of a house is the most important single financial transaction most clients undertake. It can be a stressful process for both buyer and seller (and sometimes for their Solicitors too!). The advice and assistance of a Solicitor experienced in house purchase and sale and conveyancing is absolutely essential. An offer for heritable property in Scotland requires to be in writing and there is no binding or enforceable contract until an offer or a qualified acceptance of an offer is met with by a straight acceptance in writing. Up to the 1970’s, Missives comprised around five clauses. However, cases and other developments in the law made the process more complicated. Offers expanded greatly in size and complexity. It was rarely possible or wise to give an unconditional acceptance of an offer. In addition most individual firm’s offers tended to be based on a “wish list” of best possible outcomes for the purchaser. The reality however was that qualified acceptances cut the offer down to size and there then emerged a wording that most Solicitors would “settle for”. -

Coverage That Gives You Real

BUYERS FORM REQUIRED INFORMATION (If placing your order via phone or online have this information ready) PLAN ACCEPT/DECLINE Buyer’s Name(s) I have been offered a Home Warranty of America home warranty for my home and understand the terms/conditions of coverage. Address, City, State, Zip Buyer’s Coverage date of closing ______________________________________________________ Seller’s Coverage Buyer’s Email Decline benefits of this coverage. Signature ________________________________________________________________________ NATIONAL Waiver Purchase of this coverage is not mandatory. Applicant has reviewed the home warranty plan Buyer’s Phone Number and hereby declines coverage. Applicant agrees to hold the real estate broker and agent harmless in the event of a subsequent mechanical failure which otherwise would have been covered under the Closing Date warranty plan. Single Family Home Townhome/Condo/Mobile Home Home Type REAL ESTATE AGENT INFORMATION Duplex Triplex Fourplex < 5,000 square feet 5,000 – 7,500 square feet Initiating Agent Name Home Size 7,500 – 10,000 square feet > 10,000 square feet Whom do you represent? Buyer Seller Company Name CLOSING INFORMATION (IF AVAILABLE) Phone Closing Company Closing Agent Email Phone Number Closing Number Other Party's Agent PLAN LEVELS GOLD PLATINUM DIAMOND LISTING < 5,000 Square Feet $475 $550 $600 FREE OPTIONAL COVERAGE Same as Buyer Trade Call Fee $75 $100 $100 Plan $50 Optional Seller’s Coverage (Heating/Cooling/Ductwork) Covered Items* $70 Green Plus Coverage Unknown Pre-Existing Conditions+ -

Home Warranty Service Agreement for Buyers, Sellers & Homeowners

...................................................... HOME WARRANTY SERVICE AGREEMENT FOR BUYERS, SELLERS & HOMEOWNERS ...................................................... (800) 597-0552 nationalhomeguaranteed.com HOME WARRANTY WHAT IS A HOME WARRANTY OR SERVICE CONTRACT? FOR THE BUYER/HOMEOWNER: A home warranty is a service plan which pays for the Most home buyers use all of their available cash and repair or reconstitution of covered home systems and credit to purchase a home. What if a major appliance, major, built-in appliances that break down as a result water heater or furnace malfunctions or stops operat- of normal wear and tear. The service contract can be ing altogether after the purchase? Who would you call? purchased by either the buyer or seller (or on behalf How will you afford the costs of repair? of buyer or seller) as part of a real estate transaction, The simple solution is a home warranty service con- or any homeowner presently living in their residence. tract. With a maximum deductible charge of $45.00 WHY IS A HOME WARRANTY SO IMPORTANT? for each occurrence of unrelated problems on each of the covered eligible items of equipment and one phone Home warranties provide benefits to both parties in a call to National Home Guaranteed, your covered sys- residential real estate transaction. Warranties offer both tems will be repaired or reconstituted. home sellers, home buyers or homeowners valuable protection, during the term, against the high cost of CUSTOMER SATISFACTION repairing or reconstituting a home’s mechanical systems National Home Guaranteed wants every customer to and built-in appliances which break down due to nor- be satisfied with our product. -

BHHS Kansas City Realty Brochure Download

HOME WARRANTY PLUS + an alliance with A.B. May Heating A/C Plumbing Electrical Appliance No Claims, No Hassle 13-month coverage 24/7 emergency service Preventative System Checks Schedule Service: 913.383.2222 Home Warranty Specialist: 816.763.3330 [email protected] hwplusBHHS.abmay.com For more information, visit hwplusBHHS.abmay.com or call 816.763.3330 | 1 WELCOME TO YOUR NEW HOME! Adding a home warranty to your purchase is a great decision that can save you time, stress, and money as a new homeowner. Our warranties cover hundreds of household repairs due to normal wear and tear and optional coverage for many more, but like all home warranties, there are some exclusions. Take a few minutes to read and understand all A.B. May Home Warranty Plus has to offer. We know things tend to break at the worst times. Whenever a problem pops up, you can feel confident because you have a plan to get things working again. Just call A.B. May. We understand the challenges homeowners face, and we work hard to make it easy for you to do business with us. Plus, our included System Checks proactively take care of home maintenance to improve performance and prevent breakdowns. YOUR A.B. MAY HOME WARRANTY PLUS Your home systems work hard every day, and we are here to keep them running. If something can’t be fixed, we’ll provide options to replace it. See the trade pages to review coverage for each home system. You can count on exceptional service from start to finish with A.B. -

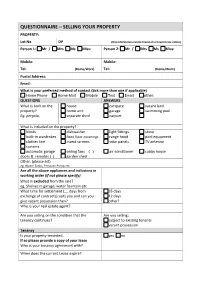

Questionnaire – Selling Your Property Property

QUESTIONNAIRE – SELLING YOUR PROPERTY PROPERTY: Lot No DP (this information can be found on a Council rate notice) Person 1: Mr / Mrs Ms Miss: Person 2: Mr / Mrs Ms Miss: Mobile: Mobile: Tel: (Home/Work) Tel: (Home/Work) Postal Address: Email: What is your preferred method of contact (tick more than one if applicable) Home Phone Home Mail Mobile Text Email other: QUESTIONS ANSWERS What is built on the house carspace vacant land property? home unit garage swimming pool Eg. pergola, separate shed carport What is included on the property? blinds dishwasher light fittings stove built-in wardrobes fixed floor coverings range hood pool equipment clothes line insect screens solar panels TV antenna curtains automatic garage ceiling fans ( ) air conditioner cubby house doors & remotes ( ) garden shed Other: (please list) eg. Water Tanks, Pressure Pump etc. Are all the above appliances and inclusions in working order (if not please specify) What is excluded from the sale? eg. Shelves in garage, water fountain etc What time for settlement (__ days from 35 days exchange of contracts) suits you and can you 42 days give vacant possession then? other? Who is your real estate agent? Are you selling on the condition that the Are you selling; tenancy continues? subject to existing tenants vacant possession Tenancy Is your property tenanted, yes no If so please provide a copy of your lease Who is your tenancy agreement with? When does the current Lease expire? Mortgage Have you borrowed money on the property? If so from whom? Where are is the Title Deeds? (usually with lender) Please provide your loan number: Please advise whether this is a Business Loan Are there any Guarantors on the Loan? Are you liable to pay land tax? yes no Do you expect there will be sufficient funds to yes no completely pay out the loan you may have against the property? What is the approximate payout amount? Is the loan that is to be paid out also secured by another property? If so please advise the details.